Risk identification method and device for vehicle insurance claim settlement case, equipment and storage medium

A risk identification and case technology, applied in the field of big data analysis, can solve the problems of high risk of auto insurance claims, high anti-fraud, low efficiency, etc., and achieve the effect of reducing amount leakage

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

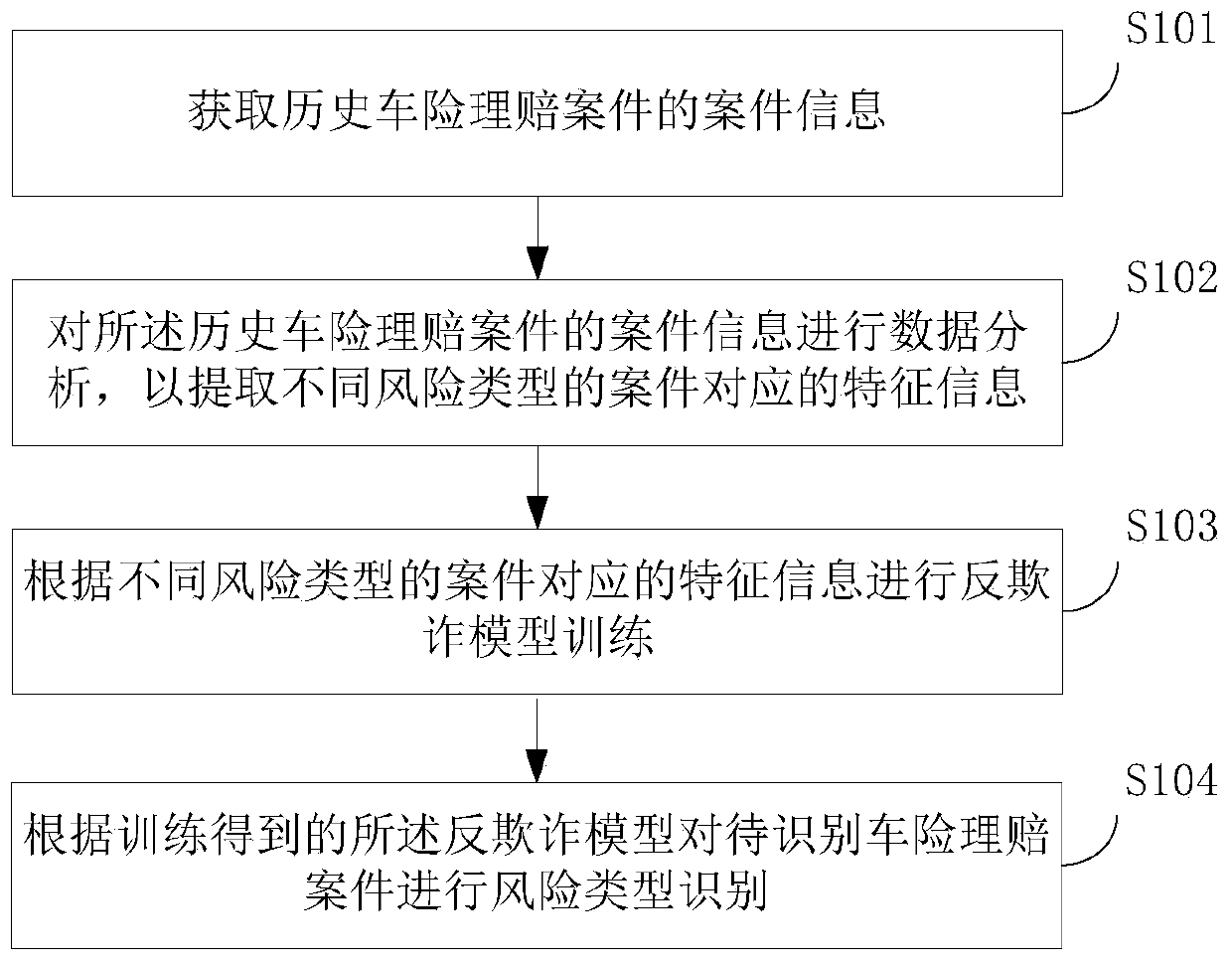

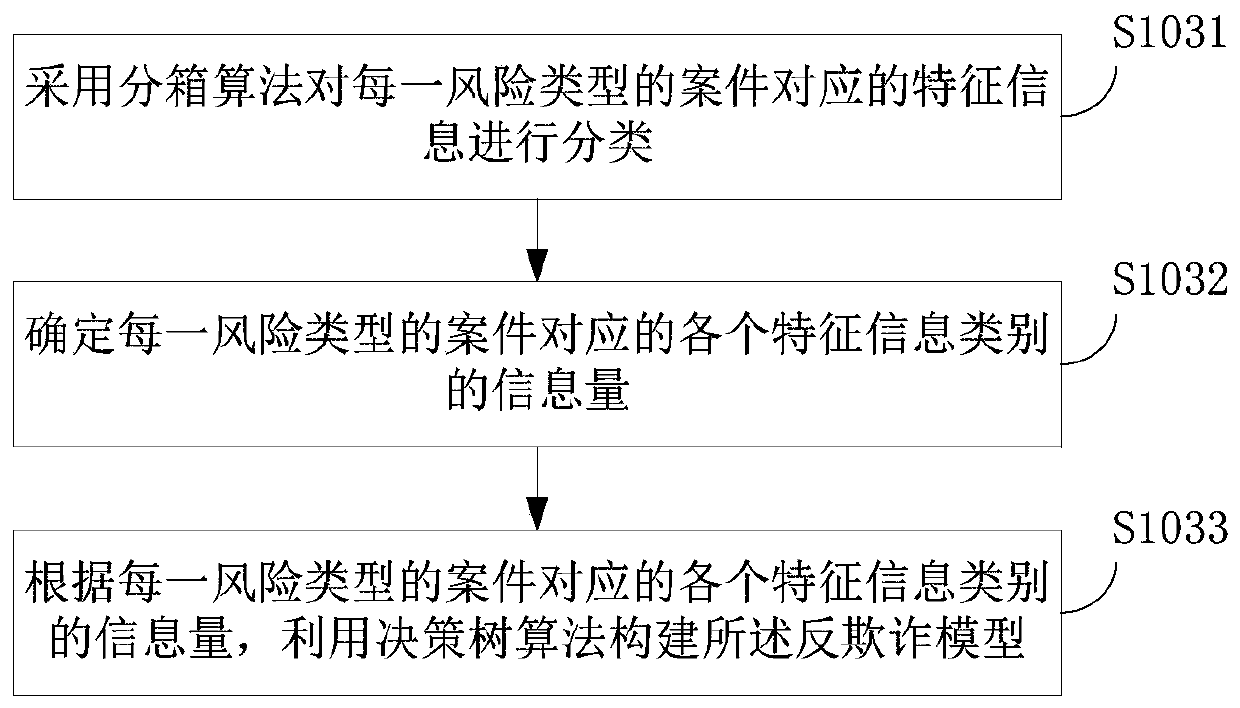

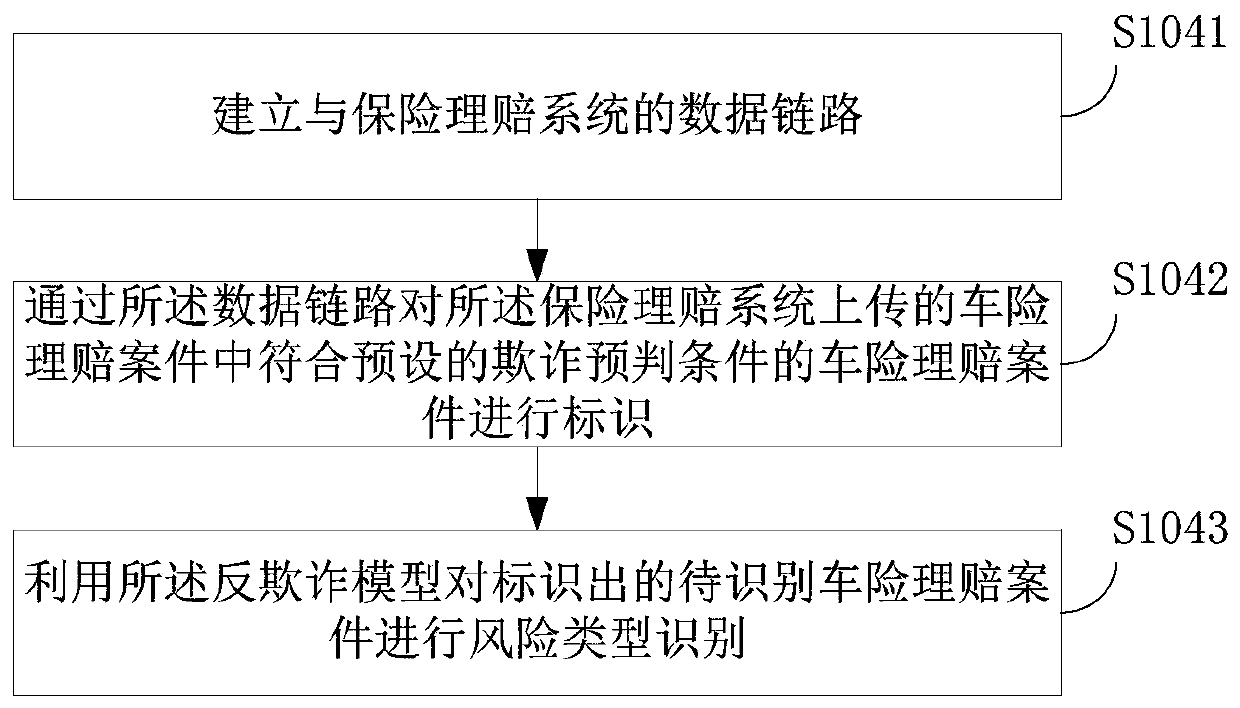

[0051] The embodiment of the present invention of the present application provides a risk identification method for auto insurance claim settlement cases, such as figure 1 As shown, the method includes: step S101, step S102, step S103 and step S103S104.

[0052] Step S101, acquiring case information of historical auto insurance claim cases.

[0053] Specifically, the data source of historical auto insurance claim cases may be the auto insurance claim case data of an insurance company with a cooperative relationship in a certain period of time in the past.

[0054] Among them, the case information includes the time when the accident occurred, the person who reported the case, the time when the case was reported, the reason for the occurrence, and the type of case risk. If it is not a case of fraud, it can also give information such as the amount of money that the insurance company eventually paid out, the list of spare parts for vehicle repair or replacement, and the price rat...

Embodiment 2

[0082] The embodiment of the present invention of the present application provides a risk identification device for auto insurance claims, such as Figure 4 As shown, the risk identification device for the auto insurance claim case may include: a data acquisition module 401, a feature extraction module 402, a model training module 403 and a risk identification module 404, wherein,

[0083] A data acquisition module 401, configured to acquire case information of historical auto insurance claims;

[0084] A feature extraction module 402, configured to perform data analysis on the case information of the historical auto insurance claim cases, so as to extract feature information corresponding to cases of different risk types;

[0085] The model training module 403 is used to perform anti-fraud model training according to the feature information corresponding to cases of different risk types;

[0086] The risk identification module 404 is configured to identify the risk type of t...

Embodiment 3

[0099] An embodiment of the present invention provides an electronic device, such as Figure 5 as shown, Figure 5 The electronic device 500 shown includes: a processor 5001 and a transceiver 5004 . Wherein, the processor 5001 is connected to the transceiver 5004 , such as through a bus 5002 . Optionally, the electronic device 500 may further include a memory 5003 . It should be noted that in practical applications, the transceiver 5004 is not limited to one, and the structure of the electronic device 500 does not limit the embodiment of the present invention.

[0100] The processor 5001 may be a CPU, a general processor, DSP, ASIC, FPGA or other programmable logic devices, transistor logic devices, hardware components or any combination thereof. It can implement or execute the various illustrative logical blocks, modules and circuits described in connection with the present disclosure. The processor 5001 may also be a combination that implements computing functions, for e...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com