Credit assessment method and device and electronic equipment

A credit evaluation and credit technology, applied in data processing applications, finance, instruments, etc., can solve the problem that the applicant's credit degree cannot be accurately evaluated, and achieve the effect of solving the problem of inaccurate evaluation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0029]According to an embodiment of the present invention, an embodiment of a credit evaluation method is provided. It should be noted that the steps shown in the flowcharts of the drawings can be executed in a computer system such as a set of computer-executable instructions, and, although A logical order is shown in the flowcharts, but in some cases the steps shown or described may be performed in an order different from that shown or described herein.

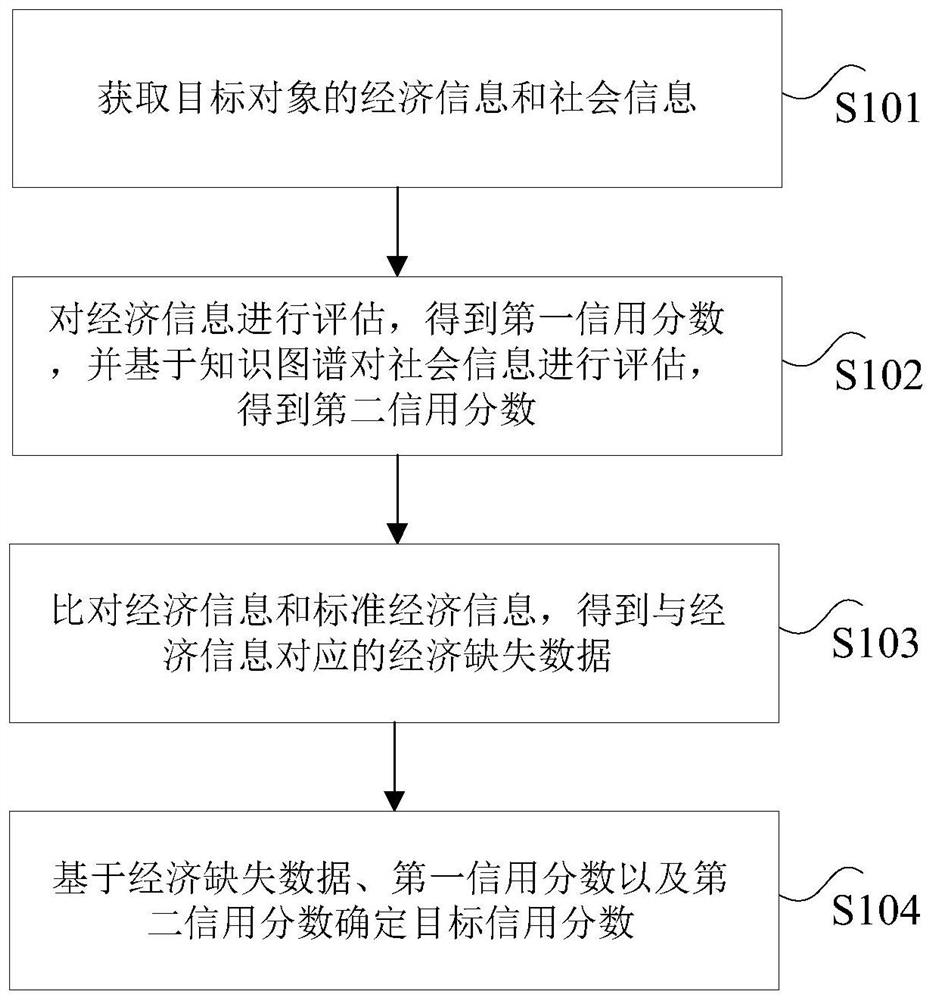

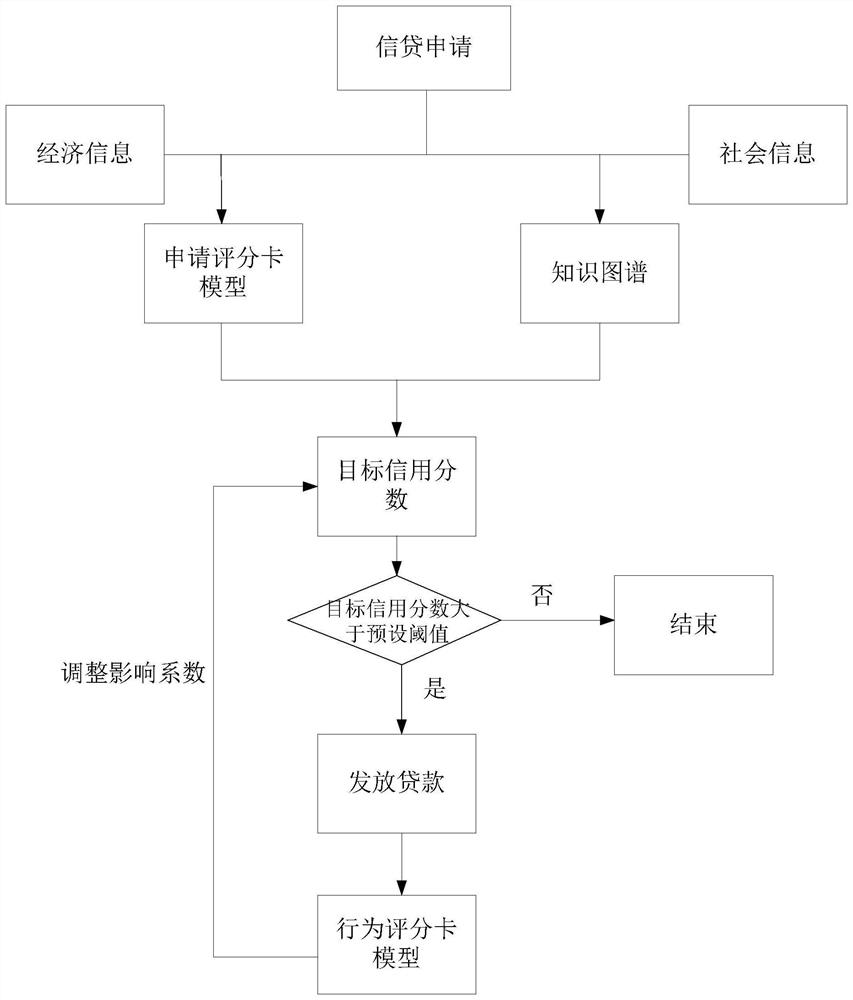

[0030] figure 1 is a schematic diagram of an optional credit evaluation method according to an embodiment of the present invention, such as figure 1 As shown, the method includes the following steps:

[0031] Step S101, obtaining economic information and social information of the target object, wherein the economic information includes application information, loan information and transaction information, and the social information is used to represent the social relationship of the target object.

[0032] In step S101, th...

Embodiment 2

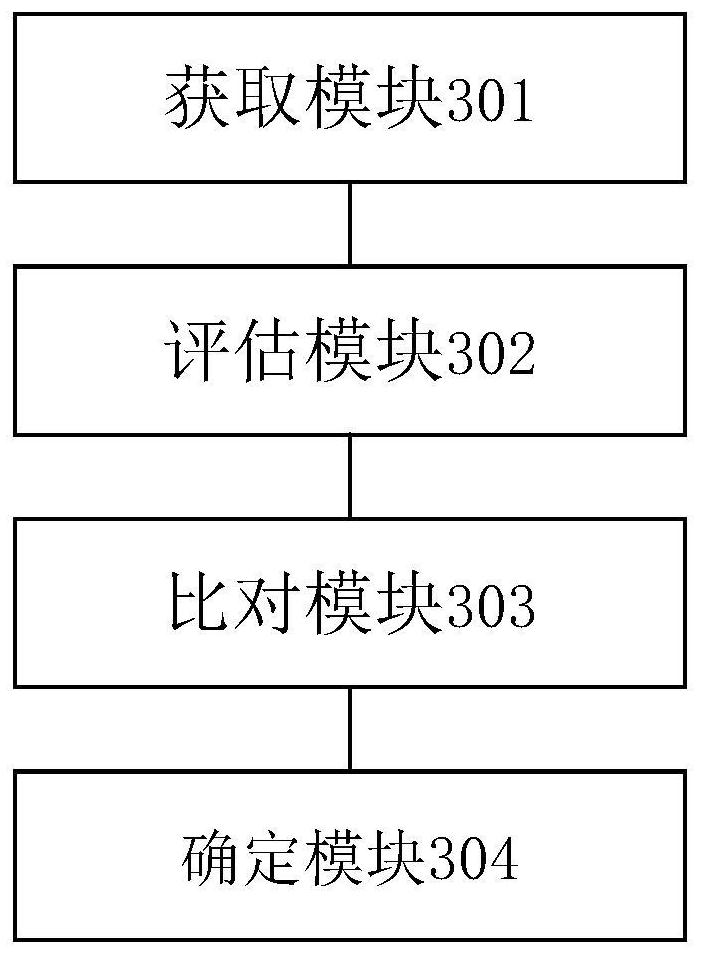

[0083] According to an embodiment of the present invention, an embodiment of a credit evaluation device is provided, wherein, image 3 is a schematic diagram of an optional credit evaluation device according to an embodiment of the present invention, such as image 3 As shown, the device includes:

[0084] An acquisition module 301, configured to acquire economic information and social information of the target object, wherein the economic information includes application information, loan information, and transaction information, and the social information is used to represent the social relationship of the target object;

[0085] An evaluation module 302, configured to evaluate economic information to obtain a first credit score, and evaluate social information based on the knowledge graph to obtain a second credit score;

[0086] The comparison module 303 is used to compare the economic information with the standard economic information, and obtain economic missing data co...

Embodiment 3

[0096] According to another aspect of the embodiments of the present invention, a computer-readable storage medium is also provided, and a computer program is stored in the computer-readable storage medium, wherein the computer program is configured to execute the above-mentioned credit evaluation method when running.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com