Credit Data, Model Guarantee and Verification Method Based on Block Chain

A verification method and blockchain technology, applied in the field of model warranty and verification, and credit data, can solve problems such as model and tampering that it is difficult for banks to confirm whether the original data is complete and credible credit evaluation, so as to protect data confidentiality, The effect of preventing malicious tampering and compressing storage space

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0028] The following will clearly and completely describe the technical solutions in the embodiments of the present invention with reference to the accompanying drawings in the embodiments of the present invention. Obviously, the described embodiments are only some, not all, embodiments of the present invention.

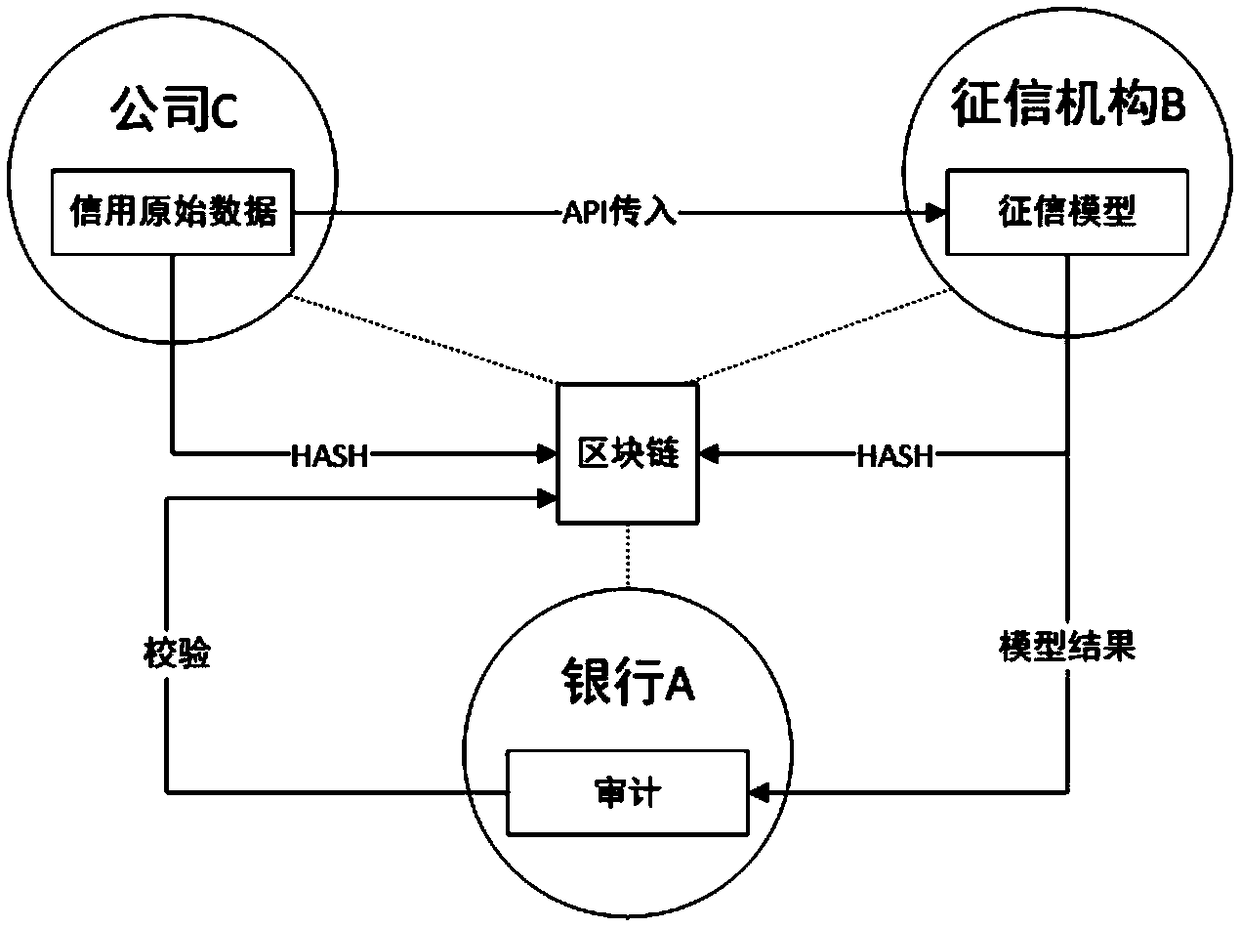

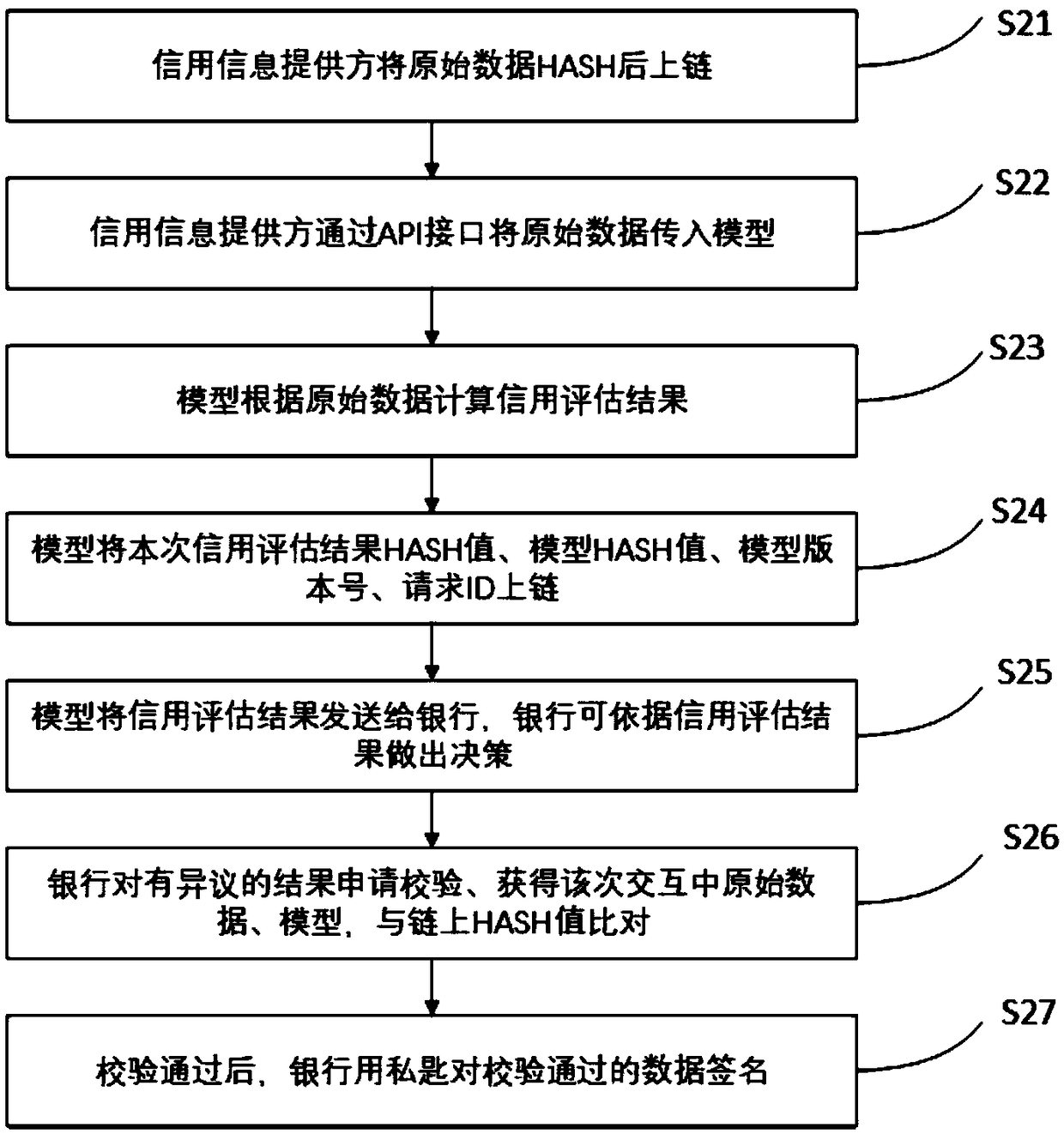

[0029] Here, we assume that there are three user entities, namely bank A, the demand side of personal credit information, credit agency B, the executor of credit investigation and the provider of the model, and company C, the provider of original credit information data. We assume that bank A needs to conduct credit investigation on company C through credit investigation agency B, and needs to verify a certain credit information after the credit investigation is completed.

[0030] figure 1 An embodiment of the application is shown, that is, a schematic diagram of a blockchain-based credit evaluation and data security system, which shows the interaction between vario...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com