Novel securities, supporting systems and methods thereof

a technology of security and supporting systems, applied in the field of new security structures, can solve the problems of reducing earnings per share, negating all the benefits of convertible bond issuance, increasing the number of outstanding shares of the company, etc., and limiting the potential for stock dilution. , the effect of cost efficiency and flexibility in raising capital

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

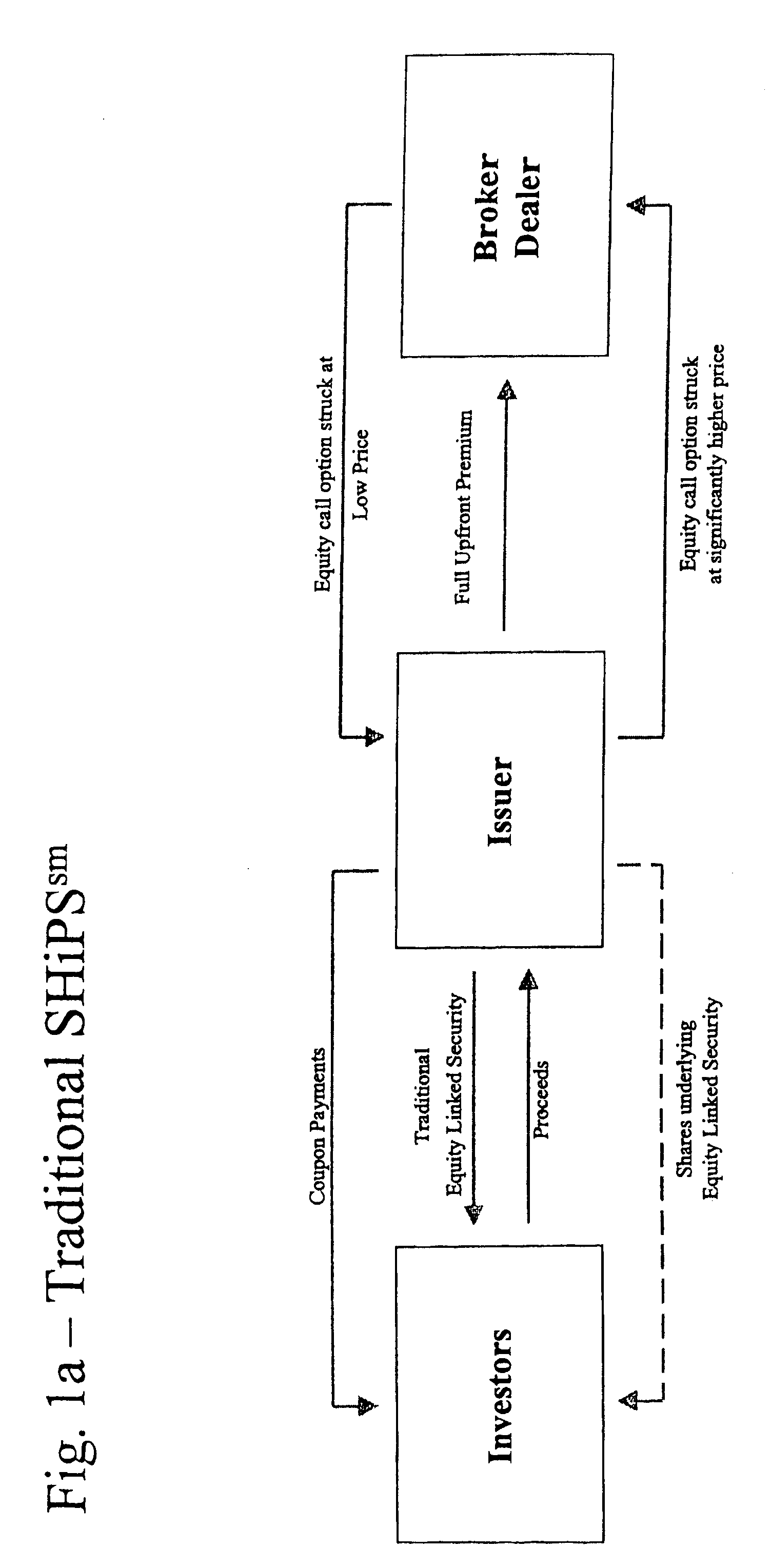

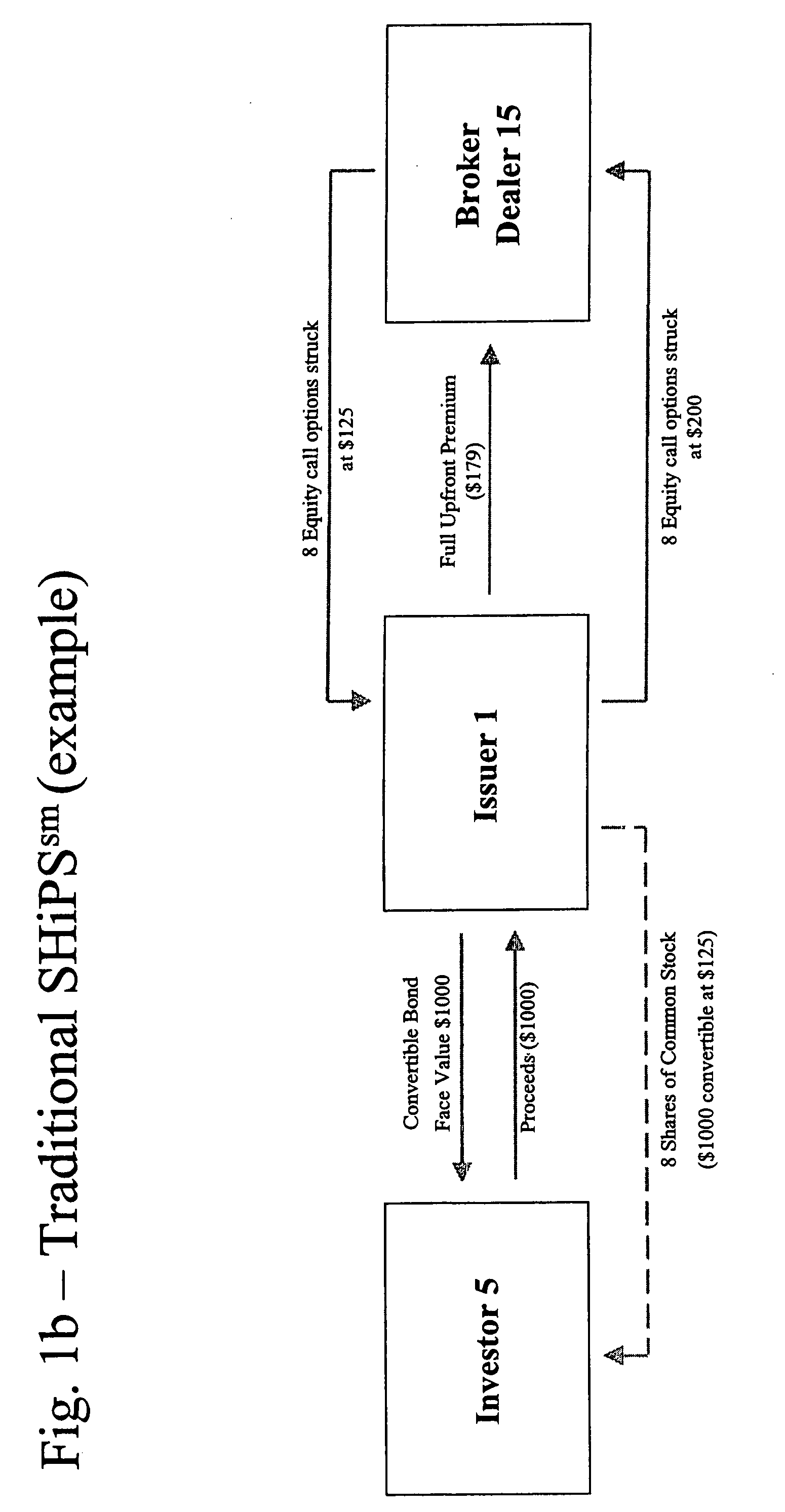

[0039]First briefly by way of background, the present invention is directed to a novel investment vehicle for increasing the flexibility of select convertible bonds and other equity-linked securities. The inventive investment is best illustrated as the coupling of a convertible bond with a callspread option corresponding to the same underlying asset. The payment for the callspread option, in one variation of the invention, is spread over a select time period and permits exchange rights based on events that accrue within the pre-selected time span. This innovative investment provides the purchaser the flexibility of canceling the investment and avoiding any future payments at any point in time. This is extremely significant since market conditions may change making the original intention of the investment irrelevant.

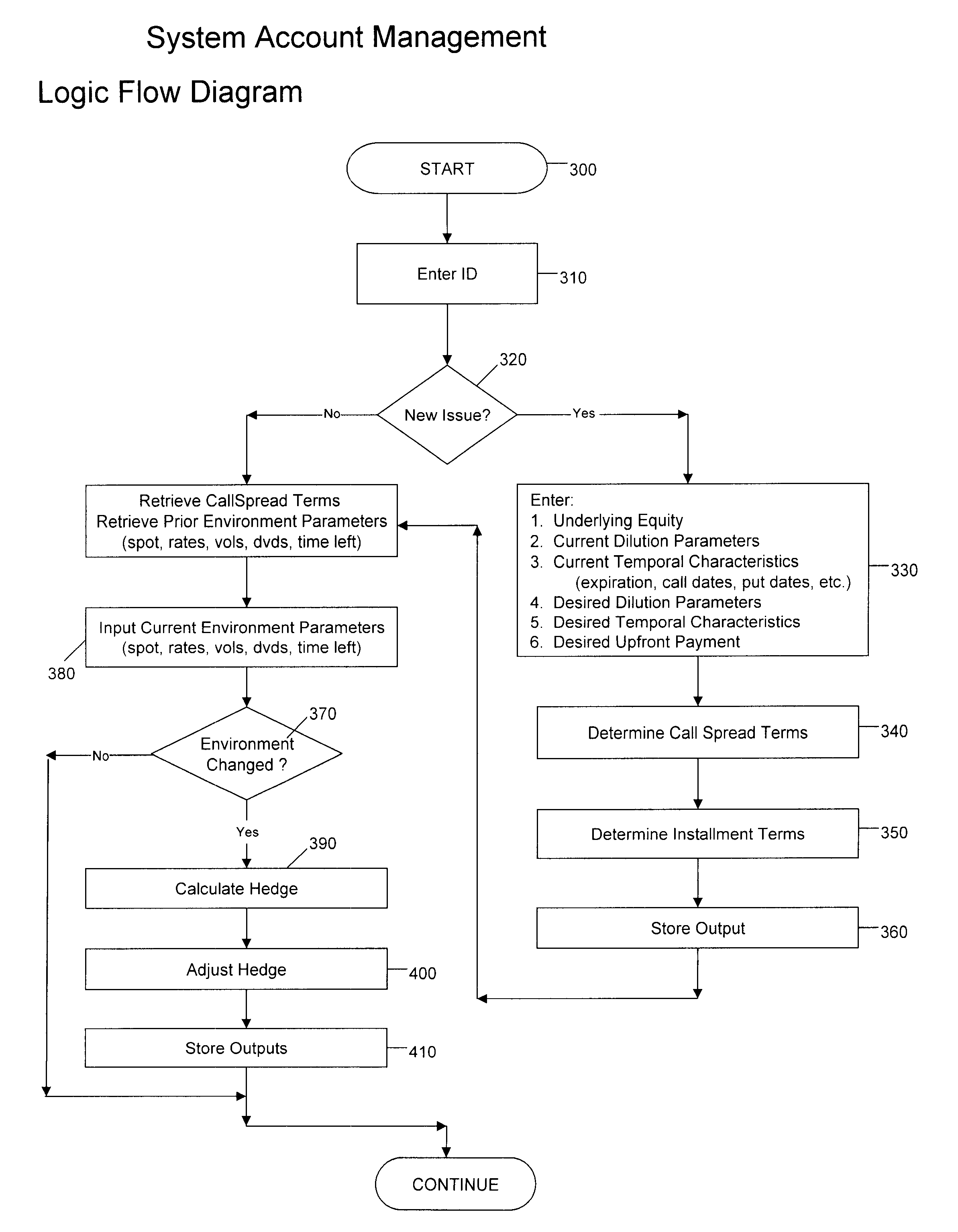

[0040]Implementation of the investment vehicle is accomplished on a program controlled data processing system, operated by the system administrator. Functional characteri...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com