Bank dynamic credit monitoring system based on wireless sensing network and method

A technology of wireless sensor network and monitoring system, which is applied in the direction of program control, electrical program control and instruments in the sequence/logic controller, and can solve the problems of inaccurate credit rating collection data, unrecoverable loans, credit rating lag, etc. problems, to achieve the effect of reducing credit management costs, avoiding principal-agent problems, and facilitating timely processing

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

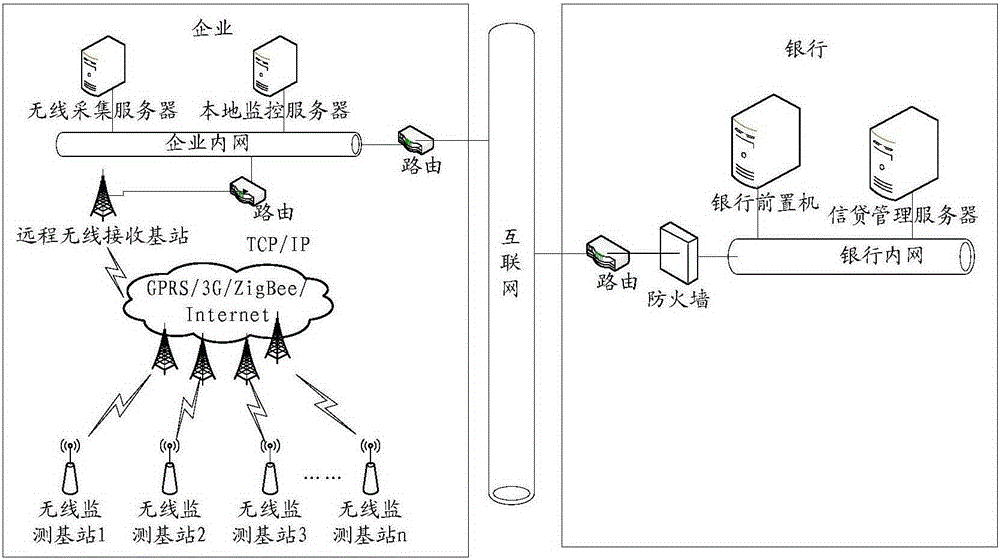

[0051] see Figure 1 to Figure 5 As shown, a kind of bank dynamic credit monitoring system based on wireless sensor network of the present invention comprises a plurality of wireless monitoring base stations, a wireless acquisition server, a truck scale controller, a local monitoring server, a bank front-end computer and a Credit management server; the plurality of wireless monitoring base stations are deployed in each enterprise, and the plurality of wireless monitoring base stations are all connected to the wireless collection server and the local monitoring server, and the local monitoring server is wirelessly connected to the bank front-end computer , the bank front-end computer is connected to the credit management server;

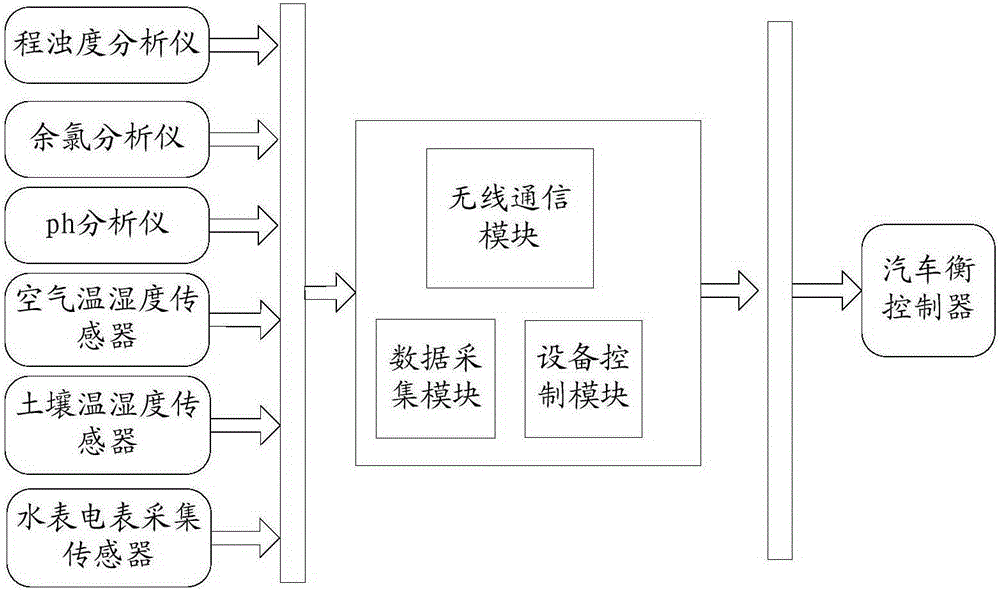

[0052] The wireless monitoring base station collects the plant growth data of the forestry enterprise, the water quality data of the aquaculture enterprise, and the data of the enterprise's water meter and electric meter respectively; the collected da...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com