Calculation method and device for feature data of lending user in financial scene

A technology of user characteristics and user data, applied in the field of big data, can solve the problems that the characteristics cannot be counted relatively completely, manual processing is time-consuming and laborious, and achieve the effect of reducing labor and time costs and reducing financial risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0036] It should be noted that, in the case of no conflict, the implementation modes in the present application and the features in each implementation mode can be combined with each other.

[0037] Hereinafter, the present application will be described in detail with reference to the accompanying drawings and in combination with embodiments.

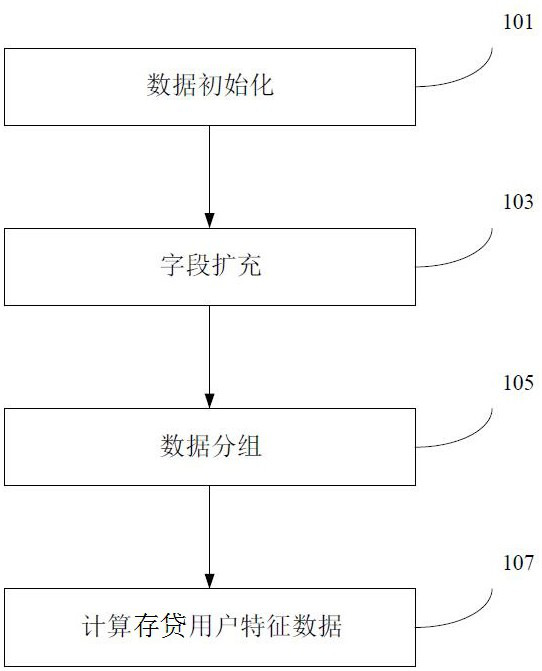

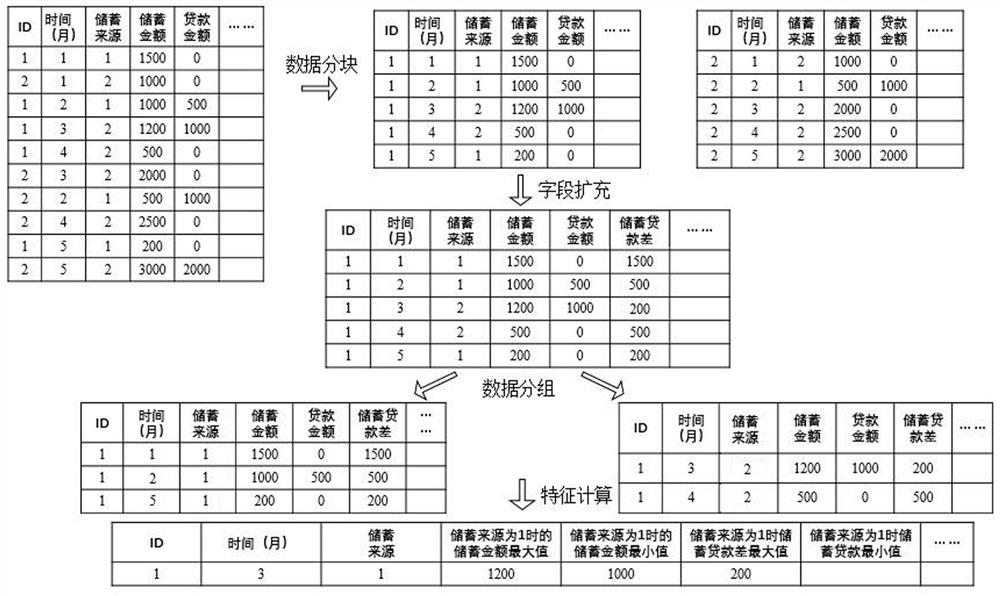

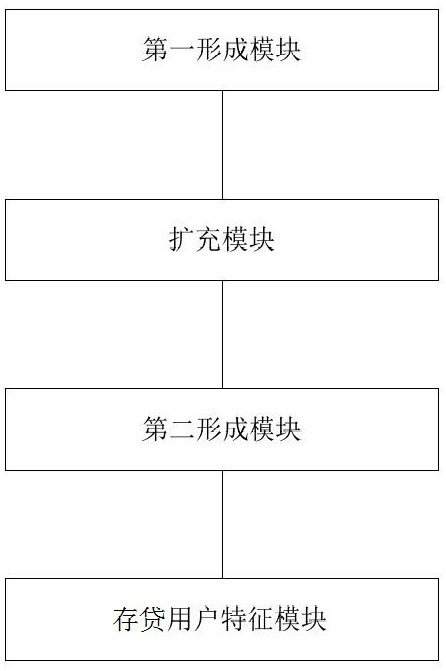

[0038] This application is aimed at financial scenarios (such as banks) to calculate the feature data of deposit and loan users (such as users with deposit and loan time series records), and is divided into four parts, including data initialization, field expansion, data grouping, and feature calculation. Each part is independent of each other and interrelated. The modular structure is flexible, which facilitates the combination of modules, and has high reusability and maintainability.

[0039] The calculation method of the deposit and loan user characteristic data provided by this application is as follows: figure 1 shown, including: ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com