Dynamic high-risk customer-group detection method and system

A high-risk, detection algorithm technology, applied in the direction of instruments, finance, character and pattern recognition, etc., can solve the problems of affecting efficiency, personal credit is difficult to be effectively controlled, and the cycle is long

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047] In order to better clearly express the technical solution of the present invention, the invention will be further described below in conjunction with the accompanying drawings.

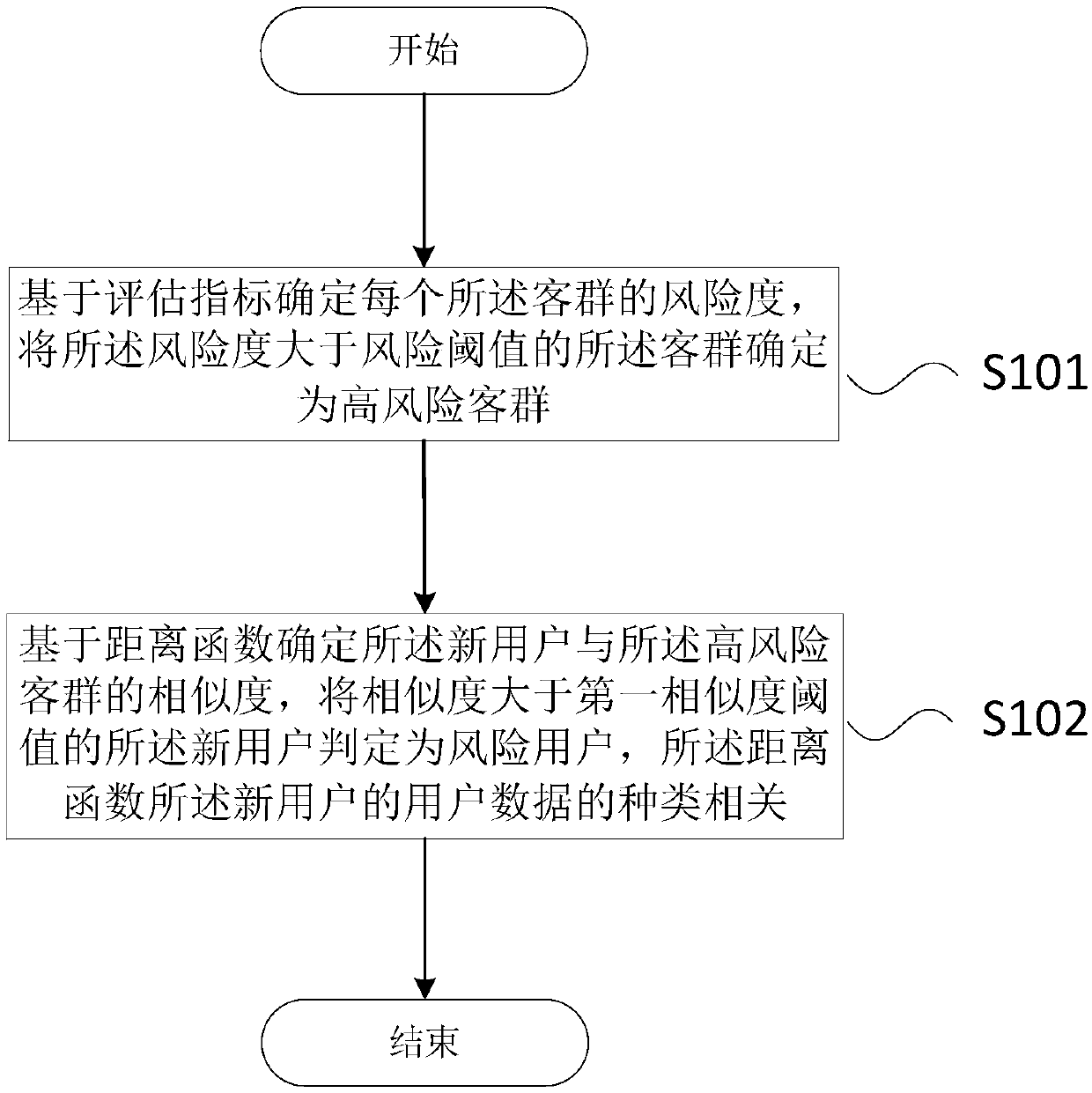

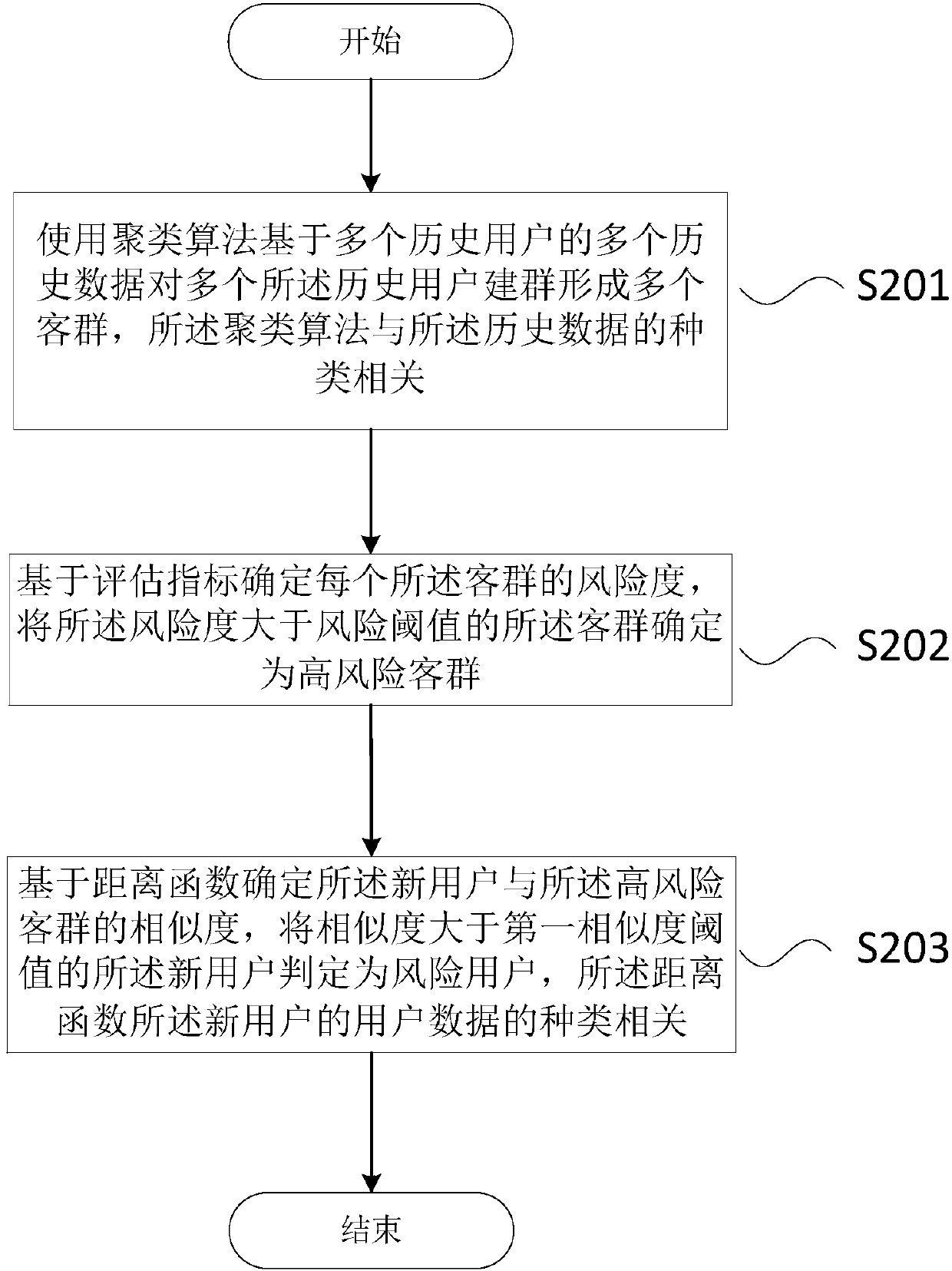

[0048] figure 1 Showing the first specific embodiment of the present invention, a specific flow diagram of a dynamic high-risk customer group detection algorithm, specifically, including the following steps:

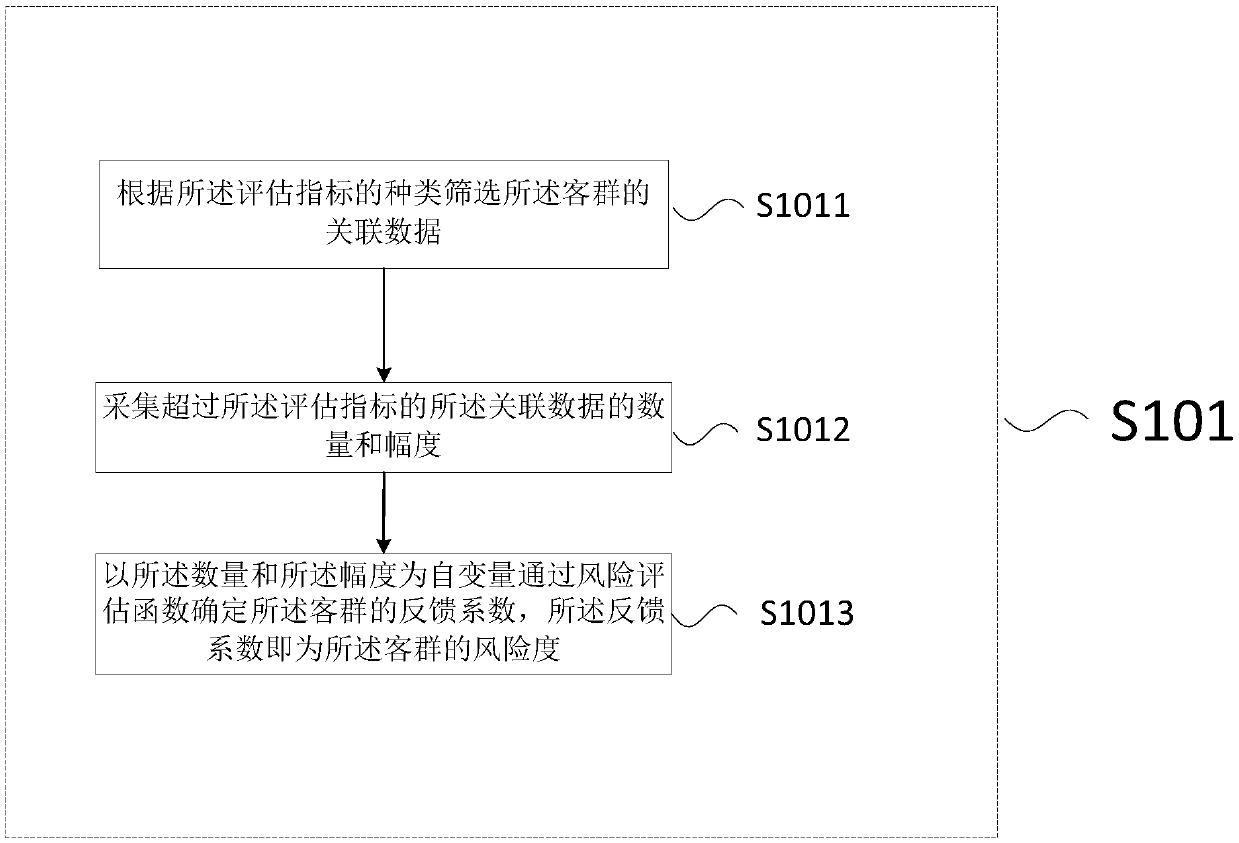

[0049] First, enter step S101, determine the risk degree of each customer group based on the evaluation index, determine the customer group whose risk degree is greater than the risk threshold as a high-risk customer group, and multiple historical data of multiple historical users forming a plurality of customer groups by building a plurality of historical users, and determining the risk degree of each customer group based on the evaluation index, and determining the customer group whose risk degree is greater than a risk threshold as a high-risk customer group, The evaluation index is d...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com