Patents

Literature

62 results about "Credit card fraud" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Credit card fraud is a wide-ranging term for theft and fraud committed using or involving a payment card, such as a credit card or debit card, as a fraudulent source of funds in a transaction. The purpose may be to obtain goods without paying, or to obtain unauthorized funds from an account. Credit card fraud is also an adjunct to identity theft. According to the United States Federal Trade Commission, while the rate of identity theft had been holding steady during the mid 2000s, it increased by 21 percent in 2008. However, credit card fraud, that crime which most people associate with ID theft, decreased as a percentage of all ID theft complaints for the sixth year in a row.

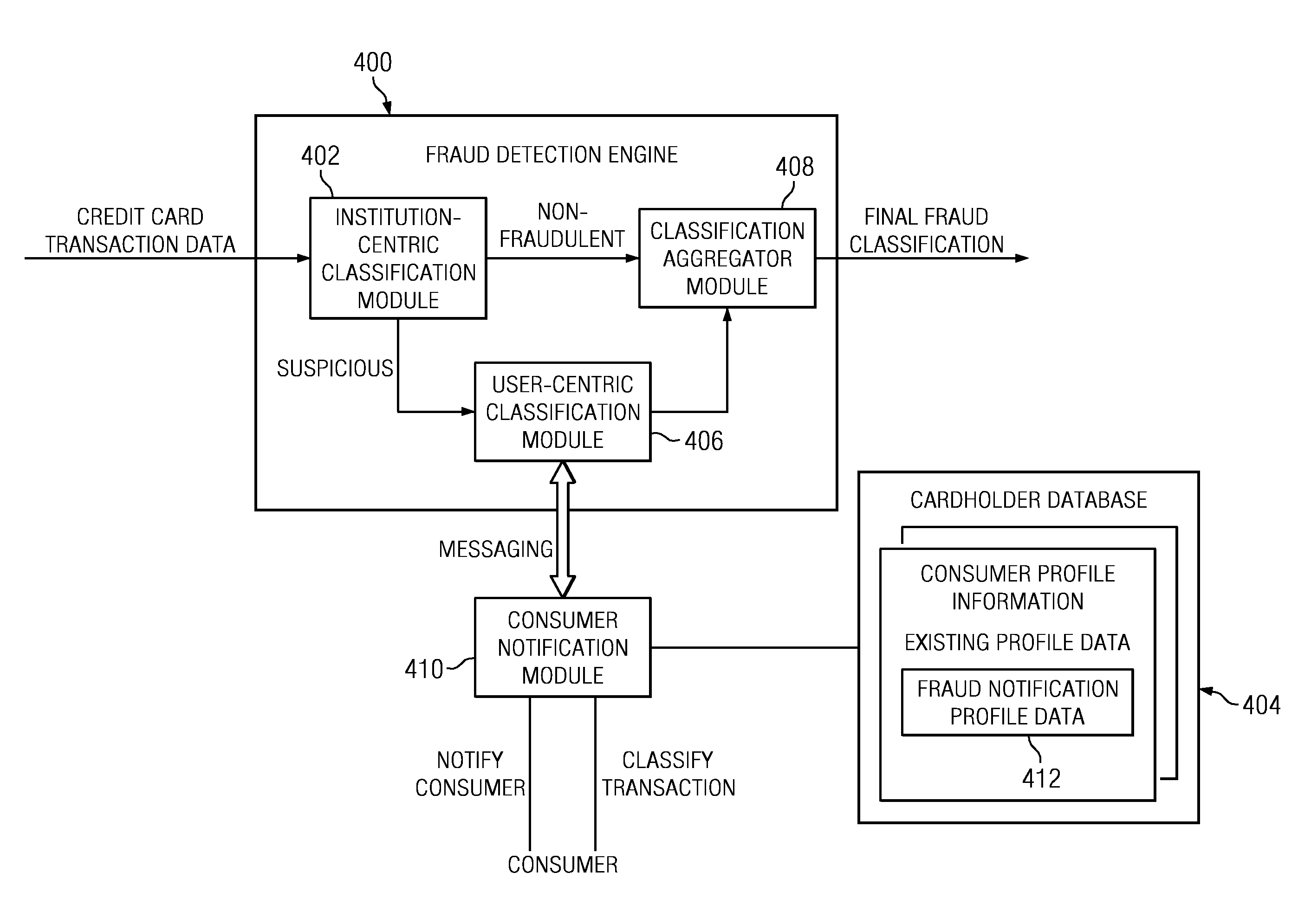

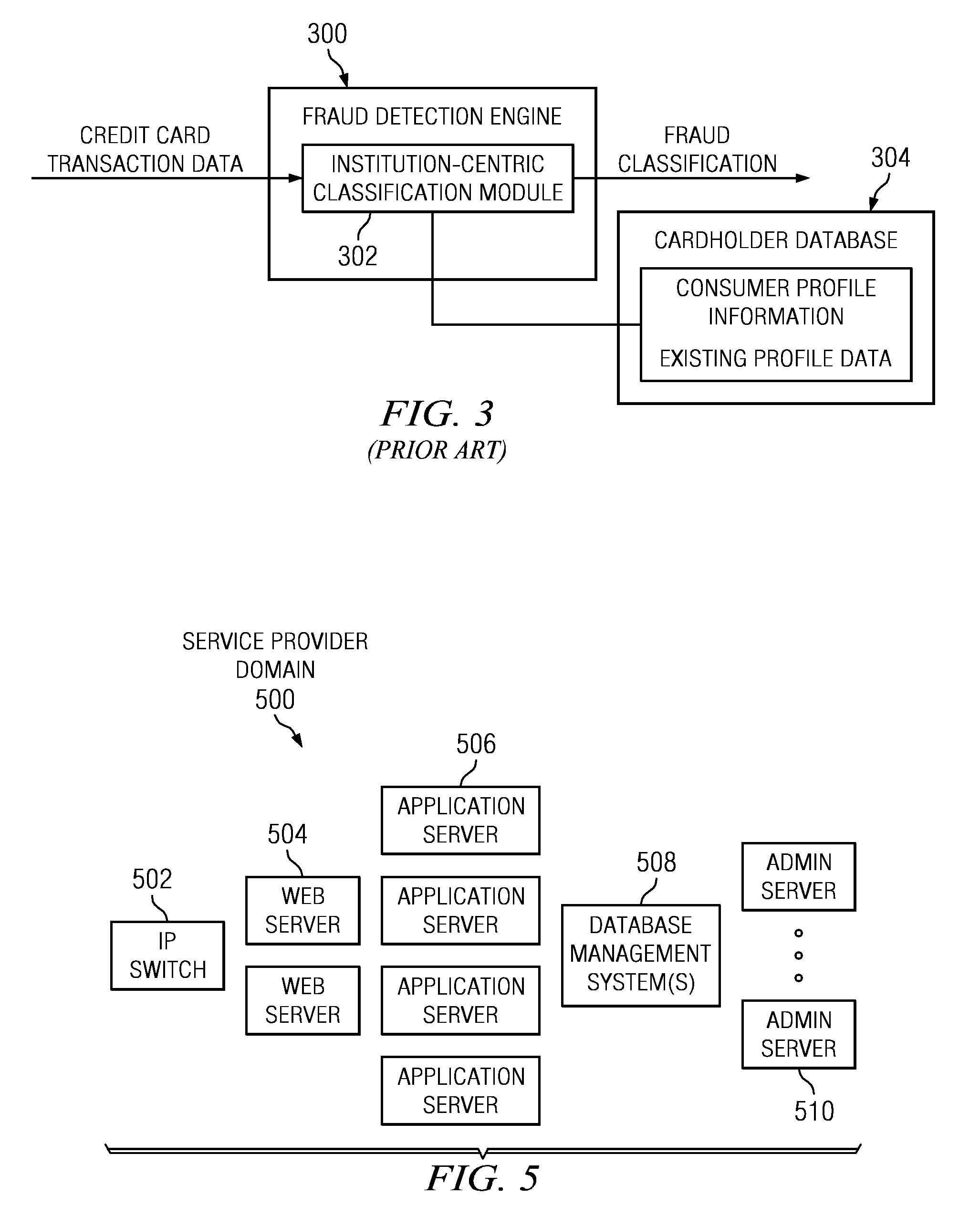

Method and System for Identification By A Cardholder of Credit Card Fraud

A method for fraud detection leverages an existing financial institution's fraud classification functionality, which produces a first level detection, with a “user-centric” classification functionality, which produces a “second” or more fine-grained detection regarding a potentially fraudulent transaction. After passing through an existing (“institution-centric”) fraud detection technique, a transaction that has been identified as potentially fraudulent is then subject to further analysis and classification at the “user” level, as it is the user is presumed to be the best source of knowledge of the legitimate credit card use. Information about the transaction is shared with the consumer, preferably via one or more near real-time mechanisms, such as SMS, email, or the like. Based on the user's response (or lack thereof, as the case may be), one or more business rules in the institution's fraud detection system can then take an appropriate action (e.g., no action, reverse the transaction if complete, deny the transaction if in-progress, or the like).

Owner:IBM CORP

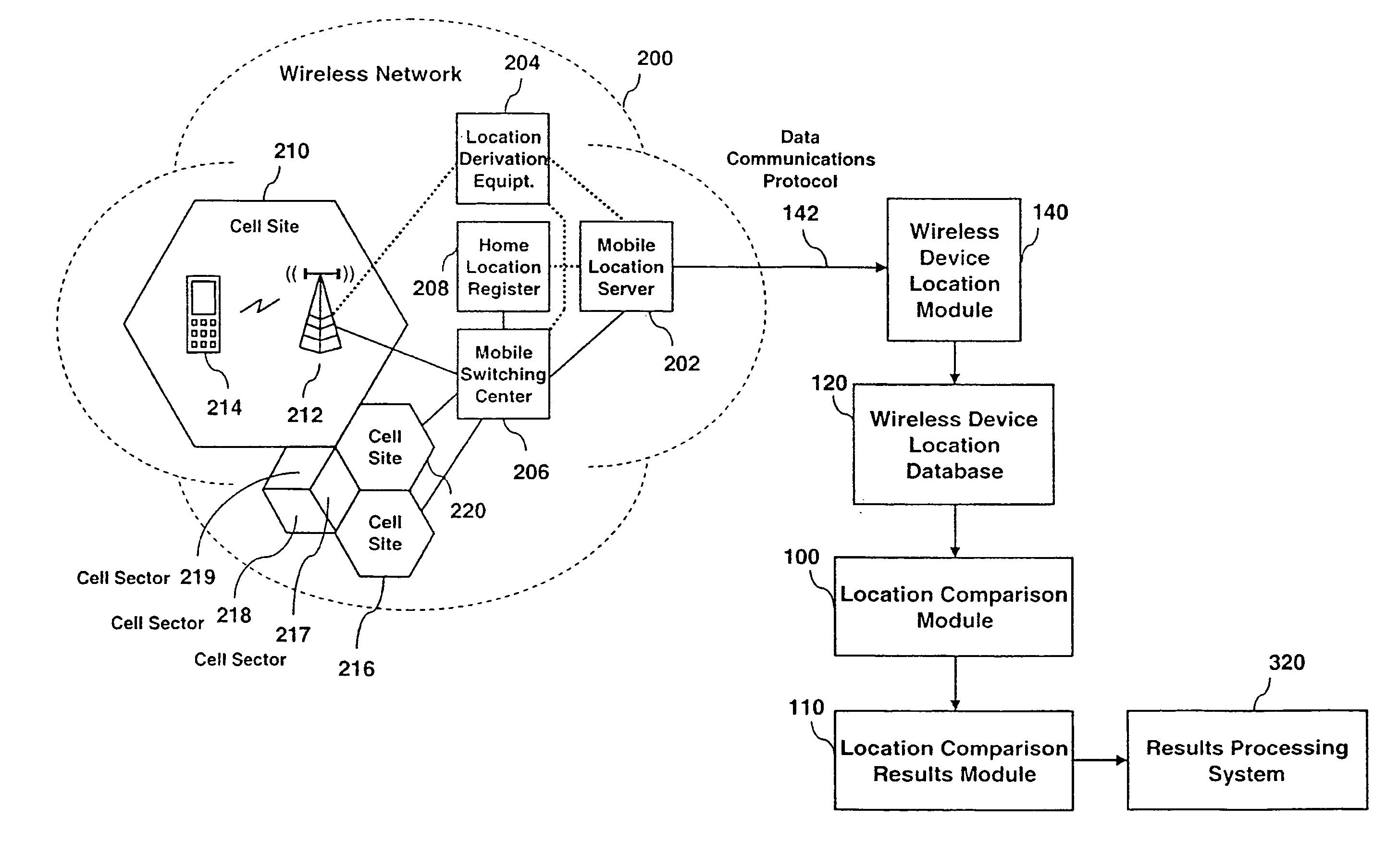

Method for tracking credit card fraud

ActiveUS20080227471A1Reduce morbidityRadio/inductive link selection arrangementsLocation information based serviceGeolocationComputer science

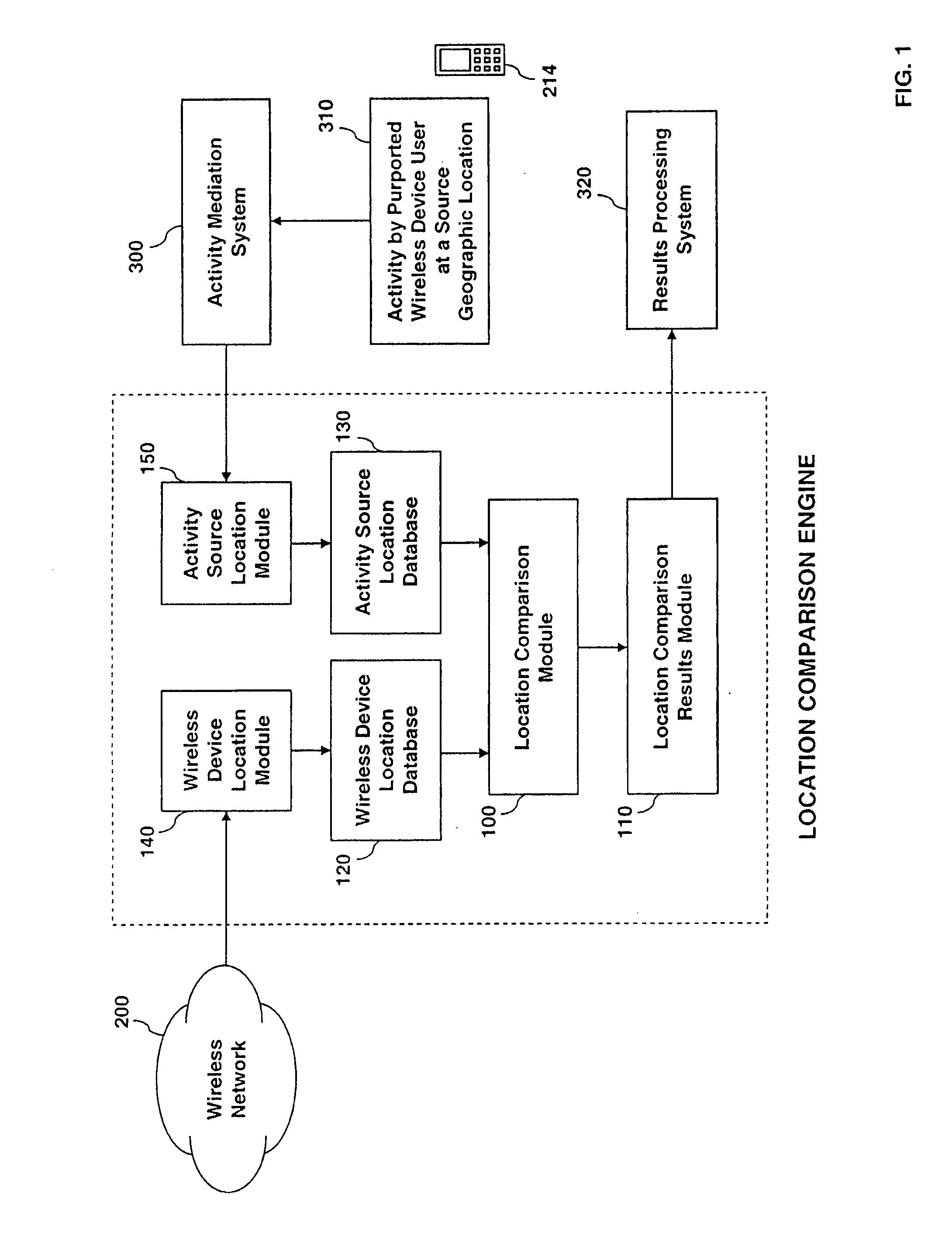

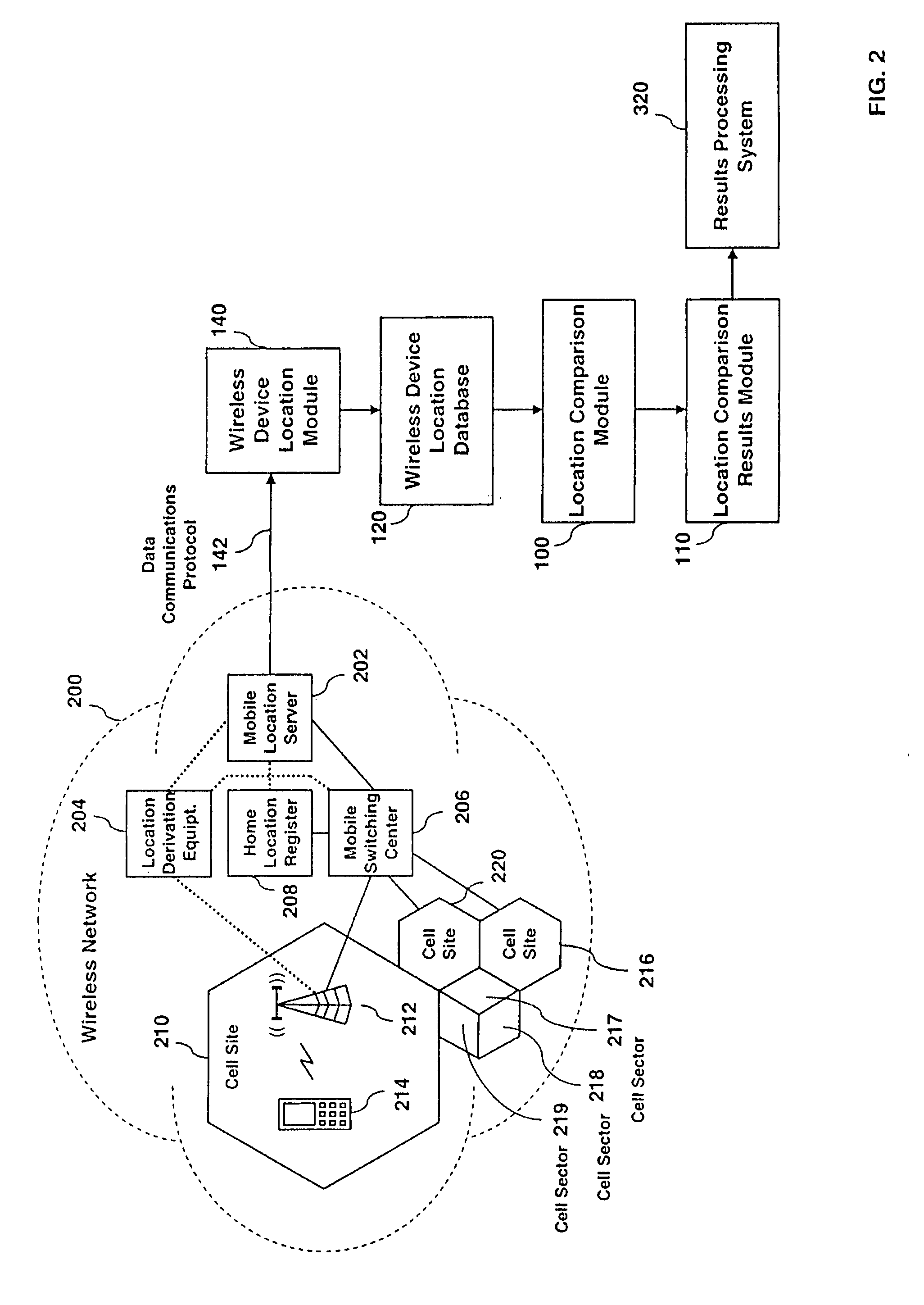

A system and method for automatically comparing obtained wireless device location information from a wireless network and comparing that location with another independent source geographic location is provided. Location information is derived from two or more sources in a multiplicity of ways and a comparison is made within a Location Comparison Engine. The Location Comparison Engine makes use of databases that assist in resolving obtained raw positioning information and converting that positioning information into one or more formats for adequate location comparison. Results of the location comparison are deduced to determine if the wireless device is in some proximity to some other activity source location. Other location information used for comparison may be obtained from a multiplicity of sources, such as another network based on some activity of the wireless device user, another wireless device via a wireless network, or any system capable of providing location information to the Location Comparison Engine.

Owner:VISA INT SERVICE ASSOC

Credit authorization system and method

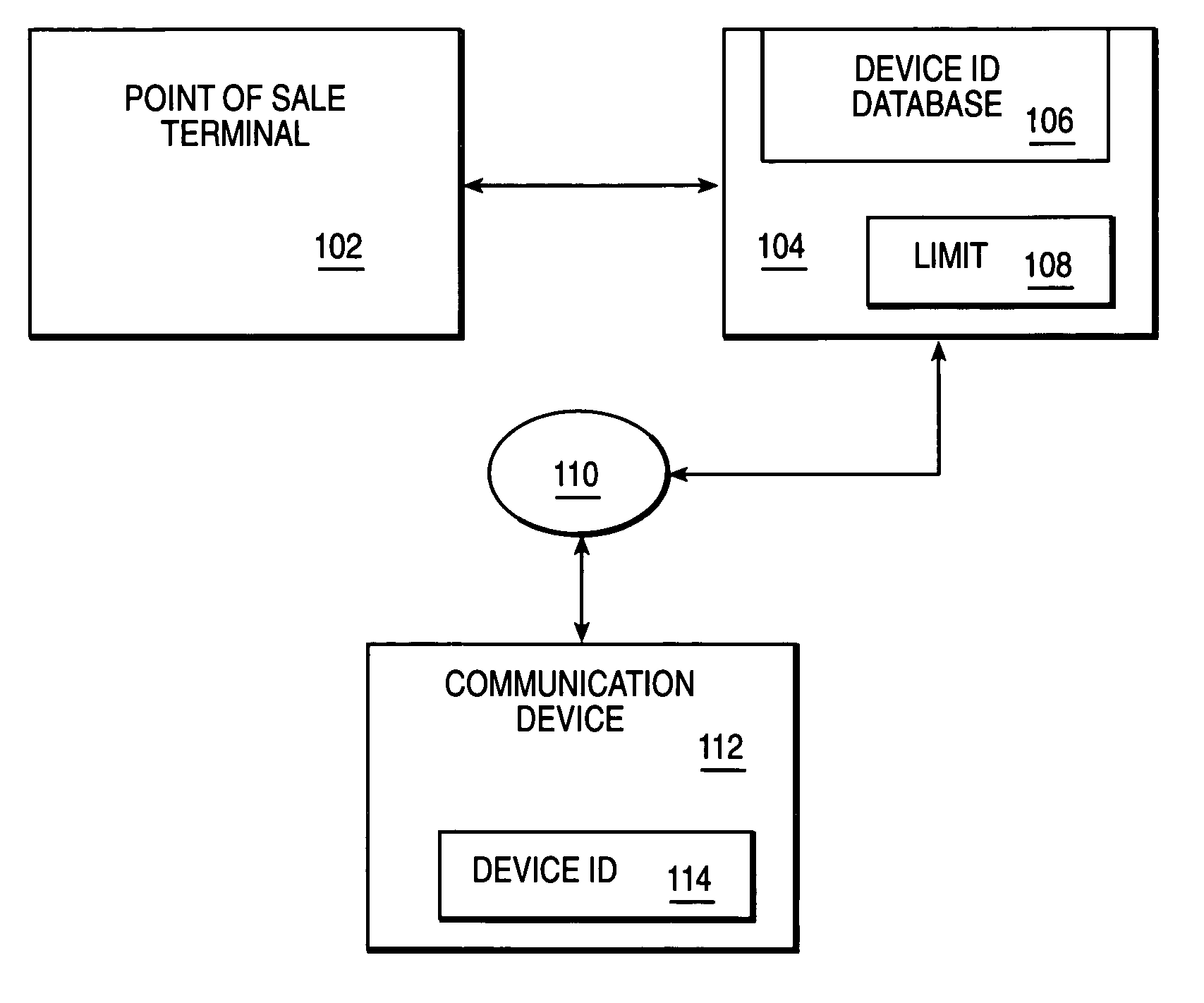

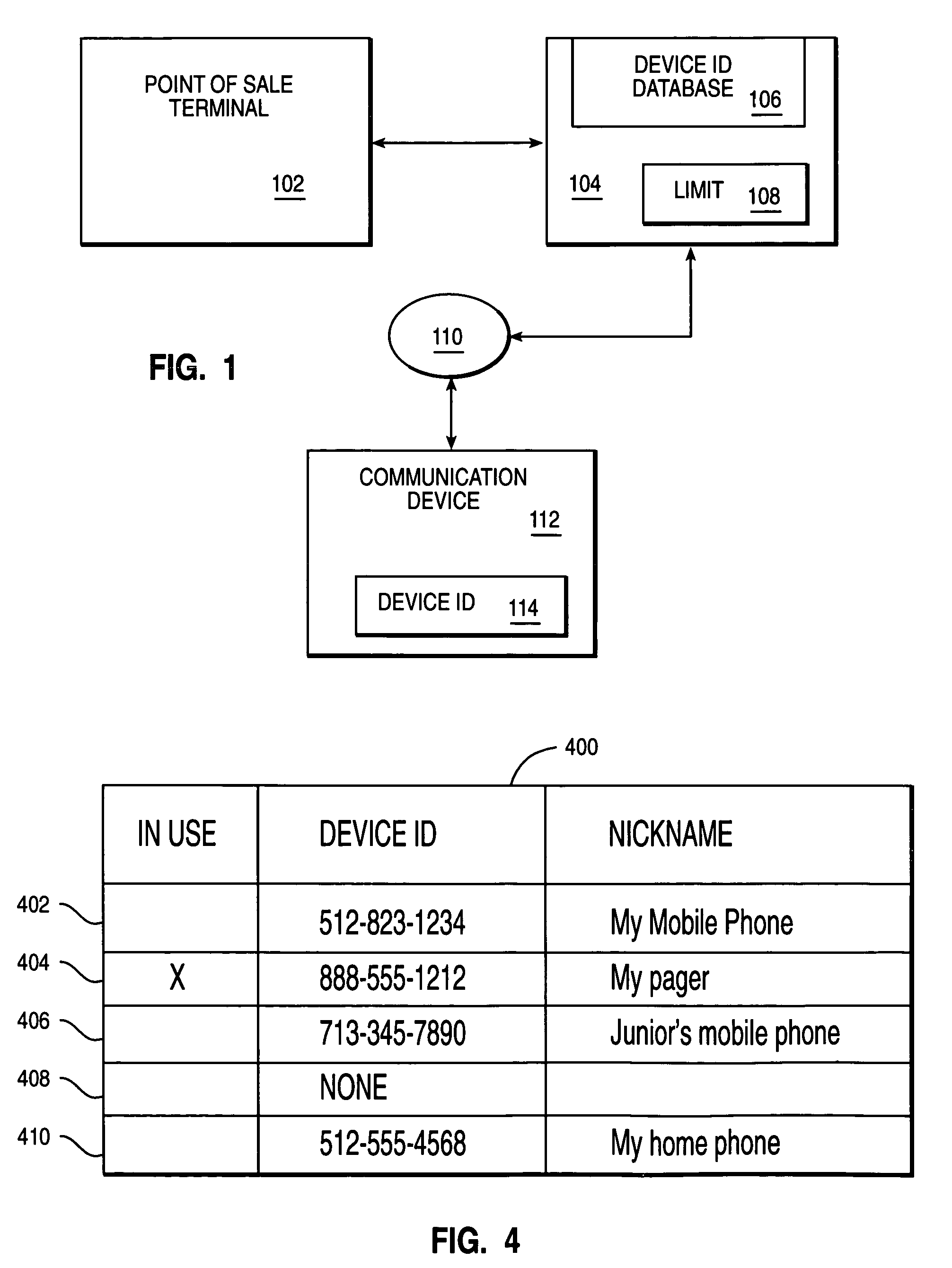

A system and method for preventing credit card fraud by comparing the location of a given transaction with the location of a predetermined communication device is provided.

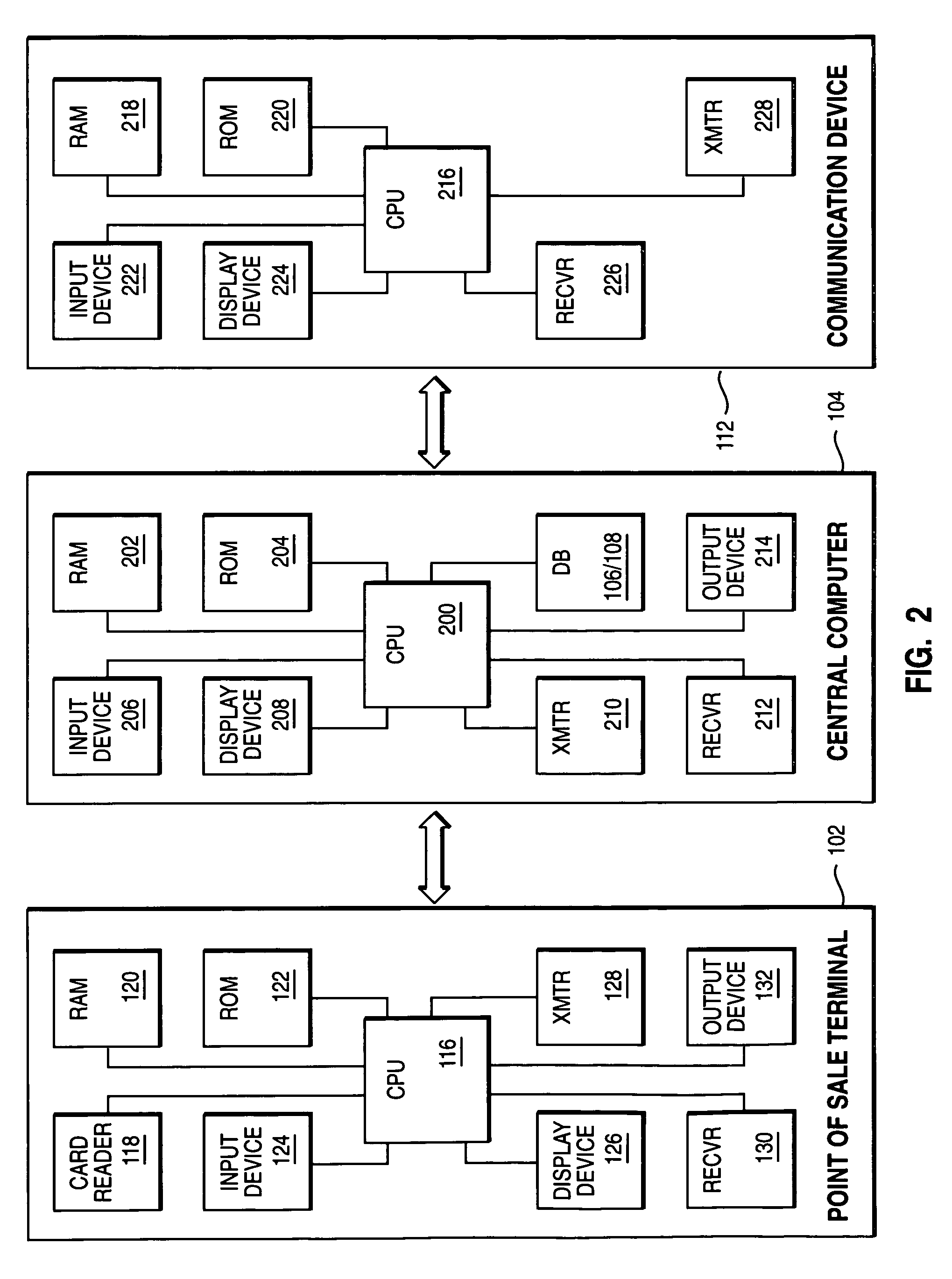

Owner:TOSHIBA GLOBAL COMMERCE SOLUTIONS HLDG

Watermark systems and methods

A number of novel watermarking applications, and improvements to watermarking methods, are disclosed. Included are techniques for encoding printed circuit boards and street signs with watermarks, deterring credit card fraud and controlling software licensing using watermarks, registering collectibles via watermarks, encoding the margins of printed pages with watermarks, and using watermarks to convey extra information in video by which fidelity of the rendered video may be improved.One particular arrangement is a method in which a PDA, wristwatch, or other portable device with a display screen presents an image that depicts a proprietor of the device, and also includes a machine-readable identifier (e.g., a watermark or barcode). This image is sensed by a separate device, such as a webcam or a camera-equipped cell phone. The sensing device can then take an action based on the identifier (e.g., linking to an email account or to a web site that corresponds to the person depicted on the display screen).

Owner:DIGIMARC CORP (FORMERLY DMRC CORP)

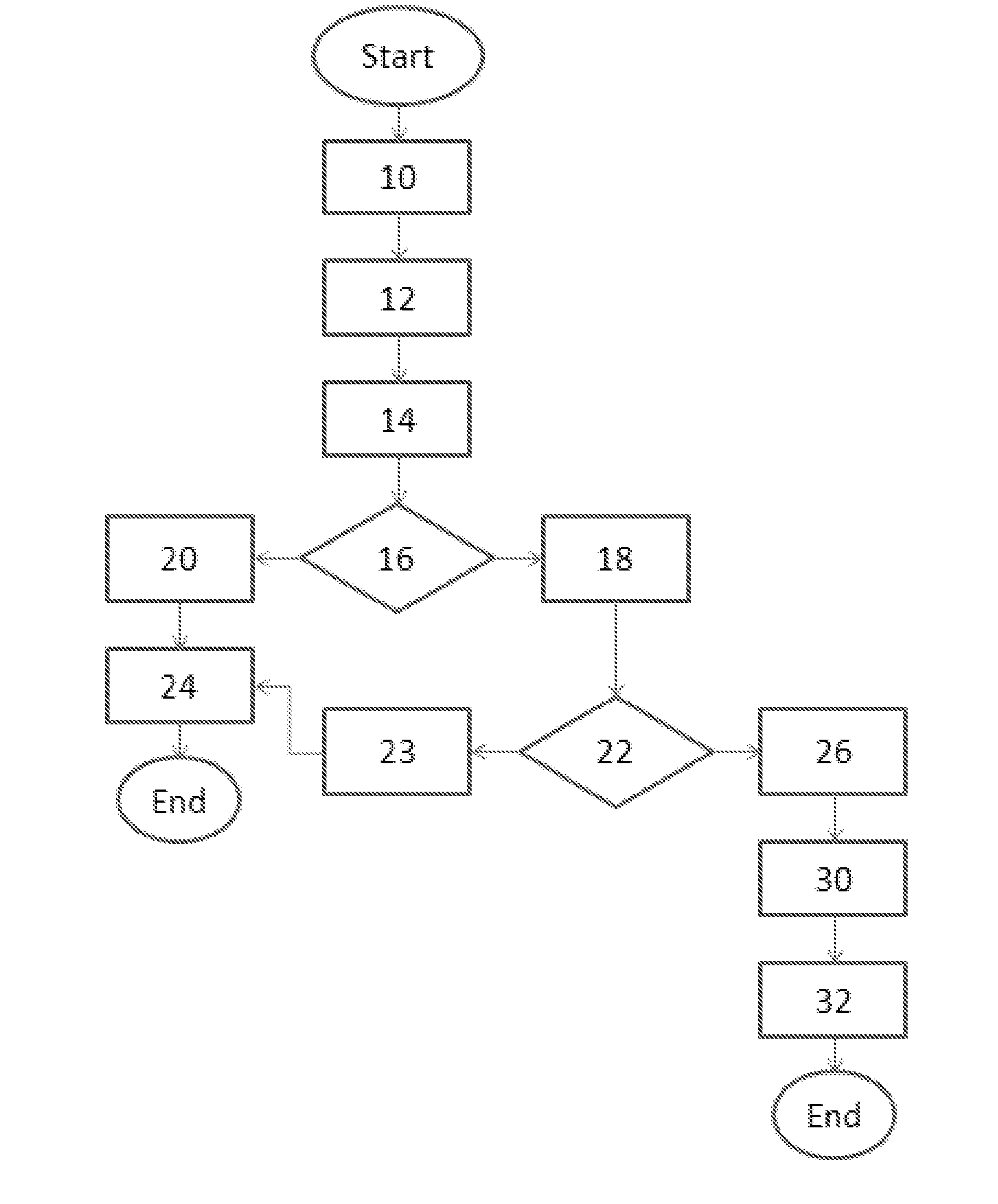

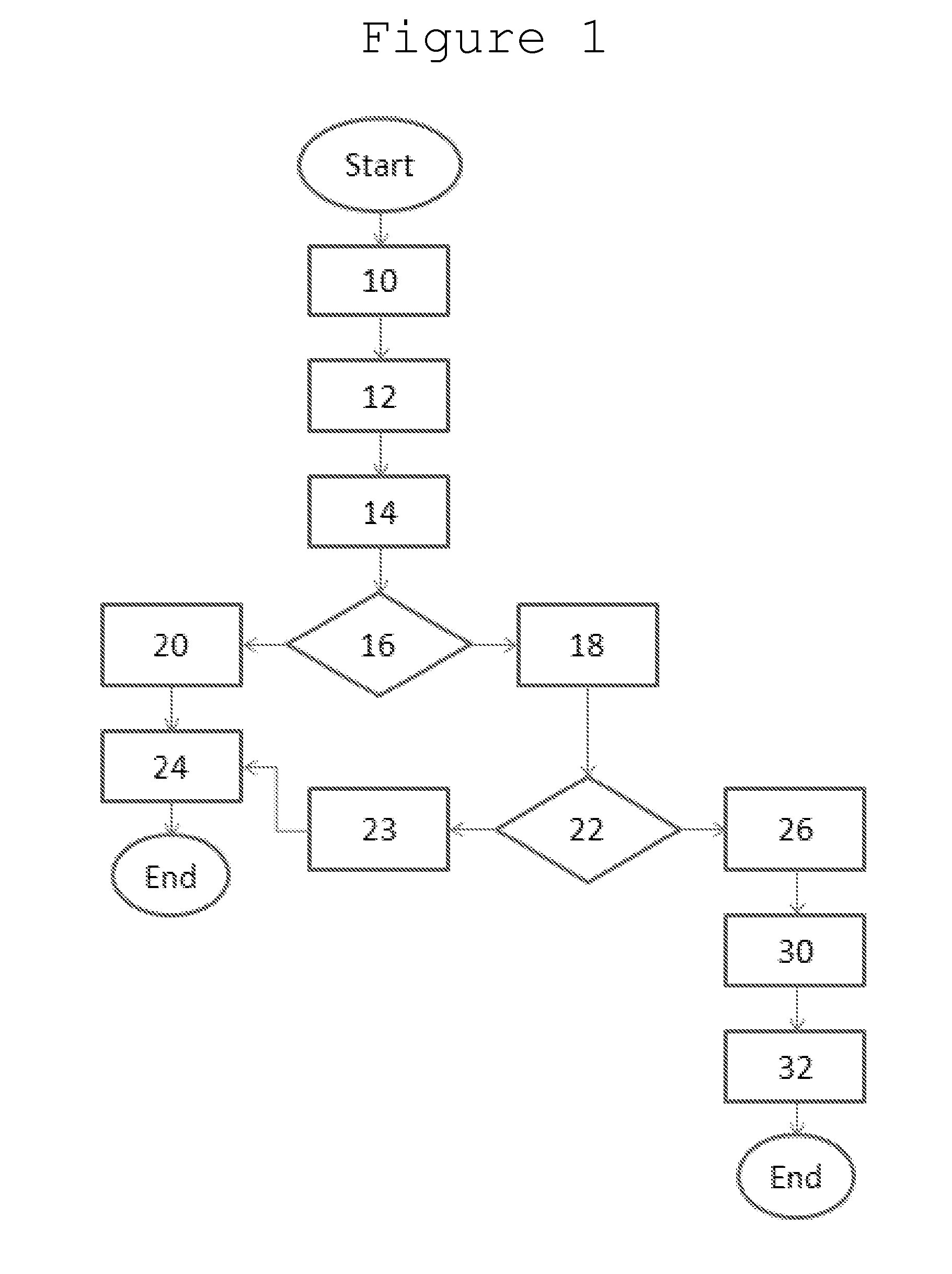

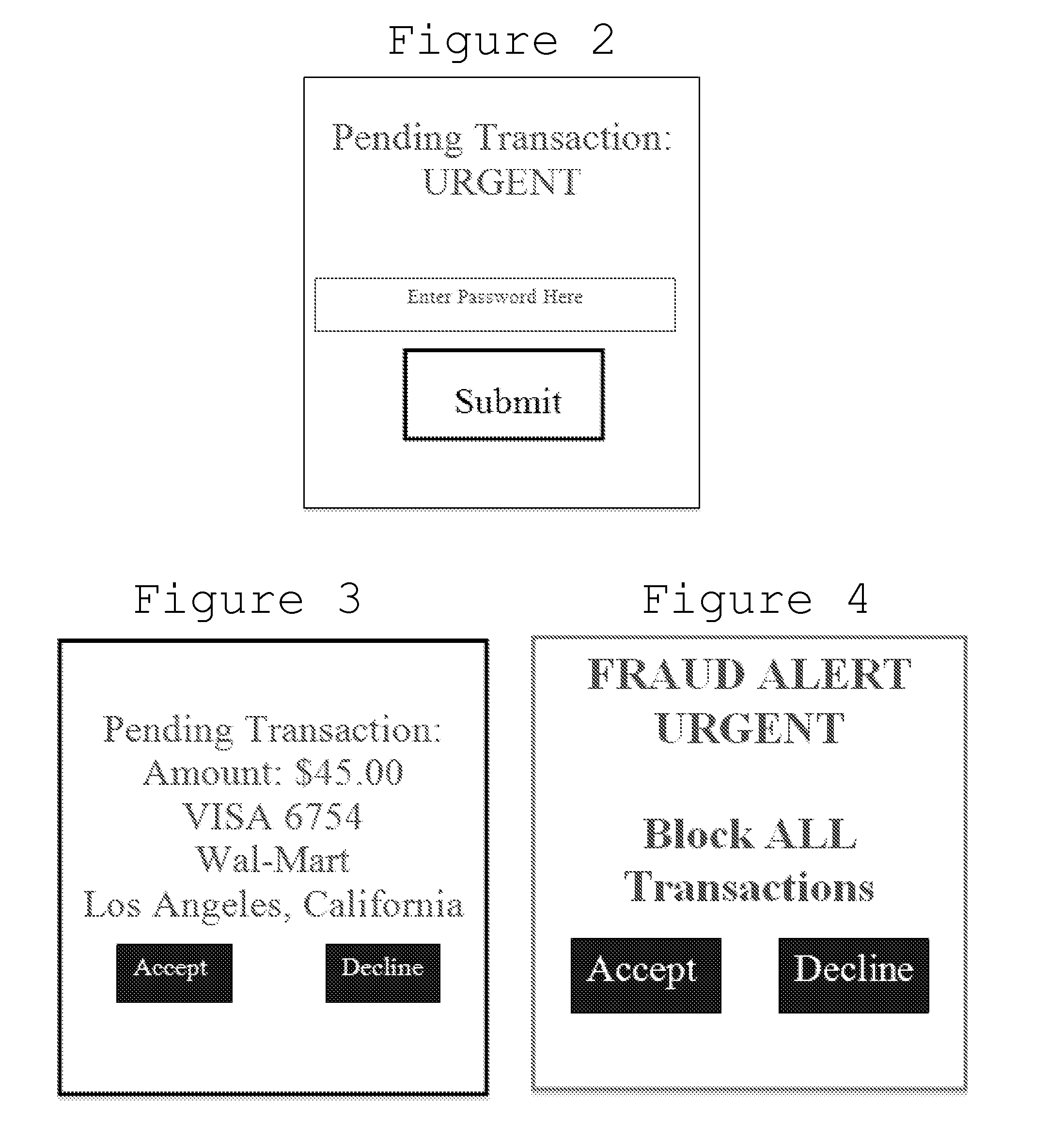

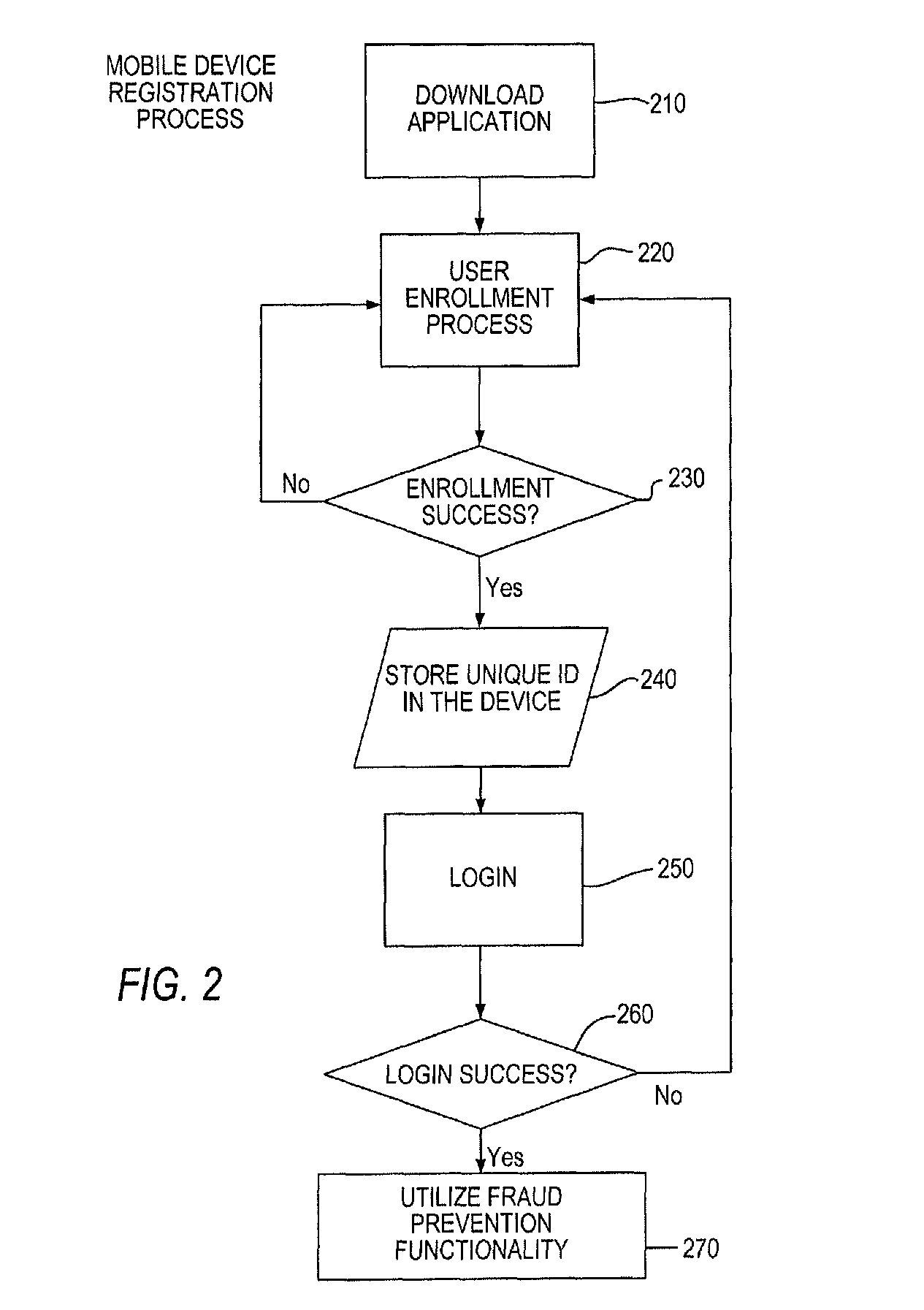

Debit/Credit Card Fraud Prevention Software and Smart Phone Application System and Process

InactiveUS20140250009A1Reduce riskReduced activityFinanceProtocol authorisationComputer hardwareApplication software

The present invention is a bank card fraud prevention system comprising a smart phone application and fraud prevention software placed within financial institutions that provide the subscriber the option to approve or decline a bank card transaction in real time based on a comparison between the user's smart phone geographical location at the time of the pending bank card transaction and the location of the purchase. The subscriber will have the ability to either immediately approve or decline the pending transaction by responding to the alert on the subscriber's present invention's smart phone application. The present invention smart phone application and fraud prevention software placed is within the subscriber's financial institution will further allow the subscriber to block all bank card transactions until the subscriber and the financial institution can determine if the subscriber's account has been compromised.

Owner:CARLSON DANIEL EDWARD

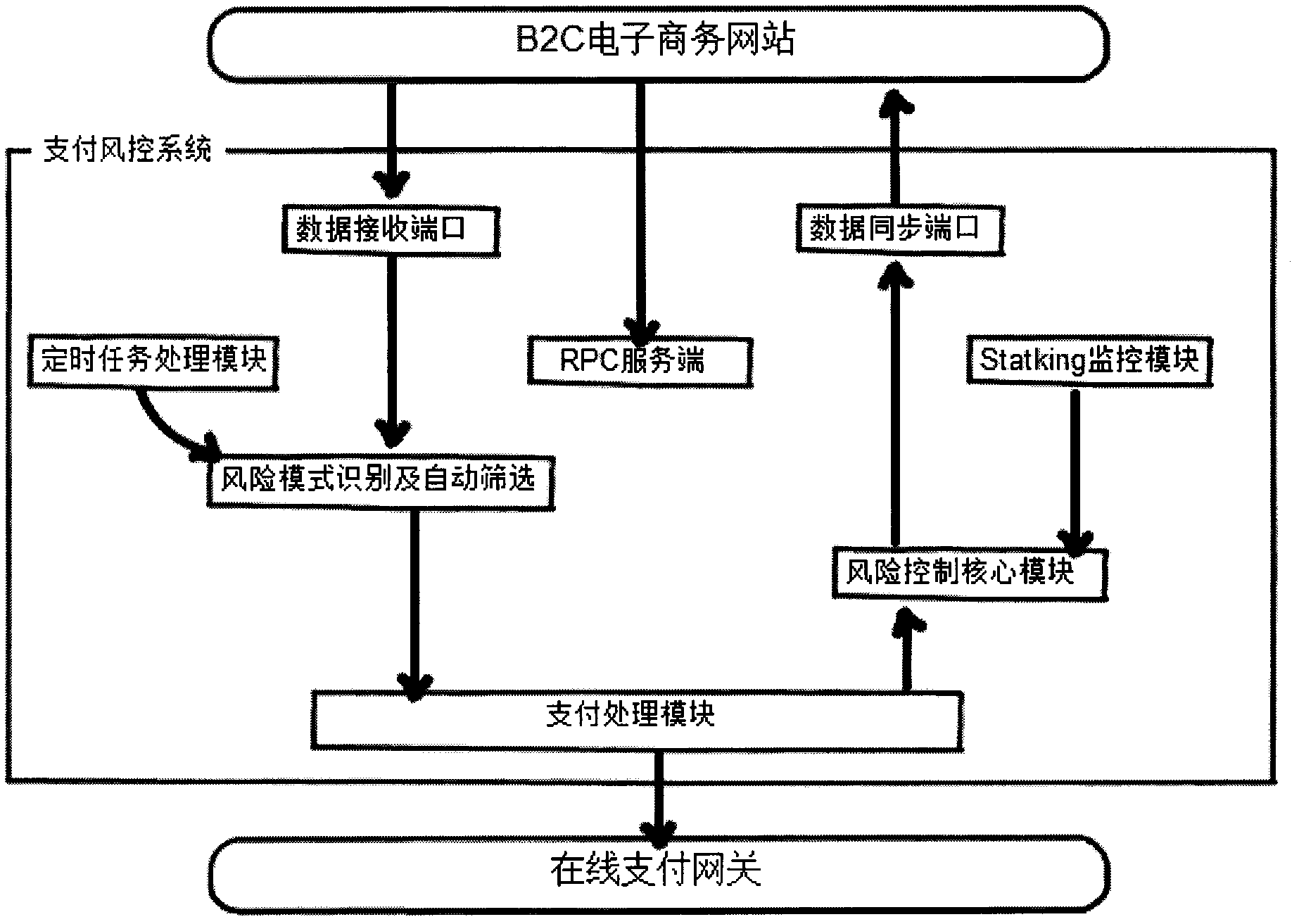

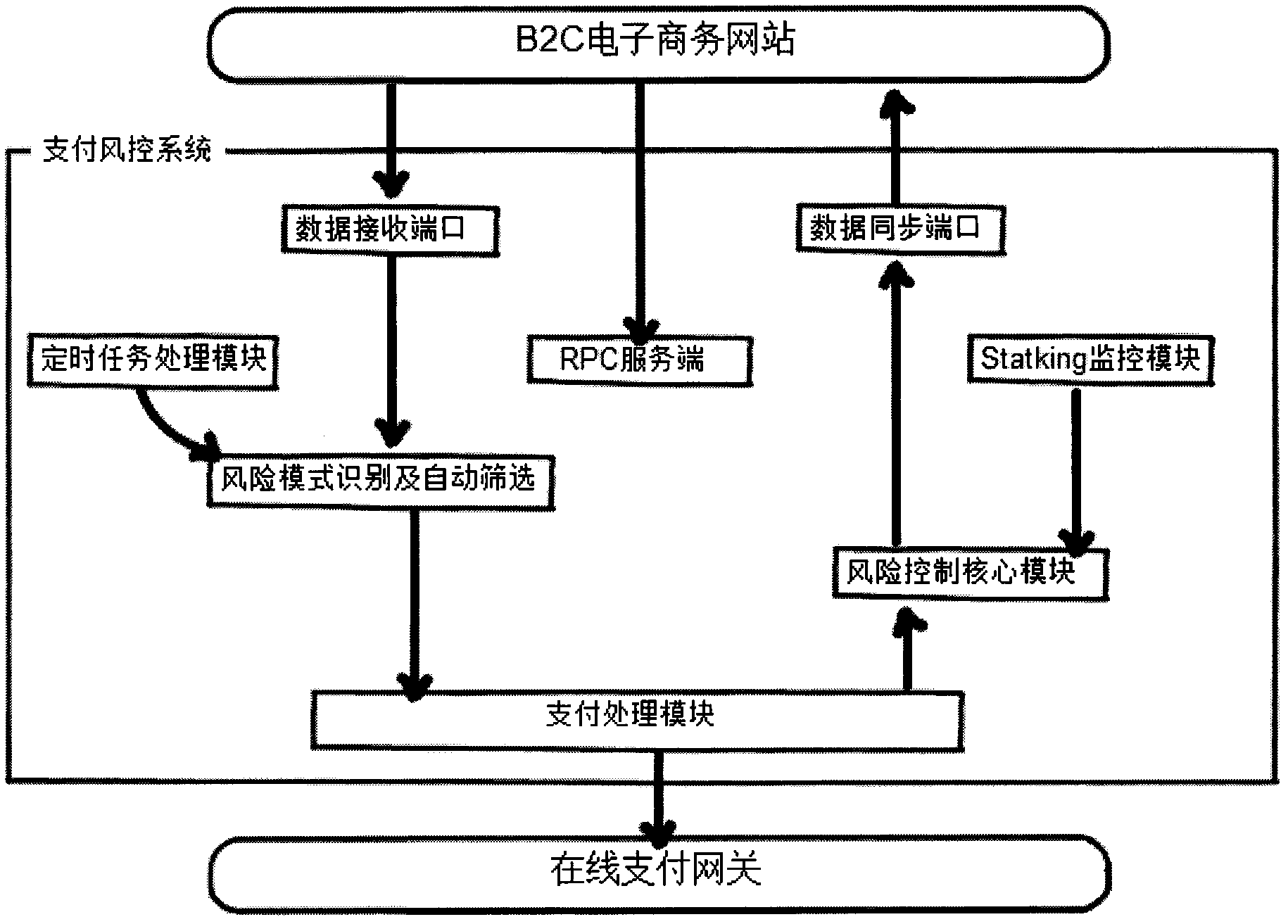

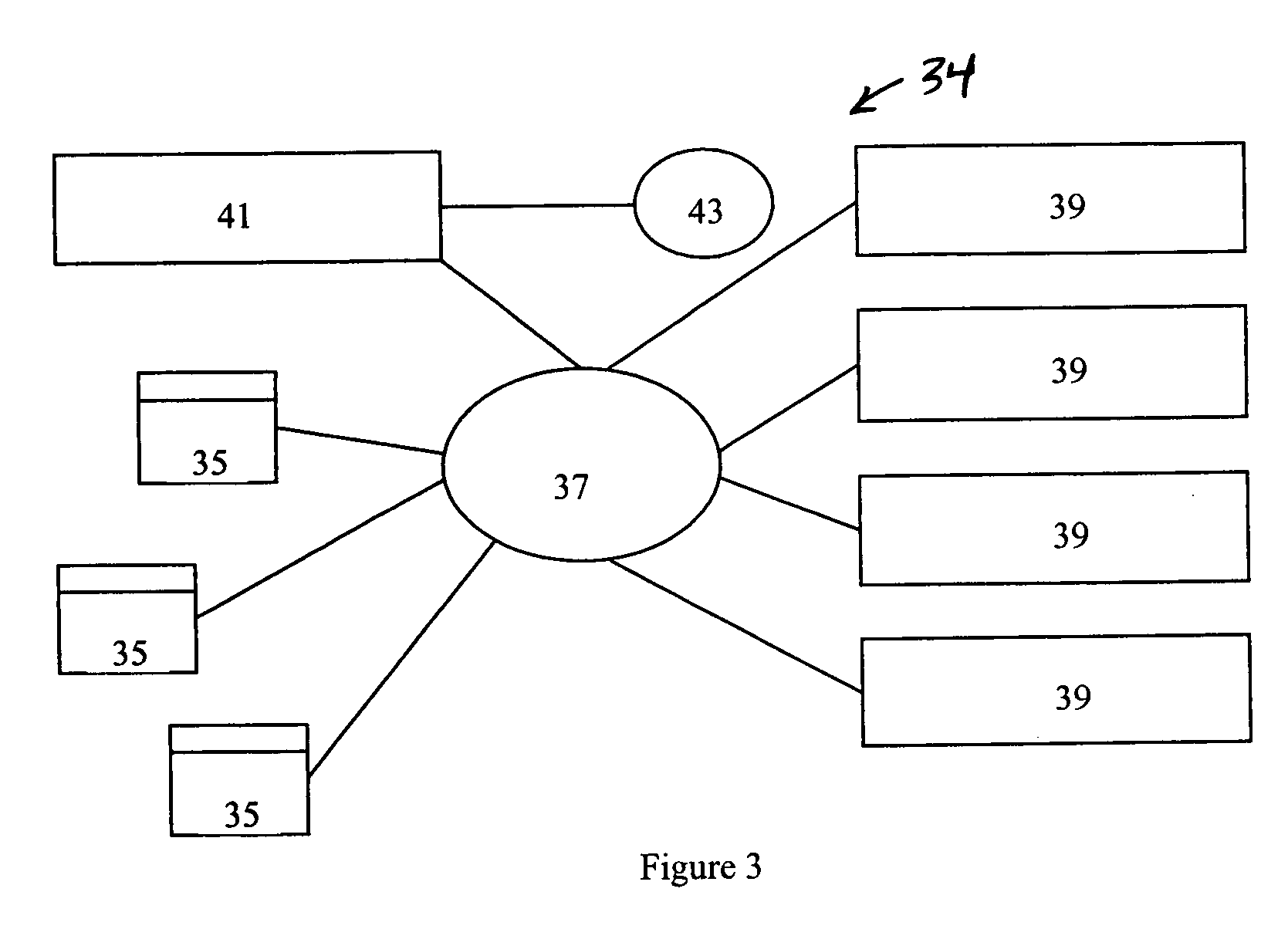

System for risk control over online payment

InactiveCN102194177AEffective controlEnsure safetyPayment architectureData synchronizationData connection

The invention discloses a system for risk control over online payment. An electronic commerce website is subjected to data connection with an online payment gateway through the system; the system comprises a data receiving port, a risk pattern identifying and automatic screening module, a risk control core module, a payment processing module, a data synchronizing port and an RPC (Remote Procedure Call) server side and is used for finishing the payment risk control and online payment flow. After a user order is generated, the system can be used for automatically analyzing and distinguishing the user order and then determining whether the user order belongs to high-risk orders, suspicious orders or trust orders by integrating various elements. Aiming at credit-card fraud, order cancel and the like in the current electronic commerce transaction process, particularly in the foreign trade B2C (Business to Customer) industry, the risk control system disclosed by the invention establishes an identification model, can carry out automatic identification and screening and can be used for effectively controlling the online payment so as to reduce the collection risk of online payment.

Owner:NANJING COFREE SOFTWARE TECH

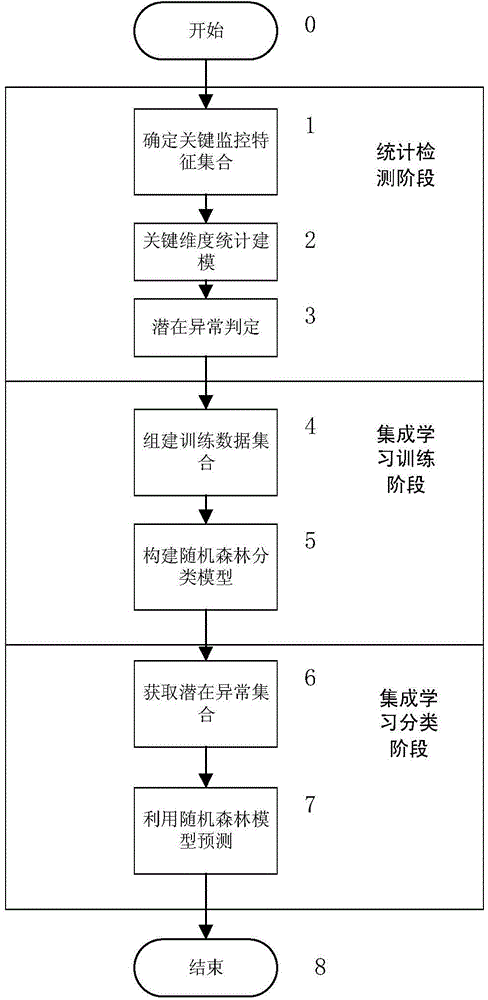

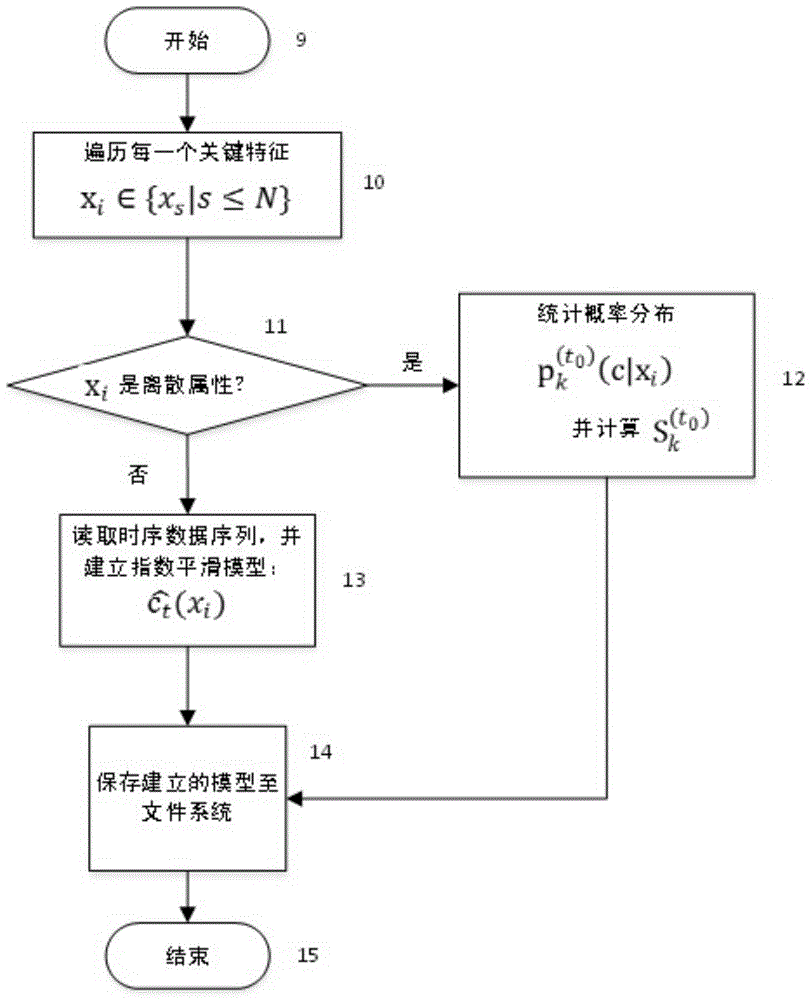

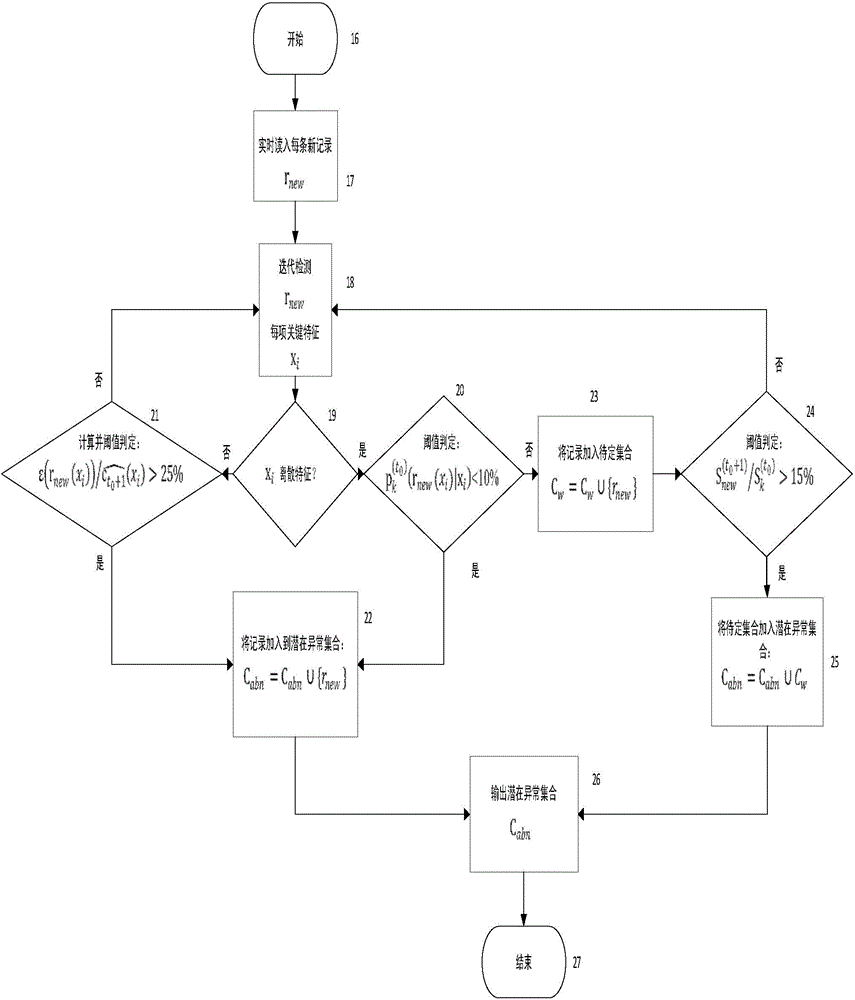

Multi-level anomaly detection method based on exponential smoothing and integrated learning model

ActiveCN104794192AIncrease training speedEfficient miningSpecial data processing applicationsData setAlgorithm

A multi-level anomaly detection method based on exponential smoothing, sliding window distribution statistics and an integrated learning model comprises the following steps of a statistic detection stage, an integrated learning training stage and an integrated learning classification stage, wherein in the statistic detection stage, a, a key feature set is determined according to the application scene; b, for discrete characteristics, a model is built through a sliding window distribution histogram, and a model is built through exponential smoothing for continuous characteristics; c, the observation features of all key features are input periodically; d, the process is ended. In the integrated learning training stage, a, a training data set is formed by marked normal and abnormal examples; b, a random forest classification model is trained. The method provides a general framework for anomaly detection problems comprising time sequence characteristics and complex behavior patterns and is suitable for online permanent detection, the random forest model is used in the integrated learning stage to achieve the advantages of parallelization and high generalization ability, and the method can be applied to multiple scenes like business violation detection in the telecom industry, credit card fraud detection in the financial industry and network attack detection.

Owner:NANJING UNIV

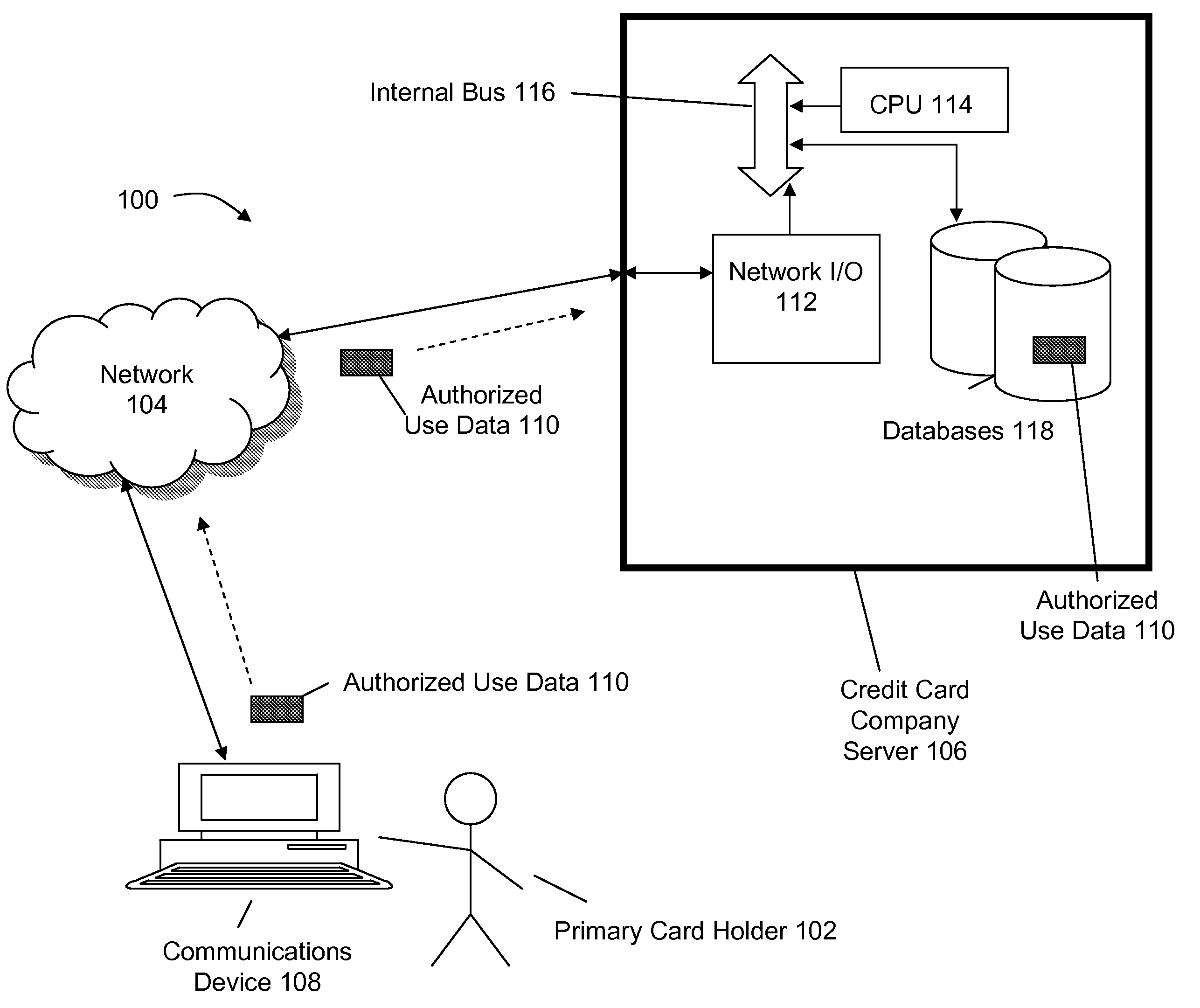

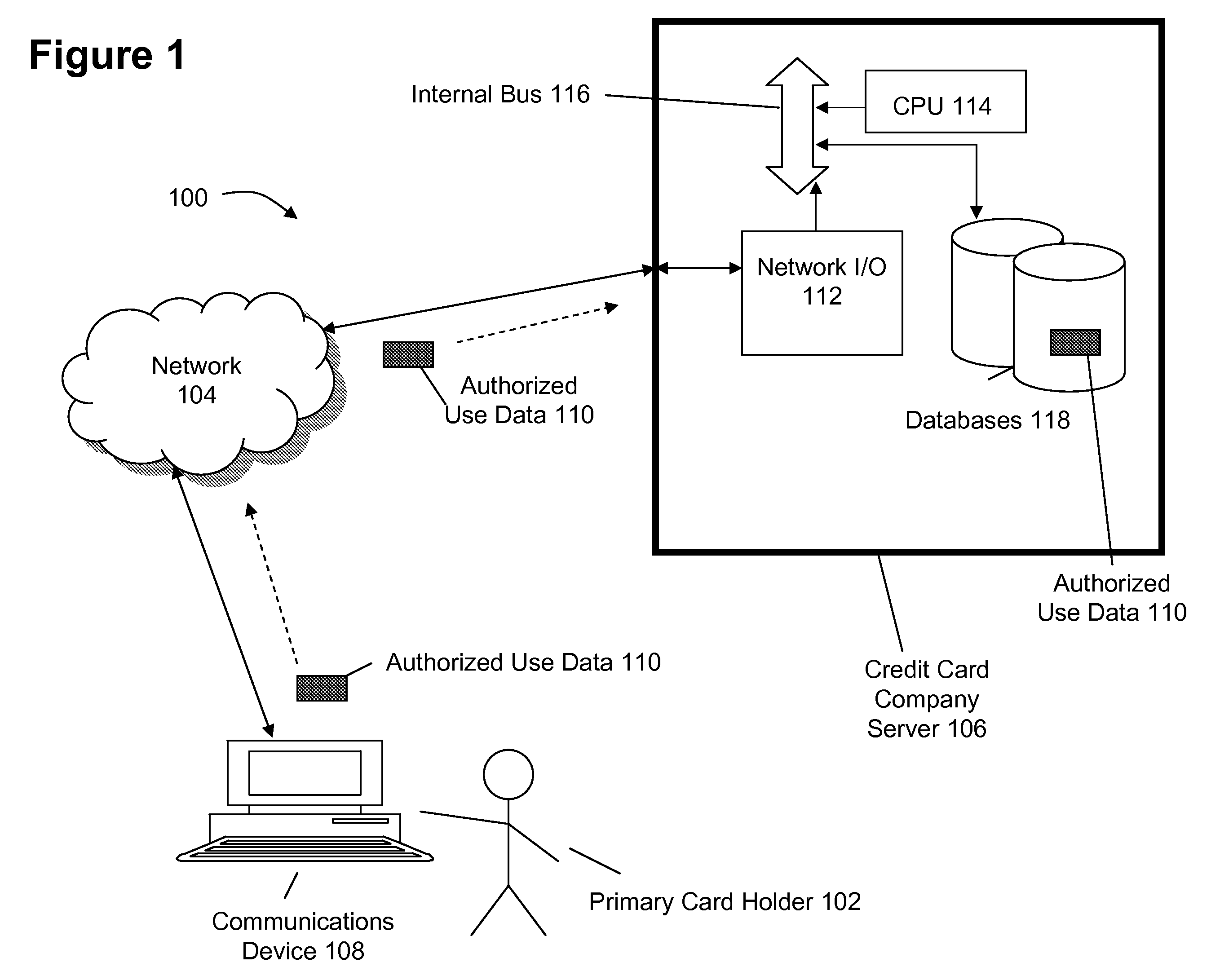

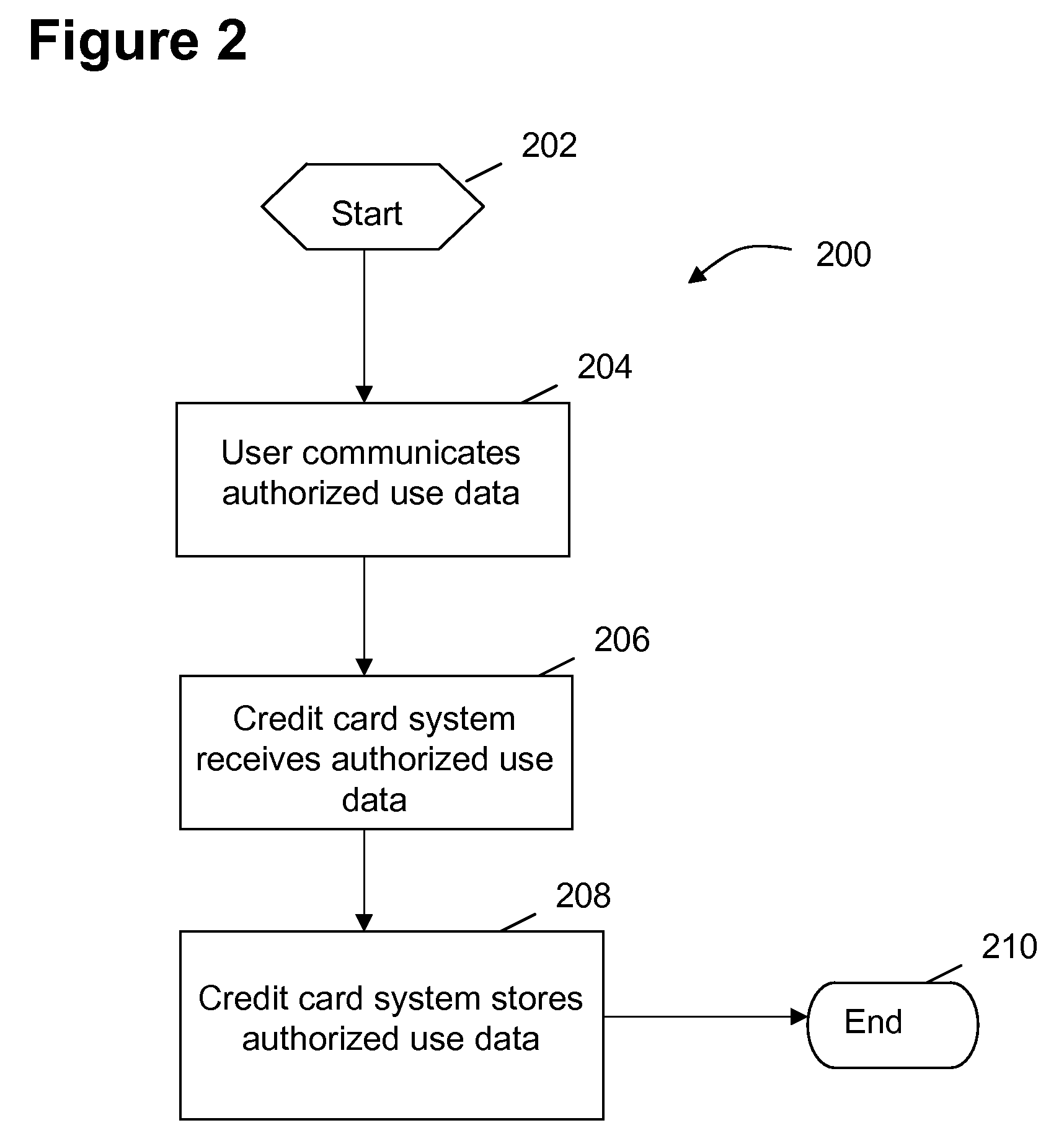

Restricting bank card access based upon use authorization data

The present invention provides a system and method to detect credit card fraud. It allows the user, or the credit card company, to limit the use of a particular credit card according to authorized use data which is prespecified by the card holder, such as allowing authorized use within a geographical area or a set of ZIP codes. This way, the credit card owner, can limit the credit card's use according to the card holder, such as within a specified geographical area, a date frame, a time frame or even to within particular stores or with particular vendors. In addition, data from the credit card's magnetic stripe is conveyed and compared against the authorized use data. With respect to geographical information, the present use geographical data is provided either by the particular point-of-sale terminal or from a GPS system.

Owner:IBM CORP

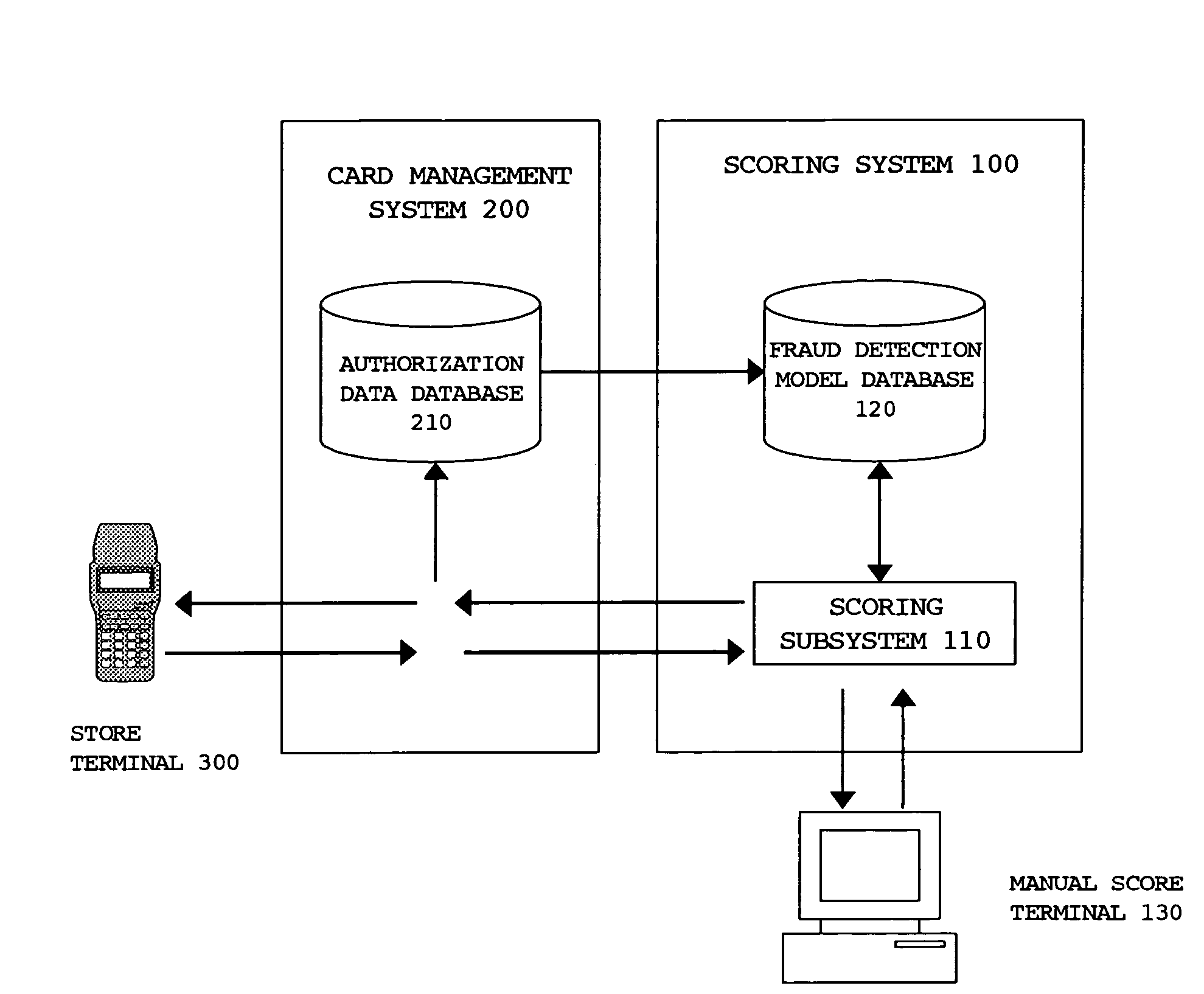

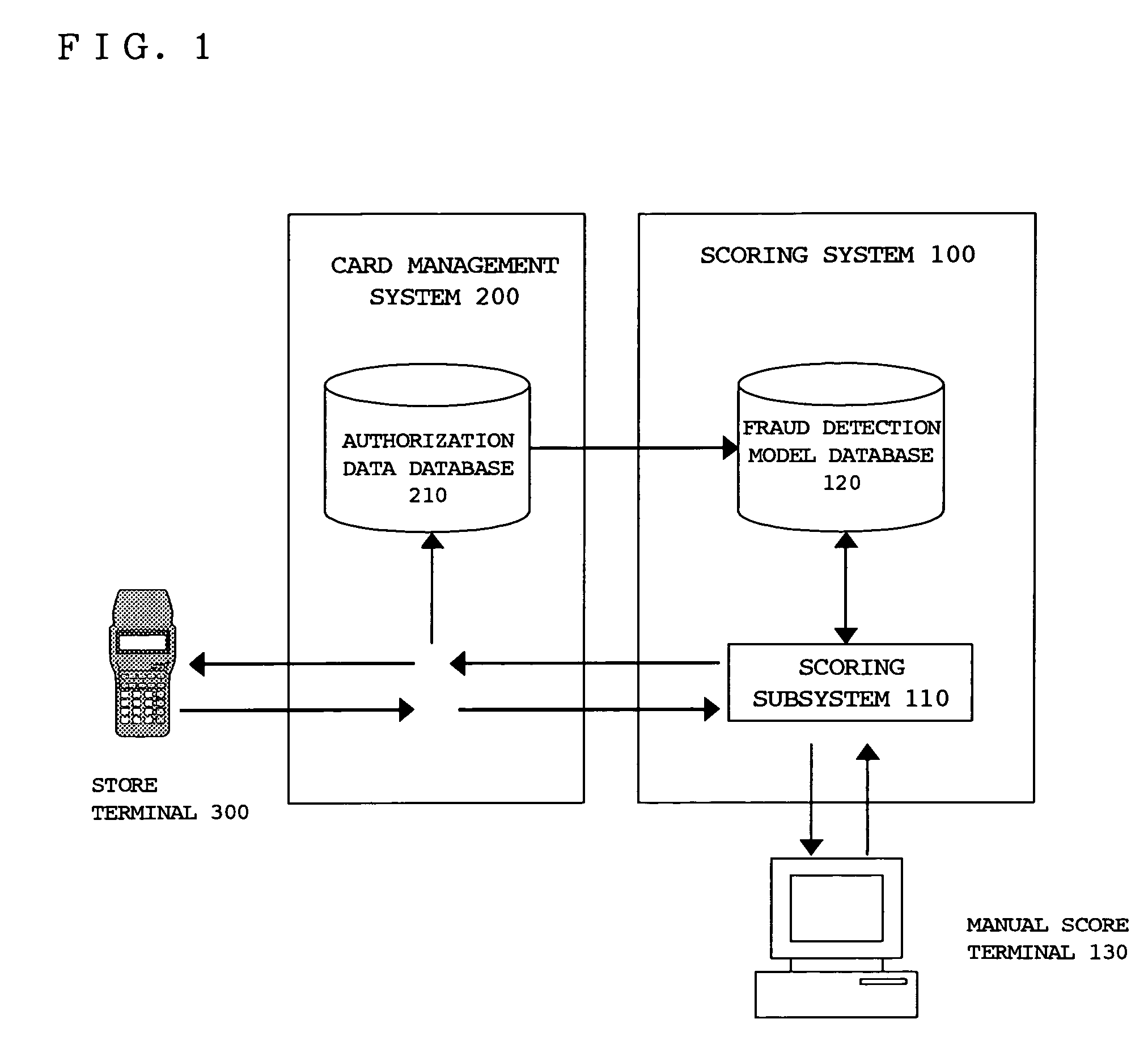

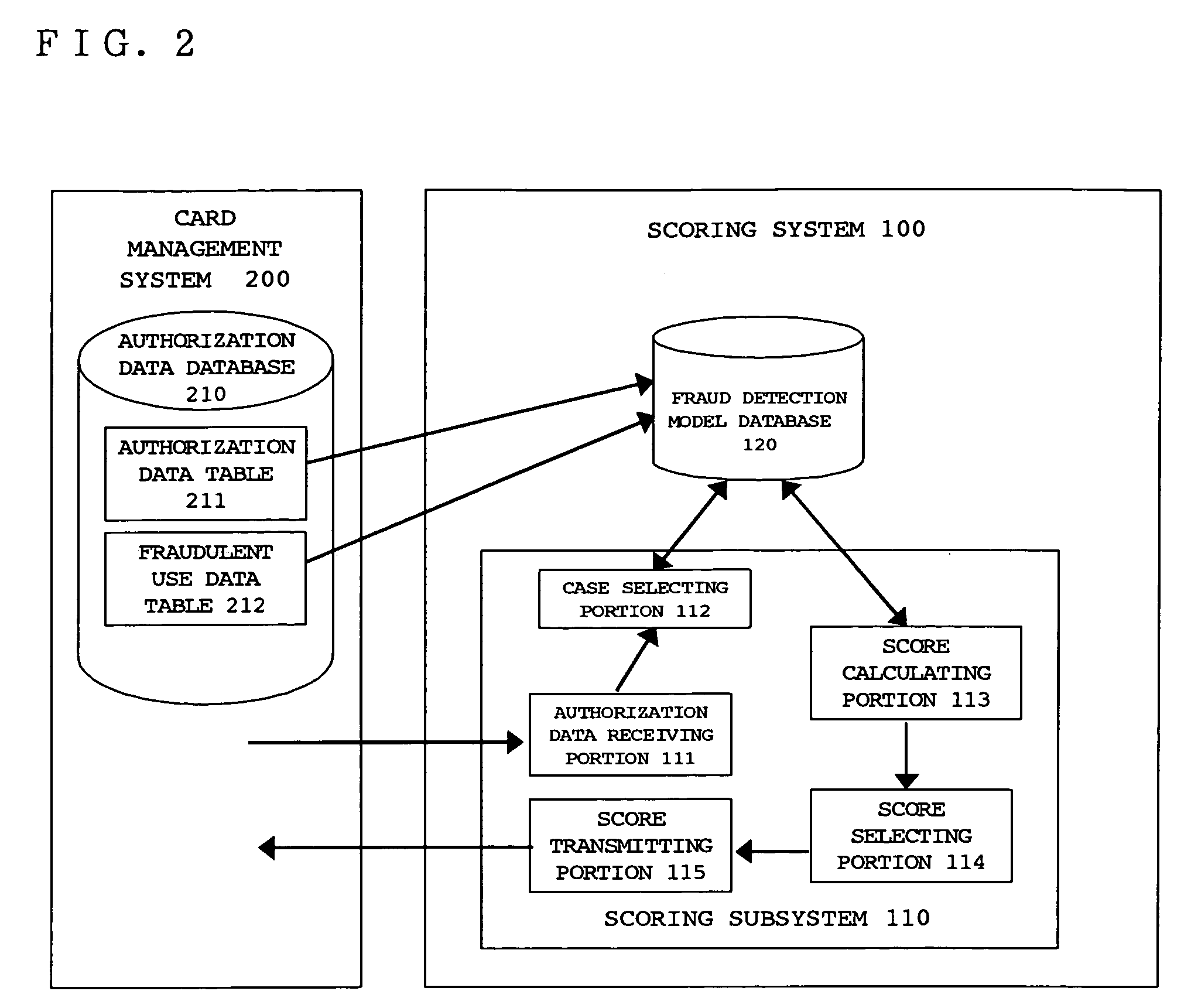

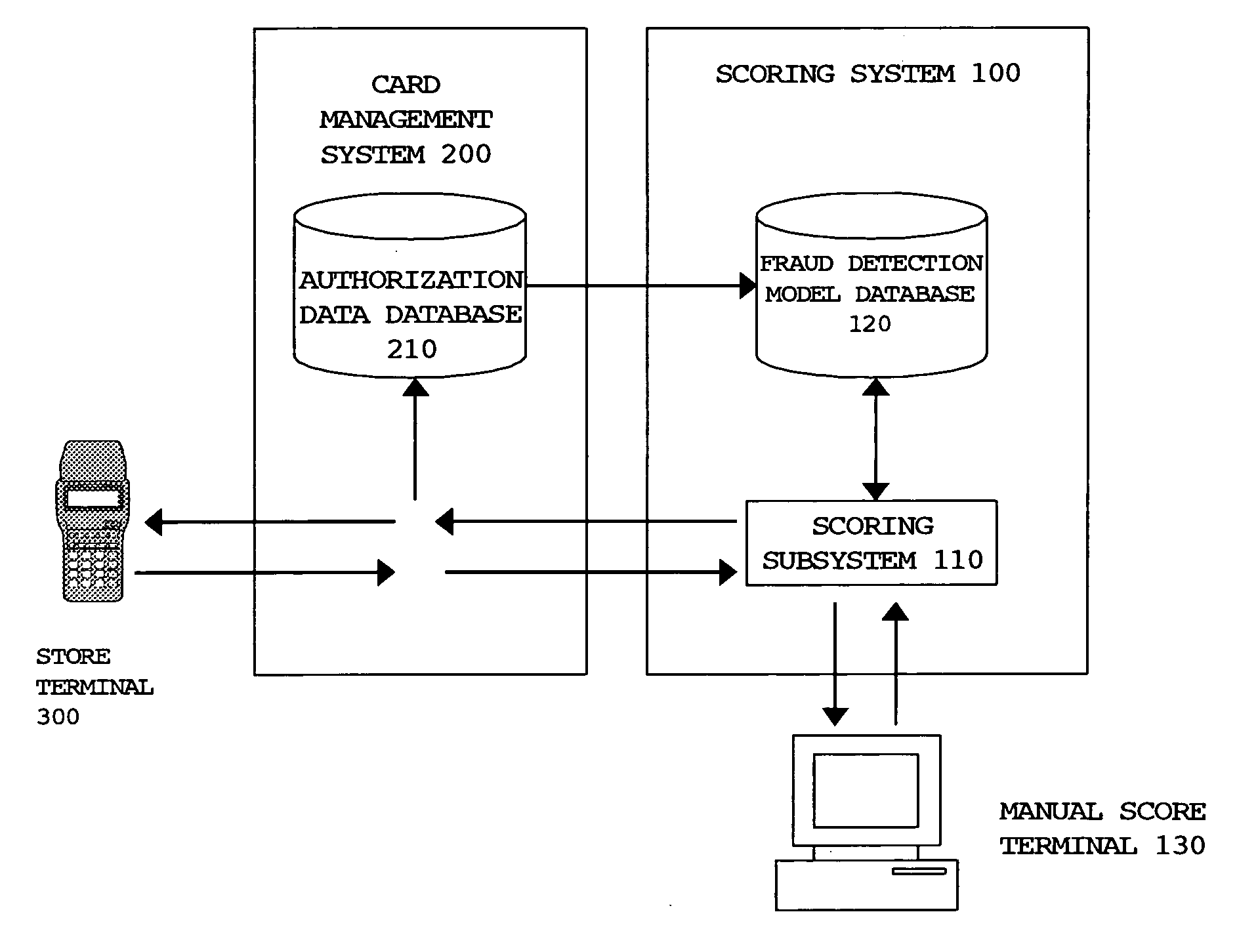

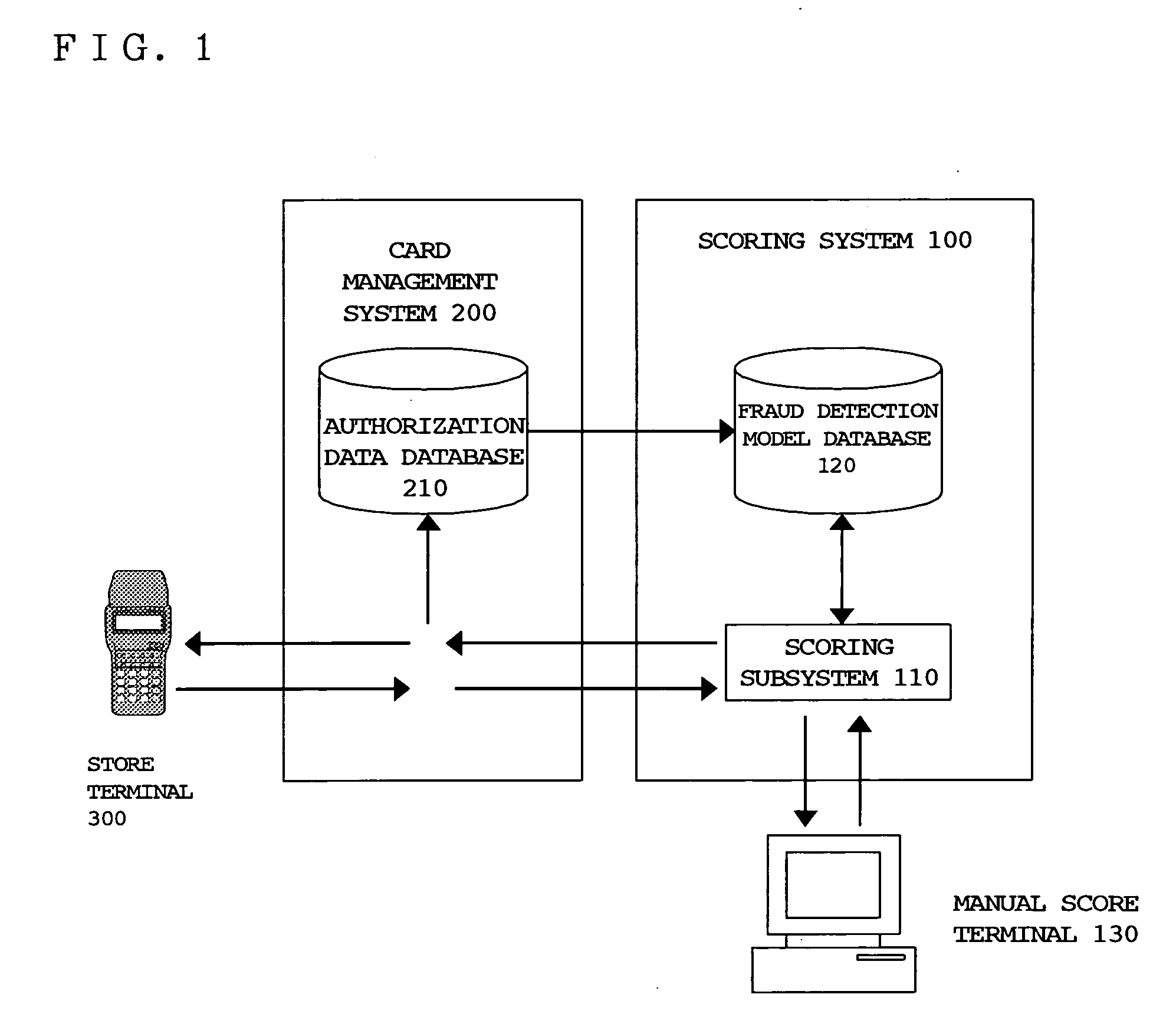

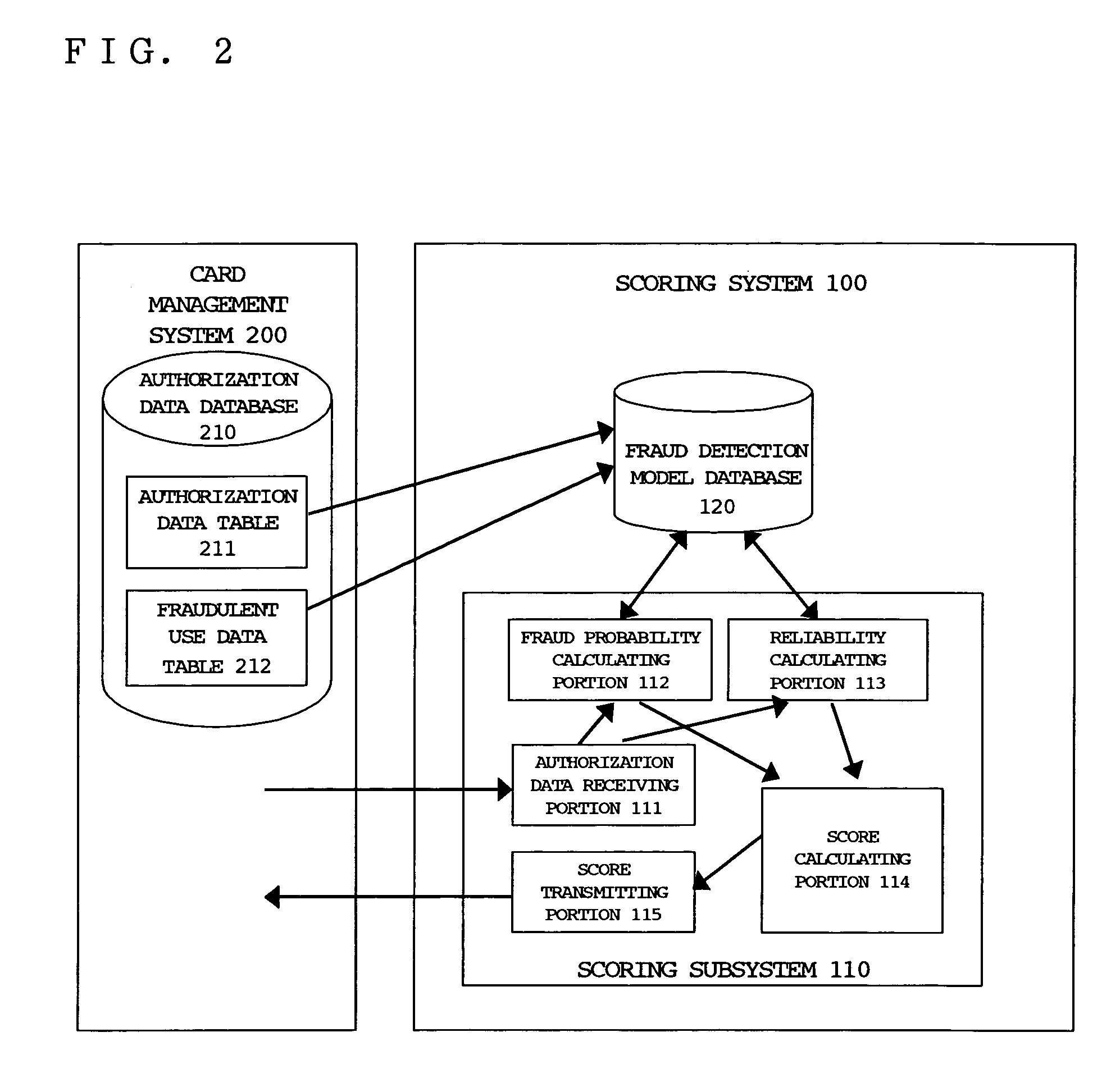

Fraud score calculating program, method of calculating fraud score, and fraud score calculating system for credit cards

A fraud score calculating program primarily for use in determining the possibility of credit card fraud can calculate a score reflecting the reliability of a model created based on Bayesian theory. Various factors are extracted from authorization data, and cases are selected for various combinations of the factors. A fraud score is calculated for each case, and a result of score calculation is specified using at least one of the calculated scores. The result of score calculation may be an average of a plurality of the calculated scores. When each score reflects reliability, the result of score calculation may be the largest of the calculated scores.

Owner:INTELLIGENT WAVE INC

Fraud score calculating program, method of calculating fraud score, and fraud score calculating system for credit cards

InactiveUS20040225473A1Easy to getReduce weightFinanceDigital computer detailsComputational modelDependability

A fraud score calculating program primarily for use in determining the possibility of credit card fraud can calculate a score reflecting the reliability of a model created based on Bayesian theory. A model which is stored in a fraud detection model database 120 obtains new authorization data and continues learning as the number of data samples increases. Calculation of the score is performed by a calculation logic provided in a scoring subsystem 110. The sample number data for a case corresponding to the authorization data are obtained from the model, and the probability of the occurrence of fraudulent use is calculated. The reliability of the model is also calculated on the basis of, for example, the number of the registered samples, and a fraud score is calculated using both the calculated probability of the occurrence of fraud and the calculated reliability of the model.

Owner:INTELLIGENT WAVE INC

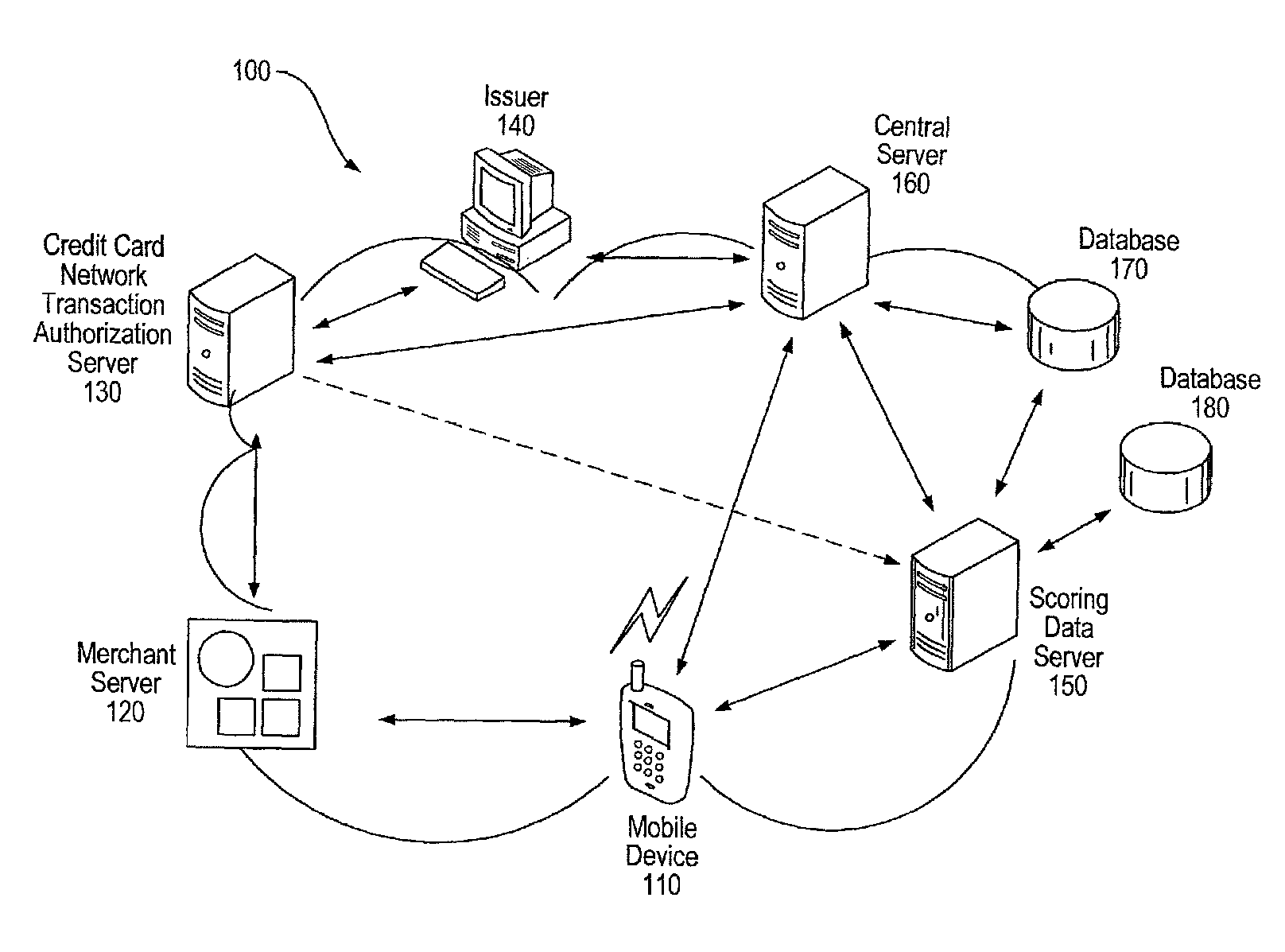

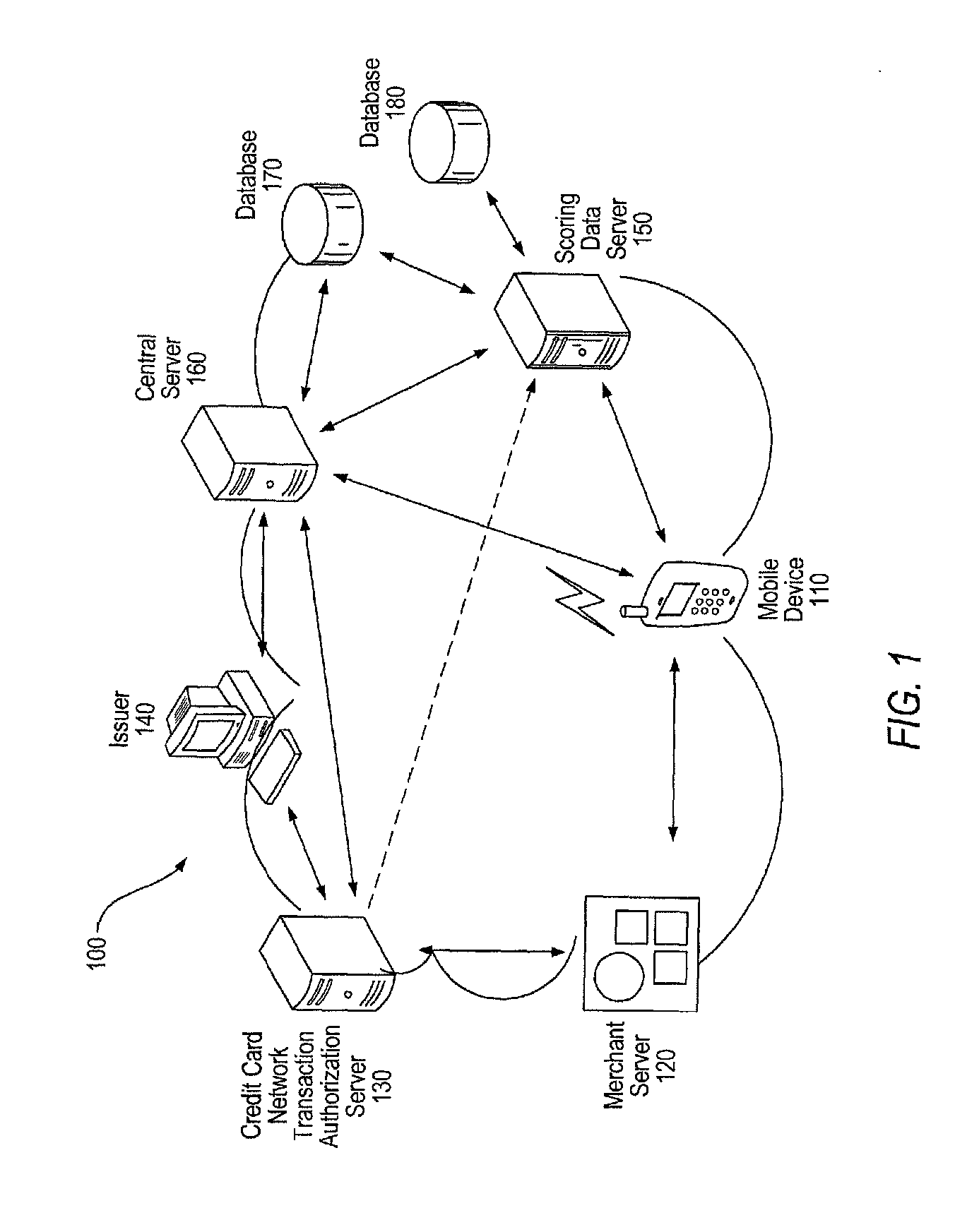

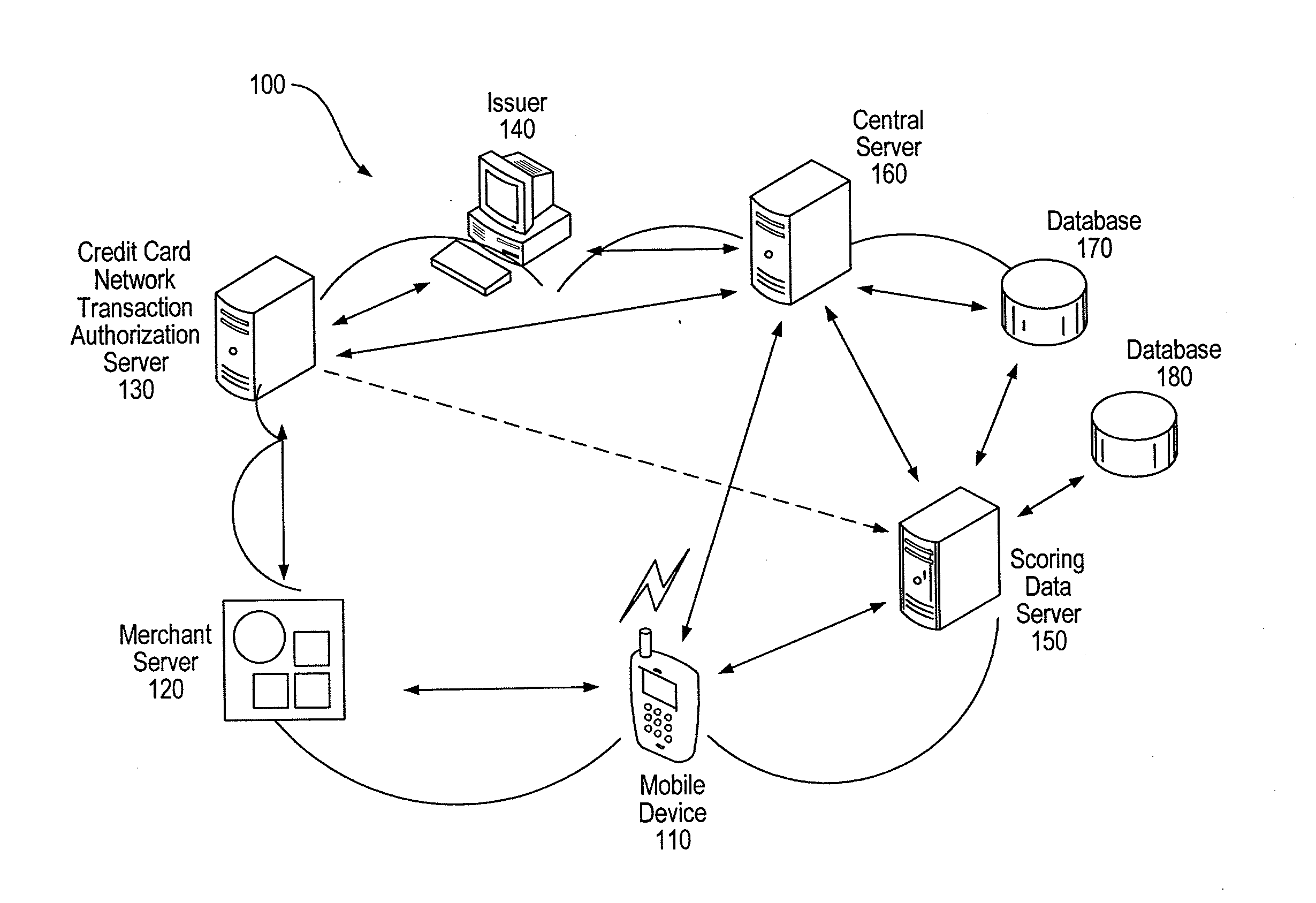

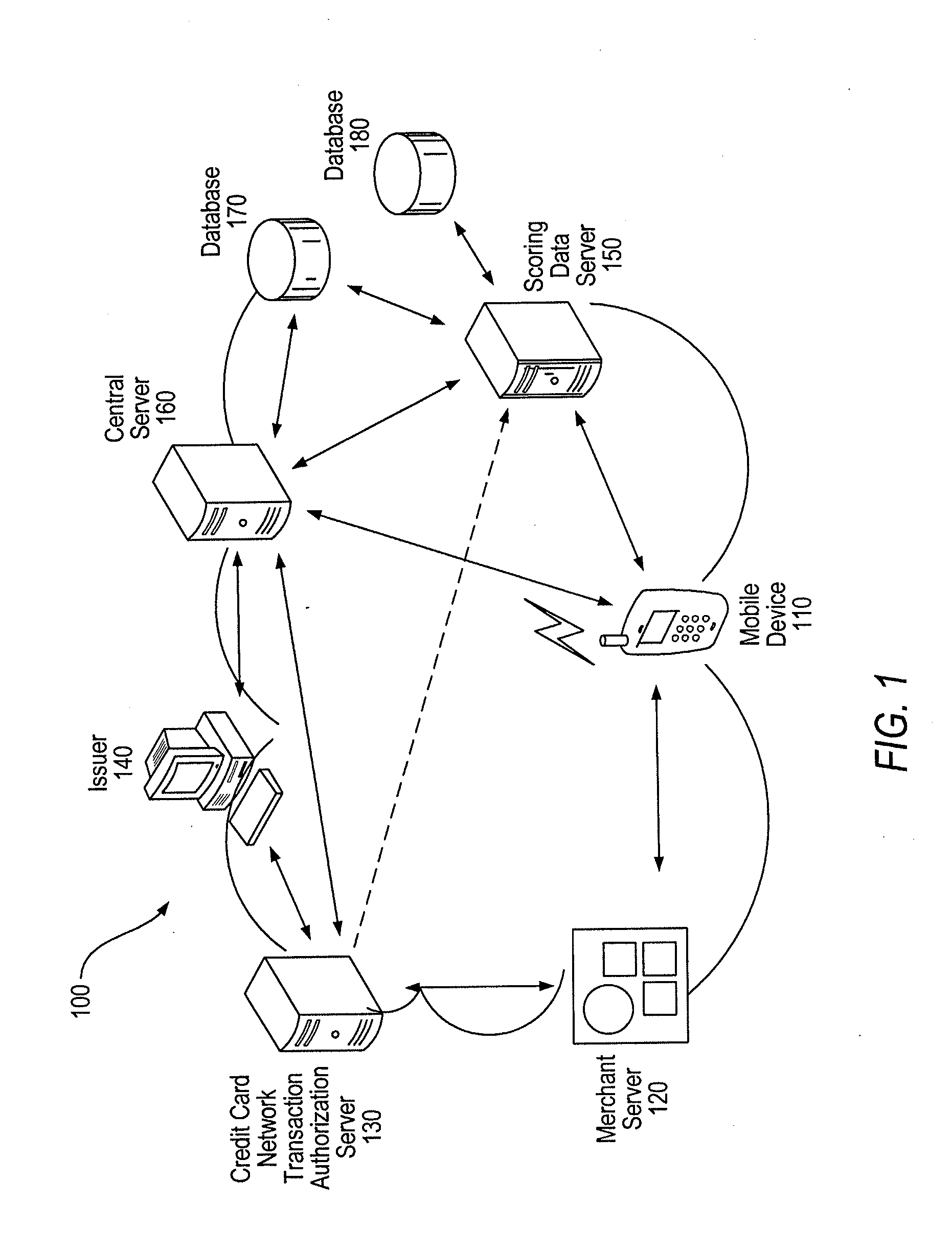

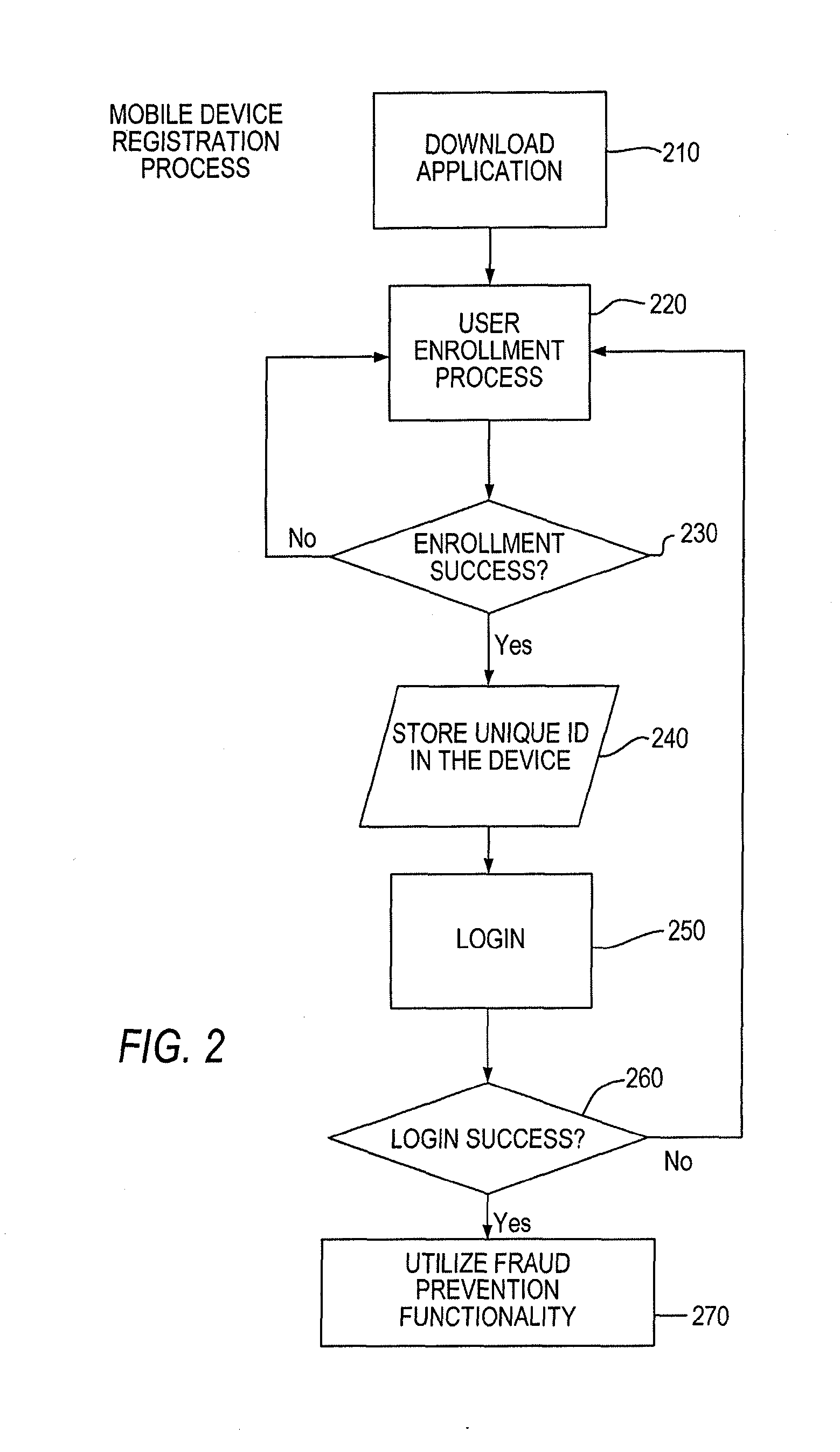

Credit card fraud prevention system and method

InactiveUS9031877B1Computer security arrangementsProtocol authorisationTransaction dataFinancial transaction

A mobile computing device is adapted to transmit to a scoring server URLs of websites browsed using the device. The scoring server can compare these URLs against a merchant URL obtained within a preselected time period from transaction data resulting from a transaction involving a payment product of the device user. A score can be calculated based on the similarity between each URL obtained from the device and the URL from the transaction data. The score represents the likelihood that a website browsed using the device and, as a result, the transaction, is fraudulent. The browsed URLs can also be scored against a database of known fraudulent websites. A notification concerning the legitimacy of the transaction based on the score can be generated and sent to the mobile device in real-time. On receiving the notification, the device can be used to either accept or decline the transaction in real-time.

Owner:DELOITTE DEV

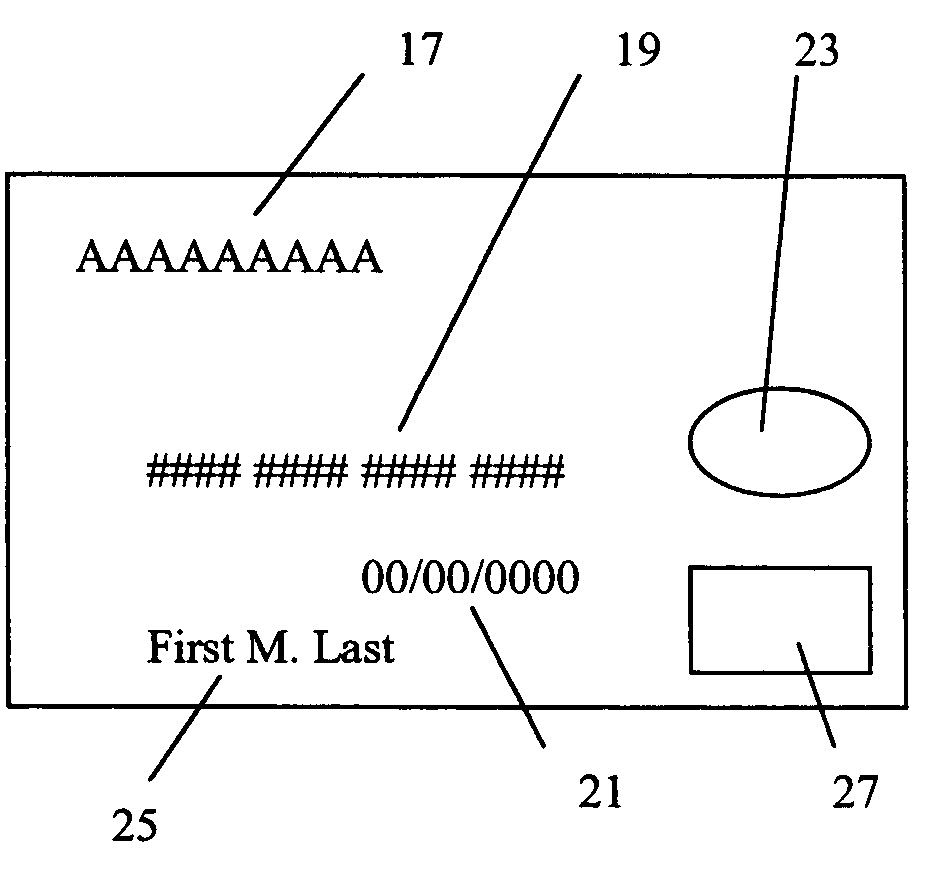

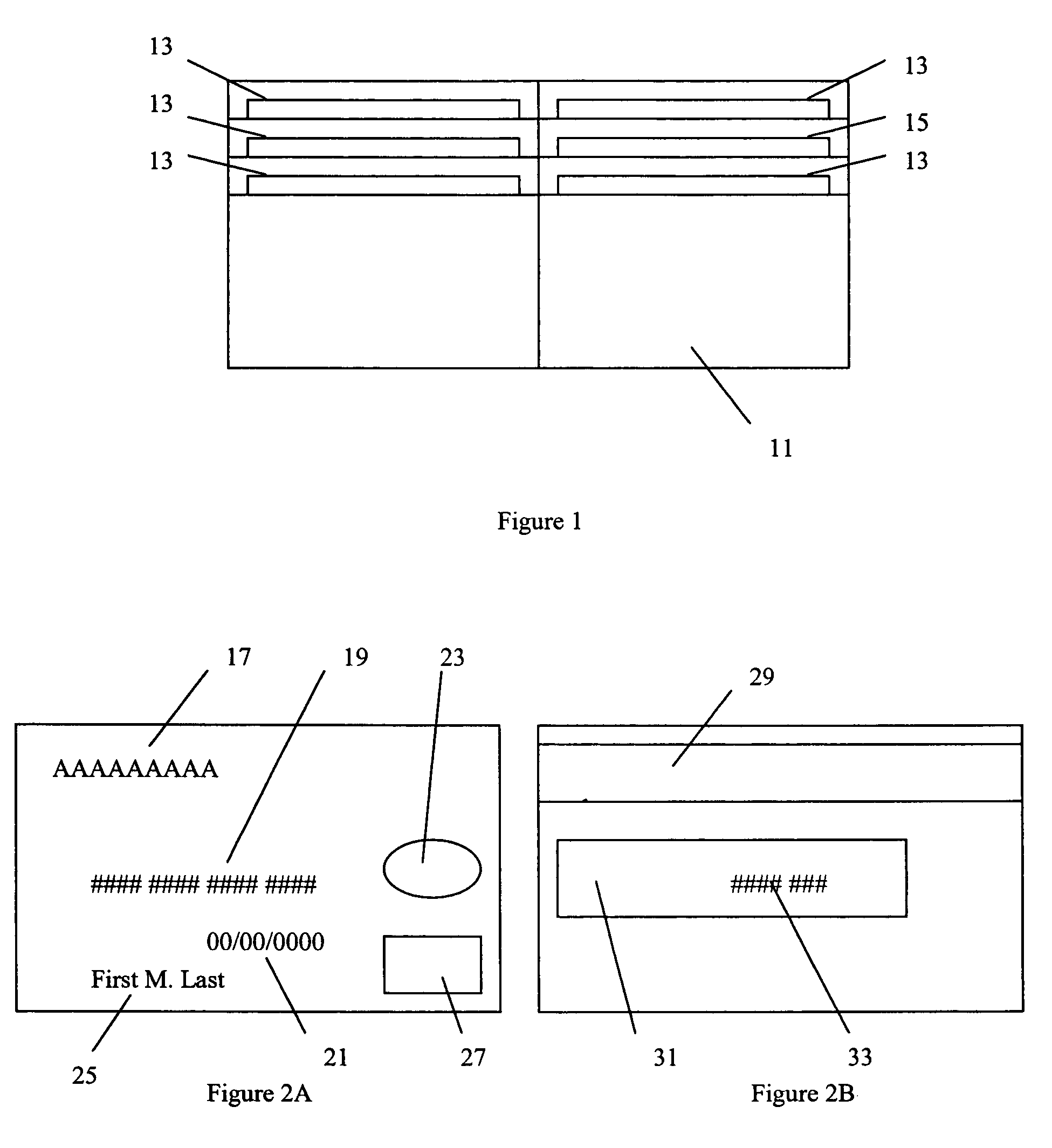

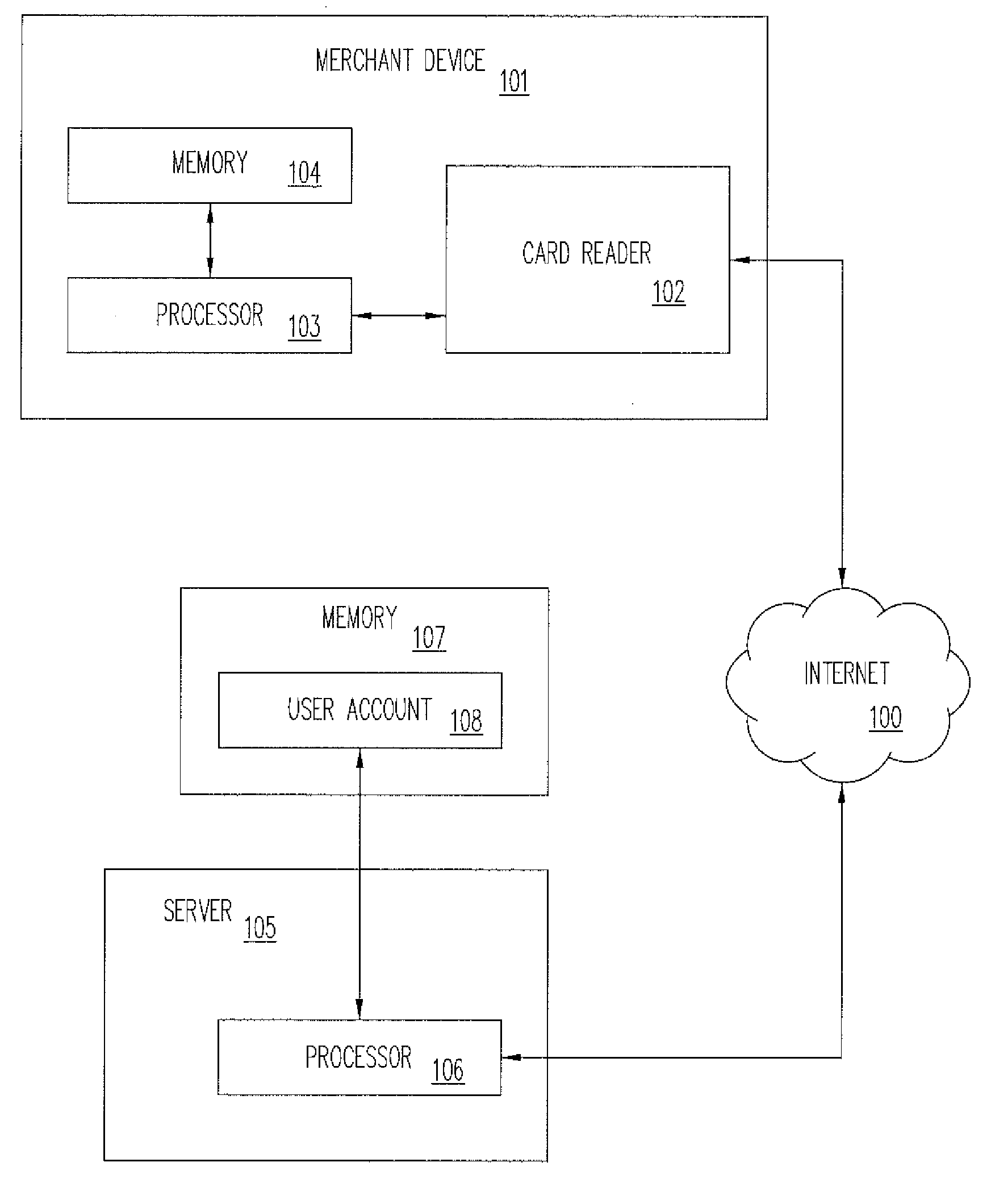

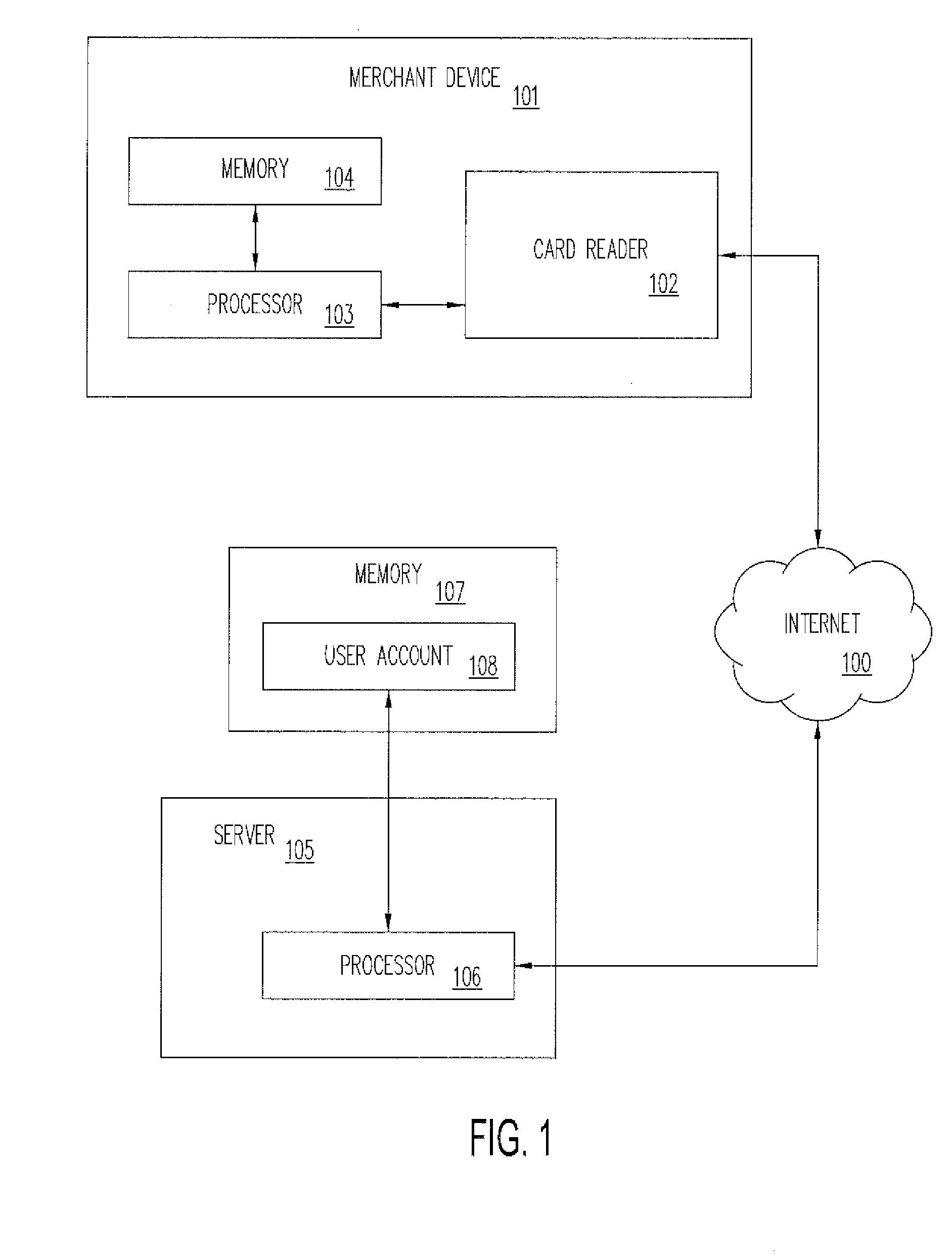

Apparatus and method for preventing credit card fraud

ActiveUS6955294B1Increases arrest rateIncrease in arrest rateComplete banking machinesFinanceInternet privacyEngineering

A trigger card and system for preventing credit and debit card fraud is disclosed. The trigger card is adapted to be indistinguishable from typical credit cards and other cards issued by financial institutions. The system is adapted to receive signals when a standard card reader reads the trigger card. The system is further adapted to initiate an automated procedure to reduce fraud upon receipt of the signal indicating that the trigger card has been read by the card reader.

Owner:SEEGAR MARK

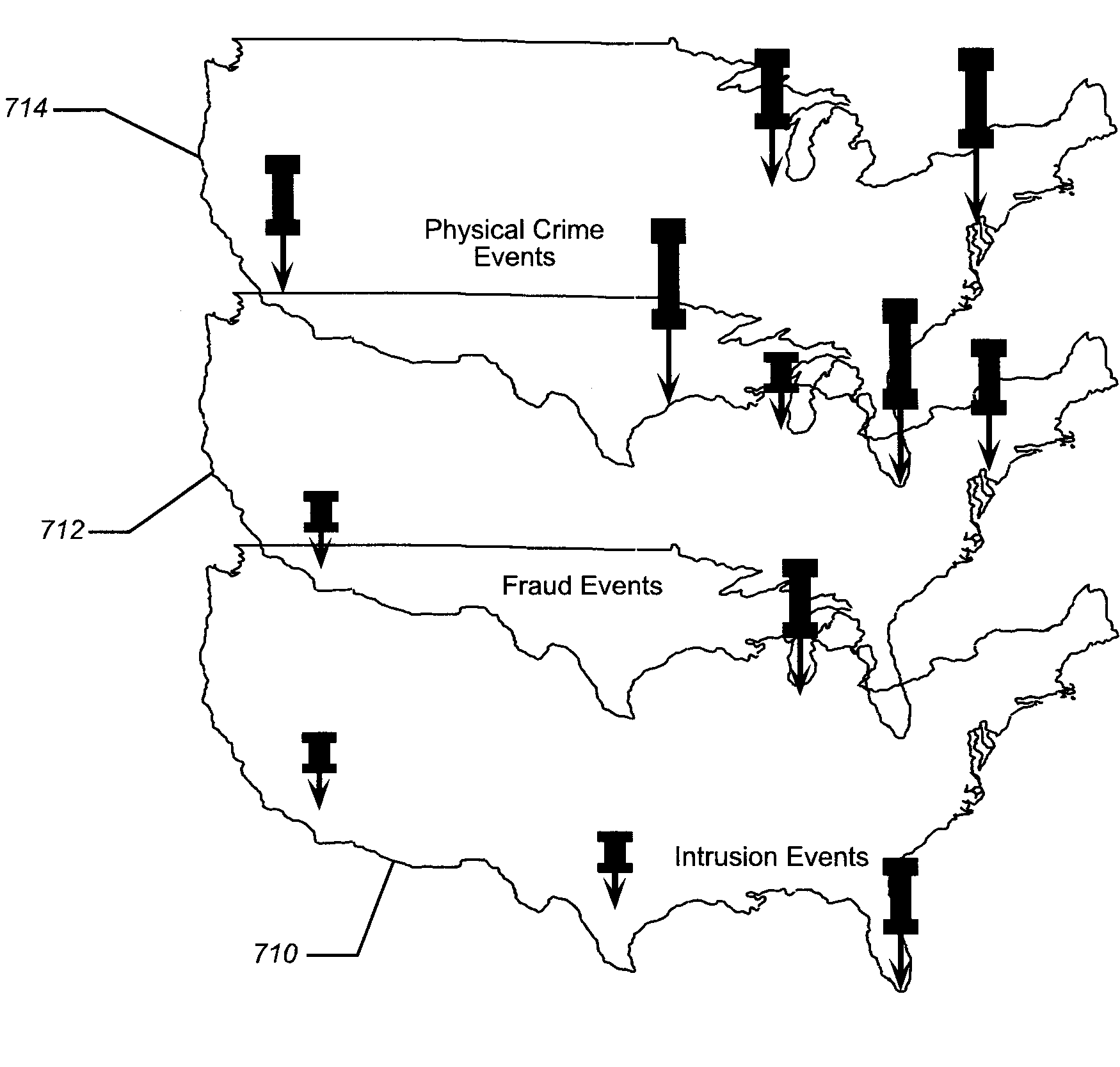

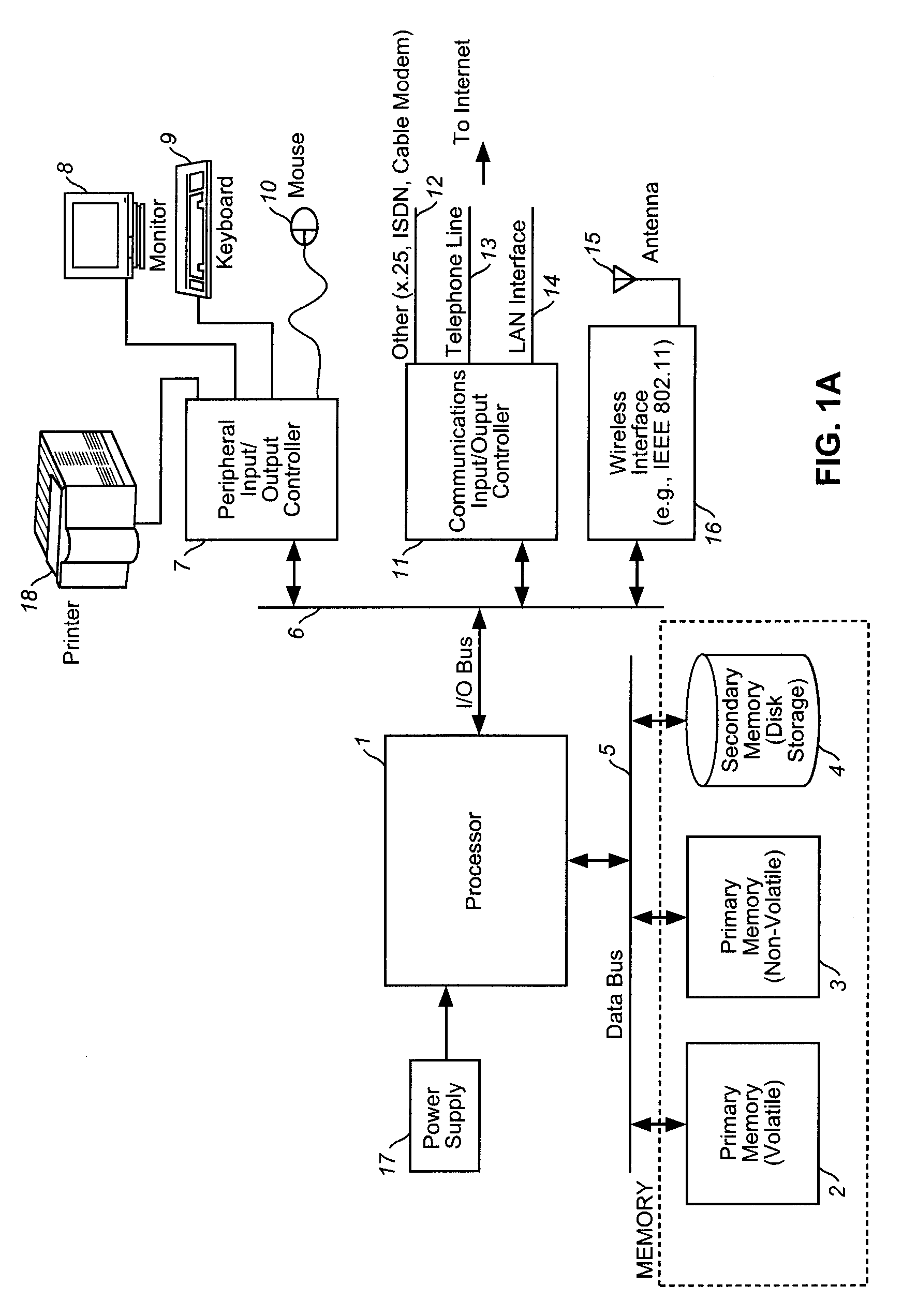

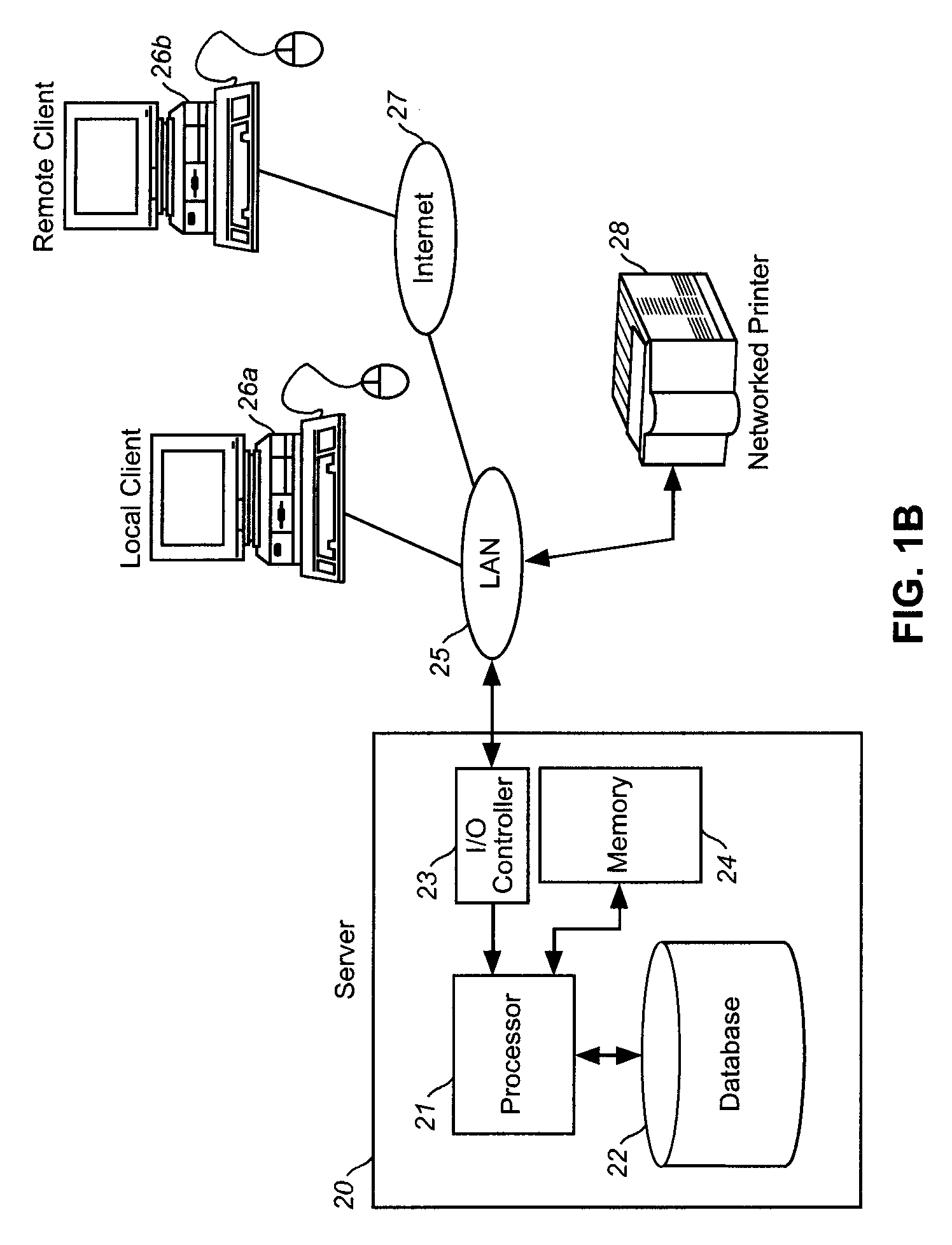

Layered Graphical Event Mapping

InactiveUS20080162556A1Computer security arrangementsSpecial data processing applicationsDisplay deviceCheque

A system, method and computer program product for graphically overlaying multiple types of events in order to facilitate determining one or more courses of action are each disclosed. Events are received from an event detection system or from another source, correlated with an address or location, and representatively mapped on an electronic map configured to be displayed on a display device. Mapped events may include cyber attacks or intrusions, credit card fraud based on the location of use of the credit card, check (and check-card) fraud based on usage location, 911 calls, law enforcement demographic data, and telecommunications based fraud.

Owner:VERIZON PATENT & LICENSING INC

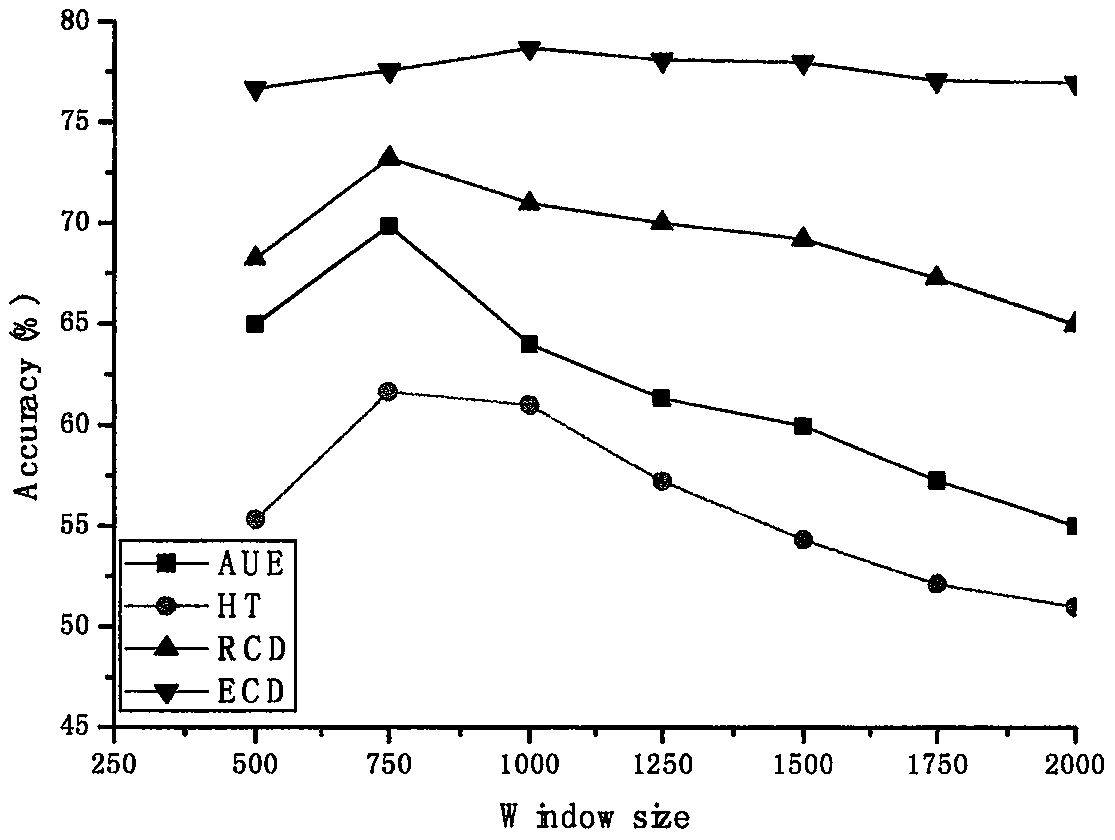

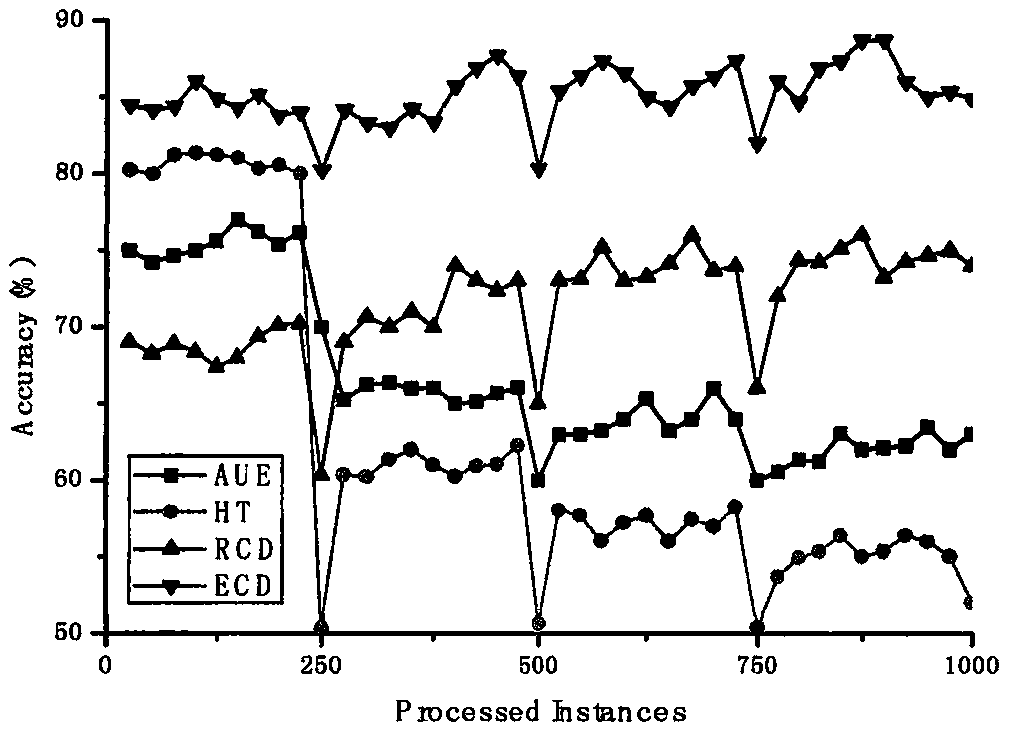

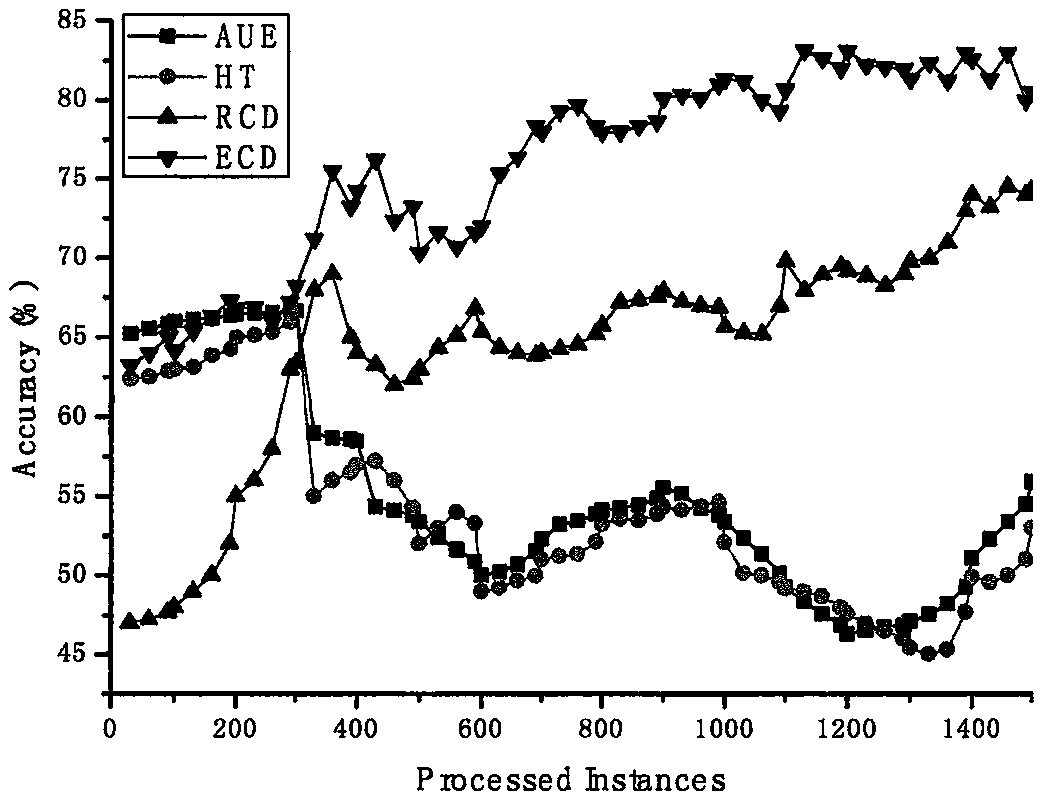

Information entropy-based self-adaptive integrated classification method of data streams

The invention discloses an information entropy-based self-adaptive integrated classification method of data streams. Concept drift can be detected, and duplicate concepts can also be identified. In asystem, a new classifier is reconstructed and put into a classifier pool only when existence of a new concept is detected, the problem of duplicate training caused by duplicate concept appearance is prevented, model updating frequency is reduced, and real-time classification ability and classification effect of a model are improved. Through carrying out performance analysis comparison with classical data stream algorithms on a synthetic dataset and a real dataset, experiments show that the method of the invention can cope with multiple types of concept drift, improves anti-noise ability of theclassification model, and also has lower time cost consumption on the premise of ensuring higher classification accuracy. The method of the invention can be applied to many practical problems of sensor network anomaly detection, credit-card fraud behavior detection, weather forecasting, electricity price prediction and the like.

Owner:XINYANG NORMAL UNIVERSITY

Watermark Systems and Methods

InactiveUS20070183623A1Television system detailsCharacter and pattern recognitionPersonalizationControl software

A number of novel watermarking applications, and improvements to watermarking methods, are disclosed. Included are techniques for encoding printed circuit boards and street signs with watermarks, deterring credit card fraud and controlling software licensing using watermarks, registering collectibles via watermarks, encoding the margins of printed pages with watermarks, and using watermarks to convey extra information in video by which fidelity of the rendered video may be improved. One particular arrangement is a method in which a PDA, wristwatch, or other portable device with a display screen presents a pattern that includes a machine-readable identifier. This image is sensed by a separate device, such as a webcam or a camera-equipped cell phone. The sensing device can then take an action based on the identifier. In some arrangements, the action is personalized to the user.

Owner:DIGIMARC CORP

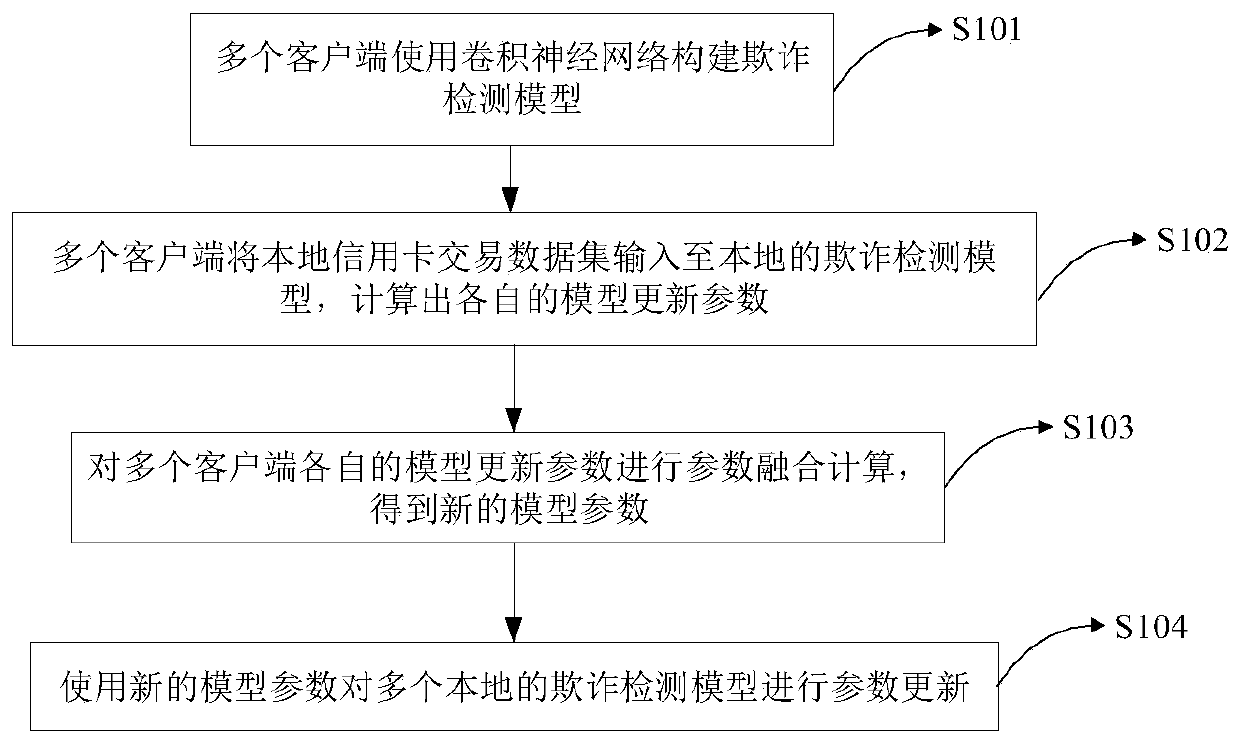

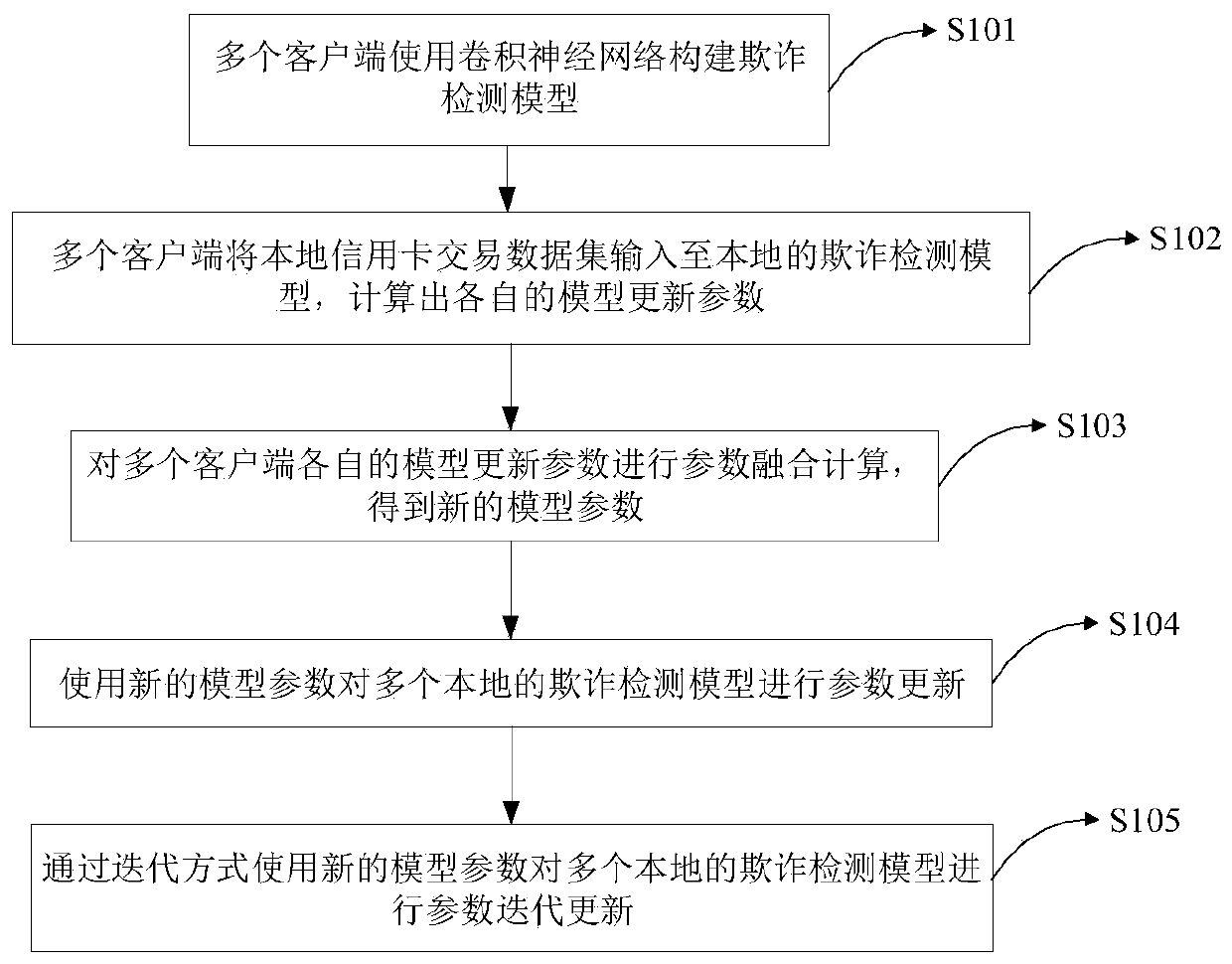

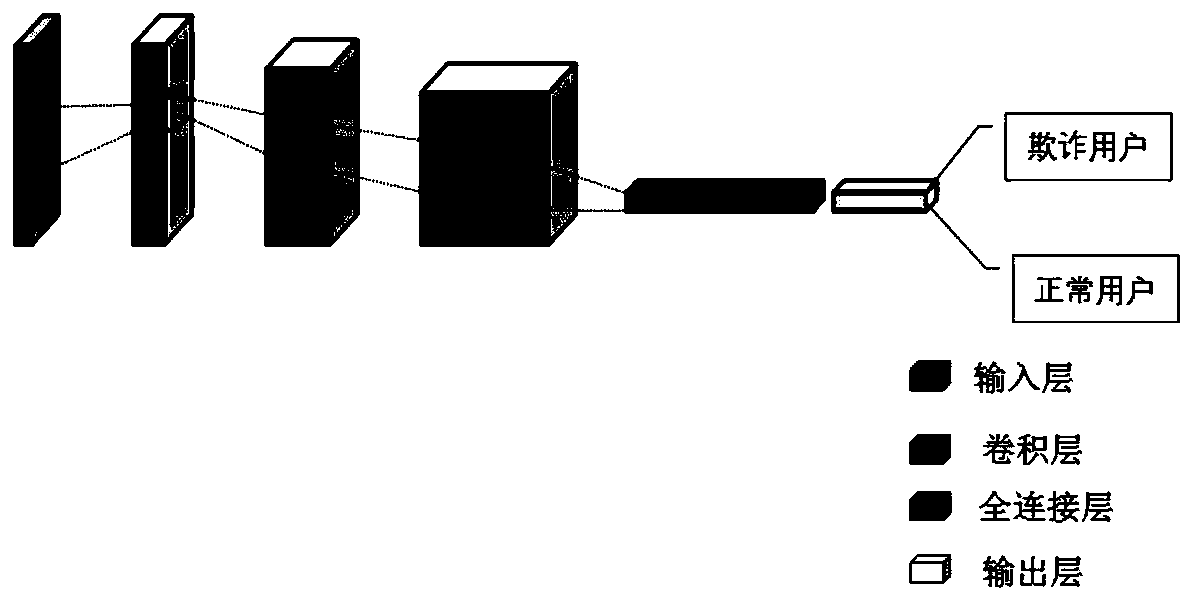

Credit card fraud detection model updating method and device based on joint learning

PendingCN111325619AImprove modeling efficiencyFinanceCharacter and pattern recognitionData setData information

The invention relates to the field of credit cards, and particularly relates to a credit card fraud detection model updating method and device based on joint learning. The method comprises the following steps: firstly, constructing a fraud detection model by using a convolutional neural network; inputting the local credit card transaction data set into a local fraud detection model; calculating respective model updating parameters; and performing parameter fusion calculation on the plurality of model updating parameters to obtain new model parameters, performing parameter updating on a plurality of local fraud detection models by using the new model parameters, and training and updating own fraud detection models by means of data information of other clients in a form of sharing the modelparameters by different clients. And the model efficiency is improved on the premise of protecting the data privacy of each client from being invaded.

Owner:SHENZHEN INST OF ADVANCED TECH

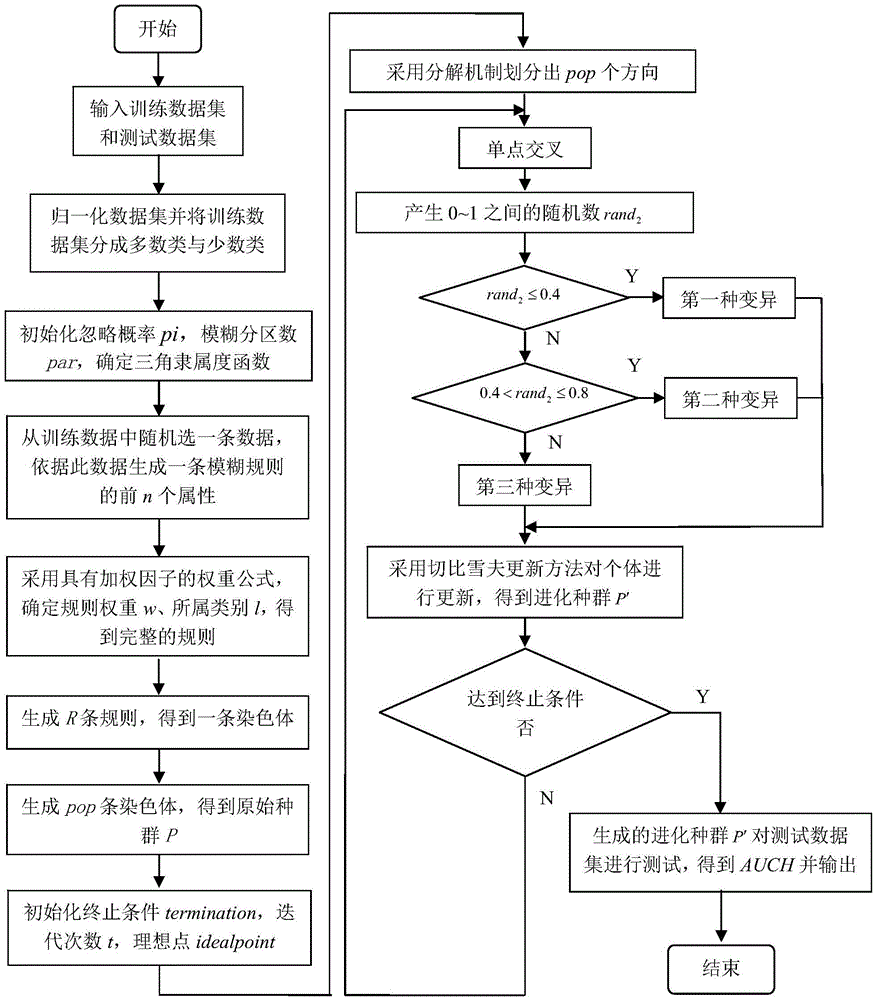

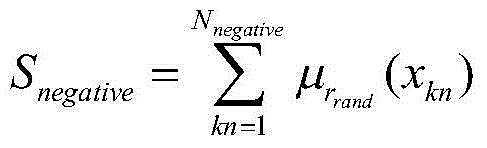

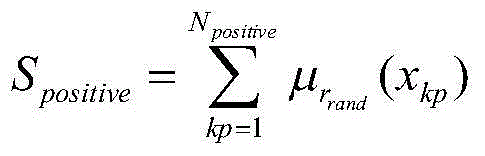

Multi-target evolutionary fuzzy rule classification method based on decomposition

ActiveCN104809476ASpeed up evolutionBalance imbalanceGenetic modelsCharacter and pattern recognitionData setMajority class

The invention discloses a multi-target evolutionary fuzzy rule classification method based on decomposition, which mainly solves the problem of poor classification effect of an existing classification method on unbalanced data. The multi-target evolutionary fuzzy rule classification method comprises the steps of: obtaining a training data set and a test data set; normalizing and dividing the training data set into a majority class and a minority class; initializing an ignoring probability, a fuzzy partition number and a membership degree function; initializing an original group, and determining weight by adopting a fuzzy rule weight formula with a weighting factor; determining stopping criteria for iteration, iteration times, a step size and an ideal point; dividing direction vectors according to groups; performing evolutionary operation on the original group, and updating the original group by adopting a Chebyshev update mode until the criteria for iteration is stopped; obtaining classification results of the test data set; then projecting to obtain AUCH and output. The multi-target evolutionary fuzzy rule classification method has the advantages of high operating speed and good classification effect and can be applied in the technical fields of tumor detection, error detection, credit card fraud detection, spam messages recognition and the like.

Owner:XIDIAN UNIV

Method for Financial Fraud Prevention Through User-Determined Regulations

InactiveUS20160371699A1Improving authentication and verificationLimited abilityCredit schemesProtocol authorisationPayment transactionTransaction data

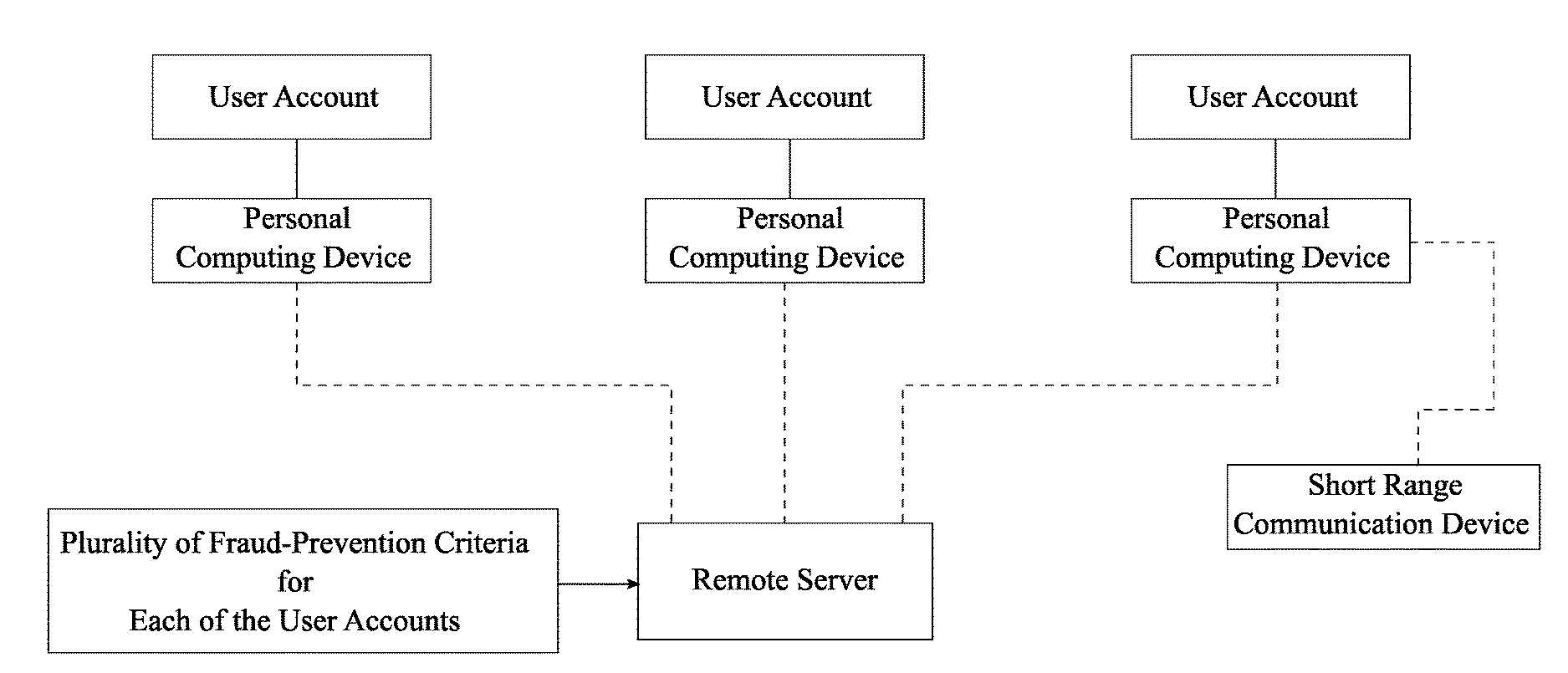

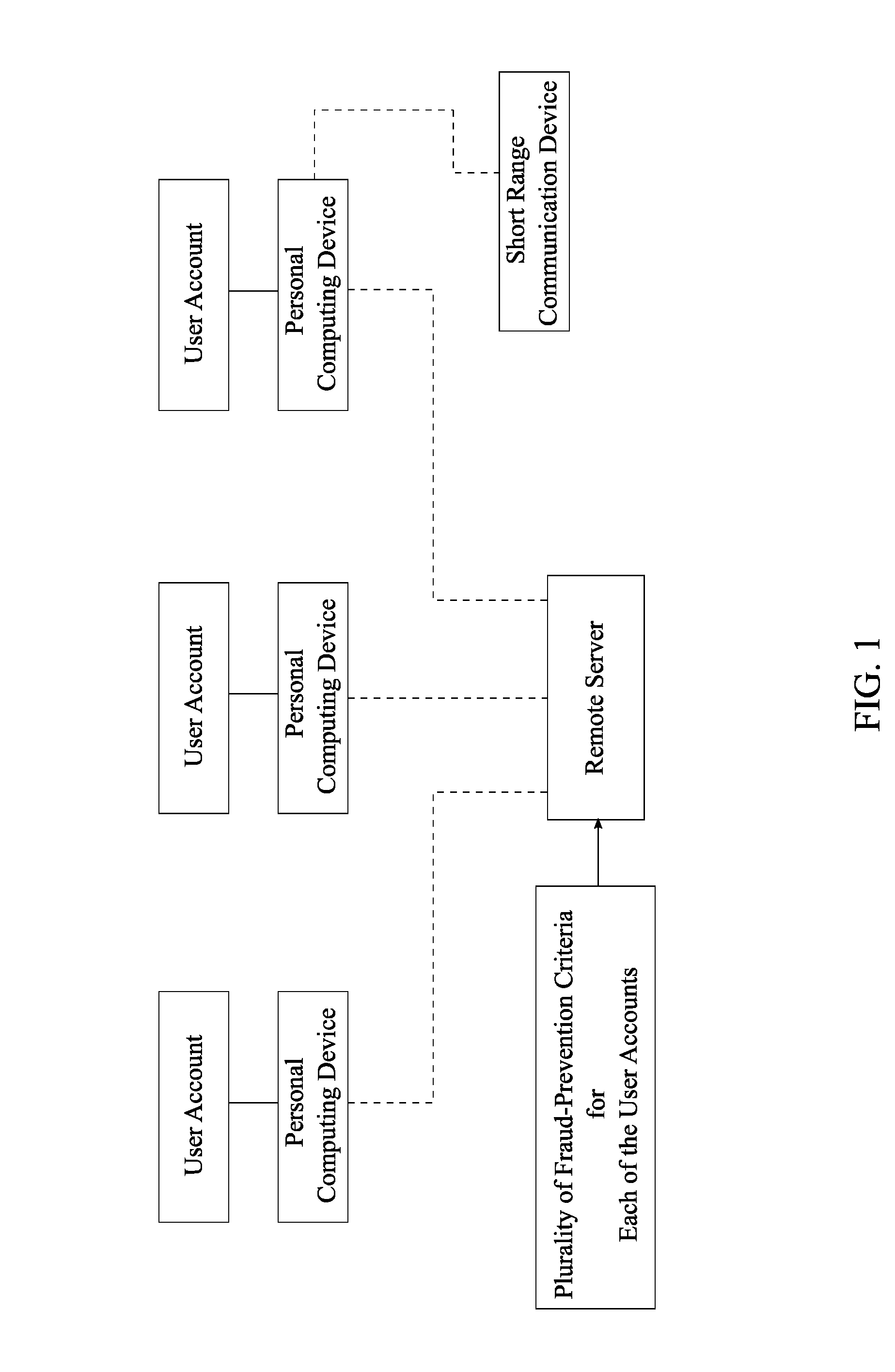

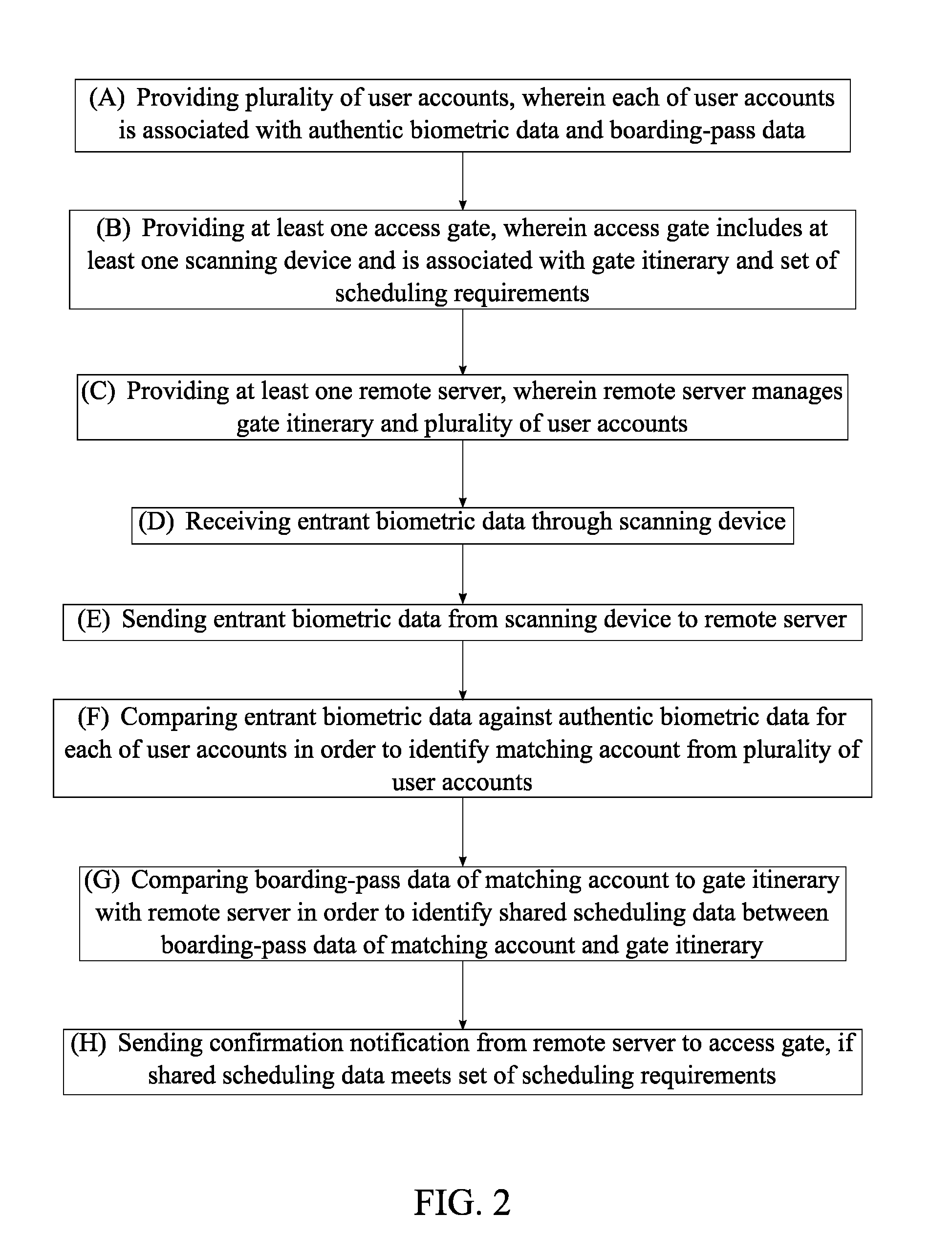

A credit card fraud-prevention system which allows user accounts to customize a personal portfolio to monitor their individual transactions. The system allows each user account to pick a plurality of fraud-prevention criteria to monitor a payment card(s). The overall process begins with receiving payment transaction data with a remote server. A matching account is then identified for the payment transaction data by searching through a card identification information of each user account. Once the matching account is identified, the remote server then compares the payment transaction data to each fraud-prevention criteria in order to identify a met criterion. If the met criterion is not identified, then the payment transaction data is verified and sent to financial entities. If the met criterion is identified, then a predefined response of the met criterion is executed. This includes notifying the matching account about the possible fraudulent activity and requesting verification for the transaction.

Owner:PROCTOR REGINAL ROBERT

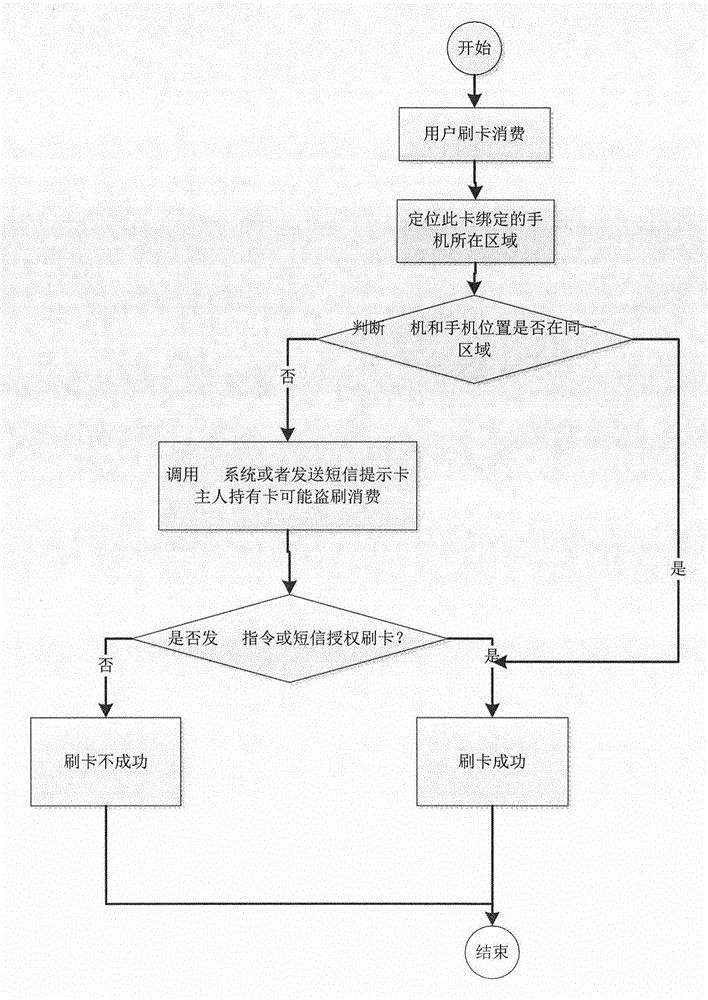

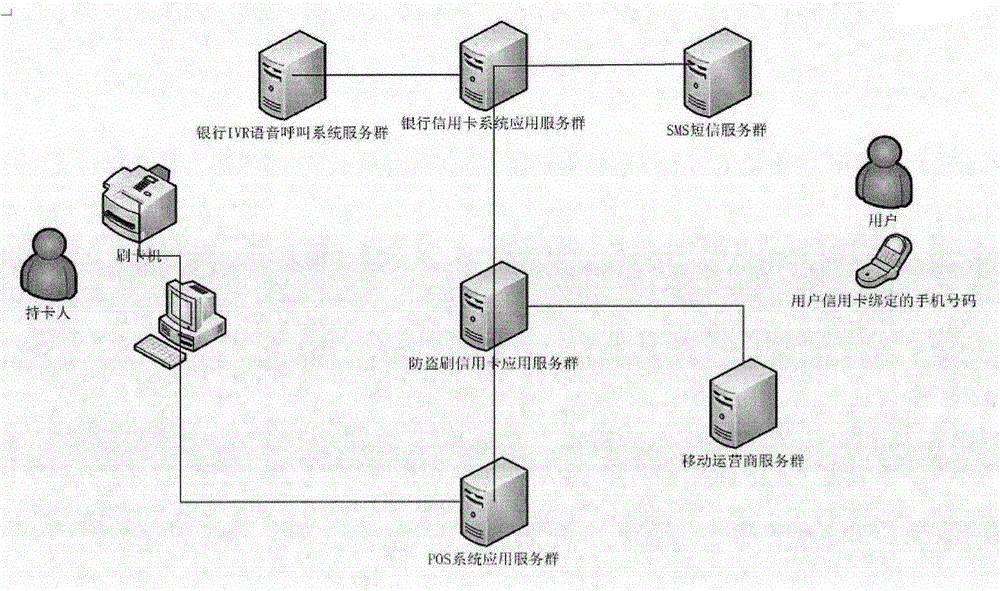

Bank card (credit card and debit card) credit card fraud prevention method and system

InactiveCN106157033APrevent theftProtect interestsProtocol authorisationMobile Telephone NumberKey pressing

The present invention provides a bank card credit card fraud prevention method. The method comprises the following steps: when a bank card holder brushes a card, the bank card is located according to the position of a card pose, an area A is determined; corresponding bank card user's phone number is read in the bank card system database of the bank through a financial bank center; a location access of a communication service provider position service platform is called, the position of the phone number is located, an area B is determined; when the area A is the same as the area B, the card is brushed, when the area A and the area B are not located at the same area, the financial bank center is configured to call a financial bank voice IVR system or a manual calling user, or call a financial bank message SMS system to send message to a user's phone for notifying user that the bank card may be stolen; and if the credit card fraud is discovered by the user, it is determined whether the card brush is permitted or not through a button instruction or an assigned message is sent to the financial bank message SMS system to realize alarm or freezing the card in the guidance of the financial bank voice IVR system.

Owner:SHENZHEN WEIZHIWANG TECH CO LTD

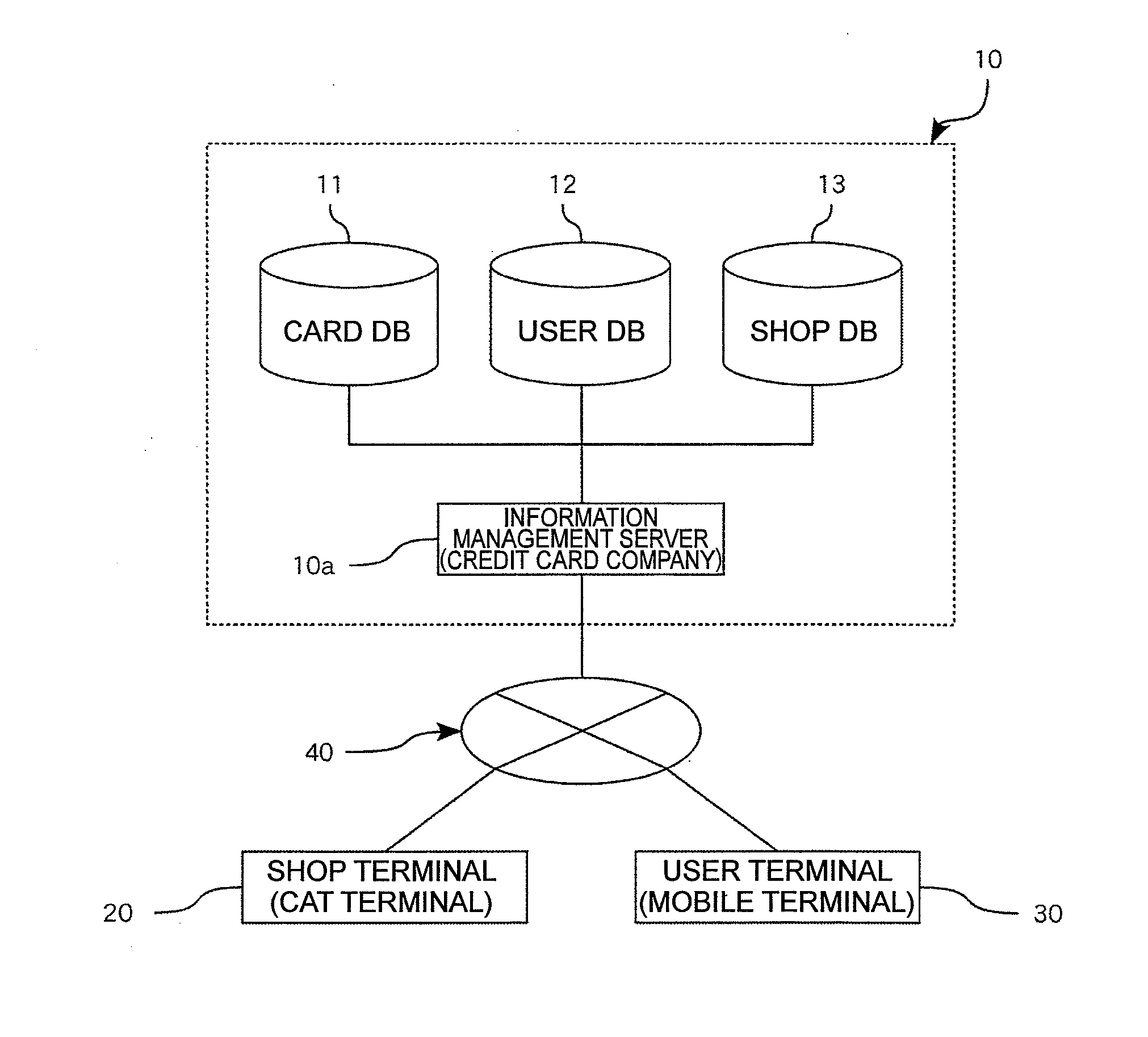

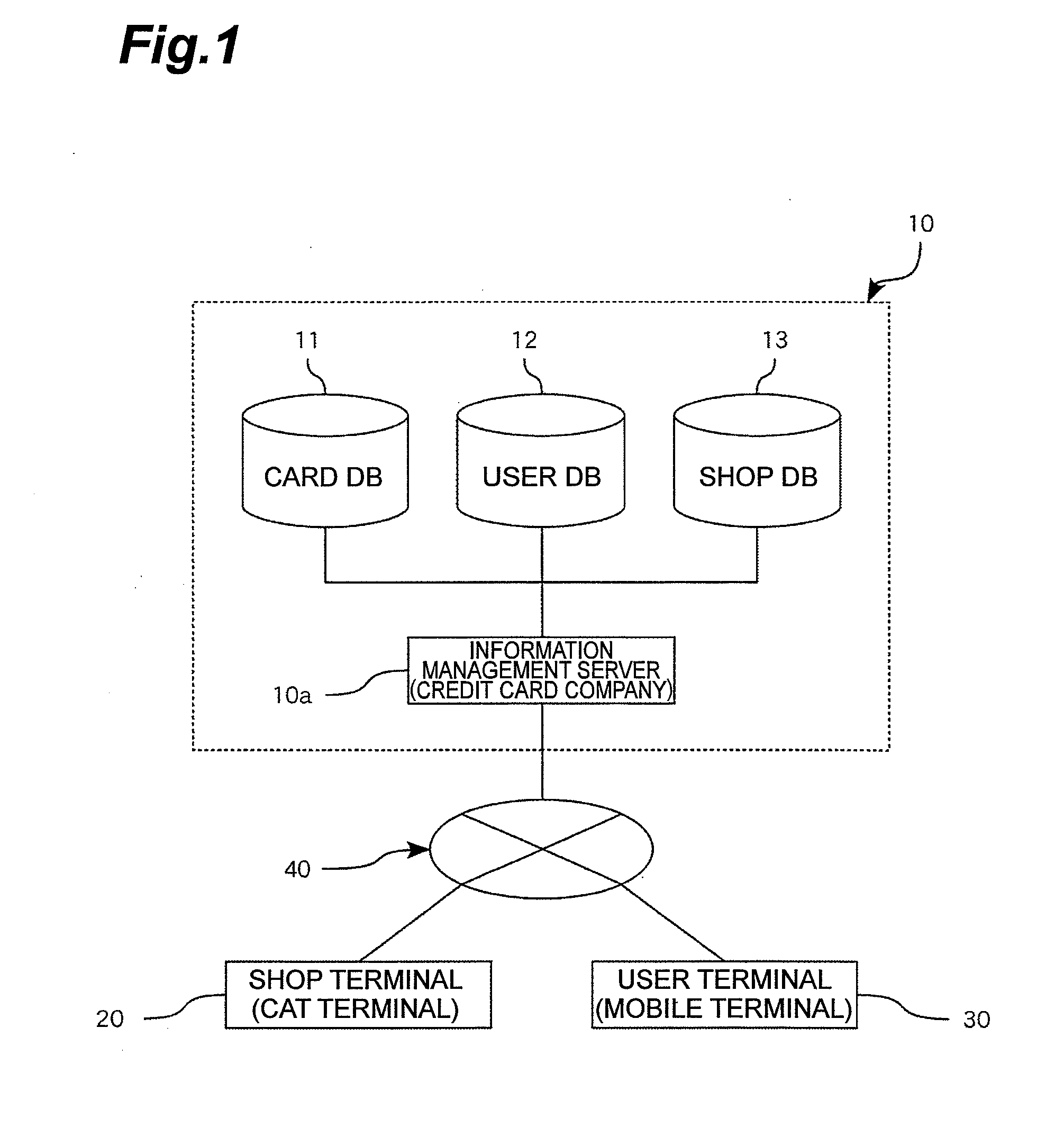

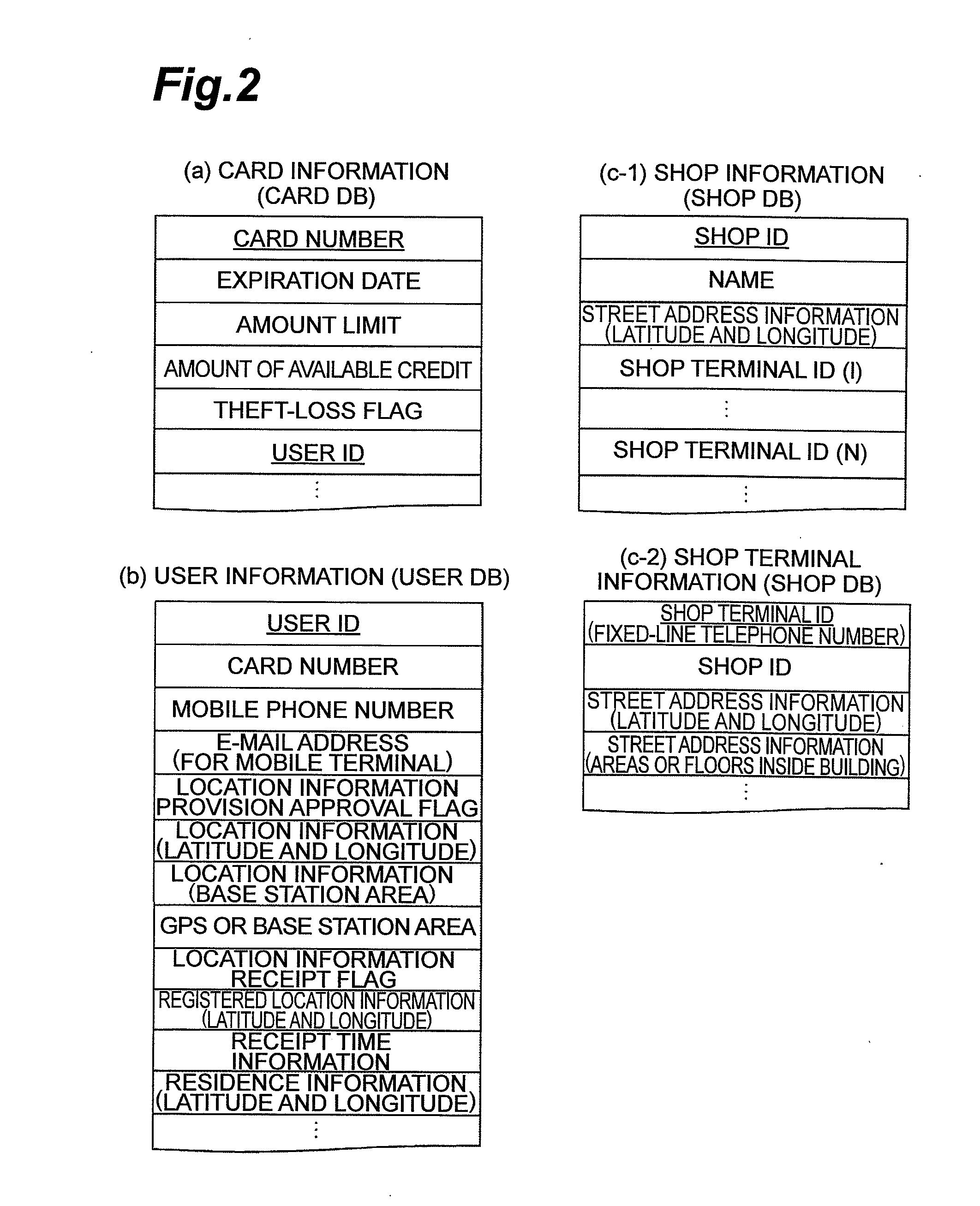

Credit card fraud prevention system

ActiveUS20120246076A1Prevent fraudulent useFinanceLocation information based serviceUser identifierComputer science

An object of the present invention is to prevent a fraudulent use of a credit card such as spoofing.A server receives a card ID of a credit card, a credit amount, and a terminal ID for identifying a shop terminal from a shop terminal (S102), to start credit processing. The server acquires a corresponding user ID from the card ID (S104), to find out whether this user has approved that location information can be acquired from his / her mobile terminal (S106). In the case where the user has approved that location information is acquired in advance (OK at S106), the server acquires a mobile phone number from the user ID (S108), to know a location of the mobile terminal with use of this mobile phone number (S110). Area information of a base station in which the mobile phone resides is provided in the case where the mobile terminal is not equipped with a GPS function. The server acquires a shop ID from the terminal ID (fixed-line telephone number) of the shop terminal (S112), to be able to acquire a shop location from the shop ID (S114). The server compares the location of the mobile terminal and the location of the shop, to judge whether or not conformance is made with a predetermined condition (S116). In the case where it is judged that conformance is made with the condition (OK at S116), the server makes a normal credit judgment (S118), thereby sending a reply (availability / unavailability information) to the credit inquiry (S120 or S122).

Owner:RAKUTEN GRP INC

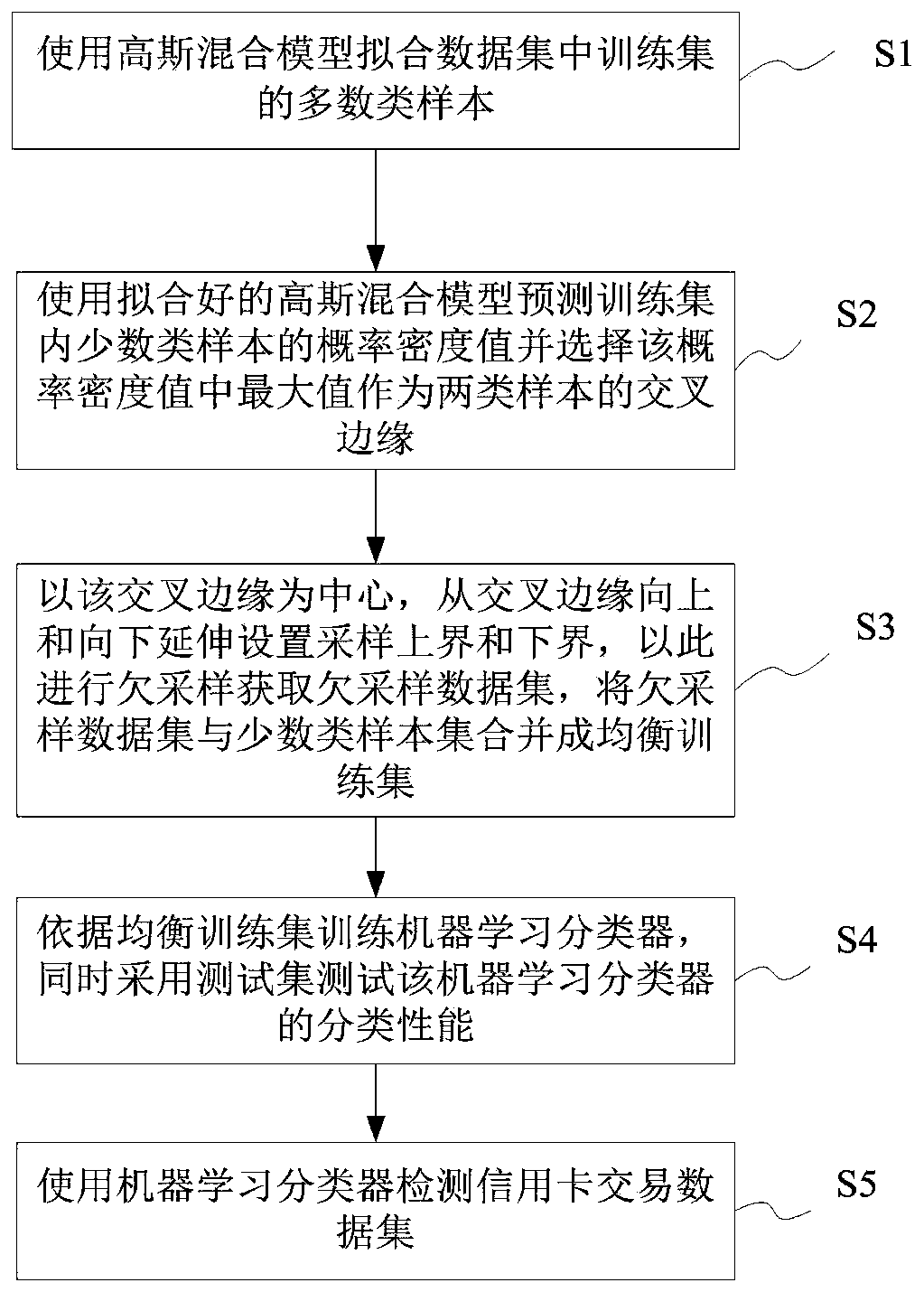

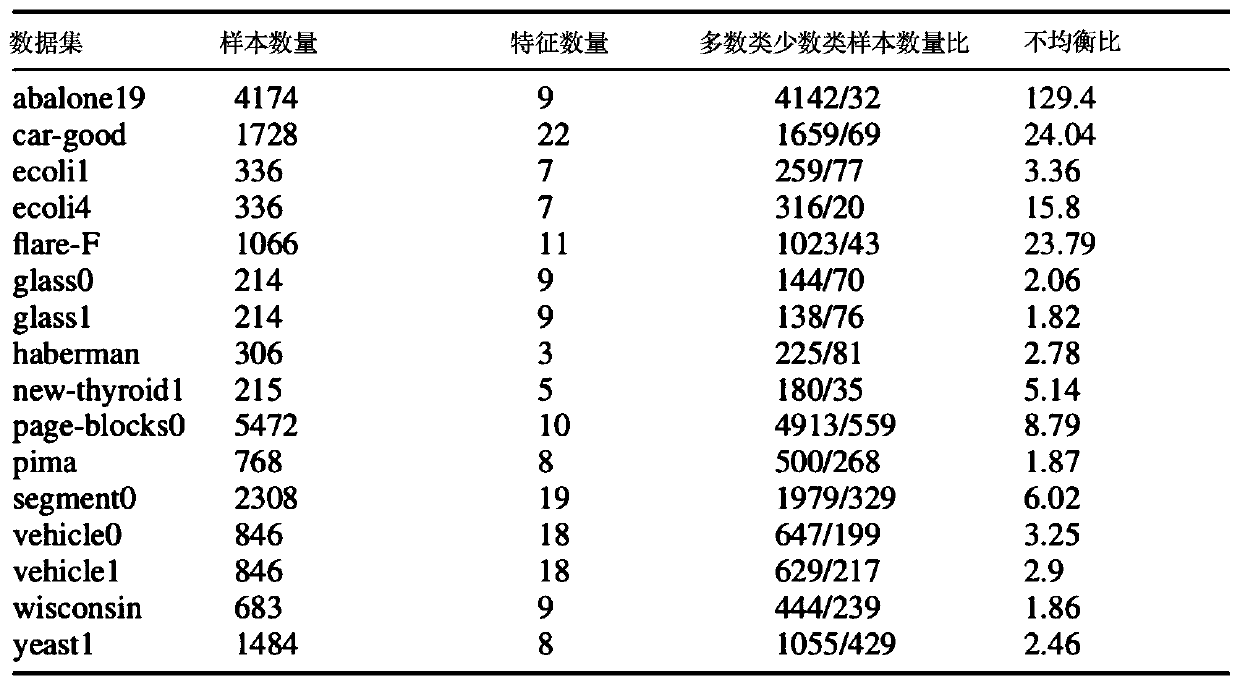

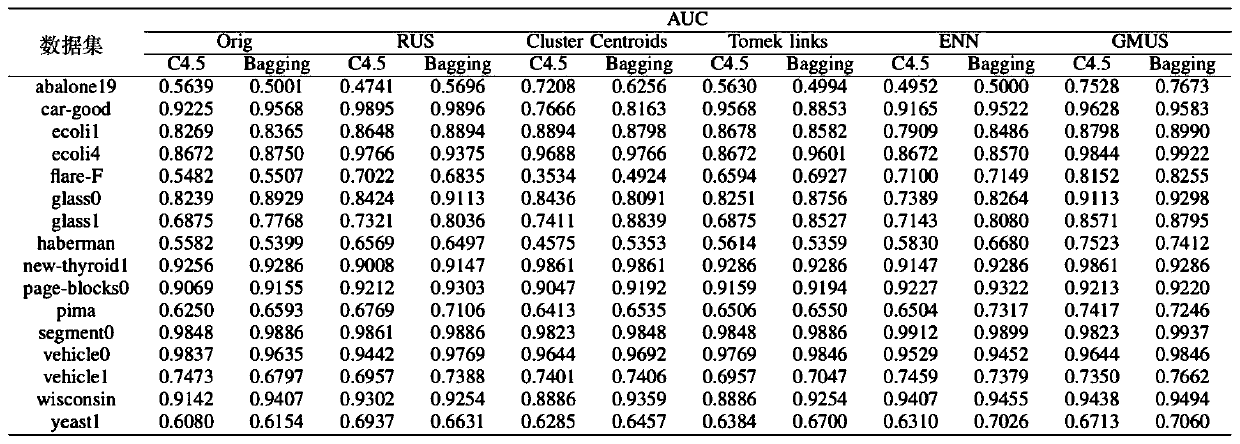

Credit card fraud detection method and system based on undersampling, medium and equipment

ActiveCN111461855AImplement preprocessingMake up for deficienciesInternal combustion piston enginesFinanceData setAlgorithm

The invention provides a credit card fraud detection method and system based on undersampling, a medium and equipment. The method comprises: fitting majority class samples of a training set in a dataset by using a Gaussian mixture model; predicting probability density values of minority class samples in the training set by using the fitted Gaussian mixture model, and selecting a maximum value inthe probability density values as a cross edge of the two classes of samples; taking the cross edge as a center, extending upwards and downwards from the cross edge to set a sampling upper bound and asampling lower bound so as to carry out undersampling to obtain an undersampling data set, and combining the undersampling data set with the minority class sample set to form an equalization trainingset; training a machine learning classifier according to the balanced training set; and detecting a credit card transaction data set by using the trained machine learning classifier. The Gaussian mixture model is used for grabbing the samples with the two types of samples distributed at the crossed edges, more useful information is provided for recognition of the two types of samples, and the recognition accuracy of the classifier in the field of credit card fraud detection is improved.

Owner:TONGJI UNIV

Credit card fraud prevention verification method and apparatus

ActiveCN107529078APrevent theftIncrease attractivenessSelective content distributionAudience participationValidation methods

The invention provides a credit card fraud prevention verification method and apparatus. A client validity verification scheme is set according to gift taking times, audience participation or automatic verification modes are set for different gift taking times, the clients having greater gift taking times can be managed and controlled to prevent hikers or artisans from brushing the gifts by using software tools, more audience taking the gifts have the opportunity to obtain the gifts, accordingly more audience participate in the live broadcast activity, and the attraction of the live broadcast platforms and the user experience are improved.

Owner:WUHAN DOUYU NETWORK TECH CO LTD

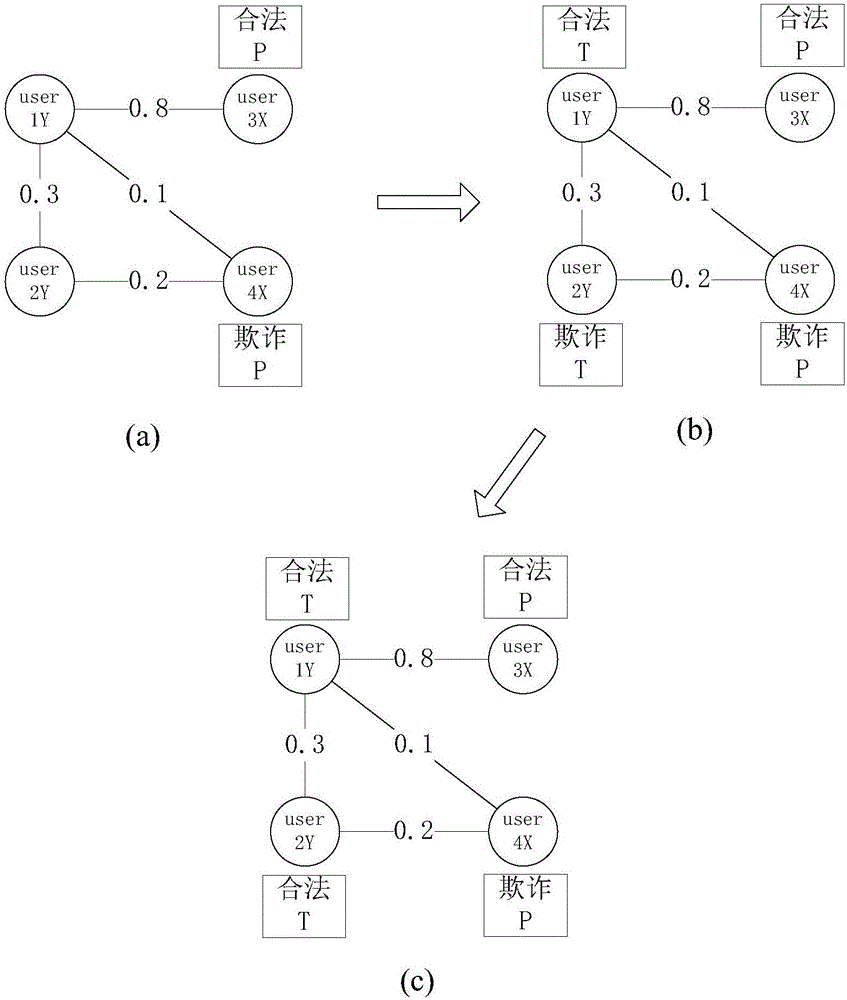

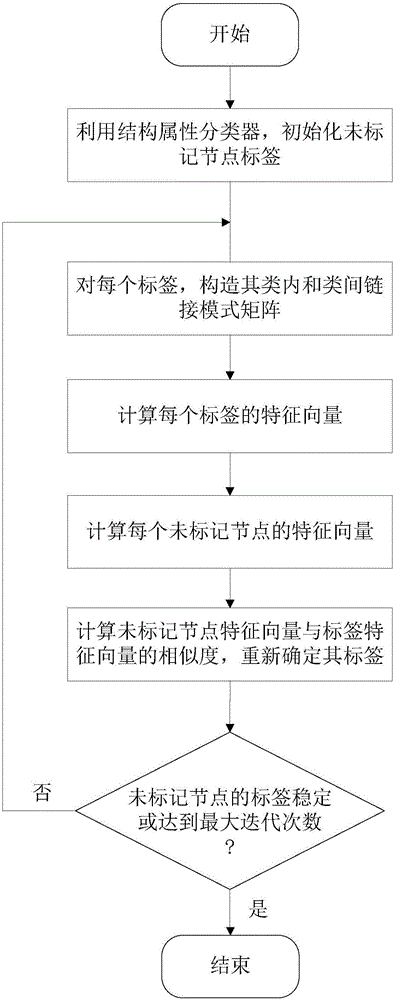

Credit card fraud prediction method based on signal transmission and link mode

InactiveCN105894038AStrong dependenceReduce dependenceCharacter and pattern recognitionFeature vectorCosine similarity

The invention discloses a credit card fraud prediction method based on a signal transmission and link mode. The credit card fraud prediction method includes the steps of firstly, constructing a structure attribute classifier based on a signal transmission idea, and initializing a label for each unlabelled node; then, conducting iterative calculation for the following process until the labels of the unlabelled nodes are stabilized or the maximum number of iterations is reached; extracting a sub-graph of each label from a graph, and constructing intra-class and inter-class link mode matrixes; next, combining a mean aggregate function, and calculating a feature vector of each label and a feature vector of each unlabelled node; and for each unlabelled node, calculating the cosine similarity between the feature vector thereof and the feature vector of each label, wherein the label of each node is assigned as a label corresponding to the feature vector with the maximum similarity. By applying a collaborative inference mechanism and meanwhile considering the label and unlabelled node information, the invention reduces the dependence on the label information, and has a very important practical significance in the study of credit card fraud prediction.

Owner:TIANYUN RONGCHUANG DATA TECH BEIJING CO LTD

Credit card fraud prevention system and method

A mobile computing device is adapted to transmit to a scoring server URLs of websites browsed using the device. The scoring server can compare these URLs against a merchant URL obtained within a preselected time period from transaction data resulting from a transaction involving a payment product of the device user. A score can be calculated based on the similarity between each URL obtained from the device and the URL from the transaction data. The score represents the likelihood that a website browsed using the device and, as a result, the transaction, is fraudulent. The browsed URLs can also be scored against a database of known fraudulent websites. A notification concerning the legitimacy of the transaction based on the score can be generated and sent to the mobile device in real-time. On receiving the notification, the device can be used to either accept or decline the transaction in real-time.

Owner:DELOITTE DEV

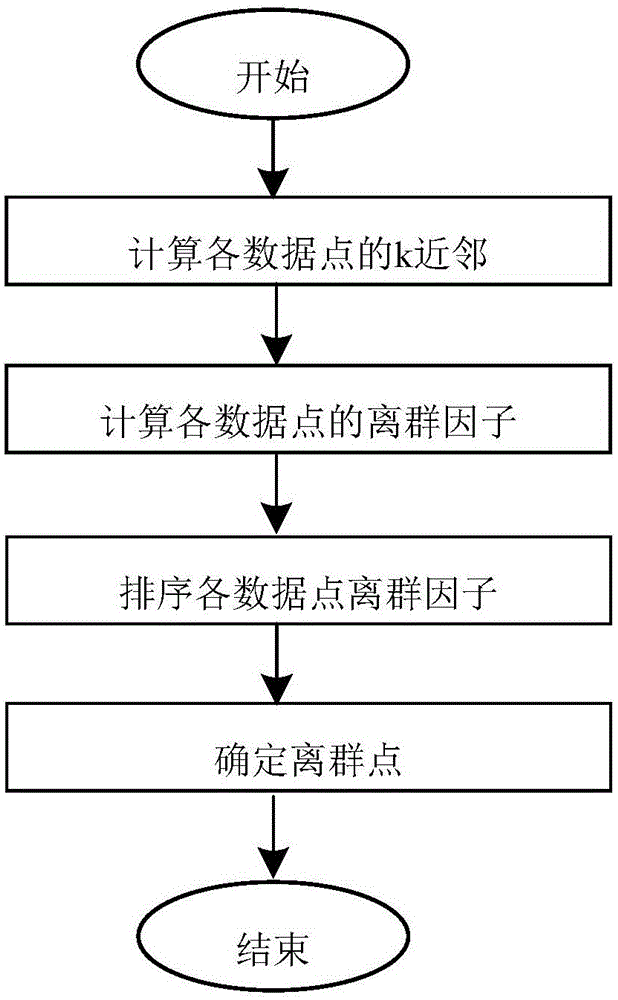

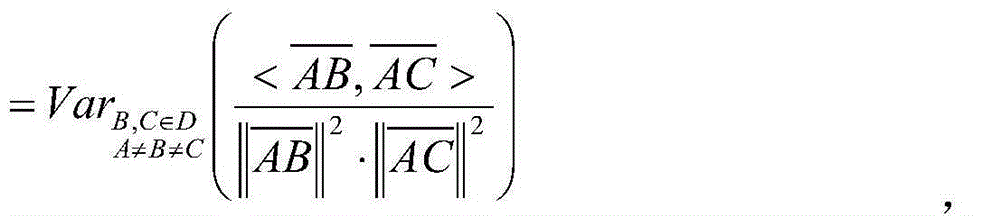

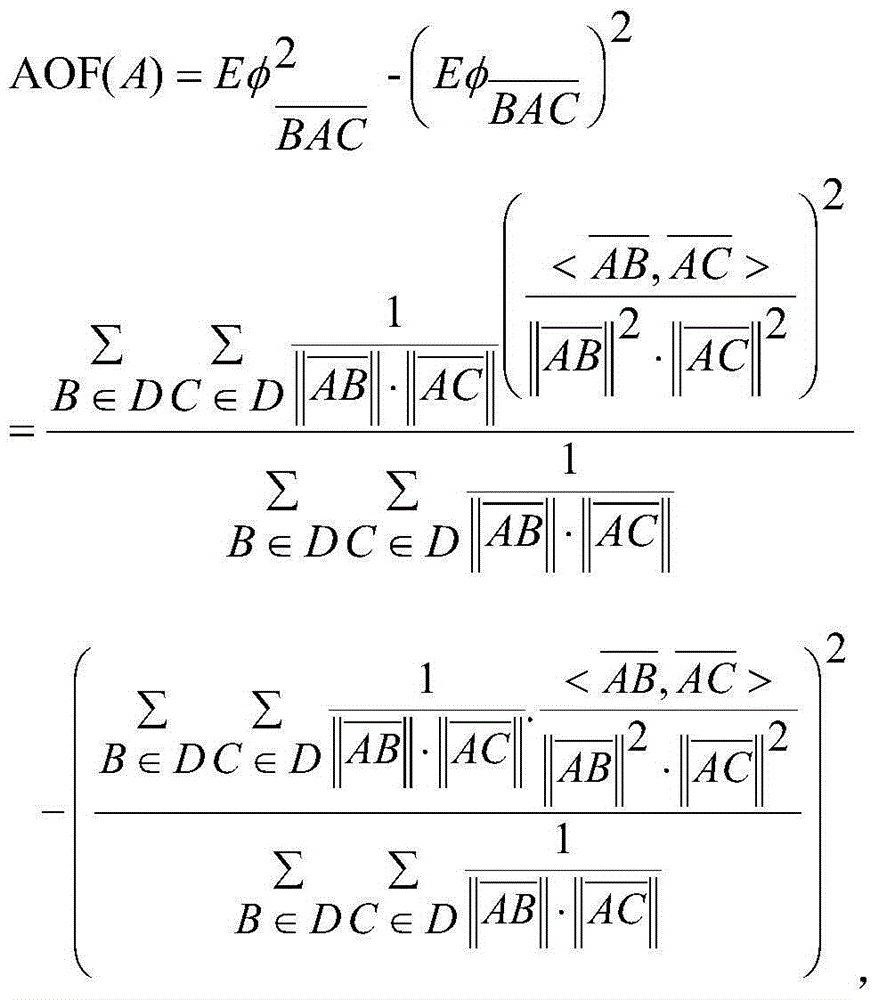

Angle-based high dimensional data outlier detection method

InactiveCN105138641AEfficient discoveryOvercoming the "curse of dimensionality" problemMulti-dimensional databasesSpecial data processing applicationsData setCurse of dimensionality

The invention discloses an angle-based high dimensional data outlier detection method and belongs to the technical field of outlier data mining. The method comprises the specific steps that 1, k nearest neighbour points of each data point A belonging to a data set D are obtained in the data set D; 2, an angle-based outlier factor of each data point is calculated; 3, the outlier factors of the data points are ranked, and a point set with the minimum outlier factor is selected as an outlier point set with the largest data outlier degree; 4, outlier data are determined. According to the method, outlier data concealed in large-scale high dimensional data can be found efficiently and rapidly, the problem of curse of dimensionality of the outlier detection method based on high dimensional distance, nearest neighbour and the like can be effectively solved, and the method can be widely applied in high dimensional data for credit card fraud detection, traffic accident detection, scientific data measurement abnormal detection and the like.

Owner:HOHAI UNIV

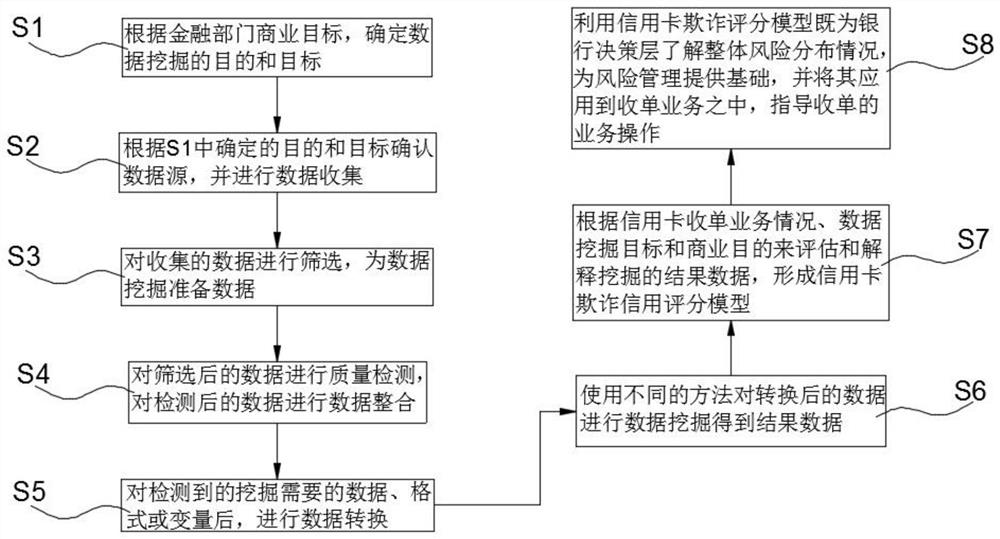

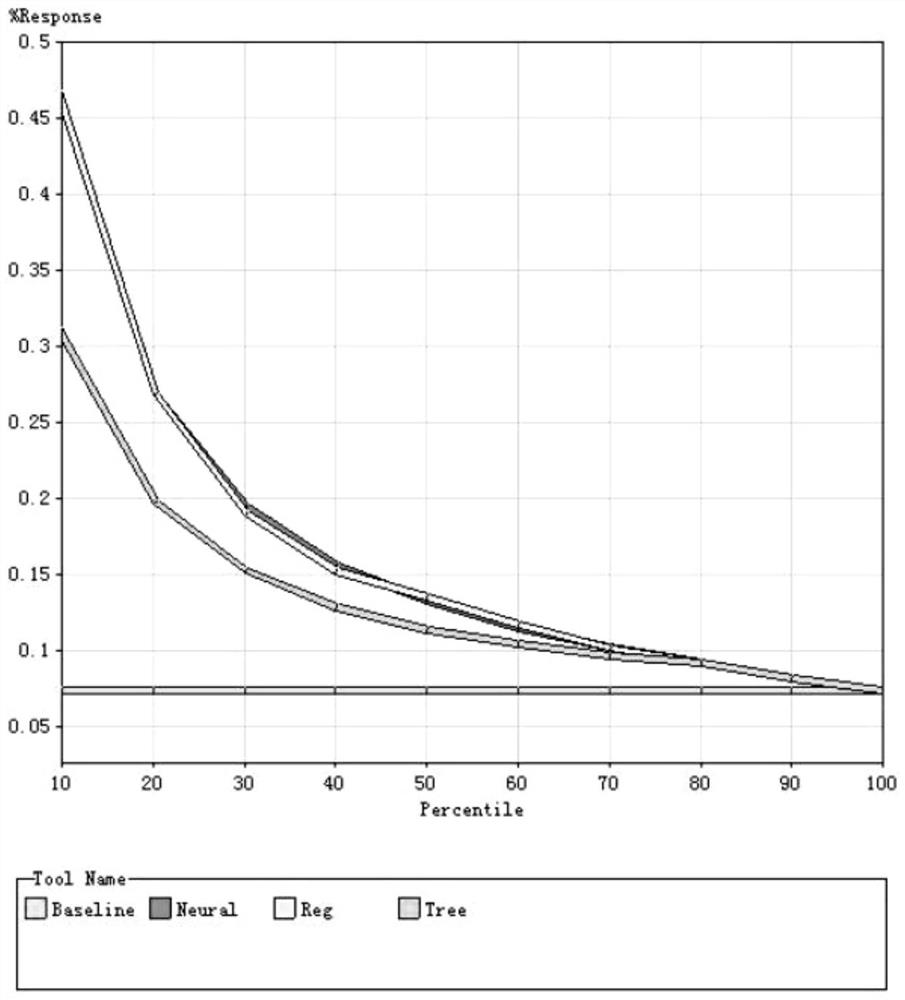

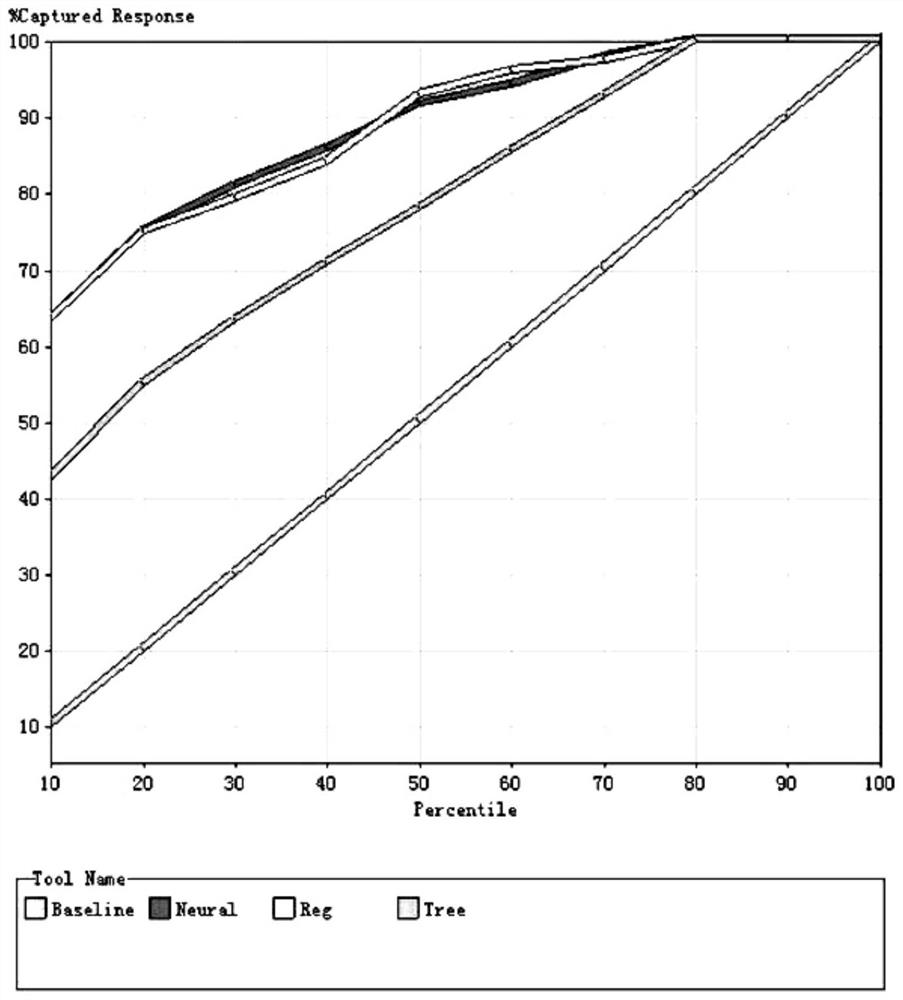

Merchant fraud risk monitoring system and data mining method

The invention relates to the technical field of financial risk control, in particular to a merchant fraud risk monitoring system and a data mining method. The method includes: determining the purposeand target of data mining according to the commercial target of a financial department; confirming a data source according to the purpose and the target, and collecting data; screening the collected data, and preparing data for data mining; carrying out quality detection on the screened data, and carrying out data integration on the detected data; after data, formats or variables needed by miningare detected, carrying out data conversion; performing data mining on the converted data by using different methods to obtain result data. A large amount of credit card transaction data is analyzed through a data mining means, a credit card fraud analysis model is established, credit card transactions with high fraud risks are identified, early warning prompts are given in time, a basis is provided for risk management, or a credit card fraud scoring model is applied to an order receiving service to guide order receiving service operation.

Owner:交通银行股份有限公司上海市分行

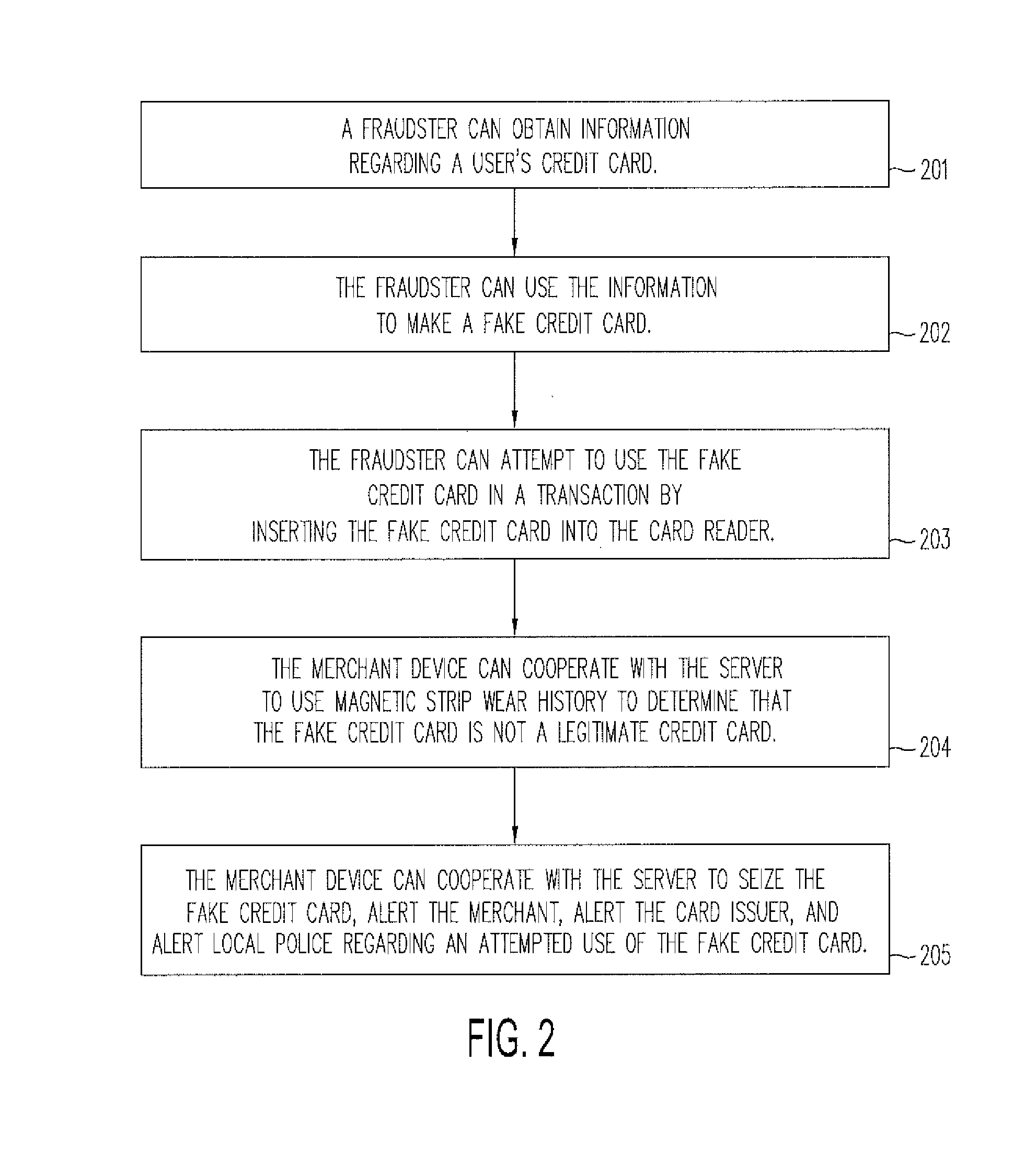

Credit Card Fraud Detection

Methods and systems are provided for detecting and preventing fraudulent use of credit cards and the like. The amount of wear of a magnetic strip of a suspect credit card can be compared to an amount of wear of the magnetic strip of the corresponding legitimate credit card. If the amount of wear of the magnetic strip of the suspect credit card is less than the amount of wear of the magnetic strip of the legitimate credit card, then both the suspect credit card and the legitimate credit card can be deactivated.

Owner:PAYPAL INC

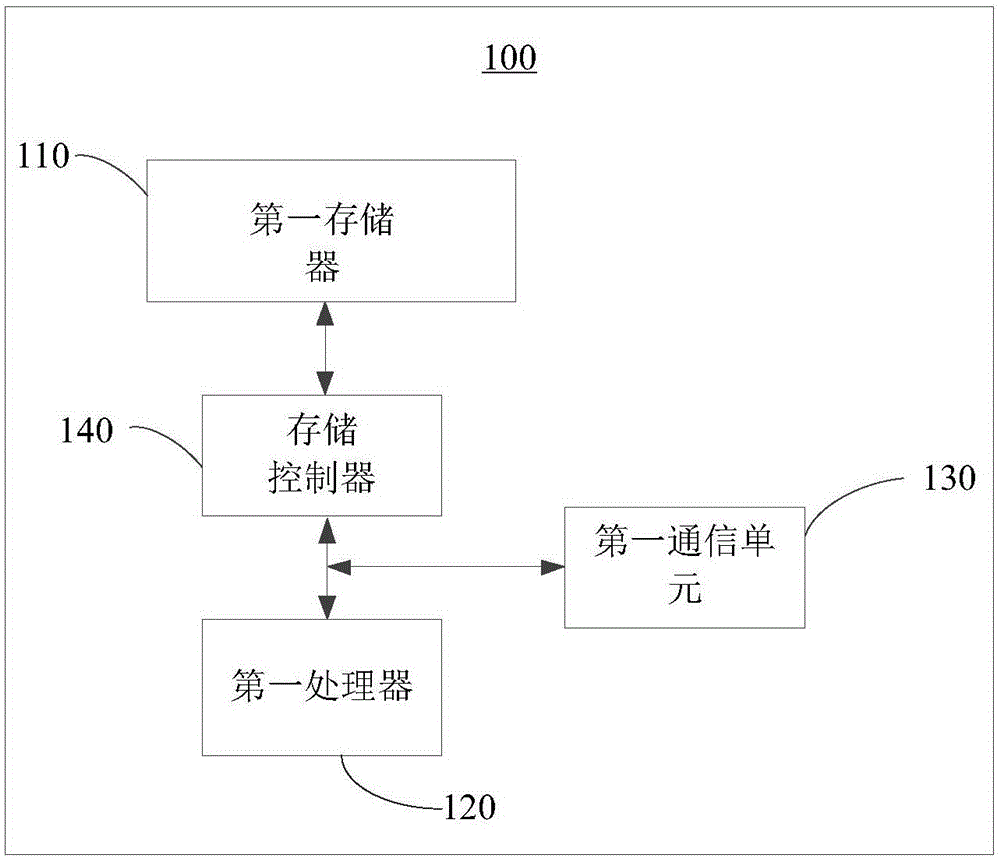

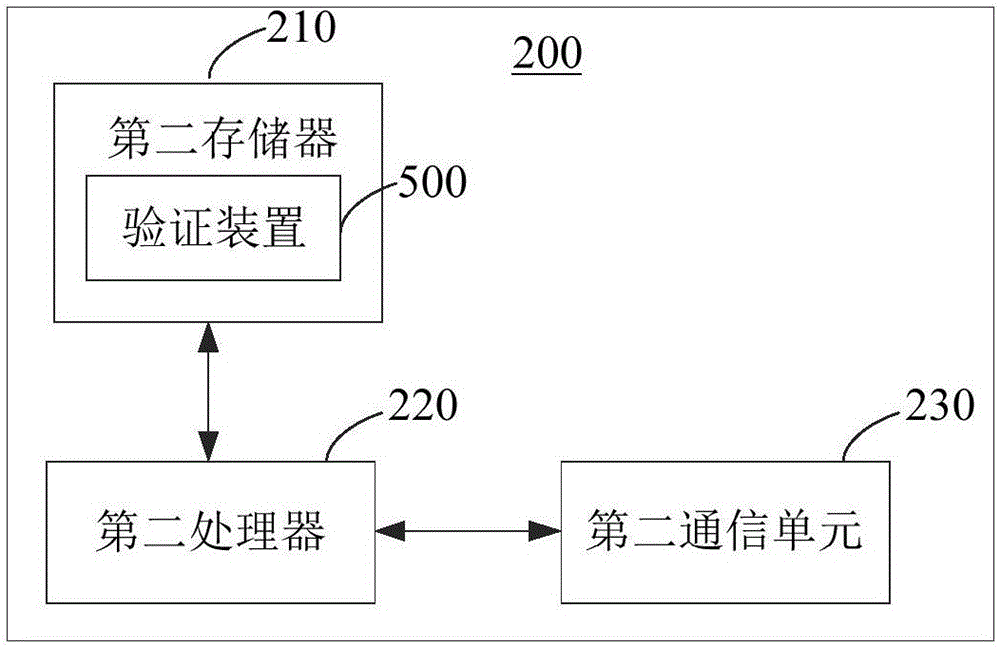

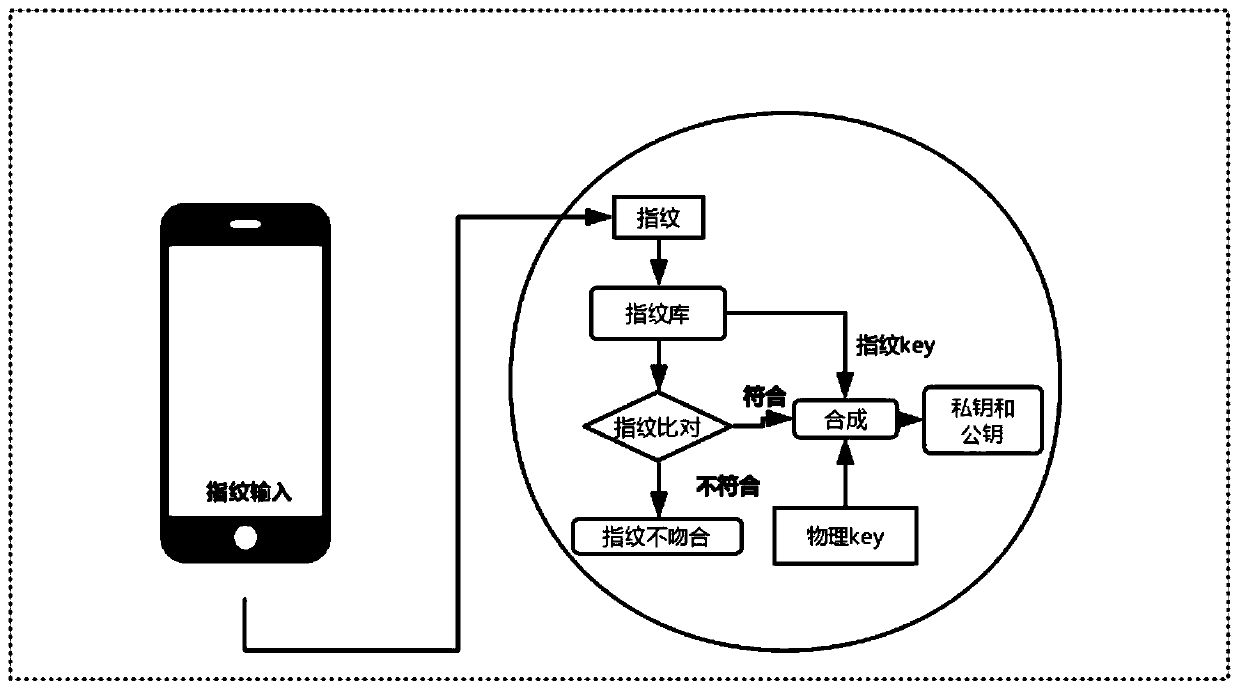

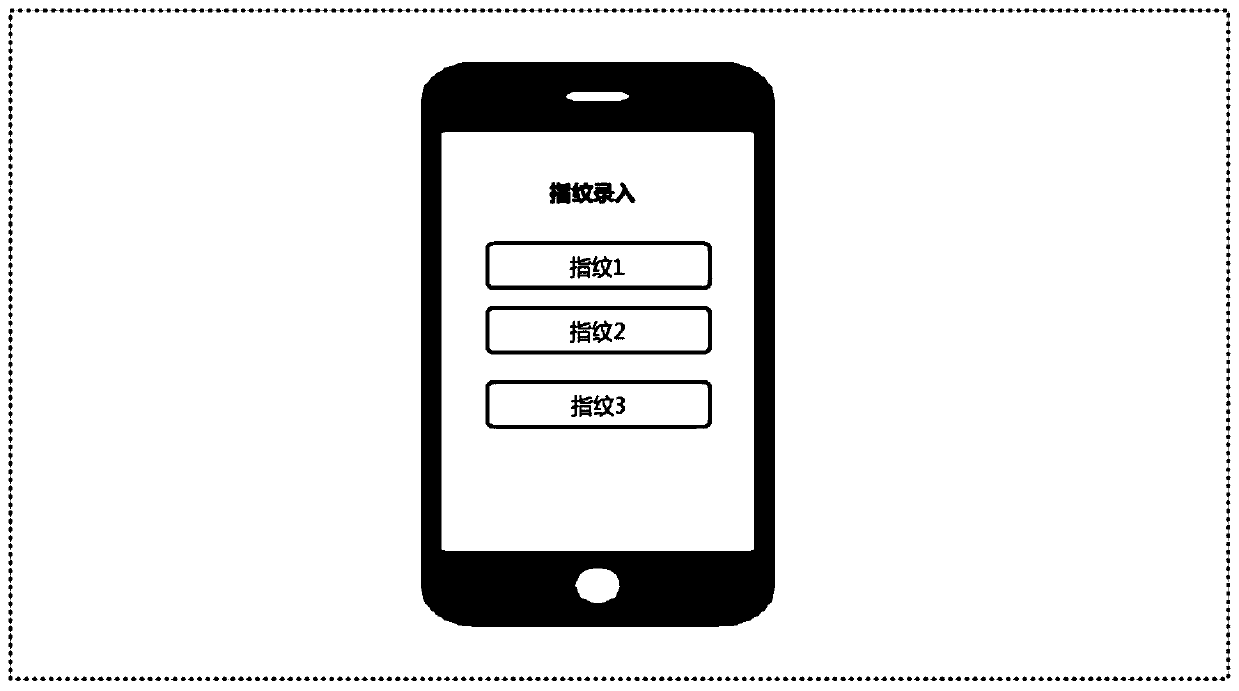

Hardware wallet anti-credit-card-fraud method and system based on biological recognition technology

InactiveCN110210855AMeet security requirementsMeet reliability requirementsProtocol authorisationComputer hardwareCredit card fraud

The invention discloses a hardware wallet anti-credit-card-fraud method and system based on a biological recognition technology. The hardware wallet anti-credit-card-fraud system comprises a hardwarewallet end and a smart phone end. Based on the biological recognition technology, personal biological characteristic data of a user is acquired at the smart phone APP end as a factor for generating asecret key, and the factor is transmitted into the hardware wallet through NFC, and a private key and a public key of the hardware wallet are generated, namely a wallet address, by utilizing the factor and a physical key of the hardware wallet. A user does not need to memorize a PIN code when operating the hardware wallet, so that the safety of the hardware wallet is effectively ensured, and the credit-card-fraud of the hardware wallet is prevented.

Owner:PEKING UNIV

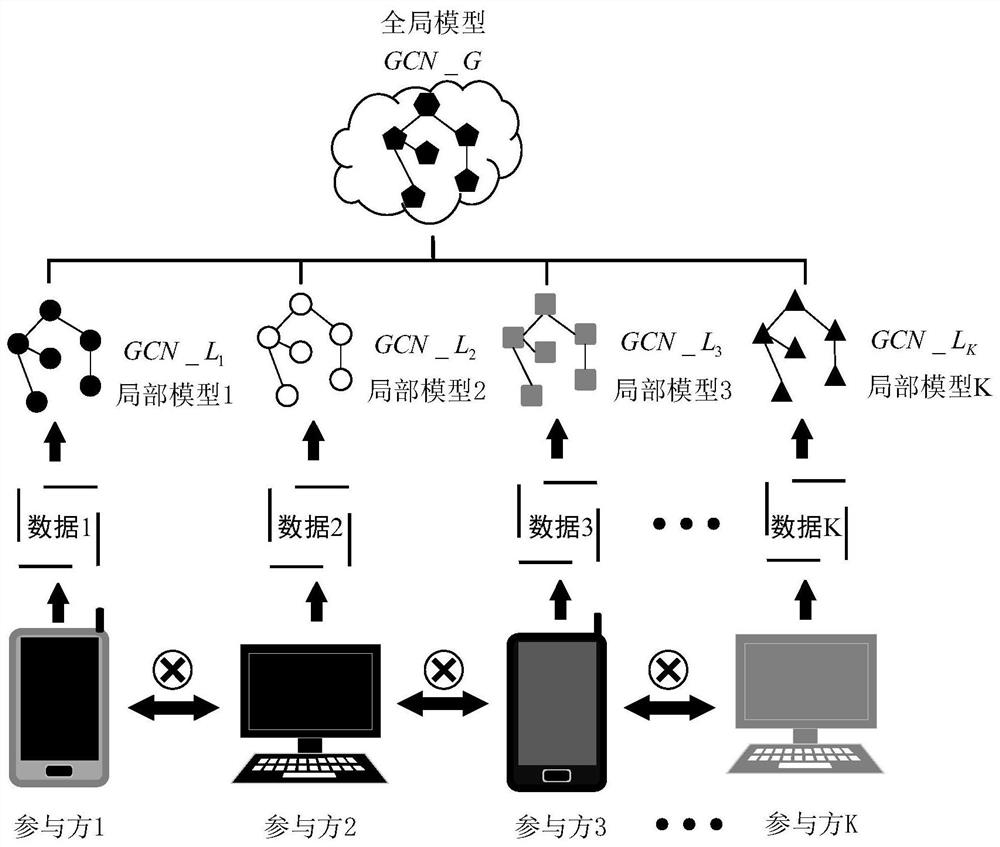

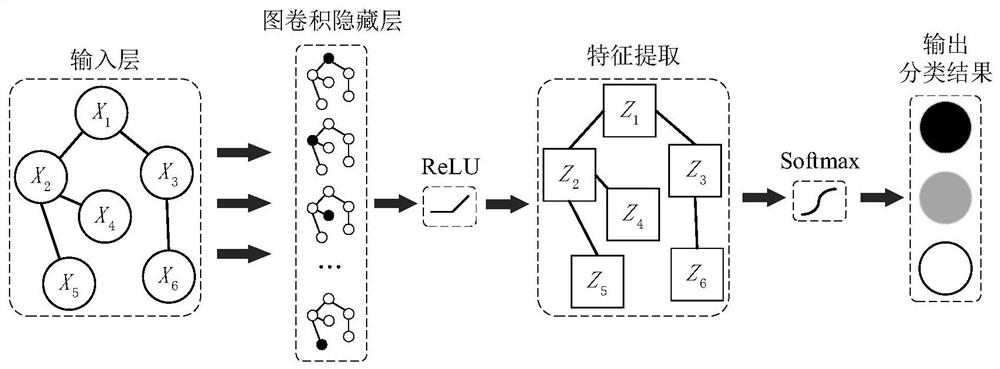

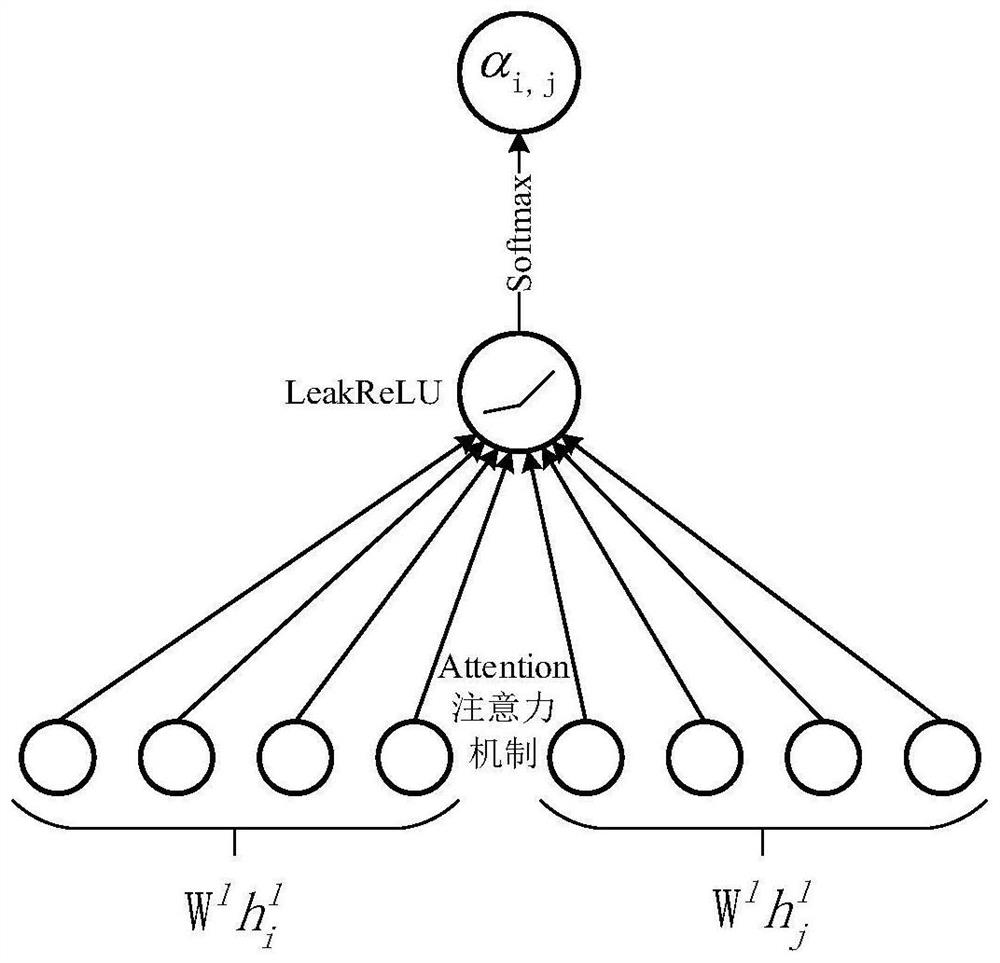

Federal learning method and device for credit card fraud prevention

PendingCN113362160AImproving Anti-Fraud Assessment AccuracyImprove training accuracyFinanceNeural architecturesEngineeringData mining

The invention discloses a federated learning method and device for credit card fraud prevention. The method comprises the following steps: constructing local graph convolutional neural network models corresponding to K federated learning participants with different fraud categories; performing federated learning training by using the local graph convolutional neural network models, wherein the aggregation process of federal learning parameters is improved by adopting an attention mechanism, so that each local graph convolutional neural network model has a weight matched with the local graph convolutional neural network model for aggregation; and outputting a global graph convolutional neural network model, the global graph convolutional neural network model being used for processing imported user data and identifying corresponding fraud categories. Aiming at the existing problems of an existing credit card fraud evaluation method and a classical federated learning algorithm, the invention provides a federated learning algorithm suitable for non-Euclidean space data and participant individuation characteristics to process financial data and carry out credit card anti-fraud judgment.

Owner:NANJING UNIV OF INFORMATION SCI & TECH

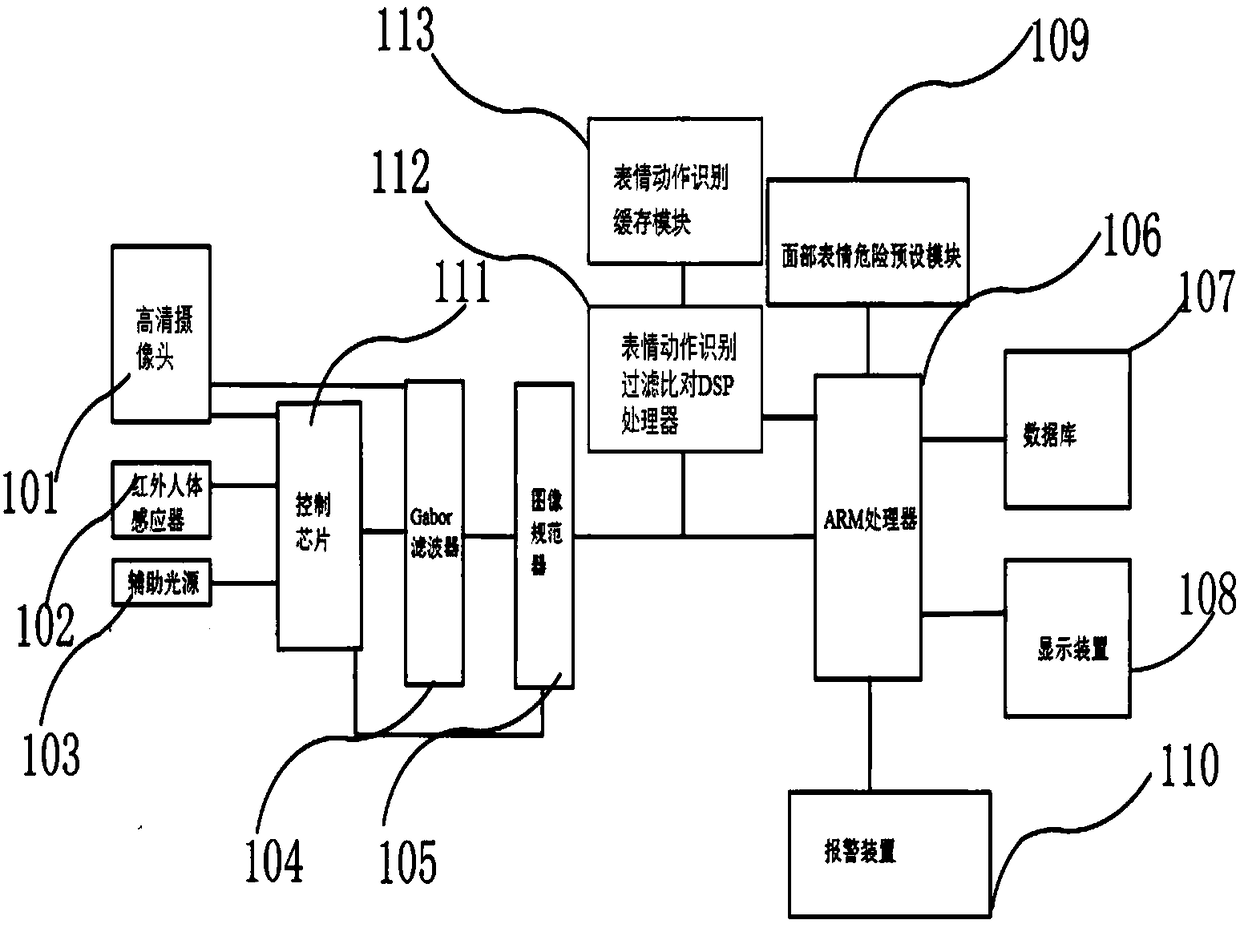

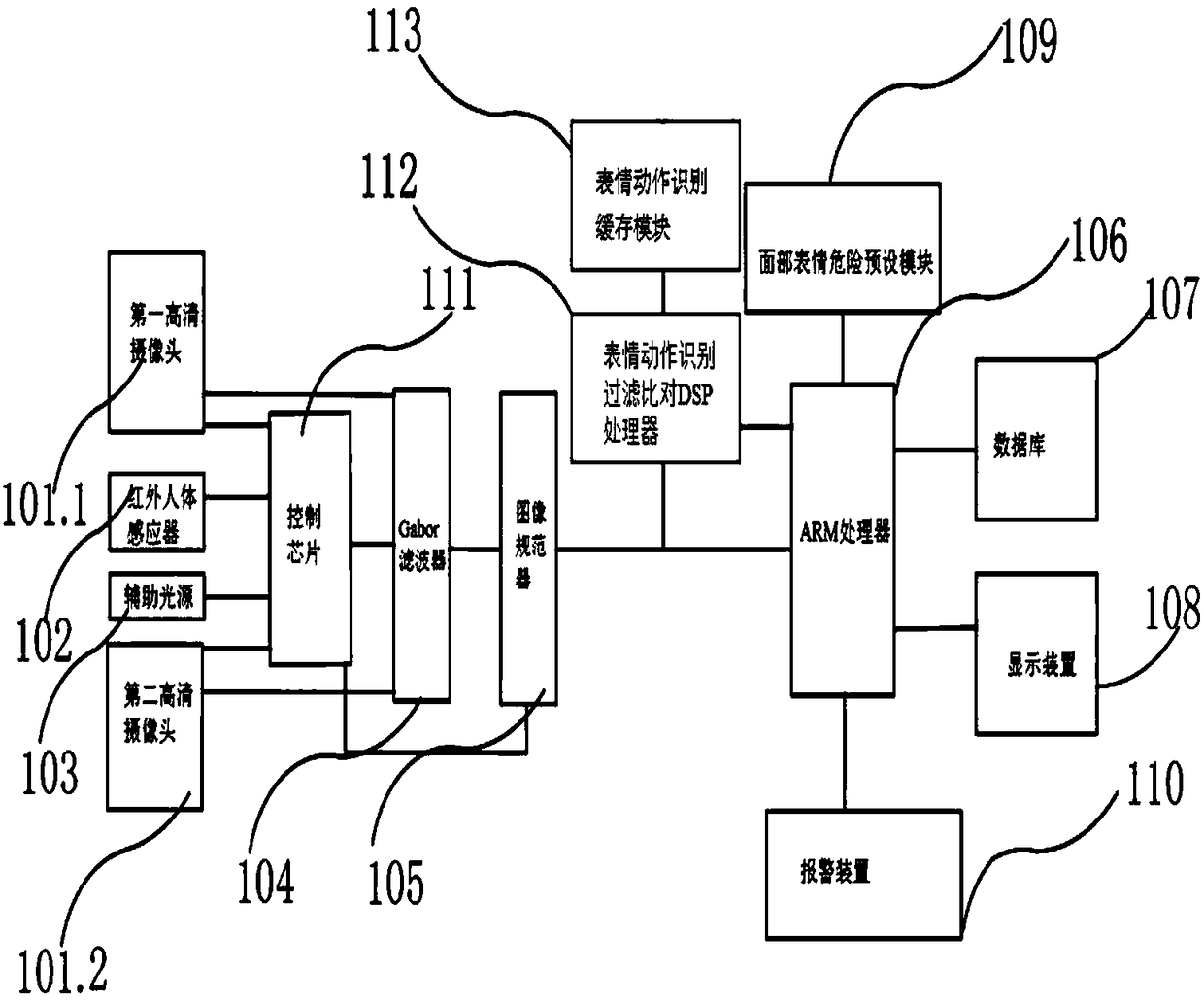

Precise face recognition system

PendingCN108197609APrevent theftEasily solve facial recognition problemsCharacter and pattern recognitionProtocol authorisationPaymentDisplay device

The invention belongs to the technical field of face recognition and especially relates to a novel precise face recognition system. The system includes a high definition camera, an infrared human bodysensor, an auxiliary light source, a control chip, a Gabor filter, an image normalizer, an ARM processor, a database and a display device. An expression action recognition filtering and comparison DSP processor is also connected with an expression action recognition buffer module. Through setting of the expression action recognition filtering and comparison DSP processor and the expression actionrecognition buffer module, a series of expressions or actions for identity verification of a person can be taken as identify verification information, so that credit card fraud when the precision face recognition system is applied to payment can be prevented and a problem of face recognition of twins can be solved easily.

Owner:梁纳星

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com