Self-adaption controllable management system for cheat risk of online transaction

An online transaction and management system technology, applied in the fields of financial services and payment security, can solve the problems of hurting customer conversion rate, mistrust, inconvenience, etc., achieve real-time and adaptability, reduce fraud risk and high fraud cost Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

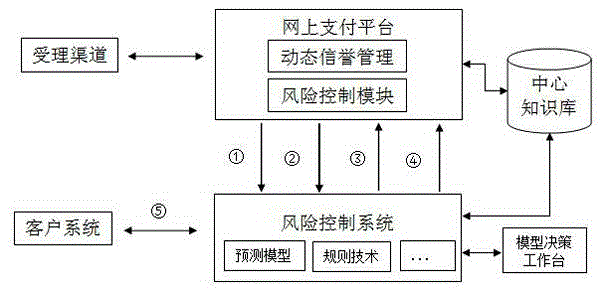

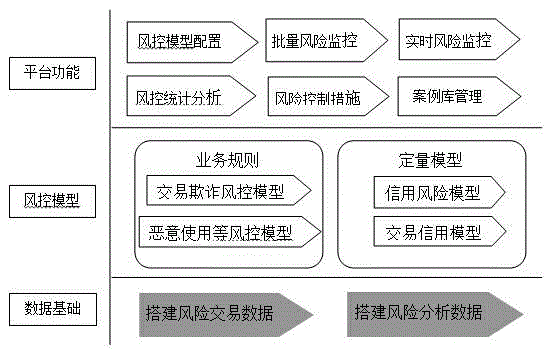

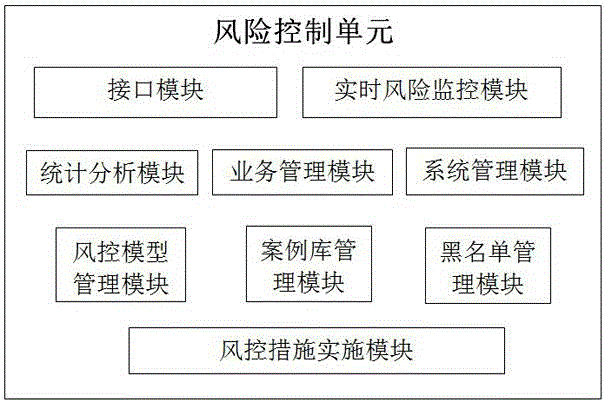

[0024] In order to make the object, technical solution and advantages of the present invention clearer, the present invention will be further described in detail below in combination with examples of implementation and accompanying drawings.

[0025] The current third-party payment companies basically have their own set of risk control systems, but from many aspects, they have many shortcomings. From a comprehensive example, there are roughly the following points: 1. A good crawling tool, but The rate of change has a negative impact; 2. The existing device identification technology is not very effective; 3. Event analysis must be sent; 4. Lack of influential analysis and experimental architecture; 5. A large number of application blacklists 6. It is difficult to maintain a large number of complex original sets of fraud rules; 7. Provide discontinuous suggestions; 8. It takes too long to consider; 9. Data format issues, client-side Java Script, and Java libraries are difficult t...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com