Stock price data prediction method and device

A data prediction and stock price technology, applied in the computer field, can solve the problems of ignoring long-memory characteristics, affecting the trend of stock prices, and low accuracy of stock price prediction results, so as to solve long-term dependencies and improve accuracy.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

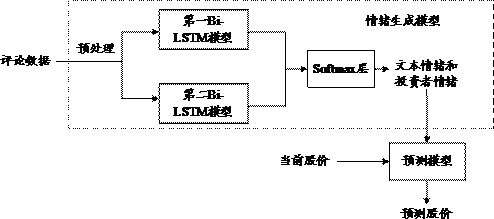

[0046] see image 3 , image 3 It is a structural schematic diagram of a stock price prediction model provided in the embodiment of this application. Such as image 3 As shown, the stock price prediction model includes a sentiment generation model and a prediction model.

[0047] Among them, the input of the sentiment generation model is input data (investor's comment data), and the output is text sentiment and investor sentiment. The emotion generation model can include different Bi-LSTM models based on the Attention mechanism, such as image 3 As shown, the sentiment generation model includes a first Bi-LSTM model, a second Bi-LSTM model and a Softmax layer, the first Bi-LSTM model is used to obtain text sentiment features, and the second Bi-LSTM model is used to obtain investment The Softmax layer is used to concatenate and calculate text sentiment features and investor sentiment features to obtain the final text sentiment and investor sentiment.

[0048] The training ...

Embodiment 2

[0054] see Figure 4 , Figure 4 It is a schematic flowchart of a stock price data prediction method provided in the embodiment of this application. Such as Figure 4 As shown, the method includes the following steps:

[0055] S410. Obtain a target data set and a target stock price, the target data set includes multiple comment data published by multiple first investors on the target stock within the i-th period, and the target stock price is The average stock price of the target stock within the period, and the i is a positive integer greater than 1.

[0056] Wherein, the above-mentioned target data set may be the comment data published by investors on the target stock automatically obtained from the stock investment application program or page, and the comment data may include at least one of text, emoticon, and image. The cycle time can be set independently by the user, such as 3 hours, one day, two days, one week, two weeks, one month, etc.; it can also be set by the s...

Embodiment 3

[0070] An embodiment of the present application provides a method for training a stock price prediction model, and the stock price prediction model may be the stock price prediction model in Embodiment 2. This training method can be used for image 3 The stock price prediction model is trained, and the stock price prediction model includes an emotion generation model and a prediction model. Since the emotion generation model and the prediction model are both Bi-LSTM models, and the output of the emotion generation model is the input of the prediction model, it can be used The training data trains both the sentiment generation model and the predictive model.

[0071] see Figure 5 , Figure 5 It is a training method for an emotion generation model provided in the embodiment of this application, and the emotion generation can be the emotion generation module in the first embodiment. This training method can be used as image 3 The structural implementation of the stock price...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com