System and method for automatic online verification of customer identity in financial industry

A technology of customer identity and financial industry, applied in finance, special data processing applications, instruments, etc., can solve problems such as customer dissatisfaction, practitioners who do not strictly follow the system, network congestion, etc., and achieve the effect of improving response speed

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

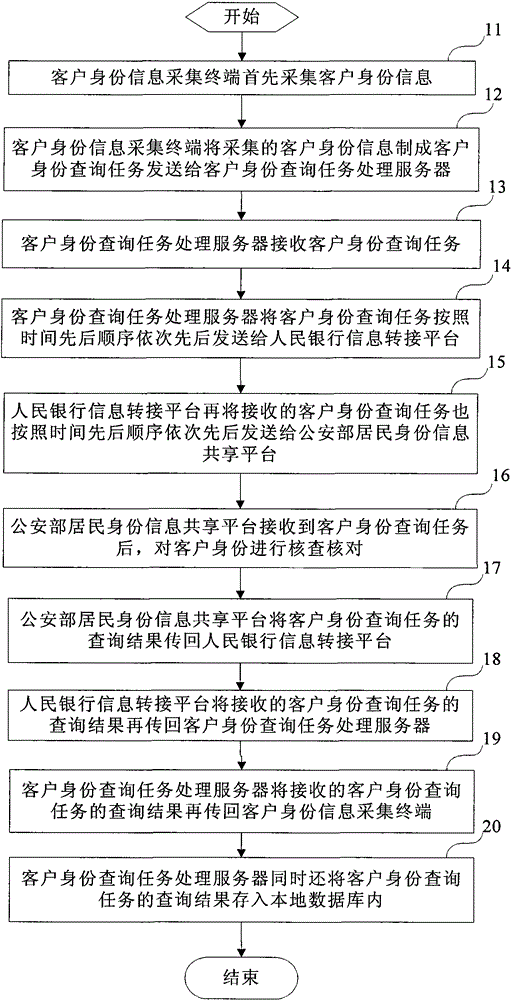

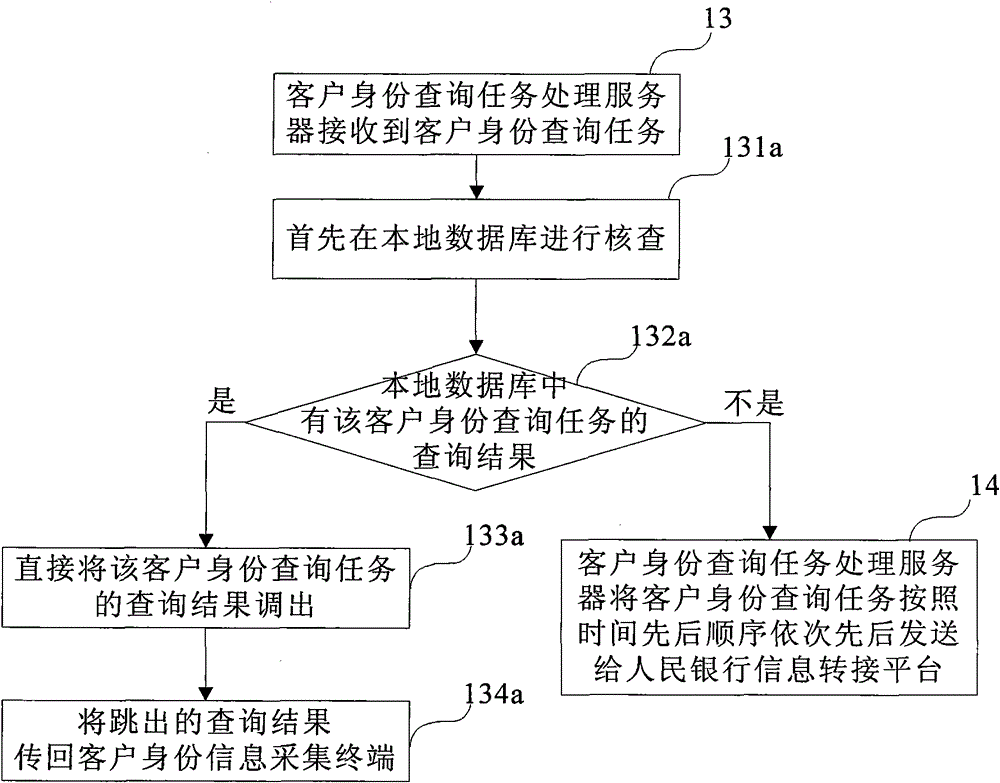

[0035] The present invention will be further described in detail below in conjunction with the accompanying drawings and embodiments.

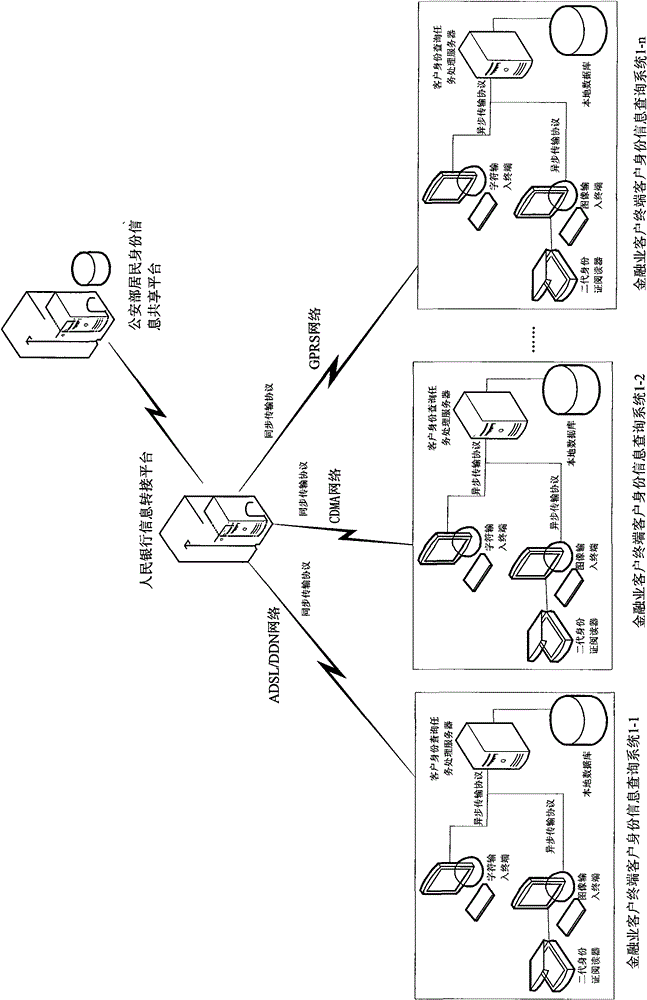

[0036] The present invention firstly provides a financial industry customer identity automatic network verification system, please refer to figure 1 shown, which includes

[0037] A plurality of financial industry client terminal client identity information query systems 1-1, 1-2...1-n, the financial industry client terminal client identity information query system includes a client identity information collection terminal, a client identity query task processing server, and a The local database connected to the identity query task processing server; the customer identity information collection terminal character input terminal and image input terminal, the character input terminal is mainly for the generation of ID cards, directly input the customer's name and ID card number, etc. through the character input terminal information, the image i...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com