Method and system for calculating retail asset risk

A computing method and computing system technology, applied in the computer field, can solve problems such as lack of uniform standards and inaccurate risk assessment of retail assets, and achieve the effects of improving use efficiency, reducing manual operation costs, and reducing randomness.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

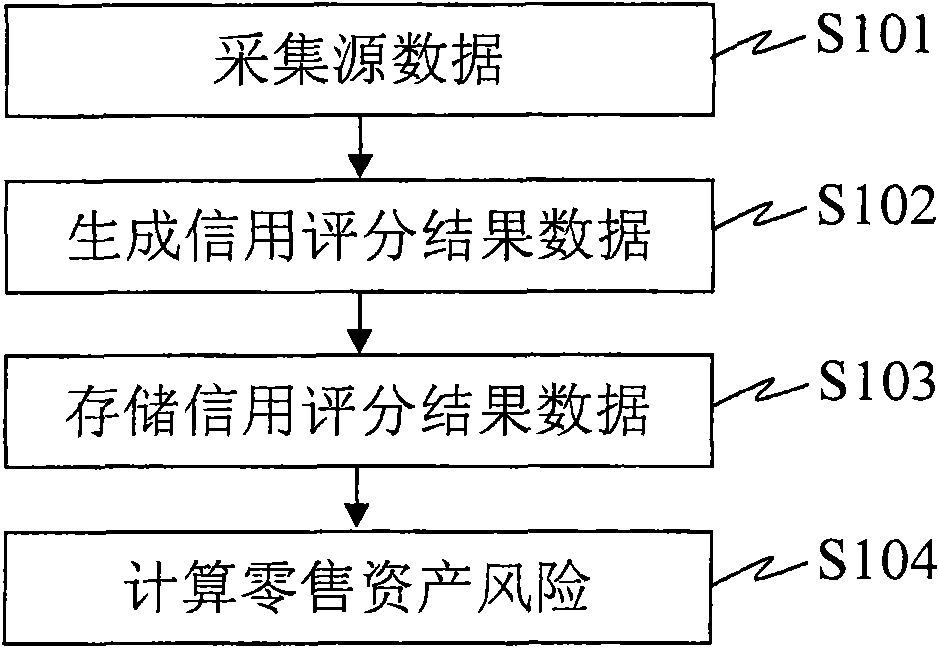

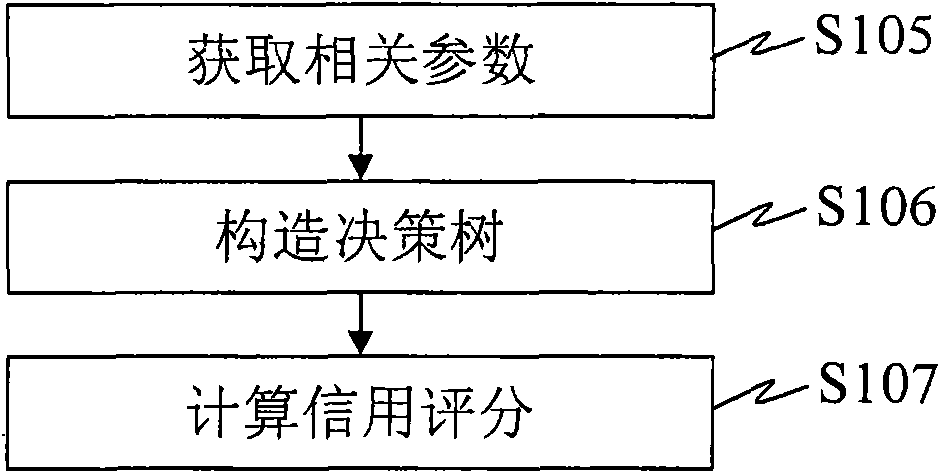

[0025] Figure 1A Shown is a flow chart of the calculation method for retail asset risk in Embodiment 1 of the present invention. Such as Figure 1A As shown, the calculation method of retail asset risk in Embodiment 1 of the present invention includes:

[0026] S101: Collect source data, which includes loan, credit card transaction data, customer asset data collected from various business systems of the bank, and customer and account data collected in real time from the personal credit system and bank card system at the time of application, as well as from Customer credit data at the time of application collected by the PBOC credit system in real time;

[0027] S102: Receive the above source data and perform credit scoring processing and credit rating processing to generate credit scoring result data;

[0028] S103: Store the above credit score result data in the data storage device for the user to call;

[0029] S104: Invoking the above credit score result data to calculat...

Embodiment 2

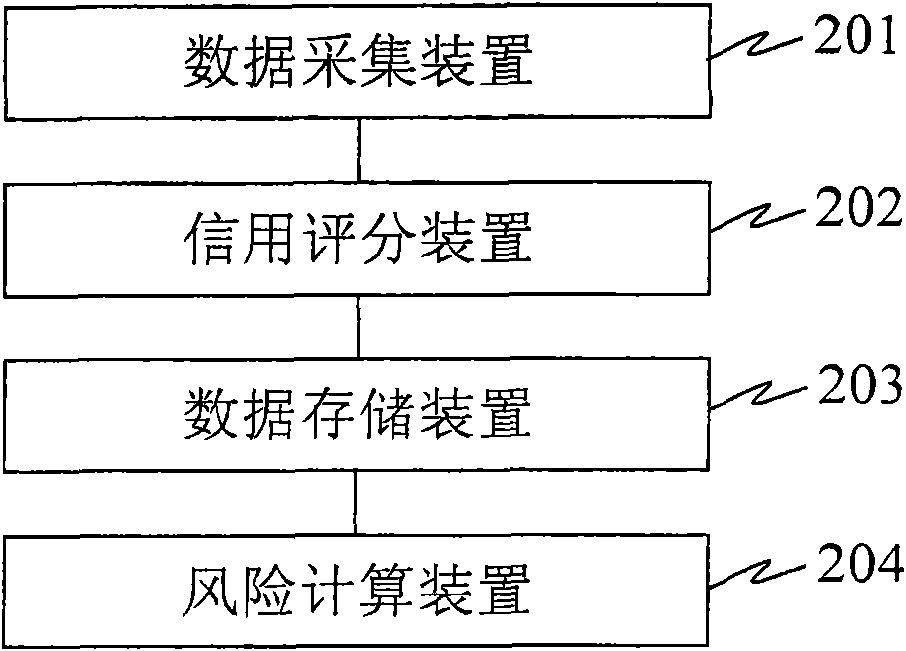

[0041] Figure 2A Shown is a structural block diagram of a retail asset risk calculation system according to Embodiment 2 of the present invention. Such as Figure 2A As shown, the calculation system of retail asset risk in Embodiment 2 of the present invention includes:

[0042] The data collection device 201 is used to collect source data, which includes loans collected from various business systems of the bank, credit card transaction data, customer asset data, and real-time collected from the personal credit system and bank card system. Account data, as well as customer credit data at the time of application collected in real time from the credit reference system of the People’s Bank of China;

[0043] The credit scoring device 202 is configured to receive the above-mentioned source data, perform credit scoring processing and credit rating processing, and generate credit scoring result data;

[0044] The data storage device 203 is used to store the above-mentioned credi...

Embodiment 3

[0059] Embodiment 3 of the present invention provides a calculation method and system for retail asset risk, which uses logistic regression and the method of establishing a decision tree to realize the measurement and evaluation of bank retail asset risk, and can automatically collect source data of various business systems, and These source data are analyzed and processed, and the generated evaluation result data is stored in the data storage device.

[0060] image 3 Shown is a structural block diagram of a retail asset risk calculation system according to Embodiment 3 of the present invention. Such as image 3 As shown, the retail asset risk calculation system according to Embodiment 3 of the present invention includes: a data collection device 301 , a risk calculation device 302 , and a data storage device 303 . The data collection device 301 and the risk calculation device 302, and the risk calculation device 302 and the data storage device 303 may be connected through ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com