Method and system for distributing receivables

a receivable and system technology, applied in the field of method and system for distributing receivables, can solve the problems of limiting the efficiency of buyers and sellers of conventional forward flow sale arrangements, and limiting the efficiency of market participants, so as to reduce the risk of holding period, and reduce the effect of lost collection opportunities

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

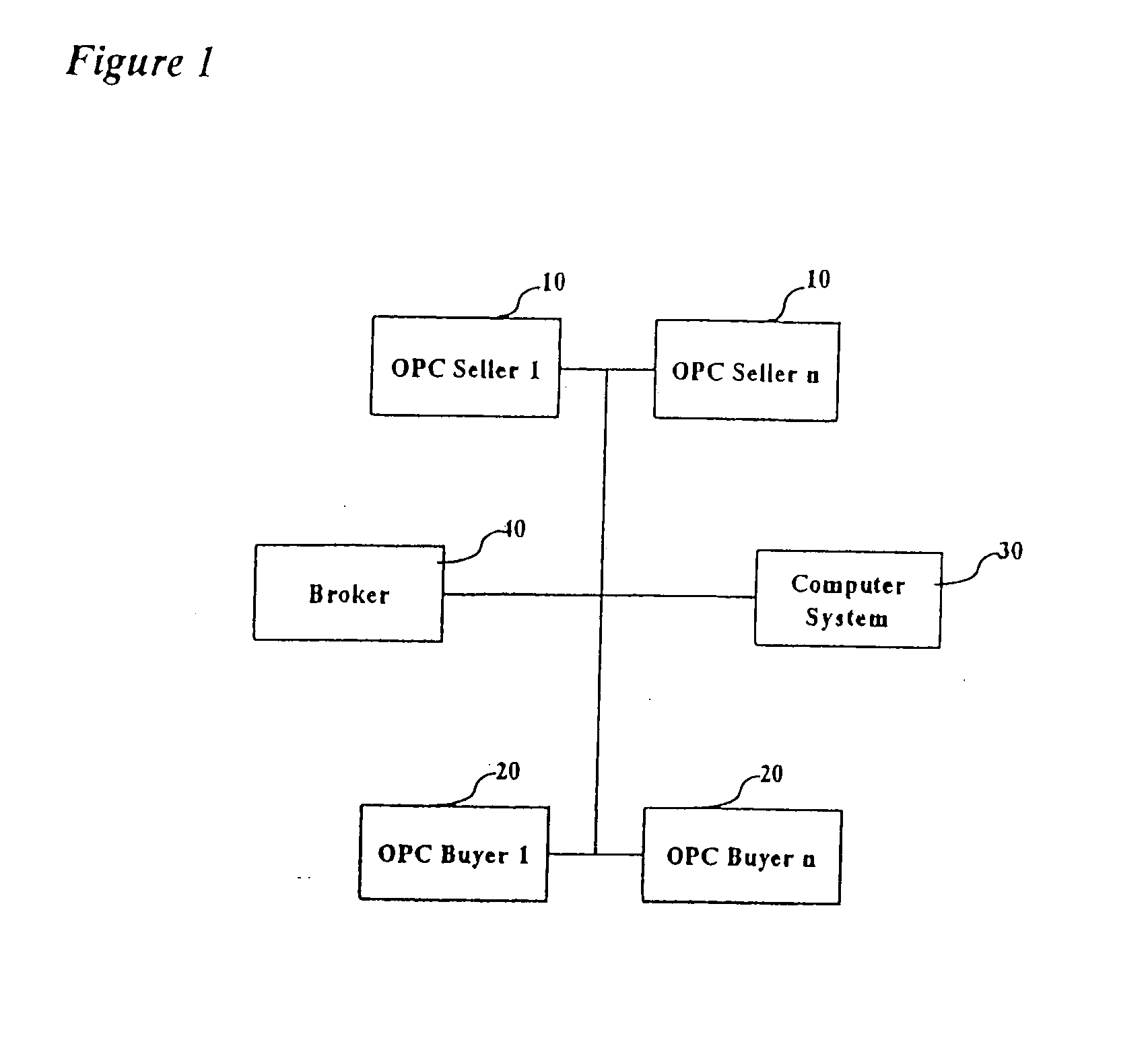

[0065] In the Drawings, FIG. 1 is a diagram illustrating the participants in the OPC process in accordance with the method of the invention. As shown in FIG. 1, the OPC process includes at least one OPC seller 10. Accordingly, it should be appreciated that the OPC process of the invention may include any number of OPC sellers. Additionally, as shown in FIG. 1, another participant in the OPC process of the invention is at least one OPC buyer 20. In a similar manner to the sellers, there may be any number of OPC buyers.

[0066] As shown in FIG. 1, the OPC process of the invention may also include a broker 40. The broker or brokers 40 may participate in the OPC process of the invention in any suitable manner. For example, a broker 40 may be an intermediary between a seller 10 and a buyer 20. Alternatively, a broker 40 may represent either a seller or a buyer, or alternatively, a collection of sellers or a collection of buyers.

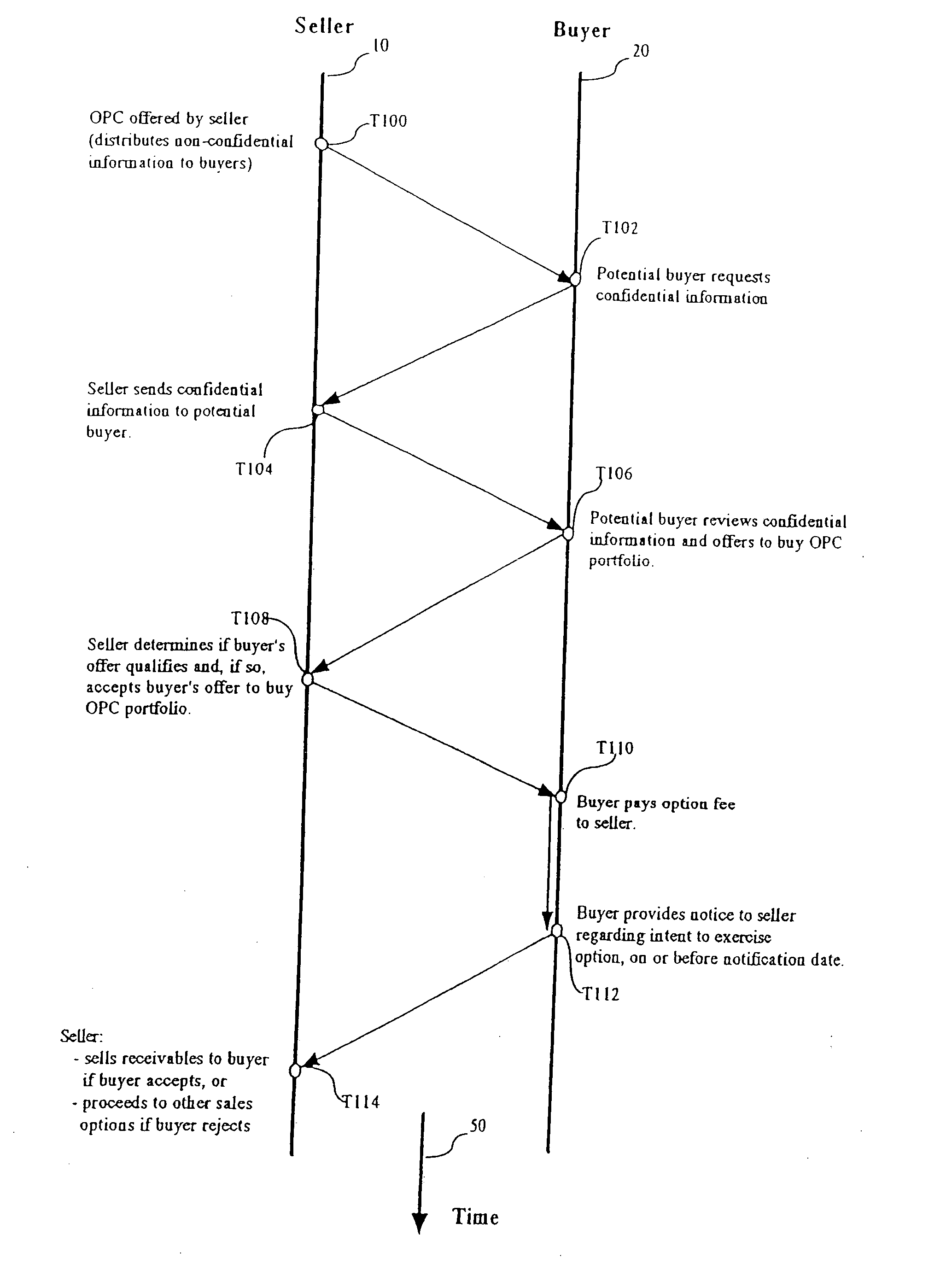

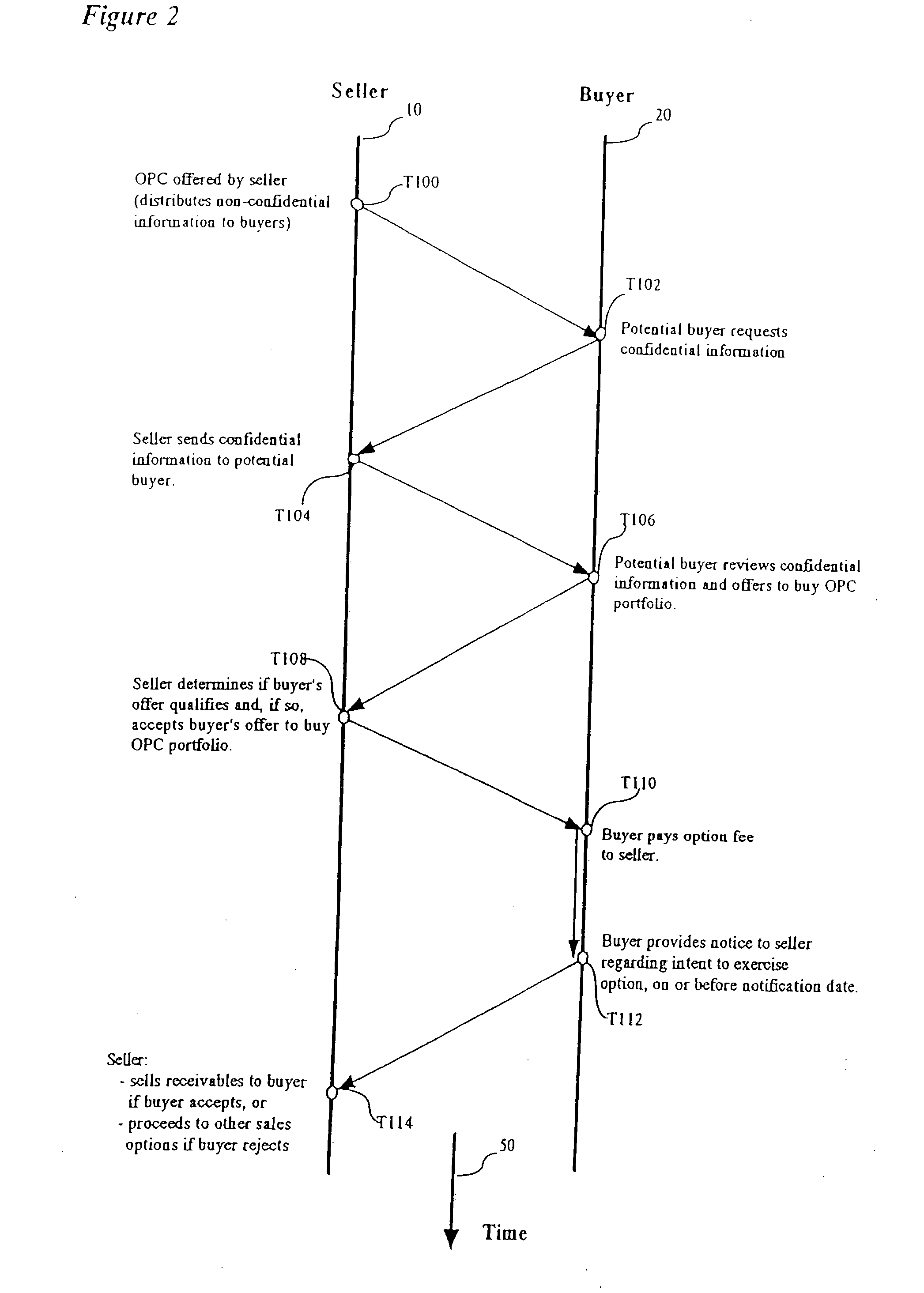

[0067]FIG. 2 is a diagram showing further aspects of the OPC...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com