Personal online credit method, device and equipment for medium and small banks and a medium

A technology for small and medium-sized banks and credit management systems. It is applied in the fields of instruments, finance, and data processing applications. It can solve the problems that online loan platforms are not suitable for small and medium-sized banks, limited funds, and slow start. Effects of direct manipulation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

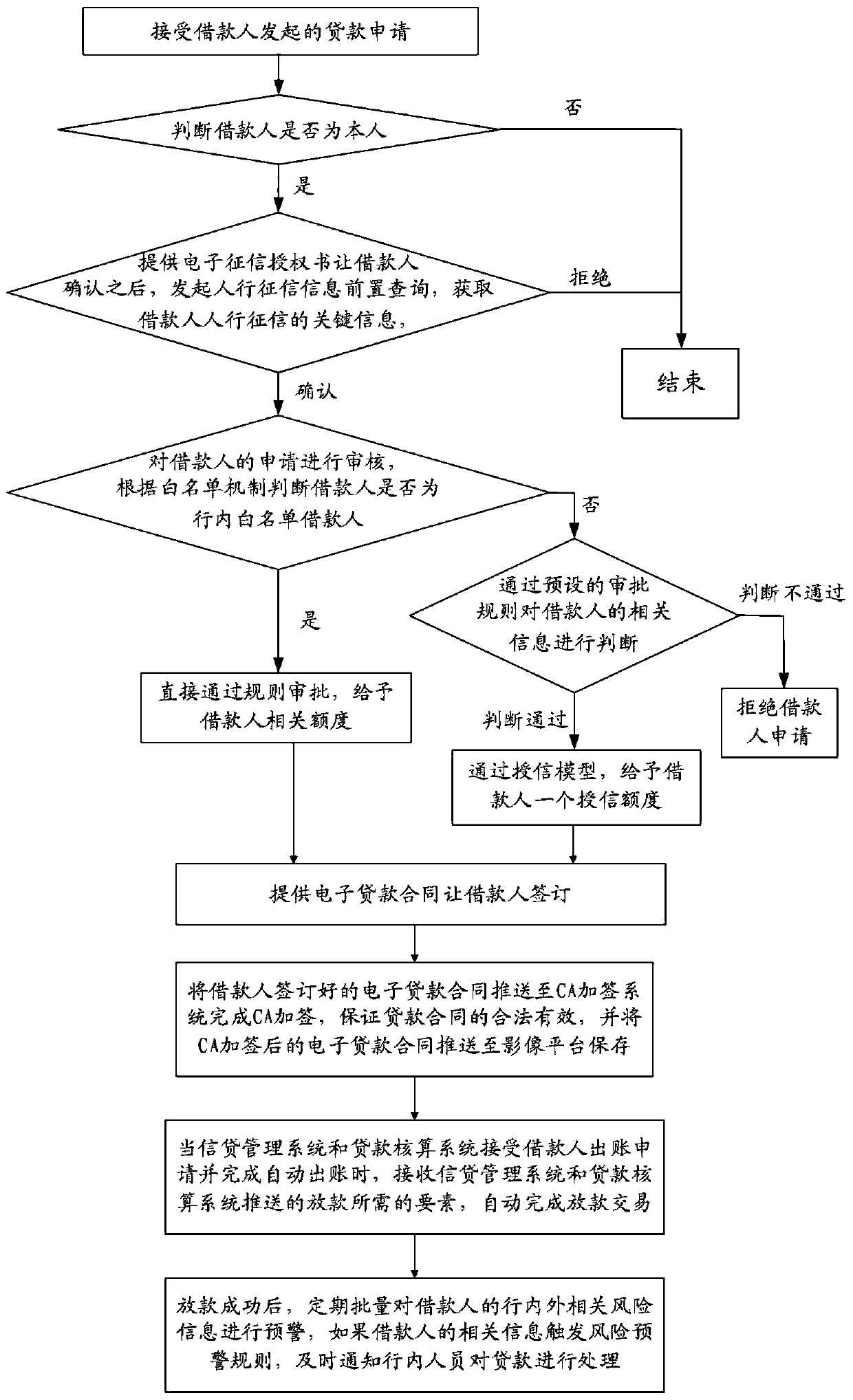

[0067] This embodiment provides a personal online credit method for small and medium-sized banks for use in online loan platforms, such as figure 2 Shown, including the following steps:

[0068] S1. Accept the loan application initiated by the borrower. The borrower initiates from the bank channel such as the bank’s mobile banking APP or online banking channel, or according to the cooperation with the third party, such as the specific consumer credit scenario of the e-commerce platform, from the third party The platform’s channel initiates the loan application, and then determines whether the borrower is the person, if it is, proceed to the next step, otherwise, the process is terminated; the method to determine whether the borrower is the person is: face recognition and biometric inspection of the borrower, and Compare the stock photos of the borrower in the bank or the photos of the public security system to determine whether the borrower is himself;

[0069] S2. After providing...

Embodiment 2

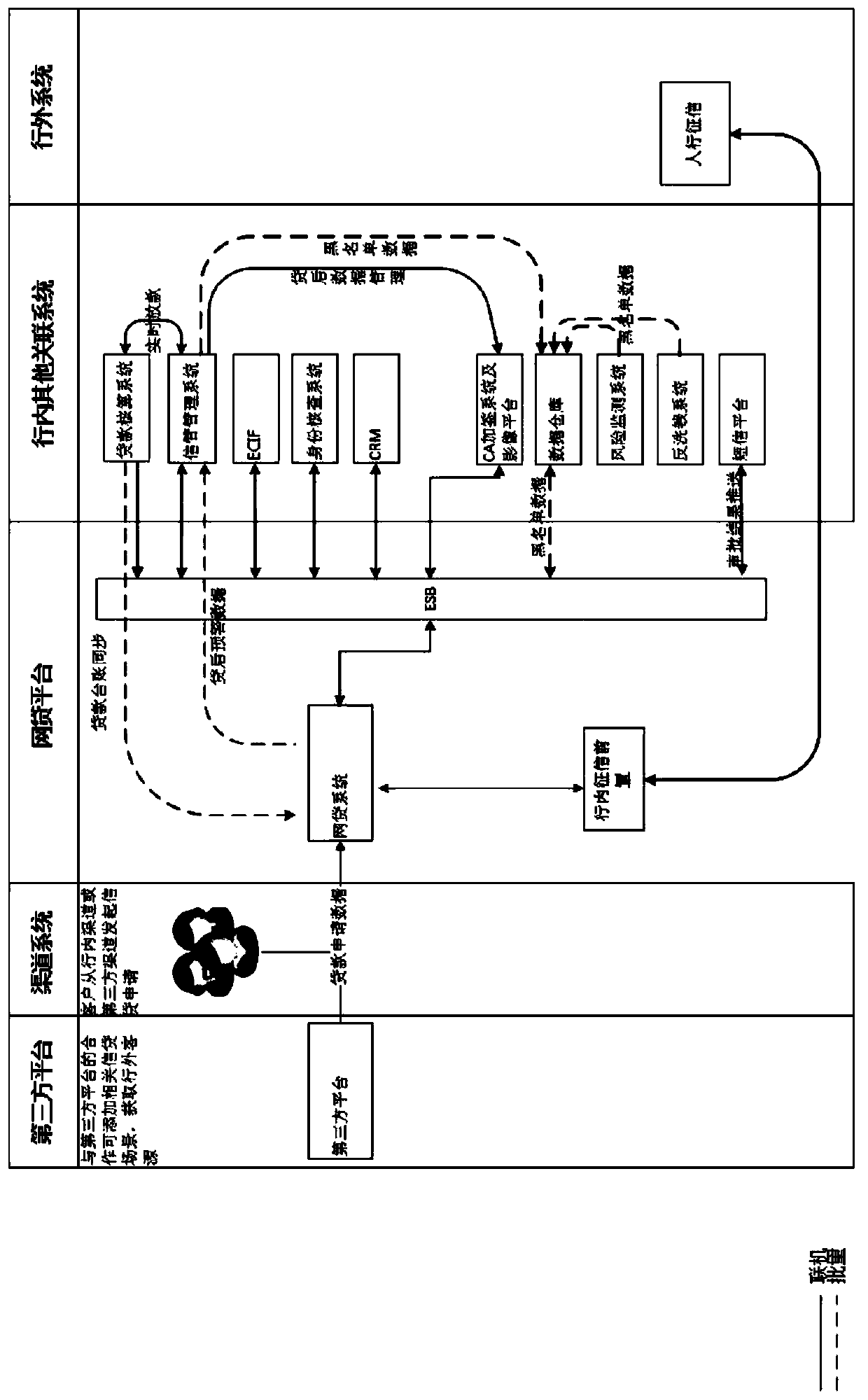

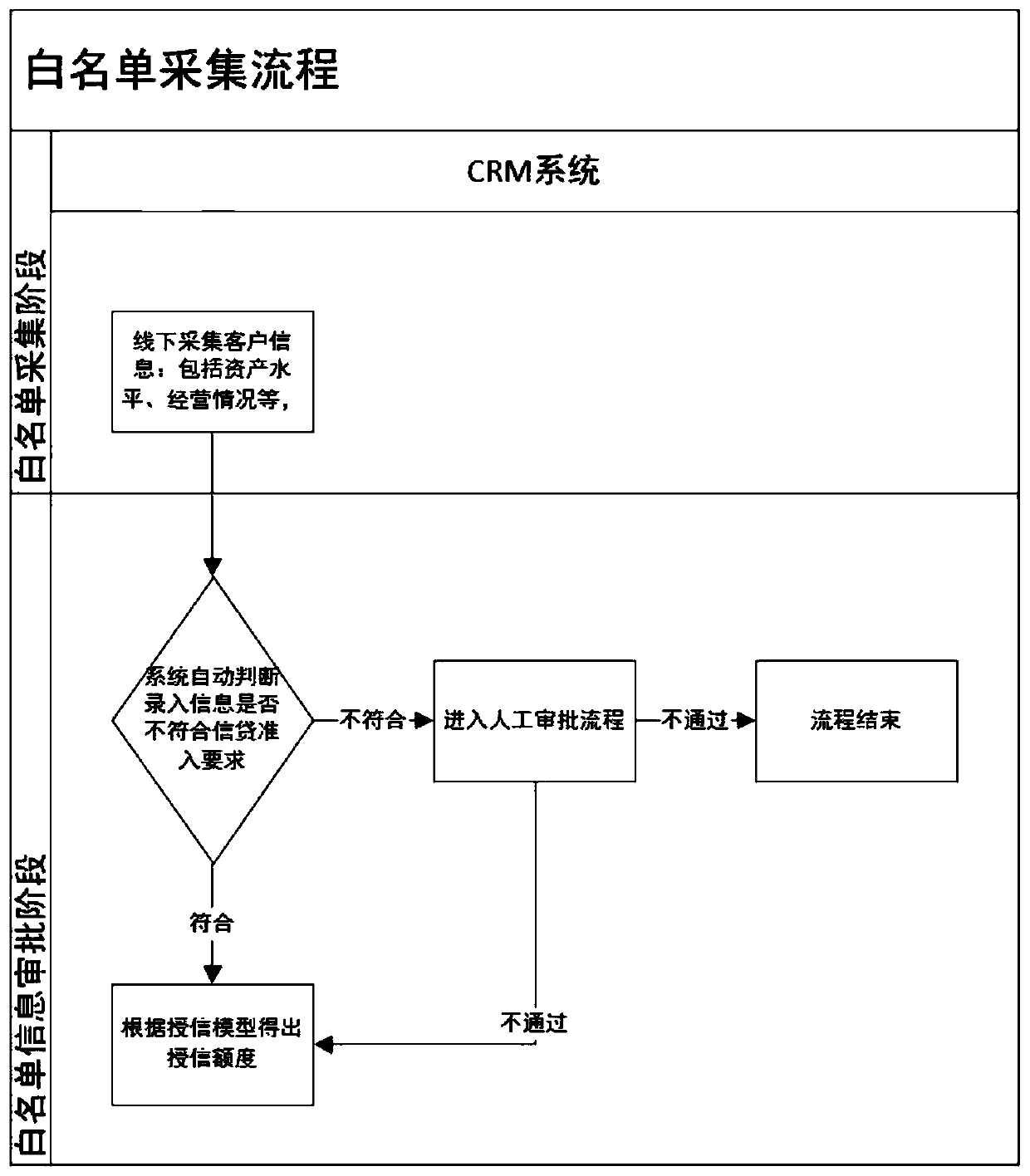

[0103] In this embodiment, a personal online credit method for small and medium banks is provided, such as figure 1 with 4 Shown, including steps:

[0104] S1. The bank channel system or third-party cooperation platform accepts the loan application initiated by the borrower, and forwards the application to the online lending platform. The online lending platform determines whether the borrower is himself, if so, proceed to the next step, otherwise terminate the process; determine the loan The method to determine whether the person is the person is to check the borrower's face and live recognition, and compare it with the stock photos of the borrower in the bank or the photos of the public security system to determine whether the borrower is the person;

[0105] S2. After the online lending platform provides the electronic credit investigation authorization letter to the bank channel system or third-party cooperation platform for the borrower to confirm, the online lending platform i...

Embodiment 3

[0113] In this embodiment, a personal online credit device for small and medium banks is provided, such as Figure 5 As shown, the device is an online lending platform, including:

[0114] The receiving module is used to accept the loan application initiated by the borrower and determine whether the borrower is himself, if so, proceed to the next step, otherwise end the process; among them, the borrower is checked for face recognition and living body recognition, and the stock of borrowers in the bank Compare the photo or the photo of the public security system to determine whether the borrower is himself;

[0115] The pre-credit investigation module is used to provide an electronic credit investigation authorization letter for the borrower to confirm, the originator bank's credit investigation information pre-query to obtain key information of the borrower's PBOC credit investigation, if the borrower refuses to confirm, the process ends;

[0116] The review module is used to review ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com