Patents

Literature

463 results about "Risk prediction models" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Risk prediction models estimate the risk of developing future outcomes for individuals based on one or more underlying characteristics (predictors). We review how researchers develop and validate risk prediction models within an individual participant data (IPD) meta-analysis, in order to assess the feasibility and conduct of the approach.

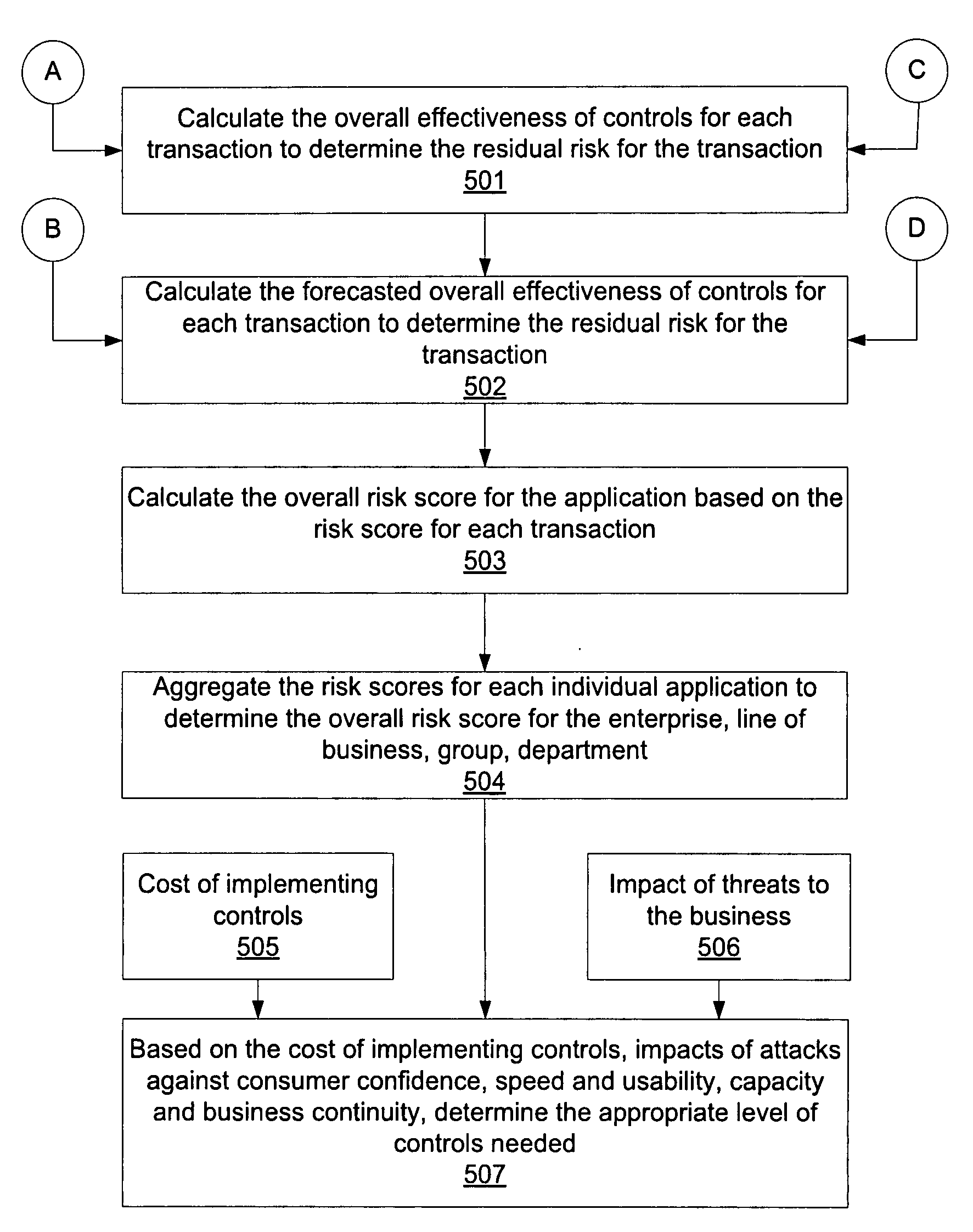

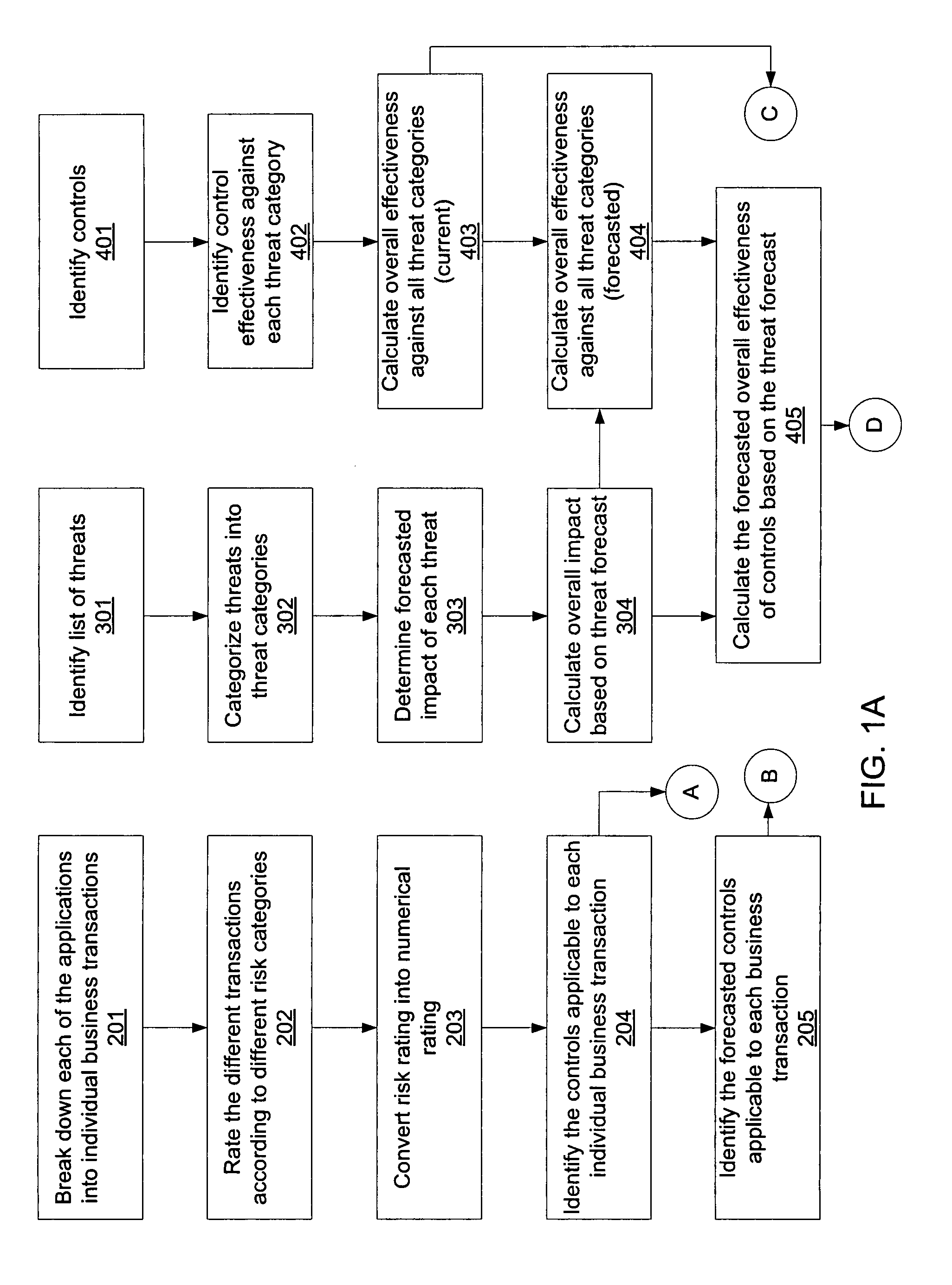

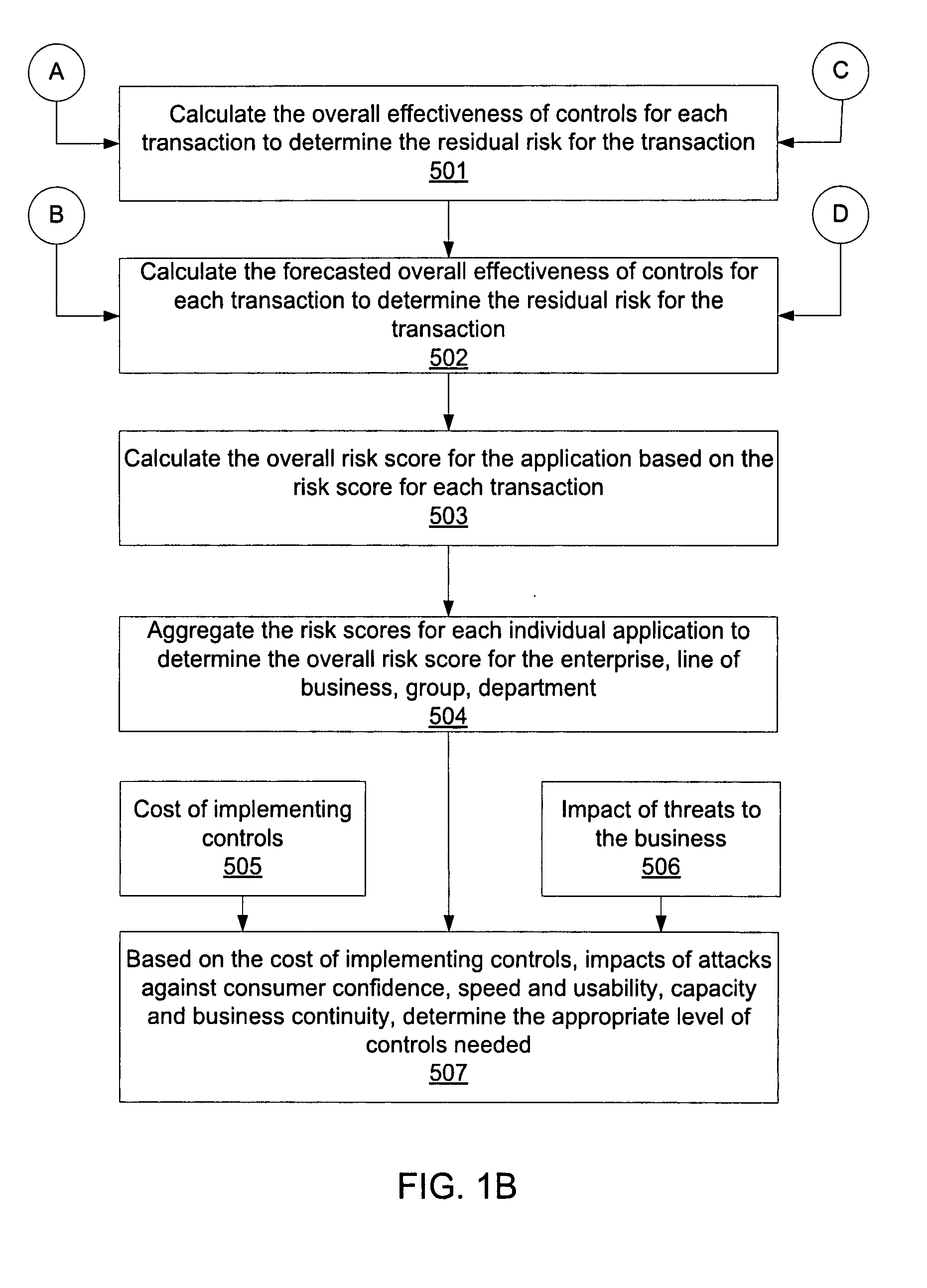

Threat Modeling and Risk Forecasting Model

InactiveUS20090030751A1Reduce the impactReduce determined residual riskFinanceForecastingComputer scienceResidual risk

A system and method for determining residual business risks by correlating threats, controls, business continuity factors, and other general risk considerations is described. Requirements of an initiative of a project are mapped to a taxonomy, and the mapped requirements are rated with respect to its importance to the project. Projected changes in the mapped requirements are forecasted over a specified period of time, such as an eighteen month period. A threat to the project is mapped to the taxonomy, and the mapped threat is rated with respect to its impact on the project. Projected changes in the effectiveness of the control are forecasted based upon historical data, a maturity rating, and the rated effectiveness of the control. Residual risk associated with the project is then determined, and adjustments to one or more resources associated with the project may be made to reduce the determined residual risk.

Owner:BANK OF AMERICA CORP

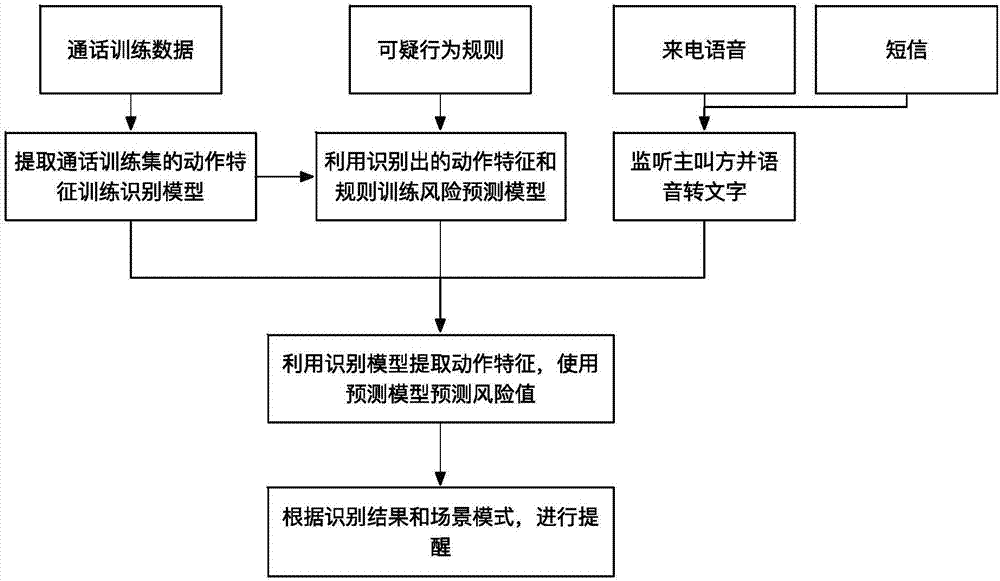

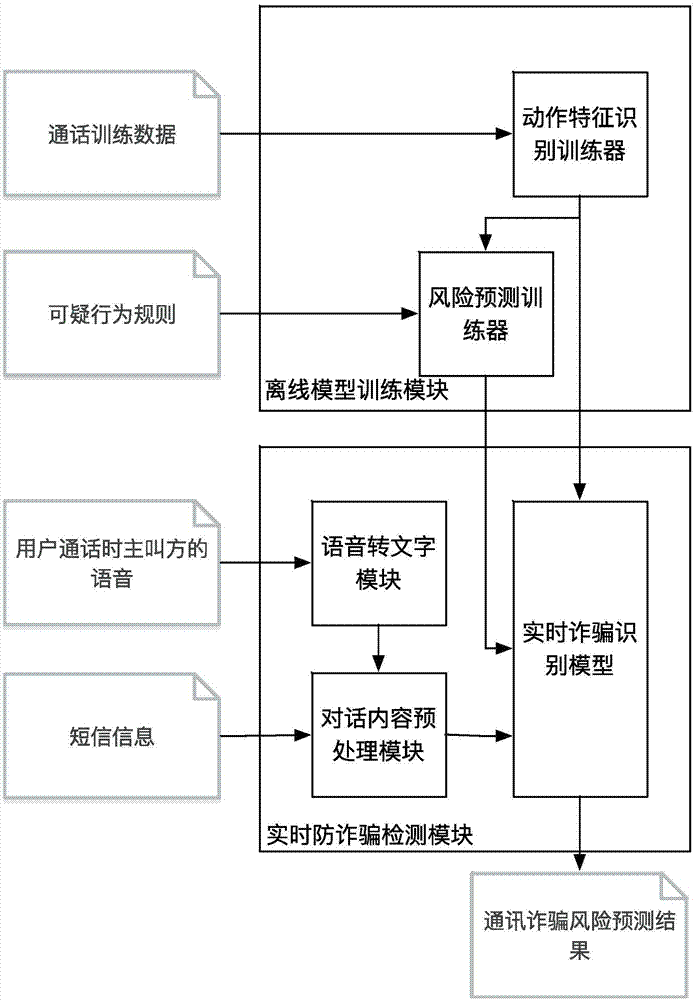

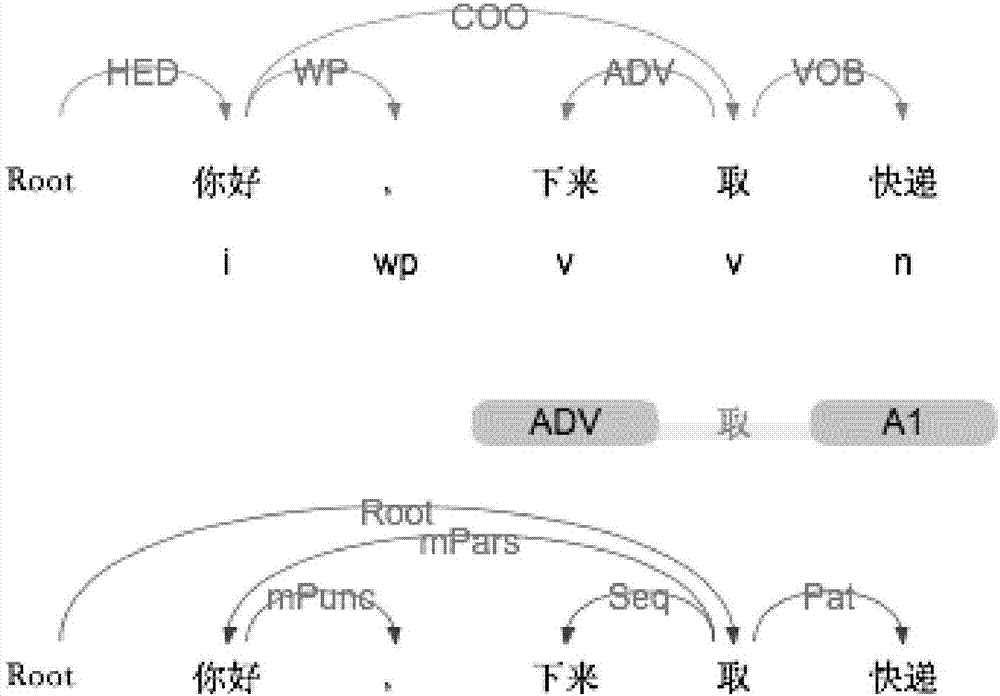

Method and system for real-time detection of communication fraud base on suspicious behavior recognition

ActiveCN107222865AReduce Privacy LossEnsure safetyNatural language data processingSubstation equipmentPhases of clinical researchSpeech sound

The invention discloses a method and a system for real-time detection of communication fraud base on suspicious behavior recognition. The method comprises an offline model training stage and a real-time fraud detection stage, wherein an action characteristic recognition model and an action characteristic risk prediction model are established, and a voice call and a content of a short message of a strange call are analyzed to detect abnormal and suspicious behaviors in order to carry out fraud prediction. Through a voice-to-text way, a call content of the voice call of a calling party is turned into text information, and the call content and the content of the short message synchronously utilize a natural language processing method to extract action behavior characteristics and judge whether the action behavior characteristics in dialogue include suspicious behaviors, such as privacy information inquiry and malicious commands. According to the technical scheme for the real-time detection of the communication fraud, the quick and accurate communication fraud prevention detection can be realized, and the possibility of fraud of a user is reduced.

Owner:PEKING UNIV

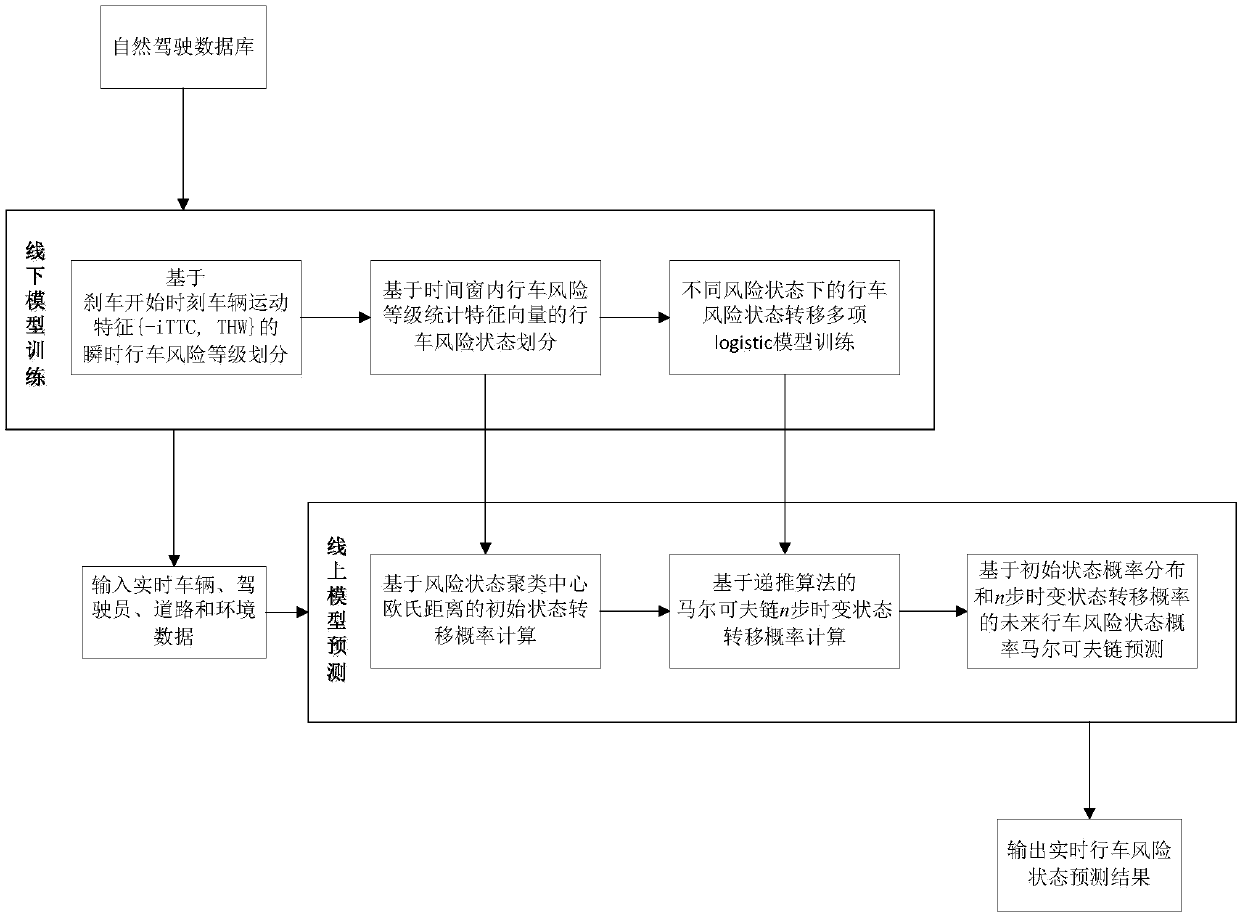

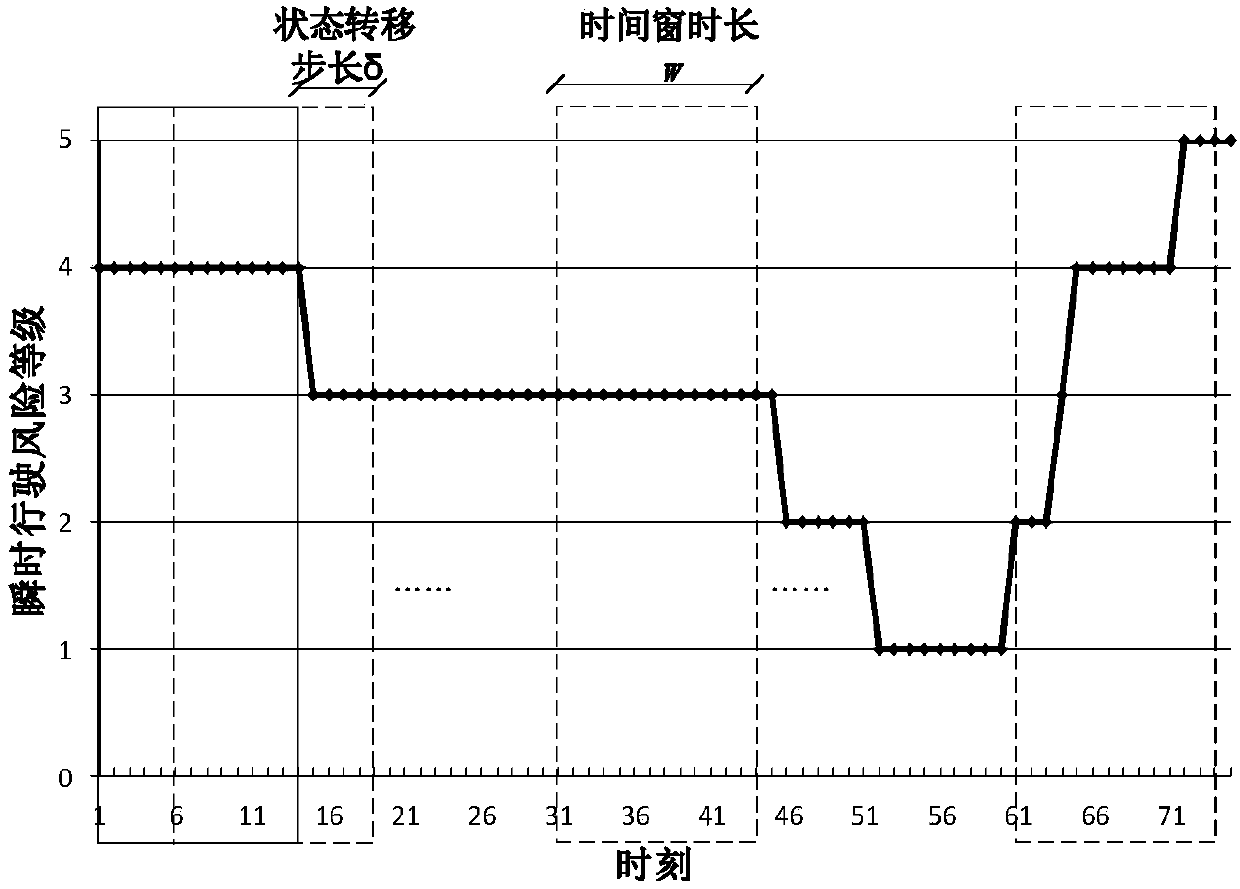

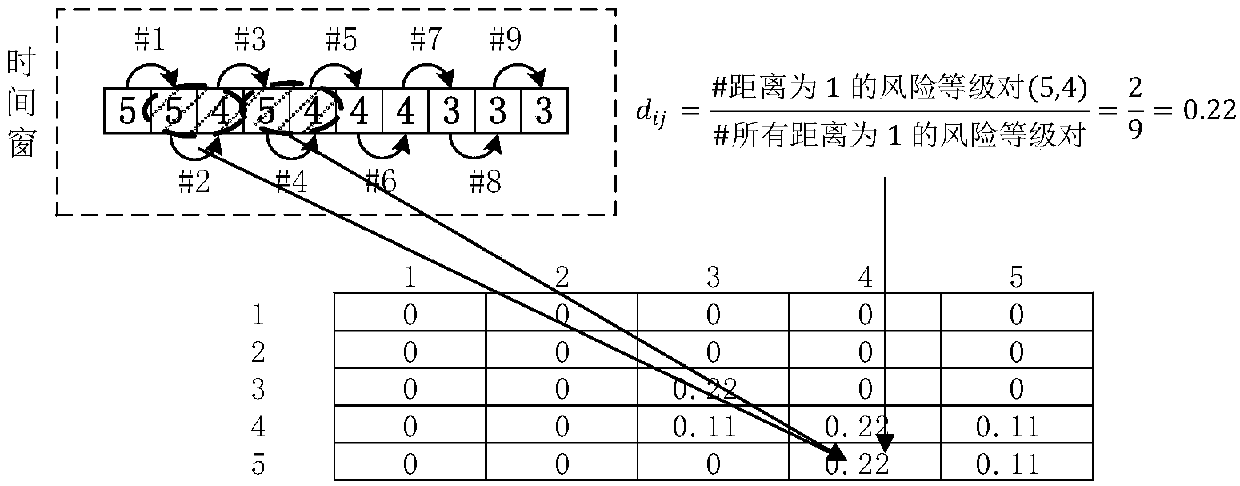

Vehicle driving risk prediction method based on time varying state transition probability markov chain

ActiveCN107742193AMeet the real-time requirements of anti-collision warningImprove accuracyResourcesDriving riskRisk model

The invention provides a vehicle driving risk prediction method based on time varying state transition probability markov chain. Firstly, an offline vehicle driving risk prediction model training: based on samples of accidents and near accidents, real-time vehicle driving risk states are divided by clustering time window characteristics parameters and regarded as countable states of the markov chain, and a multiterm logistic model of vehicle driving risk states transition in different vehicle driving risk states is built. Secondly, an online vehicle driving risk model real-time prediction: under the circumstance of car networking, the variable parameters required by a prediction model are collected in real time, through a risk state clustering center position and markov property, an original state probability distribution vector and a markov chain n steps transition probability at any time in the future are calculated, and the prediction result of the vehicle risk states in the futureis obtained. According to the invention, by means of a recurrence algorithm, the estimation of markov chain n steps time varying state transition probability is achieved, which can reflect the characteristics of the vehicle driving risk states changing with the characteristics of the transportation system, and can meet the requirement of early warning in real time.

Owner:JIANGSU UNIV

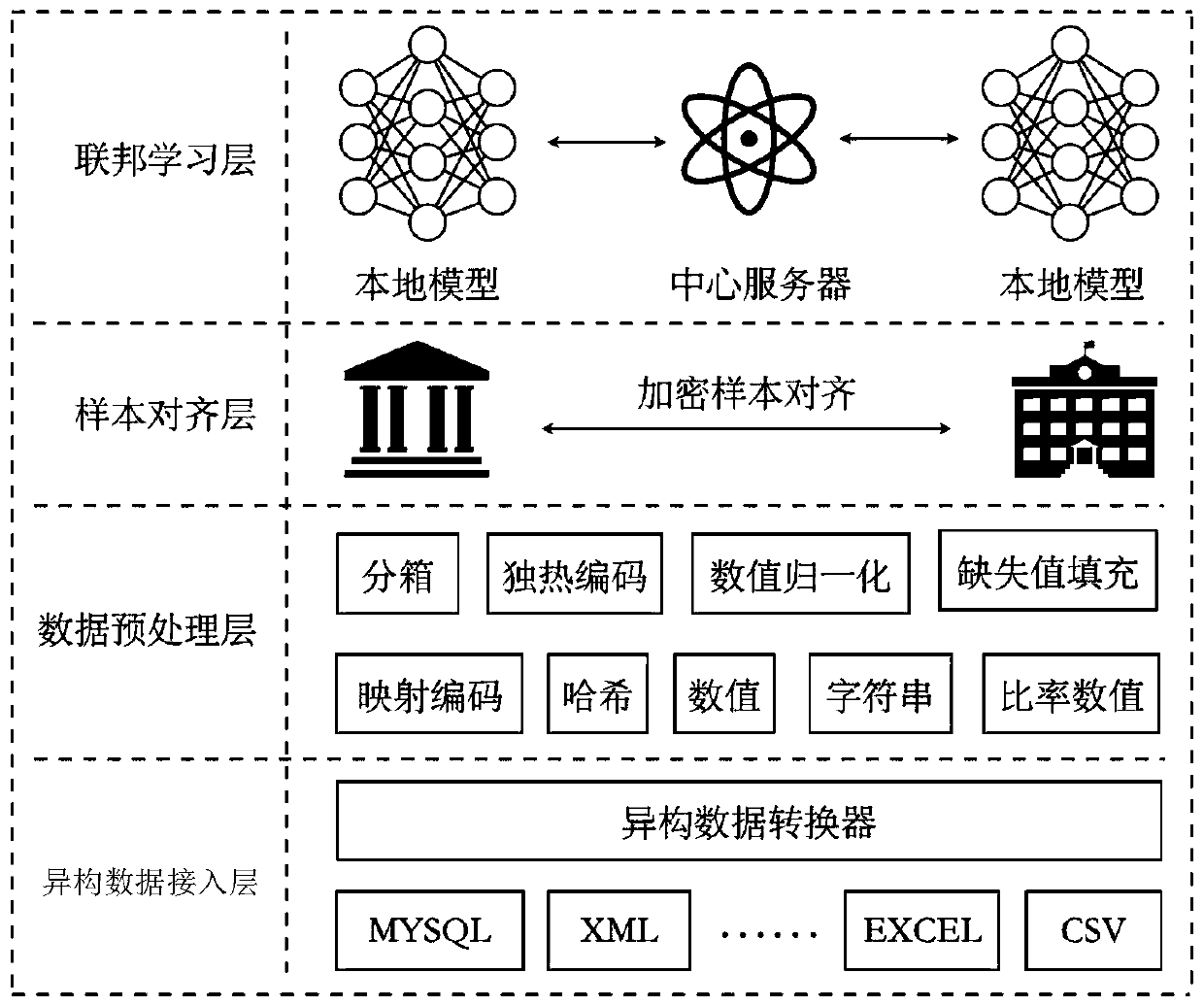

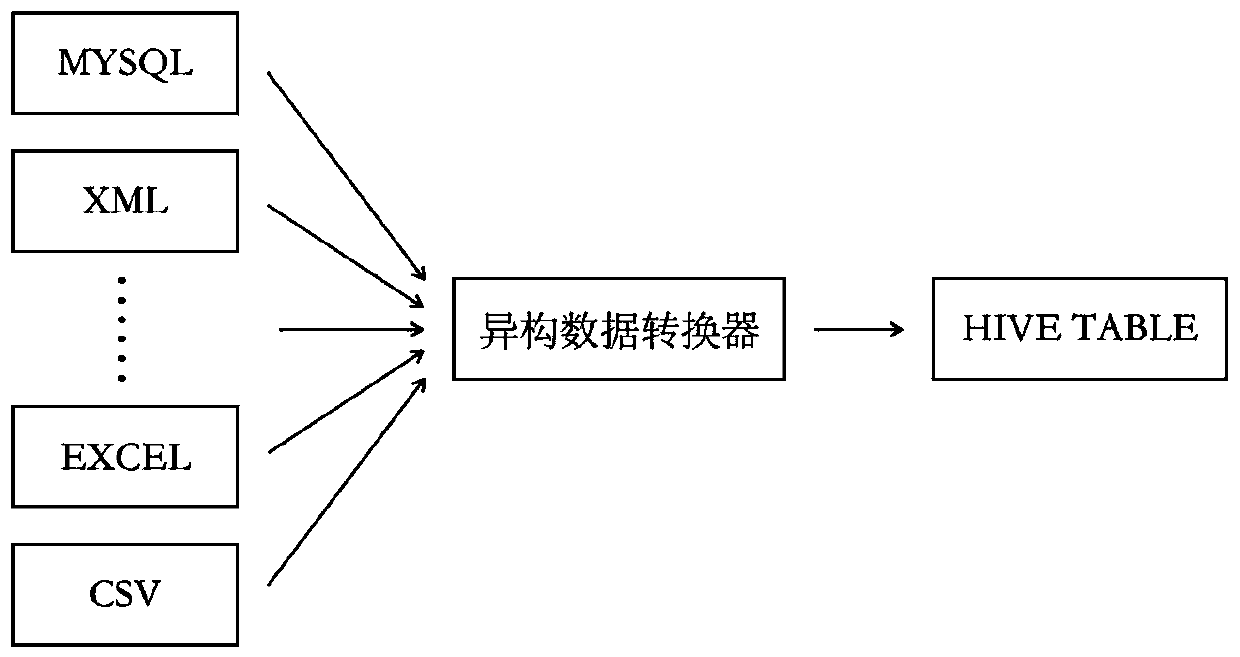

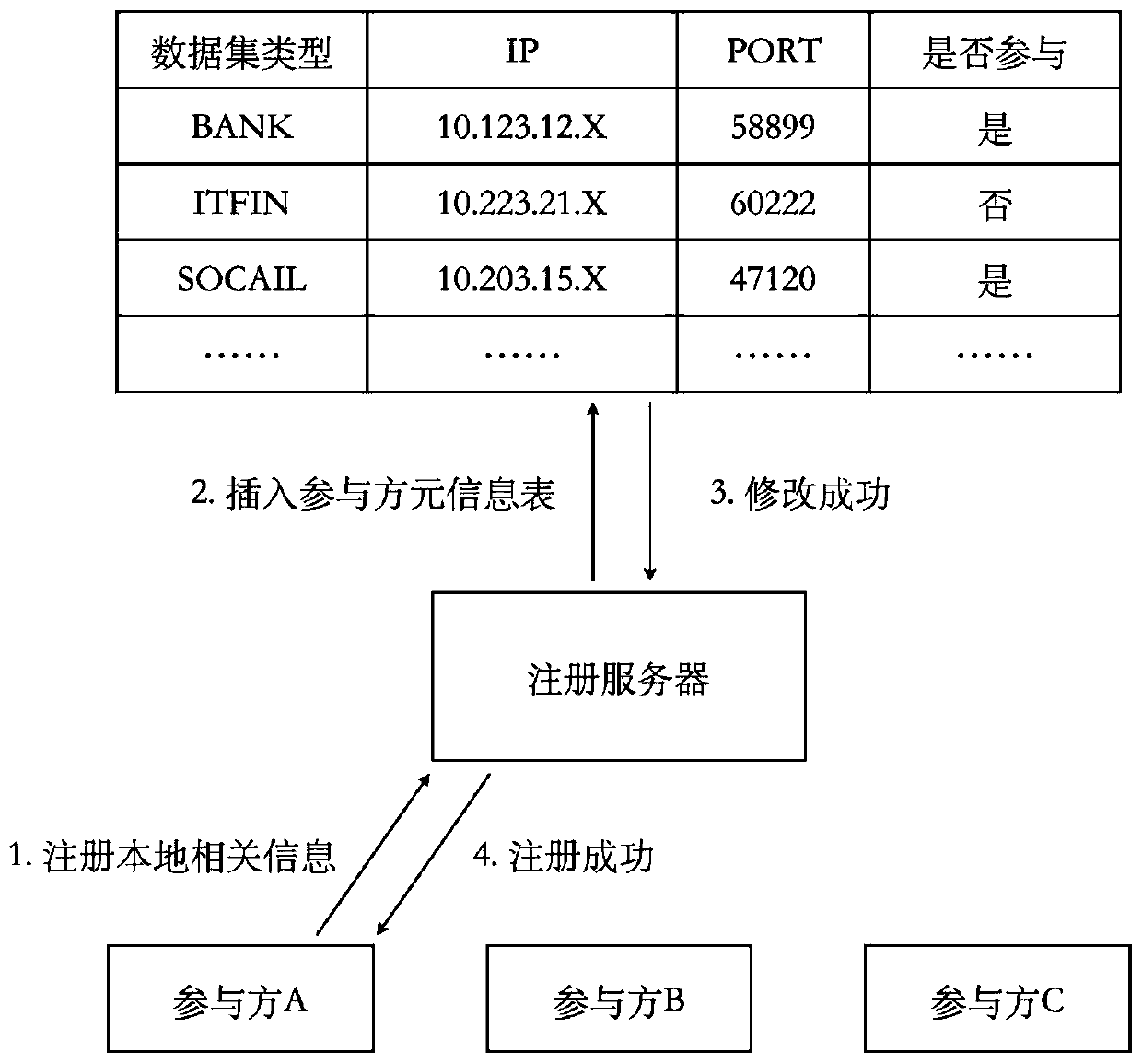

Credit risk control system and method based on federation mode

The invention relates to a big data technology, and aims to provide a credit risk control system and method based on a federation mode. The system comprises a heterogeneous data access layer used foraccessing and converting data, a data preprocessing layer used for preprocessing original data, and a sample alignment layer used for keeping training samples of different data providers aligned, anda federated learning layer used for training a local model by utilizing the participant local data and forming a global model after gradient aggregation. The invention provides a unified data access format, data preprocessing and a risk prediction model based on federated learning, and solves the challenge problem brought by data heterogeneity and privacy leakage to risk control. A central serverdoes not need to participate in the model training and learning process, and it can be guaranteed that user privacy is not eavesdropped. Risk control modeling can be carried out by combining a plurality of different participants, the modeling process is standardized, the risk control capability is finally improved, and the cost is reduced for enterprises.

Owner:ZHEJIANG UNIV

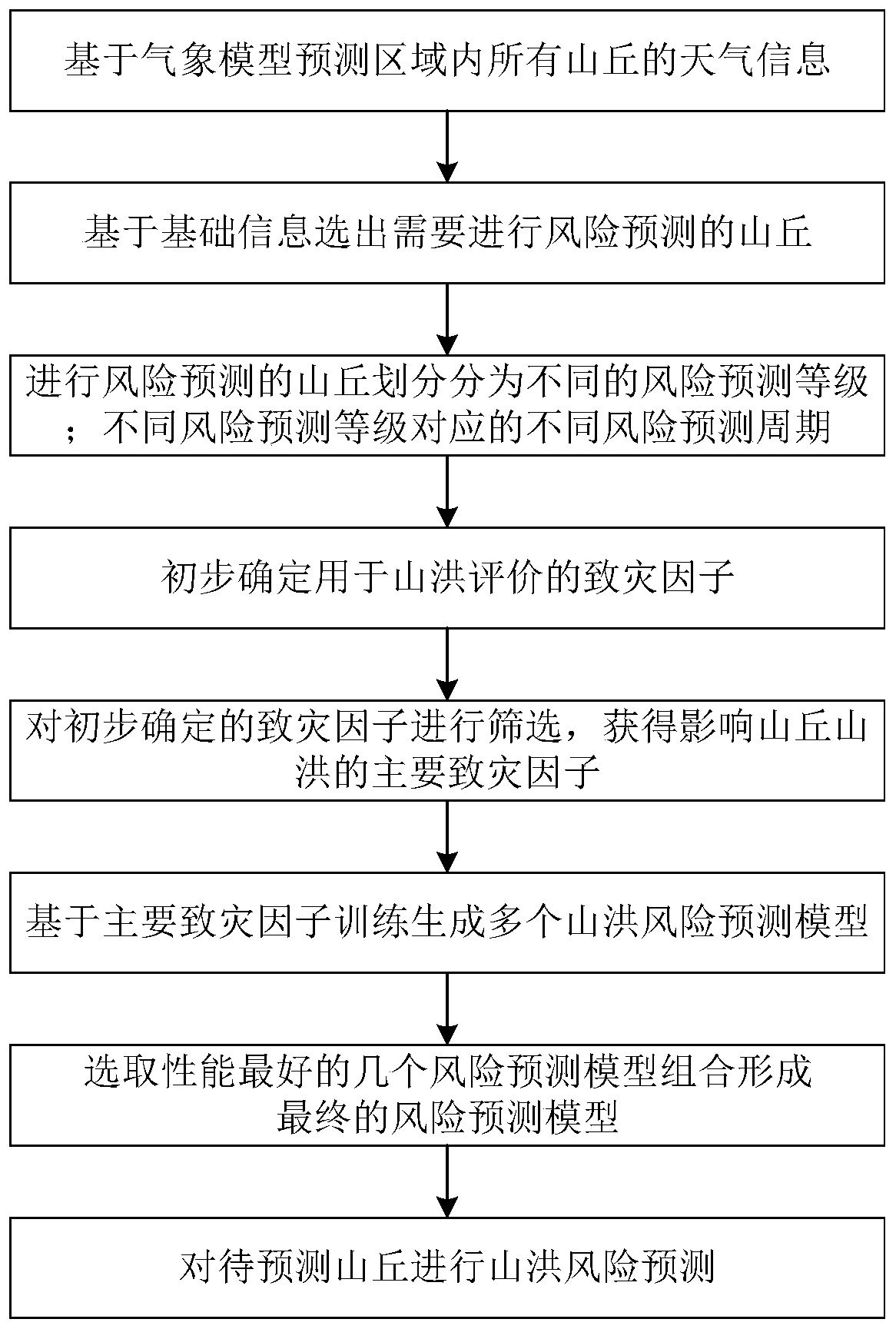

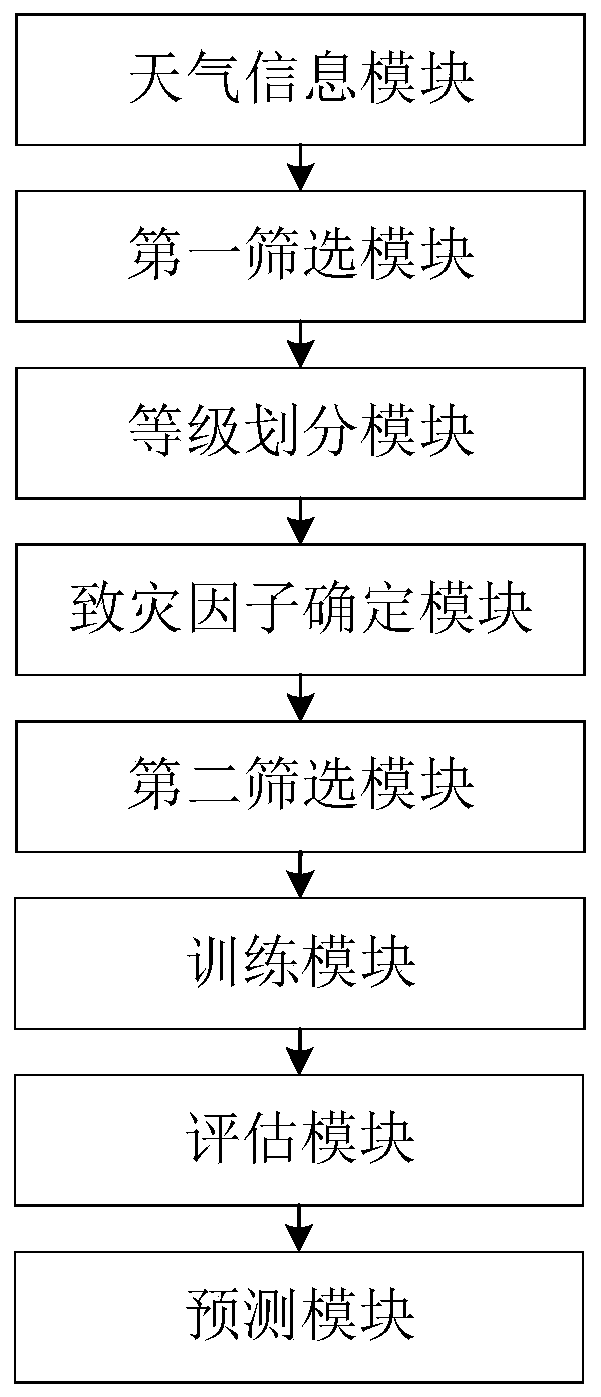

Regional mountain torrent risk prediction method and system

ActiveCN111047099APredicted Value at RiskAchieve forecastClimate change adaptationForecastingEngineeringAtmospheric sciences

The invention discloses a regional mountain torrent risk prediction method and system. The method comprises the steps: S1, predicting the weather information of all hills in a region based on a meteorological model; S2, screening out hills needing risk prediction based on the weather information; S3, dividing hills needing risk prediction into different risk prediction levels according to the basic information of the hills; wherein different risk prediction levels correspond to different risk prediction periods; S4, preliminarily determining disaster-causing factors for mountain torrent evaluation; S5, screening the preliminarily determined disaster-causing factors to obtain main disaster-causing factors influencing the mountain torrent; S6, training and generating a plurality of mountaintorrent risk prediction models based on the main disaster-causing factors; S7, several risk prediction models with the best performance are selected to be combined to form a final risk prediction model; and S8, performing mountain torrent risk prediction on the hill to be predicted. According to the method, the risk prediction of the regional hill is realized, the realization cost is low, the coverage is wide, the processing efficiency is high, and the safety of the hill is improved.

Owner:杭州鲁尔物联科技有限公司

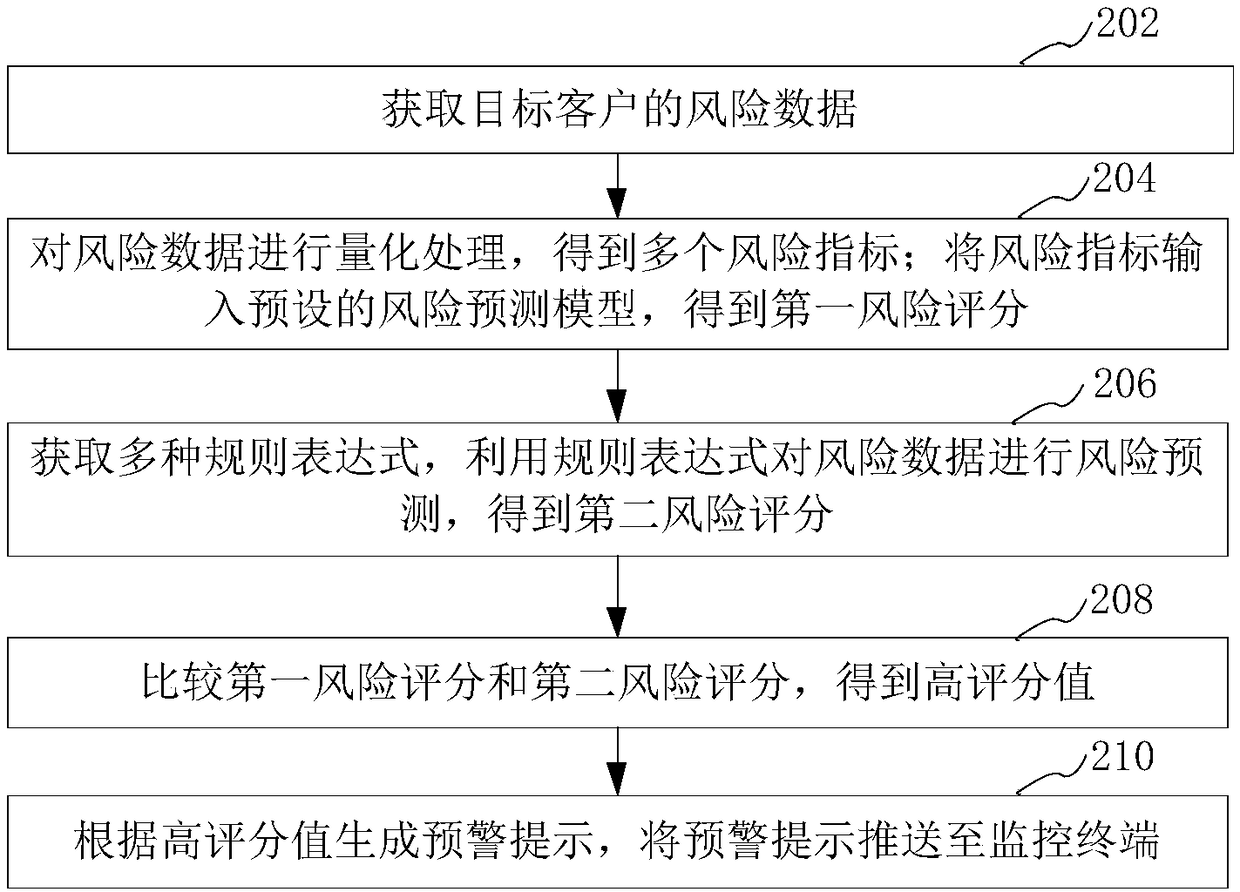

Early warning information push method, device, computer device and medium

ActiveCN108876600AReduce false negative rateHigh scoreFinanceEnergy efficient computingRisk indicatorRisk prediction models

The present application relates to a big data analysis-based early warning information push method, an early warning information push device, a computer device and a storage medium. The method includes the following steps that: the risk data of a target customer are acquired; the risk data are quantified, so that a plurality of risk indicators are obtained; the risk indicators are inputted into apreset risk prediction model, so that a first risk score is obtained; a plurality of rule expressions are obtained, the rule expressions are adopted to perform risk prediction on the risk data, so that a second risk score can be obtained; and the first risk score and the second risk score are compared with each other, so that a high score value is obtained; and an early warning prompt is generatedaccording to the high score value, and the early warning prompt is pushed to a monitoring terminal. With the method adopted, the reliability of early warning information can be improved, and the false negative rate of risks can be reduced.

Owner:PING AN TECH (SHENZHEN) CO LTD

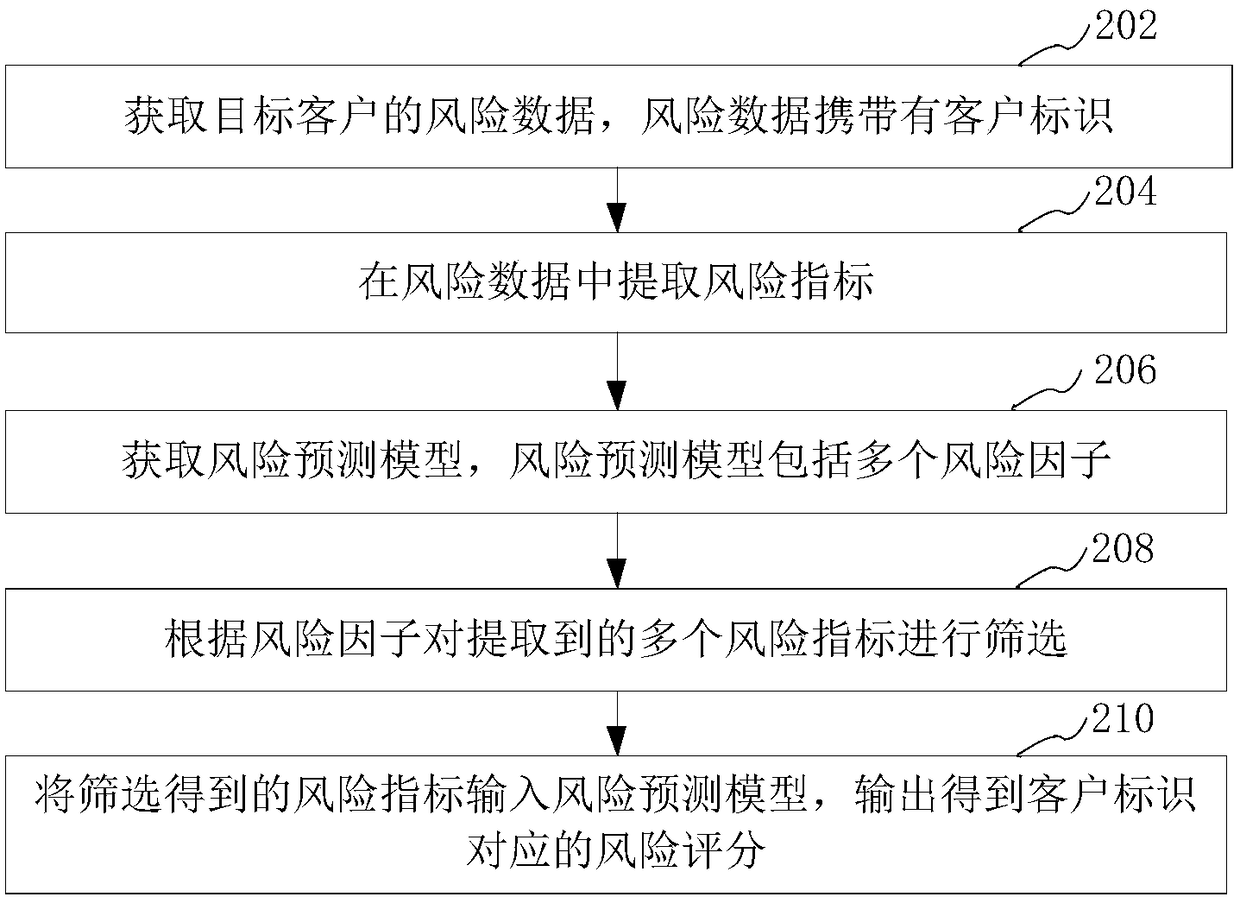

Risk prediction processing method and apparatus, computer device and medium

ActiveCN109165840AImprove the efficiency of risk predictionImprove forecasting efficiencyFinanceResourcesRisk indicatorCustomer identification

The present application relates to a risk prediction processing method and apparatus based on big data analysis, a computer device and a storage medium. The method comprises the following steps of: obtaining risk data of a target customer, wherein the risk data carries a customer identification; extracting a risk indicator from the risk data; acquiring a risk prediction model, the risk predictionmodel comprising a plurality of risk factors; screening the extracted plurality of risk indicators according to the risk factors; inputting the screened risk indicators into the risk prediction model,and outputting the risk score corresponding to the customer identification. The method can improve the efficiency and accuracy of risk prediction.

Owner:PING AN TECH (SHENZHEN) CO LTD

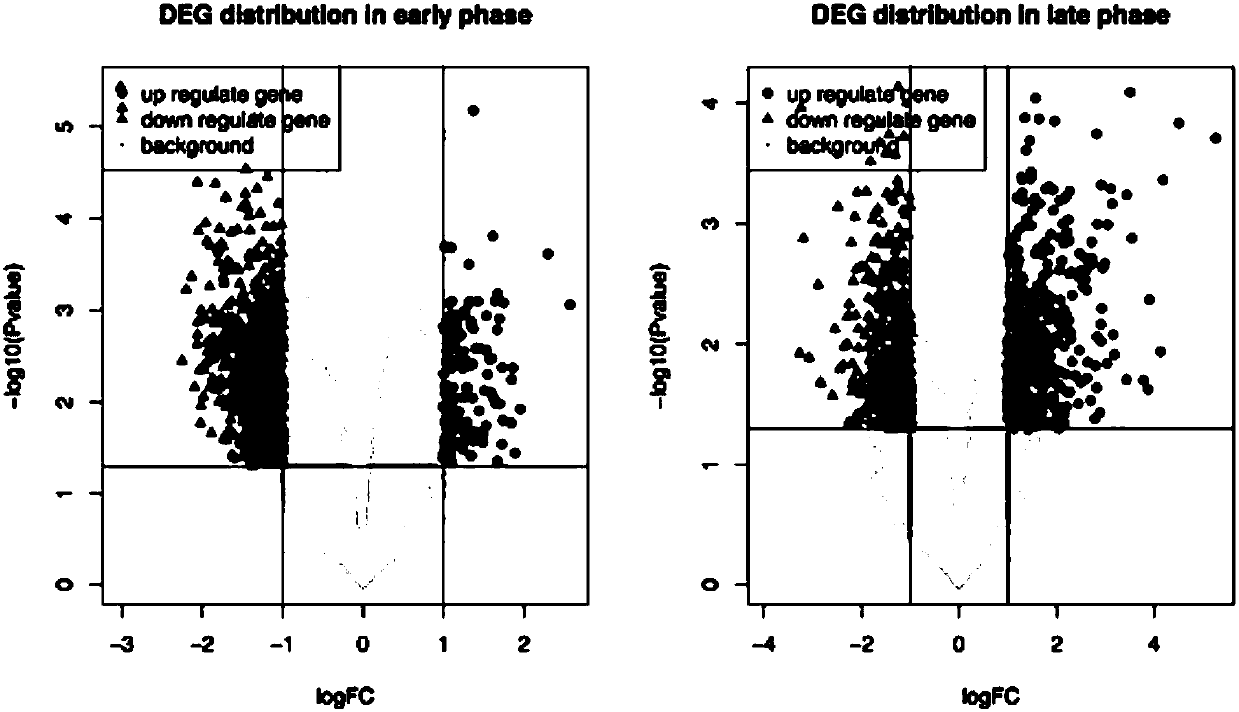

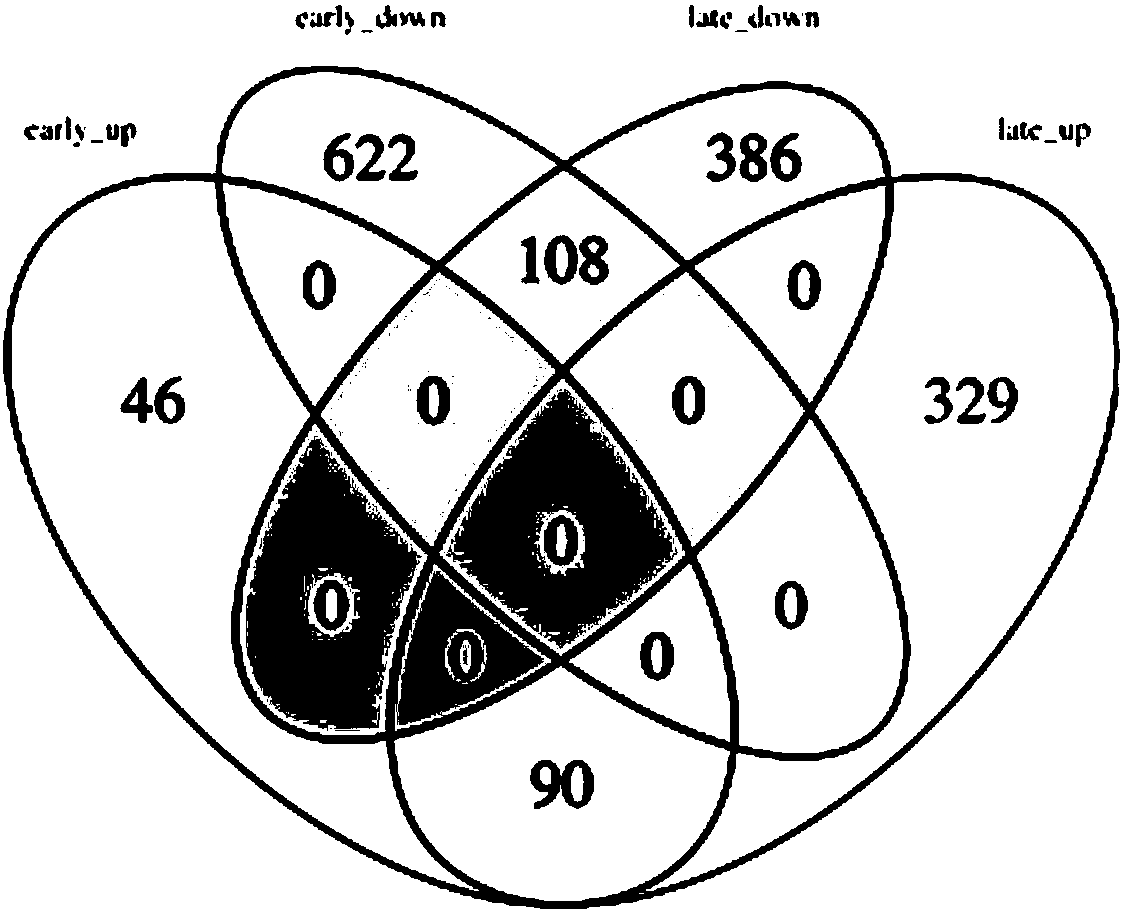

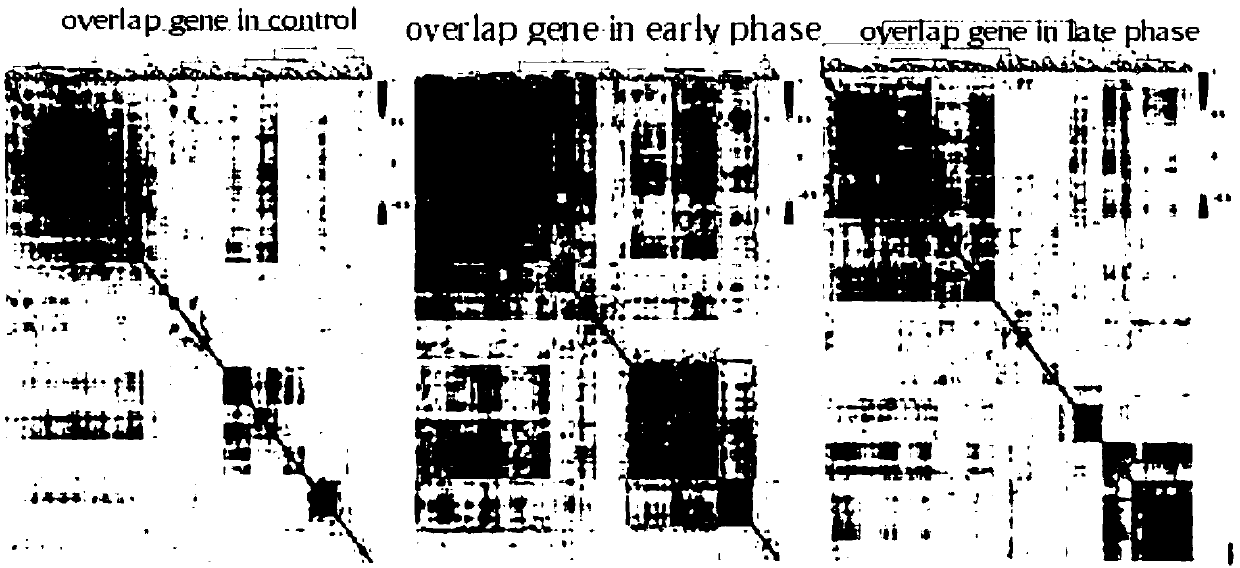

Identification of early diagnosis markers of lung adenocarcinoma based on co-expression similarity, and constructing method of risk prediction model

ActiveCN109841281ARealize automatic classification predictionRealize non-invasive diagnosisHealth-index calculationMedical automated diagnosisCorrelation analysisUnsupervised clustering

The invention belongs to the technical field of lung adenocarcinoma prediction, and specifically relates to an identification of early diagnosis markers of lung adenocarcinoma based on co-expression similarity, and a constructing method of a risk prediction model. The constructing method includes the steps of: data remodeling and grouping, data standardization, phase specific gene extraction, geneco-expression correlation analysis, unsupervised cluster analysis, specific and non-specific co-expression network analysis, functional pathway gathering, significant variation pathway identification, screening of early screening marker genes by using an REE algorithm, establishment of a classification model based on early screening risk genes, survival analysis verification, and the like. The identification of early diagnosis markers of lung adenocarcinoma based on co-expression similarity, and the constructing method of a risk prediction model can realize the early diagnosis of lung cancer,and can identify gene markers which change significantly with the progress of lung cancer at the same time.

Owner:THE FIRST AFFILIATED HOSPITAL OF ZHENGZHOU UNIV

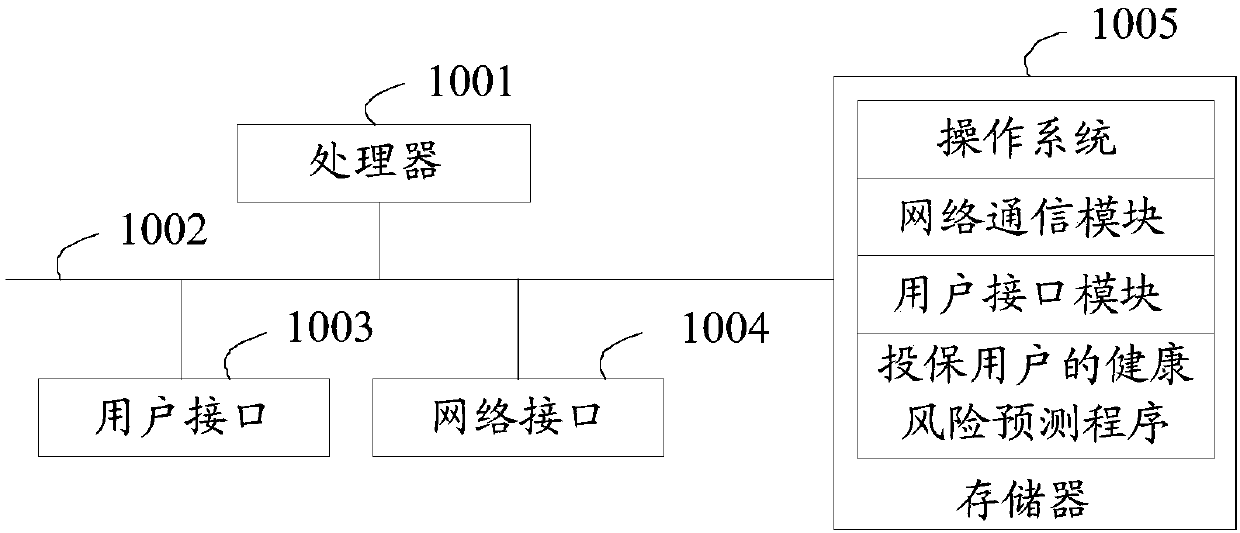

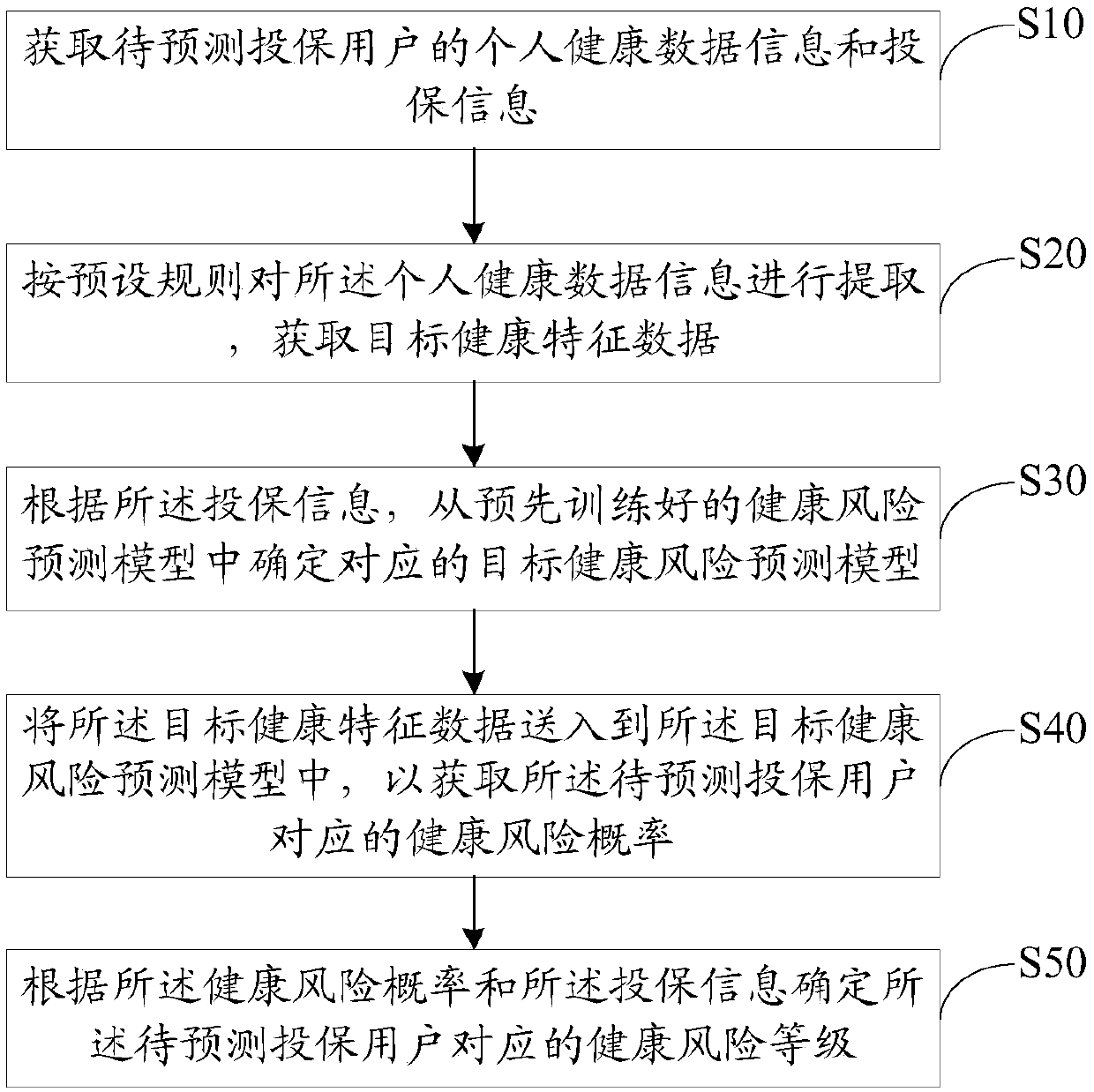

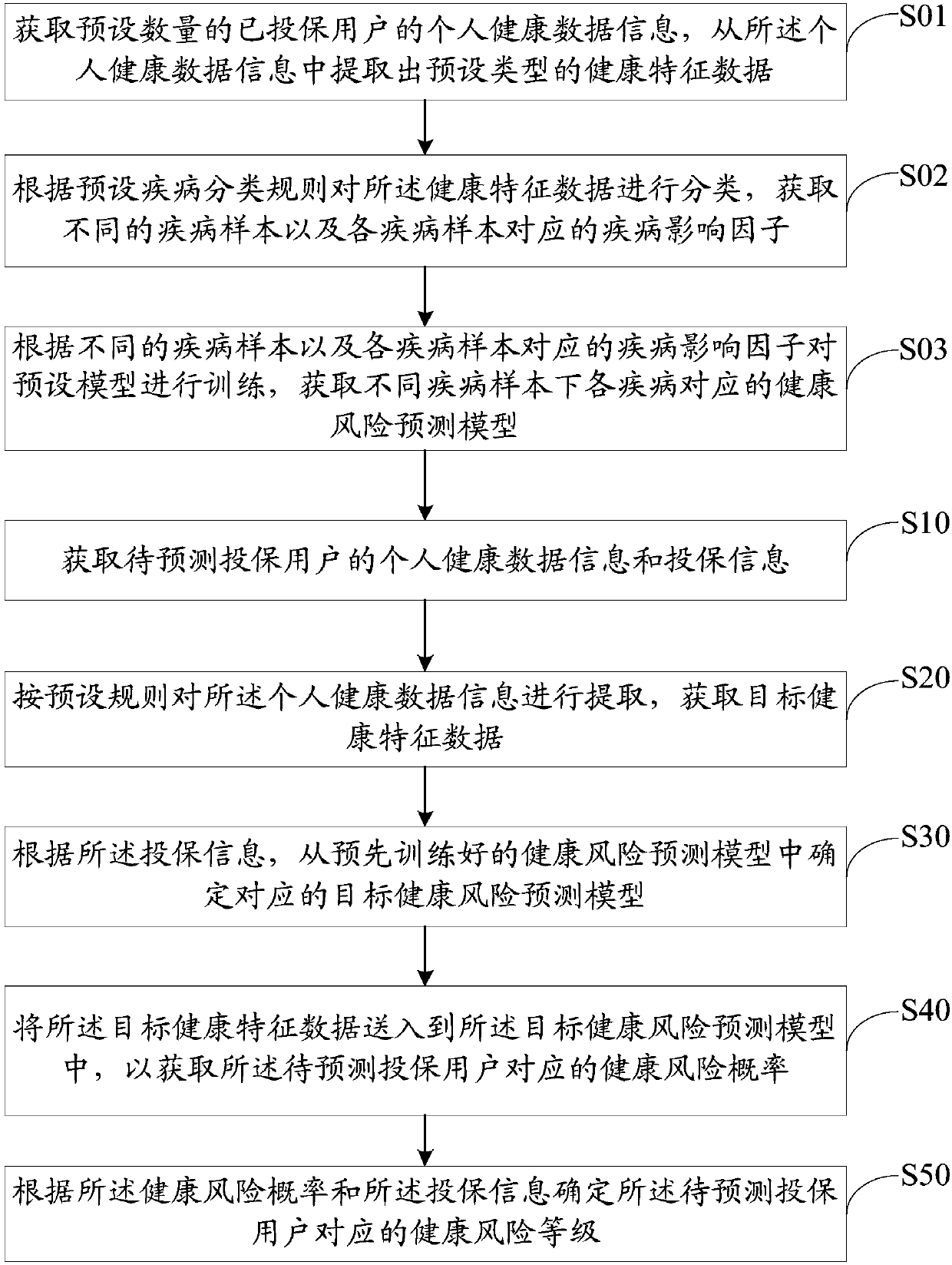

Health risk prediction method, device and equipment for insured users, and storage medium

InactiveCN107910068AReduce workloadGuaranteed accuracyFinanceHealth-index calculationHealth riskData information

The invention discloses a health risk prediction method, device and equipment for insured users, and a storage medium. The method includes the following steps: obtaining personal health data information and insurance information of a to-be-predicted insured user; carrying out extraction on the personal health data information according to a preset rule to obtain target health feature data; determining a corresponding target health risk prediction model from pre-trained health risk prediction models according to the insurance information; and sending the target health feature data to the targethealth risk prediction model to obtain the health risk probability corresponding to the to-be-predicted insured user. As the corresponding target health risk prediction model is determined accordingto the pre-trained health risk prediction models and the health risk probability is calculated through the model, the health risk level corresponding to the to-be-predicted insured user can be determined accurately according to the insurance information. The workload of the staff is reduced while the effect of health risk prediction is ensured.

Owner:PING AN HEALTH INSURANCE CO LTD

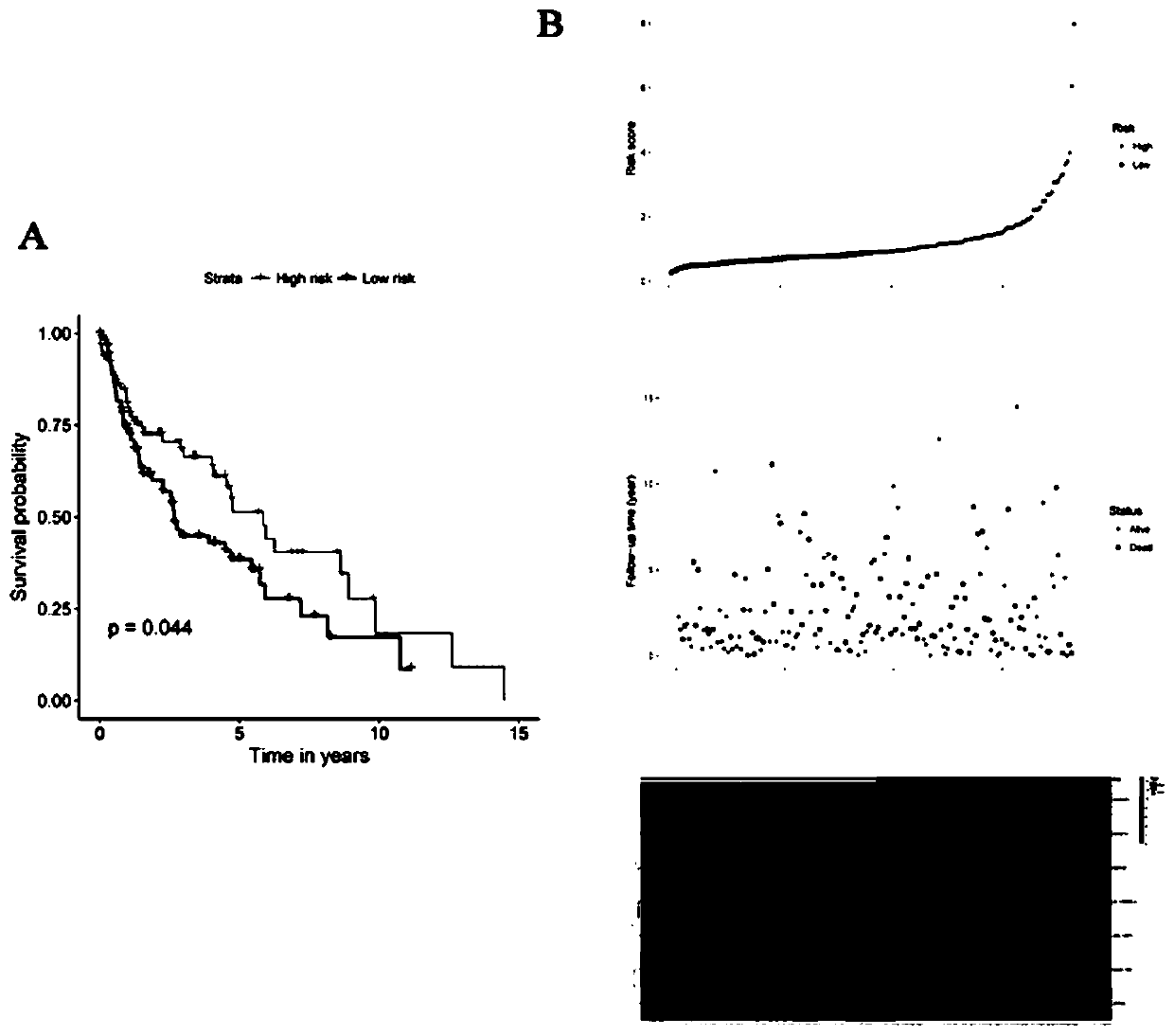

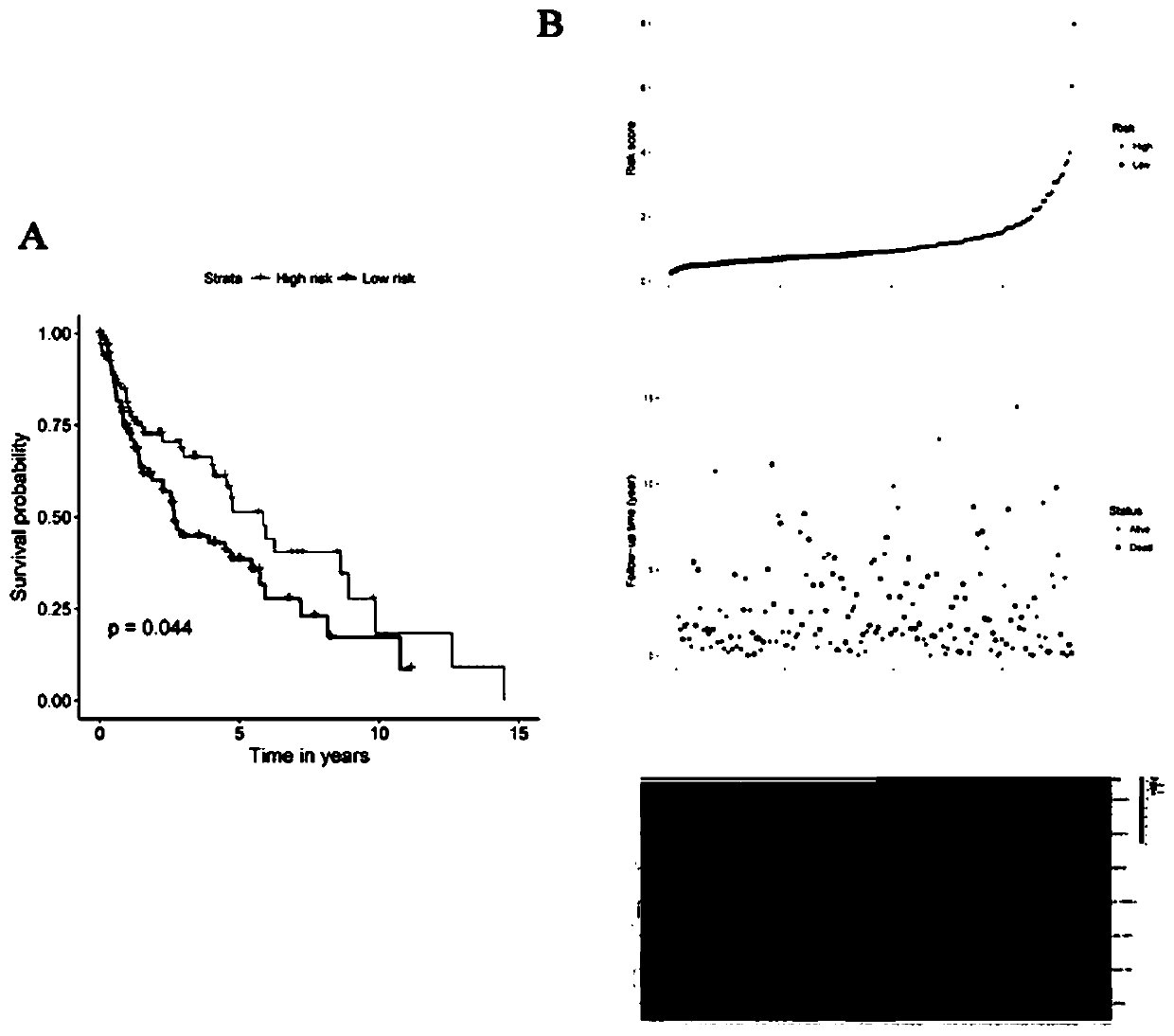

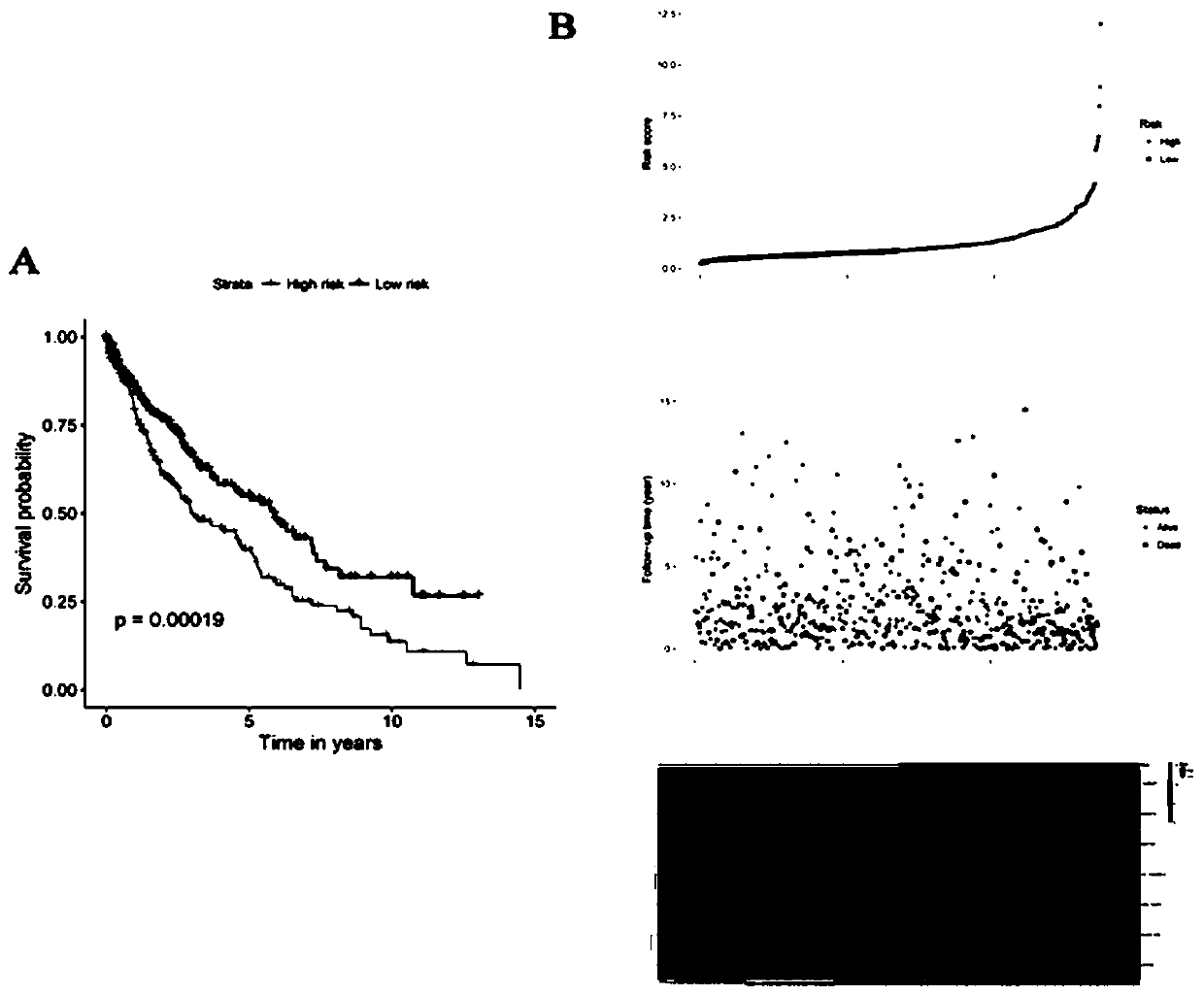

Model for predicting prognosis of lung squamous cell carcinoma with seven genes as biomarkers, and establishing method thereof

PendingCN109859801AVerify feasibilityBiostatisticsHybridisationOvarian Squamous Cell CarcinomaLung squamous cell carcinoma

The invention relates to a the field of biomedicine, and specifically relates to a model for predicting prognosis of lung squamous cell carcinoma with seven genes as biomarkers, and an establishing method thereof. The model for predicting prognosis of lung squamous cell carcinoma includes seven genes related to prognosis of lung squamous cell carcinoma: CSRNP1, CLEC18B, MIR27A, AC130456.4, DEFA6,ARL14EPL and ZFP42, wherein expressions of CSRNP1 and CLEC18B are positively correlated with a survival rate while expressions of MIR27A, AC130456.4, DEFA6, ARL14EPL and ZFP42 are negatively correlated with the survival rate. The model for predicting prognosis of lung squamous cell carcinoma provides a plurality of genes as biomarkers, and improves the prognosis sensitivity and accuracy for predicting lung squamous cell carcinoma, thereby reducing mortality and local recurrence rate in patients with lung squamous cell carcinoma, and improving the prognosis of patients through the risk prediction model.

Owner:辽宁省肿瘤医院

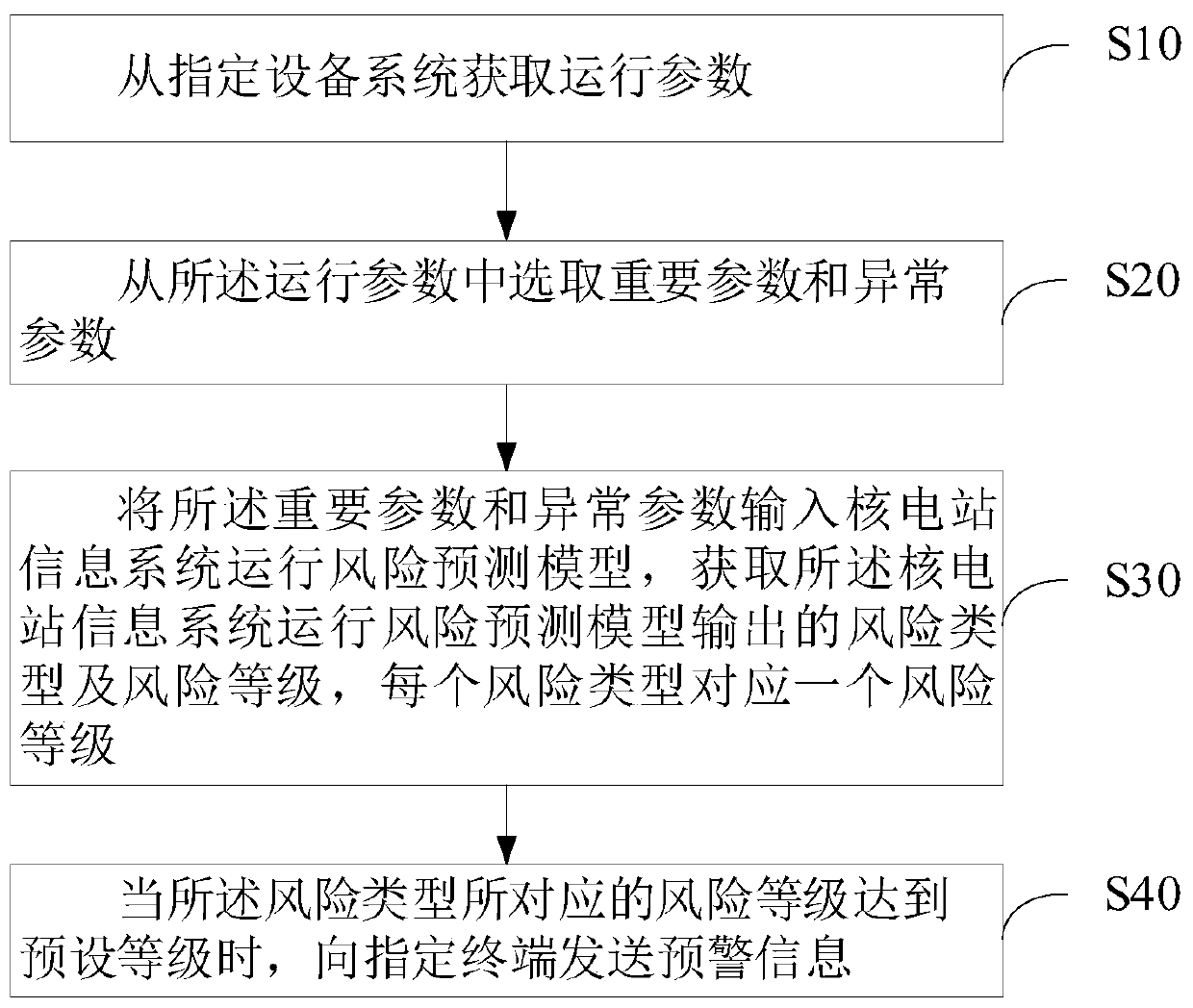

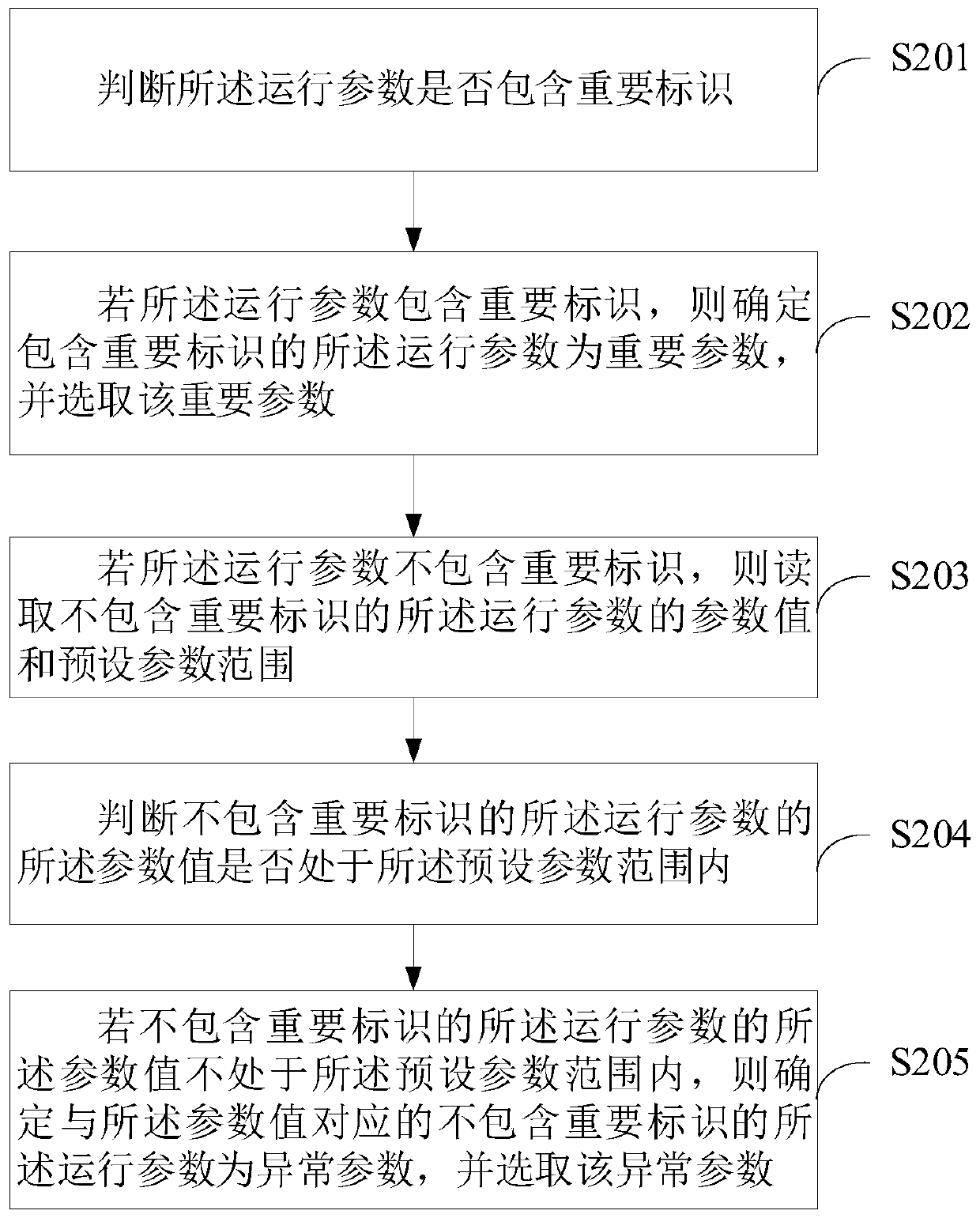

Nuclear power station information system operation safety early warning method and device, apparatus and medium

ActiveCN110175756AReduce processingImprove judgment accuracyResourcesInformation technology support systemRisk levelNuclear power

The invention belongs to the technical field of nuclear power station information construction, and discloses a nuclear power station information system operation safety pre-warning method and devicesuitable for the information machine room dynamic environment monitoring, a computer apparatus and a storage medium. The method comprises the steps of obtaining the power distribution and environmentparameters of the related apparatuses of an information machine room information system from a designated apparatus system; selecting the important parameters and the abnormal parameters from the operation parameters; inputting the important parameters and the abnormal parameters into a nuclear power station information system operation risk prediction model, obtaining the risk types and the risklevels outputted by the nuclear power station information system operation risk prediction model, and enabling each risk type to correspond to one risk level; and when the risk level corresponding tothe risk type reaches a preset level, sending the early warning information to a designated terminal. According to the nuclear power station information system operation safety early warning method provided by the invention, the judgment precision of the nuclear power station on the safety risk can be improved, and meanwhile, the timeliness of the systematic risk feedback is ensured.

Owner:LINGAO NUCLEAR POWER +5

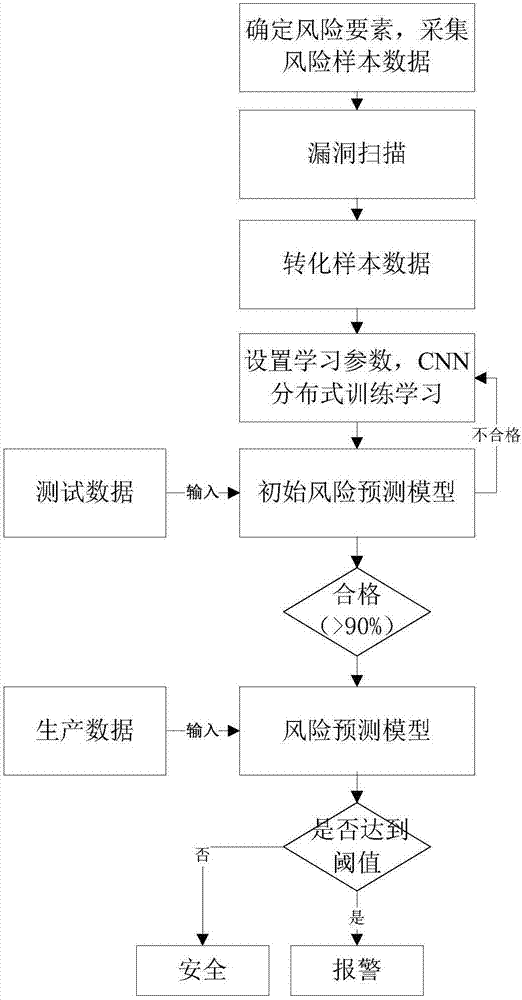

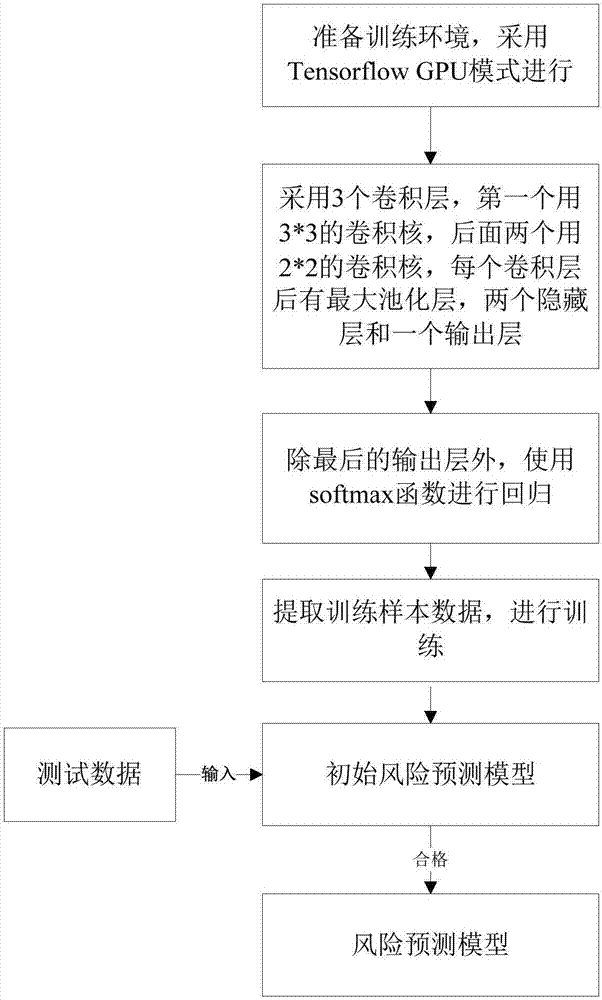

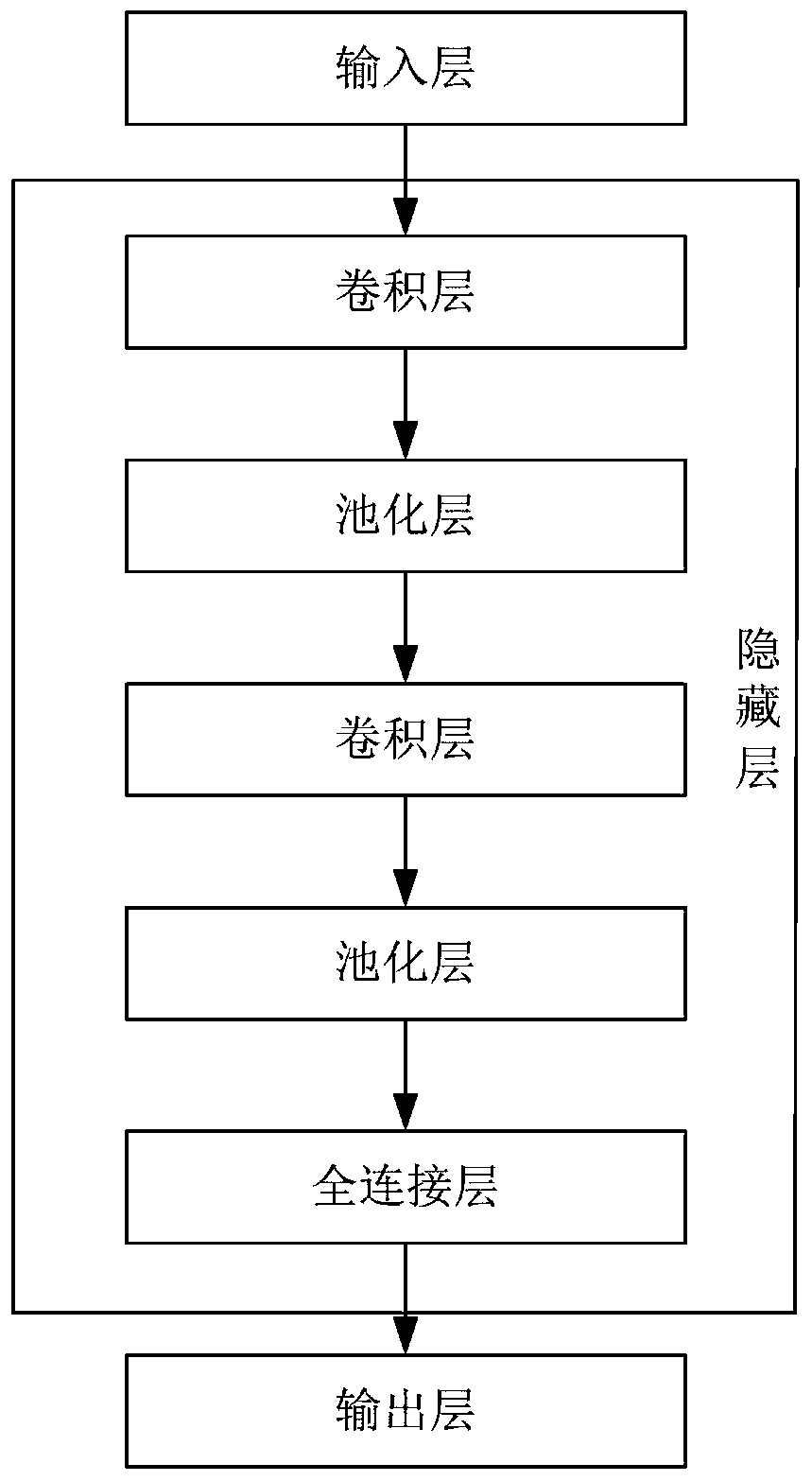

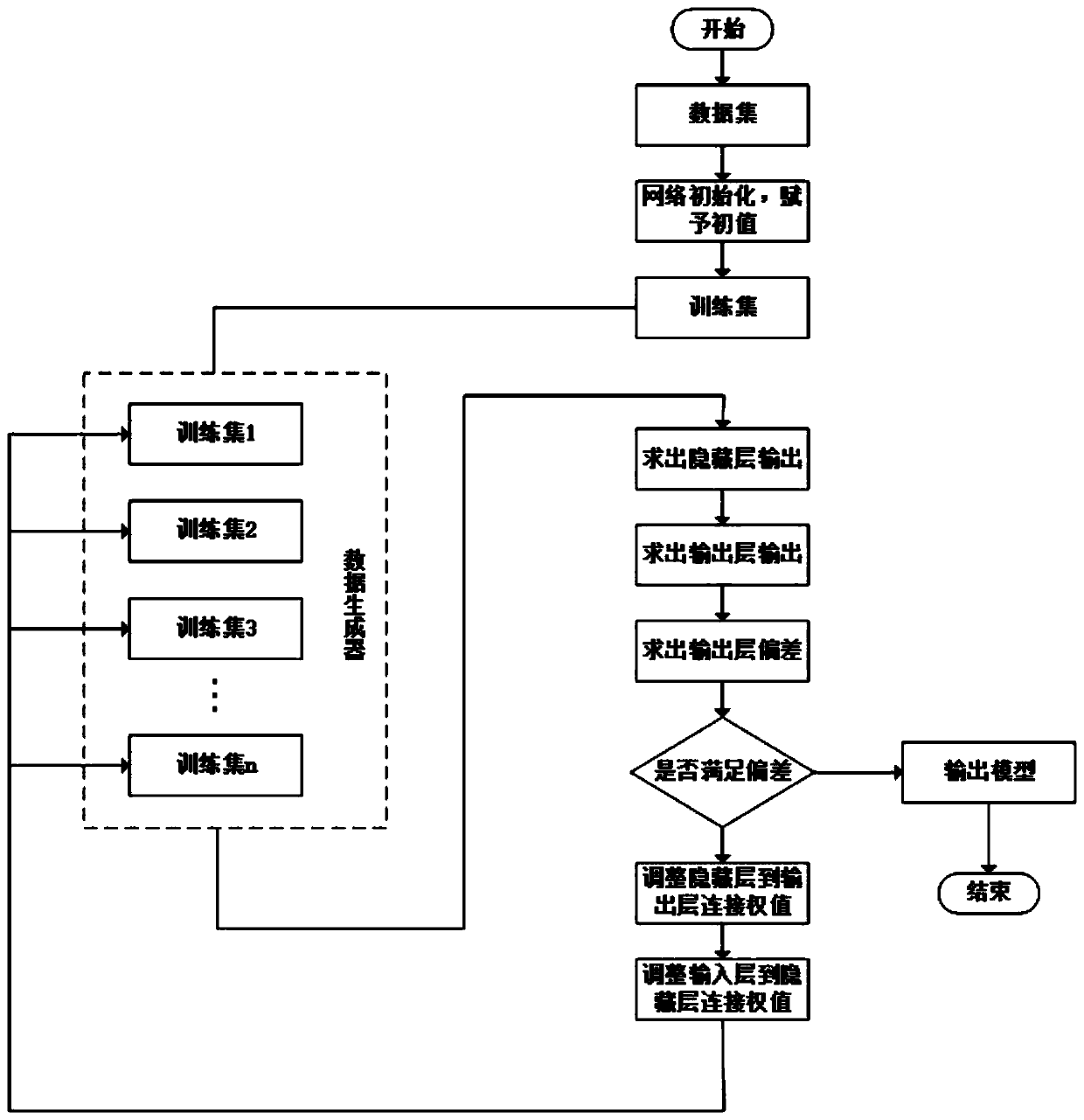

Depth study-based network risk early warning method

ActiveCN107104978AQuick discoveryQuick responseTransmissionSpecial data processing applicationsData miningRisk evaluation

The invention discloses a depth study-based network risk early warning method. The method comprises the following steps of: A1. collecting cyberspace asset risk sample data of a full network segment, and storing the cyberspace asset risk sample data in a database; A2. extracting data from the database, and performing convolutional neural network distributed training study, so as to form an initial risk prediction model; and A3. inputting production data into the risk prediction model, evaluating a risk value of the production data, if the risk value reaches an early warning threshold, alarming. Through adoption of the method and device, security risk evaluation and early warning are performed on multiple target networks or targets without obvious vulnerability, and the security state of one network can be evaluated overall; the response speed is improved, and the risk points can be found rapidly; and the maintenance cost is lowered, and the manpower is saved.

Owner:赖洪昌

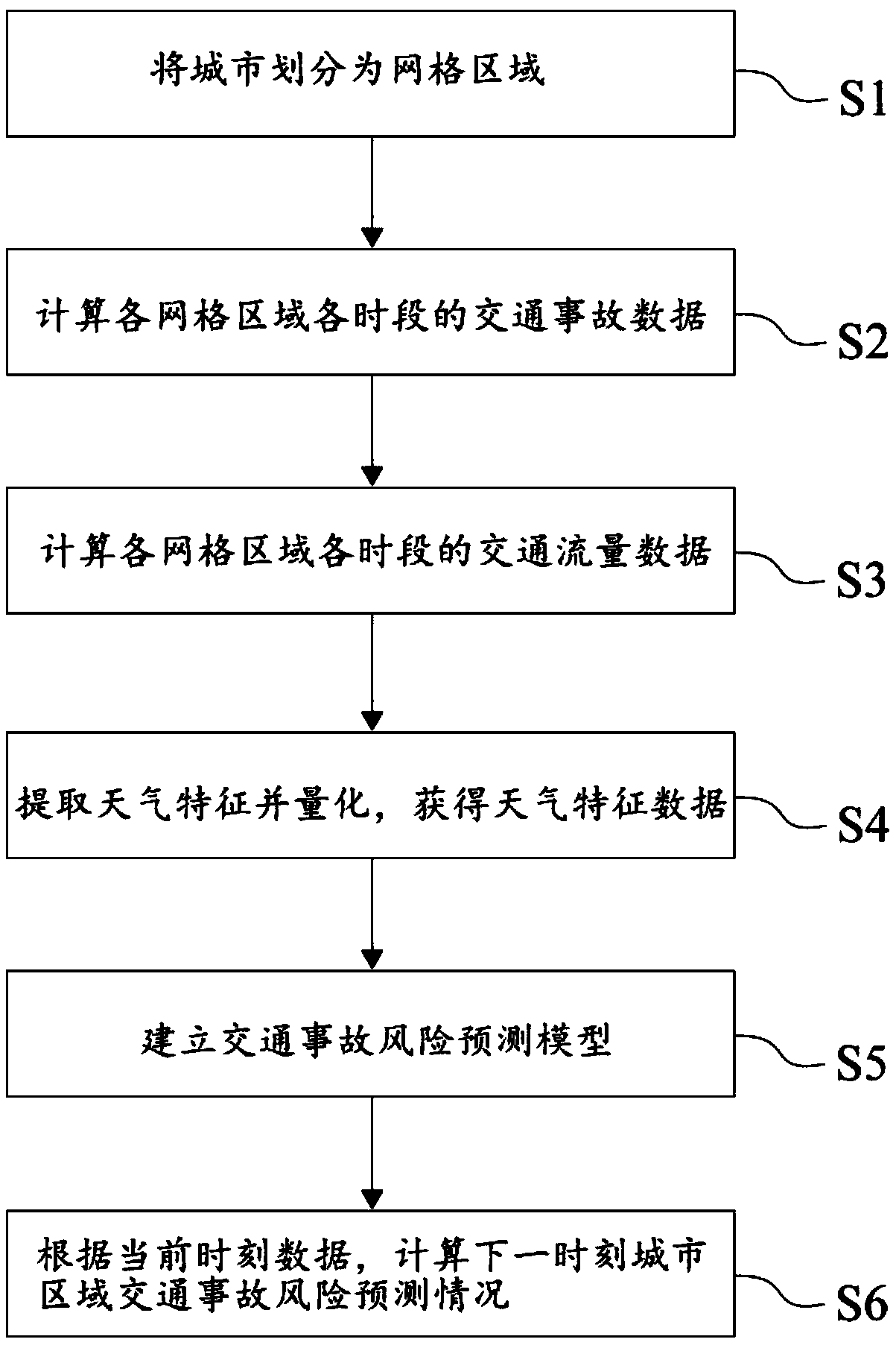

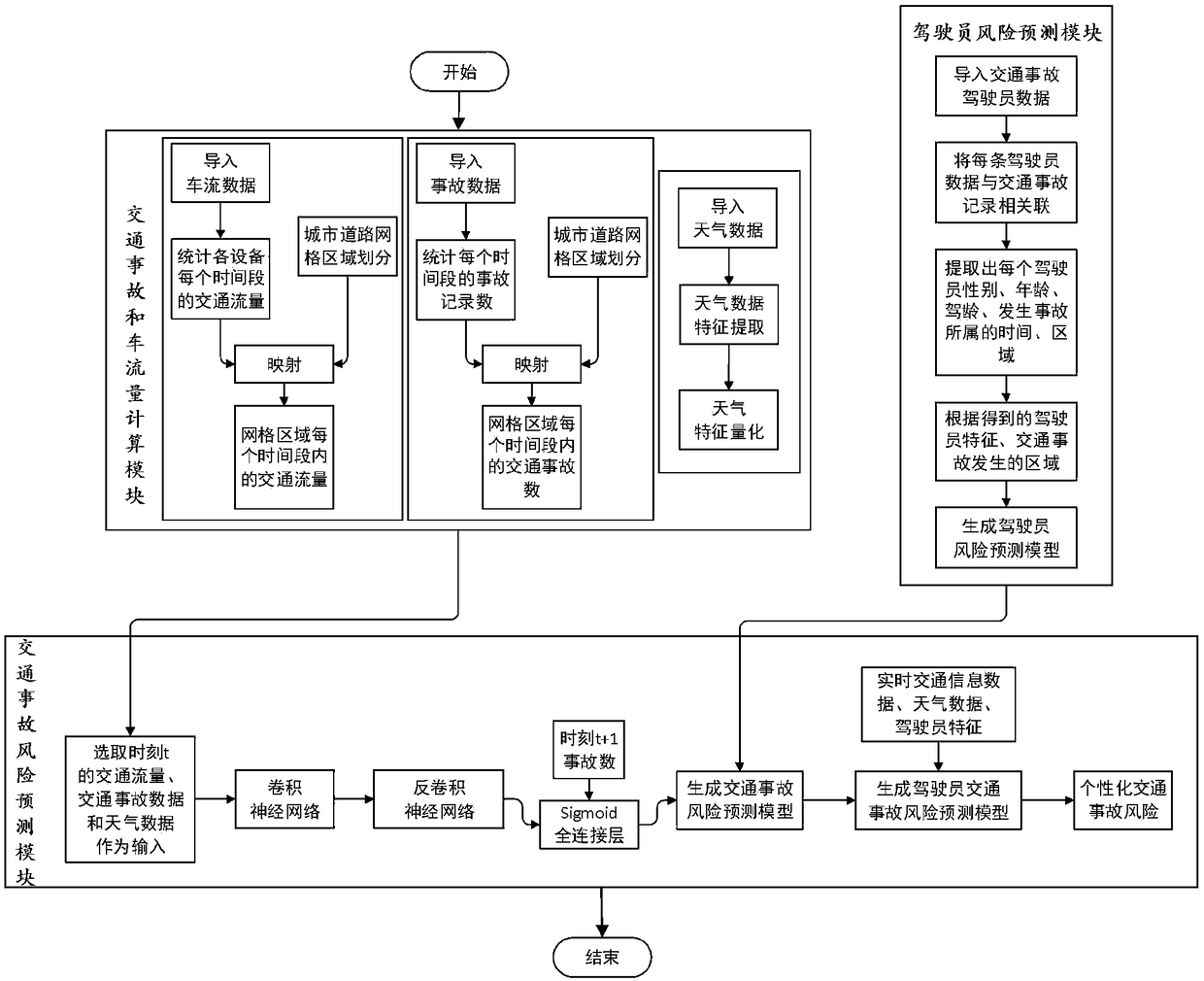

Personalized traffic accident risk prediction and recommendation method based on depth learning

The invention discloses a personalized traffic accident risk prediction recommendation method based on depth learning, which comprises the following steps: dividing a city into grid regions; calculating traffic accident data, traffic flow data and weather characteristic data of each grid region and each period; using the depth learning method to train the model, the traffic accident risk prediction model being obtained. According to the traffic accident data, traffic flow data and weather characteristics data input at the present time, the traffic accident risk prediction model is used to calculate the traffic accident risk prediction at the next time. The invention utilizes the depth learning method to learn the non-linear, high-dimensional and complex correlation relationship between thetraffic accident influence factor and the traffic accident, predicts the traffic accident risk at the city level, and improves the accuracy of the prediction result.

Owner:XIAMEN UNIV

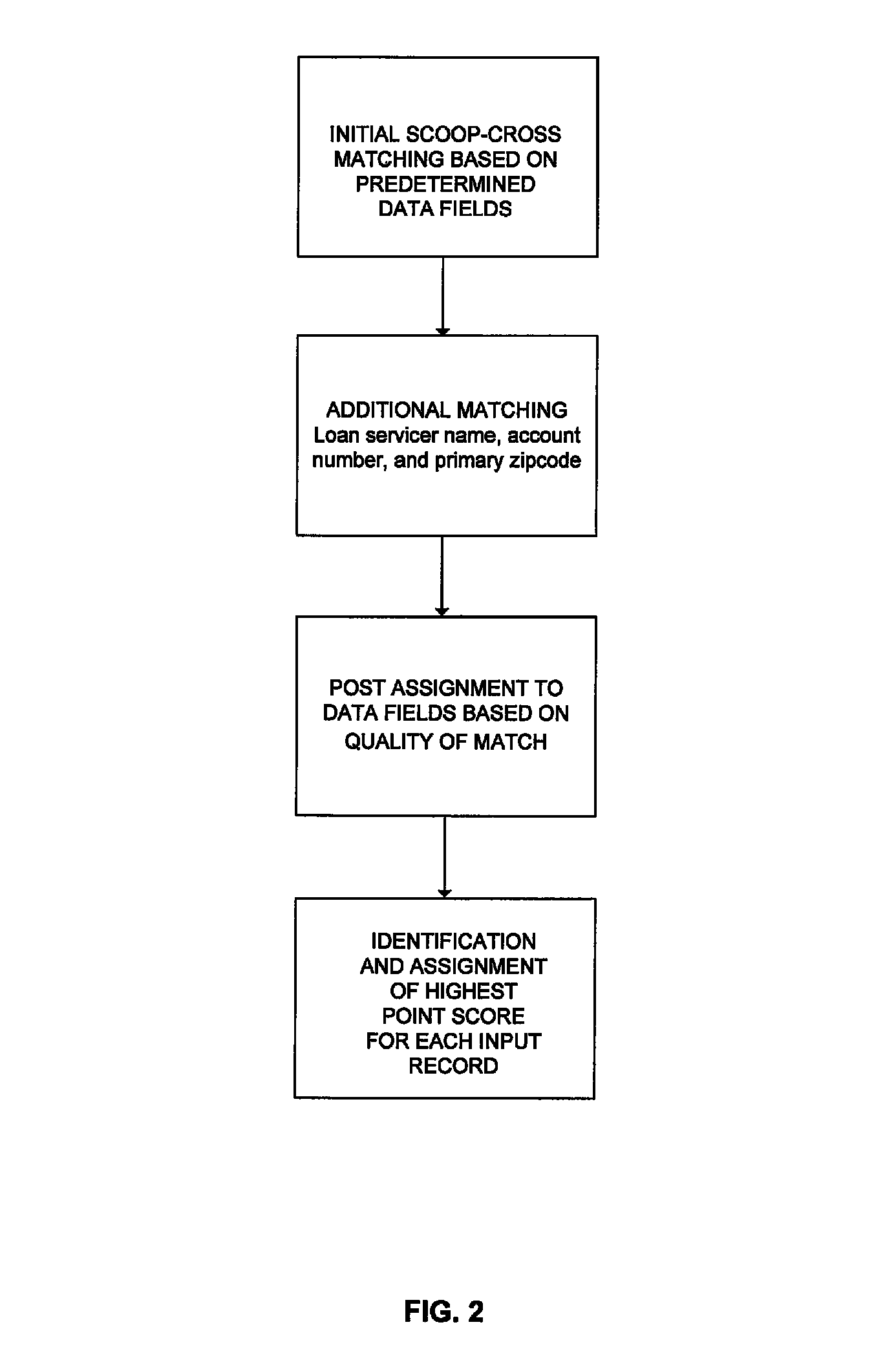

Systems and methods for enrichment of data relating to consumer credit collateralized debt and real property and utilization of same to maximize risk prediction

Systems and methods for enrichment of data associated with risk prediction. Data may be enriched by incorporating one or more aspects of consumer credit, collateralized debt, mortgage, real property, and loan data for use in systems, products, and methods relying on risk prediction models to maximize the effectiveness of the risk prediction. A time-series of consumer credit data may be provided to provide historical context to data. In a particular application, enriched data is leveraged to predict occurrence of an event relating to underlying assets of a structured security, such as a mortgage-backed security. Other systems and methods are disclosed.

Owner:TRANSUNION

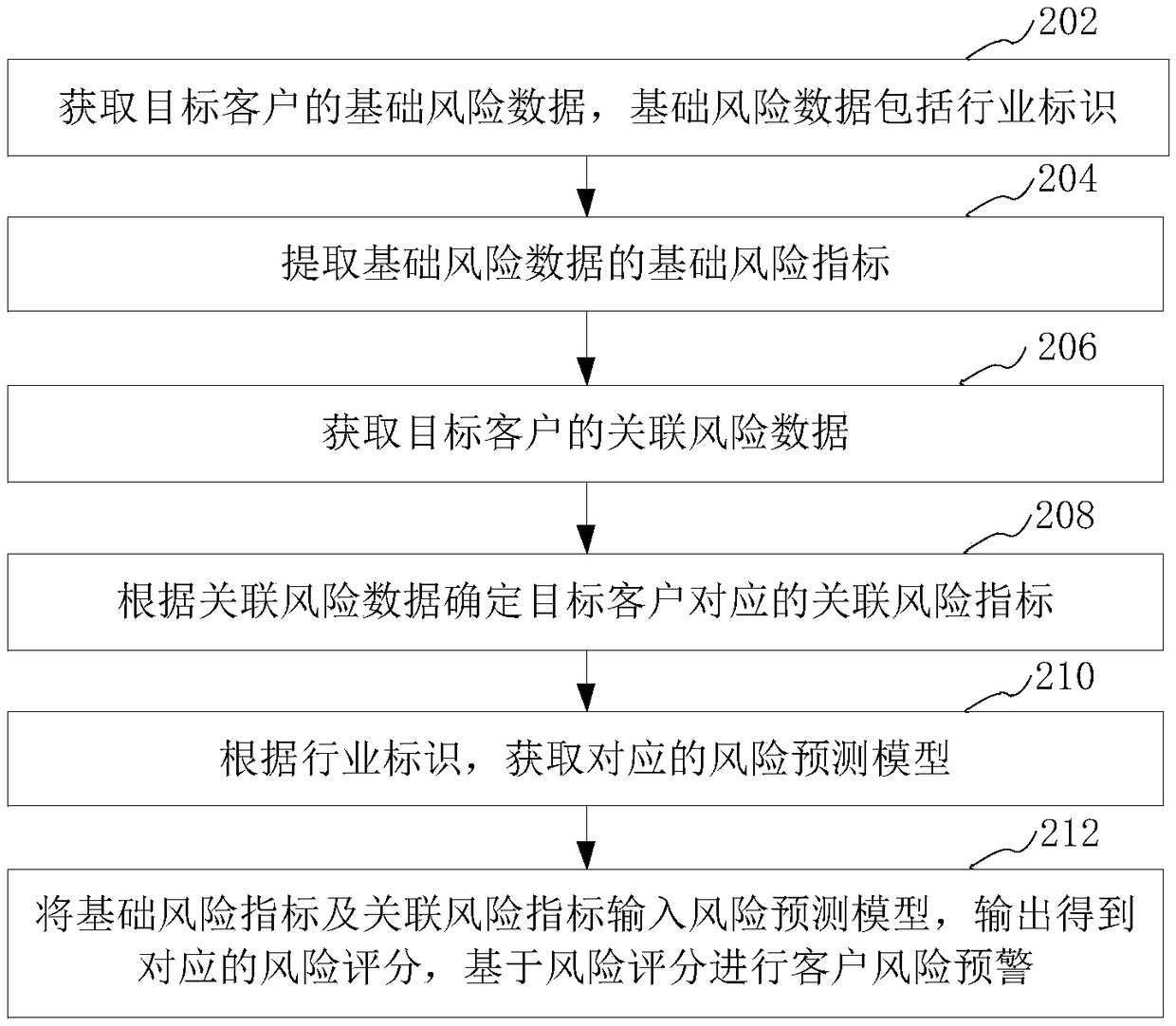

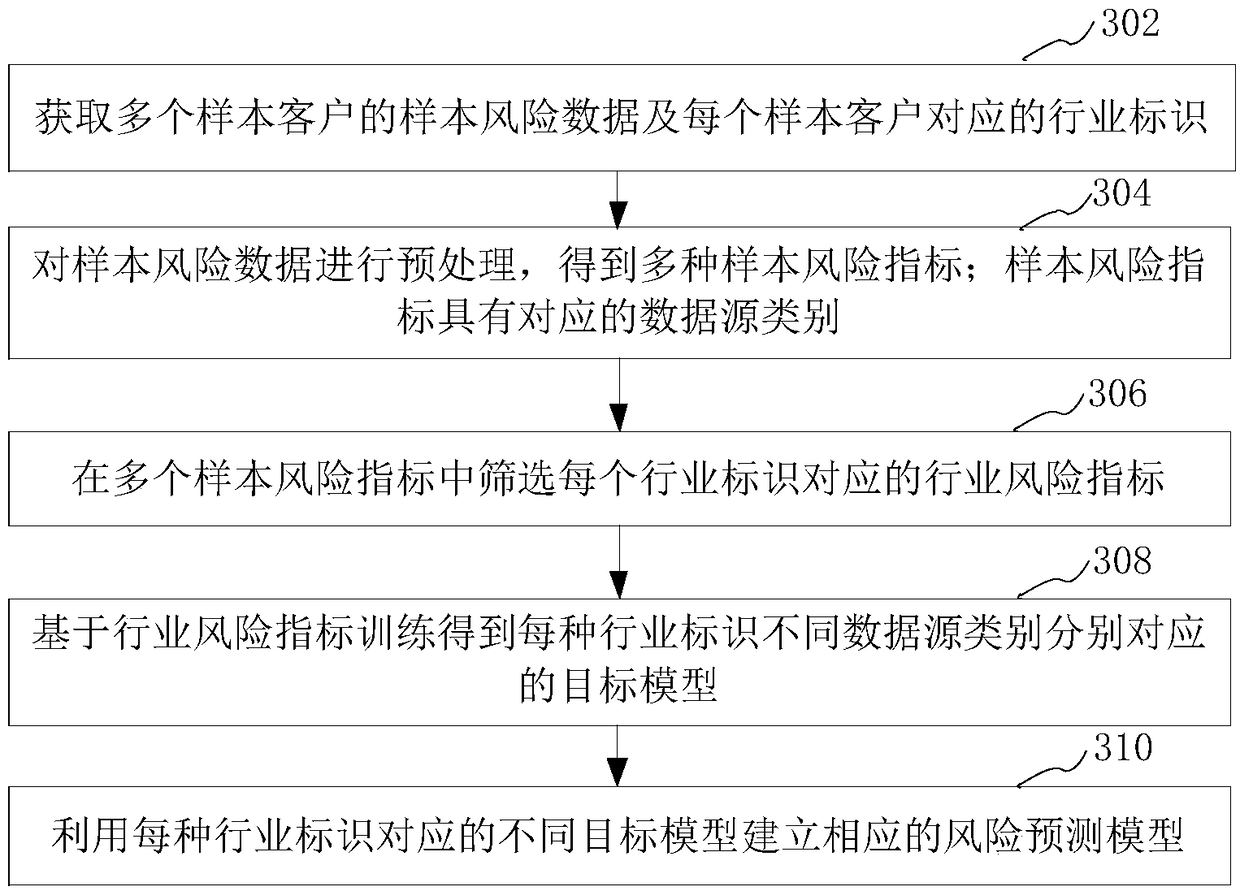

Customer risk early warning method, apparatus, computer device and medium

ActiveCN109272396AImprove the accuracy of risk warningImprove accuracyFinanceRisk indexData analysis

The present application relates to a customer risk early warning method, apparatus, computer device and storage medium based on big data analysis. The method comprises the following steps of: acquiring basic risk data of a target customer, wherein the basic risk data comprises an industry identification; extracting a basic risk index of the basic risk data; acquiring associated risk data of the target customer; determining an associated risk index corresponding to the target customer according to the associated risk data; obtaining a corresponding risk prediction model according to the industry identification; inputting the basic risk index and the associated risk index into the risk prediction model, outputting to obtain a corresponding risk score, and carrying out customer risk early warning based on the risk score. The method can improve the accuracy of risk early warning.

Owner:PING AN TECH (SHENZHEN) CO LTD

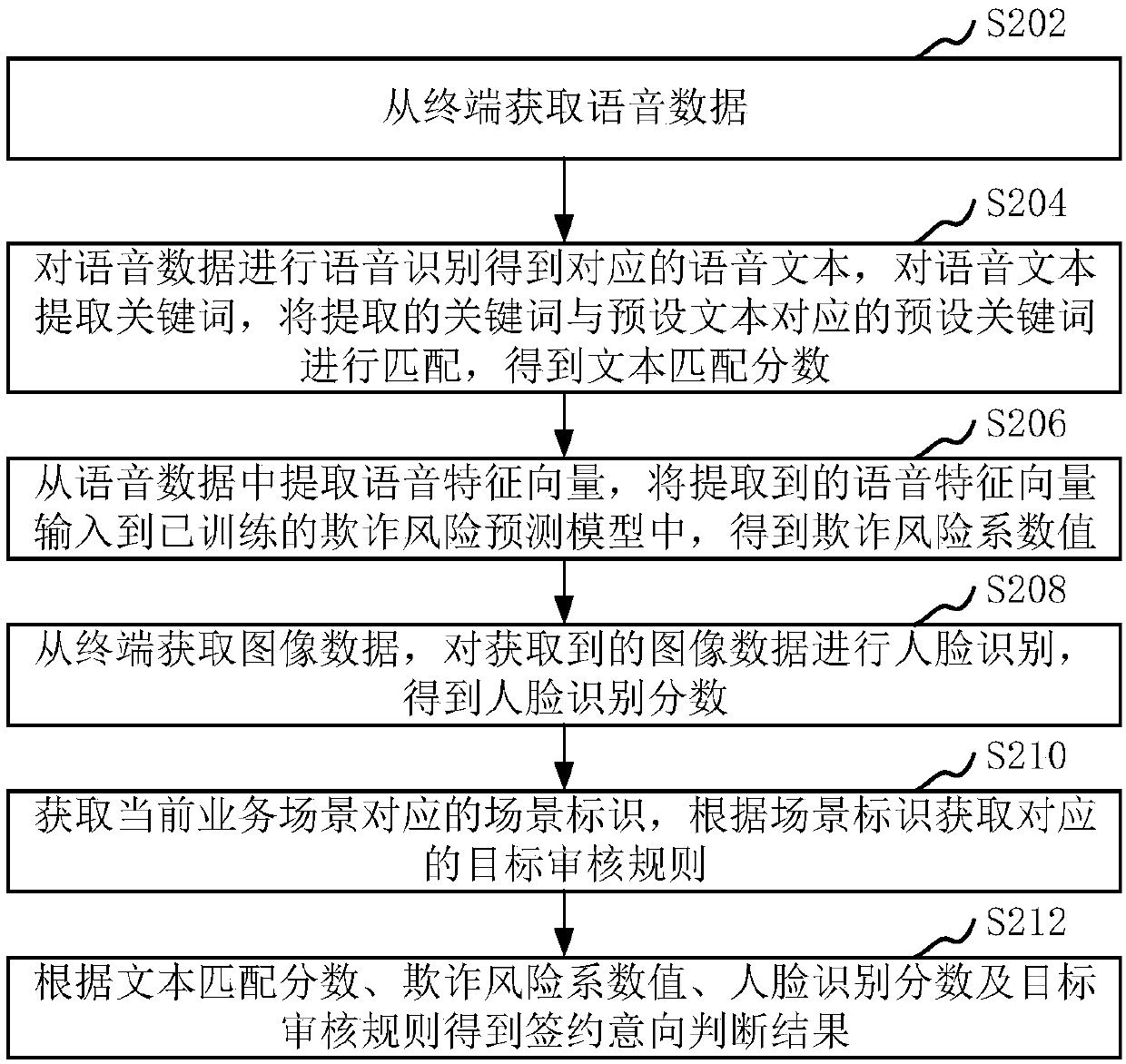

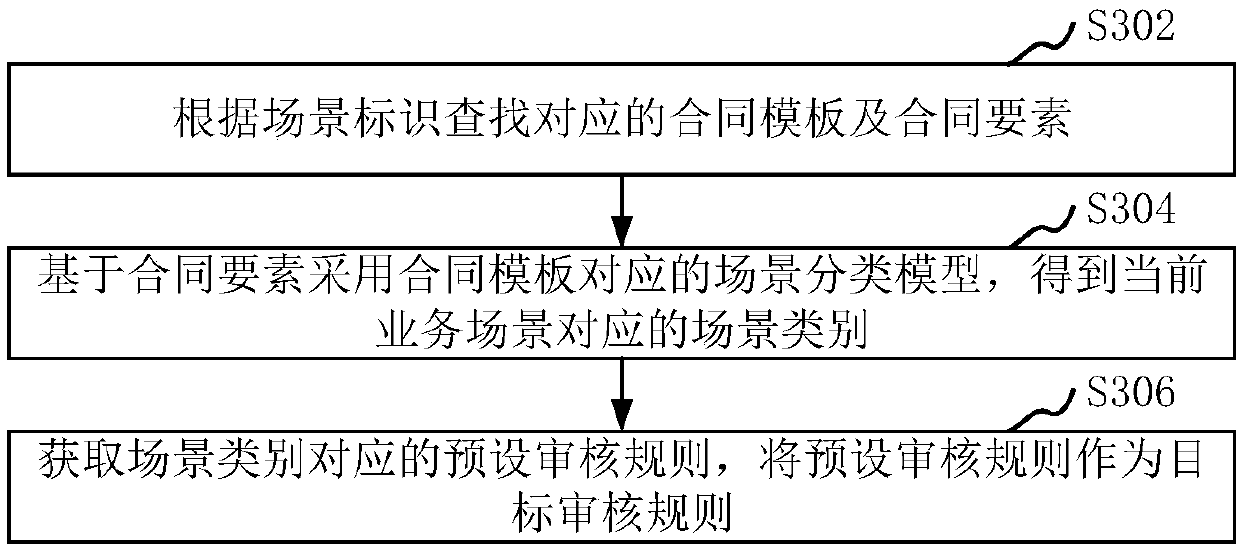

Contract intention judgement method and apparatus, computer apparatus, and storage medium

PendingCN109543516AImplement automatic reviewImprove judgment efficiencySpeech recognitionSpoof detectionFeature vectorSpeech identification

The present application relates to the field of natural language processing technology and provides a contract intention judgement method and apparatus, a computer apparatus, and a storage medium. Themethod comprises the following steps of: acquiring voice data from a terminal; obtaining a speech text by performing speech recognition of speech data, extracting keywords from speech text, matchingthe extracted keywords with preset keywords corresponding to preset text, and obtaining text matching score; extracting the speech feature vector from the speech data, and inputting the extracted speech feature vector into the trained fraud risk prediction model to obtain the fraud risk coefficient value; acquiring image data from a terminal, performing face recognition on the acquired image datato obtain a face recognition score; acquiring scene identifiers corresponding to the current business scenario, and acquiring corresponding target audit rules according to the scene identifiers; according to the text matching score, fraud risk coefficient value, face recognition score and target audit rule, judging the intent to sign the contract.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

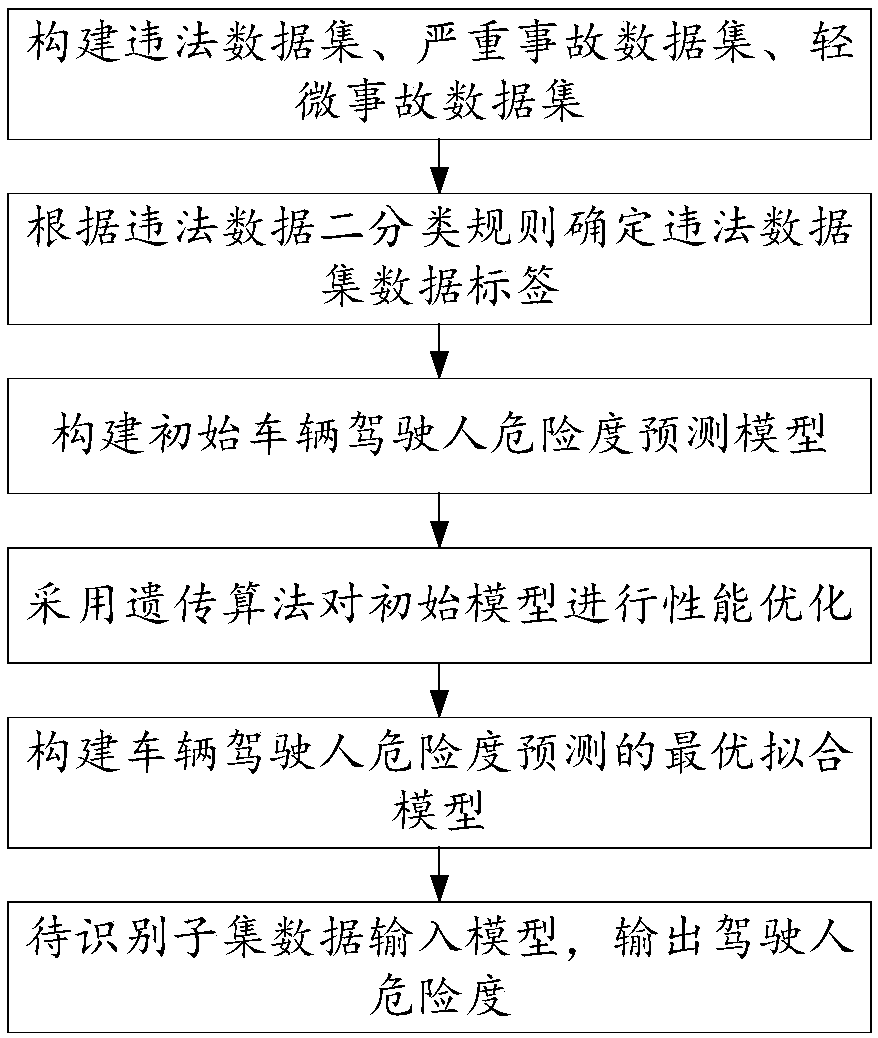

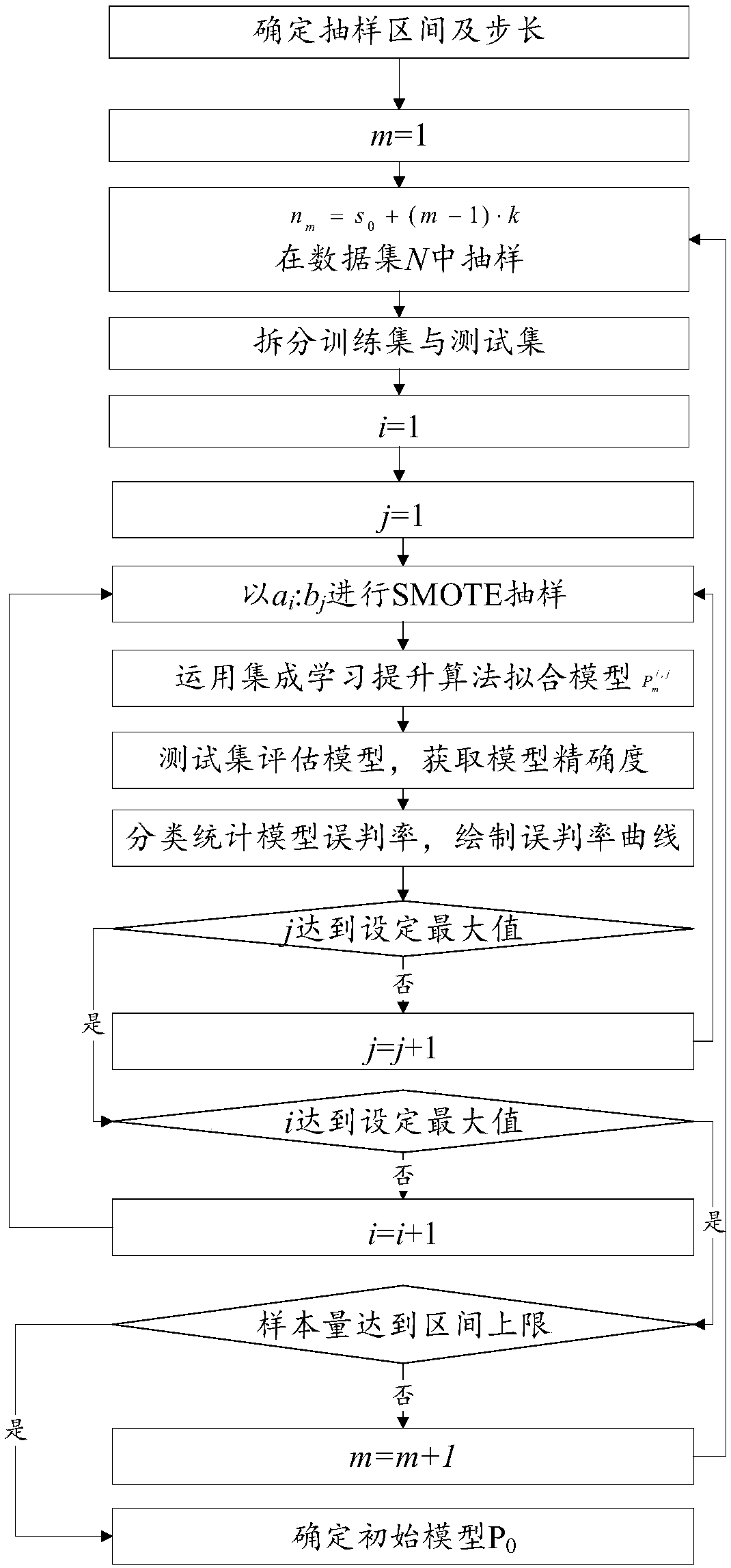

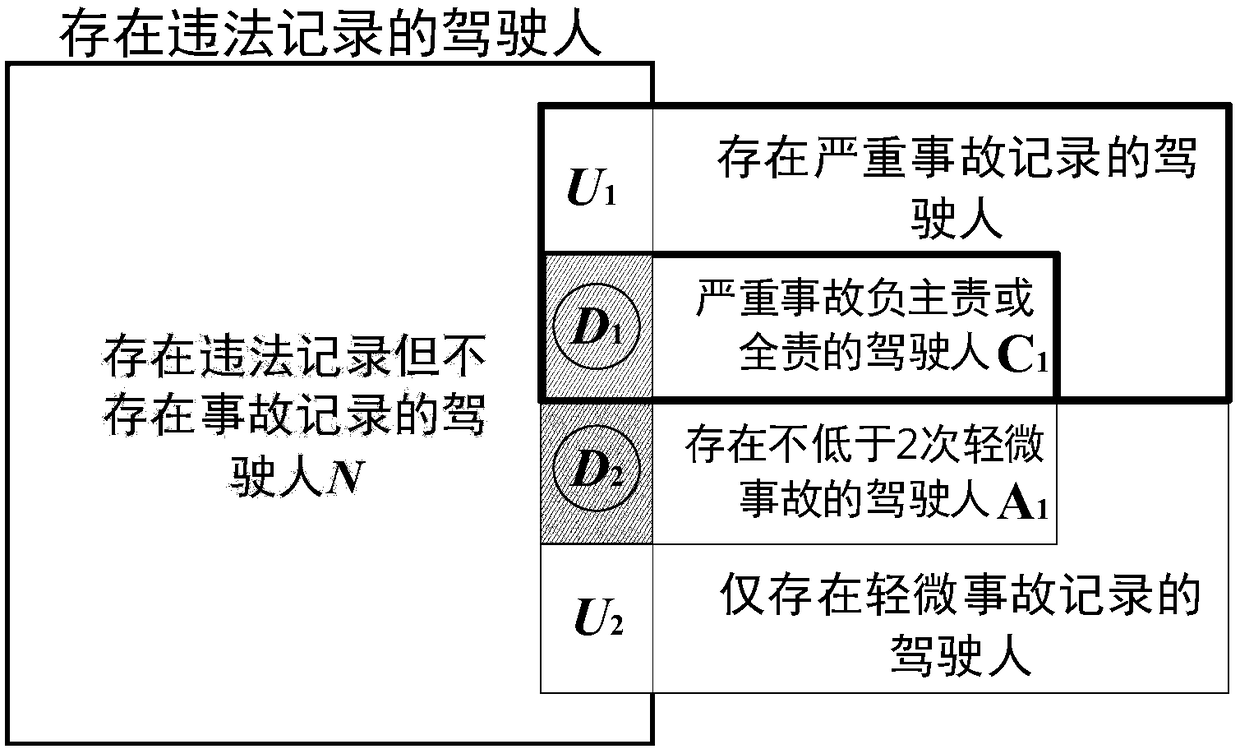

Method for enhancing traffic hazard personnel accident risk prediction precision

ActiveCN108596409AFast convergenceAvoid situations where oscillations do not convergeForecastingAlgorithmTraffic accident

The invention provides a method for enhancing traffic hazard personnel accident risk prediction precision. According to the method, traffic violation data and accident data samples are obtained via anoptimized sampling method; an integrated learning algorithm is used for training a traffic participator traffic accident risk prediction model; and a genetic algorithm is used for optimizing the model. According to the method, the integrated learning algorithm is used for mining safety characteristics of passengers from traffic violation data, the initial model performance is improved in the sampling link of the model construction by adoption of the optimized sampling method, and the genetic algorithm is used for optimizing model parameters, so that the high-risk personnel accident risk prediction precision is effectively enhanced.

Owner:JIANGSU ZHITONG TRANSPORTATION TECH

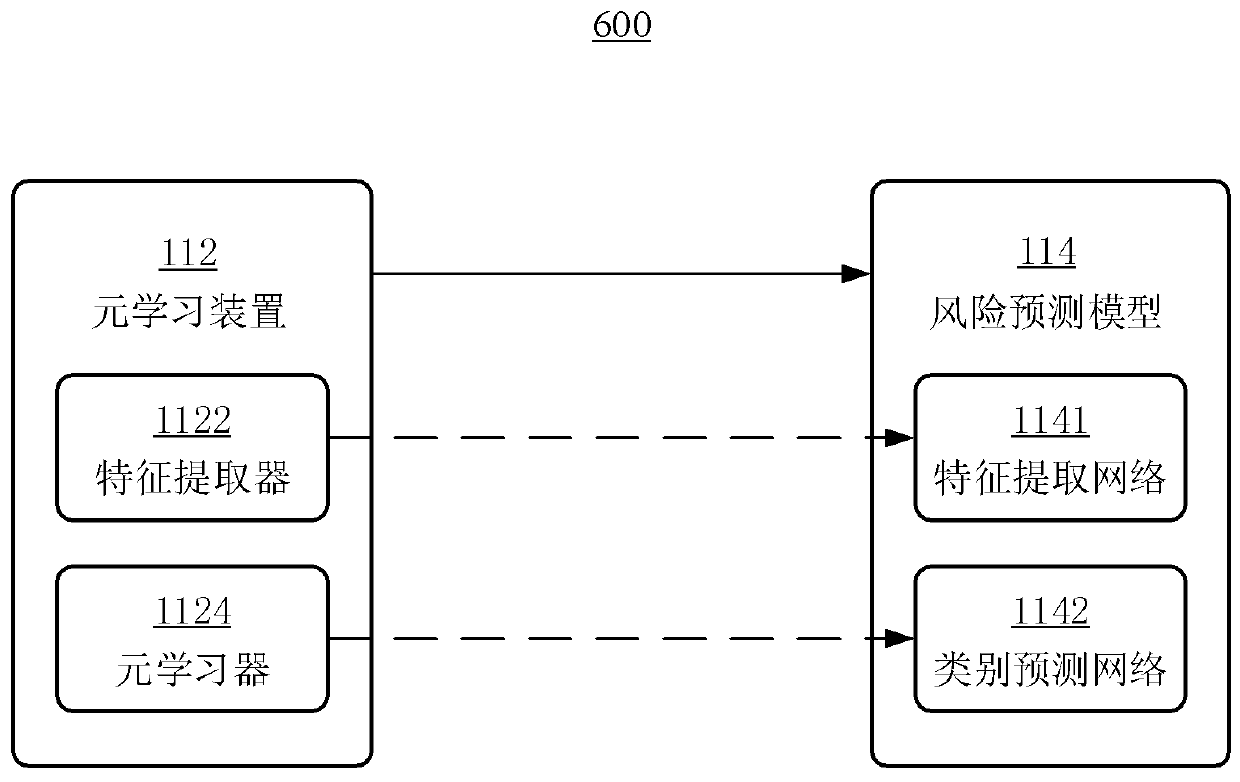

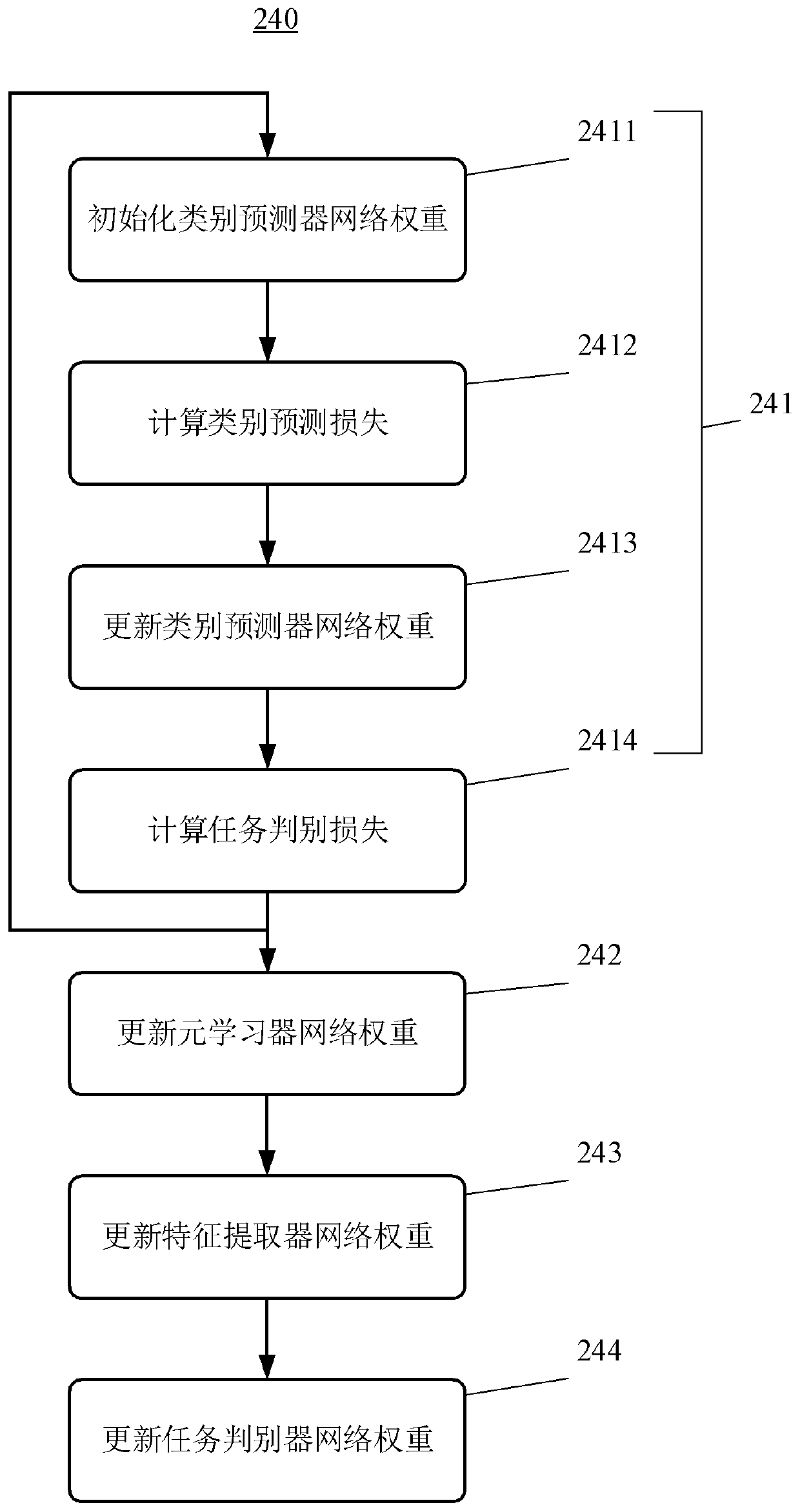

Meta-learning method and device, initialization method, computing equipment and storage medium

ActiveCN110852447AImprove generalization abilityFast trainingMachine learningDiscriminatorFeature extraction

The invention relates to a meta-learning method and device of a risk prediction model, an initialization method, computing equipment and a computer readable storage medium. The meta-learning method includes: generating a training task set including a plurality of training tasks, wherein the plurality of training tasks are provided with respective different category predictors; initializing networkweights of a meta-learner, a feature extractor and a task discriminator, the category predictor, the meta-learner, the feature extractor and the task discriminator being an artificial neural network,and the category predictor having the same network structure as the meta-learner; dividing the training tasks in the training task set into a plurality of batches, and updating the network weights ofthe meta-learner, the feature extractor and the task discriminator on the basis of each batch, the updating being carried out according to the category prediction loss and the task discrimination loss. According to the method, the generalization ability of the meta-learner can be improved, so that an optimal risk prediction model can be quickly obtained in small sample training in a financial risk control scene.

Owner:TENCENT CLOUD COMPUTING BEIJING CO LTD

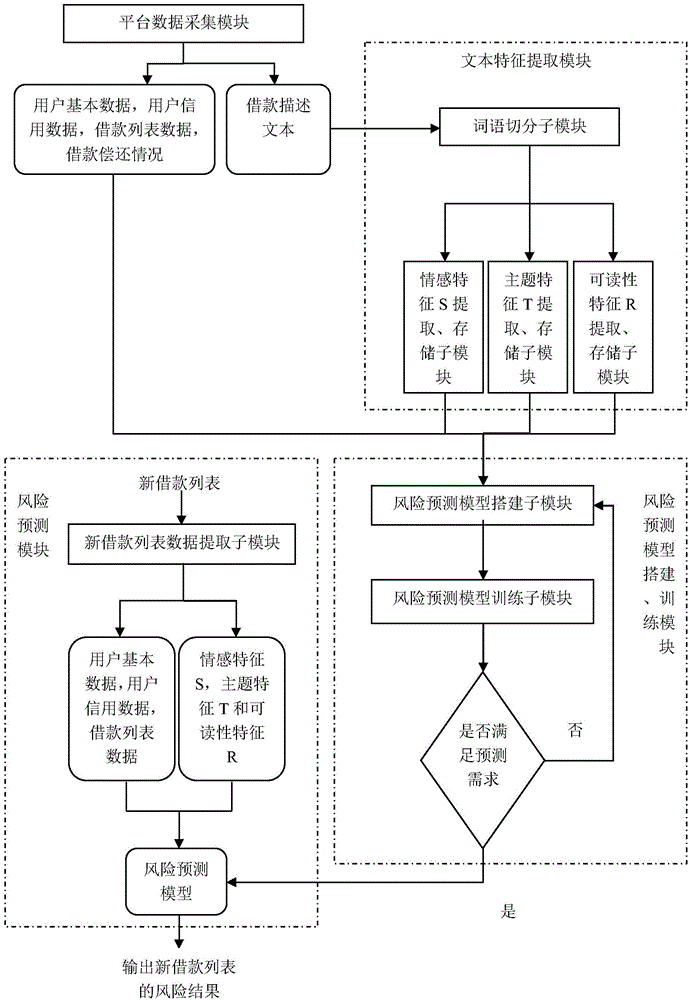

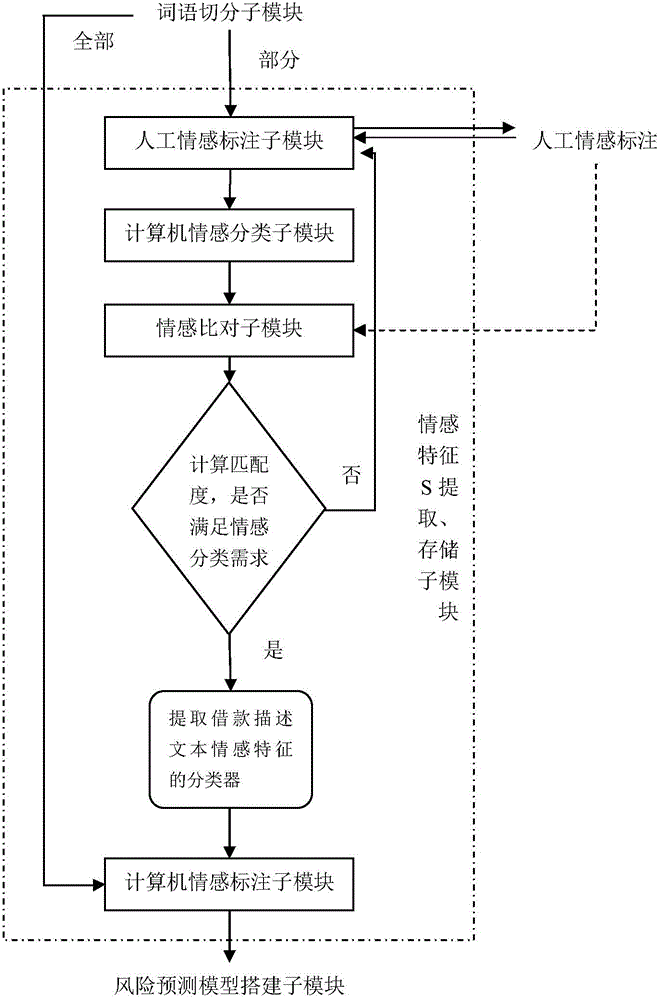

P2P (peer-to-peer) network lending risk prediction system based on text analysis

ActiveCN104616198AImprove accuracySave review timeFinanceSpecial data processing applicationsFeature extractionWord list

The invention relates to P2P network lending risk prediction systems, in particular to a P2P network lending risk prediction system based on text analysis. The P2P network lending risk prediction system based on text analysis comprises a platform data acquisition module, a text feature extraction module, a risk prediction model building and training module and a risk prediction module. The text feature extraction module is used for performing word segmentation on a loan description text acquired by the platform data acquisition module, removing words having no actual meaning according to a stop word list and extracting emotional characteristics S, theme characteristics T and readability characteristics R in the loan description text; and then a risk prediction model is built and trained; finally the emotional characteristics S, the theme characteristics T and the readability characteristics R in the new loan list and user basic data, user credit data and loan list data in the platform data acquisition module are used as input variables to be input into the risk prediction model to obtain a risk prediction result. The P2P network lending risk prediction system based on text analysis is applicable to P2P network lending risk prediction.

Owner:哈尔滨工业大学人工智能研究院有限公司

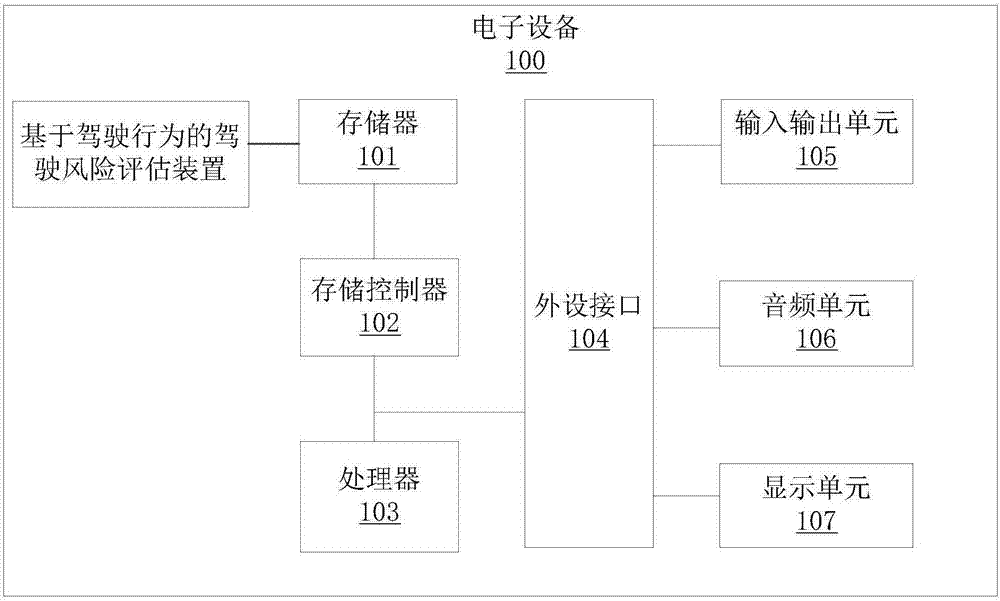

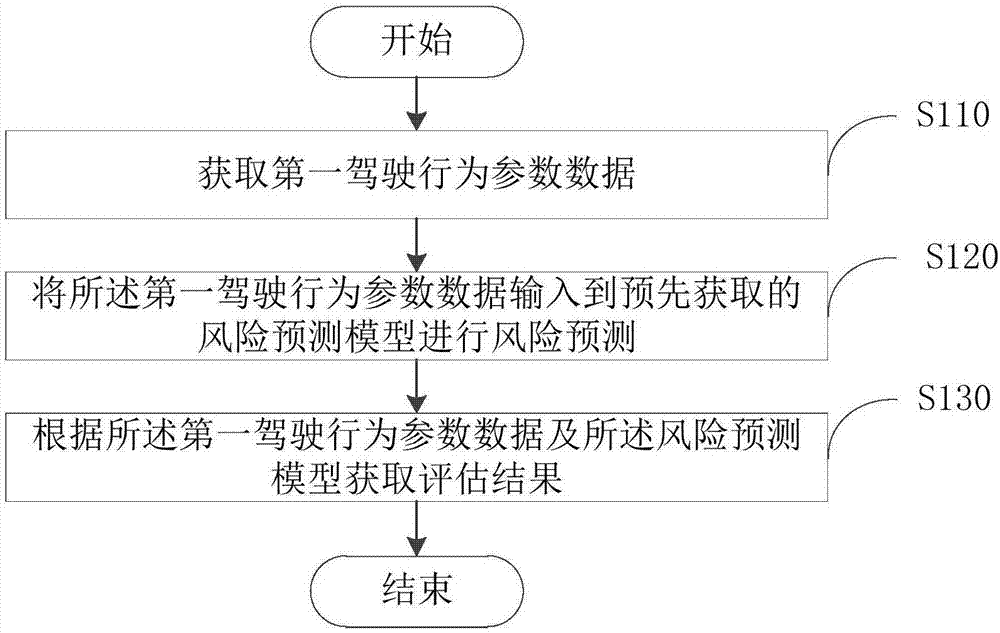

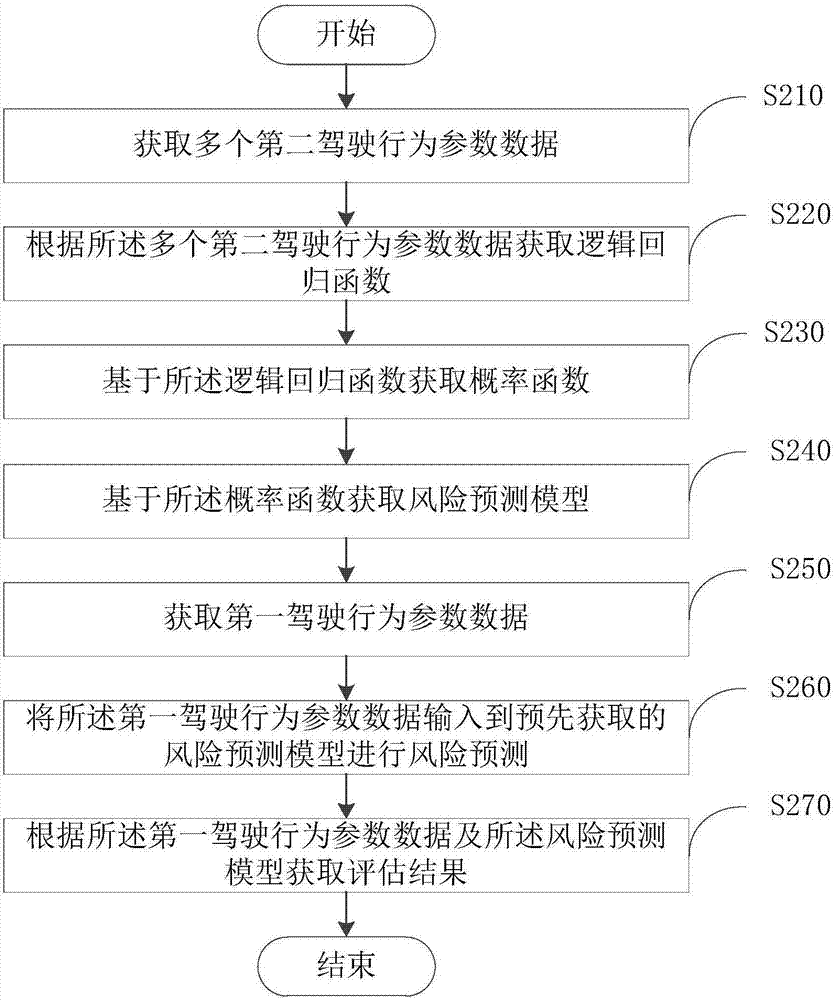

Driving risk assessment method and device based on driving behaviors

InactiveCN106952002AImprove accuracyReduce the comprehensive payout ratioFinanceForecastingDriving riskEngineering

An embodiment of the invention provides a driving risk assessment method and a driving risk assessment device based on driving behaviors, and the driving risk assessment method and the driving risk assessment device belong to the field of risk prediction. The driving risk assessment method comprises the steps of: acquiring first driving behavior parameter data; inputting the first driving behavior parameter data into a pre-acquired risk prediction model for risk prediction; and acquiring an assessment result according to the first driving behavior parameter data and the risk prediction model. According to the driving risk assessment method and the driving risk assessment device, the assessment result is high in precision, and can be identified by insurance companies through data output and used for screening driving risks, thereby reducing a combined ratio thereof, and realizing a win-win situation; meanwhile, the driving risk assessment method and the driving risk assessment device can provide technical support and data support for the innovative differential pricing in the car insurance industry, and can earn fairer and more reasonable commercial insurance premium pricing for the good vehicle owners who drive safely.

Owner:南京人人保网络技术有限公司

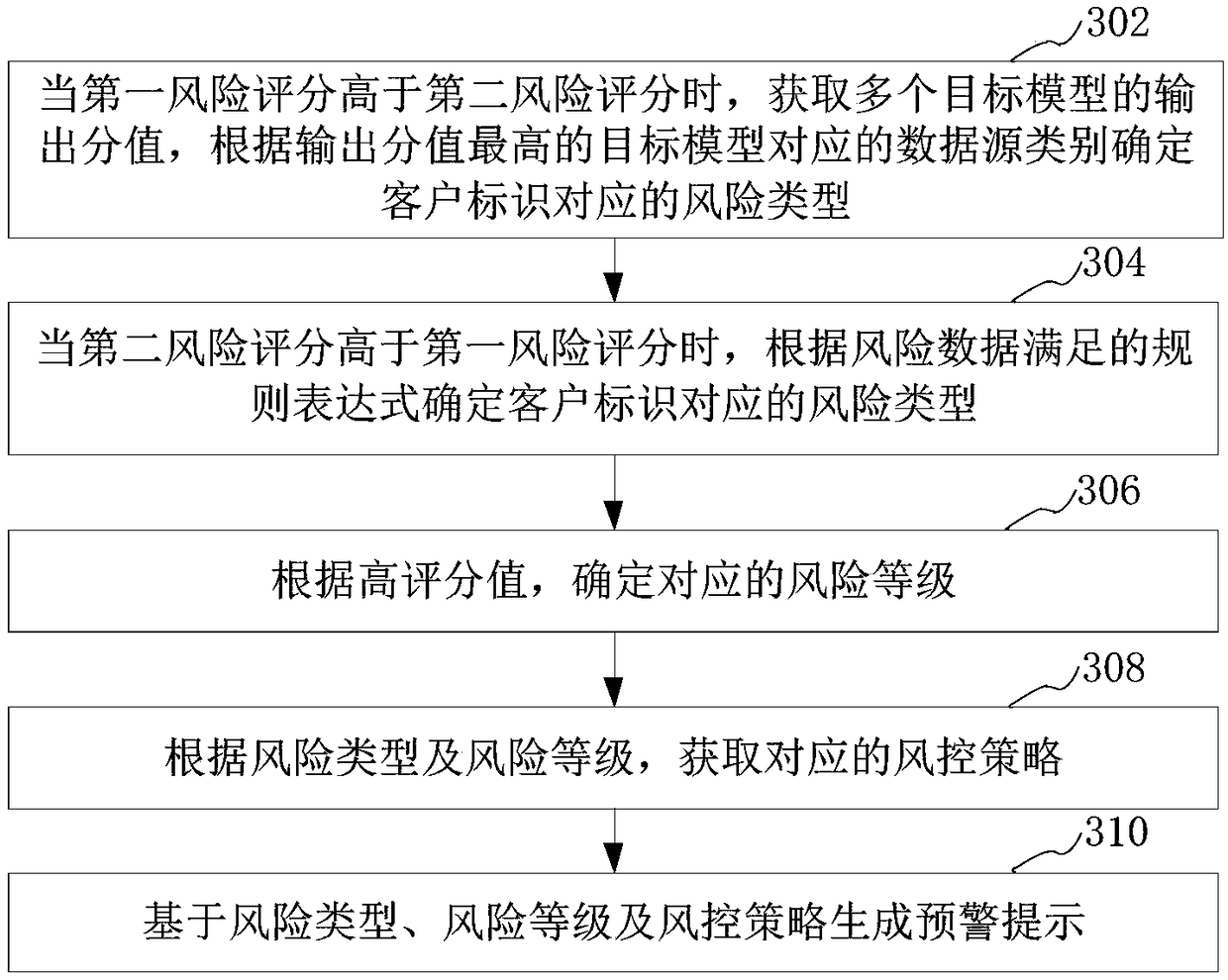

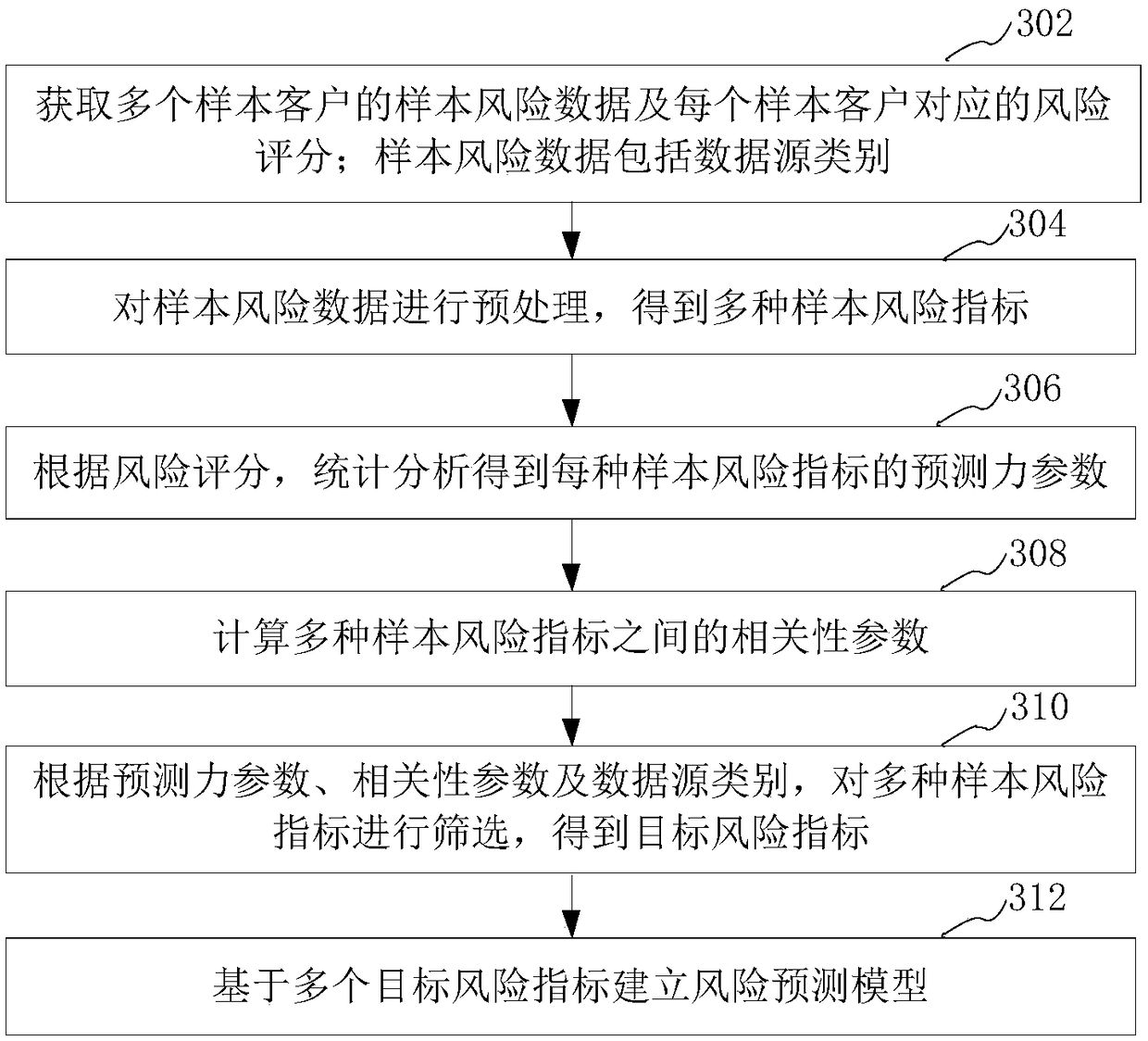

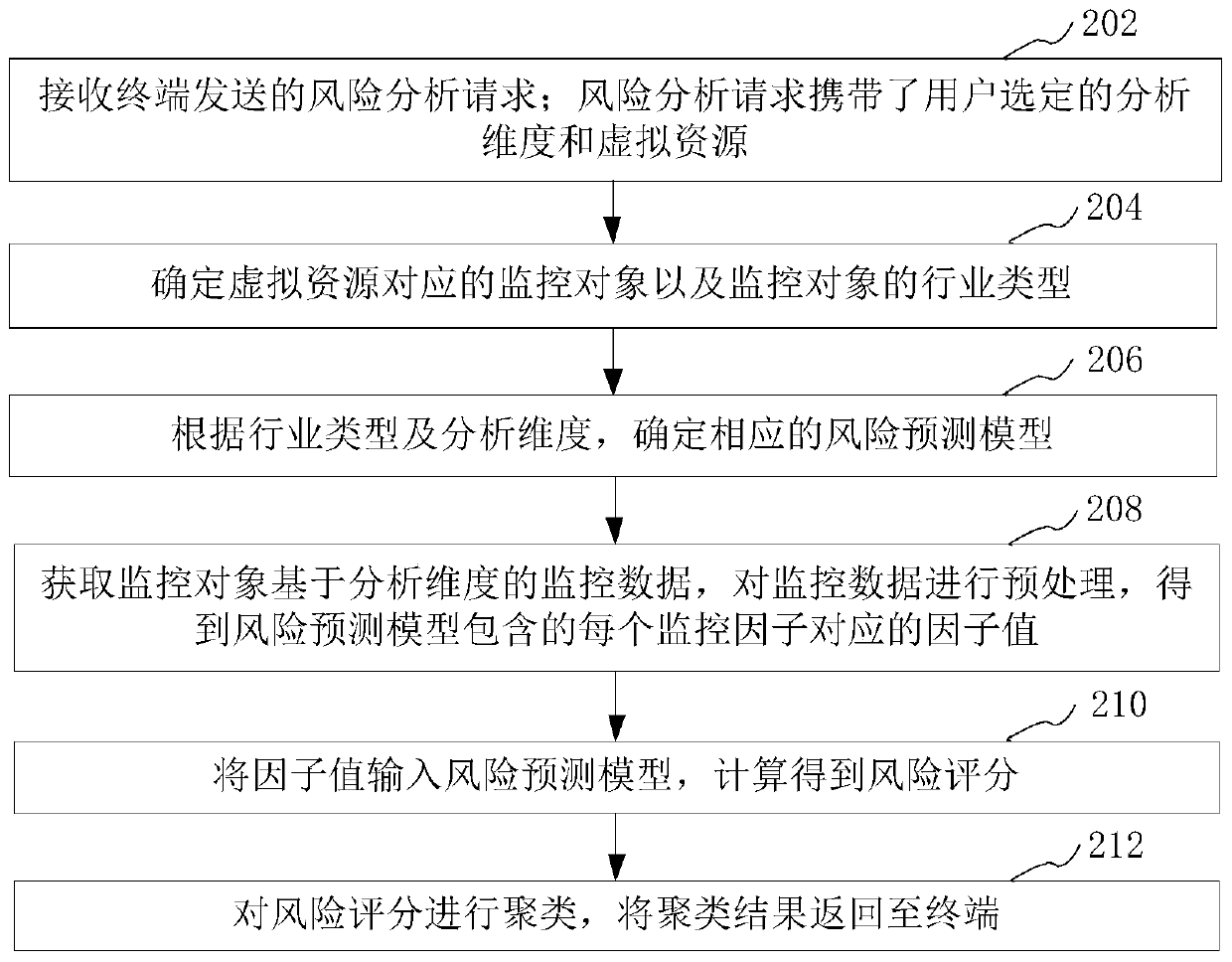

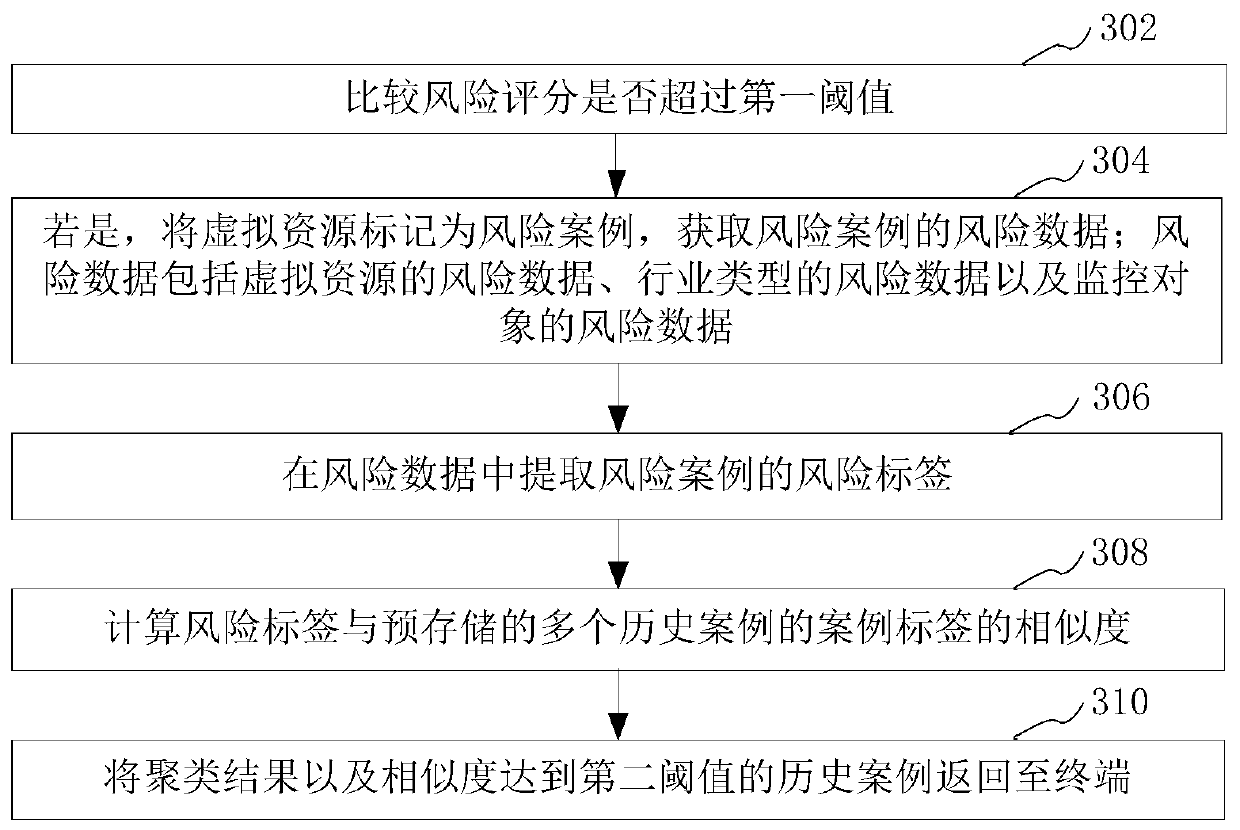

Risk early warning method and device based on big data and computer equipment

PendingCN109829628AImprove the efficiency of risk predictionImprove the accuracy of risk warningForecastingResourcesRisk profilingComputer science

The invention relates to a risk early warning method and device based on big data, computer equipment and a storage medium. The method comprises the steps of receiving a risk analysis request sent bya terminal, wherein the risk analysis request carries an analysis dimension and virtual resources selected by a user; determining a monitoring object corresponding to the virtual resource and an industry type of the monitoring object; determining a corresponding risk prediction model according to the industry type and the analysis dimension; obtaining monitoring data of the monitoring object basedon the analysis dimension, and preprocessing the monitoring data to obtain a factor value corresponding to each monitoring factor contained in the risk prediction model; inputting the factor value into a risk prediction model, and calculating and obtaining a risk score; and clustering the risk scores, and returning a clustering result to the terminal. By adopting the method, the risk early warning efficiency can be improved.

Owner:PING AN TECH (SHENZHEN) CO LTD

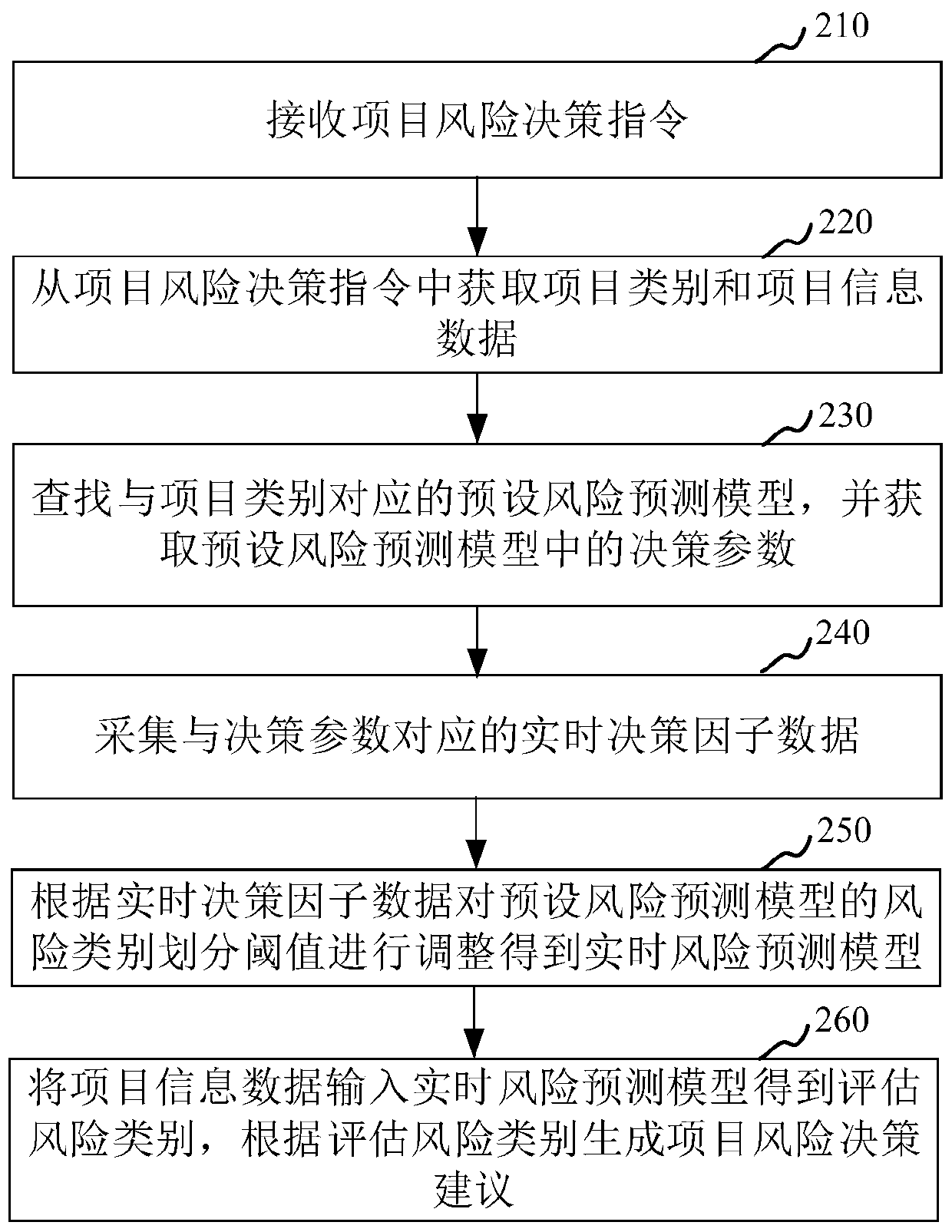

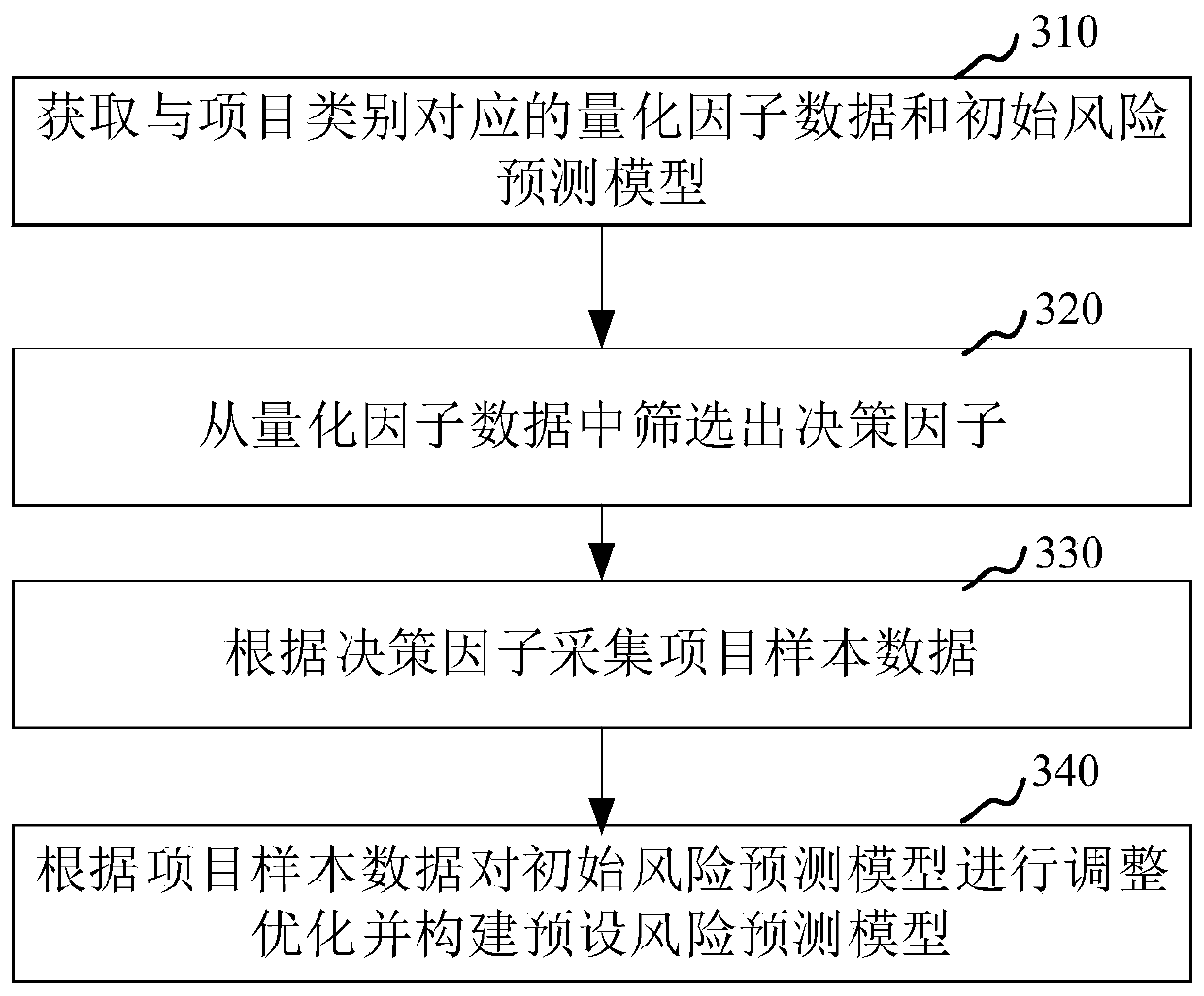

Project risk decision-making method and device, computer equipment and storage medium

PendingCN109816221AImprove the effectiveness of risk classificationThe risk assessment is reasonable and effectiveForecastingResourcesDecision takingData treatment

The invention relates to the field of big data processing, in particular to a project risk decision-making method and device, computer equipment and a storage medium. The method comprises the steps ofreceiving a project risk decision instruction; obtaining a project category and project information data from the project risk decision instruction; searching a preset risk prediction model corresponding to the project category, and obtaining a decision parameter in the preset risk prediction model; collecting real-time decision factor data corresponding to the decision parameters; adjusting a risk category division threshold value of a preset risk prediction model according to the real-time decision factor data to obtain a real-time risk prediction model; inputting the project information data into a real-time risk prediction model to obtain an assessment risk category, and generating project risk decision suggestions according to the assessment risk category. By adopting the method, theproject risk assessment accuracy can be improved.

Owner:PING AN TECH (SHENZHEN) CO LTD

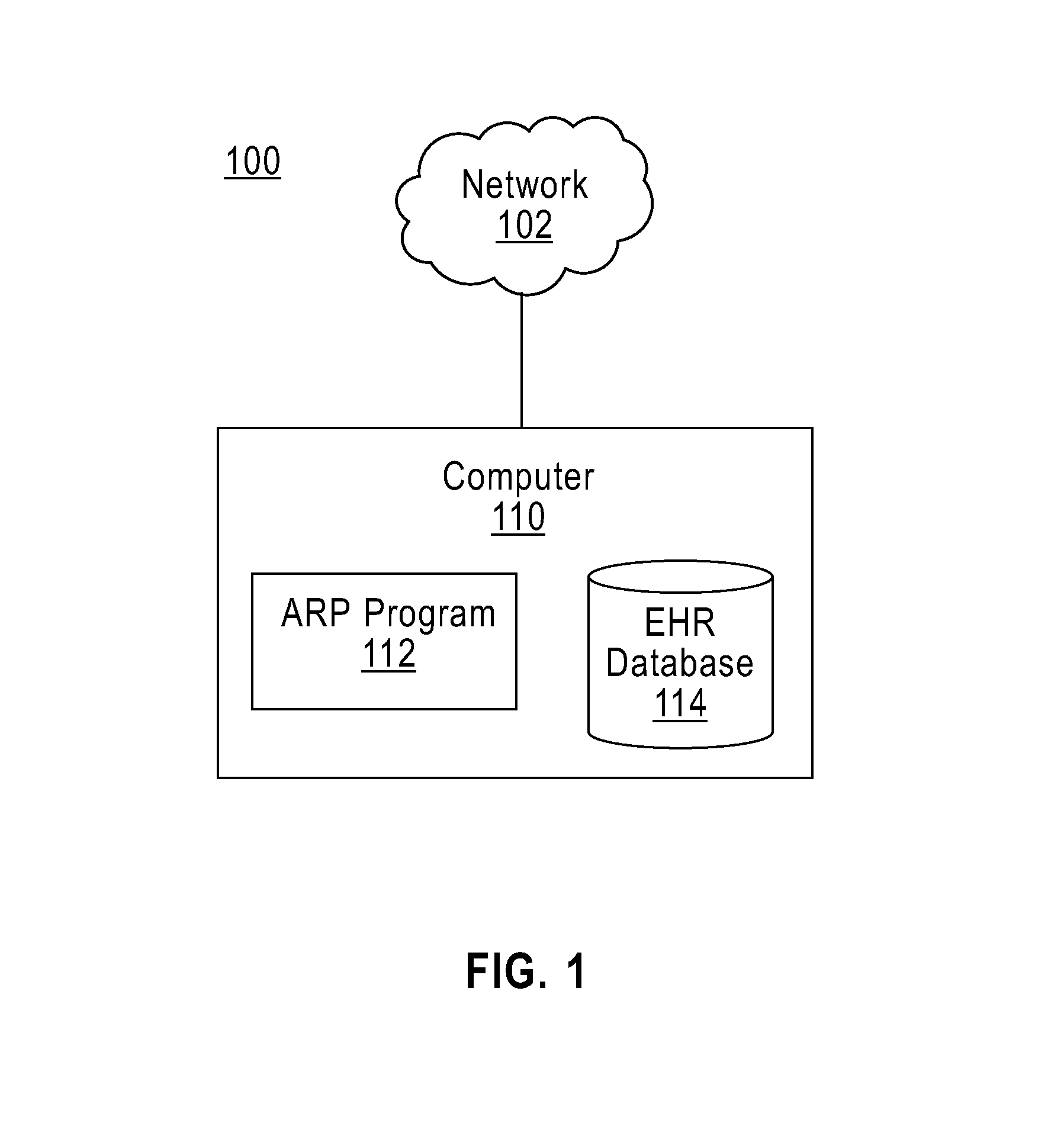

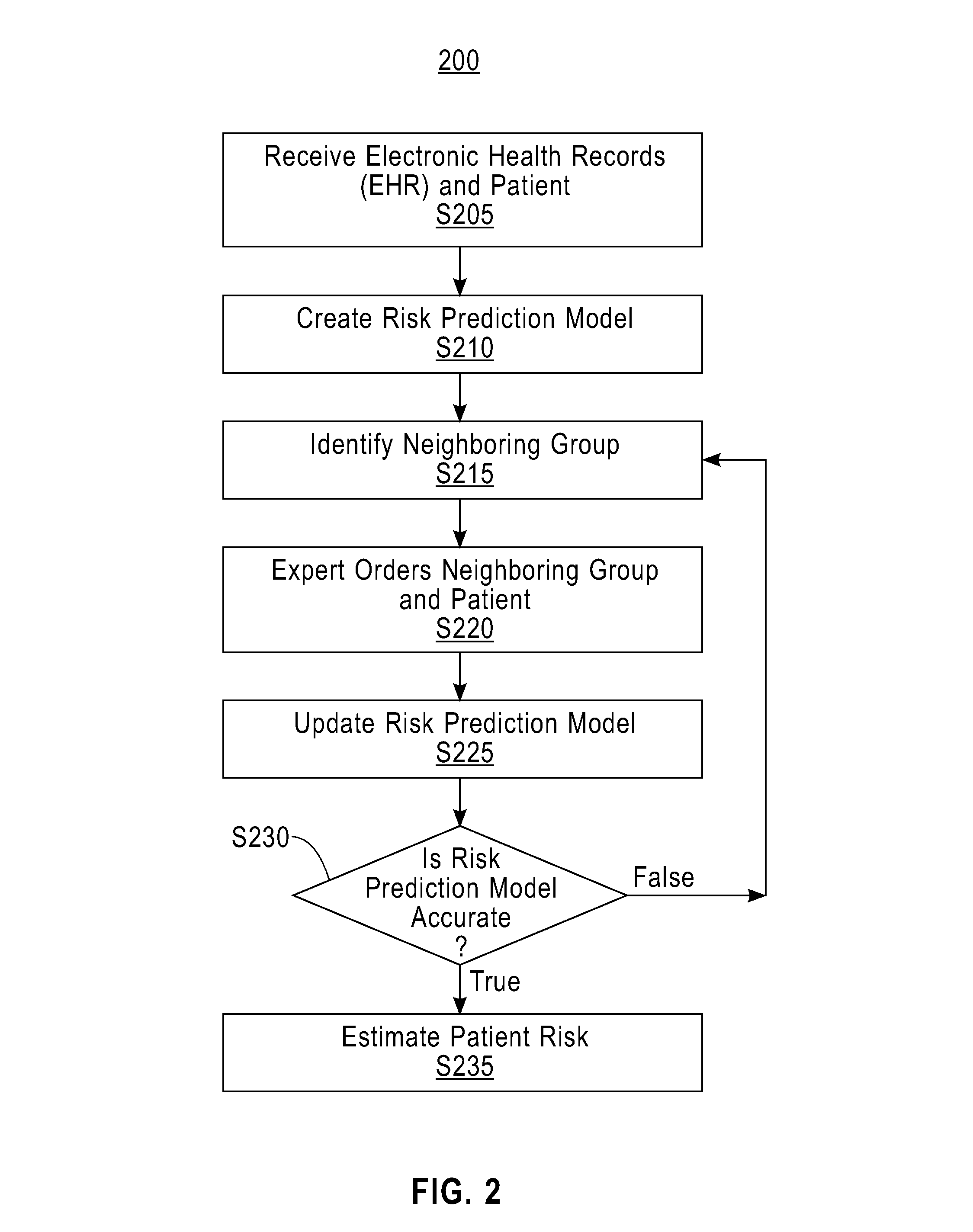

Active patient risk prediction

Electronic health records of a plurality of patients are received. A risk prediction model for a disease based on the electronic health records of the plurality of patients is created. An electronic health record of an original patient is received. A neighboring group of patients of the plurality of patients is identified, wherein the neighboring group of patients is two or more patients similar to the original patient. An ordering of the two or more patients of the neighboring group of patients is received, wherein the ordering of the two or more patients of the neighboring group of patients is based upon how similar each patient of the two or more patients is to the original patient. The risk prediction model is updated based on the ordering of the two or more patients of the neighboring group of patients.

Owner:IBM CORP

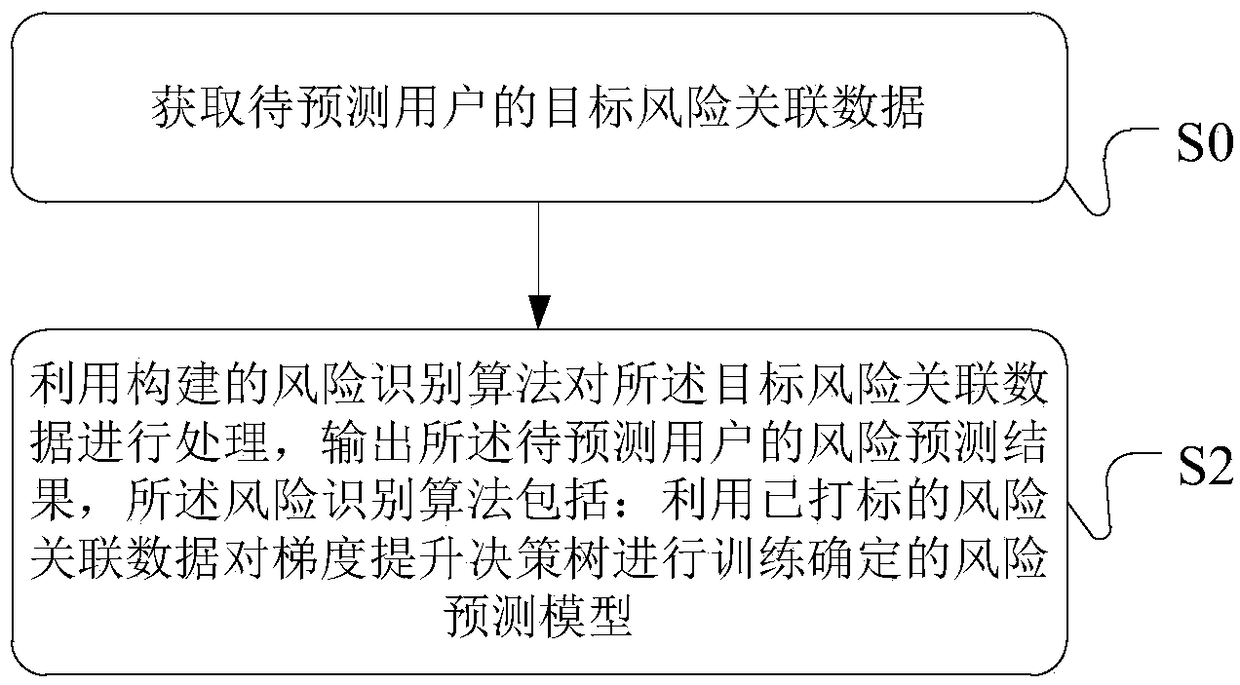

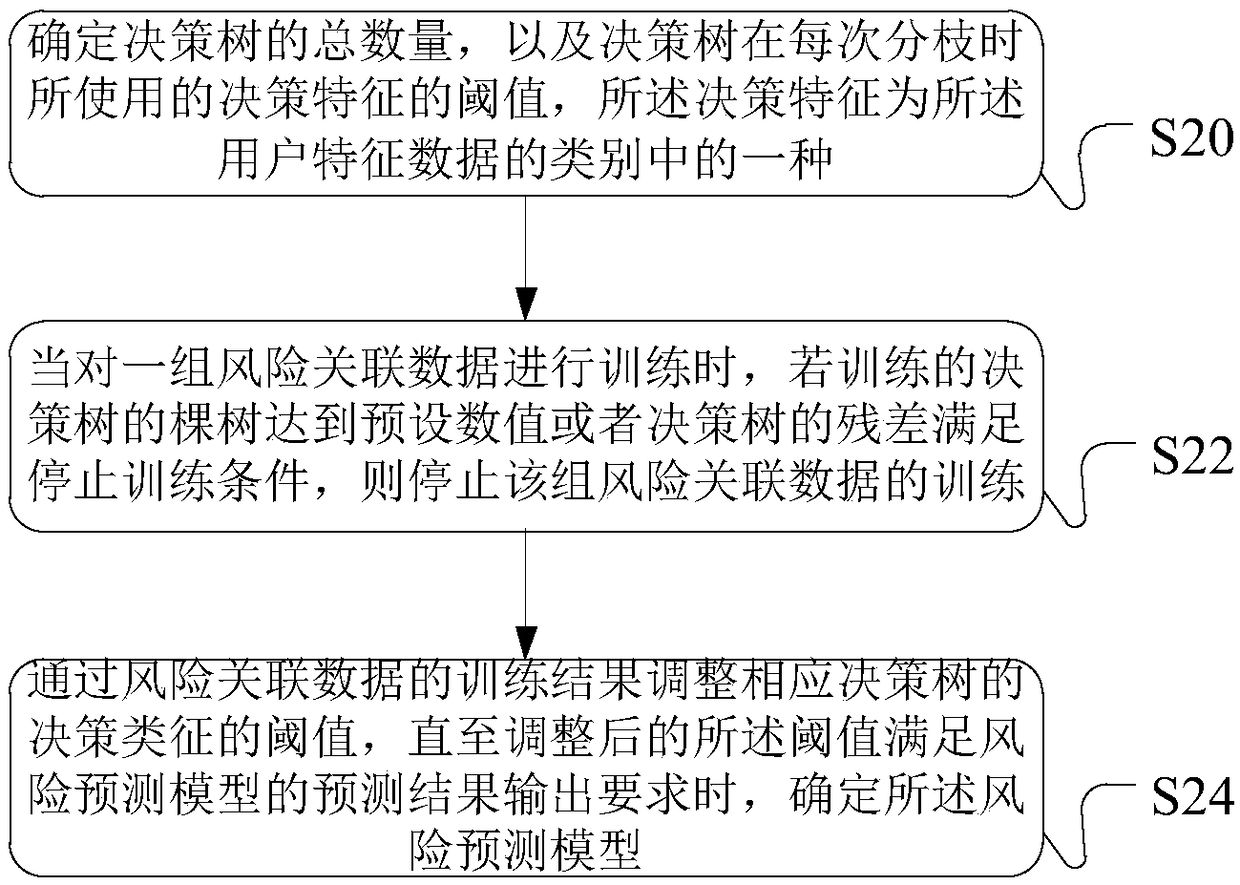

Processing method and device and processing equipment for insurance service risk prediction

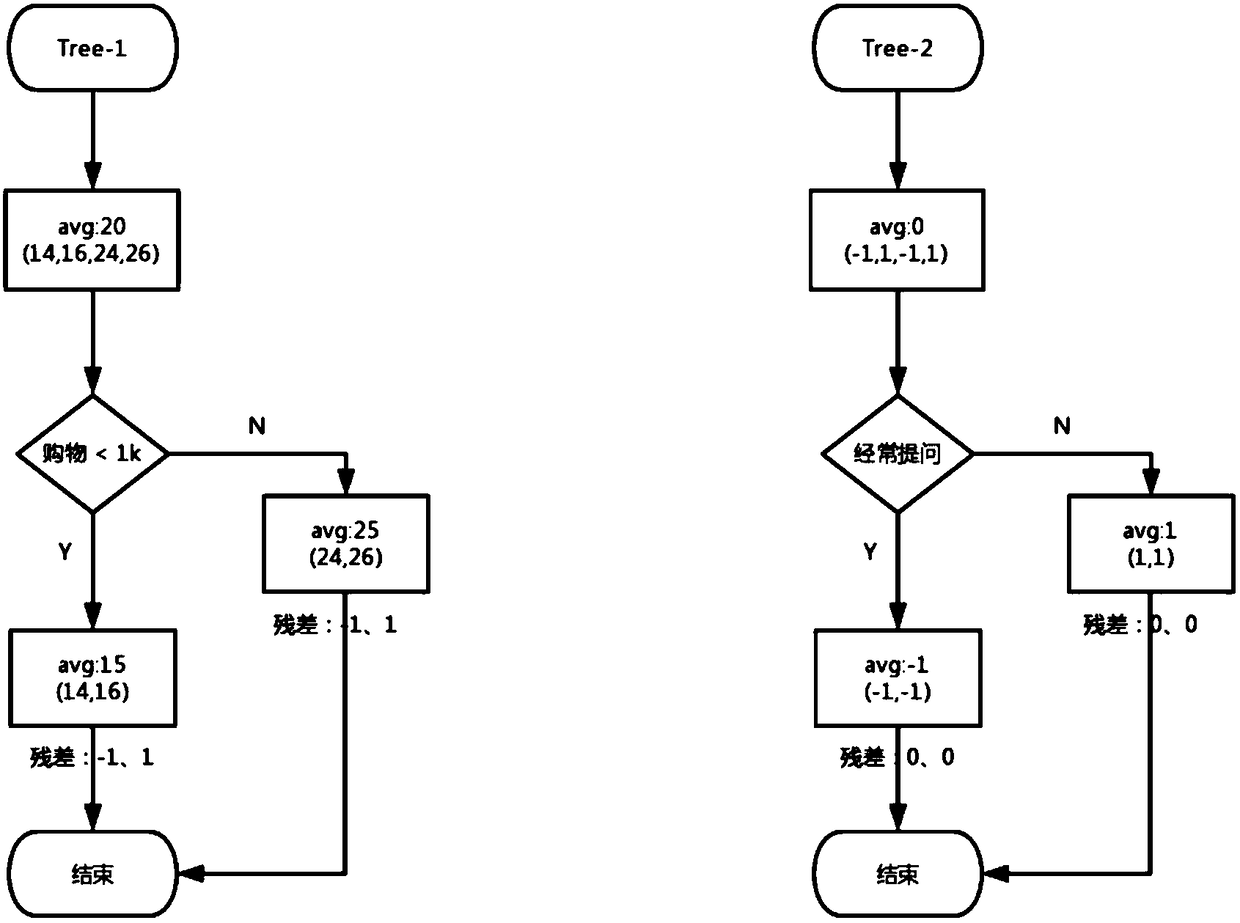

InactiveCN108665175AImprove service experienceImprove accuracyFinanceCharacter and pattern recognitionService experienceLinear model

The embodiment of the invention discloses a processing method and device and processing equipment for insurance service risk prediction. According to the method, the gradient boosted decision tree canbe pre-used to construct a risk prediction module, and the risk prediction module can be trained by using marked risk associated data related to an insurance service; when the risk prediction moduletraining reaches prediction requirements, the risk prediction module can be used for online risk prediction, insurance service risk prediction is carried out on a to-be-tested user, and a prediction result is output. The provided method can reasonably effectively use multidimensional nonlinear variables in the insurance service; the risk prediction module based on a nonlinear relationship of the gradient boosted decision tree can have good compatibility of linear and nonlinear variables; compared with a conventional linear module, the accuracy of a prediction result is markedly improved, the deficiency of the conventional linear module is effectively remedied, and the service experience of the insurance service is improved.

Owner:ADVANCED NEW TECH CO LTD

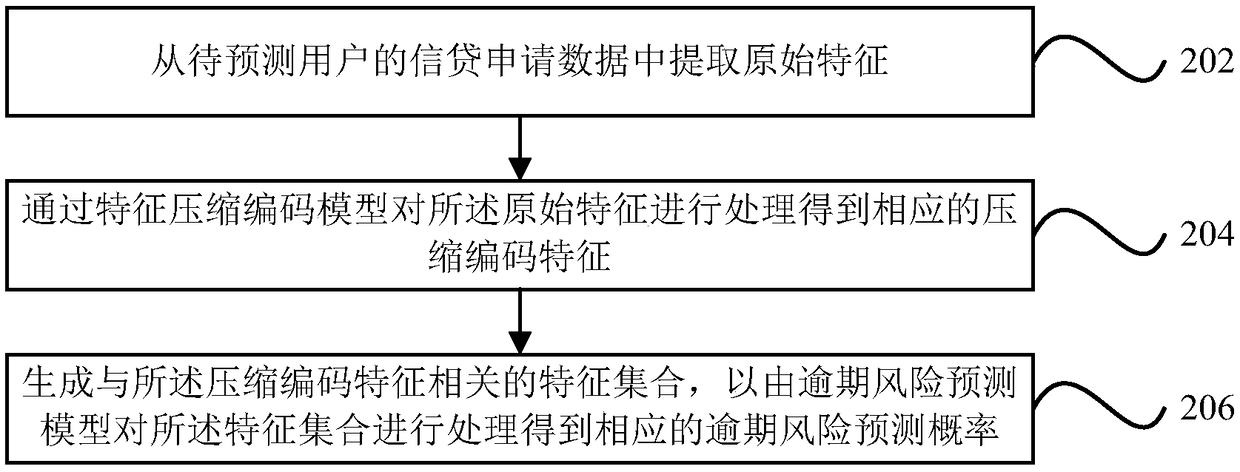

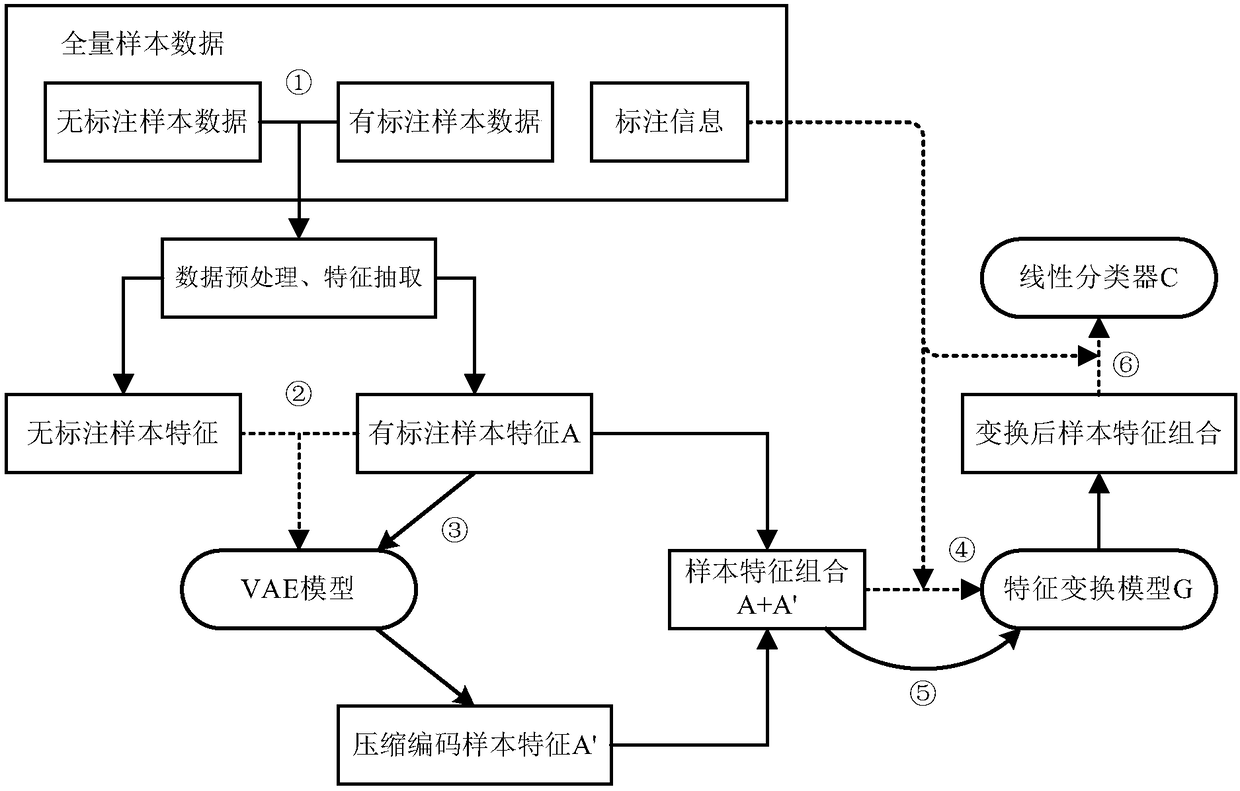

Overdue risk prediction method and device of credit application

The invention provides an overdue risk prediction method and device of credit application. The method can comprise that original characteristic is extracted from credit application data of a user to be predicted; a characteristic compressed coding model is used to process the original characteristic to obtain a corresponding compressed coding characteristic; the characteristic compressed coding model is obtained by training a mark sample characteristic corresponding to mark sample data and a mark-free sample characteristic corresponding to mark-free sample data without monitoring, the mark sample data is form credit application users who succeed in application, and the mark-free sample data is form credit application users who fail in application; and a characteristic set related to the compressed coding characteristic is generated, and an overdue risk prediction model is used to process the characteristic set to obtain a corresponding overdue risk prediction probability.

Owner:杭州茂财网络技术有限公司

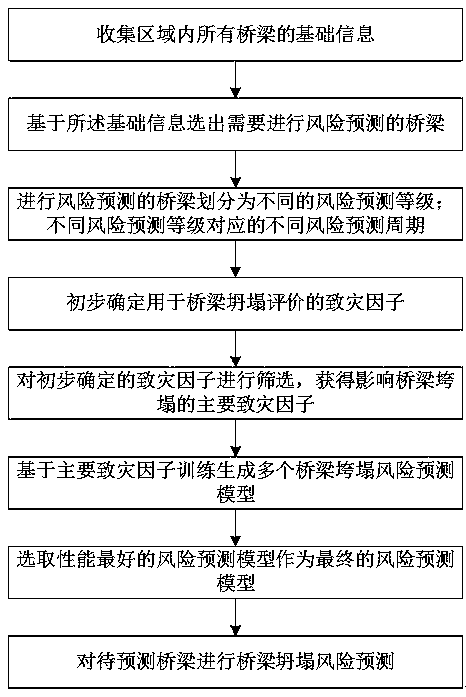

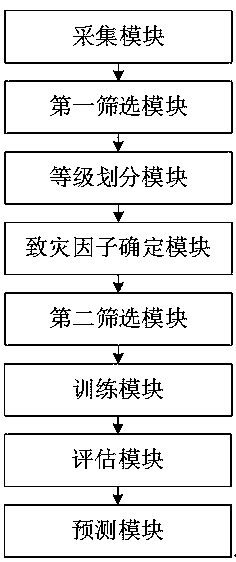

Regional bridge risk prediction method and system

ActiveCN110807562APredicted risk of collapseAchieve forecastForecastingCharacter and pattern recognitionBridge CollapsesReliability engineering

The invention discloses a regional bridge risk prediction method and system. The method comprises. The method comprises the following steps: S1, collecting the basic information of all bridges in a region; S2, screening out a bridge needing risk prediction based on the basic information; S3, dividing the bridges needing risk prediction into different risk prediction levels according to the basic information of the bridges; wherein different risk prediction levels correspond to different risk prediction periods; S4, preliminarily determining disaster-causing factors for bridge collapse evaluation; S5, screening the preliminarily determined disaster-causing factors to obtain main disaster-causing factors influencing bridge collapse; S6, training and generating a plurality of bridge collapserisk prediction models based on the main disaster-causing factors; S7, selecting the risk prediction model with the best performance as a final risk prediction model; and S8, performing bridge collapse risk prediction on the to-be-predicted bridge. According to the invention, the risk prediction of the regional bridge is realized, the realization cost is low, the coverage is wide, the processing efficiency is high, and the safety of the bridge is improved.

Owner:杭州鲁尔物联科技有限公司

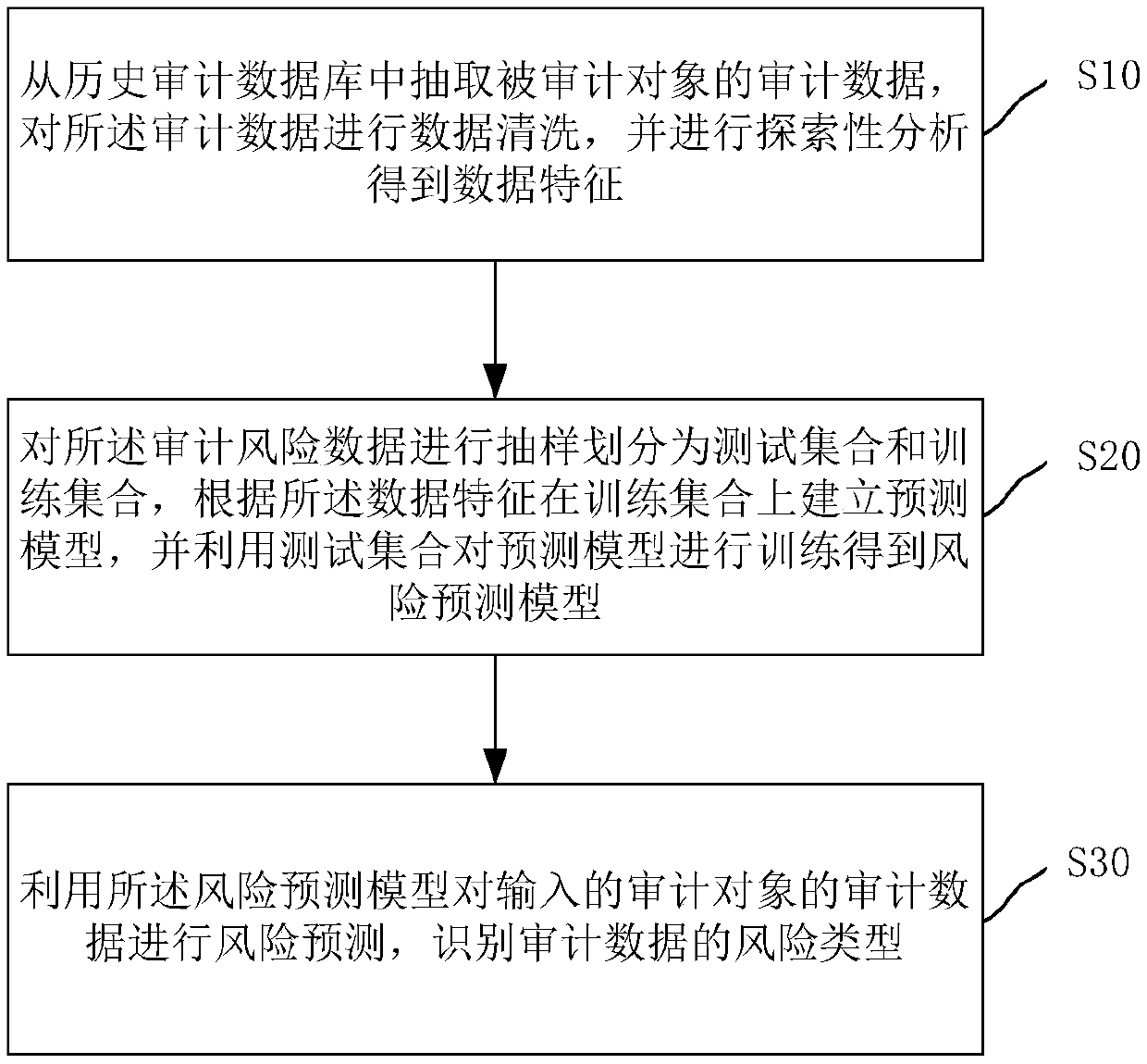

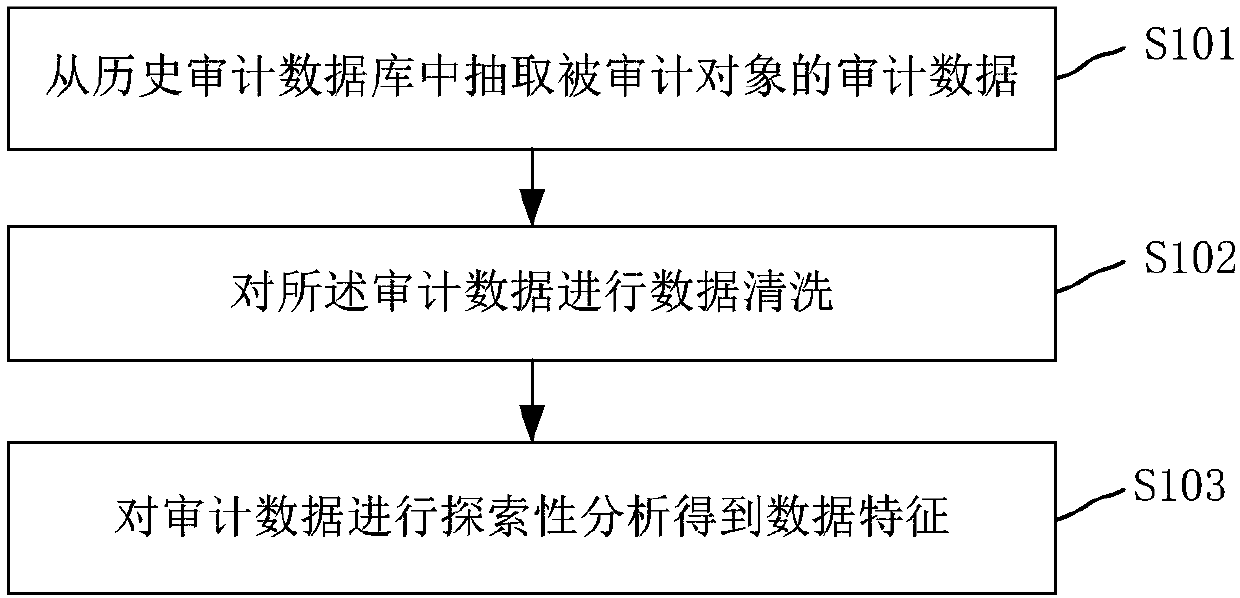

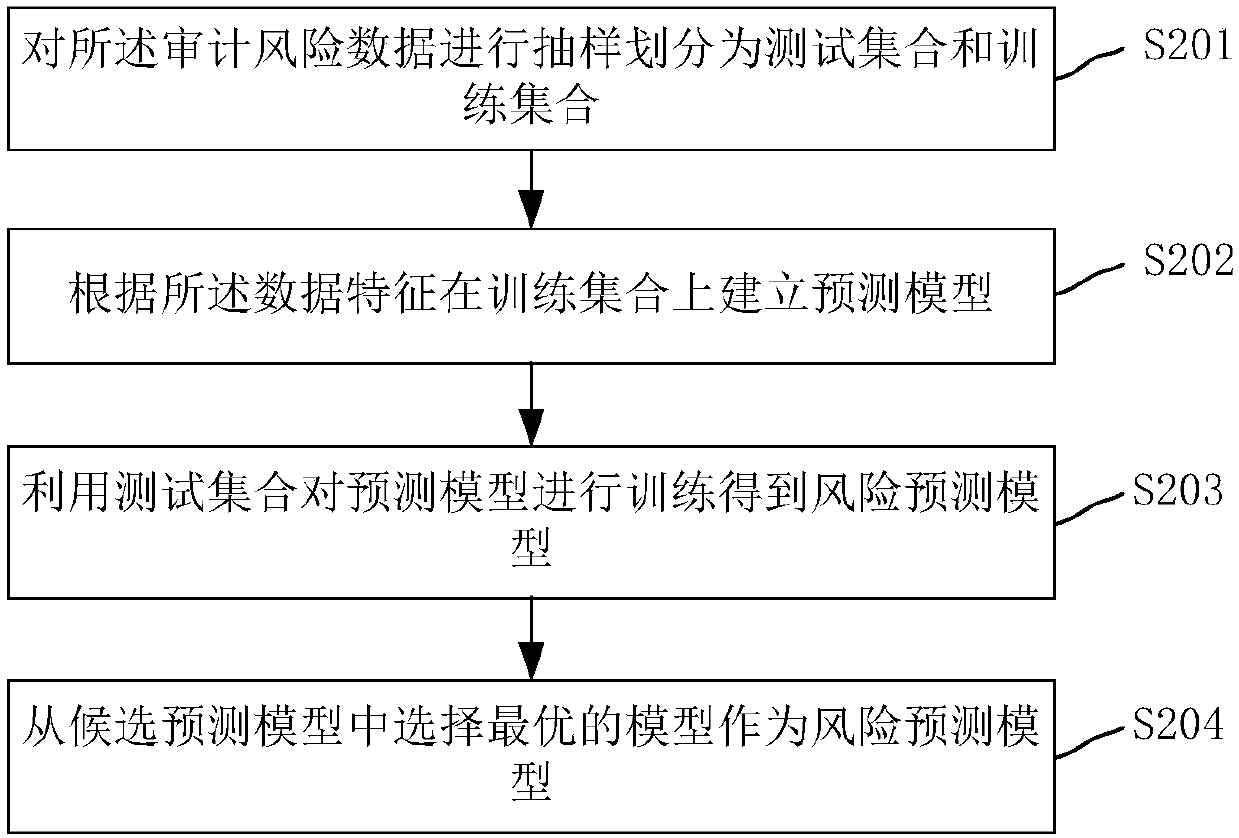

Method and system for processing audit data

InactiveCN107832429AImprove the effectiveness of audit processingAccurate predictionForecastingResourcesData miningRisk type

Owner:GUANGZHOU POWER SUPPLY CO LTD

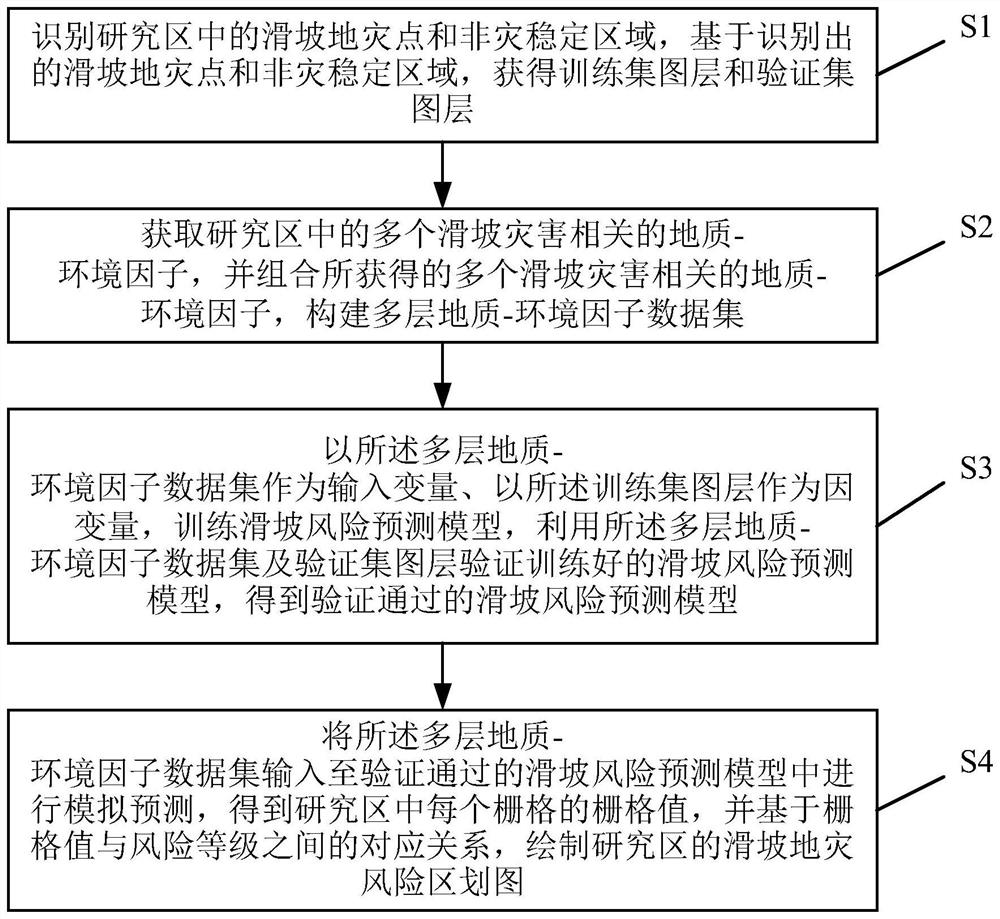

Landslide disaster risk regionalization map generation method

ActiveCN111858803AForecast refinementComprehensive descriptionForecastingGeographical information databasesSoil scienceData set

The invention relates to a landslide disaster risk regionalization map generation method, belongs to the technical field of landslide risk prediction and early warning, and solves the problem of low accuracy of an existing landslide risk prediction method. The method comprises the following steps: identifying landslide disaster points and non-disaster stable areas in a research area, and obtaininga training set layer and a verification set layer; obtaining and combining geological-environmental factors related to a plurality of landslide disasters in the research area, and constructing a multilayer geological-environmental factor data set; training a landslide risk prediction model by taking the constructed data set as an input variable and the training set layer as a dependent variable,and verifying the trained landslide risk prediction model by utilizing the constructed data set and the verification set layer to obtain a successfully verified landslide risk prediction model; and inputting the constructed data set into the verified landslide risk prediction model, carrying out processing to obtain a grid value of each grid in the research area, and drawing a landslide disaster risk regionalization map of the research area based on a corresponding relationship between the grid values and risk levels.

Owner:EAST CHINA UNIV OF TECH

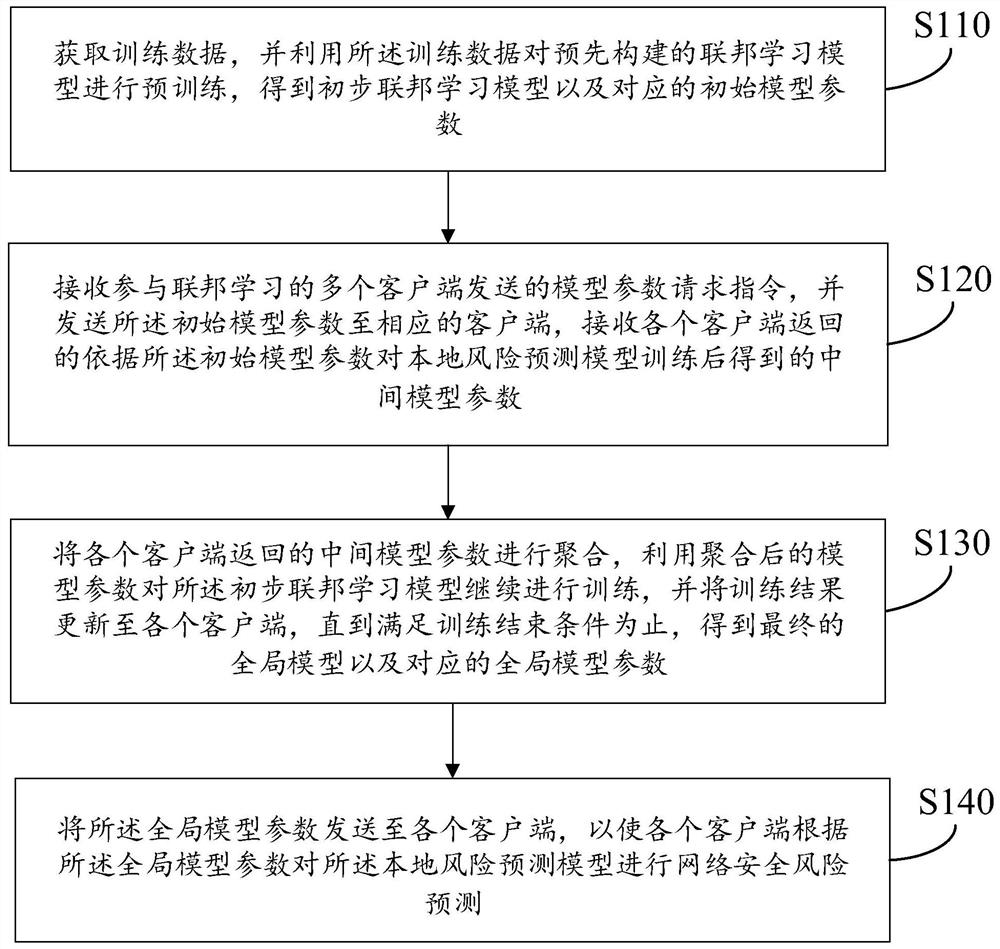

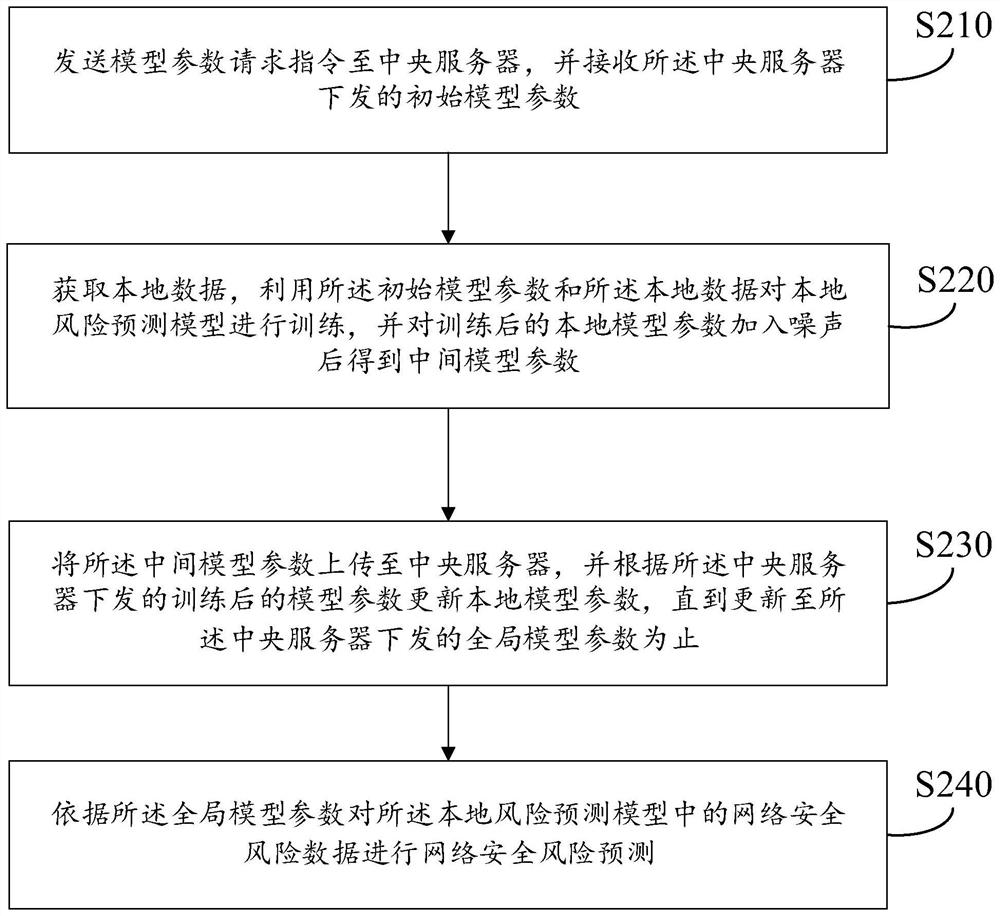

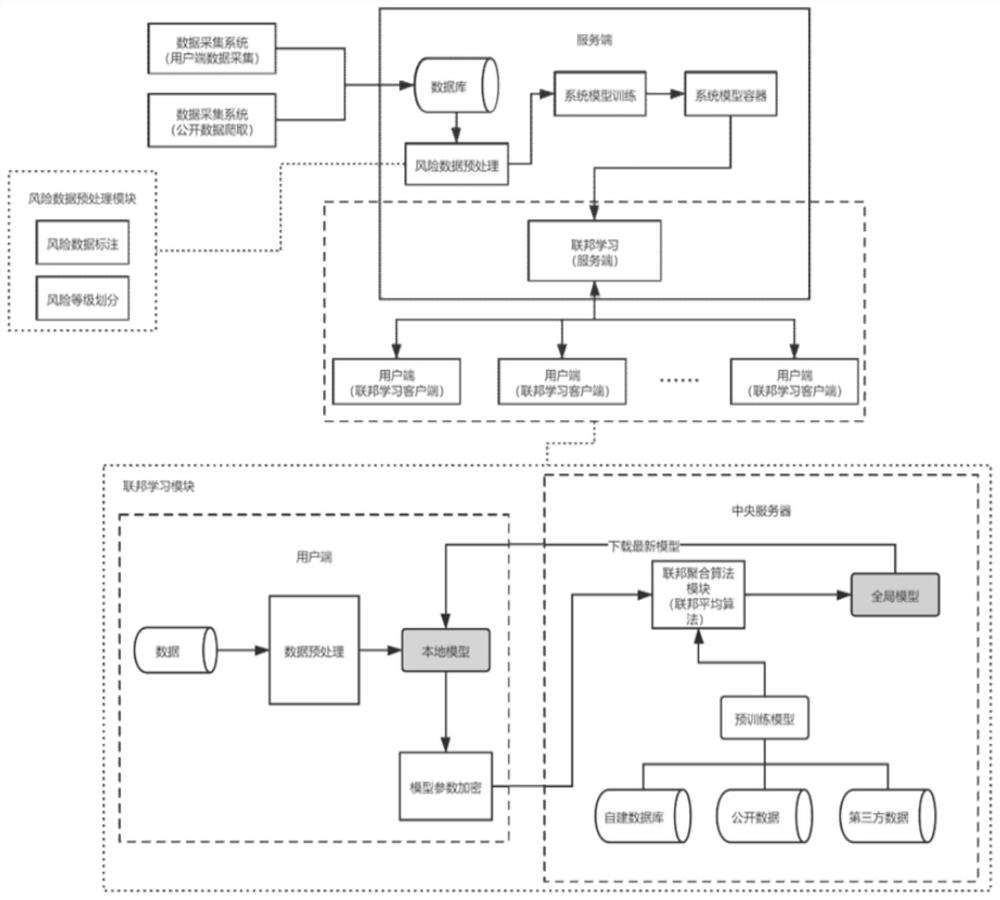

Network safety risk prediction method and device, storage medium and computer equipment

PendingCN112906903AReduce cleaning costsImprove the accuracy of security risk predictionForecastingResourcesEngineeringModel parameters

According to the network safety risk prediction method and device, the storage medium and the computer equipment provided by the invention, firstly, the initial model parameters obtained after pre-training are updated to the plurality of clients participating in federated learning, and the local risk prediction model is trained by using the updated model parameters; then, each client sends the intermediate model parameters obtained after training to the central server so as to continue to train the preliminary federated learning model; according to the global model obtained by training the model parameters, related safety data does not need to be directly obtained from an enterprise and a user side, so that the cost of cleaning and labeling the obtained data is avoided; besides, the trained global model parameters are deployed at the user client, and the safety risk prediction is carried out according to the network environment where the enterprise user is located, the local safety configuration and other related parameters, so that the accuracy of the enterprise safety risk prediction can be further improved.

Owner:北京源堡科技有限公司

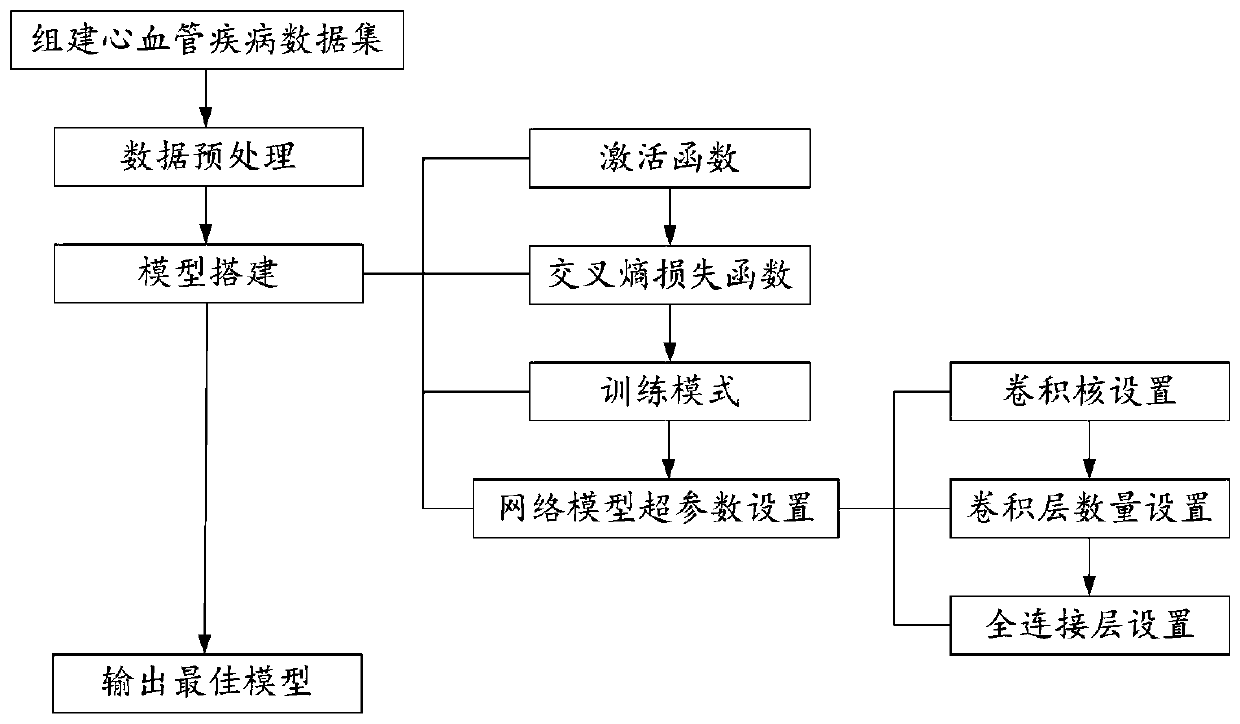

Cardiovascular disease risk prediction network model based on multiple parameters and construction method thereof

ActiveCN111292853AEasy access to clinical dataGood effectMedical data miningHealth-index calculationData setCardiac chest pain

The invention discloses a cardiovascular disease risk prediction network model based on multiple parameters and a construction method thereof, relates to a risk prediction model, and solves the problems that an existing cardiovascular disease risk prediction model cannot predict multiple physiological parameters and is not ideal in prediction effect. The method comprises the following steps: establishing a cardiovascular disease data set; preprocessing the data set data, and dividing the data set into a training set and a test set according to the ratio of the number of the training set data to the number of the test set data being 7: 3; performing model construction: both the training set and the test set comprise samples and labels, model training is conducted on training set data through the minimum error of forward propagation and reverse propagation in the training process, and the trained model is evaluated through the test set data. The risk of suffering from cardiovascular diseases is evaluated by detecting multiple physiological parameters such as age, gender, chest pain type, resting blood pressure, serum cholesterol, fasting blood glucose, resting electrocardiogram, maximum heart rate and the like of a person.

Owner:CHANGCHUN UNIV OF SCI & TECH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com