Risk control method and system for credit business risk control differential pricing of subdividing customer group

A differentiated and risk-controlled technology, which is applied in the fields of instruments, finance, and data processing applications, can solve the problems of unsustainable service to high-quality customers of the credit platform, and the inability to effectively prevent malicious fraud.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

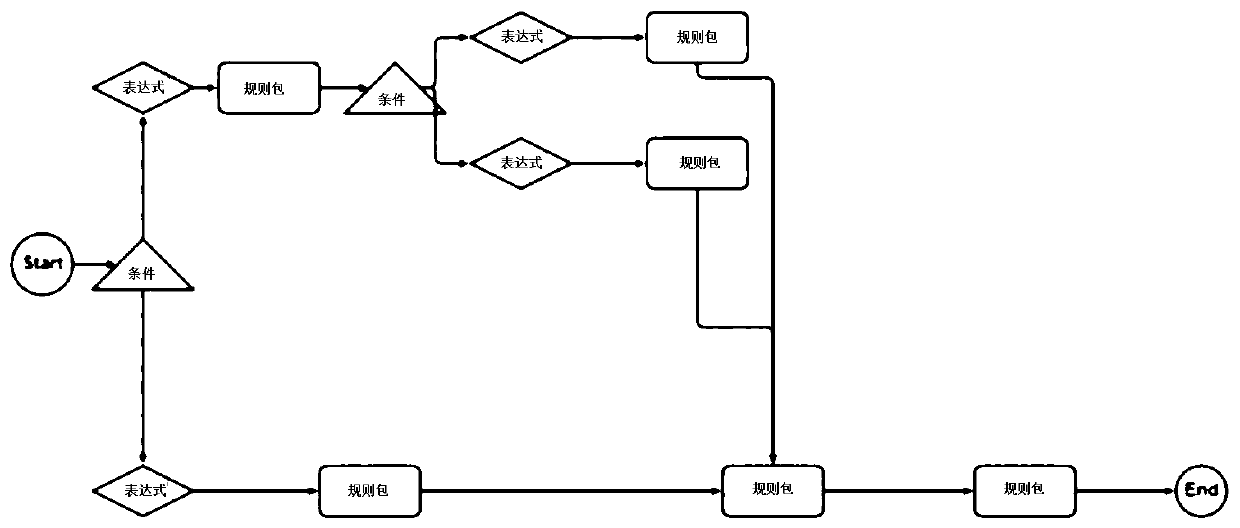

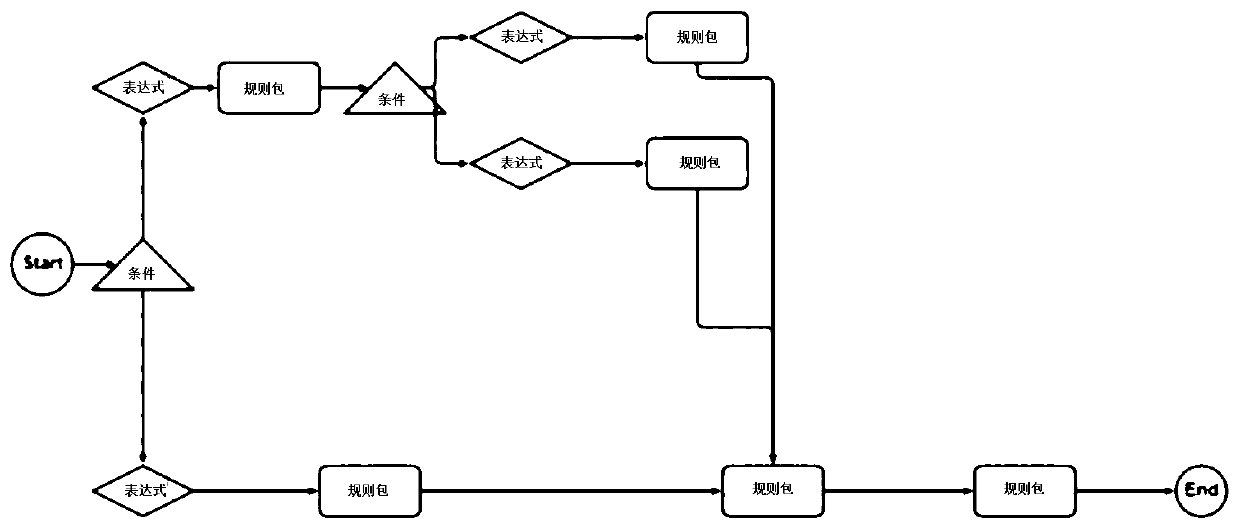

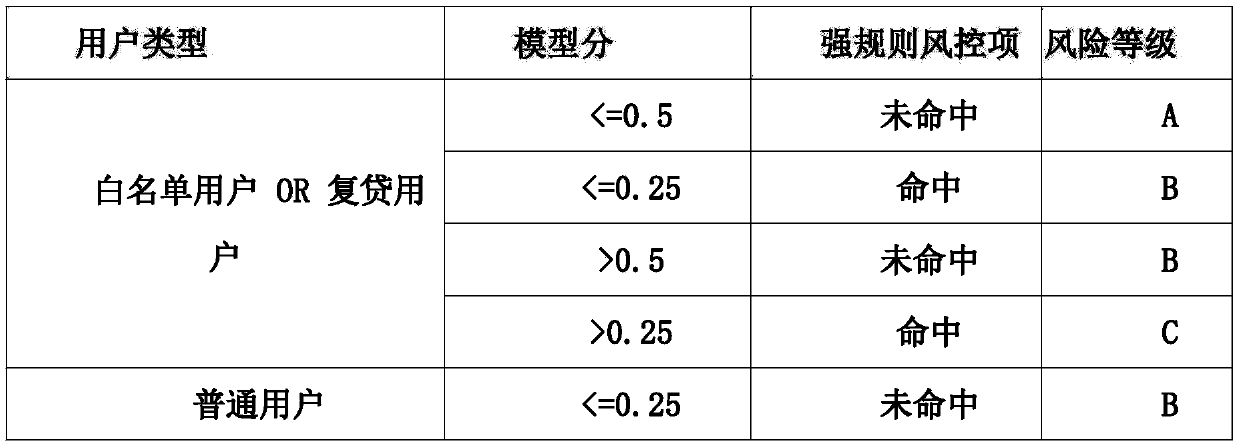

[0070] The present invention will be further described below with a collection of drawings and embodiments.

[0071] like figure 1 As shown, the system of the present invention includes: 1. data access module; 2. data storage module; 3. data processing module; 4. decision-making module; 5. decision-making result output module; 6. user risk management module.

[0072] (1) Data access module: the main function is to collect the required data. Including: identity authentication data, operator call data, long-term lending data, address book data, Taobao e-commerce data, blacklist data, device information, location information, emergency contact information, etc., and put these data into the data pending queue and stored in the distributed file system at the same time.

[0073] (2) Data storage module: The data storage module mainly stores original file data, risk control feature data, business rule data, user data, and risk management data.

[0074] (3) Data processing module: ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com