Tax-controlled invoice check management method

A management method and invoice technology, applied in the direction of dealing with coins or valuable banknotes, authenticity inspection of banknotes, instruments, etc., can solve the problems of lack of necessary conditions for operation, obvious regional differences, backward network communication, etc., to promote quality and Efficiency, simple operation, and the effect of strengthening unified management

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

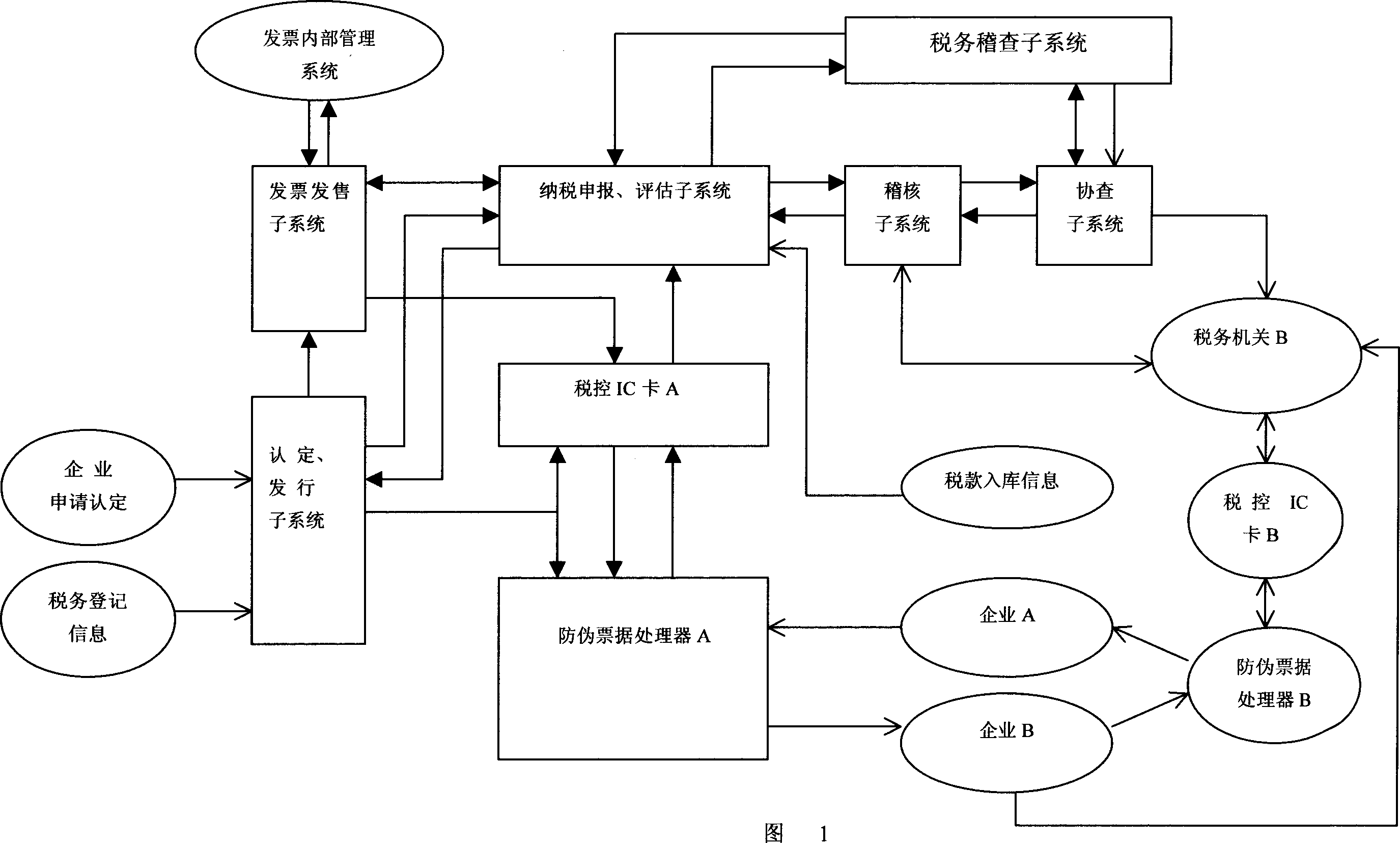

[0031] The anti-counterfeit bill processor used in the present invention is the anti-counterfeit bill processor disclosed by the authorized announcement number CN2390241Y.

[0032] The invoice used in the present invention has magnetic recording information, and the magnetic strip can be attached to the front or back of the invoice.

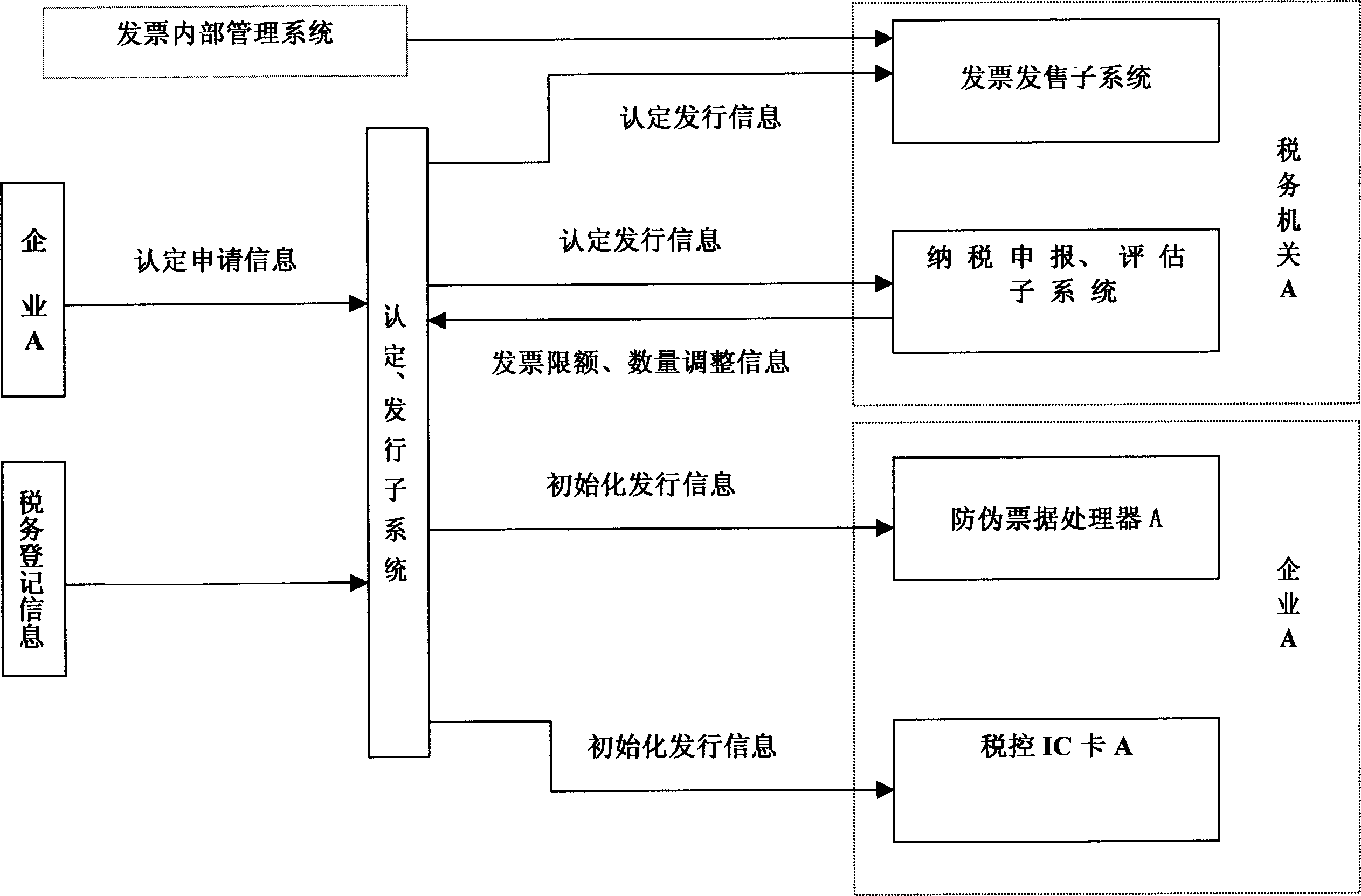

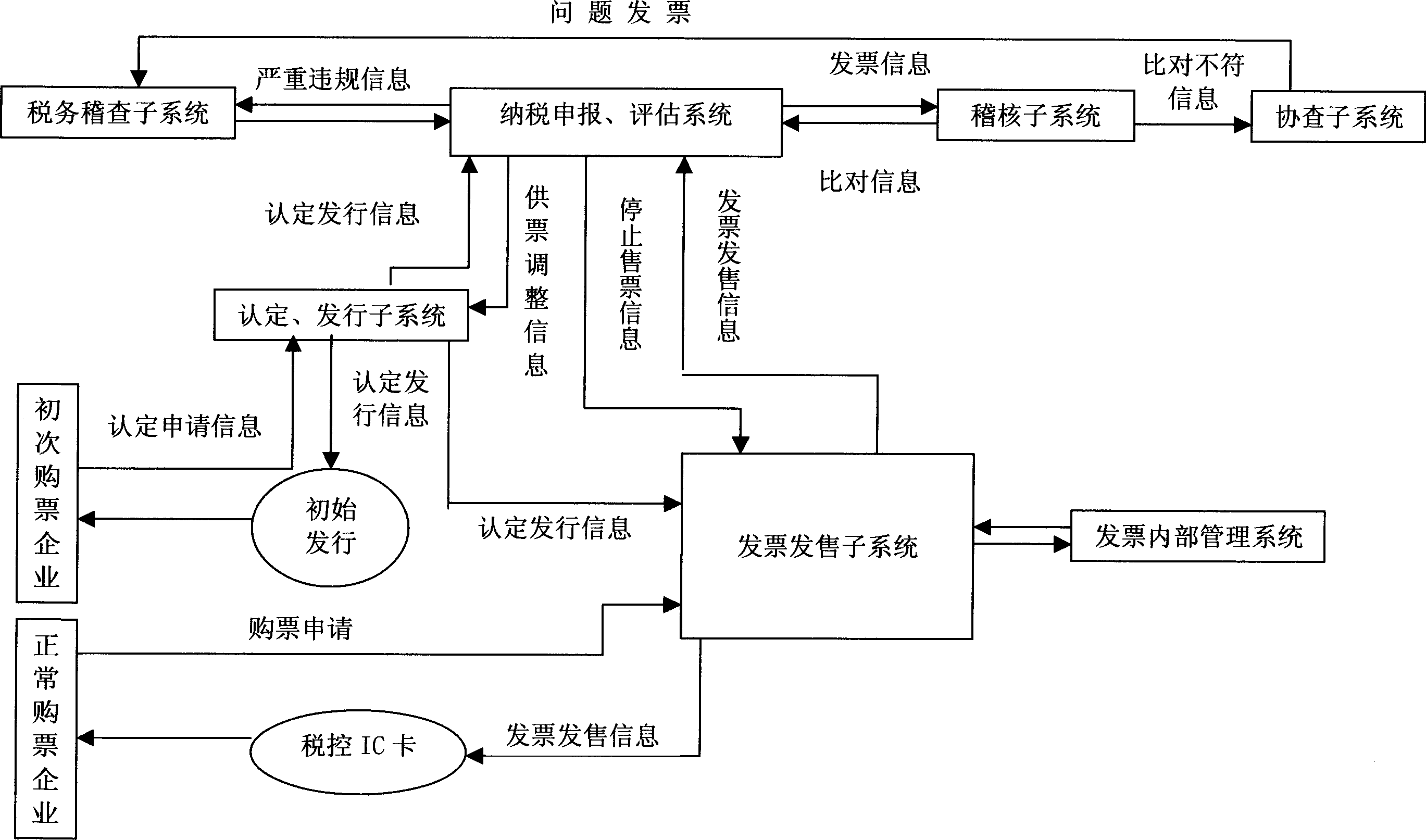

[0033] The anti-counterfeit bill processor includes a CPU, a memory connected to the CPU, a keyboard, a display, a communication interface, an IC card reader, and a magnetic stripe reader. Each enterprise has an anti-counterfeit bill processor and a matching tax control IC card that has been reviewed and approved by its competent tax authority and has been initialized and issued. When the enterprise applies for the purchase of invoices, the competent tax authority will store the electronic information of the issued invoices into the tax authority database and write it into the tax control IC card of the enterprise while issuing paper invoices. W...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com