Bank debt risk detecting system based on WEB

A technology for risk detection and debt, applied in instrument, finance, data processing applications, etc., can solve problems such as improving and evaluating the expected loss given default rate of debt, adverse bank risk management level, etc., to avoid risks and reduce losses.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

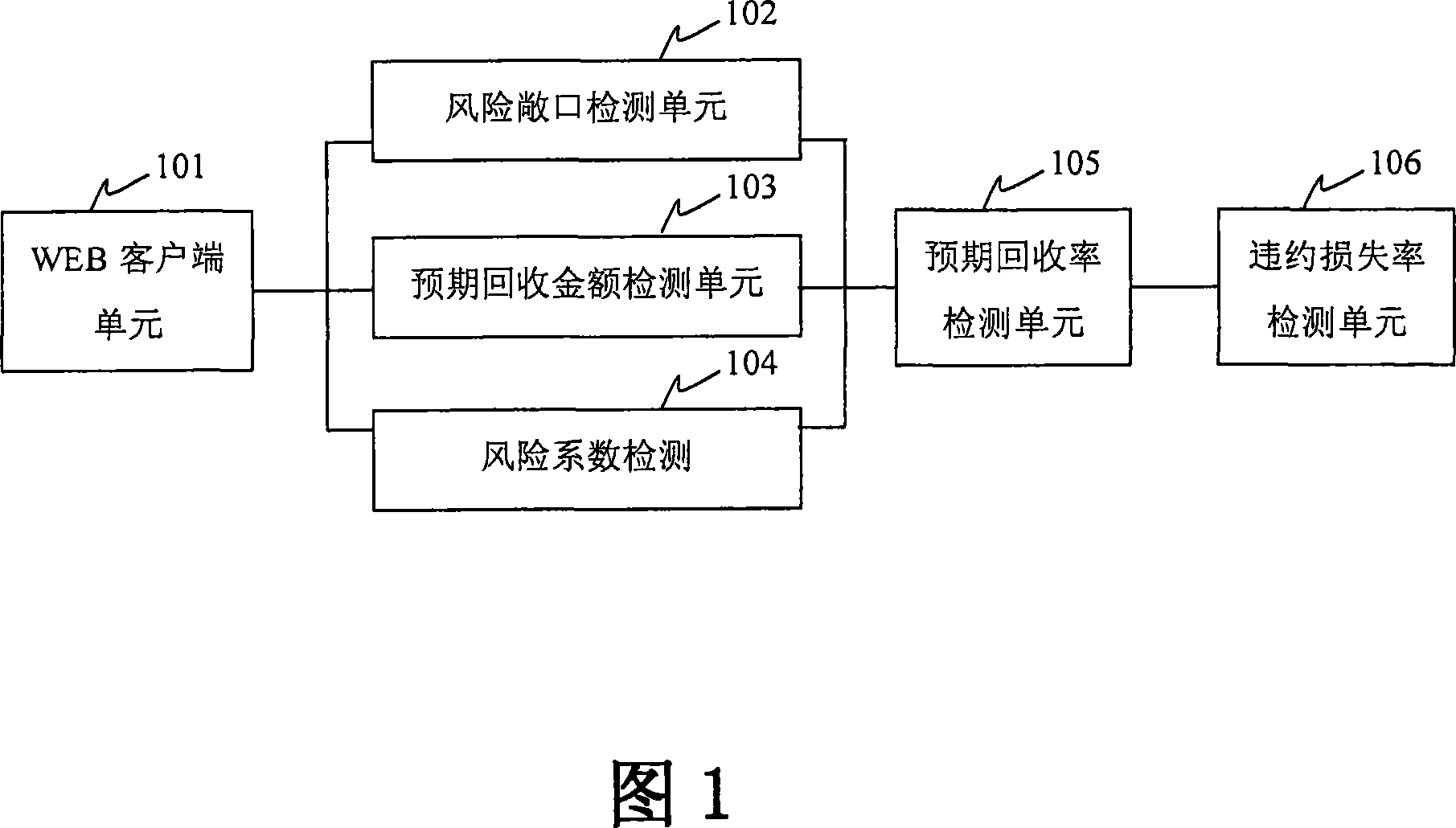

Image

Examples

Embodiment 1

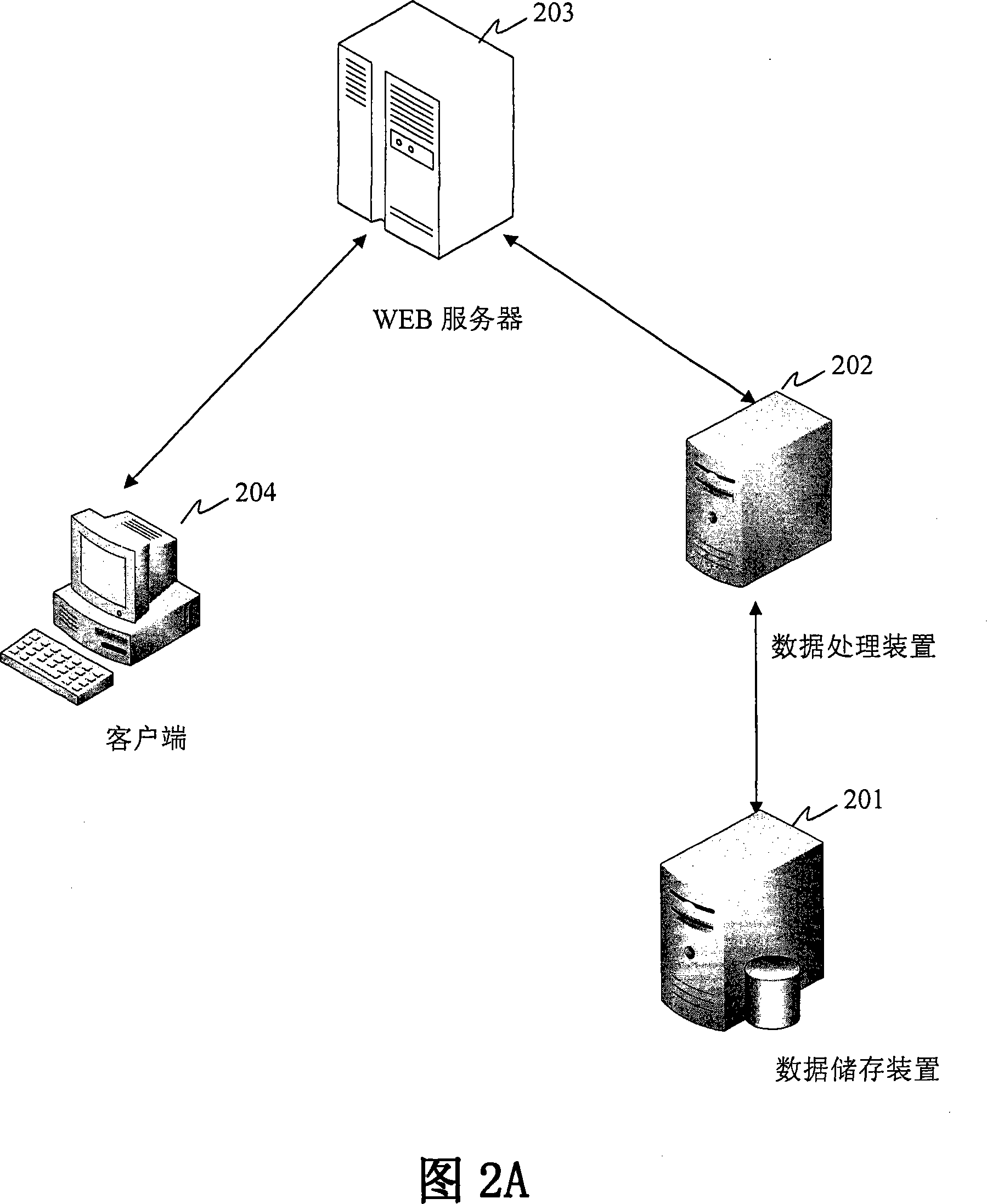

[0027] What Fig. 2A shows is the schematic diagram of the bank debt risk detection system based on WEB of embodiment 1 of the present invention, and this system comprises WEB service device 203, data storage device 201, client device 204, data processing device 202, wherein the The data storage device 201 and the data processing device 202 form an application server (not shown). The client device 204 and the data processing device 102 are respectively connected to the WEB service device 203 through the network, wherein the WEB service device 203 is used to provide the WEB page to the client device 204, so that the user can perform operations based on http and https, that is, through the web page to perform various operations; the data storage device 201 is used to store the basic data for calculating the debt risk, the intermediate data for calculating the debt risk, and the result data for calculating the debt risk; the client device 204 is used for sending the calculation thr...

Embodiment 2

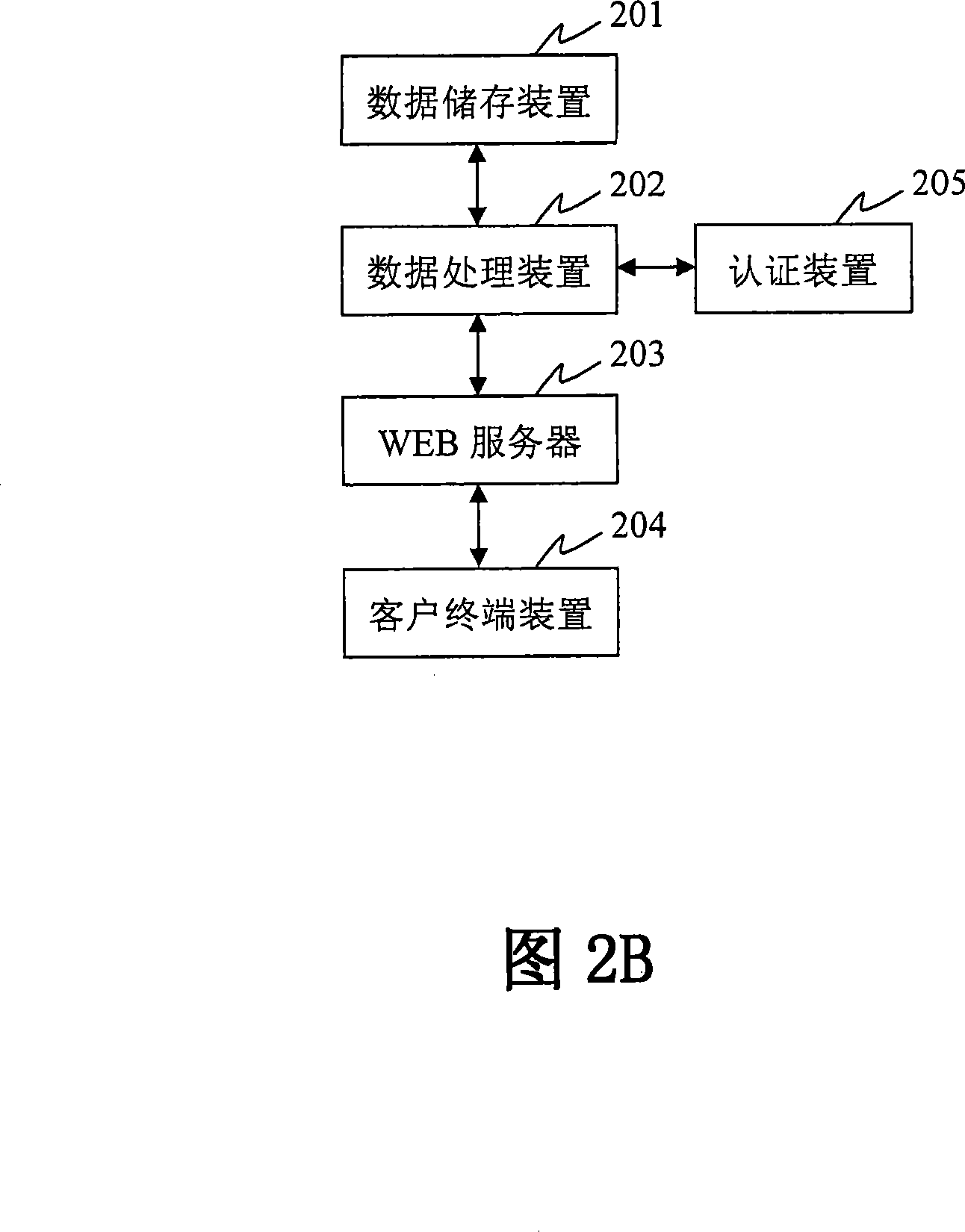

[0037] 2B is a structural block diagram of the system for calculating bank debt risk in Embodiment 2 of the present invention, wherein the data storage device 201 and the authentication device 205 are respectively connected to the data processing device 202, and the client terminal device 204 communicates with the WEB service device 203 The data processing device 202 is connected.

[0038] The above-mentioned data storage device 201 can be a PC server or host, which runs the database management system, and stores data such as basic data of debt risk assessment, intermediate data of debt risk assessment, results of debt risk assessment, etc., and provides data storage for the system. Get service.

[0039] The authentication device 205 is responsible for authenticating the user. The user must log in before using the system. The user inputs authentication information such as user name or code, password, etc. on the client terminal device 204, and the client terminal device 204 pa...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com