Oilfield development project investment portfolio optimization method and device and electronic equipment

A technology for oilfield development and optimization methods, applied in resources, office automation, data processing applications, etc., can solve the problems of not being able to take into account the overall benefits and resource utilization of individual projects and project combinations at the same time, and achieve the effect of optimizing investment

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

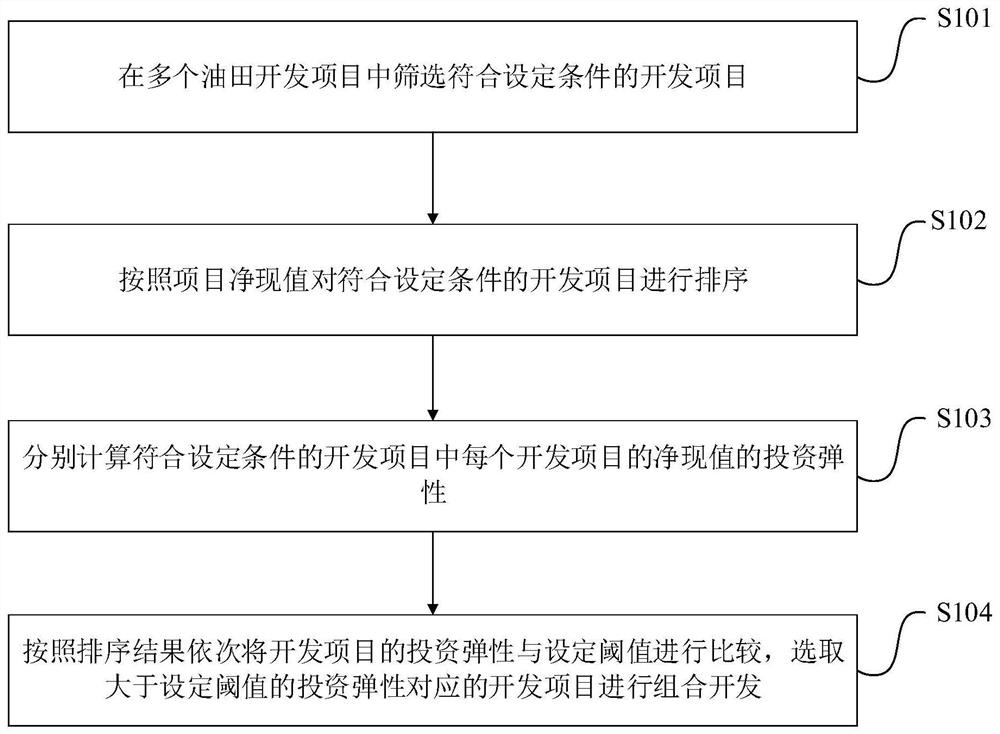

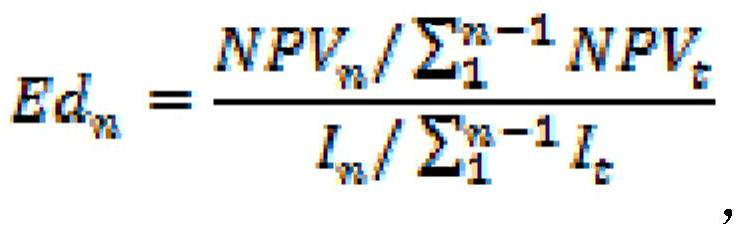

[0053] According to the project screening Ed>N (the N value selects different empirical values according to different regions, different oil fields and reservoir types, N is generally not less than 1) to determine the optimal value of investment scale and the corresponding investment portfolio, including the after-tax internal rate of return, The net present value after tax is the result of economic evaluation.

[0054]The first step is preliminary screening. Eliminate projects with after-tax net present value less than 0 and after-tax internal rate of return less than the benchmark rate of return (usually 8%) set by the enterprise. The purpose of this step is to ensure that a single block meets the most basic benefit requirements of the enterprise.

[0055] The second step is to sort the items. According to the characteristics of production capacity construction projects focusing on benefit scale, the projects are sorted in descending order of net present value, and inves...

Embodiment 2

[0064] Take the crude oil development project investment table of a branch company in 2018 as an example, including a total of 123 block projects in the new area and the old area. For this oilfield, N is 1 as the selection basis for the net present value investment elasticity coefficient of this example.

[0065] (1) Eliminate block projects with after-tax net present value less than 0. A total of 92 projects have NPV>0, and the cumulative investment is 2,862.4 million yuan. The calculation results of net present value and internal rate of return refer to the oil price of US$50 / barrel. The details are shown in Table 1.

[0066] Table 1. Basic situation of economic indicators of production capacity construction and development projects in old and new crude oil areas

[0067]

[0068]

[0069]

[0070] (2) Sort the preliminarily screened block projects in descending order of net present value, and list the block names and corresponding investments (see Table 2).

[0...

Embodiment 3

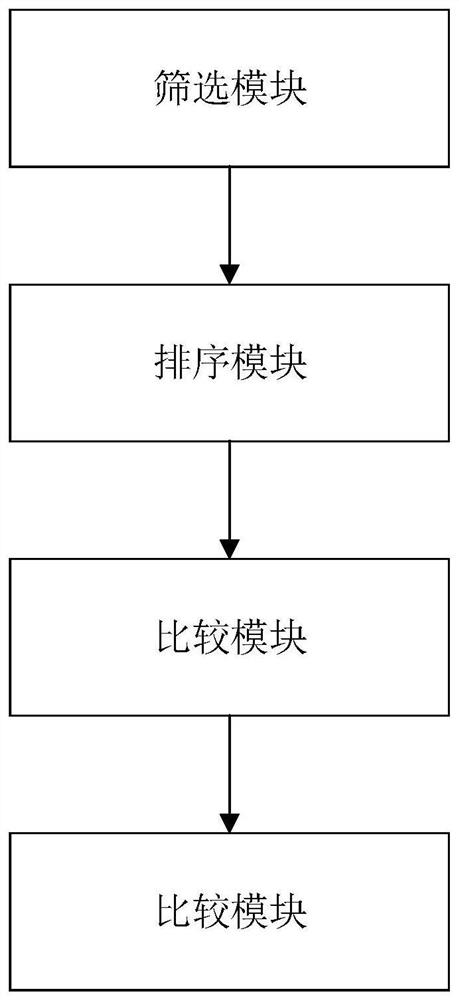

[0086] like figure 2 shown, an optimization device for an oilfield development project portfolio comprising:

[0087] Screening module for screening development projects that meet the set conditions among multiple oilfield development projects;

[0088] The sorting module is used to sort the development projects that meet the set conditions according to the net present value of the project;

[0089] A calculation module for separately calculating the investment elasticity of the net present value of each development project in the development projects that meet the set conditions;

[0090] The comparison module is used for sequentially comparing the investment elasticity of the development projects with the set threshold according to the sorting result, and selecting the development projects corresponding to the investment elasticity greater than the set threshold for combined development.

[0091] Optionally, the set threshold is not less than 1.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com