Electronic tax administration bureau-based invoice application and receiving method

A tax bureau, invoice technology, applied in data processing applications, instruments, finance, etc., can solve problems such as not adapting to tax work, and achieve the effect of improving tax work efficiency, reducing work tediousness, and reducing time waste

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

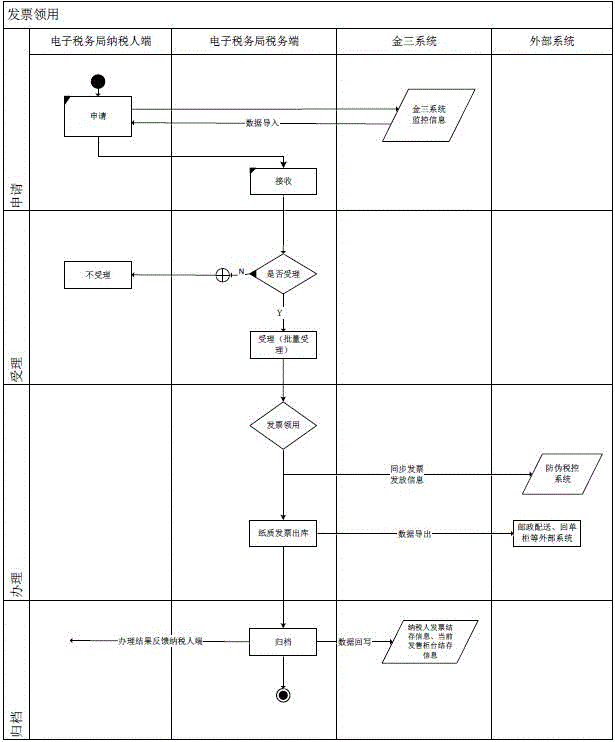

[0016] The method for applying for an invoice based on the electronic tax bureau described in this embodiment, on the basis of ensuring that the original monitoring data remains unchanged, uses the Internet to transfer the verification work of the invoice application from the tax bureau tax end to the taxpayer end , the tax office accepts invoice applications and issues invoices in batches; taxpayers can receive invoices through postal express delivery or receipt cabinets, which greatly improves the efficiency of tax processing; it mainly includes four steps: application, acceptance, processing, and filing; as attached figure 1 shown.

[0017] The invoice application method described in this embodiment, after the taxpayer after real-name authentication, judges according to the identity of the person who can receive the invoice registered in the Jinsan system, after passing, select the current taxpayer to receive the type and quantity of the invoice, and select the invoice Afte...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com