Added-value tax output invoice management system and method

A management system and value-added tax technology, applied in data processing applications, instruments, finance, etc., can solve problems such as inability to issue value-added tax invoices, achieve the effect of strengthening financial management capabilities and improving issuance efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0022] Specific embodiments of the present invention will be described in detail below in conjunction with the accompanying drawings. It should be understood that the specific embodiments described here are only used to illustrate and explain the present invention, and are not intended to limit the present invention.

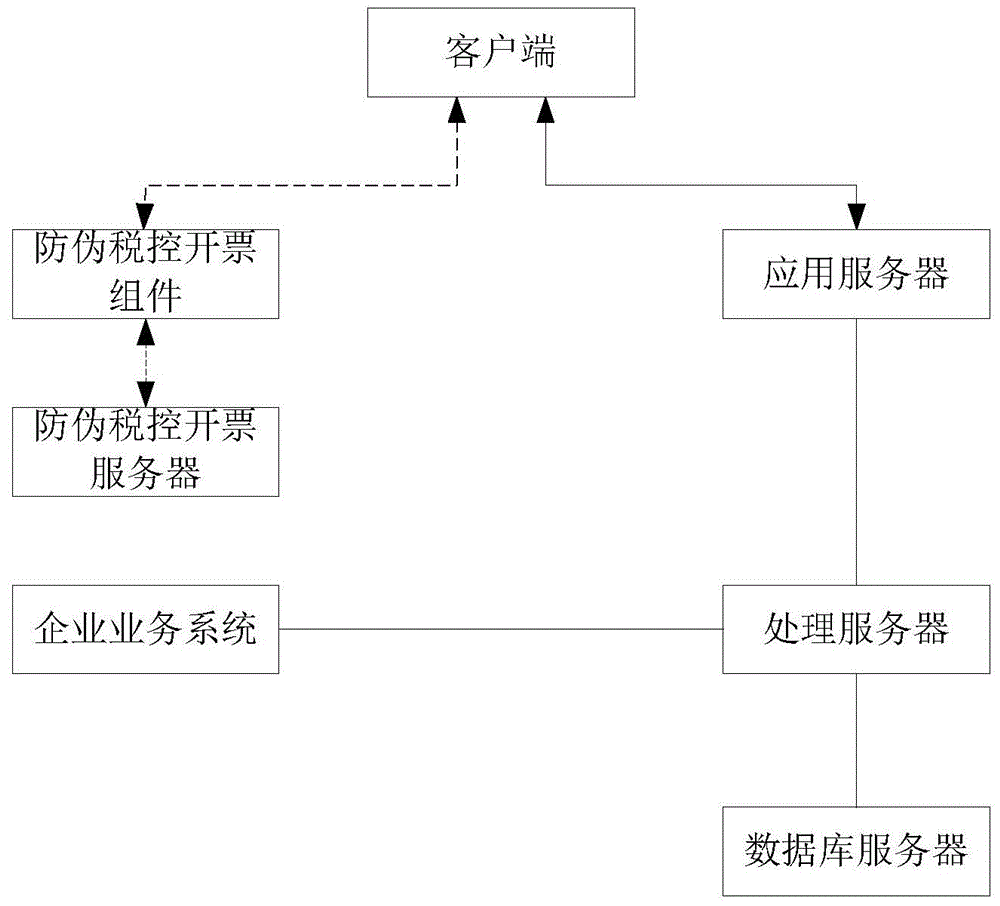

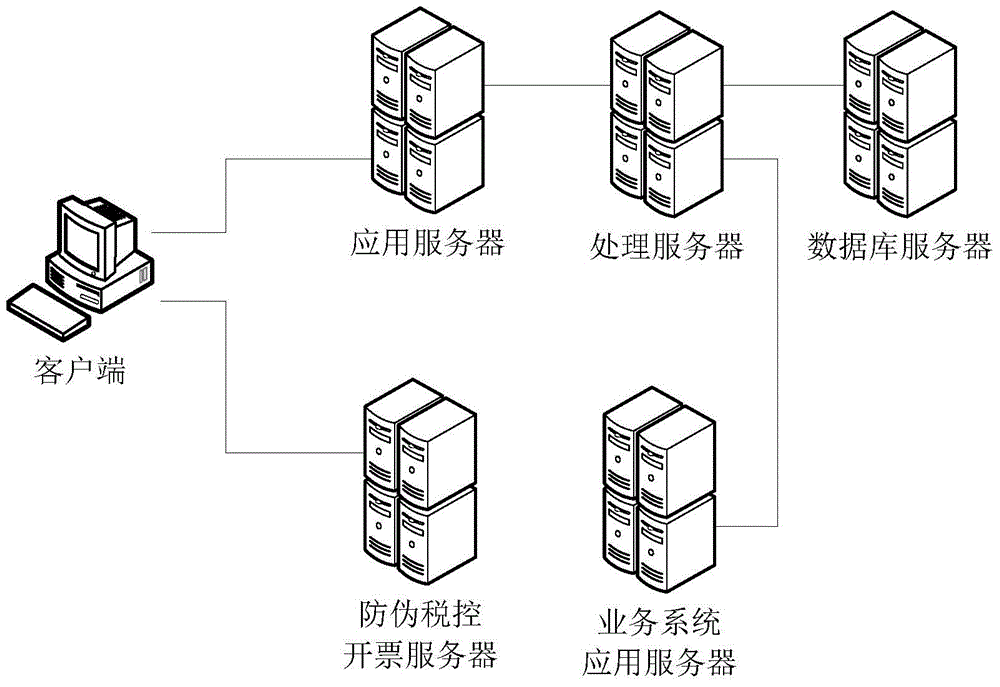

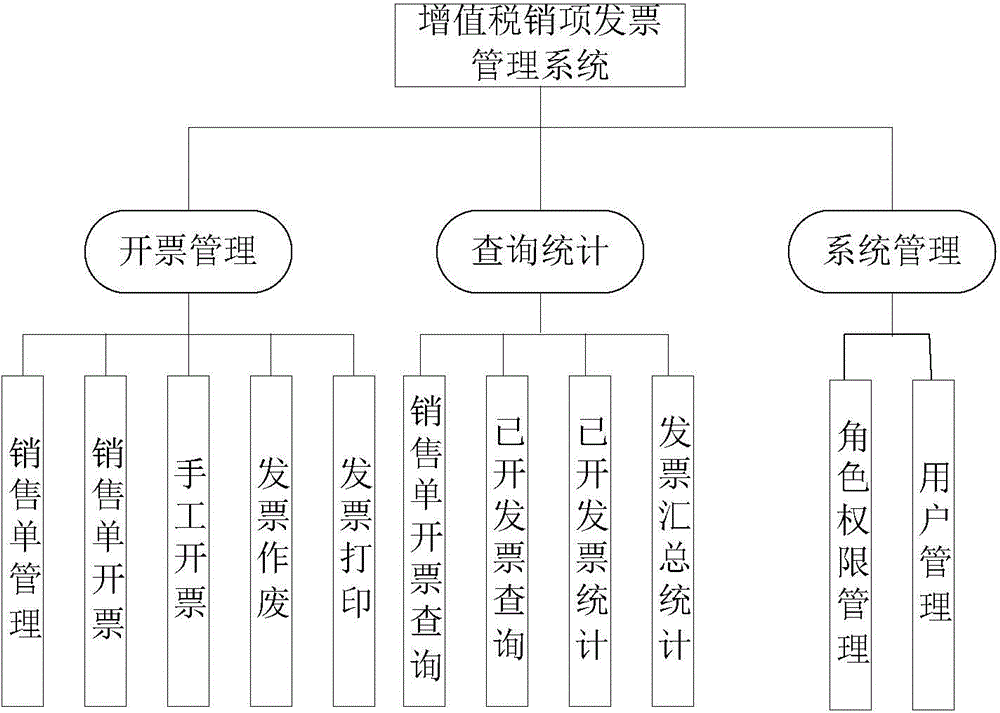

[0023] Such as figure 1 As shown, the present invention provides a value-added tax output invoice management system, which communicates with the external system formed by communicating with the enterprise business system and the anti-counterfeiting tax control system, and includes: an application server, which is used to provide a functional interface for issuing invoices; A processing server, which is used to import sales order data from the enterprise business system, and is also used to process the data access request obtained from the application server, and transmit the sales order corresponding to the data access request to the application server data; an...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com