Electronic invoice and taxation expropriation and management system and method

A technology of electronic invoices and electronic services, applied in the field of computer systems, can solve problems such as the inability to eliminate the circulation of false invoices, the inability of taxpayers to realize paperless handling of all businesses, and the cost of a large number of personnel, counters and equipment.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment approach

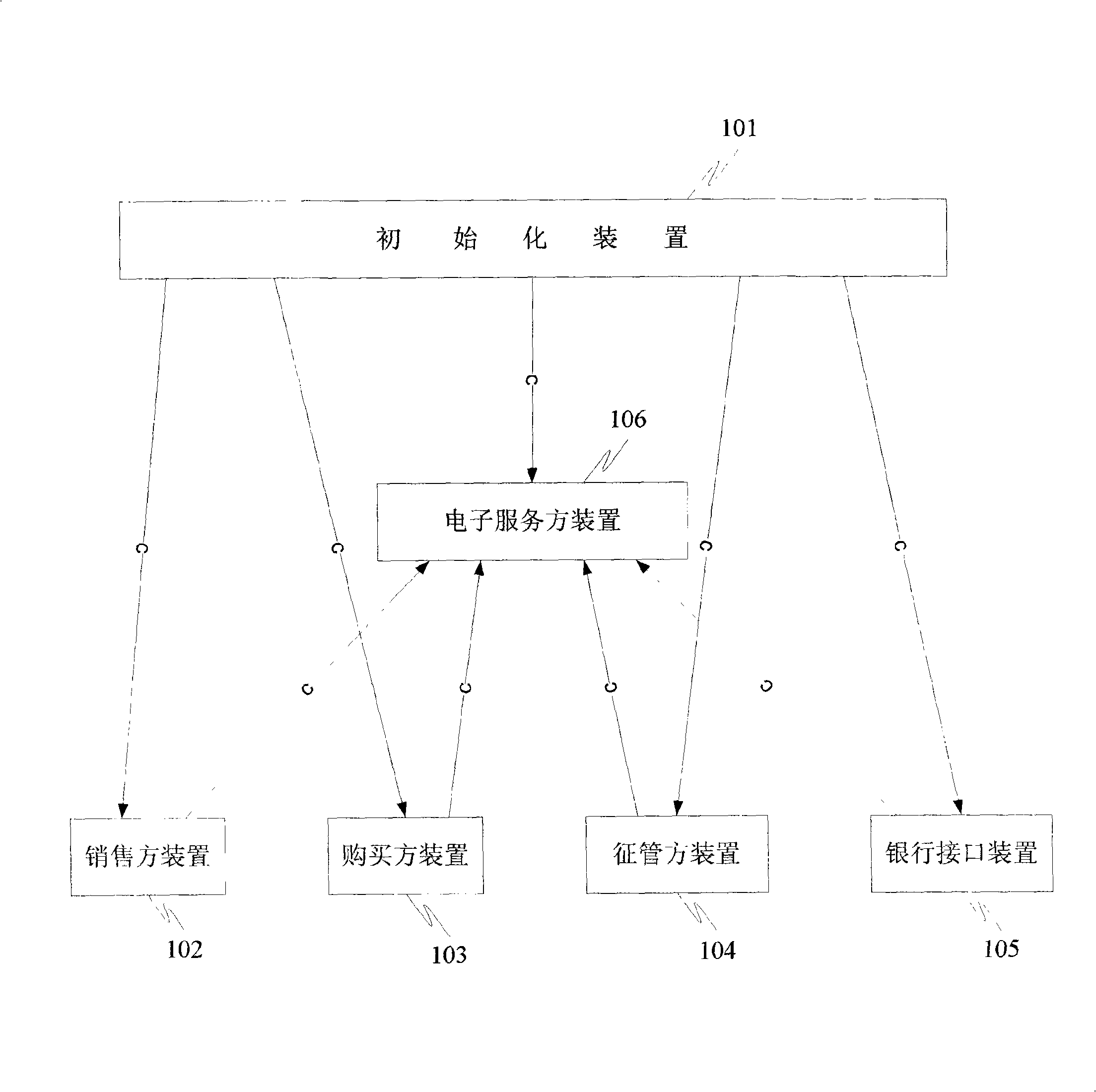

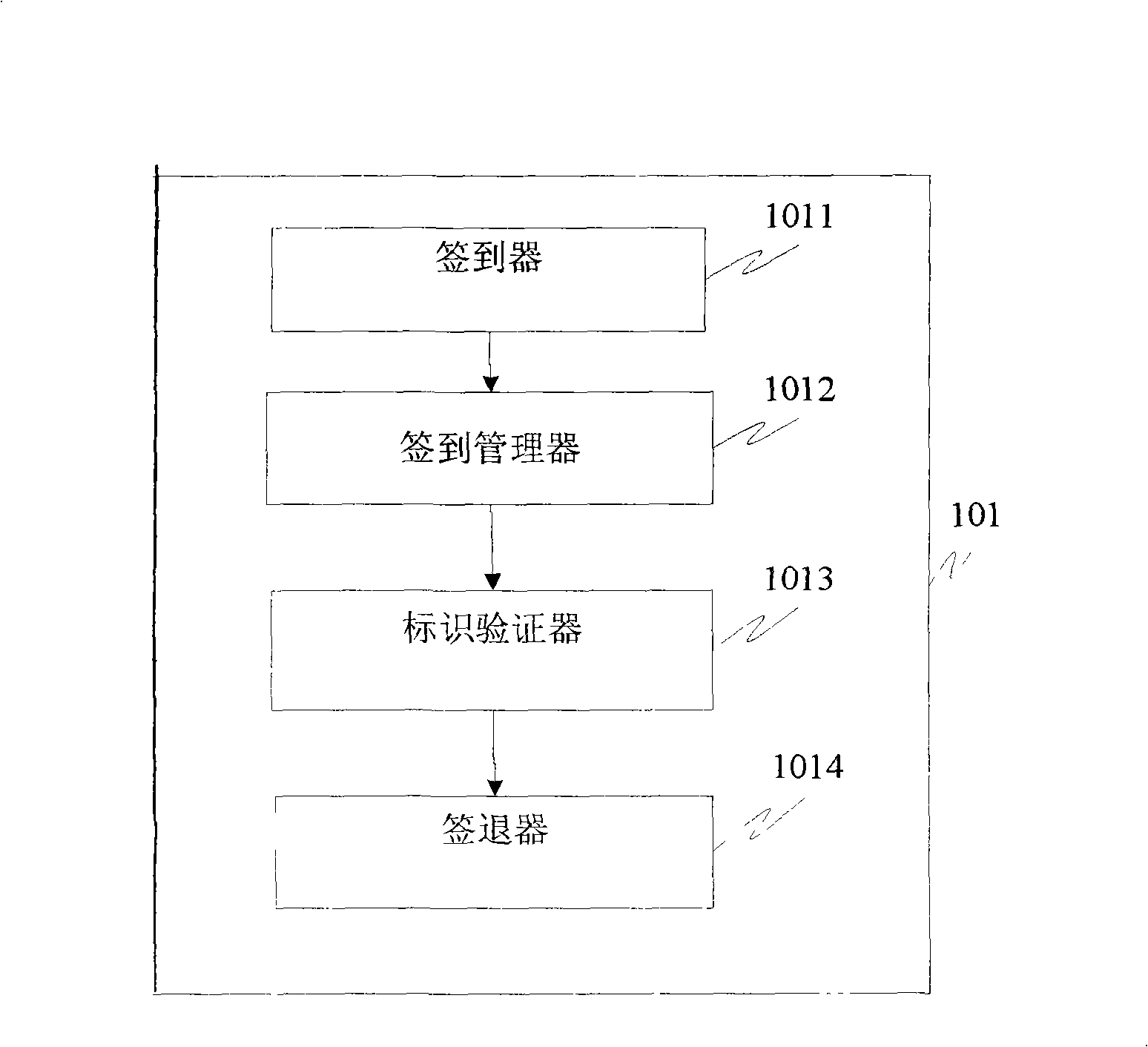

[0134] figure 1It is a schematic structural diagram of a system used for electronic invoices and tax collection and management according to an embodiment of the present invention. 101 represents an initialization device, 102 represents a seller's device, 103 represents a purchaser's device, 104 represents a collection and management device, 105 represents a bank interface device, and 106 represents an electronic service device.

[0135] The initialization device 101 is used to establish and manage a safe channel between the above-mentioned devices to ensure the authenticity, traceability and integrity of the declaration information when it is transmitted according to the set collection and management time and during the transmission process.

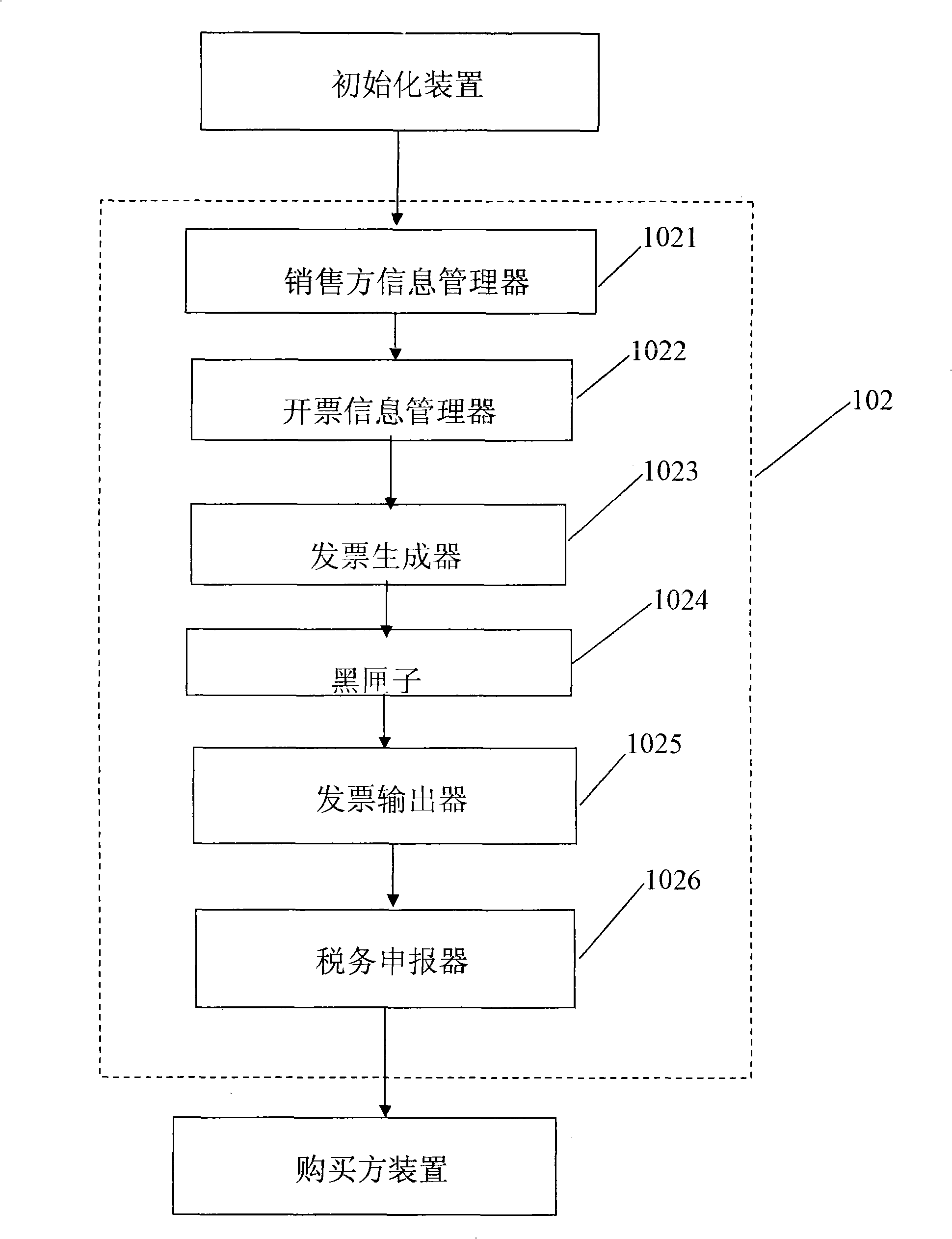

[0136] The seller's device 102 is used to generate and send the seller's electronic invoice and declare payable tax information. In seller device 102, any conventional method of generating and sending seller electronic invoices and repo...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com