Method for identifying default risks of P2P network lending borrowers

A P2P network and borrower technology, applied in the field of information security, can solve problems such as low accuracy of default identification and difficult analysis, and achieve the effects of improving overall adaptability, high identification accuracy, and increased accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0031] The specific implementation manners of the present invention will be described below in conjunction with the accompanying drawings.

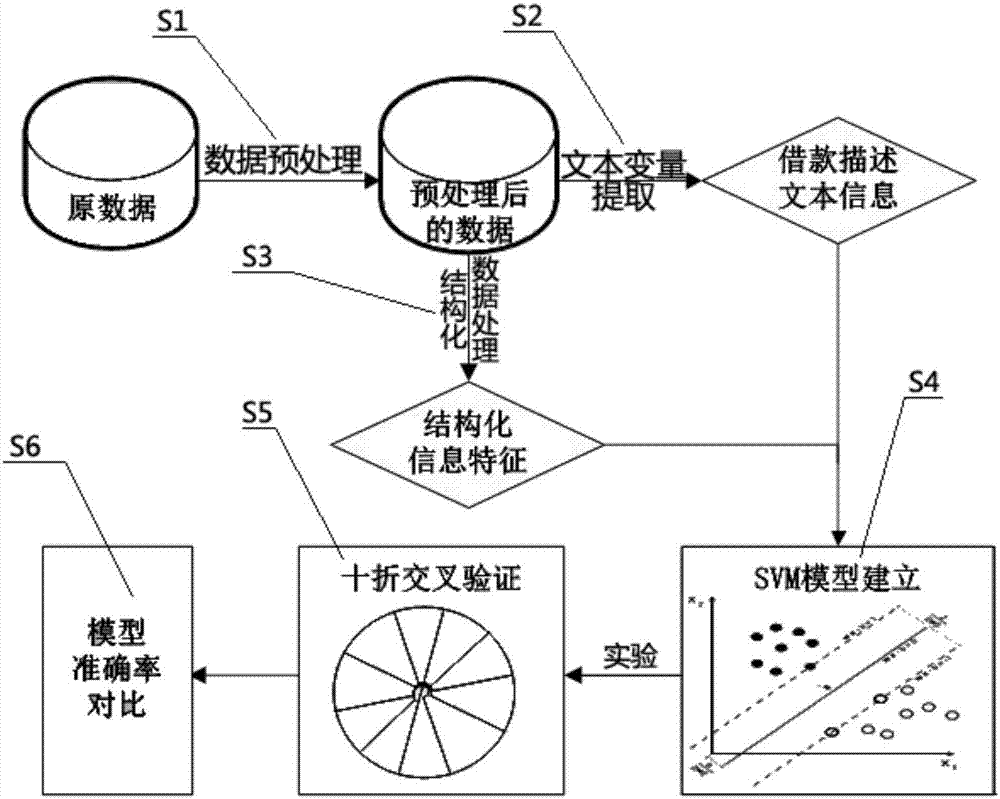

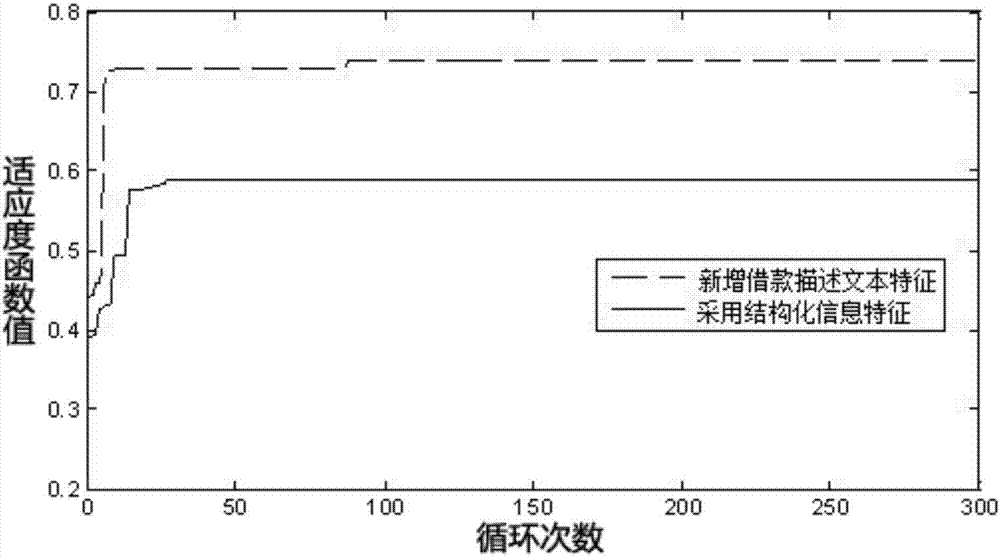

[0032] For the Internet lending industry where the information asymmetry problem is particularly serious, the current borrower default risk identification method based on the objective basic data of the borrower is difficult to play a good analytical role. The text mining-based default risk identification method proposed by the present invention is relatively The existing default risk identification algorithm based on the objective basic data of the borrower has a higher accuracy rate. The specific borrower default risk identification process is as follows: figure 1 shown.

[0033] Step S1, using a web crawler tool to collect all loan application data from the Renrendai platform (http: / / renrendai.com) during the two-year period from January 2013 to January 2015, a total of 493,888 loan applications. The invention divides the crawled loa...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com