Device for on-site payment and on-site payment method

An on-site, payee's technology, applied in the fields of electronic wearable devices, ciphers, and electronic payment, can solve the problem of not being able to connect to the third-party payment platform. The bracelet itself communicates with the third-party payment platform through the payee's communication equipment Problems such as networking, inability to connect to the third-party payment platform, and not bringing a mobile phone to achieve the effect of eliminating the pain points of payment collection

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

example 1

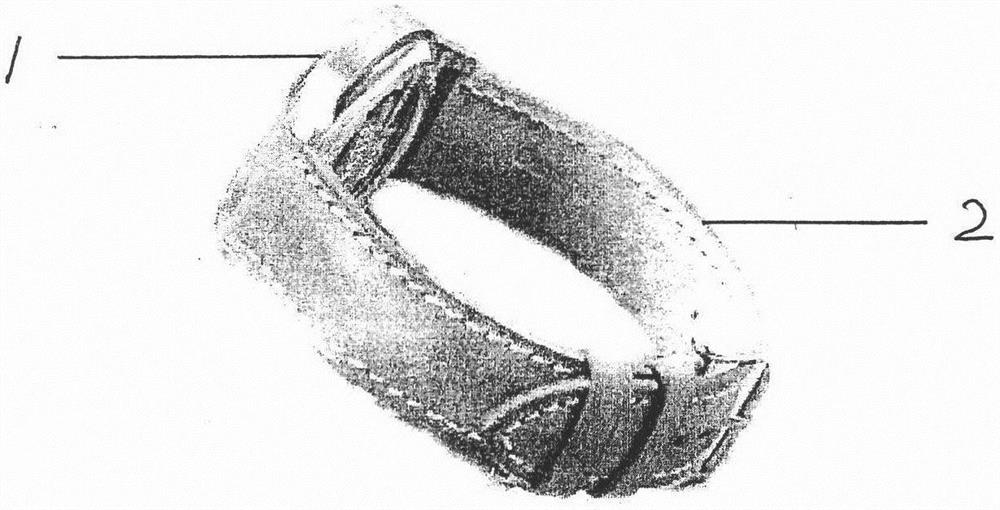

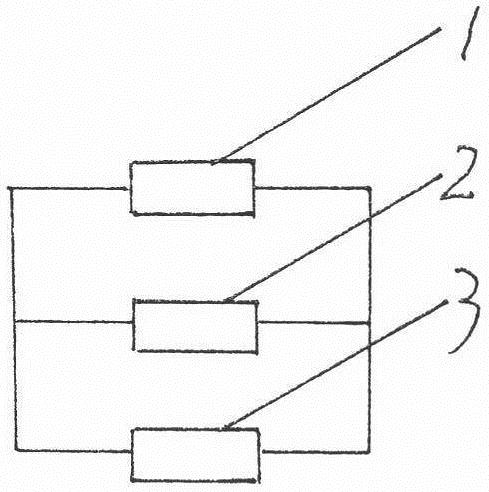

[0038] Example 1, the device W1 used for on-site payment can collect money in "serial networking"; wherein, W1 is located at the payment site and belongs to the payee, W1 includes electronic wearable device A1 and communication device B, A1 has at least a receiving module V1, A1 has a cipher device U1, and A1 has a non-temporary connection with B. W1 has a communication module S1 that can temporarily connect with "the communication device of the payer located at the payment site" C. S1 belongs to B, that is, B can make a temporary connection with C. ; Among them, when B and C are temporarily connected, and C is connected to the third-party electronic payment platform D, then two-way communication between W1 and C / two-way communication between C and D will help D to be responsible for implementing "C to W1 transfer" / D conducts "provide W1 with a coded letter concerning whether the payment has been received"; wherein, V1 receives the coded letter that C forwards first and then B ...

example 2

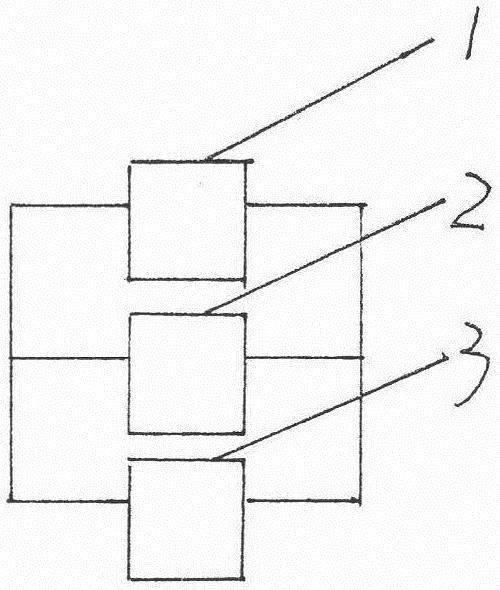

[0085] Example 2, this example refers to Example 1. Compared with Example 1, the main difference between this example and Example 1 is: First, the advantage of this example is that the payee is equipped with one less B, so A2 does not need a sending module to provide a communication device similar to B. The information of the payment has been received”; the advantage of Example 1 is that B is suitable to be placed close to the payer (such as being placed outside the booth), so that C can be connected to A1 by “conveniently connecting with B”, that is B at least enables the payee to collect money conveniently, and if B is replaced by criminals, it is meaningless, that is, W1 enables the payee to collect money safely. Second, A2 in this example verifies the encrypted letter E2, and A1 in Example 1 decrypts the encrypted letter E1.

[0086] The device W2 used for on-site payment can collect money in "serial networking"; wherein, W2 is located at the payment site and belongs to t...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com