Control and management method and device for solving credit granting risks of small and micro enterprises

A technology of risk control and management methods, applied in the field of credit risk control and management methods and devices for small and micro enterprises, can solve the problems of data scarcity, insufficient precipitation of historical information, incompleteness, etc., to improve risk control and management capabilities, The effect of enriching the credit model and reducing the frequency of manual credit review intervention

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0063] The realization of the purpose of the present invention, functional characteristics and advantages will be further described in conjunction with the embodiments and with reference to the accompanying drawings.

[0064] It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

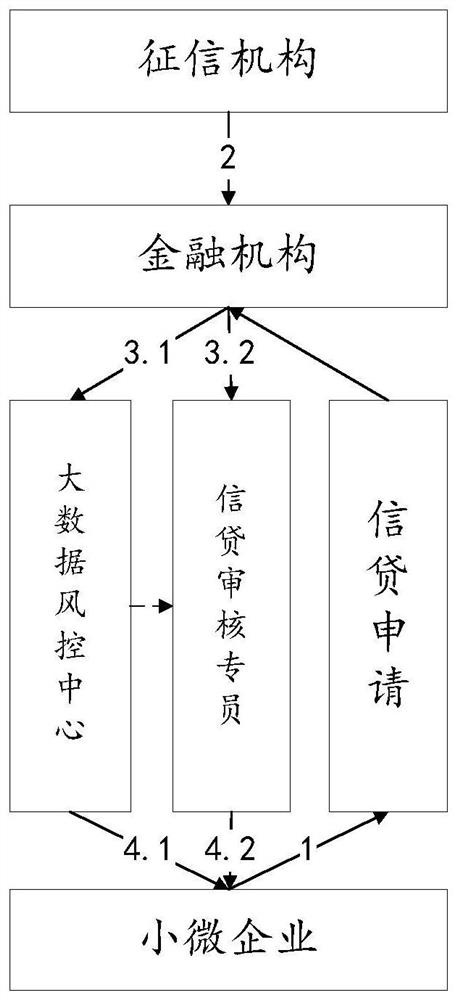

[0065] refer to figure 1 It is a schematic flowchart of the method for controlling and managing the credit risk of small and micro enterprises involved in the solution of the embodiment of the present invention.

[0066] Step 1. Credit application. Small and micro enterprises apply for credit through various online channels (including but not limited to APP, Web, and mini-programs, etc.);

[0067] Step 2. The financial institution obtains a credit application request, and obtains credit data from a third-party institution for cross-validation;

[0068] Step 3. Divide customers into three categories: b...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com