Hierarchical clustering-based suspicious taxpayer detection method

A hierarchical clustering and taxpayer's technology, applied in structured data retrieval, instruments, electronic digital data processing, etc., can solve problems such as information asymmetry, difficult tax data, loss of tax revenue loss, etc., to achieve convenient and credible operation high degree of effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0014] The present invention is described in further detail below in conjunction with accompanying drawing:

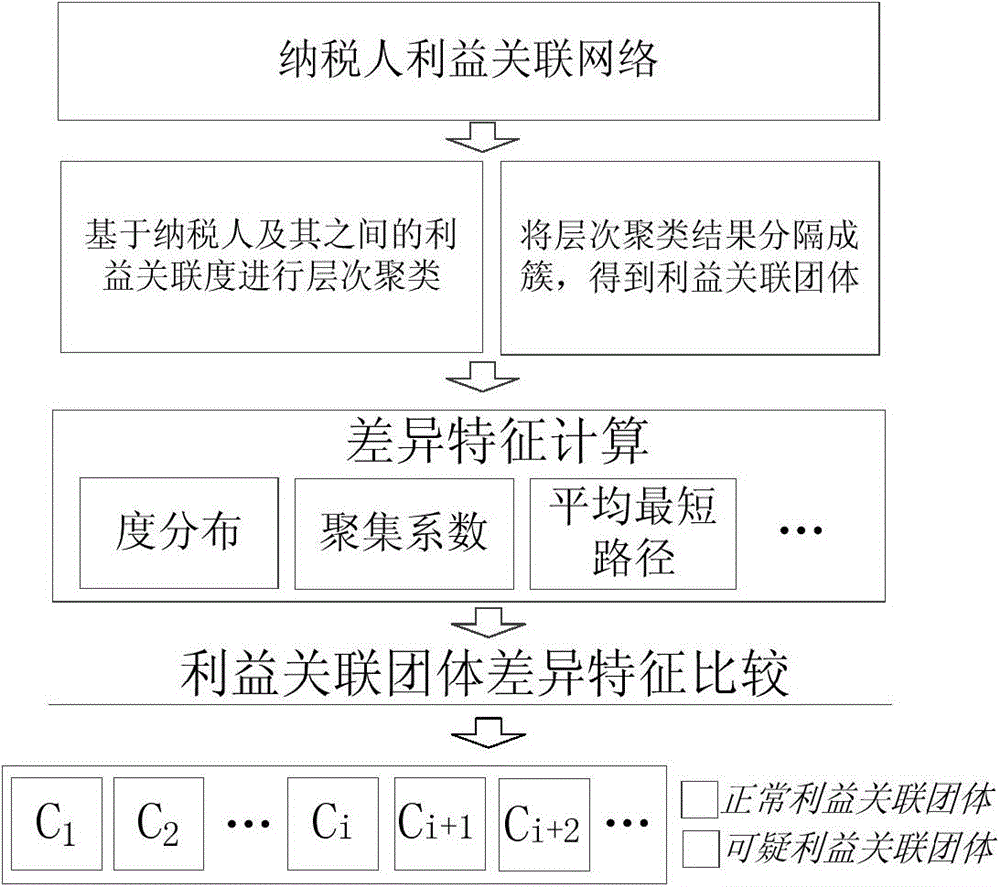

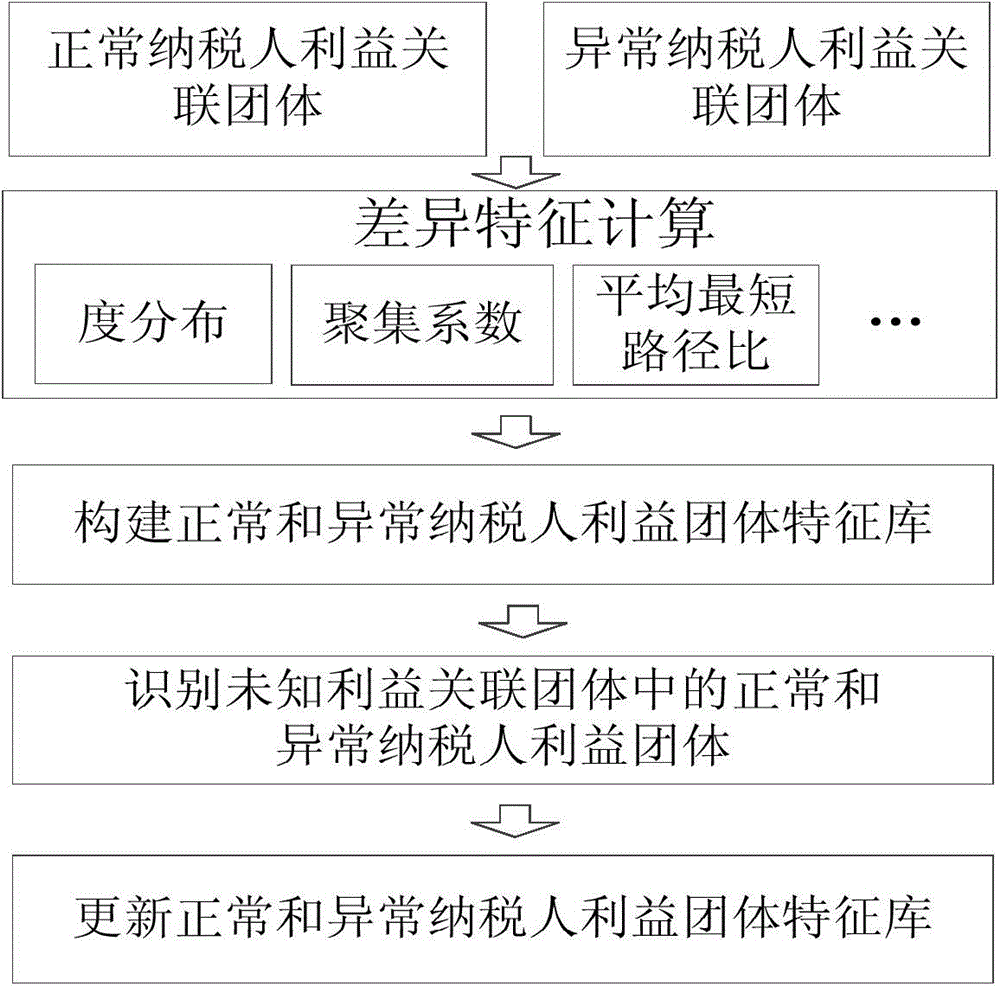

[0015] refer to figure 1 and figure 2 , the suspicious taxpayer detection method based on the hierarchical clustering of the reference graph of the present invention comprises the following steps:

[0016] 1) Obtain the taxpayer interest network, and extract the taxpayer corresponding to each node and the degree of interest association between any two taxpayers from the taxpayer interest network, and then use the hierarchical clustering algorithm to analyze the taxpayer and any two taxpayers. Hierarchical clustering is performed on the degree of interest association between people to form a binary tree, and then the binary tree is divided according to the degree of interest association between the taxpayer and any two taxpayers to obtain several clusters, wherein each hierarchical clustering is obtained All clusters are recorded as interest-related associations;

...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com