System and method for conducting secure commercial order transactions

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

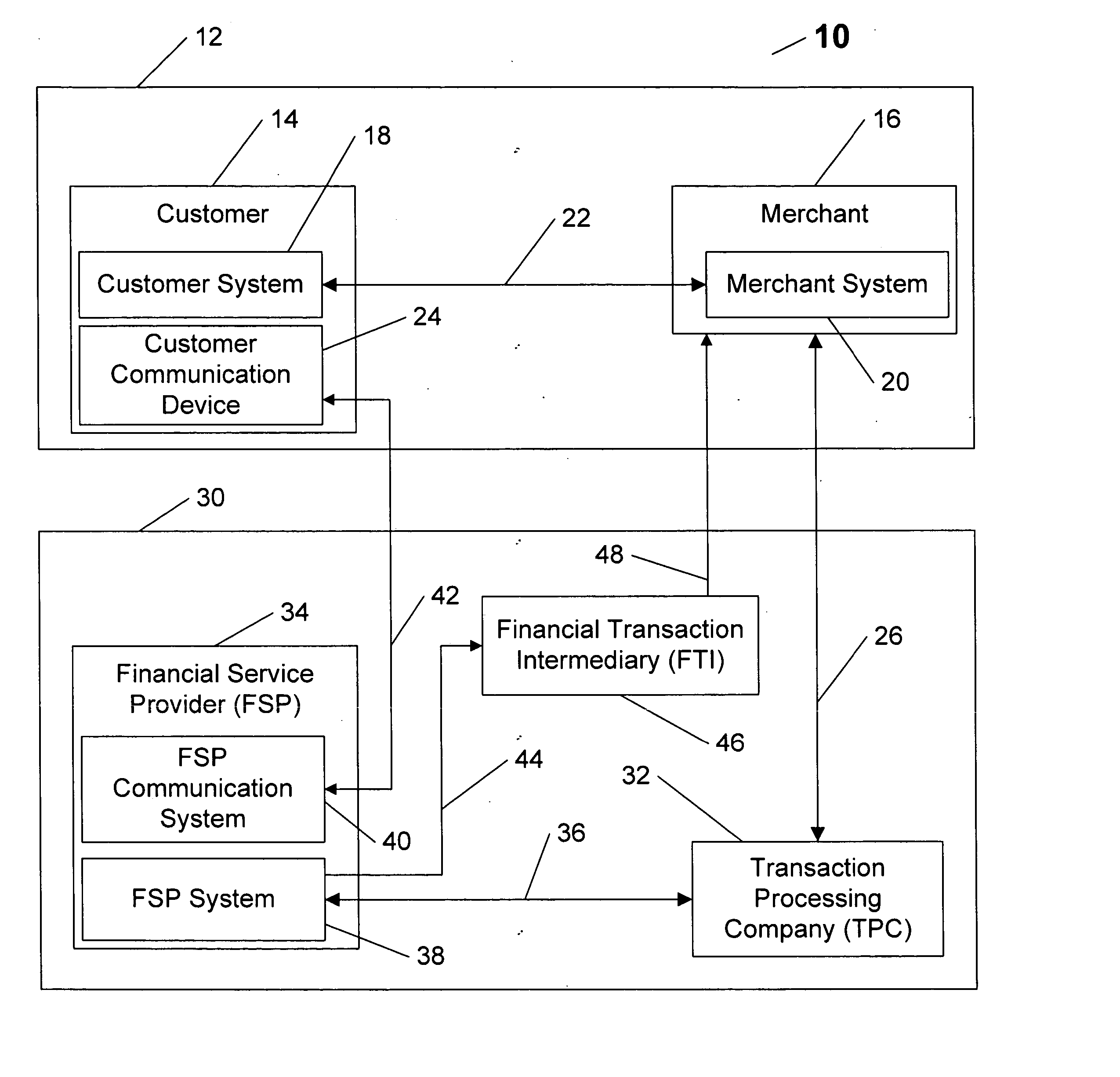

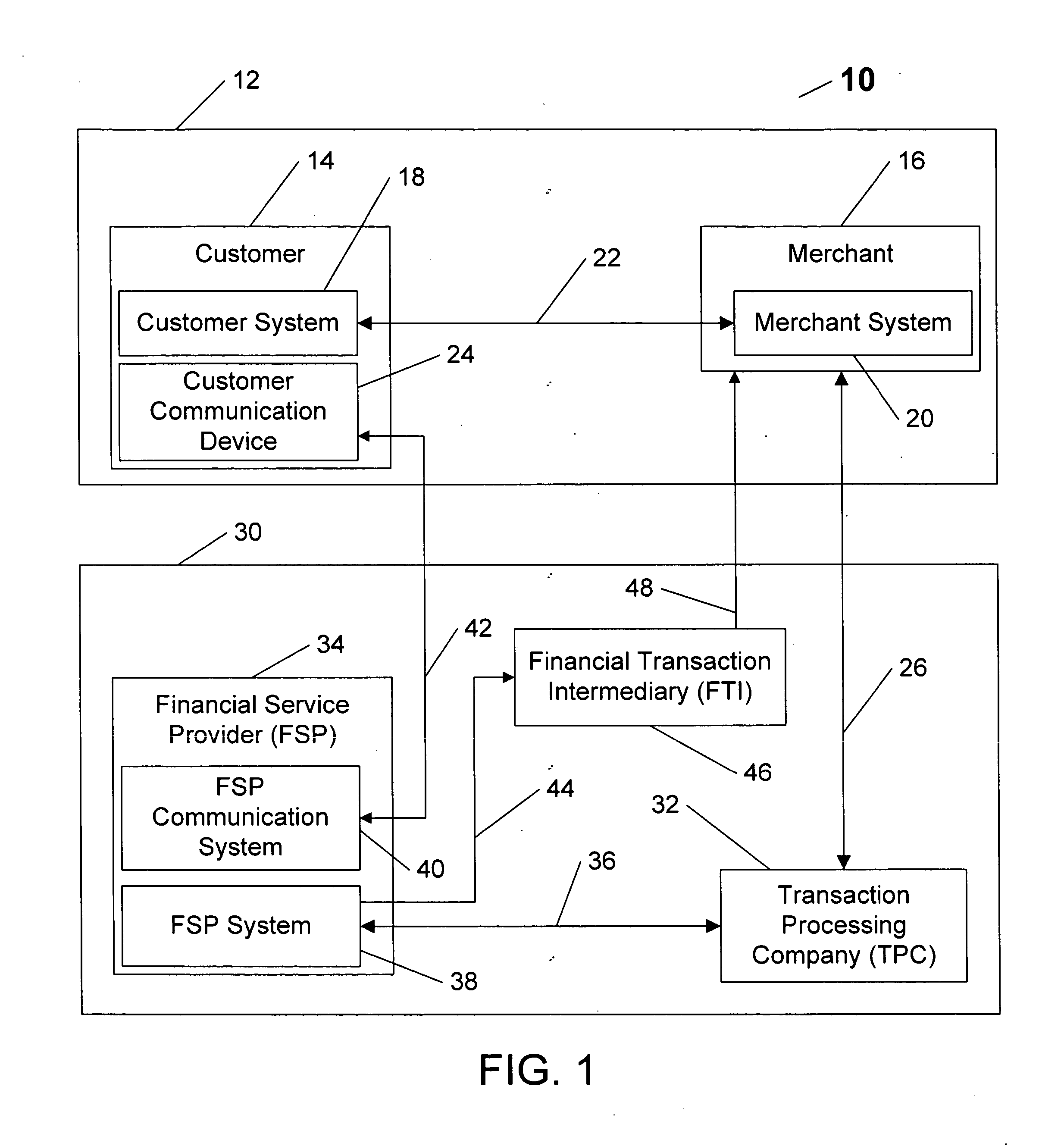

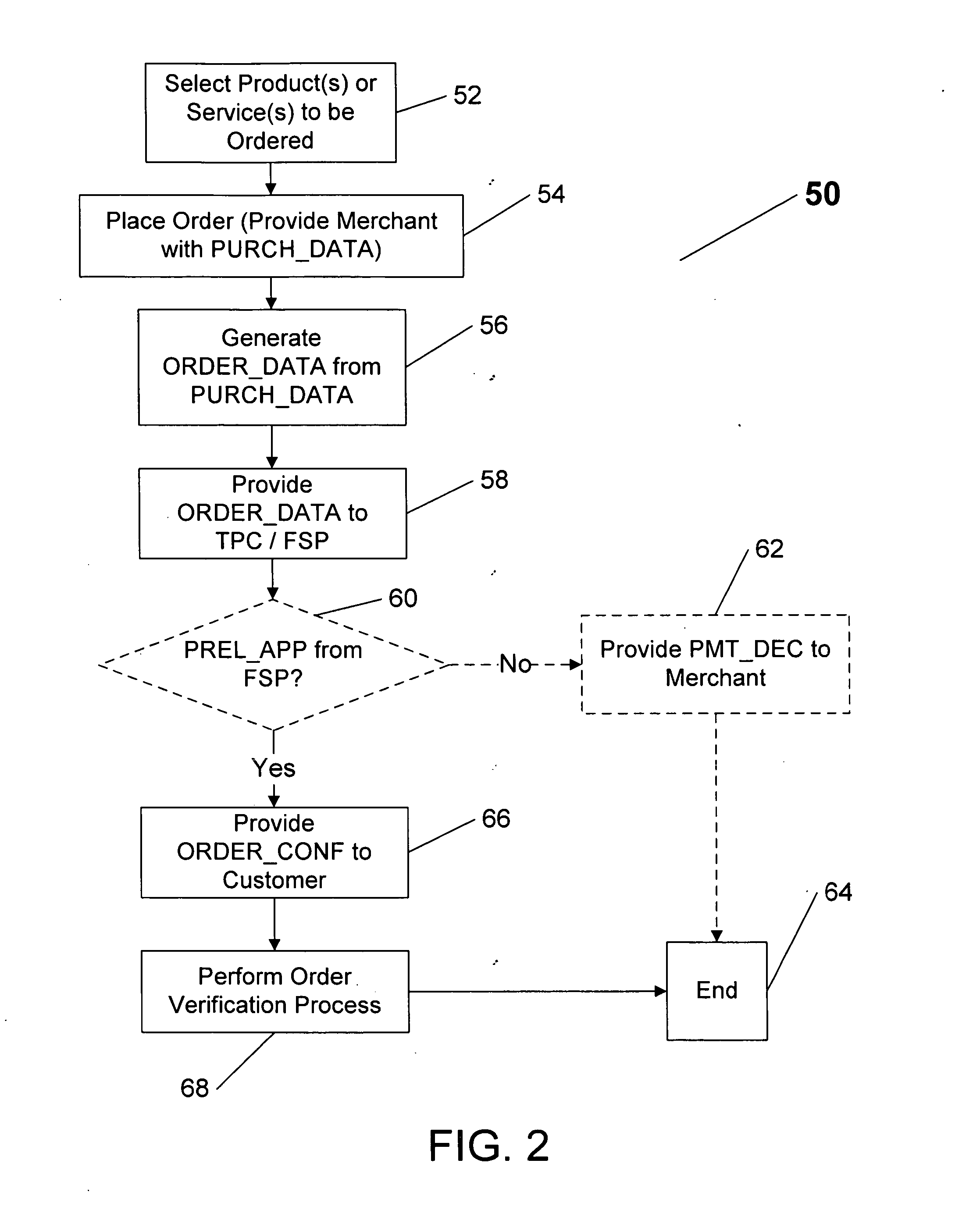

[0043] The system and method of the present invention remedy the disadvantages of previously known systems for enabling secure commercial transactions between customers and merchants. The present invention in its various embodiments, in contrast to most recently developed secure transaction techniques (which are focused only on securing on-line transactions), functions equally well for virtually all types of commercial transactions—whether one initiated by electronic orders sent over one or more communication networks (such as the Internet and / or local or long-distance telephone networks), or ones initiated by other types of contact with merchants, for example, by telephone, facsimile or through the mail. Advantageously, the system and method of the present invention enable customers to conduct secure order transactions with any type of merchant without requiring any special software, encryption, or special hardware on the part of the customer, the merchant, or the financial transac...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com