Systems and methods for administering return sweep accounts

a system and sweep account technology, applied in the field of computerized banking techniques, can solve the problems of owners of demand accounts not obtaining interest on their funds, banks and savings institutions cannot pay interest on certain types of deposit accounts, and bank clients are not comfortable with arrangements to transfer client funds

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

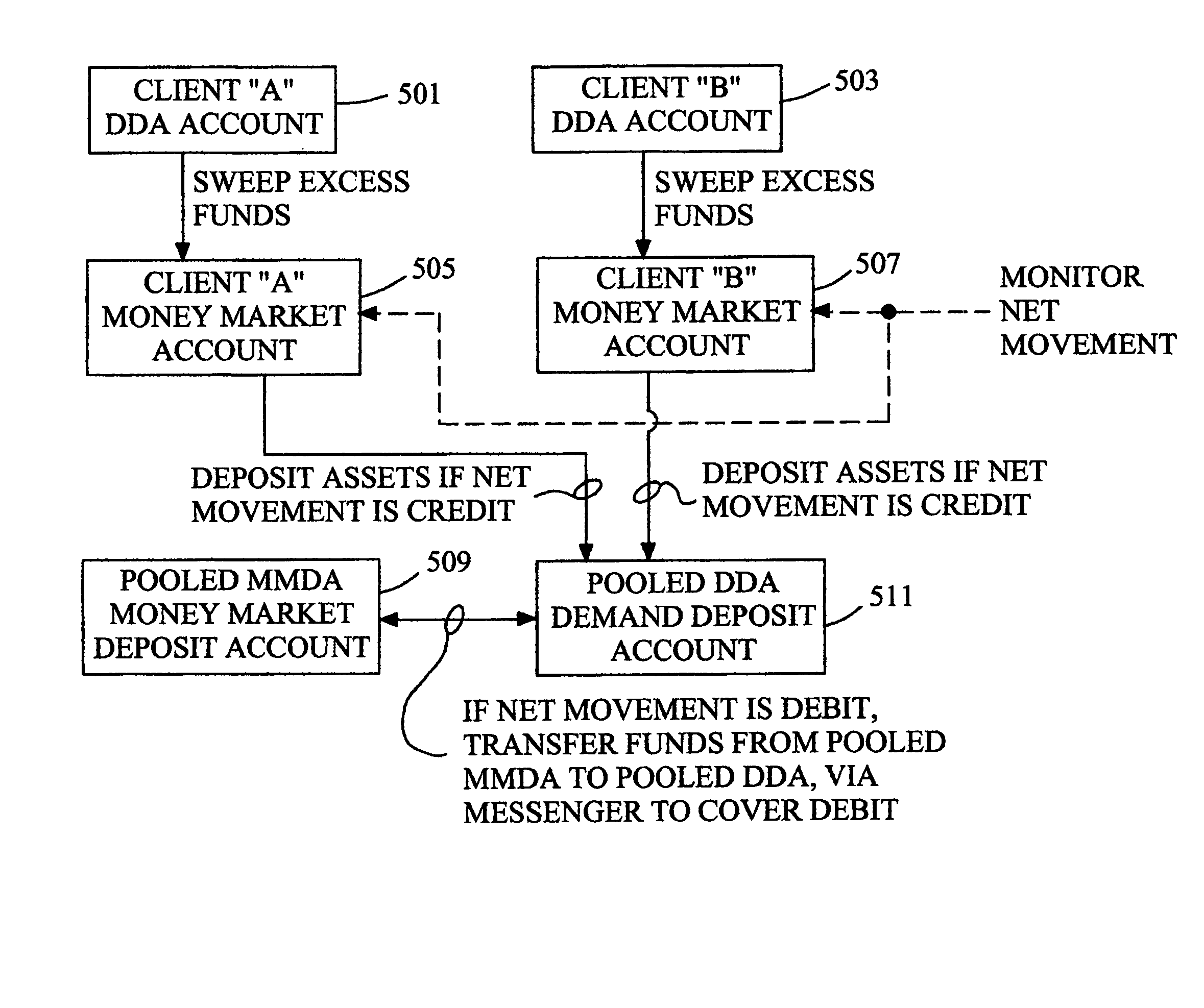

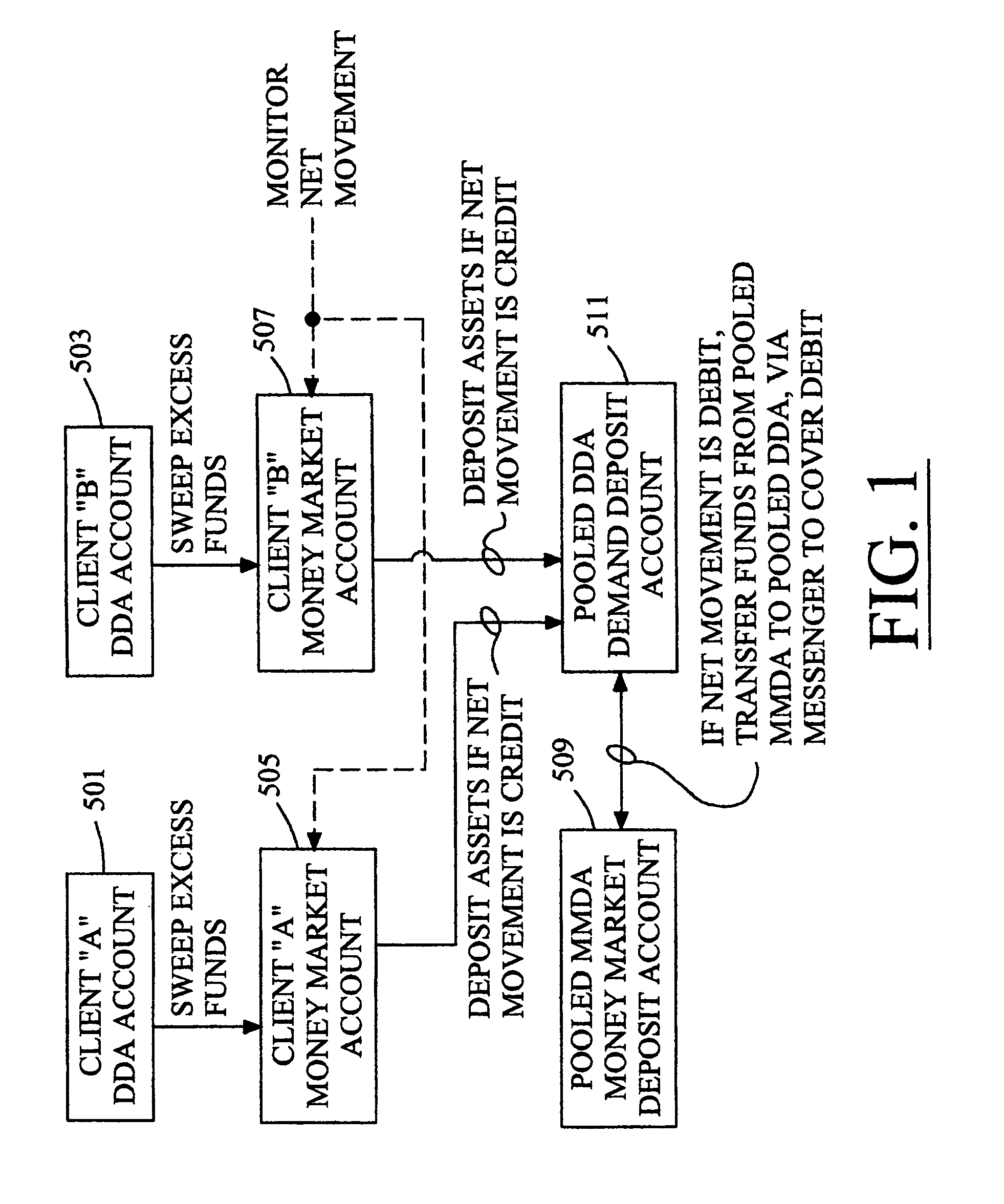

[0025]Refer now to FIG. 1, which is a flow diagram showing the transfer of client funds among a plurality of accounts pursuant to the techniques of the present invention. A plurality of client demand accounts, including Client “A” DDA (Demand Deposit Account) 501 and Client “B” DDA Account 503 are managed through the use of an insured pooled deposit account at the client's savings institution or bank. In FIG. 1, this pooled deposit account is provided in the form of a Pooled MMDA (Money Market Deposit Account) 509. Excess funds are swept from client DDA accounts (Client “A” DDA 501 and Client “B” DDA 503, respectively) to corresponding client Money Market Accounts (Client “A” Money Market Account 505 and Client “B” Money Market Account 507, respectively). Excess funds may be calculated in terms of a desired or target minimum balance for each of the client DDA accounts. The same target minimum balance could be applied to all DDA accounts, or an account-specific target balance could b...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com