Bank internet credit risk control method for small and micro enterprises

An Internet and enterprise technology, applied in the field of Internet finance, can solve problems such as restricting the development of financing risk control business, non-standard reports, and difficult credit levels, and achieve the effect of increasing the number of concurrent approvals, improving marketing conversion rates, and reducing human waste

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0013] The purpose of the present invention is to provide a bank Internet credit risk control method for small and micro enterprises that can realize credit verification before lending, intelligent approval during lending, and risk warning after lending.

[0014] In order to deepen the understanding of the present invention, the present invention will be described in further detail below in conjunction with examples, which are only used to explain the present invention and do not limit the protection scope of the present invention.

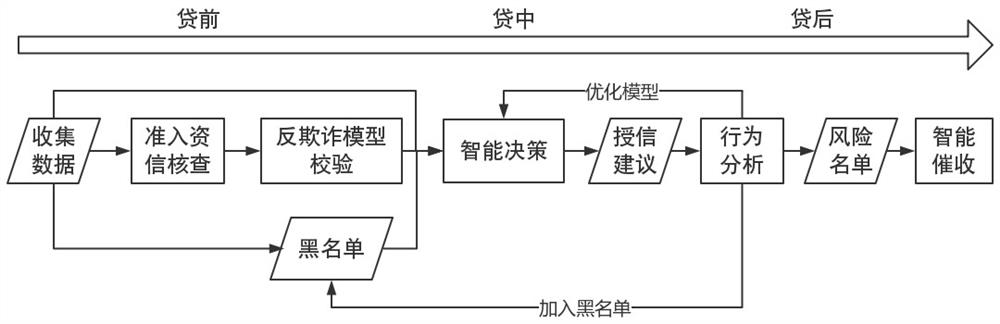

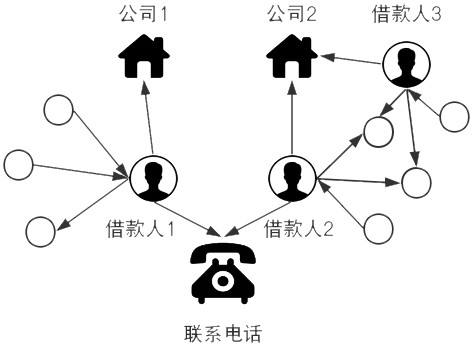

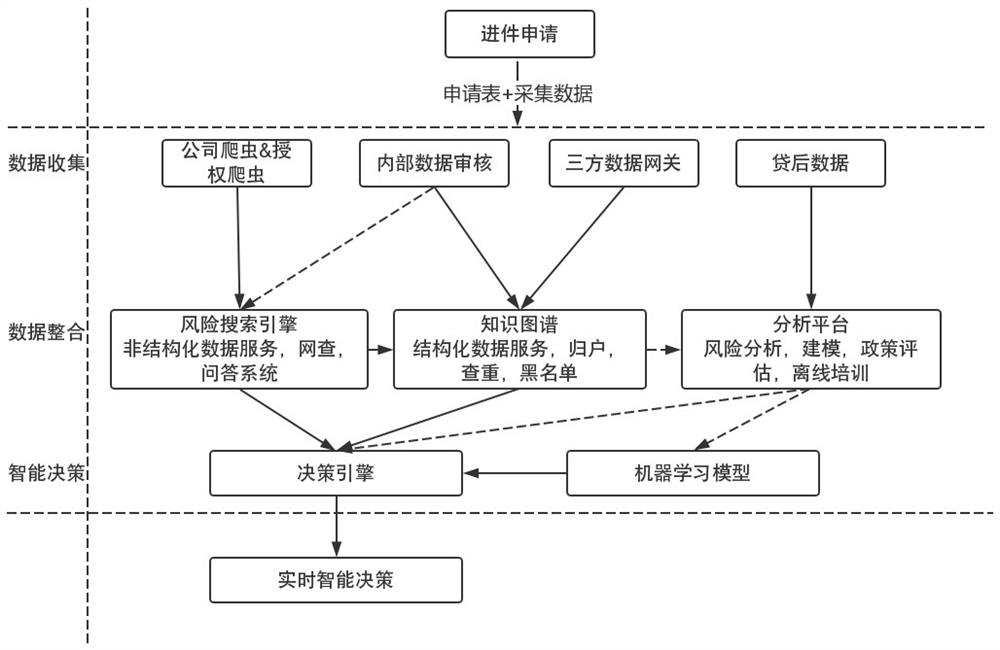

[0015] like figure 1 As shown, the bank Internet credit risk control method for small and micro enterprises, around the intelligent decision-making model, provides access verification decision-making for credit verification before lending; provides data support for intelligent approval during lending, and anti-fraud model verification; Provide risk list analysis and decision-making for post-loan risk early warning; and customer behavior and third-...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com