P2P (peer-to-peer) network lending risk prediction system based on text analysis

A P2P network and risk prediction technology, which is applied in special data processing applications, instruments, electrical digital data processing, etc., can solve the problem of low prediction accuracy of the risk prediction system, improve overall operational efficiency, reduce audit time, and accuracy Improved effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

specific Embodiment approach 1

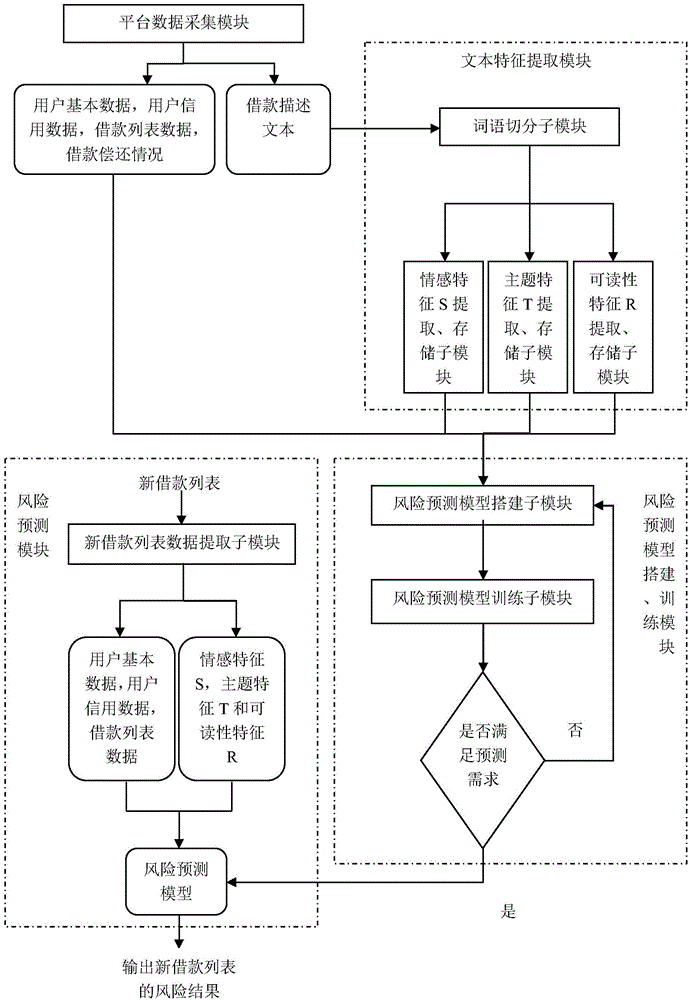

[0014] Specific implementation mode one: combine figure 1 To describe this embodiment,

[0015] The platform data collection module is used to automatically collect user data and transaction data in the P2P network lending platform, including user basic data, user credit data, loan list data, loan description text, and loan repayment;

[0016] The text feature extraction module is used to obtain the "loan description text" in the platform data collection module and perform word segmentation and remove words without actual meaning according to the stop word list, and is responsible for extracting the semantic features contained in the loan description text, including emotion feature S, theme feature T, and readability feature R;

[0017] Risk prediction model building and training modules, used to build and train risk prediction models;

[0018] The risk prediction module is used to predict and output the risk situation of the new borrowing list.

specific Embodiment approach 2

[0019] Specific implementation mode two: this implementation mode

[0020] Described text feature extraction module comprises:

[0021] The word segmentation sub-module is used to obtain the "loan description text" in the platform data collection module and perform word segmentation and remove words without actual meaning according to the list of stop words;

[0022] The emotional feature S extraction and storage sub-module is used to extract and store the emotional feature S of the loan description text;

[0023] The topic feature T extraction and storage sub-module calculates the topic probability distribution P (topic | text) in each loan description text through the LDA topic generation model, and stores it as the topic feature T of the loan description text;

[0024] The readability feature R extraction and storage sub-modules first count the number of occurrences of each word in all loan description texts, and then count the words that appear in the current loan descrip...

specific Embodiment approach 3

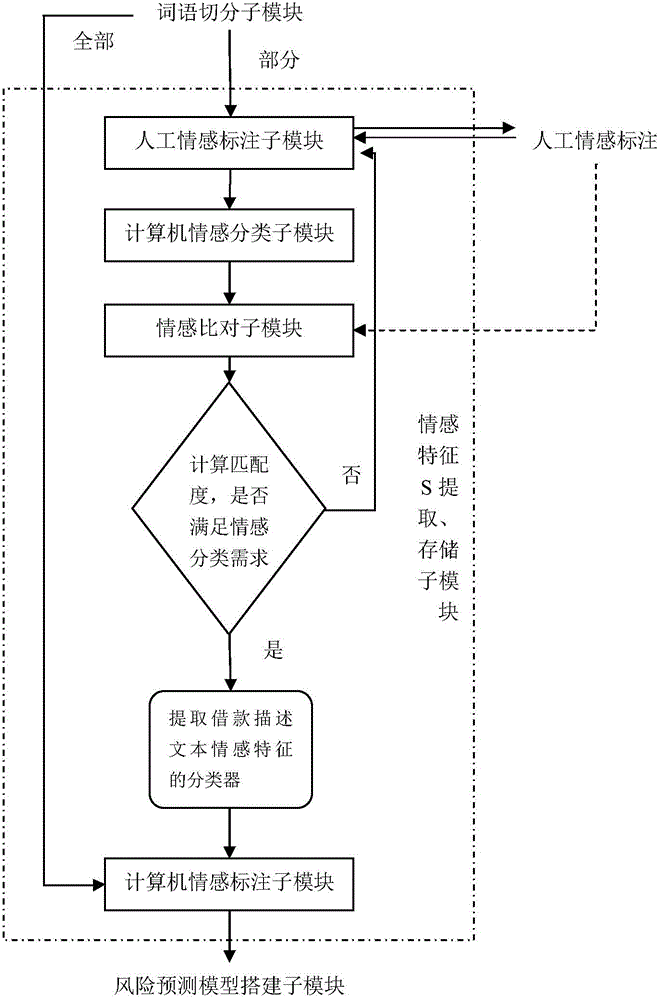

[0026] Specific implementation mode three: this implementation mode, in combination with figure 2 To describe this embodiment,

[0027] The emotional feature S extraction submodule includes

[0028] The artificial sentiment labeling sub-module randomly extracts the loan description text and outputs and displays it for users to carry out artificial sentiment labeling: commendatory, neutral and derogatory, marked with 1, 0 and -1 respectively; and the loan description text that has been artificially labeled Divided into emotional labeling training set and emotional labeling test set;

[0029] The computer emotion classification sub-module extracts the emotional labeling training set data in the artificial emotional labeling sub-module, and calculates three emotional categories of 1, 0 and -1 (commendative, neutral and derogatory) according to the artificial emotional labeling of the emotional labeling training set The number of occurrences of each word set in the set; on this...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com