Method for Replacing Traditional Payment and Identity Management Systems and Components to Provide Additional Security and a System Implementing Said Method

a technology of a payment and identity management system, applied in the field of digital and electronic wallets, can solve the problems of limiting the use and acceptance of digital wallet software solutions, the inability to fully secure mobile devices with digital wallet technologies, and the number of false starts of an already skeptical consumer market, so as to reduce the number and variety of devices, increase the security of the user authentication process and the consumer transaction, and reduce the number of payment devices and methods carried by users

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

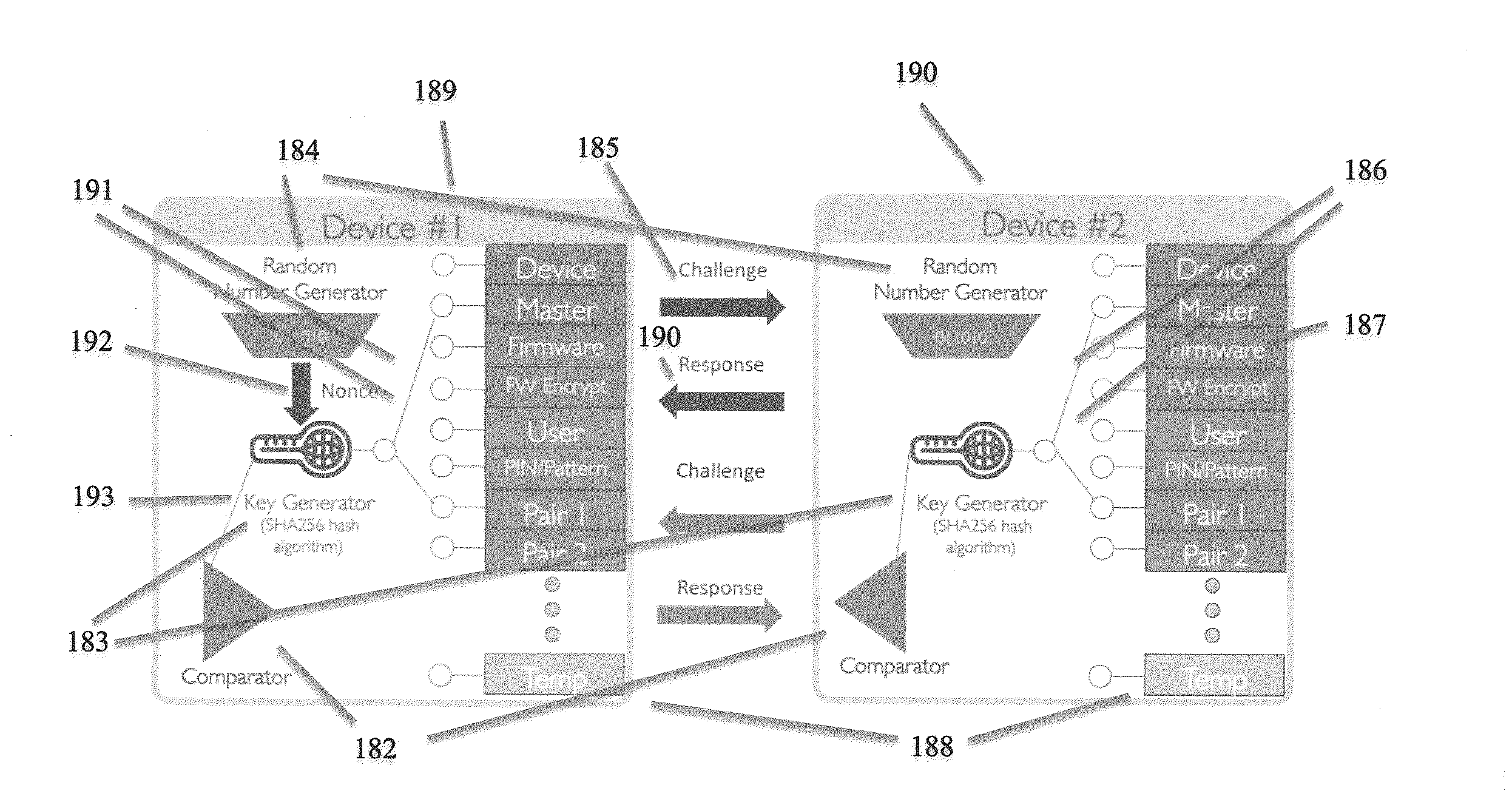

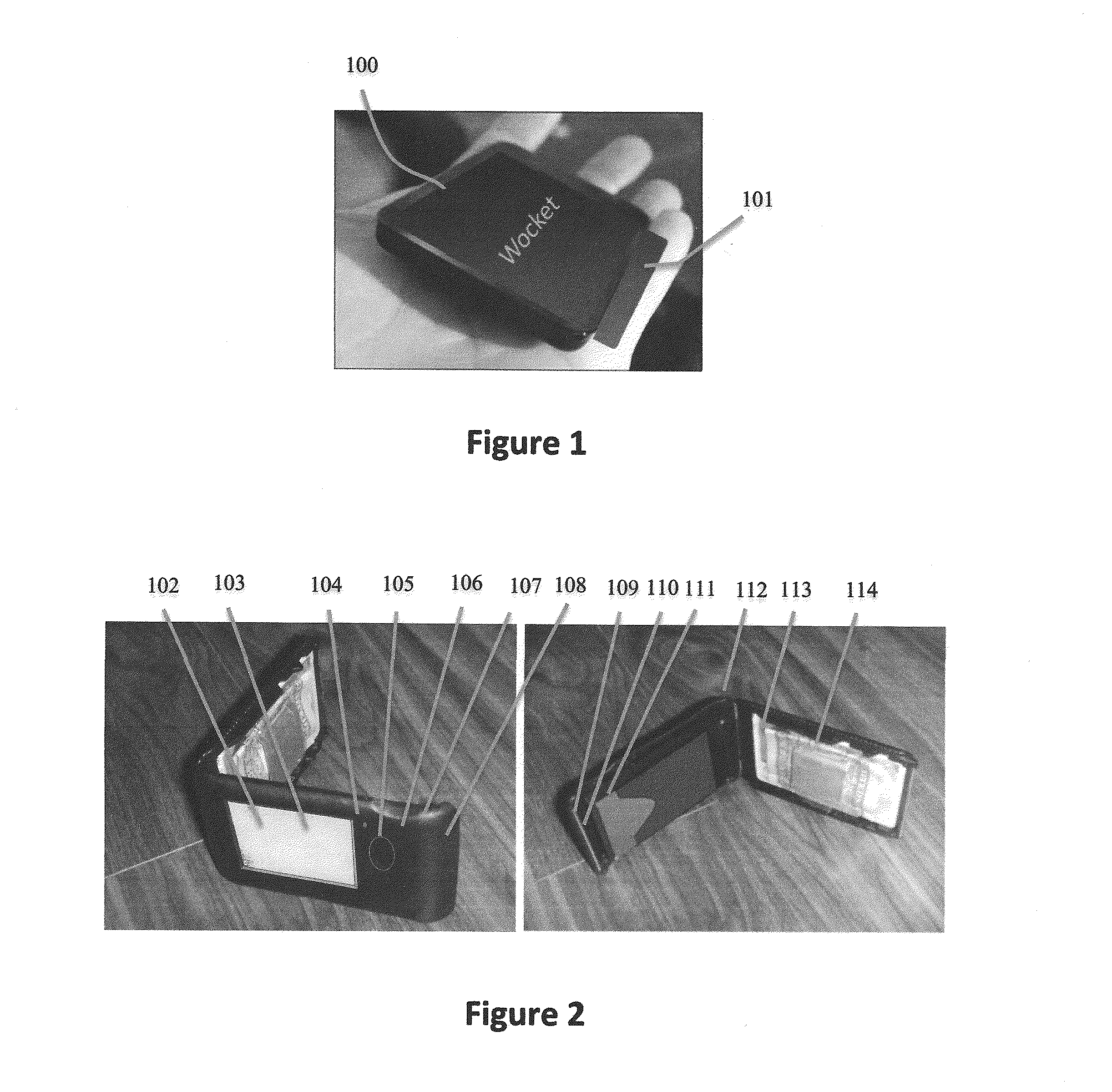

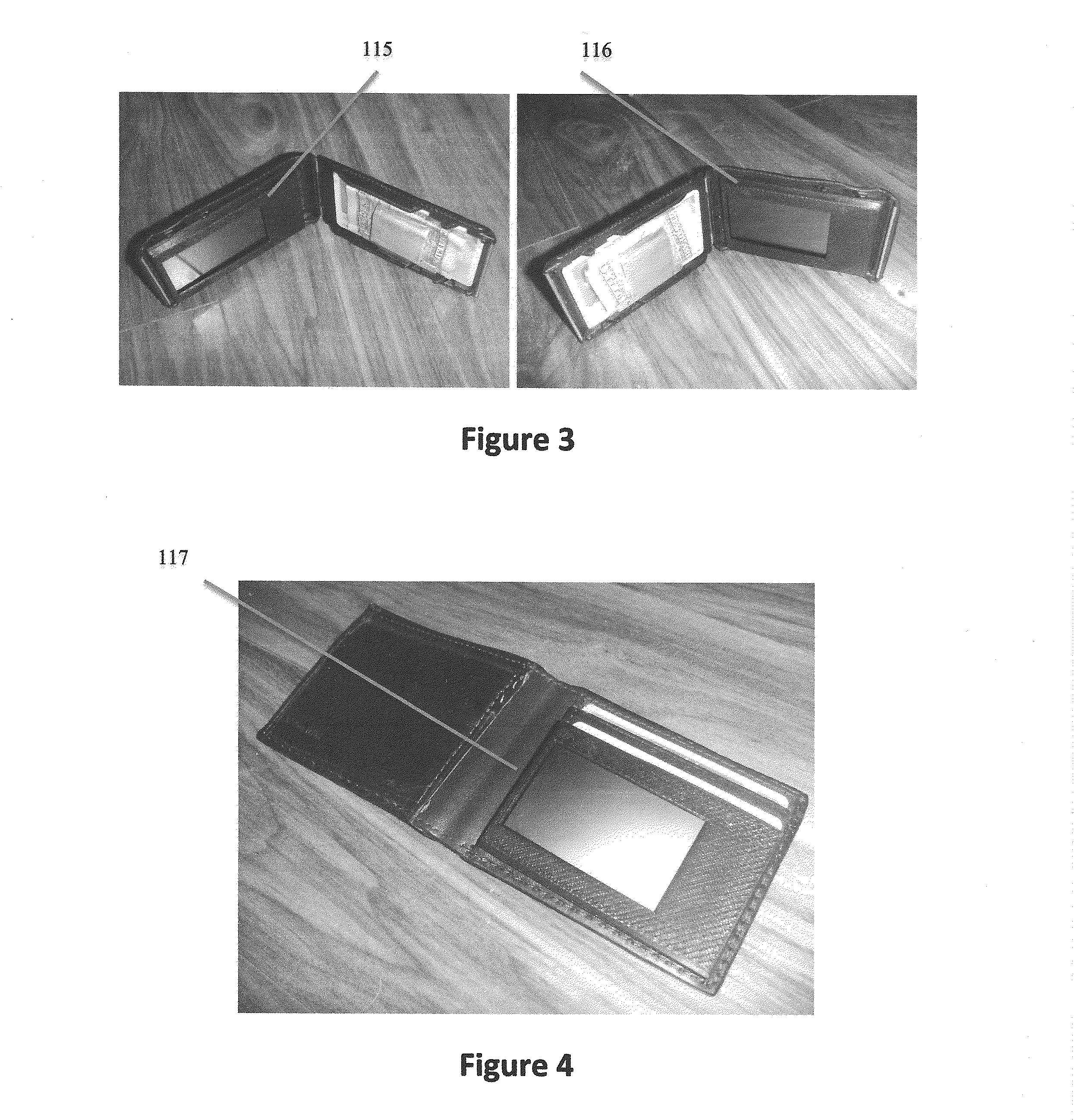

[0040]Before describing in detail the particular methods and apparatuses related to replacing traditional payment and identify management systems and components with methods and components that provide additional levels of security, it should be observed that the embodiments of the present invention reside primarily in a novel and non-obvious combination of elements and method steps. So as not to obscure the disclosure with details that will be readily apparent to those skilled in the art, certain conventional elements and steps have been presented with lesser detail, while the drawings and the specification describe in greater detail other elements and steps pertinent to understanding the embodiments. The presented embodiments are not intended to define limits as to the structures, elements or methods of the inventions, but only to provide exemplary constructions. The embodiments are permissive rather than mandatory and illustrative rather than exhaustive.

[0041]The present inventio...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com