Bulk commodity quantity-checking bill-checking tax-controlling method, system, net station and terminal

A commodity and nuclear quantity technology, applied in business, instruments, finance, etc., can solve problems such as collusion and corruption, difficulty in grasping the quantity of transportation, and difficulty in achieving control goals, and achieve the effect of reducing the workload

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

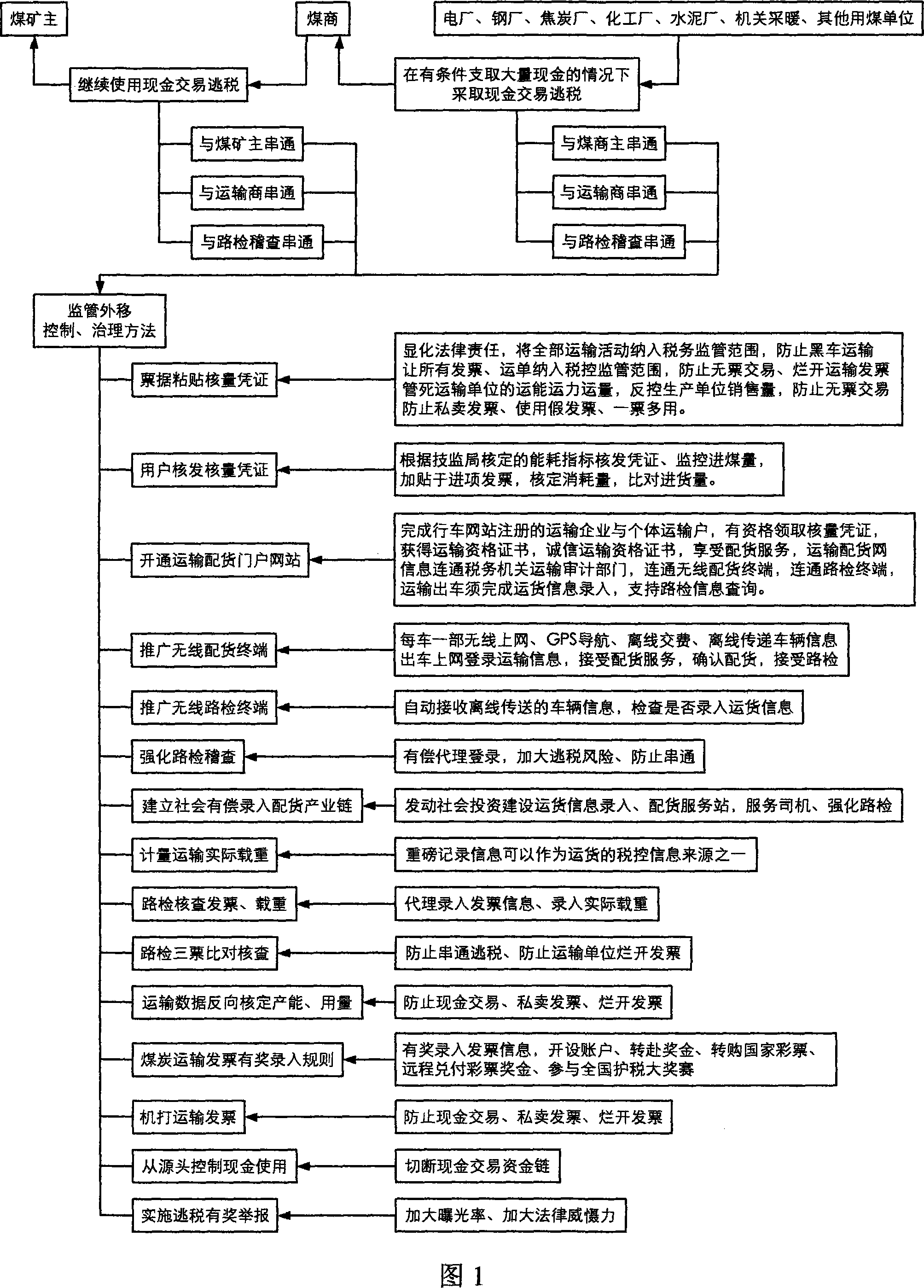

[0100] As shown in Figure 1: Taking tax evasion means, governance methods and effects in coal trading as an example, power plants, steel mills, coke plants, chemical plants, cement plants, office heating, and other coal-consuming units have some It is possible to purchase coal in a cashless purchase method, in order to reduce costs, reserve space for cash transactions of its own back-end products, and ultimately achieve the purpose of tax evasion. Between the coal user unit and the coal production unit, it is often necessary to purchase through the coal merchant, and often need to be transported by the transport unit. If the coal merchant purchases cash without a ticket, it will inevitably induce the coal merchant to purchase the goods with cash without a ticket. The method is often collusion, which starts a chain of tax evasion. The source of this chain should be mainly private coal production units, and it is difficult for state-owned enterprises to use cash to purchase goods...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com