Banknote inspection method during deposit and automatic deposit and withdrawal all-in-one machine

A technology of automatic deposit and withdrawal, all-in-one machine, applied in the verification of the authenticity of banknotes, devices and instruments for accepting coins, etc., can solve the problem of not being able to alarm or exit the system in time, affecting customer experience, and the ineffective identification of serial numbers. , to reduce the number of secondary banknote inspections, avoid malicious damage, and improve customer experience.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

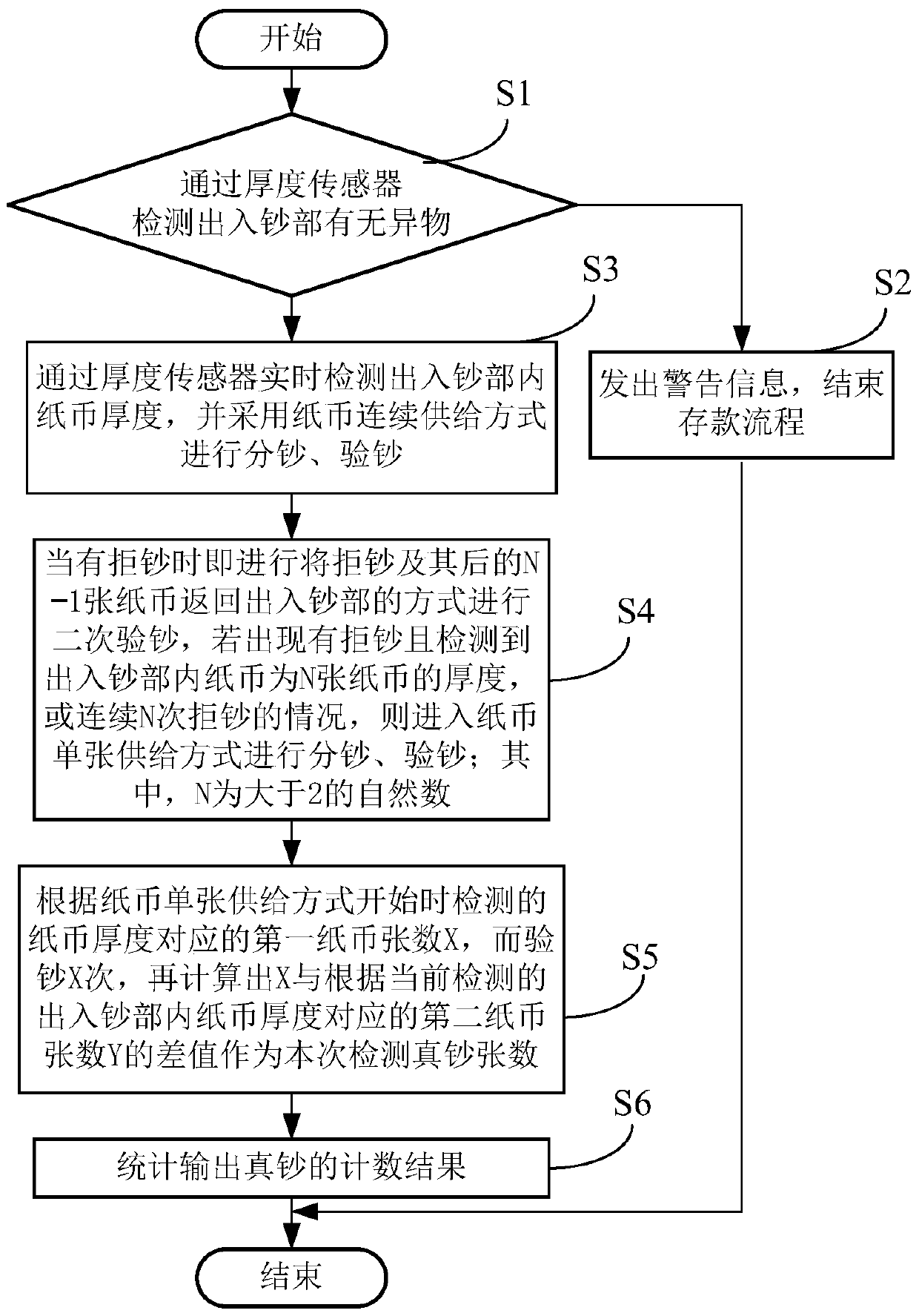

[0049]Embodiment 1. Assuming that only one rejected banknote is found in a check of banknotes (one for two), the thickness sensor 21 in the deposit and withdrawal unit 20 can detect that the thickness of the remaining banknotes is the thickness of 3 banknotes, that is, the remaining When there are 3 banknotes, the single-sheet supply method is used to separate and check banknotes. Of course, those skilled in the art can understand that the confirmation method of the remaining three banknotes can also be calculated from the quantitative relationship between the total number of banknotes inspected, the number of banknotes passed through the banknote inspection, and the number of banknotes in the transmission channel 10 . This embodiment is compared to the traditional way of obtaining and saving the identification information of the first rejected banknote when the banknote is rejected for the first time, and then finding that the identification information of the current rejected...

Embodiment 2

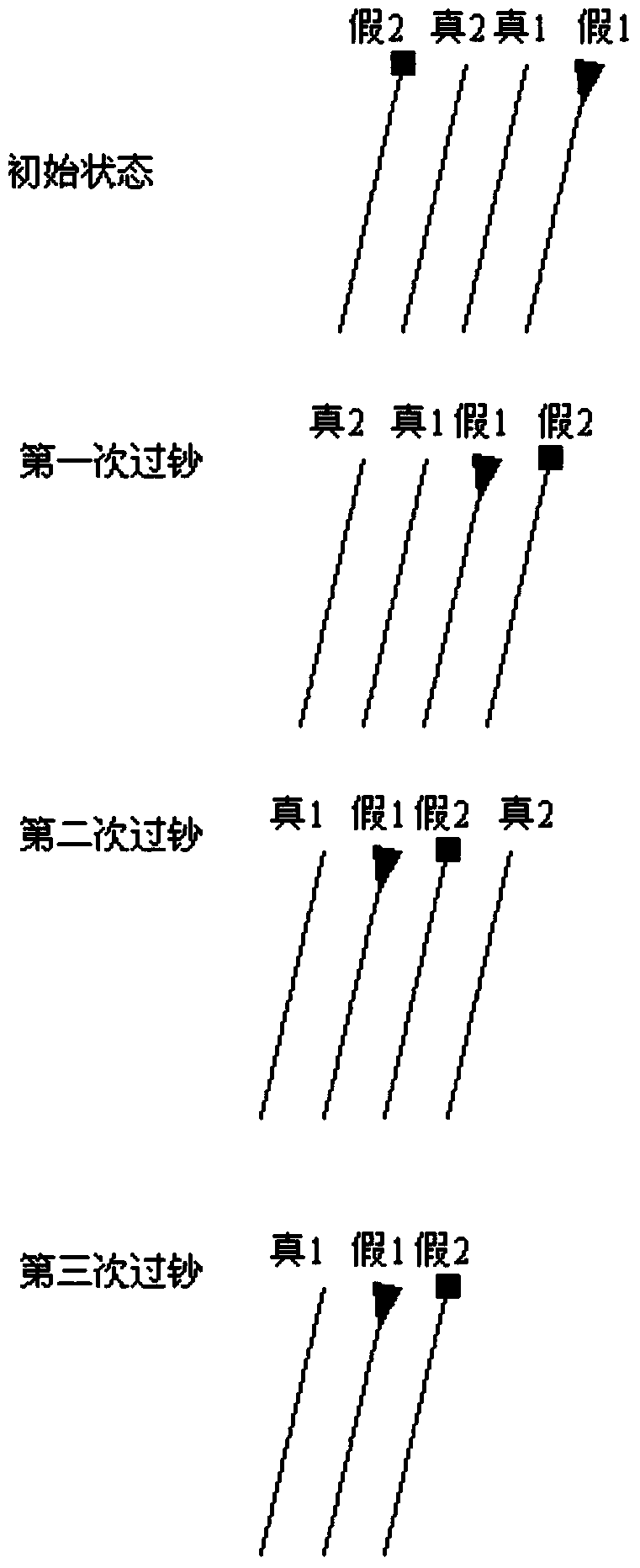

[0050] Embodiment 2, if complex counterfeit banknotes occur in sequence, more time is saved. For example, press image 3 The initial state of the banknotes shown is "false 2, true 2, true 1, false 1". The first three banknotes, namely "false 1, true 1, "True 2" is divided in turn and returned to the banknote deposit and withdrawal department 20. Similarly, when passing banknotes for the second time, "false 2, false 1, and true 1" will be divided in turn and returned to the banknote deposit and withdrawal department 20. Before passing banknotes for the third time, The sequence becomes "True 1, False 1, False 2, True 2". When passing banknotes for the third time, True 2 will be checked and stored in the temporary storage unit 40. If the condition of the thickness is not satisfied, the banknote separation and banknote inspection are carried out in the form of sheet supply. Compared with the traditional method, after the banknote rejection occurs, serial number recognition is no...

Embodiment 3

[0051] Embodiment 3, if according to the traditional banknote checking method, according to the characteristics of one dragging two, the situation that will fall into the endless loop of repeated banknote checking includes: the remaining at least three counterfeit banknotes are arranged in order "fake 1, fake 2, fake 3" (at least Including more than three counterfeit notes in a row and after three counterfeit notes in a row and detected as genuine, etc.), or the remaining banknotes are arranged as "True, True, False 1, True, True, False 2, True, True, false 3, true, true", and adopt the embodiment of the present invention, just there will be the situation of rejecting banknotes 3 times in a row, then enter the banknote single supply mode to carry out banknote separation and banknote detection.

[0052] To sum up, the embodiments of the present invention have at least the following beneficial effects.

[0053] 1. Early detection of foreign objects put into the cash-in / out unit...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com