Backward stochastic differential equation (BSDE)-based option pricing method and device

A technology of options and prices, applied in the field of option pricing methods and devices based on reverse stochastic differential equations, can solve problems such as long execution cycles

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0055] In order to make the purpose, technical solution and advantages of the present invention more clear, the embodiments of the present invention will be described in detail below in conjunction with the accompanying drawings. It should be noted that, in the case of no conflict, the embodiments in the present application and the features in the embodiments can be combined arbitrarily with each other.

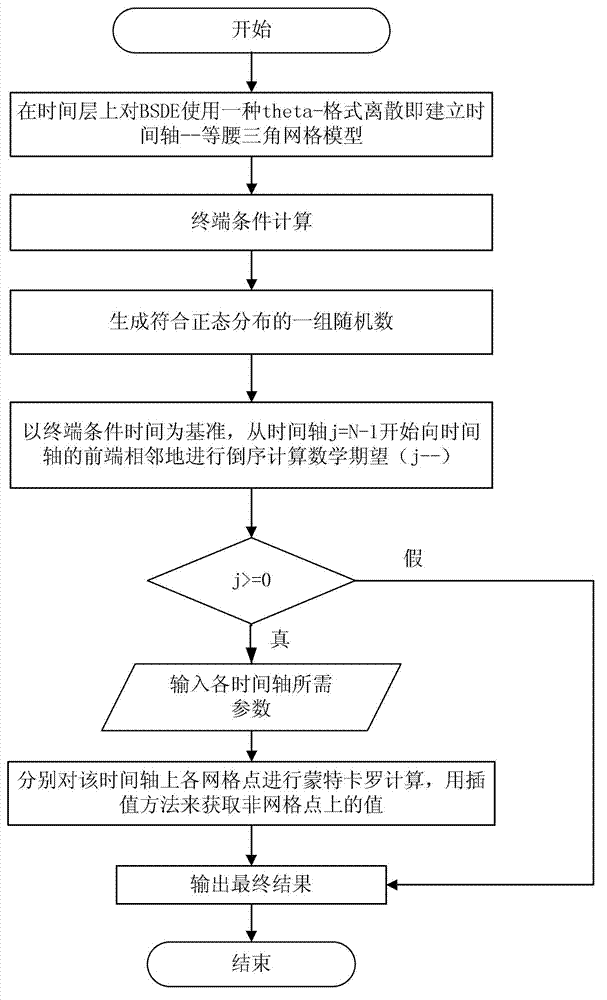

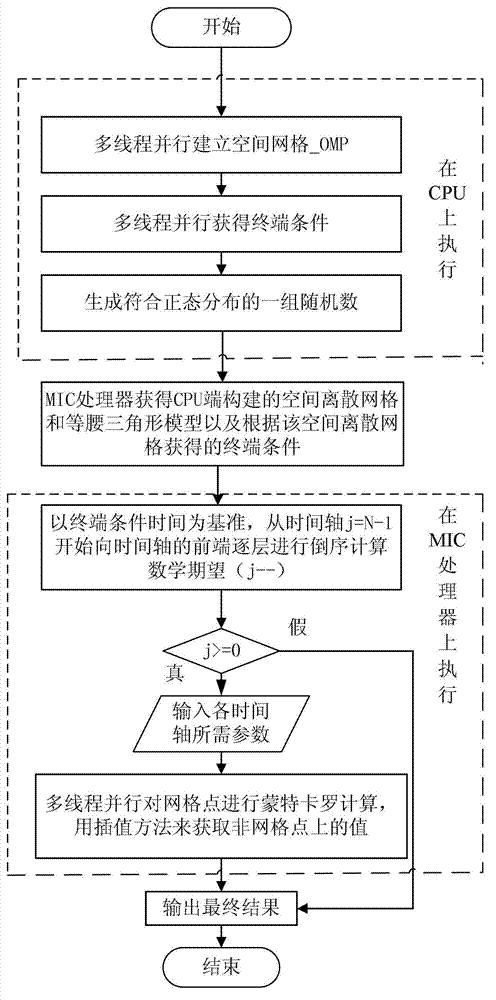

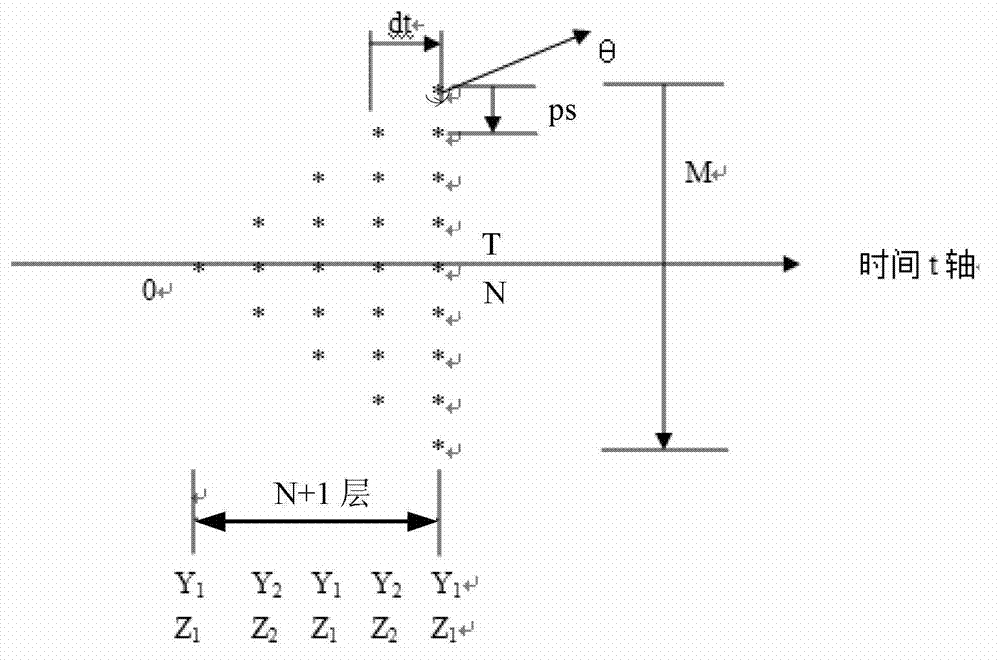

[0056] The present invention firstly analyzes the defects of option pricing with BSDE method and adopts BSDE method and option pricing serial method based on isosceles triangle model to solve the performance bottleneck of option pricing problem, finds time-consuming hot codes, and tests its performance in the whole option pricing process. The proportion of time taken up in the process and the difficulty of analyzing the performance of improving the overall method and developing the shaft end.

[0057] Analysis and research show that when using the BSDE method and the option p...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com