Federal learning method and device for credit card fraud prevention

A learning method and credit card technology, applied in the field of credit card anti-fraud federated learning methods and devices, can solve the problems of inaccurate learning, difficulty in obtaining high-performance models from data, and failure to consider local model personalization, etc., to improve training accuracy , improve accuracy, and improve the effect of anti-fraud assessment accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0061] Figure 5 This is a flowchart of a federated learning method for credit card anti-fraud according to an embodiment of the present invention. This embodiment can be applied to the situation of identifying the credit card fraud category through equipment such as a server, and the method can be executed by a federated learning device for credit card anti-fraud, which can be implemented in software and / or hardware, and can be integrated in In electronic equipment, such as integrated server equipment.

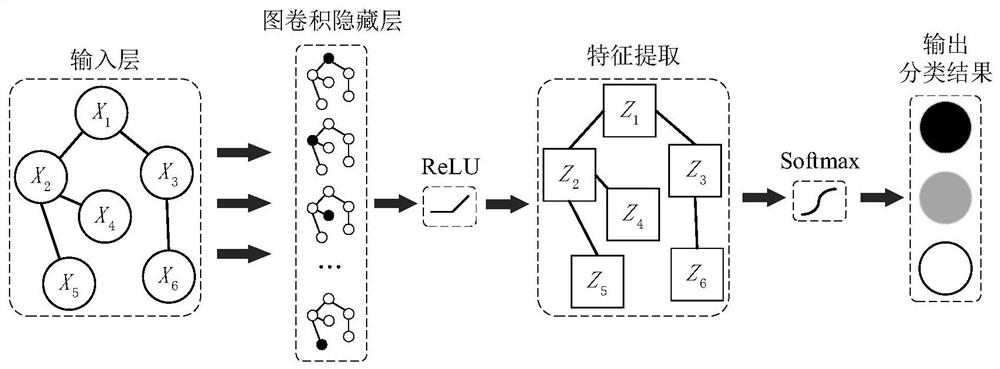

[0062] The federated learning method is mainly used to identify the two most common types of credit card fraud. Type 1 is stolen card fraud: fraudulent use or misappropriation of lost credit cards for transactions; type 2 is virtual application fraud: applicants use false information to apply for credit cards , to avoid the card issuer's review. Therefore, the goal of the federated learning method proposed in this embodiment is to improve the accuracy of the three-classific...

Embodiment 2

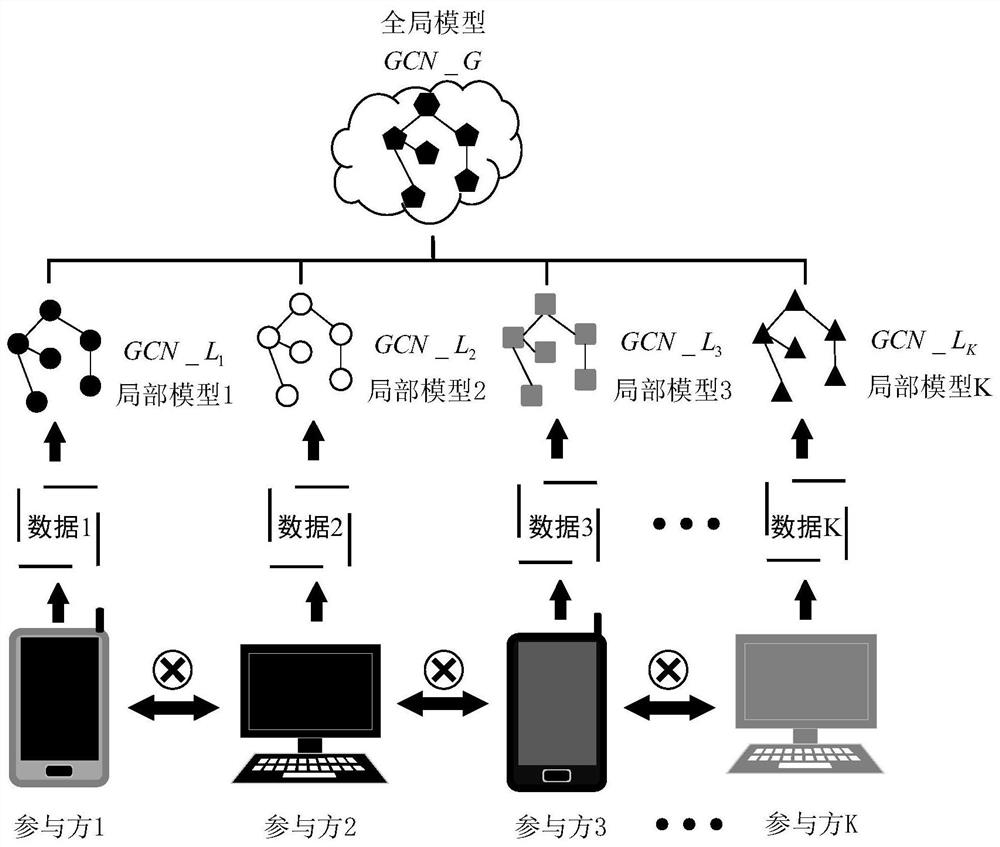

[0106] The embodiment of the present invention proposes a federated learning device for credit card anti-fraud. The federated learning device includes a local model building module, a federated learning training module and a global graph convolutional neural network model.

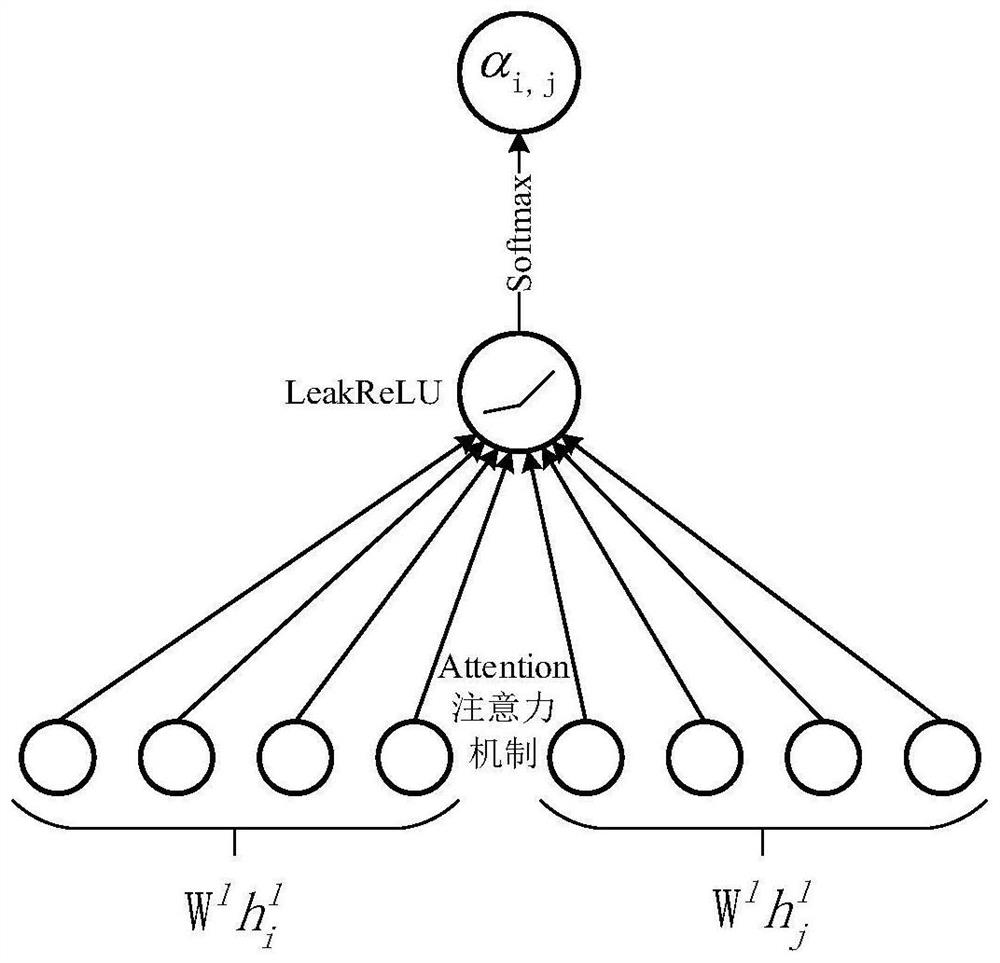

[0107] The local model building module is used to build the local graph convolutional neural network model corresponding to K federated learning participants with different fraud categories; the local undirected graph structure data owned by each participant is G i (V,E,A)(i∈K), where the set of nodes in the graph structure is v i ∈V, v i The feature on the node is x i ∈X, each node contains a variety of key feature information including user information, loan amount, deposit amount and credit data, the edge set between nodes is e i,j =(v i ,v j ) ∈ E; A represents the adjacency matrix, which defines the mutual connection between nodes; the fraud categories include stolen card fraud, virtual applicatio...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com