Credit big data-oriented risk control method and credit big data-oriented risk control system

A risk control and big data technology, applied in the security field, can solve problems such as irregular access rights setting, poor quality, and large amount of information

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

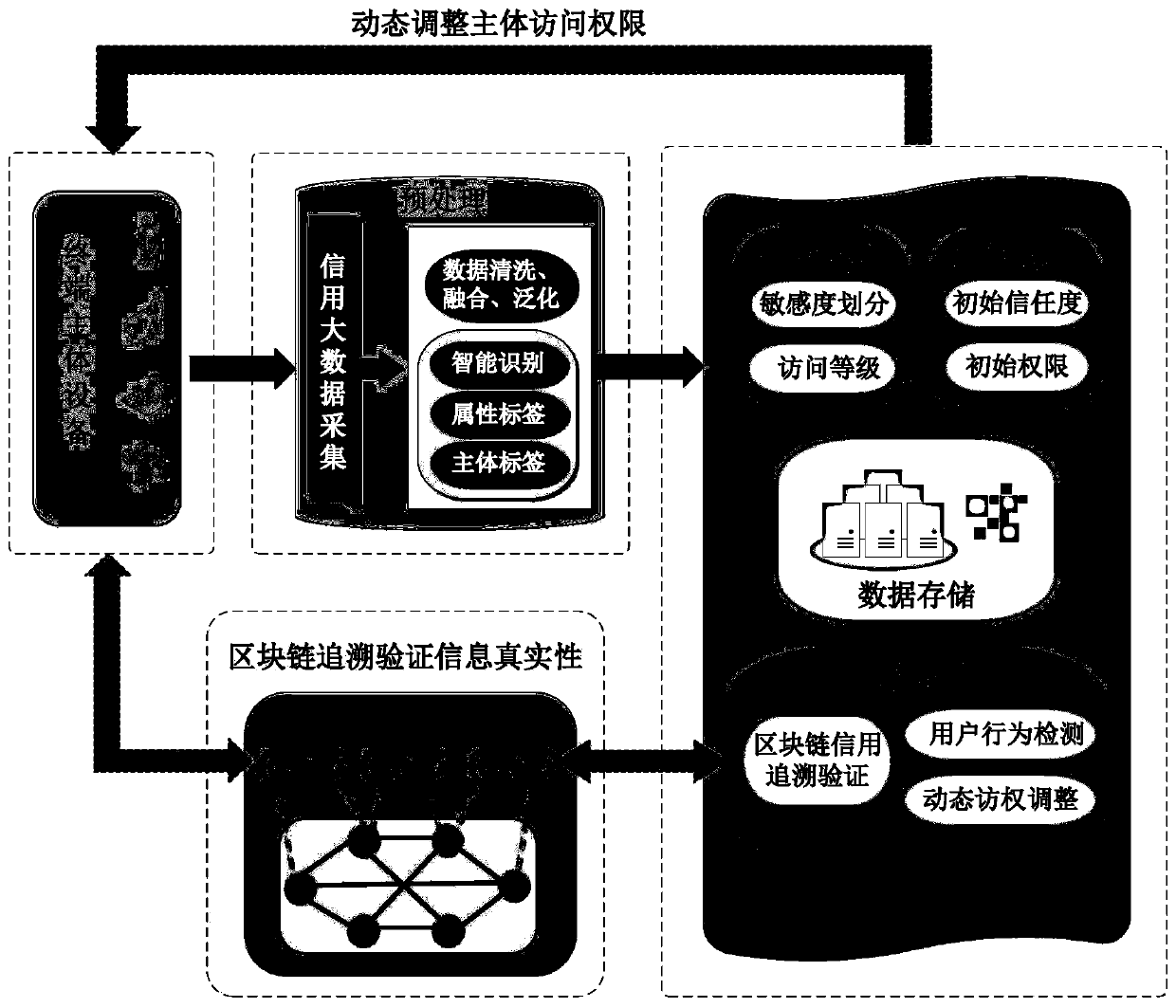

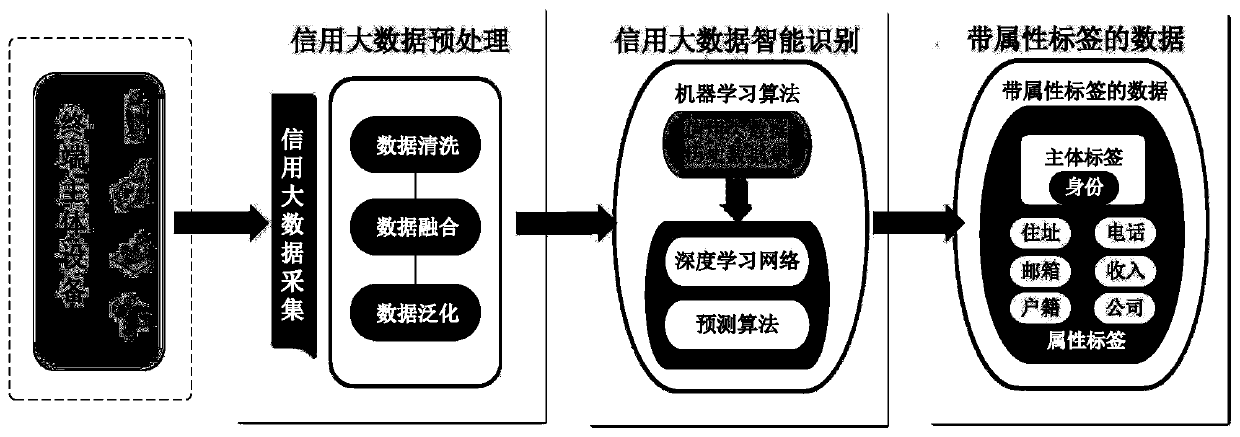

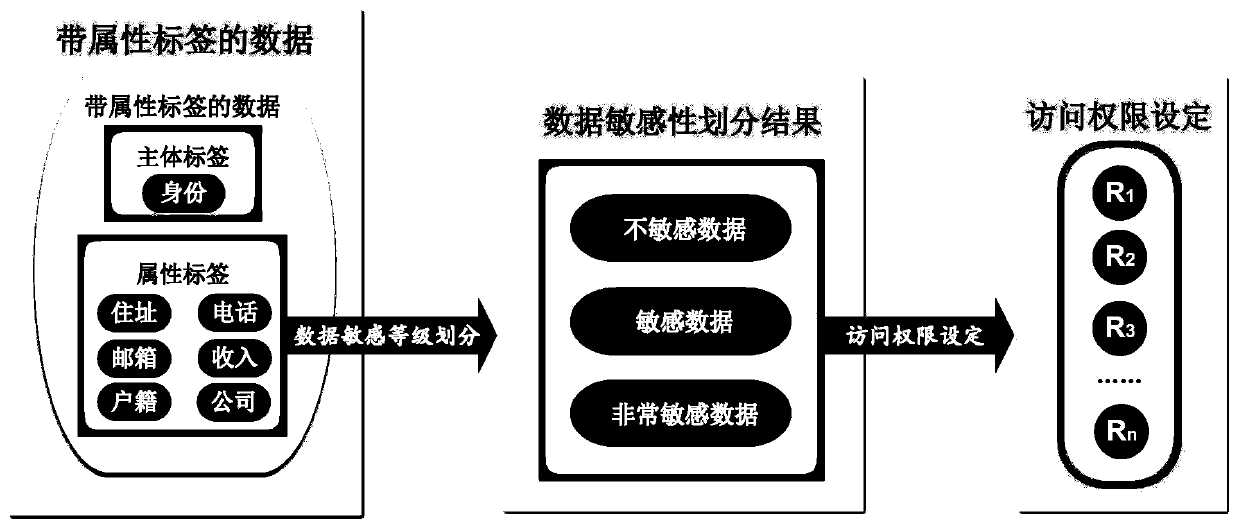

[0061] The present invention provides a credit big data-oriented risk control method. Aiming at the different impacts of data at different stages on risk control, a risk control method based on credit big data is designed, and a risk control module is designed for the original data collected by trusted terminals. By labeling the data and dividing the sensitivity, the data is divided into different sensitive levels, and then the first-level risk control is realized; for the initial credit of the users of the data storage platform, the data access is evaluated by analyzing the subject labels in the original data The initial trust degree of the visitor, to achieve the purpose of secondary risk control; for the problem that the system and the storage platform need to monitor the behavior of the data visitor in real time, relying on the blockchain technology, the trust degree is dynamically defined according to the behavior of the visitor, so as to complete Three-level risk control ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com