Authentication and authorization method, tax-related business platform and related device

A business platform, authentication and authorization technology, applied in the field of data processing, can solve problems such as inability to flexibly apply to various scenarios of third-party tax-related systems, interception, authorization failure, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

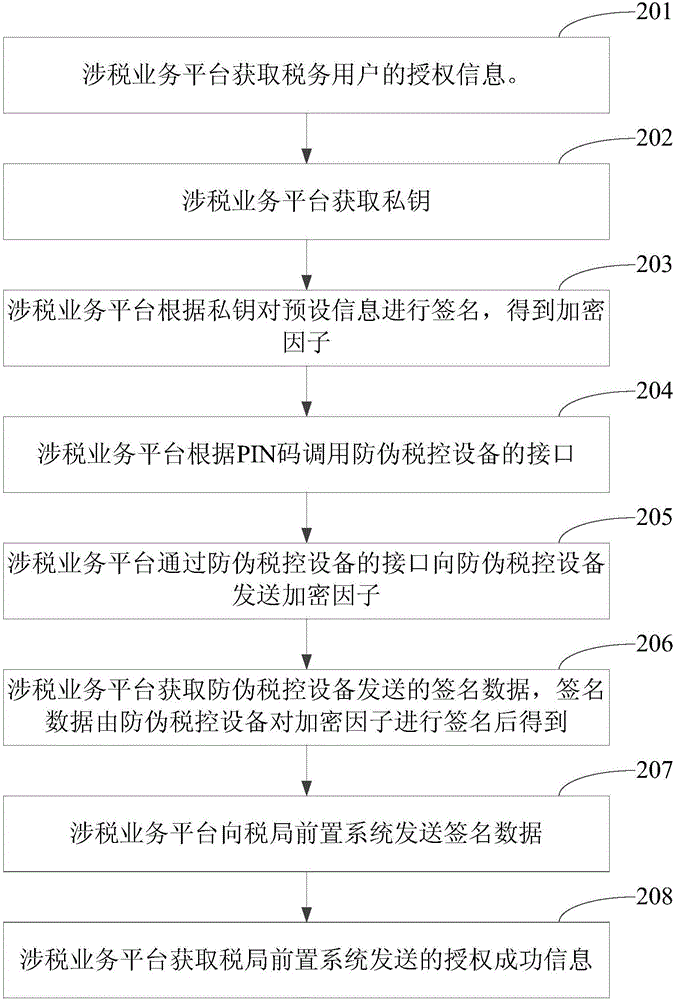

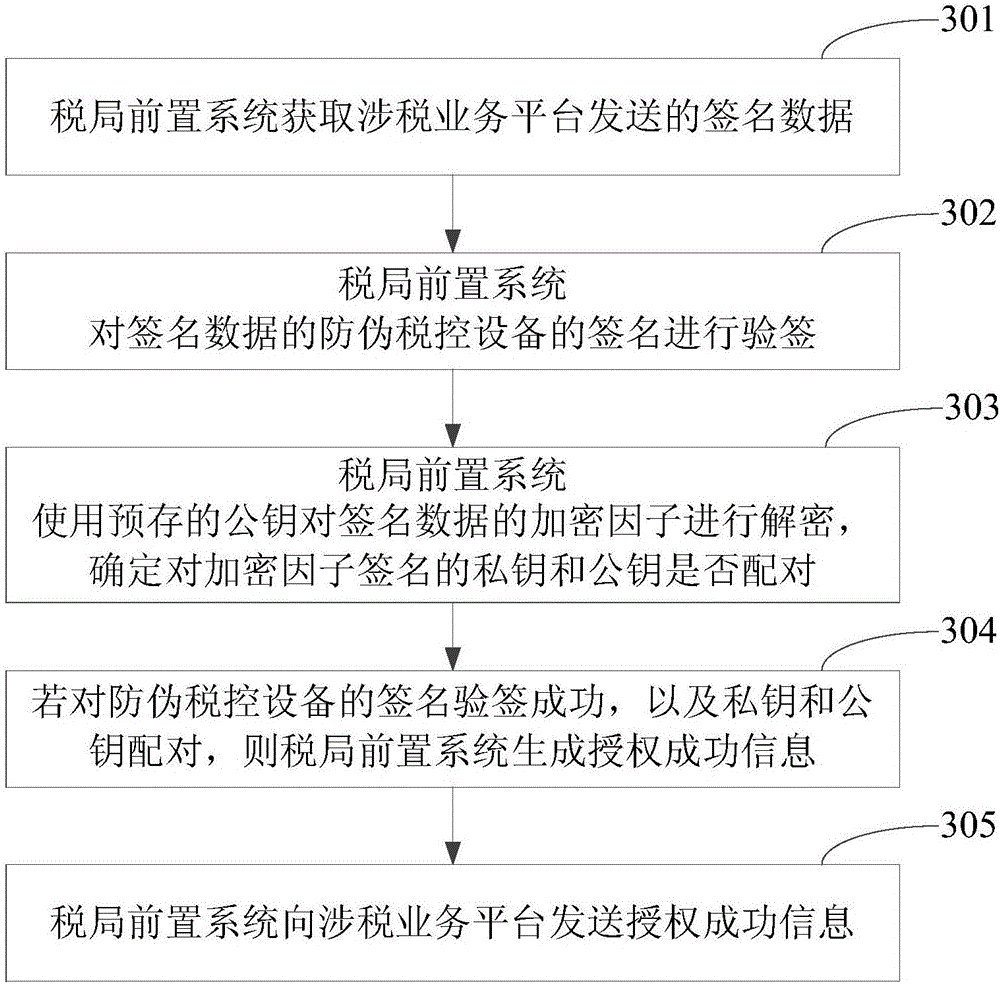

[0073] Embodiments of the present invention provide an authentication and authorization method, a tax-related business platform, a tax bureau front-end system, anti-counterfeit tax control equipment, and a tax-related system, which are used to improve the reliability and effectiveness of authentication and authorization inspections.

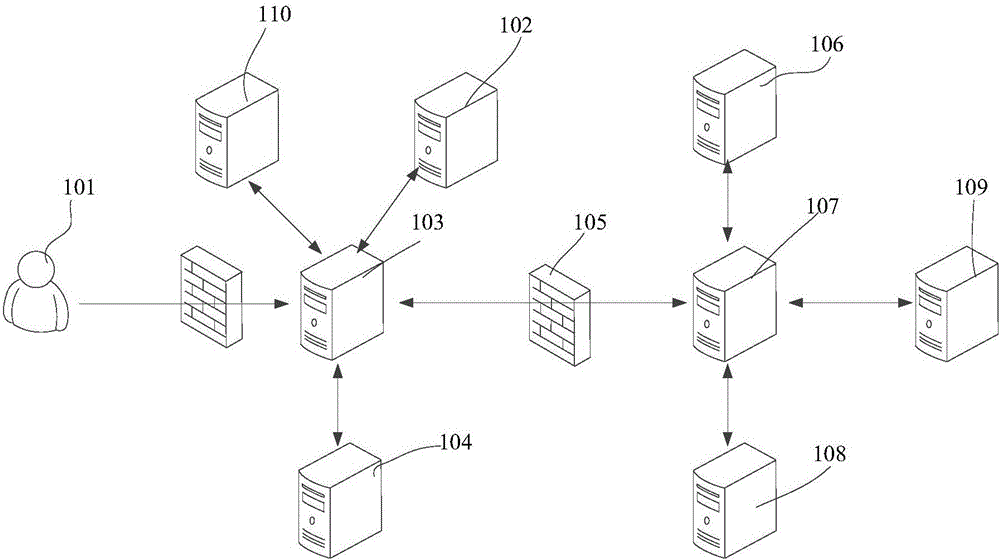

[0074] figure 1 A network architecture diagram involved in an authentication and authorization method provided for an embodiment of the present invention, which includes a tax-related business platform 103, an anti-counterfeiting tax control device 110, and a front-end tax bureau system 107, wherein

[0075] The tax-related business platform 103 can handle tax-related business on behalf of the tax user after obtaining authorization from the tax user. The tax-related business platform 103 includes a user authentication and authorization system 104 and a data storage system 102 .

[0076] The anti-counterfeiting tax control device 110 can be used f...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com