A personal credit default prediction method

A forecasting method and credit technology, applied in the field of artificial intelligence, can solve problems such as ignoring the intersection and fusion effects of multiple value information, not fully mining complex information features, and affecting the economic operation of lenders, so as to improve classification accuracy and information acquisition. Analyze comprehensive, individual effects with small effects

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0010] The application technical solution is described in detail below in conjunction with the accompanying drawings and embodiments. The present invention is a personal credit default prediction method, and the method includes the following steps:

[0011] S1. Collect the borrower's personal information data and credit account activity information data to establish a database, eliminate missing values and outliers in the data, and preprocess the data;

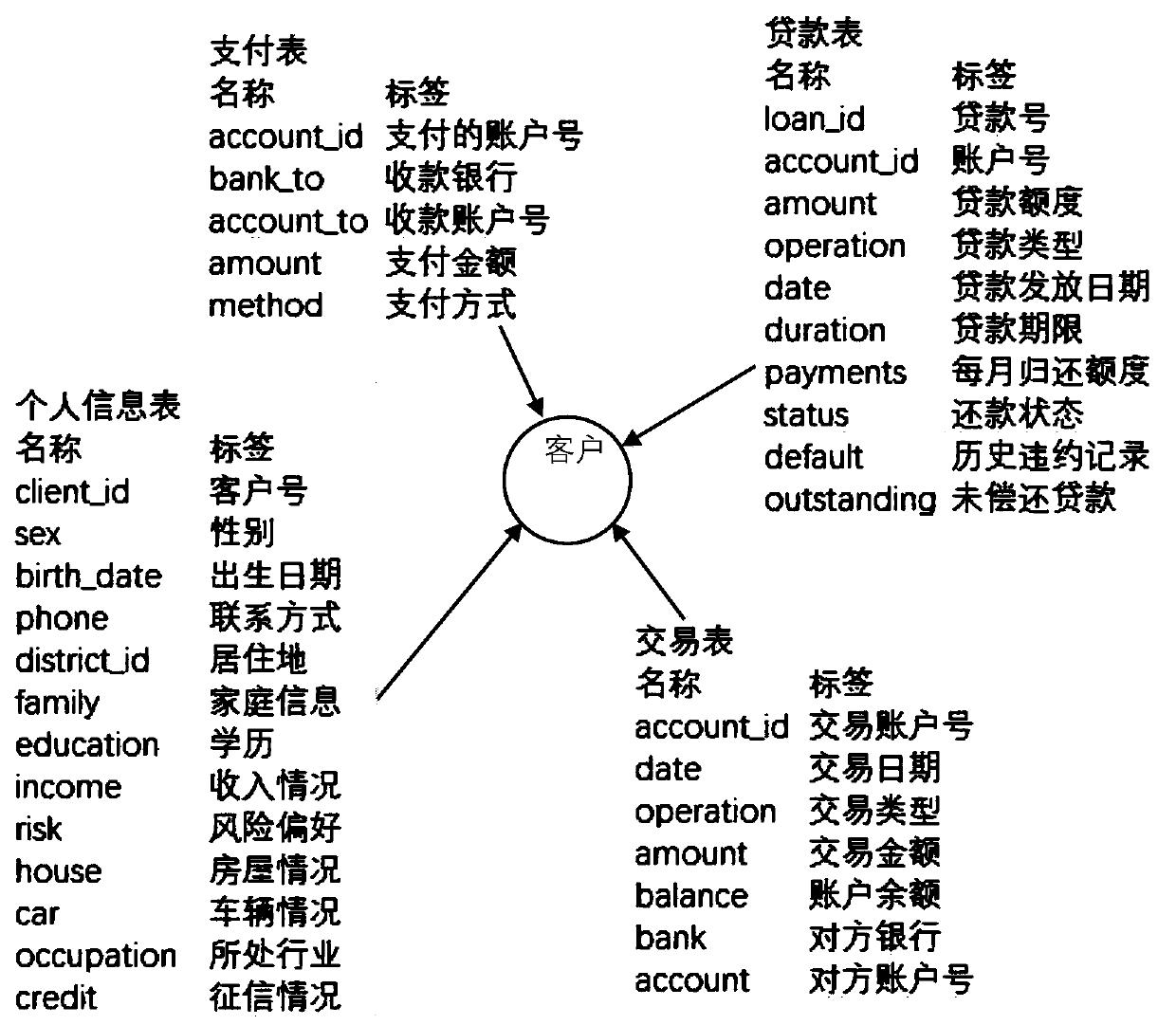

[0012] S11. Collect borrower's personal information data and credit account activity information data from the personal credit platform through web crawler technology to establish a database, such as figure 1 As shown, the personal information data that needs to be collected includes customer number, gender, date of birth, contact information, place of residence, family information, education, income, risk preference, housing and vehicle conditions, industry, credit status, etc. Credit information can be queried according to...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com