A group fraud identification system based on knowledge map

A technology of identification system and knowledge map, applied in the field of group fraud identification system, can solve problems such as stay and deep mining of gang cases without in-depth research, and achieve the effect of improving effectiveness and avoiding damage

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

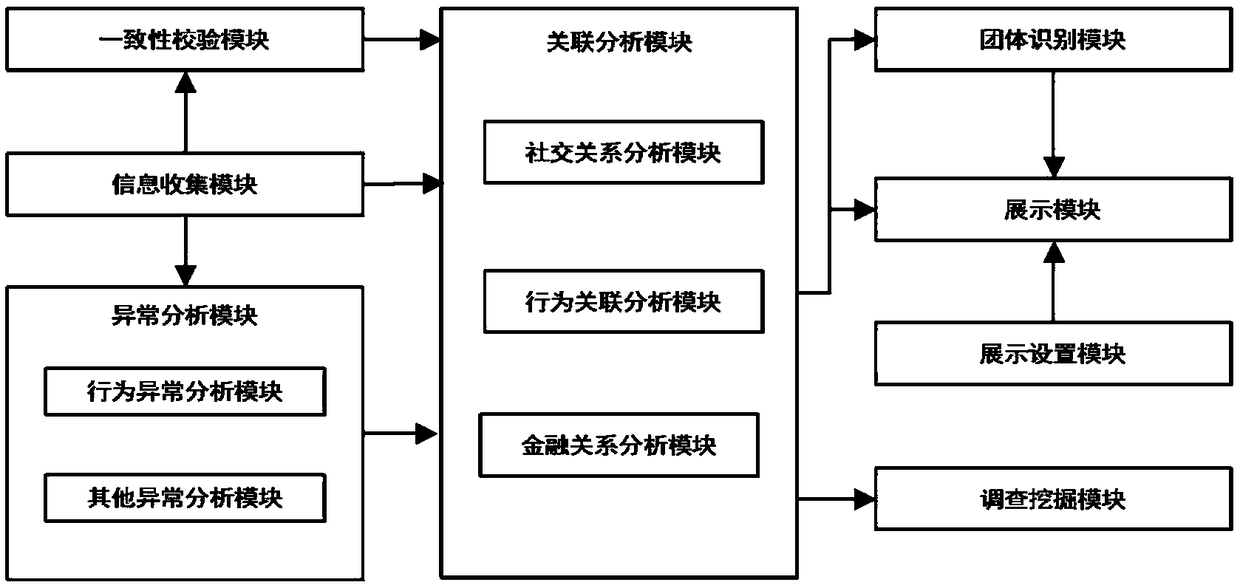

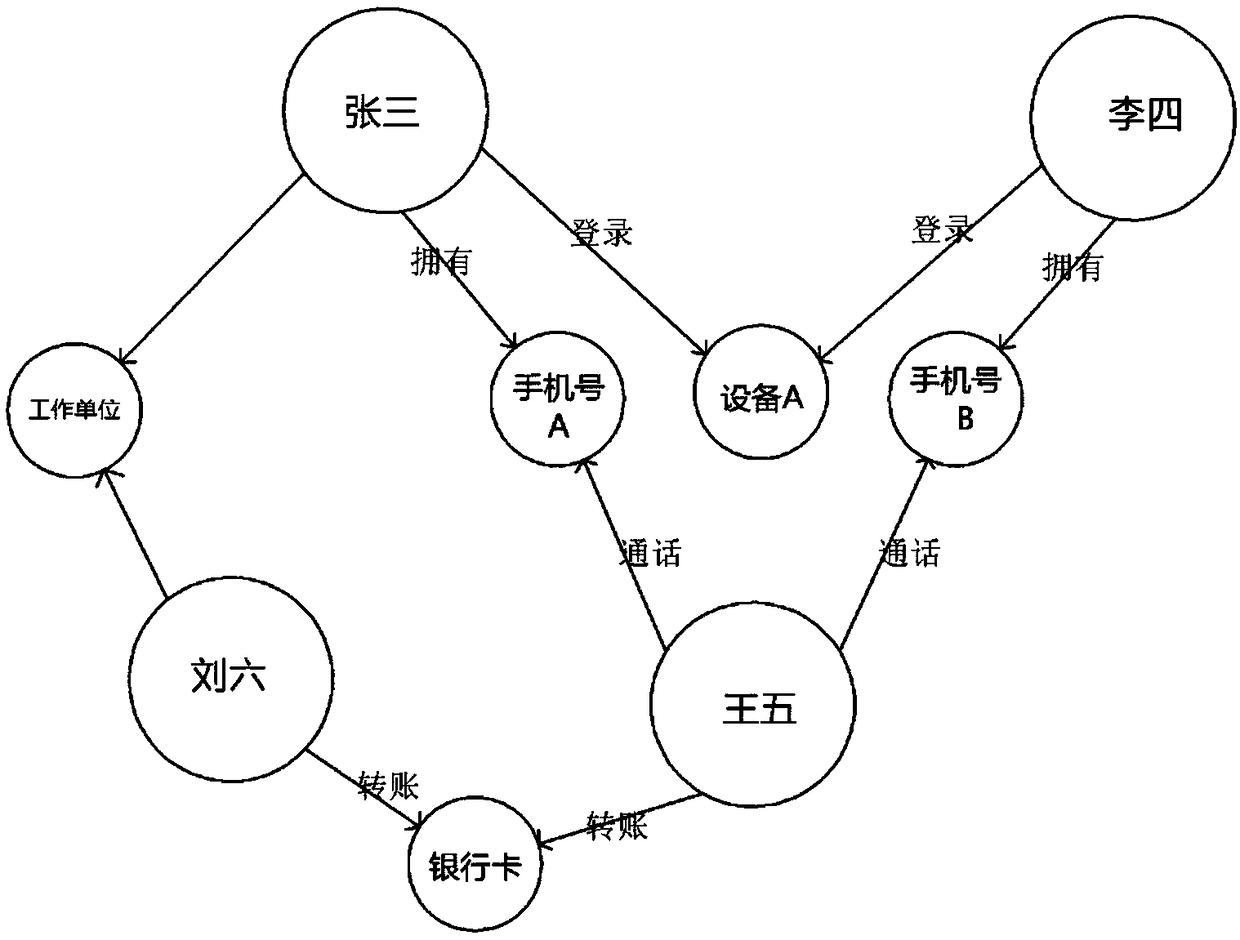

[0026] Such as figure 1 As shown, a group fraud identification system based on knowledge graph in this embodiment includes an information collection module, an abnormal analysis module, an association analysis module, a group identification module, a display module, a display setting module, and a survey mining module, wherein:

[0027] The information collection module is used to collect personal information of borrowers. Personal information includes basic information, behavior information and third-party data. Basic information includes structured data, semi-structured data and unstructured data. Structured data includes customer ID numbers , basic data such as device fingerprints, mobile phone numbers, home addresses, residential addresses, and contact information, as well as bank account and loan data, etc.;

[0028] Semi-structured data includes customer communication information, customer online banking information, customer social security information, customer provide...

Embodiment 2

[0046] The difference between this embodiment and Embodiment 1 is that the information collection module in this embodiment also includes a contact verification module, and the contact verification module is used to send a verification message to the corresponding contact when the user fills in the contact information. The contact verification module is also used to obtain the location information of the corresponding contact through a third-party interface, and the contact verification module is used to compare the location information of the borrower with the location information of the contact, and determine whether the borrower is related to the corresponding contact. Whether the distance is less than the preset value, which is 10 meters in this embodiment, and the contact verification module is used to determine that the contact is invalid after detecting that the distance between the borrower and the corresponding contact has been less than 10 meters in the last three days...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com