Personal credit evaluation method and system based on fusion neural network

A neural network and credit evaluation technology, applied in neural learning methods, biological neural network models, neural architectures, etc., can solve the problem of inability to adapt to the environment, less research on personal credit dynamic evaluation, and inability to reflect personal income fluctuations and credit fluctuations, etc. problems, to achieve the effect of achieving accuracy, improving prediction results, and reducing time variability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0033] The technical solution of the present invention will be further described below in combination with specific embodiments and accompanying drawings.

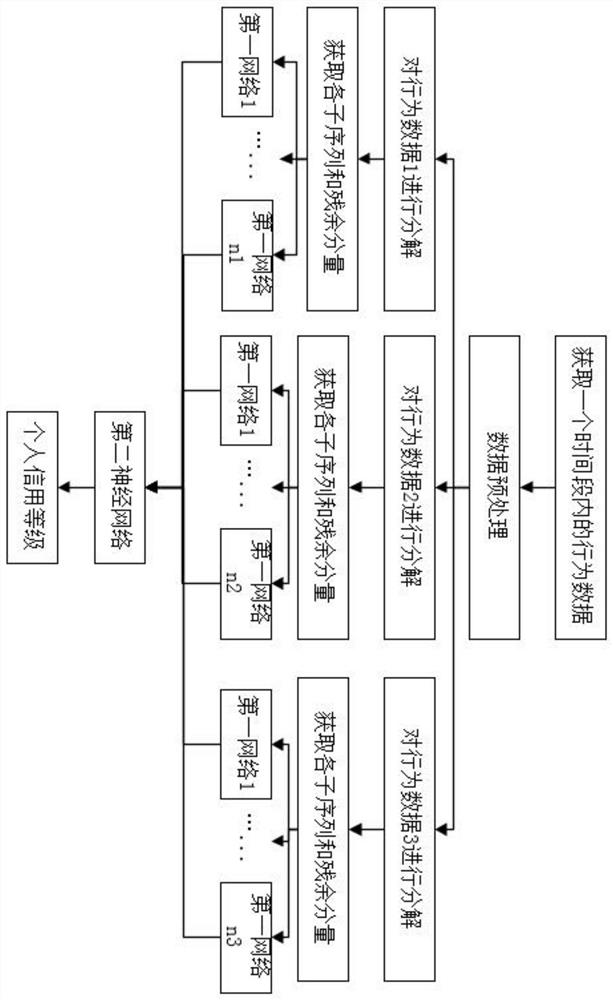

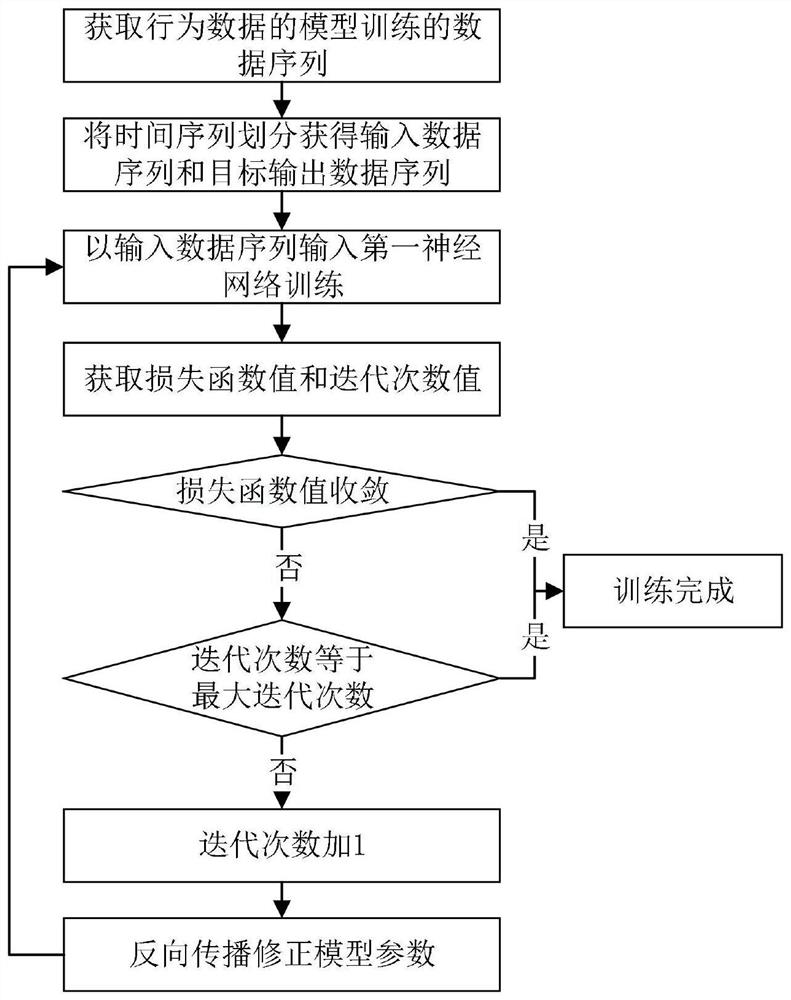

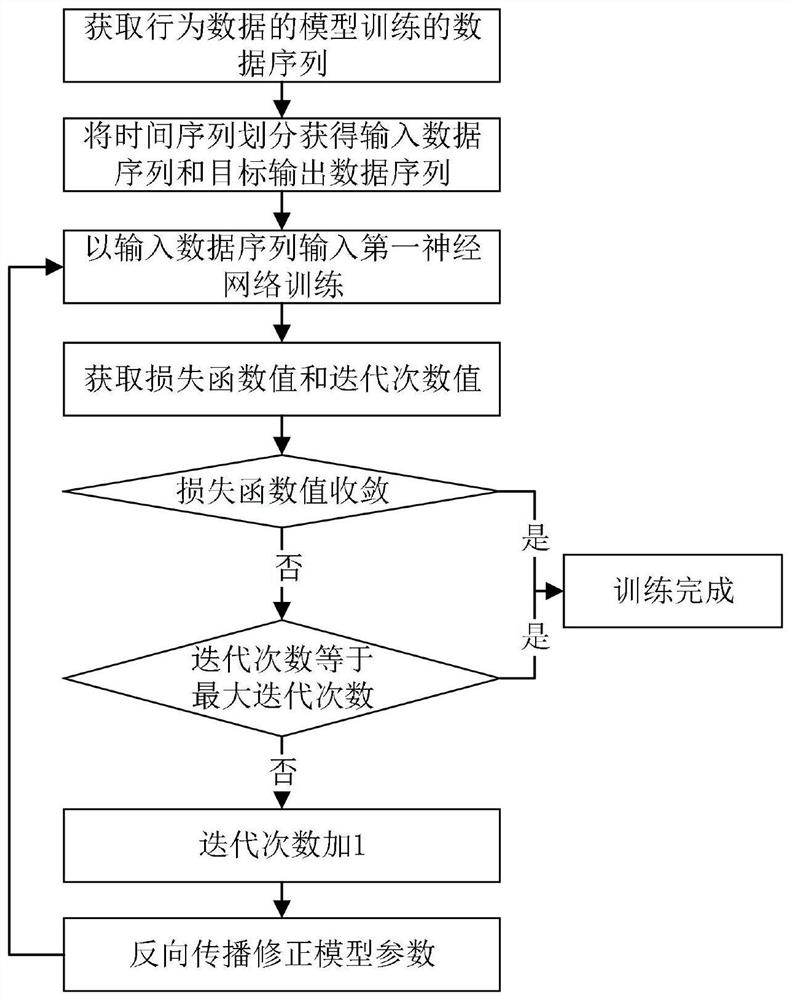

[0034] The present invention provides a personal credit evaluation method based on a fusion neural network, using LSTM neural network to predict a plurality of personal behavior data, and based on the prediction results, fitting through BP neural network to obtain personal credit rating, based on LSTM neural network The feature extraction of time series behavioral data, and the fitting of various behavioral data weights through BP neural network, realize the dynamic evaluation of personal credit, including:

[0035] Data preprocessing, obtaining behavioral data to reflect personal credit status, and performing extraction, cleaning, and normalization processing;

[0036] Among them, there are many types of behavioral data used to reflect personal credit conditions. This embodiment uses bank records, credit card records, and...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com