Risk prediction method based on sorting and device thereof, equipment and medium

A technology of risk prediction and risk model, applied in the direction of prediction, character and pattern recognition, resources, etc., can solve the information that cannot truly meet the requirements of user default risk assessment, the credit data is unsafe, untrustworthy and incorrect, and the data cannot be fully utilized. and other problems, to achieve the effect of avoiding inaccurate prediction, reducing financial risk losses, and reducing risk losses

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

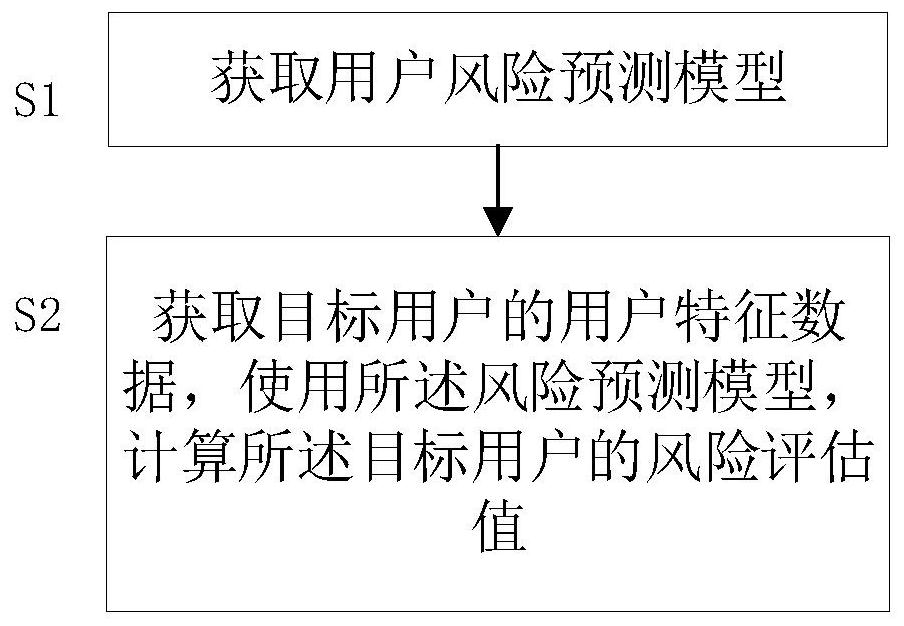

[0031] figure 1 is the main flowchart of an embodiment of the method according to the present invention. Such as figure 1 As shown, this embodiment at least includes the following steps:

[0032] Step S1. Obtain a user risk prediction model. The model uses full sample data to establish a training data set. The full sample data includes data of users with historical credit performance data and data of users without historical credit performance data.

[0033] In one embodiment, in a business scenario where data credit is required to be safe and credible, the full amount of sample data is mainly obtained from the data stored by various credit agencies and resource agencies during the approval process of resource requests such as credit data on the business platform, such as : Data in the database. Taking the financial business service platform on the Internet as an example, in the application scenario where users request and approve resource requests for financial service pro...

Embodiment 2

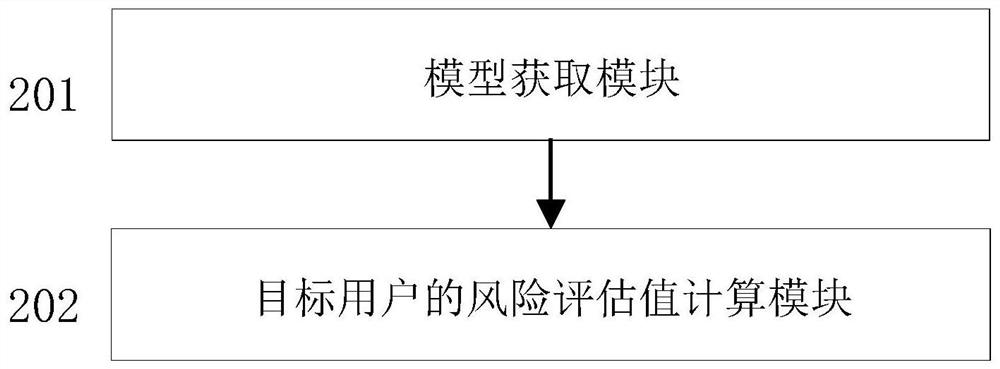

[0084] Similarly, an embodiment of the corresponding risk prediction device corresponds to the method. Such as figure 2 According to a structural block diagram of an embodiment of the device of the present invention, the device may specifically include:

[0085] The model acquisition module 201 acquires a user risk prediction model, and the model uses a full amount of sample data to establish a training data set, and the full amount of data includes data of users with historical credit performance data and data of users without historical credit performance data. For specific functions, refer to the specific steps and content of S1, which will not be repeated here.

[0086] The target user's risk assessment value calculation module 202, the module acquires the target user's user characteristic data, and uses the risk prediction model to calculate the target user's risk assessment value. For specific functions, refer to the specific steps and content of S2, which will not be...

Embodiment 3

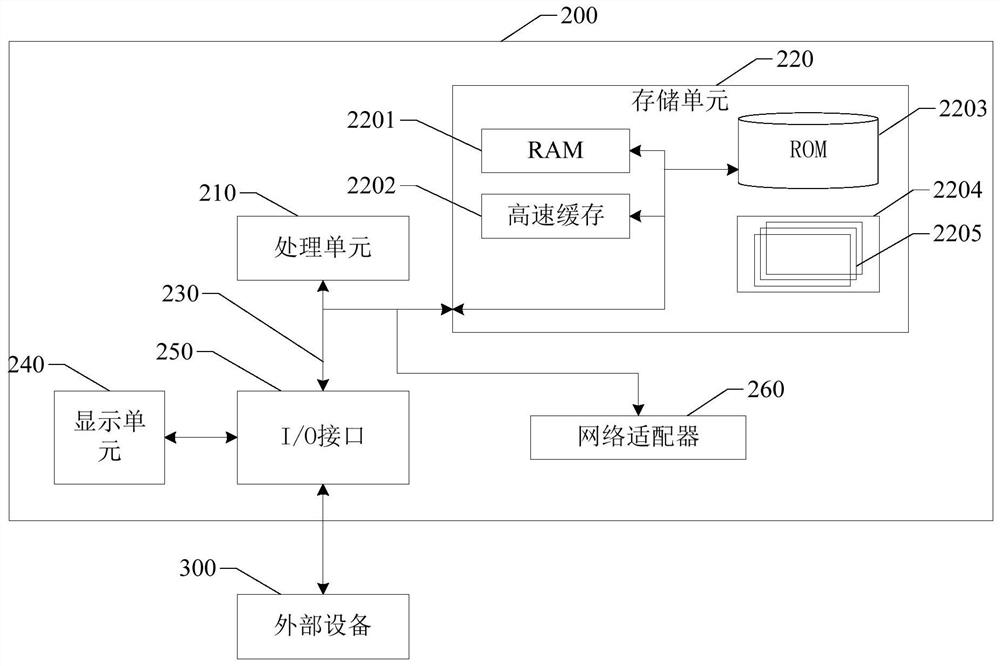

[0090] An electronic device embodiment of the present invention will be described below, and the electronic device can be regarded as a physical form implementation of the above-mentioned method and device embodiments of the present invention. The details described in the electronic device embodiments of the present invention should be regarded as supplements to the above method or device embodiments; details not disclosed in the electronic device embodiments of the present invention can be implemented by referring to the above method or device embodiments.

[0091] image 3 is a structural block diagram of an exemplary embodiment of an electronic device according to the present invention. image 3 The electronic device shown is just an example, and should not limit the functions and scope of use of the embodiments of the present invention.

[0092] Such as image 3 As shown, the electronic device 200 of this exemplary embodiment is represented in the form of a general-purpo...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com