Recommending system and method for guiding customer to handle banking business based on big data prediction

A banking business and recommendation system technology, applied in data processing applications, transmission systems, instruments, etc., can solve problems such as low queuing efficiency, unexplained, and inability to accurately identify important customers and general customers, and achieve high efficiency, low cost, and The effect of precision marketing

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

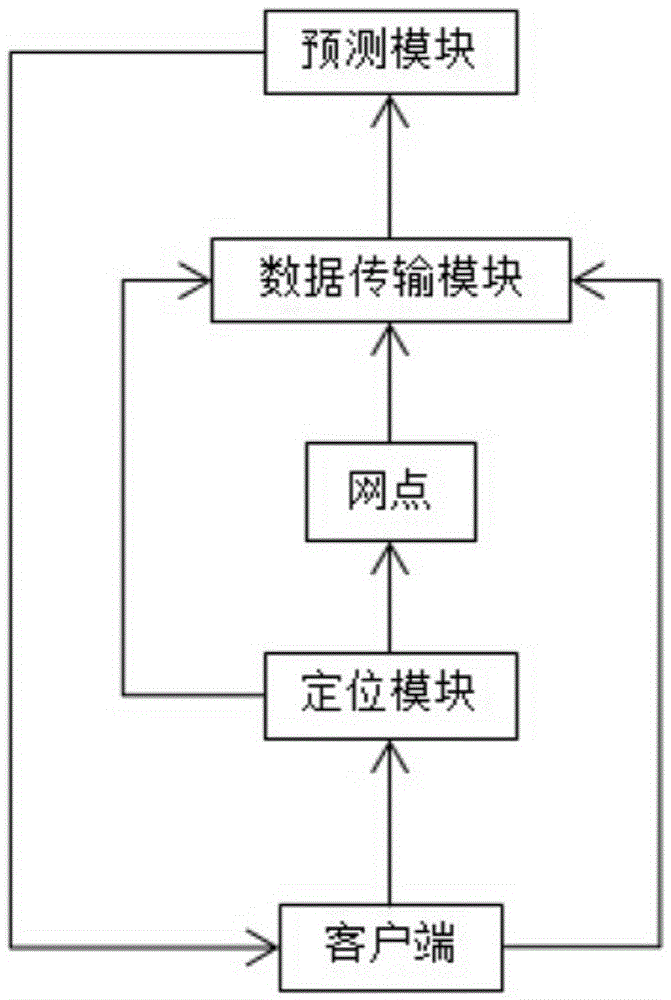

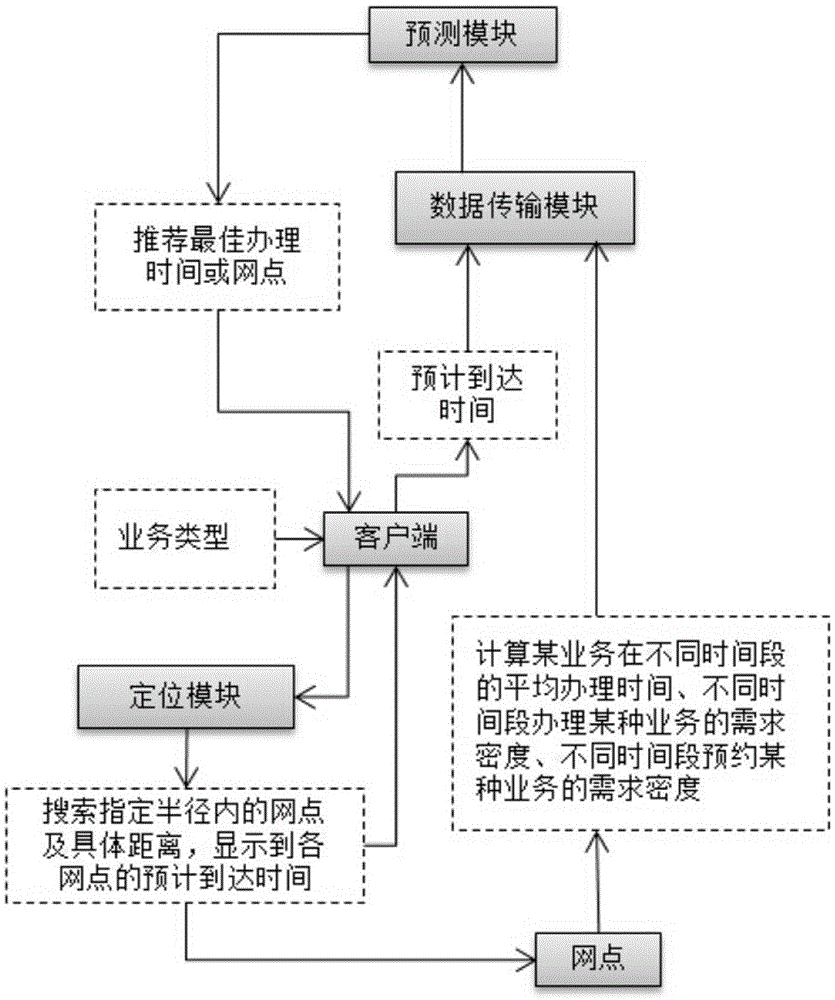

[0047] See figure 1 , a recommendation system based on big data prediction to guide customers to handle banking business, including: client, positioning module, outlet, data transmission module and prediction module.

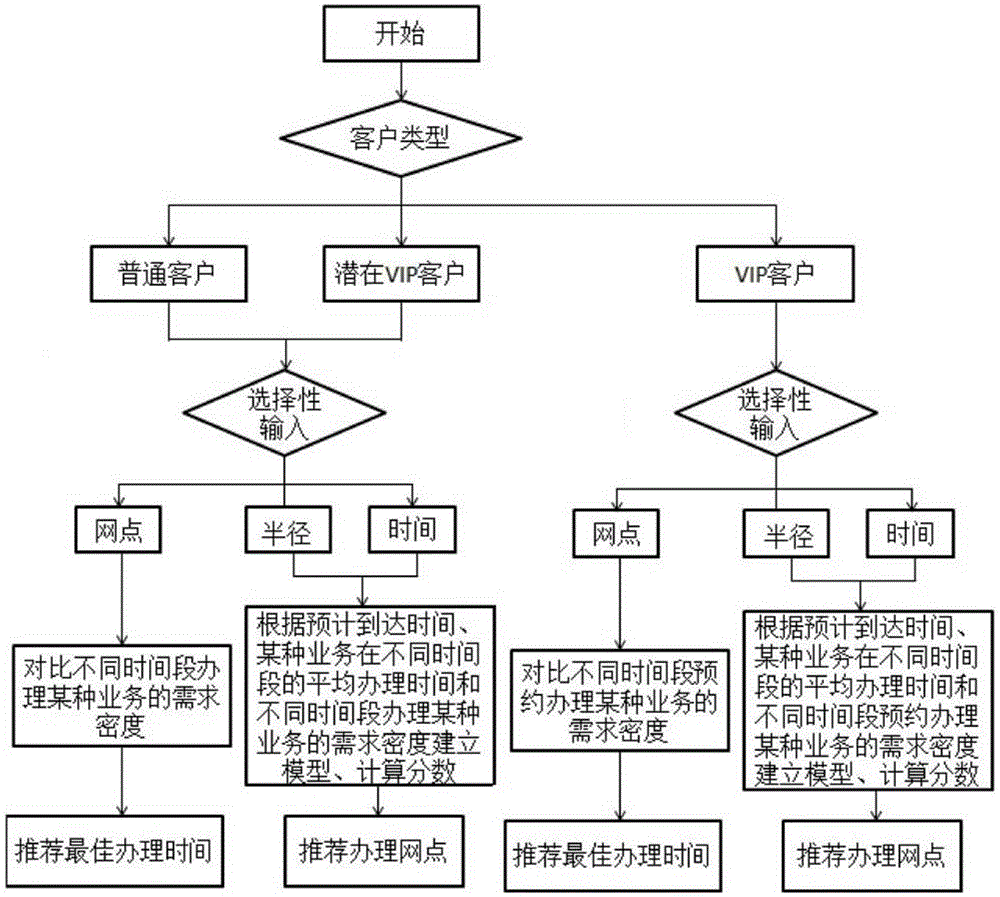

[0048] The customer enters the user name, card number, password, the type of business that needs to be handled, and optionally enters the radius, outlet or time of the business on the client terminal. Based on the credit investigation data, customers are profiled and classified into categories including ordinary customers, potential VIP customers and VIP customers.

[0049] The positioning module obtains the location information of the client user through the radio communication network (GSM network, CDMA network) of the telecom mobile operator or an external positioning method (such as GPS, etc.). After the customer authorizes the location information, it searches the outlets within the specified radius by locating the customer's current location and displays ...

Embodiment 2

[0070] Implementation object: ordinary customers.

[0071] Hypothetical conditions: At 9:45 in the morning, the customer Mr. Zhang wants to apply for personal housing loan business, and Mr. Zhang has authorized the opening of the function that the client can access the current location.

[0072] Mr. Zhang entered the user name, card number, and password on the client terminal, and optionally entered a radius of 3km. After successful login, select "personal housing loan business" in the type of business that needs to be handled.

[0073] The client makes customer portraits based on the customer's input information and personal credit information: It is known that the balance of Mr. Zhang's card in the past three months is less than 200,000, and the credit information shows that Mr. Zhang also has loans in other banks , the result of the customer profile is an ordinary customer.

[0074] After the authorization, the positioning module locates the current location of Mr. Zhang ...

Embodiment 3

[0083] Implementation object: VIP customers

[0084] Assumptions: Customer Ms. Li wants to be in B 1 The branch handles the business of consulting bank wealth management products, and Ms. Li has authorized the opening of the client to access the current location function.

[0085] Ms. Li entered the user name, card number, and password on the client terminal, and optionally entered B 1 outlets. After successful login, select "Consultation on Wealth Management Products" in the type of business that needs to be handled.

[0086] The client profile is based on the customer’s input information and personal credit information: It is known that the balance of Ms. Li’s card in the past three months has been more than 5 million, and the credit information shows that Ms. Li is a shareholder of a listed company , the customer portrait result is a VIP customer.

[0087] After authorization, the positioning module locates Ms. Li's current location and searches for B 1 outlets, the di...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com