Financial risk analysis method based on big data

A risk analysis and big data technology, applied in the field of financial risk analysis based on big data, can solve the problems of low resource utilization, inability to fully utilize multi-core features, slow calculation speed, etc., and achieve the effect of reducing financial risks.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0040] The present invention will be described in further detail below in conjunction with the accompanying drawings and specific embodiments.

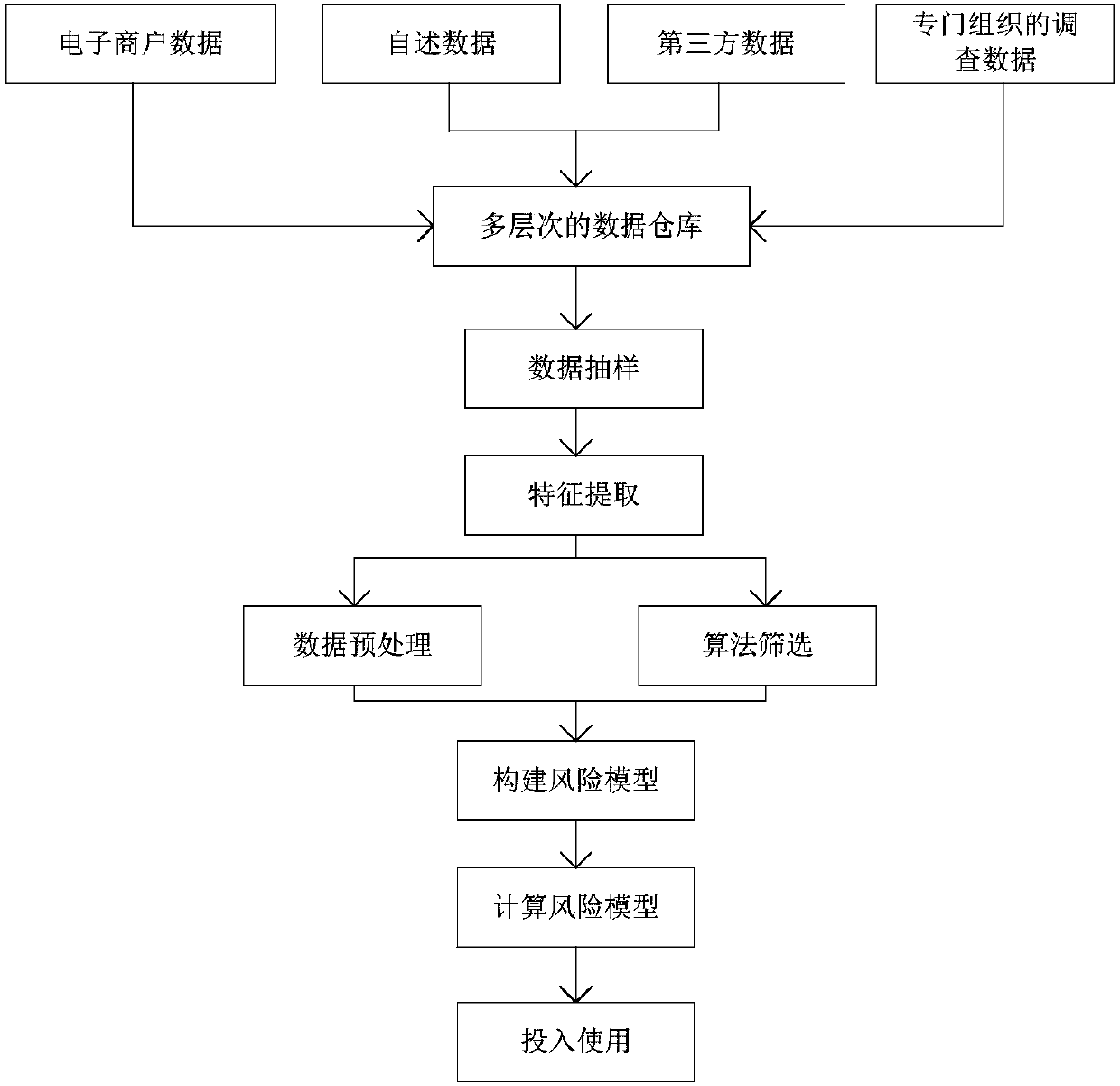

[0041] Such as figure 2 As shown, a kind of financial risk analysis method based on big data provided by the present invention comprises the following steps:

[0042] (1) Build a multi-level data warehouse. It mainly obtains data on credit mutations from the Internet, e-business data published on the Internet, self-reported data (mainly account data on various e-commerce platforms) and relevant certification materials from e-commerce customers, and data from third-party data platforms.

[0043] (2) Data preprocessing. The processed data is used to construct the risk control model, and the data preprocessing mainly adopts the following methods for filtering:

[0044] Subjective filtering: Divide data into character fields and numeric fields, and eliminate useless fields based on business experience.

[0045] Missing filtering: The...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com