System and method for biometric authorization for check cashing

a biometric authorization and check technology, applied in payment protocols, instruments, data processing applications, etc., can solve the problems of merchants being negatively affected by check and id fraud, increasing the cost of cashing payroll and other checks, and increasing the cost of honest check presenters

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

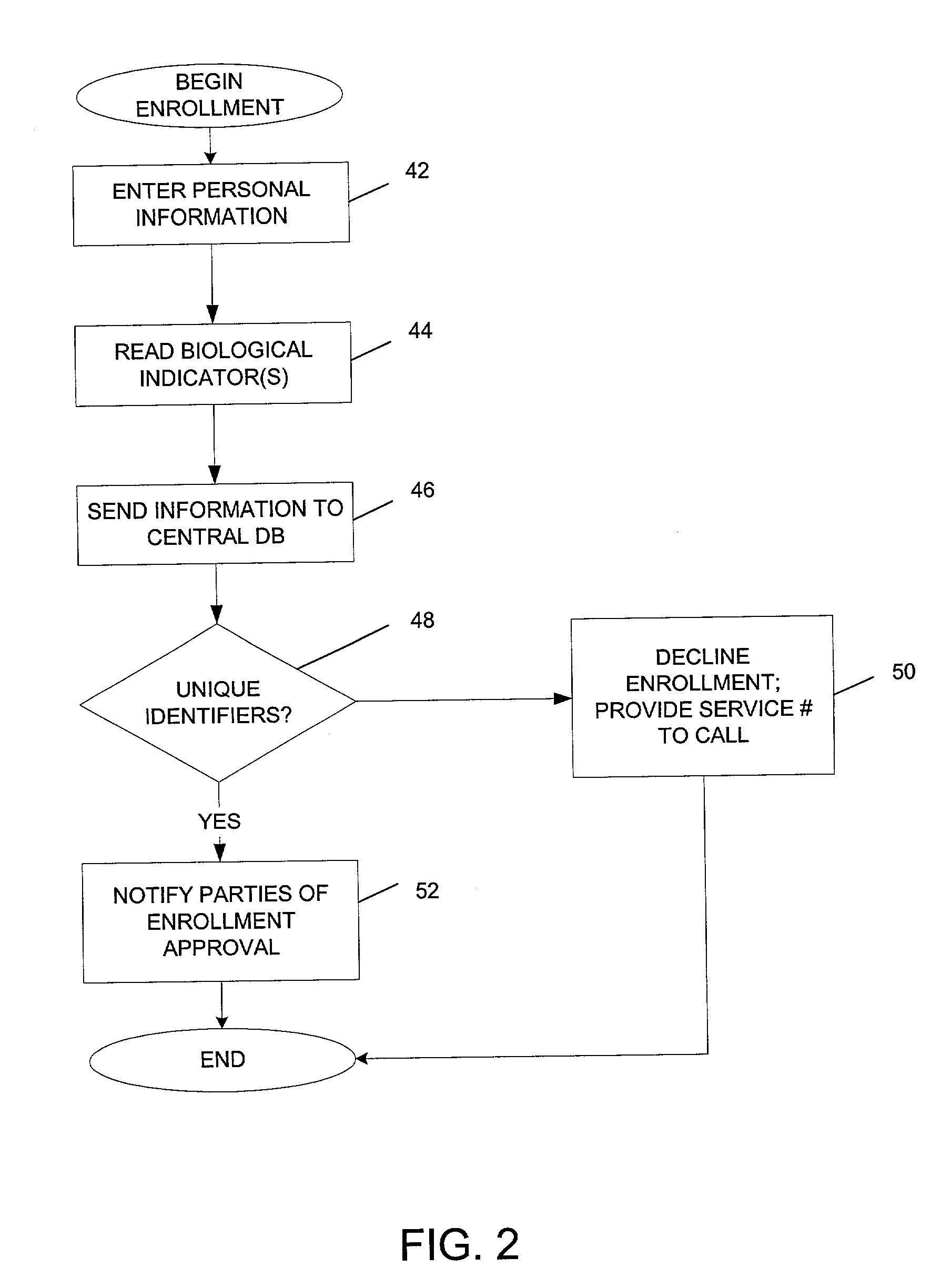

[0042]As noted above, the present invention encompasses a system and method for authorization of a check cashing transaction using either a biometric sample only or a biometric sample in combination with an ID #.

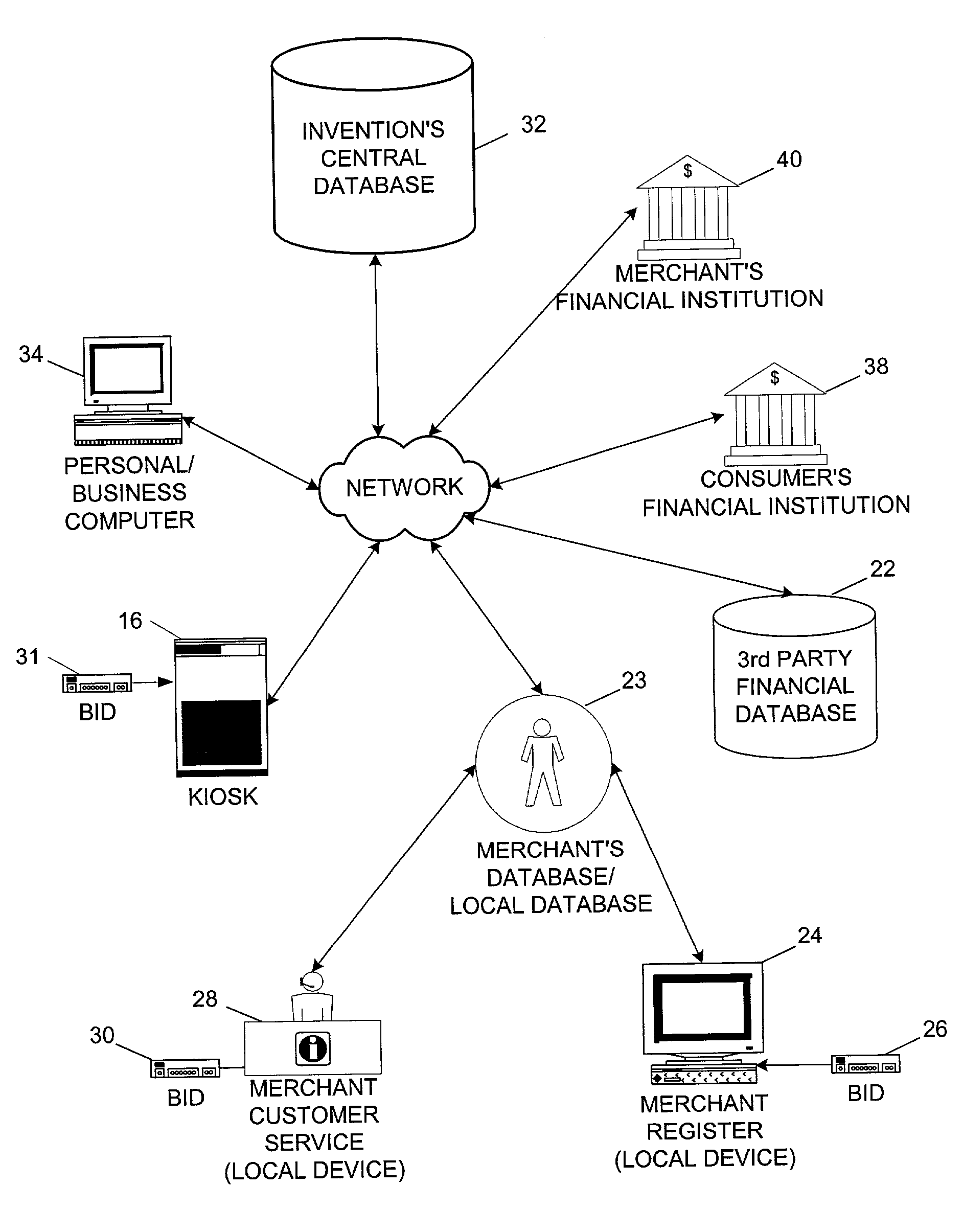

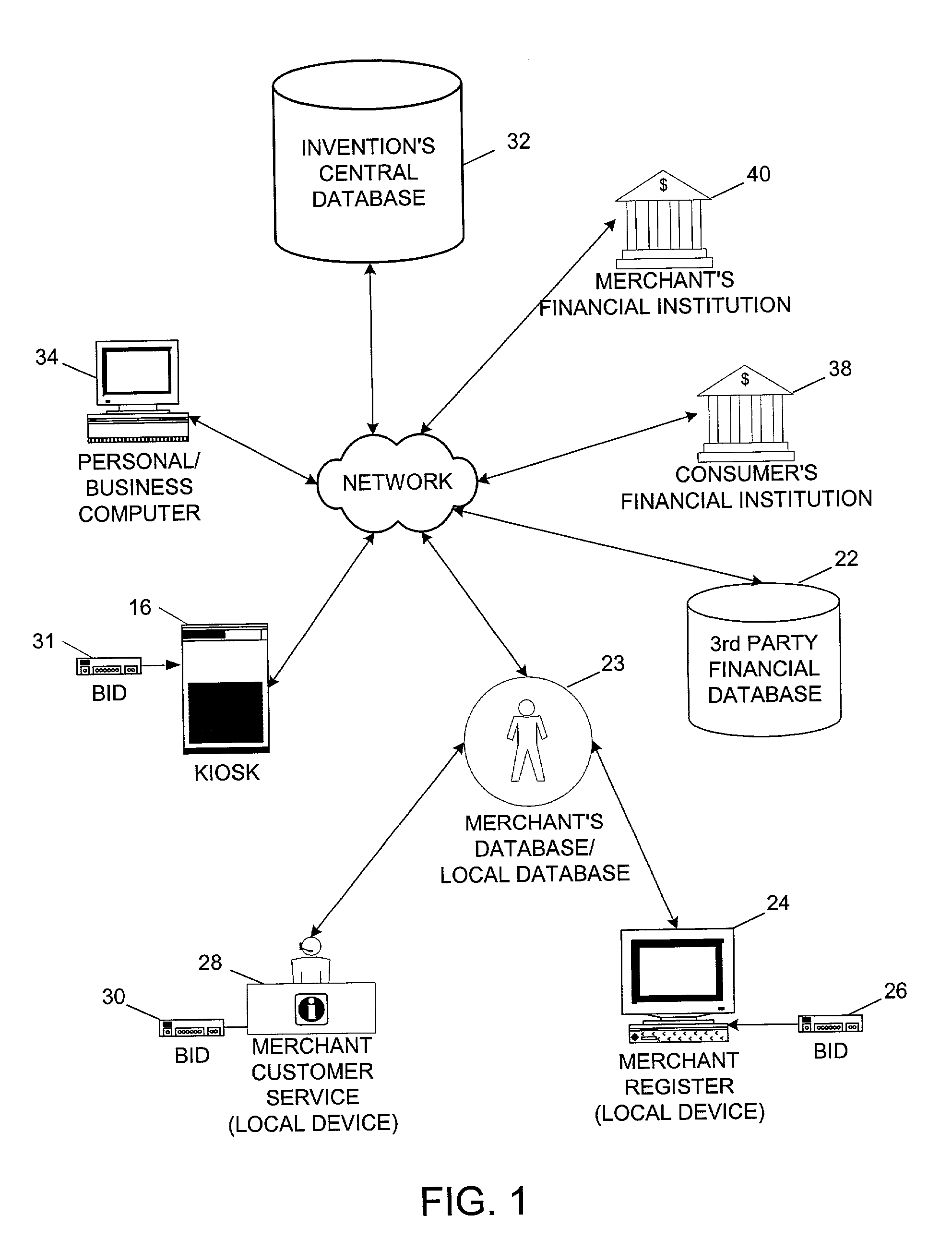

[0043]Referring to FIG. 1, a general architecture overview of a system for biometric authorization for check cashing according to an embodiment of the present invention is illustrated. One aspect of the system embodiment of the invention is the central database, which holds consumer system accounts and a list of all checking account numbers, along with their related financial data, that have been presented to the system. Accounts within the central database may be unmarked, marked negative, or marked warning. System accounts marked as either negative or warning are accounts that are preferably shared across all merchants registered with the system of the invention. Sharing this information among all registered merchants helps merchants prevent engaging in transactions with c...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com