Insurance anti-fraud method for identifying drunk driving insurance switching based on operator data

A data identification and operator technology, applied in data processing applications, finance, instruments, etc., can solve the problems of regional differences, time differences, and large manpower consumption of insurance fraud, and achieve regional differences and time differences, Good quality, true information

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0021] The following will clearly and completely describe the technical solutions in the embodiments of the present invention with reference to the accompanying drawings in the embodiments of the present invention. Obviously, the described embodiments are only some, not all, embodiments of the present invention.

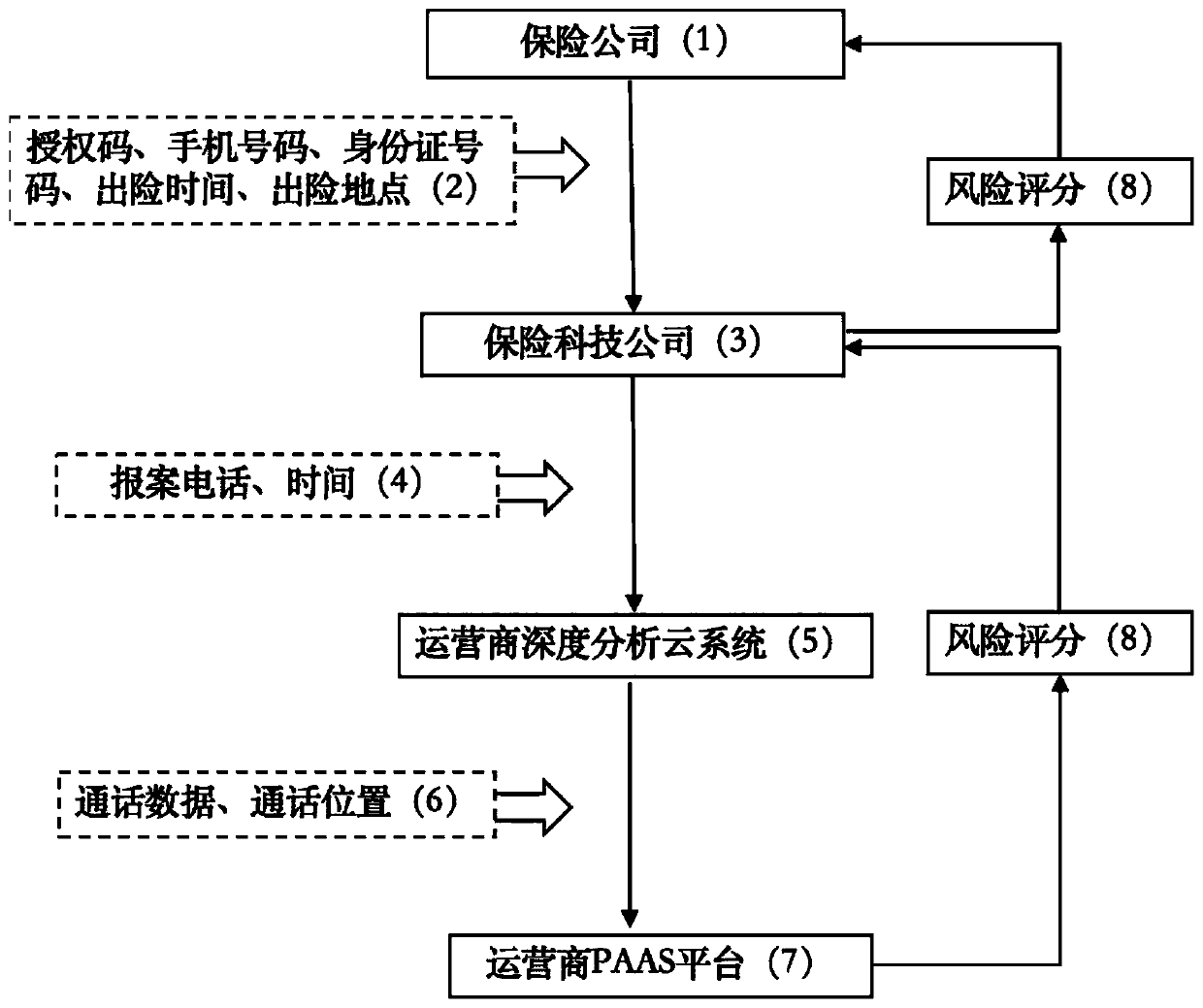

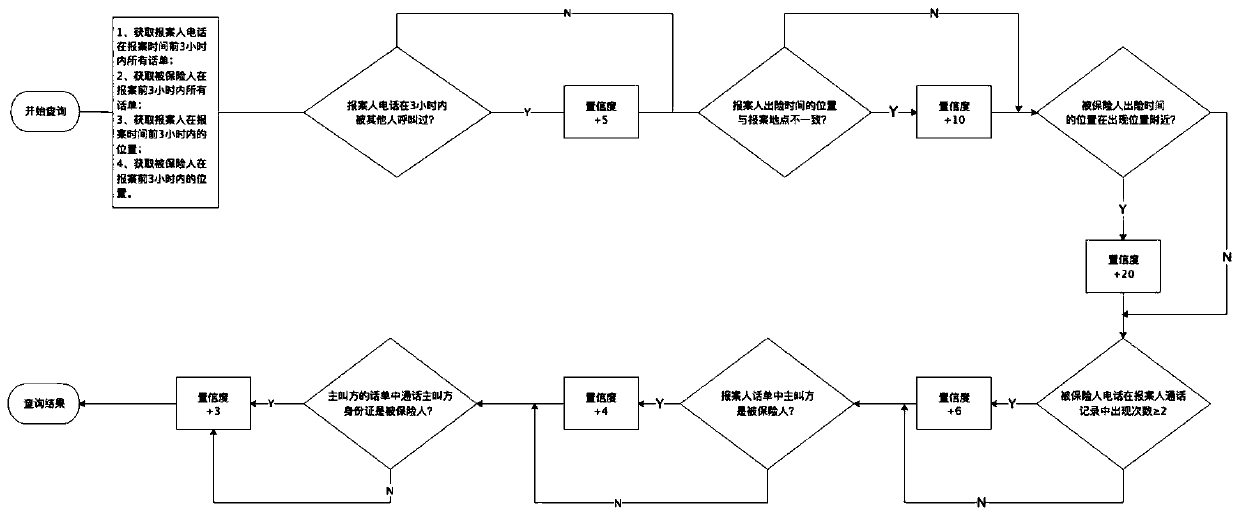

[0022] see Figure 1 to Figure 2 , the present invention provides a technical solution: an insurance anti-fraud method based on operator data to identify drunk driving and switch packages, including an insurance company (1), an operator PAAS platform (7), an operator in-depth analysis cloud system (5), An insurance technology company (3), the insurance company (1) establishes a connection with the insurance technology company (3) through a TCP connection in combination with the authorization code, mobile phone number, ID number, time of accident, and location of the accident (2) through an API , the application program interface of the insurance technology company (3...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com