Mobile user credit line evaluation method and evaluation system

A credit line and mobile user technology, applied in the field of communication, can solve problems such as lack of system analysis and data support, and achieve the effect of improving satisfaction

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

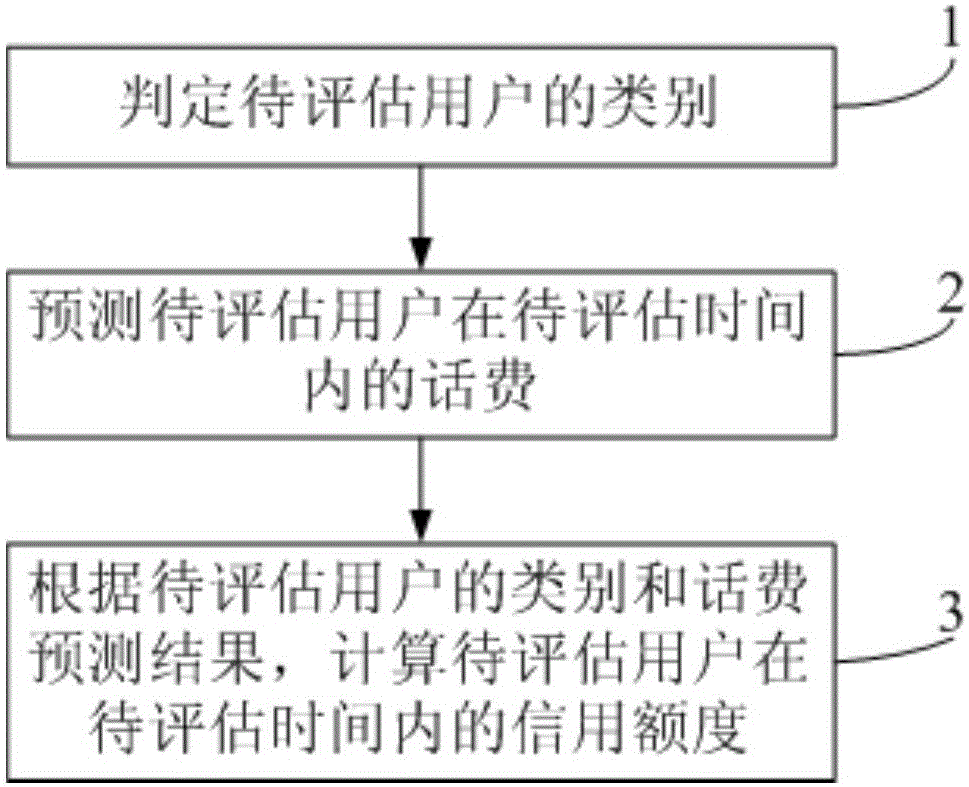

[0055] This embodiment provides a method for evaluating a mobile user's credit limit, such as figure 1 shown, including:

[0056] Step 1: Determine the category of users to be evaluated.

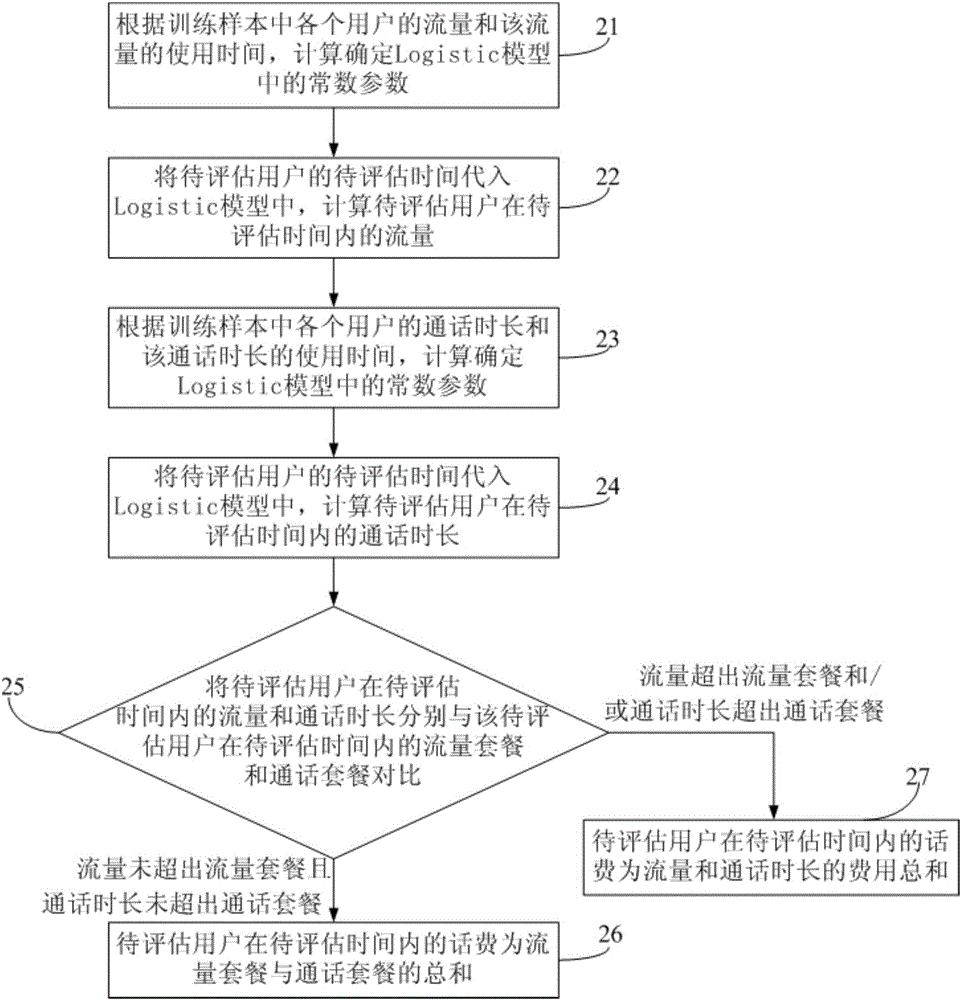

[0057] Step 2: Predict the call charges of the users to be evaluated within the time to be evaluated.

[0058] Step 3: Calculate the credit limit of the user to be evaluated within the time to be evaluated according to the category of the user to be evaluated and the prediction result of the call fee.

[0059] It should be noted that the time to be evaluated may be any time, for example, the time to be evaluated may be set to a certain month.

[0060] The evaluation method of the mobile user's credit limit can dynamically predict the user's consumption change, dynamically determine the user's credit limit according to the user's consumption change, and realize the dynamic evaluation of the user's credit limit, thereby effectively improving the user's credit limit. satisfaction.

Embodiment 2

[0062] This embodiment provides a method for evaluating a mobile user's credit limit, including:

[0063] Step 1: Determine the category of users to be evaluated.

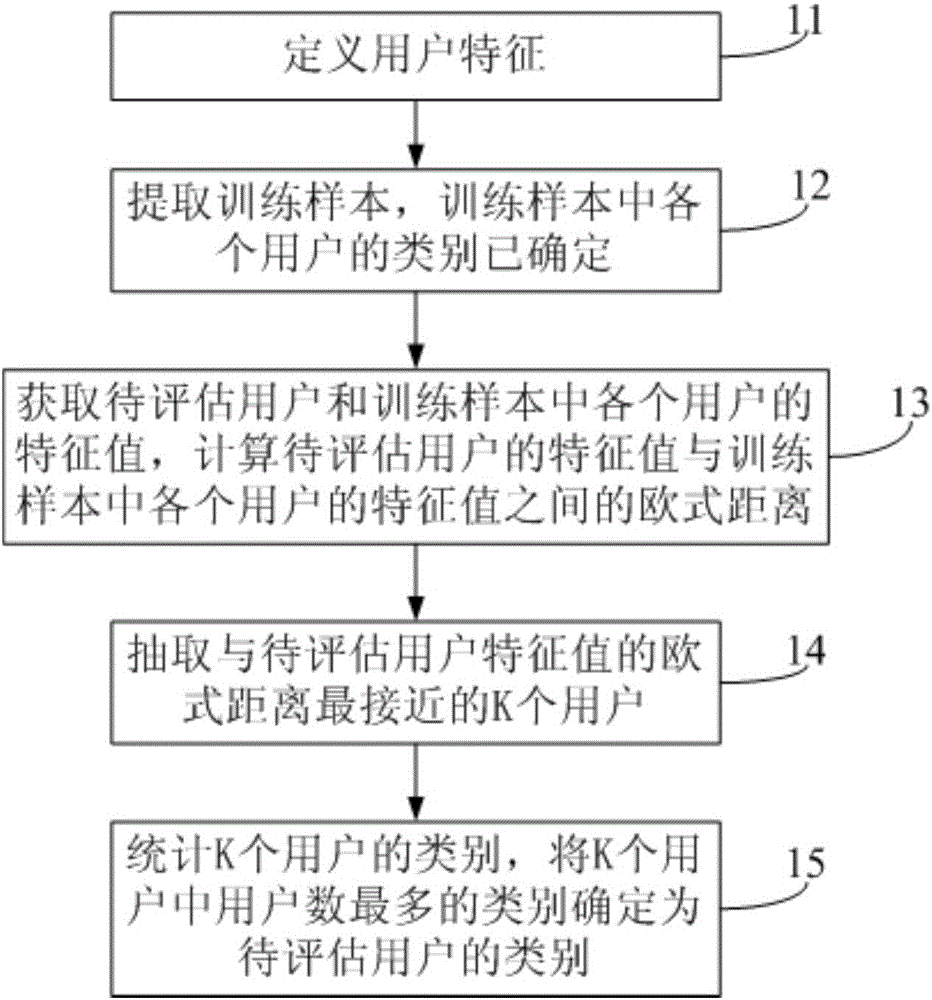

[0064] This step specifically includes: figure 2 as shown,

[0065] Step 11: Define user characteristics.

[0066] In this step, the user feature is defined as a two-dimensional vector (f, t) composed of the package price f used by the user and the terminal type price t. Among them, the package price f used by the user can be queried from the customer management system, the price t of the terminal type used by the user can be queried from the online record data system, and the terminal type price t can generally be queried from the official website of the terminal.

[0067] Step 12: Extract training samples, the category of each user in the training samples has been determined.

[0068] In this step, training samples are extracted from the customer management system. The training samples include multiple user...

Embodiment 3

[0095] This embodiment provides a mobile user credit evaluation system, such as Figure 4 As shown, it includes: a determination module 1, configured to determine the category of the user to be evaluated. The prediction module 2 is used to predict the call charges of the users to be evaluated within the time to be evaluated. The calculation module 3 is used to calculate the credit line of the user to be evaluated within the time to be evaluated according to the category of the user to be evaluated and the prediction result of the call charge.

[0096] In this embodiment, the determining module 1 includes: a defining unit 11, configured to define user characteristics. The extracting unit 12 is configured to extract training samples in which the category of each user has been determined. The first calculation unit 13 is configured to acquire the feature values of the user to be evaluated and each user in the training sample, and calculate the Euclidean distance between the f...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com