Credit card collection and repayment method and apparatus

A technology for credit cards and related information, applied in the field of data processing, can solve the problems of high labor cost, low collection efficiency, and many manual interventions, and achieve the effect of saving labor costs and improving collection efficiency.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

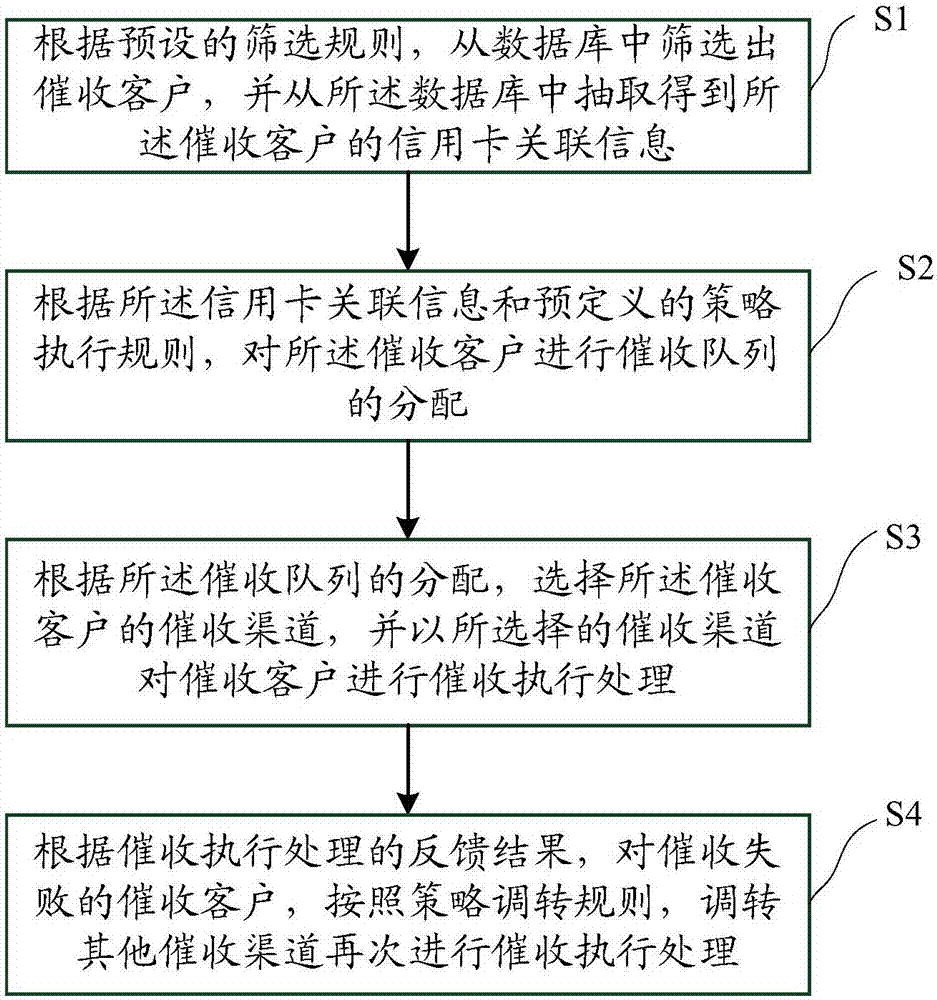

[0021] figure 1 It is a schematic flow chart of a method for credit card collection and repayment according to an embodiment of the present invention; refer to figure 1 , the method includes:

[0022] Step S1, according to the preset screening rules, screen out the collection customers from the database, and extract the credit card related information of the collection customers from the database;

[0023] Step S2, according to the credit card associated information and predefined policy execution rules, assign the collection queue to the collection customer;

[0024] Step S3, according to the allocation of the collection queue, select the collection channel of the collection customer, and perform collection execution processing on the collection customer through the selected collection channel;

[0025] Step S4, according to the feedback result of the collection execution processing, for the collection collection customers who fail to collect collection, transfer to other c...

Embodiment 2

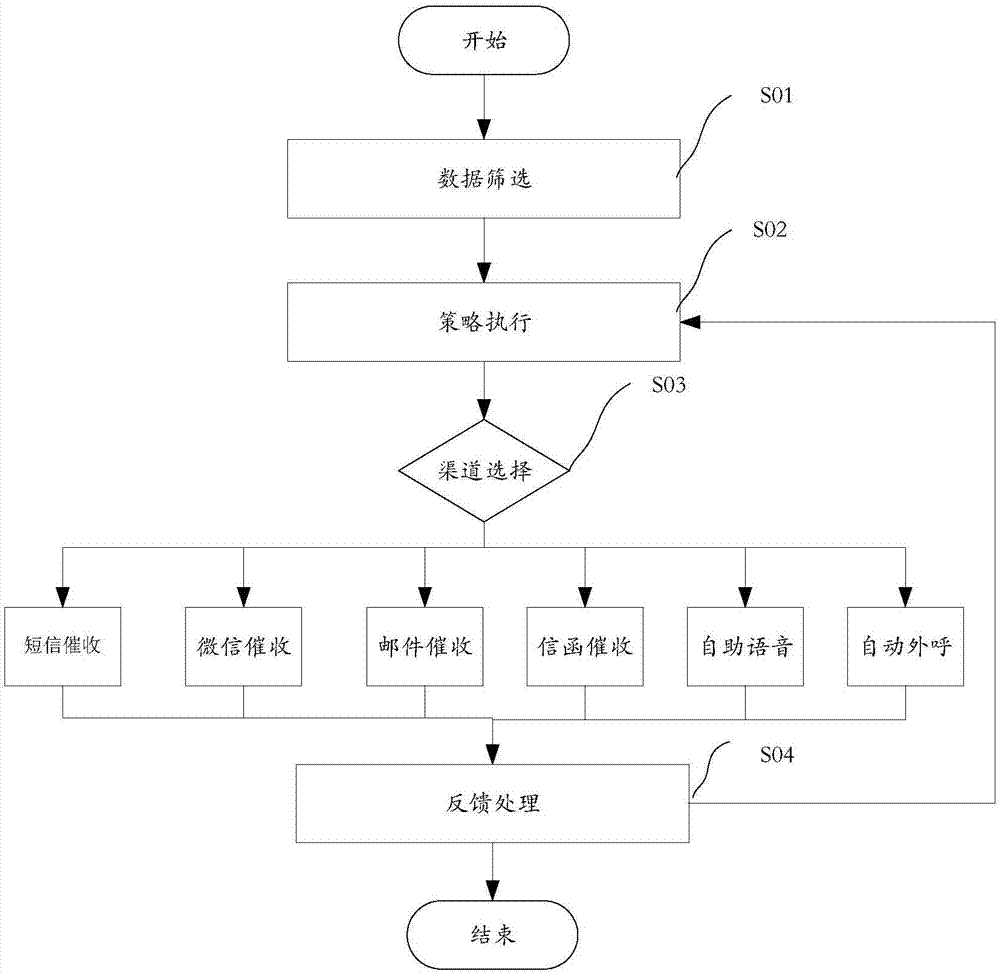

[0028] figure 2 It is a schematic flowchart of a method for credit card collection and repayment according to another embodiment of the present invention; in another embodiment of the present invention, the method includes:

[0029] Step S01, according to the preset screening rules, screen out the collection customers from the database, and extract the credit card related information of the collection customers from the database; wherein, according to the preset screening rules, screen out the collection customers Including: screen out customers who are overdue on the bill date, customers who have not paid the minimum repayment amount from the last repayment date to the next bill date (M0 customers), and repayment reminders to customers with insufficient account balance (full amount / minimum bill amount) that are not overdue Clients and Risk Scouting Indicators are Yes clients.

[0030] Step S02, according to the credit card related information and predefined policy execution...

Embodiment 3

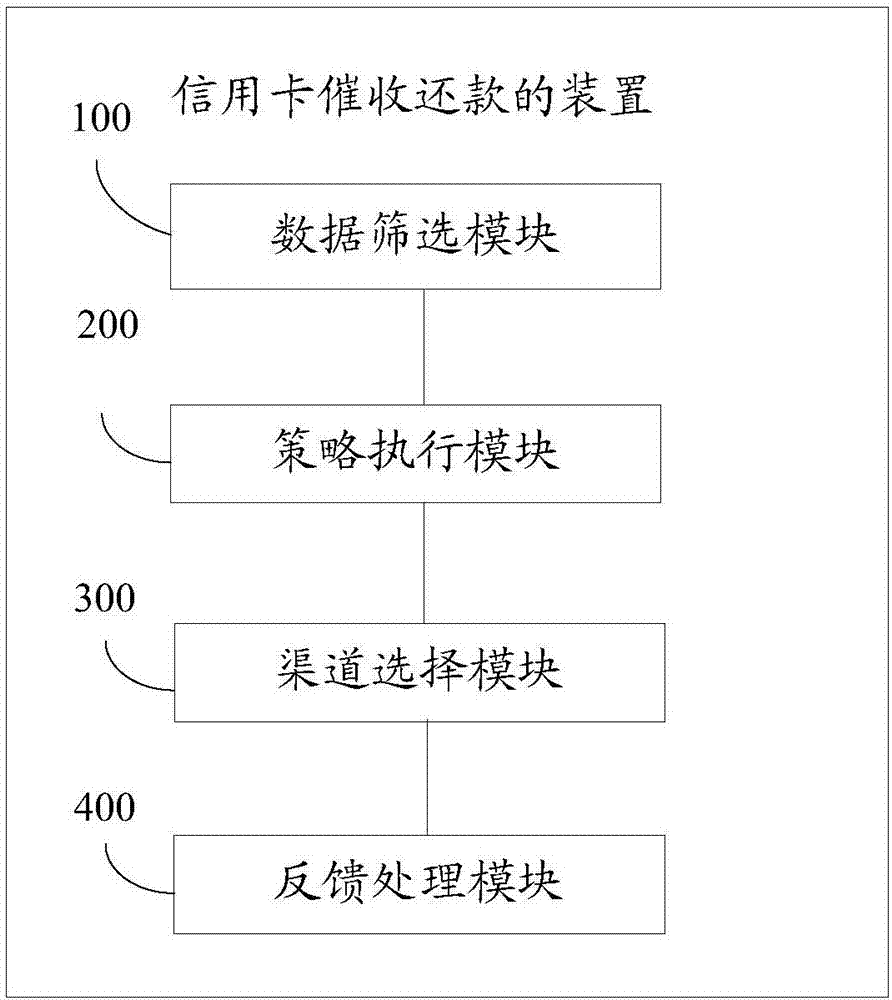

[0036] image 3 A structure diagram of a credit card collection and repayment device according to an embodiment of the present invention. see image 3 , the device includes:

[0037] The data screening module 100 is configured to screen out collection customers from the database according to preset screening rules, and extract credit card related information of the collection customers from the database; wherein, according to the preset screening rules, Screening out customers for collection includes: screening out customers who are overdue on the bill date, customers who have not paid the minimum repayment amount from the last repayment date to the next bill day (M0 customers), repayment reminding customers that the account balance is insufficient (full amount / minimum bill amount ) of non-overdue customers and customers whose risk detection indicator is Yes.

[0038]The policy execution module 200 is configured to assign the collection queue to the collection customer acco...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com