Personal credit risk measurement model based on GA-BP

A GA-BP, measurement model technology, applied in the field of personal credit risk measurement model, can solve problems such as low prediction accuracy, achieve the effects of improving accuracy and reliability, preventing market risks, and good application value

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

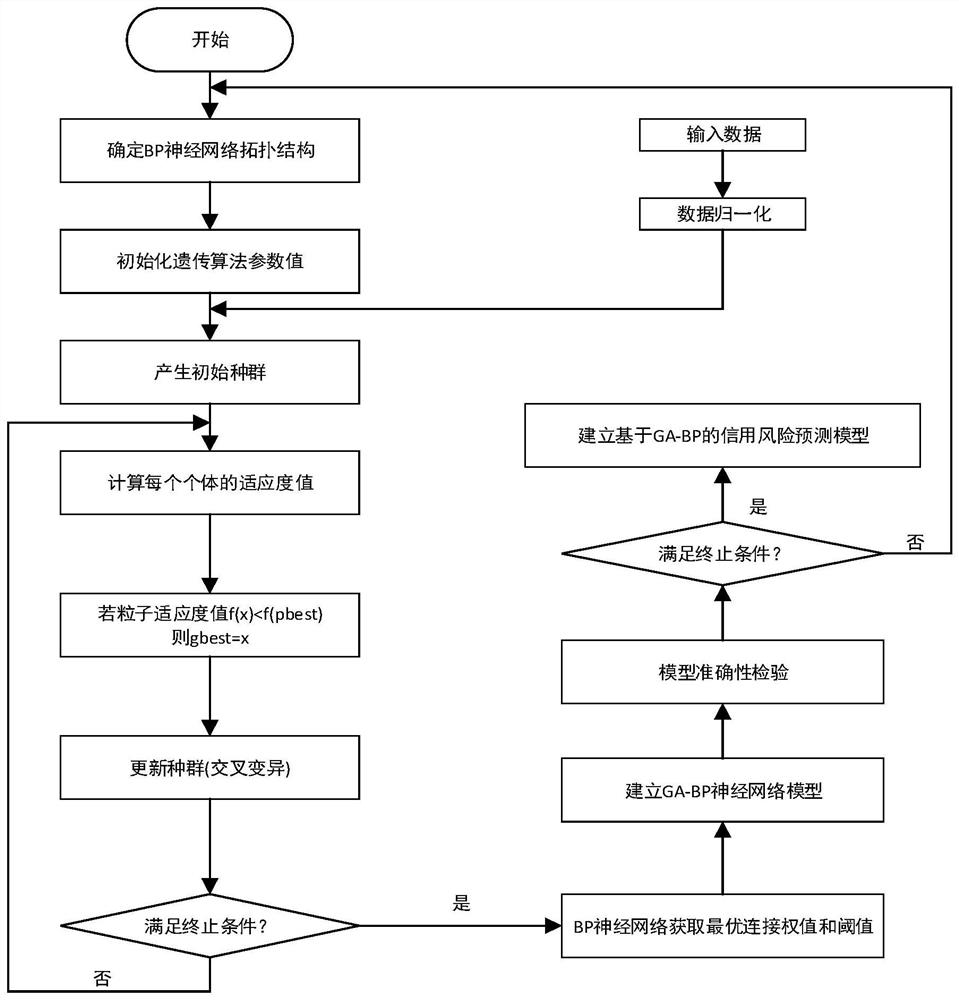

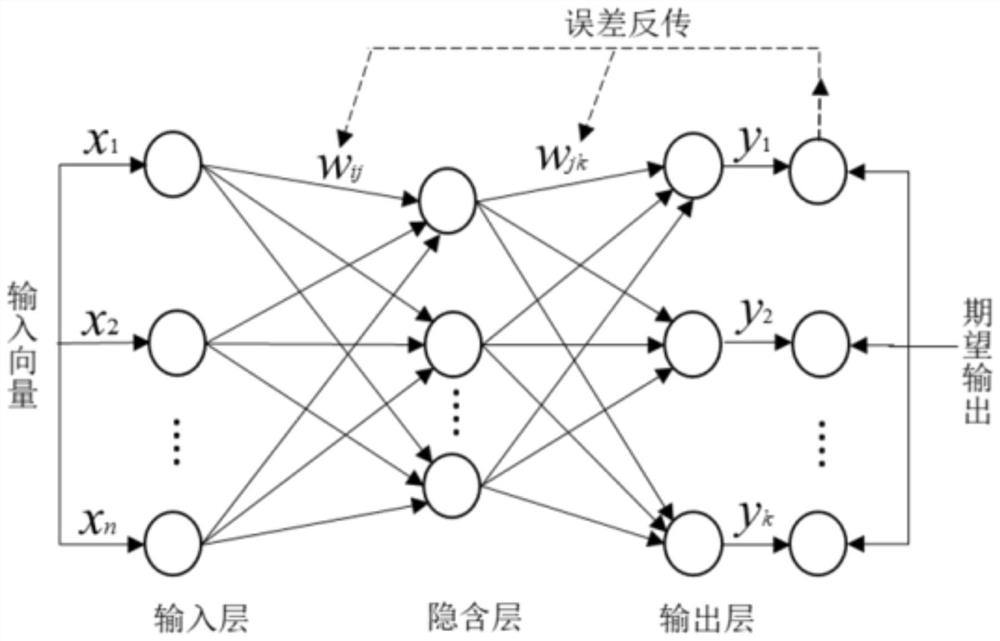

[0037] Such as Figure 1-2 As shown, the embodiment of the present invention provides a GA-BP-based personal credit risk measurement model, including the GA-BP model, the GA-BP model based on the new model of the BP neural network principle and genetic algorithm, the genetic algorithm is different from the local search of neural network. The algorithm, the genetic algorithm uses an efficient parallel global search algorithm, which can automatically obtain and accumulate knowledge about search space during searching, so that it can avoid local minimal values, which can be processed. Any form of target functions and constraints can operate any structural objects within the global scope, so there is a faster comparative speed. Genetics requires optimized solutions to form a group, and performs selection, crossings and variation operations of these coding groups, resulting in a more optimal solution, so that the algorithm is described until the algorithm is terminated. .

[0038] The B...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com