Web based bank card risk monitoring method and system

A risk monitoring and bank card technology, applied in the monitoring of bank card credit risk and fraud risk, in the field of Web-based bank card risk monitoring, can solve the problem of low timeliness of early warning of credit risk and fraud risk, low detection and identification rate, and operational problems. Risk quantification statistics and monitoring need to be improved, and the management mechanism is weak to achieve objective and effective operations, improve efficiency, and reduce losses

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

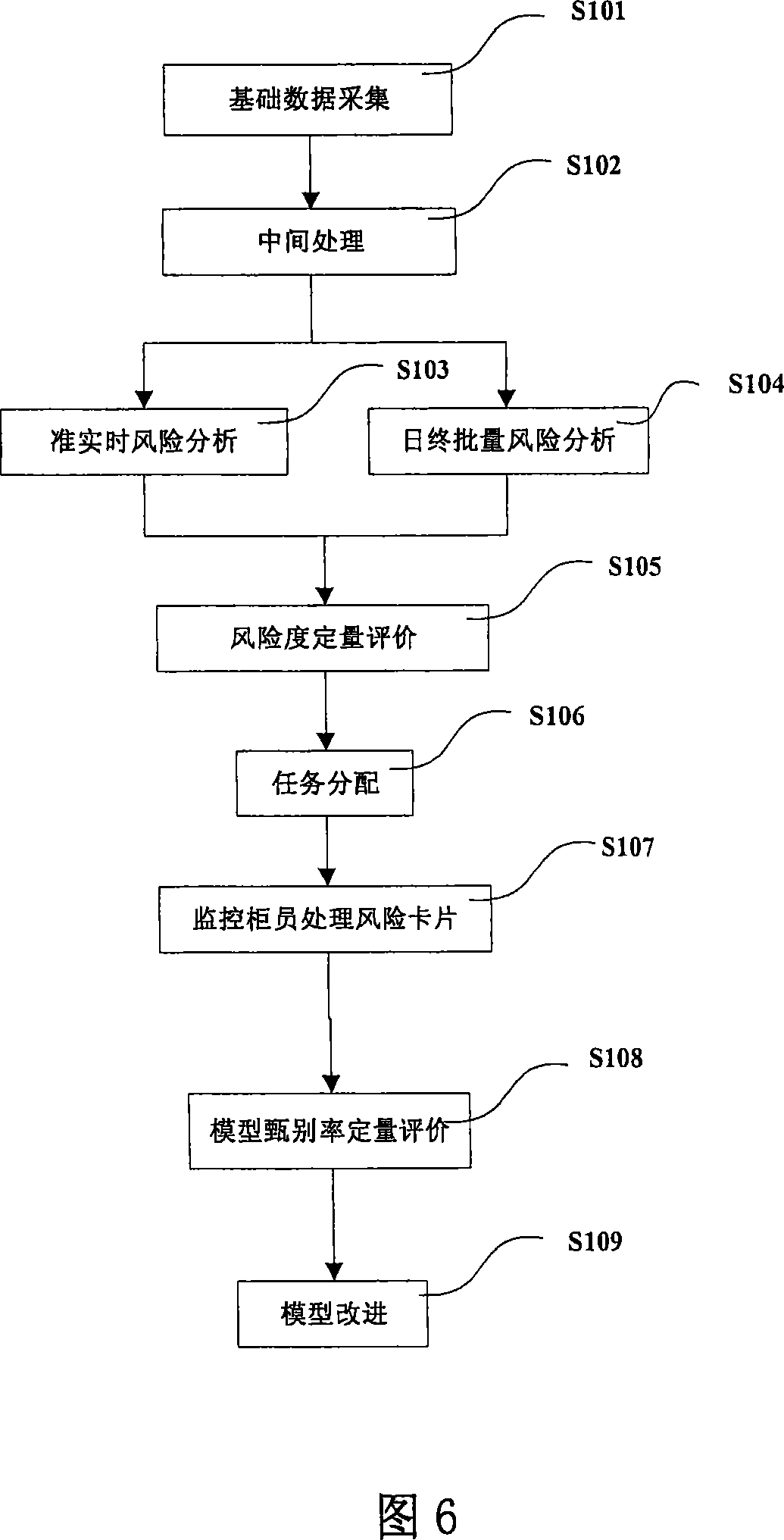

[0028] The specific implementation manner of the present invention will be described below in conjunction with the accompanying drawings. The present invention collects bank card transaction data in real time, utilizes the risk laws summarized in the analysis and research of card use risk behaviors, analyzes the transaction data and measures risks, accurately identifies risk events and corresponding bank cards, and extracts risk The related information of the card helps the bank card risk prevention personnel to deal with the incident and take timely countermeasures to prevent the loss of funds.

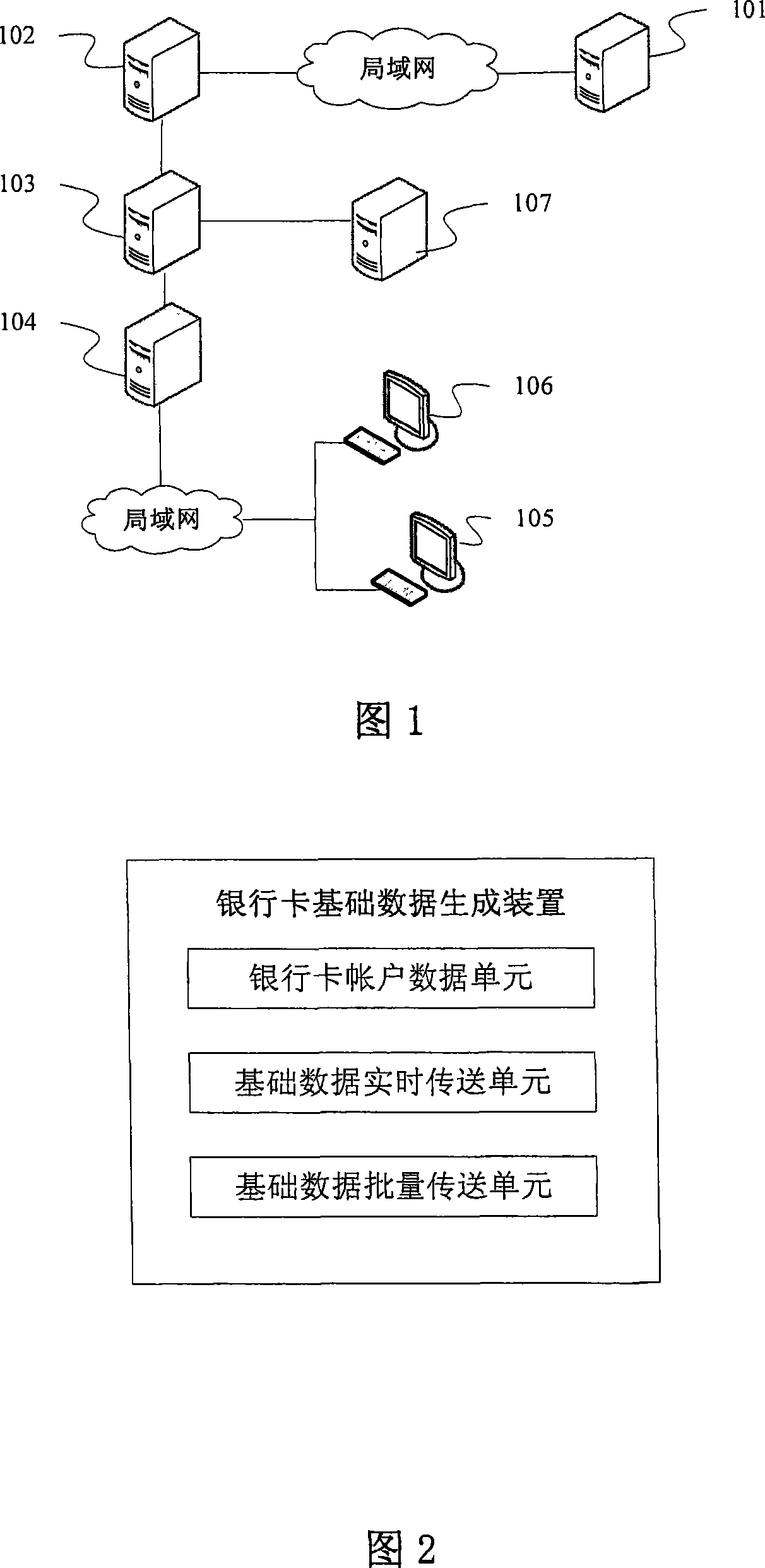

[0029] As shown in Figure 1, the bank card online business system server 101 is a daily business processing system of the bank, which is responsible for the background online processing of bank card opening, consumption, cash withdrawal and other businesses. The basic data generated by it, such as the basic account Information, account balance, account card consumption, account cash ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com