Group fraud recognition method and device of internet finance small/micro loans

An identification method and identification device technology, applied in the computer field, can solve problems such as unsatisfactory results and insignificant fraudulent features

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0037] The invention provides a method for identifying gang fraud in Internet finance small and micro loans.

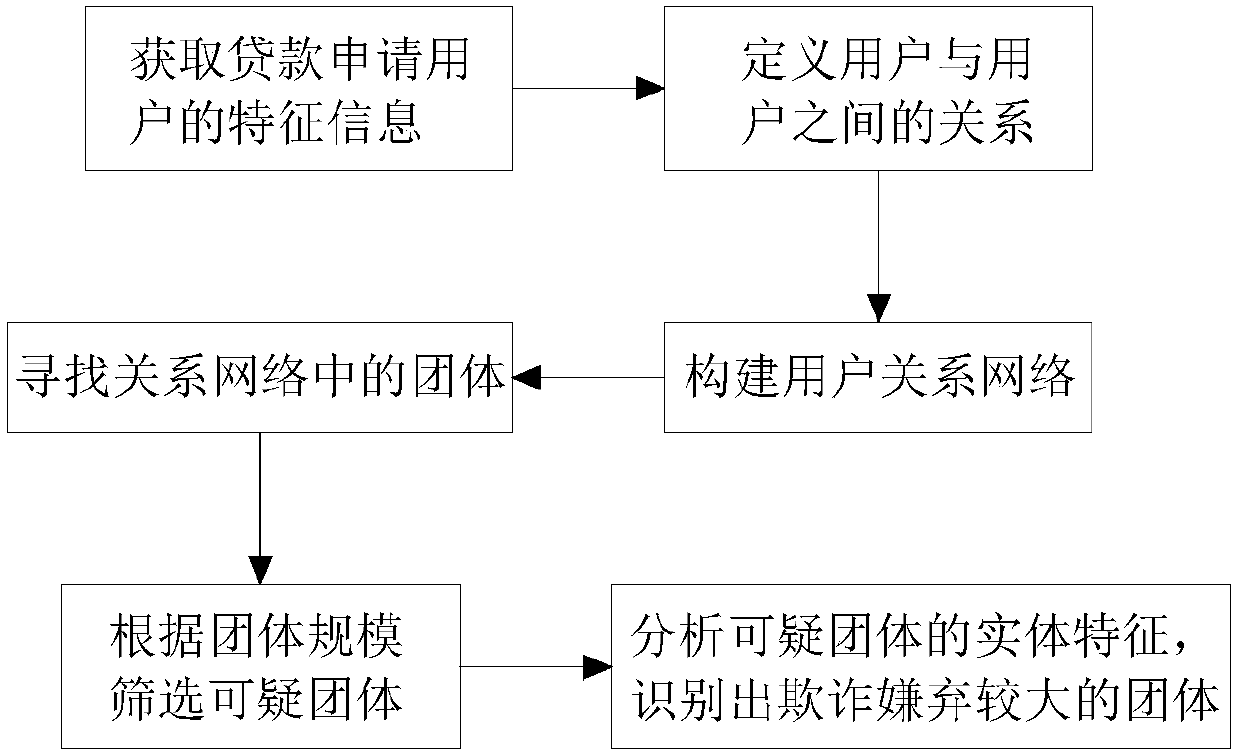

[0038] refer to figure 1 , figure 1 It is a schematic flow chart of the method for identifying gang fraud in Internet finance small and micro loans of the present invention.

[0039] The gang fraud identification method for Internet finance small and micro loans includes the following steps:

[0040] 1) Obtain the characteristic information of the loan applicant user, which includes but is not limited to the user's login device fingerprint, login ip, login password, email address used when applying, address book information, GPS positioning information, etc.;

[0041] 2) Define the relationship between users by comparing the similarity between user characteristic information, for example (including but not limited to): two users log in with high fingerprint similarity, same login ip, and log in with the same password , Log in with the same email address, high simil...

Embodiment 2

[0047] The invention provides a gang fraud identification device for Internet finance small and micro loans.

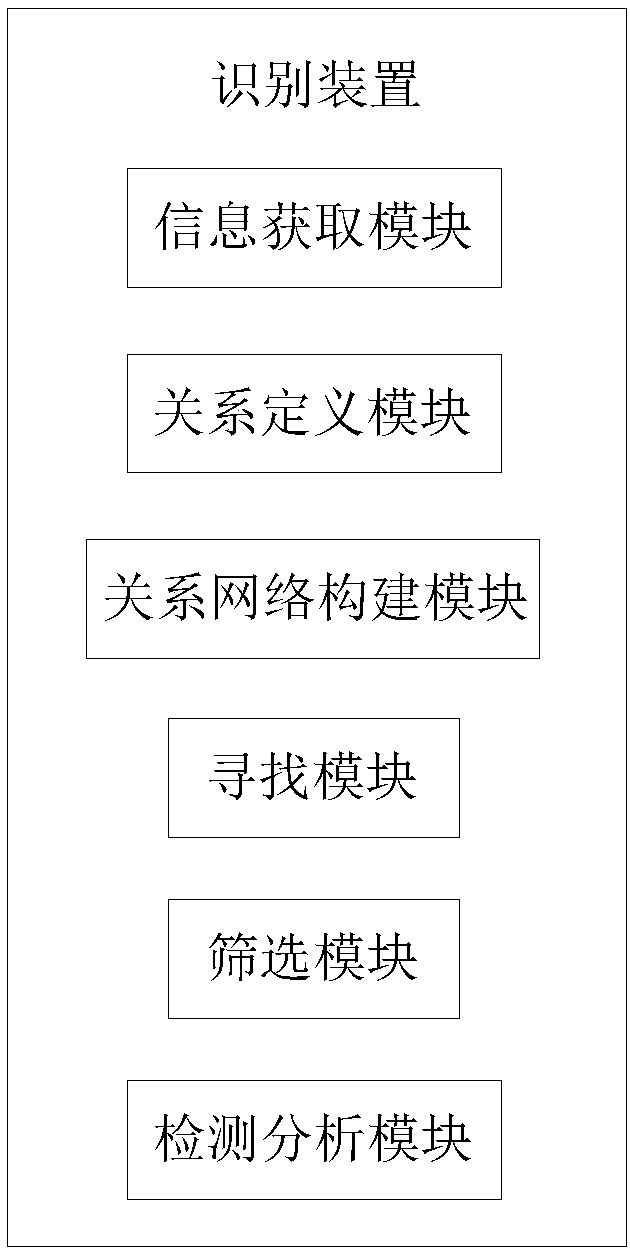

[0048] refer to figure 2 , figure 2 It is a structural block diagram of the gang fraud identification device for Internet finance small and micro loans of the present invention.

[0049] The gang fraud identification device for Internet finance small and micro loans includes:

[0050] The information acquisition module is used to obtain the characteristic information of the loan application user, the characteristic information includes but not limited to the user's login device fingerprint, login ip, login password, mailbox used when applying, address book information, GPS positioning information, etc.;

[0051] The relationship definition module is used to define the relationship between users by comparing the similarity between user feature information, for example (including but not limited to): two users log in with high fingerprint similarity, same login ip, ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com